Author: Gold News Club

In response to the Great Recession a decade ago, the international community fired off the big guns to stave off the inevitable decay of the global economy that had been manipulated and distorted through the Keynesian doctrine. Despite the massive fiscal and monetary stimulus at the time, many countries failed to recover from the financial crisis – and those that survived the market meltdown are still paying for the spending and bailouts.

After pulling the trigger on the Coronavirus-targeted bazookas, the world’s pockets are empty, potentially creating a scenario for a reset in the global monetary order. On the other side of the lockdown, who will stand tall and reign supreme? If history is any indicator, it will either be the country with a lifetime supply of printing press ink or the one with a vault full of gold.

A NEW MONETARY ORDER

Jp Cortez, the policy director at the Sound Money Defense League, believes the global pandemic could usher in a new era of sound money in the future. However, before that happens, he thinks the immediate fallout will lean against a fundamentally stable currency structure.

“Countries have massively overleveraged their economies, leaving them with two options: print now and deal with inflation later, or collapse,” Mr. Cortez explained during an interview with Liberty Nation. “While the printing presses are already running at high speed, politicians and unelected bureaucrats will seize this opportunity to pass measures with massive price tags.”

“The inevitable inflationary consequences will show up down the road as economic demand starts to recover and money velocity picks up,” he continued.

*******

The rest of this article can be found here.

Money Metals has lined up a special TRIAL OFFER for all our listeners to Greg Weldon’s Guru on Gold Report. Go to Gold-Guru.com and enter promo code MIKE and you’ll get half off your first month!

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

Coming up Greg Weldon of Weldon Financial and Gold-Guru.com joins me for an incredible interview on a range of topics including why he sees gold soaring later this year and why we need to look outside the U.S. for important clues about the economy. Greg also shares his thoughts on what will likely happen to many small businesses if we see a new round of stay home orders enacted later this year. So, don’t miss a must-hear interview with Greg Weldon, one of our favorite guests, coming up after this week’s market update.

Precious metals markets appear to be gearing up for another leg higher. On Thursday, the metals complex rose sharply across the board. Gold gained about 2.5% while silver packed on nearly 4%.

Both of the monetary metals showed signs of breaking out of the sideways trading ranges they’ve been stuck in over the past four weeks. Silver closed solidly above its 50-day moving average for the first time since late February.

Bulls will be looking for confirmation with strong weekly closes today and then follow-through early next week.

As of this Friday morning recording gold is putting together a 0.6% advance for the week to bring spot prices to $1,725 per ounce. Silver, meanwhile, shows a weekly uptick of 3.4% to trade at $15.69 an ounce.

Turning to platinum, prices are up essentially unchanged for the week to trade at $779. And finally, palladium continues to slump, down 2.1% for the week to trade at $1,929 an ounce.

Metals markets – the white metals especially – stand to benefit from gradually improving economic conditions. Although the economy remains largely locked down with tens of millions out of work, dozens of states will be lifting restrictions over the next week, unleashing pent up demand for commodities.

The Federal Reserve will also continue to run the largest monetary easing and asset buying programs in the nation’s history. And Congress may roll out another round of massive fiscal stimulus paid for with money it doesn’t have.

Senator Rand Paul appeared on Fox News earlier this week to offer his take on the situation:

Fox News Anchor: Are we going to see a fourth stimulus, or do you think they’re going to wait, and see how the first three are working?

Rand Paul: To people who ask me, I remind them that we have no money. We have no rainy-day account. We have no savings account. The three trillion that we’ve already passed out is imaginary money. It’s being borrowed basically from China, so the irony is we got the virus from China, and now we’re going to be more dependent by borrowing more money from China. The only thing that recovers our economy is opening the economy. It’s not a lack of money. It’s a lack of commerce. If you let people have commerce, if you let them trade, if you take them out from forcible home arrest, our economy will recover, but if you keep everybody under home arrest, and say you cannot practice your business, you cannot sell your goods, there will continue to be economic calamity. And all these blue state governors who don’t want to open their state they all are clamoring for federal to bail them out because no state revenue’s coming in. We don’t have any money.

Of course, the Federal Reserve’s novel policies of unlimited Quantitative Easing render the issue of budget deficits almost irrelevant – at least politically.

Deficit hawks are a dying breed in Washington. The pressures to spend during this time of crisis are overwhelming regardless of party affiliation. And politicians experience virtually no negative direct consequences for spending money they don’t have.

The consequences will be felt over time, though, by all holders of U.S. dollars and dollar-denominated IOUs. They stand to lose purchasing power in real terms and perhaps even in nominal terms as well.

In a year of unprecedented events in financial markets, the next previously unthinkable development for the history books could be U.S. interest rates going negative. On Thursday, futures markets began pricing in a negative U.S. rate environment for the first time ever.

Fed officials including Chairman Jerome Powell have repeatedly said they have no intention of pursuing negative rates, although they have admitted to studying the technical feasibility of adopting a Negative Interest Rate Policy.

But the markets may ultimately force the Fed’s hand. If market expectations increasingly reflect below-zero Treasury bill yields, and across the entire yield curve even negative-yielding longer-term Treasury bonds, then central bankers would effectively be tightening if they refused to let their benchmark funds rate fall below zero.

This is all still speculation at this point, but it’s not wild speculation – not in the least. When policymakers vow to keep rates near zero as they are now, the inherent risk of such a policy is that the rates are only one tiny move away from going negative. And there is no reason to think the odds are necessarily greater for the next move in rates to be up rather than down.

A move to negative rates would give bondholders one last hurrah to experience capital appreciation. But soon thereafter the entire debt market would become a place where capital goes to suffer the slow death of negative returns. It could become a more rapid death in real terms if the Federal Reserve note’s rate of depreciation accelerates.

For now, the U.S. Dollar Index isn’t reflecting much fear of loss versus other fiat currencies. It has traded in a range of around 99 to 101 the past few weeks and remains up overall for the year.

But it is at risk of suffering a major break down in terms of gold. The gold price has already hit new highs versus other major currencies. It is up over 13% this year in U.S. dollars and could potentially make a new all-time USD high before the summer.

That would surely accelerate public interest in precious metals as a viable and necessary hedge against an unlimited Fed.

Well now, for more on gold, some of the other commodities and a range of other economic topics, let’s get right to this week’s exclusive interview.

Mike Gleason: It is my privilege now to welcome back our good friend, Greg Weldon, CEO and President of Weldon Financial. Greg has decades of market research and trading experience specializing in the metals and commodity markets and he even authored a book back in 2006 titled Gold Trading Boot Camp where we accurately predicted the implosion of the U.S. credit market and urged people to buy gold when it was only $550 an ounce. He’s made some fantastic calls over the last few years here on our podcast and it’s great to have him back with us.

Greg, thanks, as always, for your time and welcome. How are you?

Money Metals has lined up a special TRIAL OFFER for all our listeners to Greg Weldon’s Guru on Gold Report. Go to Gold-Guru.com and enter promo code MIKE and you’ll get half off your first month!

Greg Weldon: Thanks. I’m doing well. How about yourself?

Mike Gleason: Very good and it’s a delight to have you back on. It’s been too long. We did speak to you back at the end of February before all this madness started. At the time, COVID-19 had begun seriously impacting economic activity in global markets, maybe not so much in the U.S. Now, just two months later, more than 30 million people have filed for unemployment, GDP was deeply negative in the first quarter and figures to be even worse here in Q2. But the equity markets are acting as if the worst is behind us. We got a major correction followed by an almost relentless rally. Our take is that equity markets are completely disconnected from reality. They are hitched, instead, to the Fed’s magic money machine. What is your take on how stock markets are behaving here, Greg?

Greg Weldon: Well, I think you make probably the most singular point that needs to be made right here, which is the disconnect between Main Street and Wall Street, if you will. I think that the great Jim Grant said it as beautifully, as eloquently and as he is prone to do, as simply as possible when he said, “The stock market is mistaking liquidity for solvency.” And that is dead on; exactly what’s happening. You have all this liquidity. It finds a home in the stock market. That’s what the liquidity is intended to do is to find its way to risk assets that supports the campaign against a debt deflation because that’s what you’re fighting. And so far so good.

But the questions are just so many. I mean, the field is littered with land mines. Thinking we’re going to get through this field without stepping on one, if not several, is really naïve to me. And I think if I would make two points specific to the economy and the economic side of it… number one, when you look at retail sales, when you look at personal consumption expenditures – let’s take personal consumption expenditures. You just dumped 1.12 trillion dollars in a single month. You have another big month coming because April was the bulk of the closures. You weren’t even closed in Florida in March. So, you’re looking at two trillion dollar decline in personal consumption expenditures.

In terms of retail sales, eating and drinking establishments is always the margin of the discretionary dollar. If you’re spending more for gas and food, which you will be… let’s not forget that, because food has gone up because demand is up and supply is down. It’s pretty simple. As we were talking off air, why has food prices gone up? More buyers than sellers. Pretty simple. And gasoline is at such a low level with such disinvestment in the infrastructure that there’s no doubt in my mind, anyway, that gasoline is a steal at 75 cents a gallon in the spot market. We were recommending Valero and gosh, they’ve already broken on me. Valero’s up 30% from where we bought it three weeks ago.

Food and gasoline prices going up. Consumptions come down. And when you talk about the level of retail sales… if you’re going to take eating and drinking establishments, the monthly billions of dollars spent doing that, back to levels seen in 2006. You are wiping out 14 years of growth in discretionary spending, eating and drinking establishments. Retail sales, not quite the same degree of decline but you’re looking at something like 2011/2012 levels. Even there, you’re wiping out eight years of growth in retail sales in terms of billions of dollars per month. But what you’re not doing is decreasing the debt that was created to facilitate all that buying because it’s been a credit frenzy. That’s number one.

Number two is if you look at the Feds regional surveys, which are a treasure trove of information and usually have a special questions segment at the end. The most recent batch of them from last week, of course, special questions around COVID and specifically employment. And what we learned is 37.4% of firms do not plan on hiring back all their workers. Maybe not a surprise there. What’s a surprise is 24.9%, one tenth less of a quarter, of those job losses are going to be permanent. You’re talking, what? 30 million people? Now you’re talking nine million people permanently unemployed in one fell swoop that are not coming back, not going to get their jobs.

Again, and when you go back to the first quarter Fed survey on household finances, it very specifically showed that consumers were pretty much to the levels were they start to feel stress in having to create more debt. They can’t do it. They can’t afford it. They don’t want to do it. They are either unwilling or unable to do it. And when you’re talking about the debt obligations … Credit cards, specifically, but all debt obligations on a monthly basis, $375 billion dollars now. Retail sales now just fell to about $475 billion. Those numbers can’t cross. You can’t have growth without credit. Credit is the lifeblood of this economy and has been. The time to do the right thing, academically, was 1990. We’re 30 years passed that.

The reality is they do what they do, which is print money. The problem is, are they going to save every business, every industry, every person, every household, and every country in the world? I think that’s highly unlikely. So, the stock market is very much living on borrowed time, very much running on fumes and we’re looking at selling it short again. We got short, we got long at the bottom and we rode it almost all the way up to here. Maybe we got out a little early on the long side but if this is a bear market, which I think it is, you’re going to want to be more nimble on the counter trend trades, in this case the long position.

Now we’re setting up for the next big short. And we see it in a lot of places. We see it in Canada. I see it specifically in some of the Asian markets. I think there is a reality check coming and the liquidity … If this liquidity goes in the stock market, the stock market comes down, all that liquidity goes poof! Then what? Nine million people unemployed, retail sales down with no real credit dynamic to get them back up. It’s a potential worse case scenario.

Money Metals has lined up a special TRIAL OFFER for all our listeners to Greg Weldon’s Guru on Gold Report. Go to Gold-Guru.com and enter promo code MIKE and you’ll get half off your first month!

Mike Gleason: Yeah, it does definitely seem like a fool’s rally here. Switching the metals, gold and silver prices also seem disconnected from reality. Gold is performing well but we think prices should be higher given the demand we see in the futures markets as well as the huge number of investors standing for delivery in the futures markets. The disconnect is even bigger when it comes to silver where prices are actually lower today than they were three months ago. The Fed adds four trillion dollars in stimulus. The federal deficit is projected to be three trillion dollars. The economic data is awful and should be driving demand for metals as a safe haven and in fact, demand for physical metal is unprecedented yet the paper price for the metal isn’t reflecting any of this. What gives here, Greg?

Greg Weldon: Well, you said it. The paper price. And if you take a step back and be less U.S.-centric, gold is screaming, man, in so many different currencies it’s not even funny! Because we do the charts every day. And again, this is where it’s at the margin. This is so devastating, what’s happening, because you just don’t understand. You have such a U.S.-centric view of this … And I don’t mean you, I mean us, collectively … That you just don’t realize this is every country.

Angola. 1.6 million barrels a day of oil. They’re a secondary, but semi-major oil-producing nation. Nigeria, same situation. You have places like Uzbekistan and Kazakhstan in Eastern Europe. You certainly have the situation going on right now with Malaysia, Indonesia. You can actually even through India and Korea vying to lose some of their status as having been developing over these years. And then South America’s a mess. South America is a mess. There are several currencies at record lows, the least of which isn’t the Argentinian peso, which is getting crushed. When you look at gold, in those currencies gold is screaming. Gold is up multiples just in the one year, three year, five years. This is ongoing, secular bull market in gold.

But the paper is the angle and the paper links you back to the dollar. All these things, you think they pop out four trillion that the dollar would be lower. But you have to remember, everyone’s doing the same thing. Printing money. I would say the yield differentials in the bond market have really started to narrow. And I thought this would break the back of the dollar. You need to get below 98 in the dollar index. You have failed to do that repeatedly here. And most recently, just in the last four, five, six trading sessions, same thing. You got there, you broke the first level of support and you couldn’t get through the real key support levels and the dollar snapped back.

Why is that? It’s because all these other currencies are getting mauled, man. I mean, seriously, South African rand, Brazilian real. The list is so long. Turkish lira at a new low against the dollar and the euro. Now, that opens a bigger door and I don’t know how far we want to go with our conversation, but Turkey opens the door to Europe. It does so because Spanish banks are on the hook for 100 billion+ euro in bad loans to Turkish banks and Turkish companies. France is number two on the hit parade with about 85 billion. So, between them it’s almost a quarter of a trillion euro that those two countries are on the hook for. You know the situation in Spain. You know that the Dutch and Germans are blocking union-wide, union-paid for support to the southern states; Italy, Portugal and Spain. Spain, last year, for the socialists to ratchet power from Rajoy they had to include the Bask and the Catalonian parties, two separatist parties!

I think Europe is a powder keg. I think these are some of the reasons why you don’t really see gold screaming because the dollar’s not getting crushed because all these other places, as bad as the U.S. is, all these other places are worse and the currencies reflect that. Gold is rallying in those currencies. Will the dollar go? I think it will. When it does, gold will be above $2,000 and it probably happens this year. It’s going to take patience and how this plays out, and how we get from here to there, I don’t know. I just know we’ll get there.

Mike Gleason: Switching back to the Fed here. Since the Fed has assumed an even more massive role in the markets for itself, here. We should talk about what the central planners will be up to in the months ahead. They have certainly been able to goose the equity markets, at least for now, with the stimulus they’ve already announced. Is that “Mission Accomplished” for the Fed? Or will they be likely back with trillions more in future months?

Money Metals has lined up a special TRIAL OFFER for all our listeners to Greg Weldon’s Guru on Gold Report. Go to Gold-Guru.com and enter promo code MIKE and you’ll get half off your first month!

Greg Weldon: Well, that’s a good question. I think the answer is yes and no. And no and yes. Let me explain. Yes, they think they’re done. Yes, they want to be done. No, they’re absolutely not done. And on the flip side, in terms of how we get to from point A to point B is more pain. This is kind of where the stock market plays in because the failure here would be the catalyst for the Fed to do more. I think there is pressure on the Fed to do more, anyway. What this does, though, is it actually opens the door for the political dynamic to get back in the way, so to speak, because you have the issue over buying state municipal date.

What state are you going to buy? The states that are in the worst position, like California, Illinois, New York? The ones run by the Democrats who pushed this through? Pelosi already wants another trillion dollars just spent on the states. That’s not fair. You had Ted Cruz on TV today … And I hate to get political, but this is going to be a bit of a brouhaha over this. And it’s ridiculous that the democrats are basically saying, “We’re going to try and use this opportunity,” like in the first package. In this case, they want to use it to help pay down California, New York and Illinois debt that is not related to the outbreak. You really thought that this wasn’t going to come with a moral dilemma because it wasn’t banks. No, it comes with a huge moral dilemma. Bigger than any banker’s moral dilemma is a politician’s moral dilemma and you are staring it right in the face.

That opens the door for uncertainty to return, in-fighting in the political scene. You get Nancy Pelosi on TV and it’s just a nightmare. How does this woman even still hold political office? I don’t even want to go any further with my thoughts on that but seriously. The policies and the ideas that come from this sector of the political universe are insane. It’s just like, print, print, print, spend, spend, spend.

I’ll tell you, Mike, this is where you’re going to need to really pay attention to bond markets because bond markets will tell the tale, here. Every countries printing money, essentially, for all intents and purposes. Look at what Japan is doing. The BOJ just announced a 28 trillion-yen purchase program for household debt. We think the Fed can’t do that? The Fed can absolutely do that. That’s probably where this goes. So, when we say, “Wow, how deep can the Fed go?” The Fed is in the rabbit hole. There’s no coming out.

I actually did a piece recently and it’s a debt black hole is what it is. We’ve crossed event horizon. If you know anything about it, a black hole, once you enter the black hole, you’re crossing the event horizon, you can’t get out. You’re trapped. There’s not even enough energy to withdraw light out of a black hole. The situation here is, the worst case scenario for central bankers is a debt deflation. That’s a debt black hole where everything’s consumed and prices of everything go down and it’s a complete inward collapse, if you will. In that sense, have we crossed over the event horizon and we just don’t know it yet? That’s what I think. Can they print enough money to repair what’s going on? They’ve always done this. They always papered over the issues. I don’t know that they have the willpower to potentially print as much as is going to be needed. Can we stomach a Fed balance sheet of $20 trillion?

I’m not saying that’s where they’re going to go right away or that’s the plan. Next stop, 11 to 12, it’s almost by definition what they already outlined. But if you do the math and you look at the numbers. Are they going to start buying Zimbabwe and Angolan debt, too? Where does it stop? You’re in the rabbit hole. You are not coming out. You are in the black hole. You’re not coming out and you’re going to use as much energy as you can to try and get out but if it doesn’t work, again, that’s the worst-case scenario. Ultimately, that will cause them to do whatever it takes to move the dollar.

I wrote about this in the book, which seems like I need to write another book. It seems so long ago, now, but 2006… I called it Monetary Armageddon. It’s like in the movies. I think I’ve said this on your show before. It’s like in the movies. You have two guys in the bunker in the mountain, in the complex, with the things … They lift the little protectors to put their keys in and they have to turn the keys simultaneously and press the button and when they do that, they basically vaporize ever piece of paper of U.S. treasury debt that’s ever been printed and just print more money to replace it. That’s probably where this is headed, longer term, and that’s the day you’re going to want to own gold. Big time. By then, you’re probably already talking about being close to $3,000 an ounce anyway, if not higher.

Mike Gleason: Yeah, certainly that’s where hard assets comes in and it does seem like the inflationary bubble is going to be upon us some time soon. Well lastly, Greg, as we close here, any final comments you want to share with our listeners today? Maybe you want to make another call about one of the commodities or precious metals you think people ought to be paying most closely attention to here? Or anything else you want to comment on as we begin to wrap up today?

Money Metals has lined up a special TRIAL OFFER for all our listeners to Greg Weldon’s Guru on Gold Report. Go to Gold-Guru.com and enter promo code MIKE and you’ll get half off your first month!

Greg Weldon: You know what? I’m not a crypto currency guy. I think the whole name is fraudulent in the sense that these are not currencies. They’re not legal tender, so on and so on and so on. But they’re commodities and they’re … It’s mined like gold and to whatever degree, there’s supply/demand and there’s all these little nuances to each individual little inner commodity within this commodity and I call it crypto tokens because that’s what it is. I like Bitcoin right here. I really do. And I think it’s interesting to note that Bitcoin versus gold, the ratio is kind of bumping into the down trend line, it goes all the way back to the peak in Bitcoin.

We actually bought it yesterday and today for ourselves; for my managed accounts. So, that’s one idea I throw out there. I talked gasoline on your show before. That finally busted out yesterday and we bought it at 75 cents and it’s trading 90 already. I think it goes back to $1.35. If this is redundant, pardon me, but again, you have disinvestment in this sector as a whole. You don’t build new refineries. It’s just not something that’s done very frequently. There’s a lot of regulatory houses you got to go through and it takes a lot of money to maintain these things. You got to turn around from heating oil. It’s not quite as bad as it used to be, but it is still capital-intensive.

And the degree to which you have a lack of investment because of green energy, let’s not even get into that whole discussion. But when you discuss that, it’s not like everyone’s going to stop driving gasoline-powered cars all at once. First of all, that’s all been kind of pushed back on the back burner; electric vehicles. Let alone, the main component of the battery is nickel sulfate… mining nickel, mostly in Australia, that’s not a clean, green business. So, this whole thing’s kind of ludicrous in my opinion.

Having said all that, the point is, it’s not like just because people want to go green they’re going to stop driving their cars. And you are in a situation now where any disruption will cause a major spike in prices. And once you come out of this and you work down the inventory overhang, which you have. And you have one and it’s sizable in gasoline, but it’s not going to last because you’re not refining gasoline right now, either. So, production is way down. It’s down like 25% over the year. Some of that’s a factor, people can’t work.

And I’m actually going to swing this all the way back around. I’m going to give you another quick point just because it’s so important I make this point. I forgot to make it earlier. On the economics, on the U.S. consumer, on small businesses in the U.S., unemployment, these kinds of things. Even the businesses that come out of this, the Fed surveys, again, showed the percentage of firm small businesses and self-employed people that took advantage of the PPP and whatever the fancy names were for the programs the government rolled out, but more small businesses tapped lines in credit and took out new loans from the bank or tapped cash reserves. That was the highest one; like 38% tapped cash reserves.

The point here is, the virus is not over, number one. Second wave coming for sure, depending on how irresponsible people are about going back out there. But the bigger picture thing is the cushion, the safety net, is gone. If you have another event, you have some kind of bank issue, you have some kind of sovereign debt issue in Europe, you have Japan blows up… you have any of these things. Emerging markets, commodities, whatever. Any of those other landmines get touched off, small businesses, self-employed, the majority of people, and a lot of bigger businesses have used their cushion to cushion the blow from this viral outbreak. They don’t have a cushion for a second event. You get a one-two body blow here, the second blow would potentially be even more devastating. And it won’t take much because this boxer here, the U.S. economy, is fatigued, man, and sucking for air. Sucking, gasping for air. Really sucking wind. And you take another really hard shot to the ribs from some other event, nobody out there is positioned to dig out of another hole.

Mike Gleason: Yeah, very well put. It is a very tenuous situation here and look forward to continuing to follow it with people like yourself.

Great stuff, as usual, Greg. We really appreciate the time. Before we sign off, though, please tell people about Weldon Financial, The Gold Guru and then how they can follow you more closely.

Greg Weldon: Yep. Thanks. We run a couple of businesses. It’s really just me and my very fantastic, wonderful COO Katelyn Ellis. But just the two of us. I manage money, so we’re CTA, so we do have managed accounts. I have an institutional research product called Weldon Live and that’s daily and a higher price goes out to the institutions. It covers everything. Everything. Foreign exchange, fixed income, all the things we talked about today, and has positions and recommendations and ETFs in the futures markets and the cash markets in all of those sectors… ags, energy, metals, stock indexes, global E bonds, currencies; the whole nine yards.

And then there’s The Gold Guru and it is Gold-Guru.com and we’re actually offering a special to your listeners. All they have to do is type in the world MIKE for Michael Gleason, the great orator here of Money and Metals Exchange. And I highly recommend him to all my friends. You know, Mike, that I send my friends to you. That’s how highly I think of you guys and the job you do. Yeah, just type in Mike and we’re going to give 50% off your first month subscription and it’s pretty inexpensive compared to our institutional product, which is five figures and up. The $60 a month for Gold Guru is a steal. It really is. That’s Gold-Guru.com.

Mike Gleason: Yeah, that’s fantastic. Right back at you. We really appreciate the work you do and everything that you’ve contributed to the podcast over the years. Gosh, I’m just thinking about the amount of money that people could be making just listening to your advice here on our podcast. And obviously, you go a whole lot deeper with your services. So, urge people to check that out. It is fantastic stuff for sure.

Well, glad we were able to get you back on here, Greg. And it was wonderfully speaking to you. I hope you have a great weekend and can’t wait to catch up with you again before long. And there’s going to be no shortage of things to talk about for the foreseeable future. Until then, take care, my friend.

Greg Weldon: Yes. You, too. And again, MIKE is the bonus code. That’s capital M-I-K-E. All caps. Mike.

Mike Gleason: Great stuff. That will do it for this week. Thanks again to Greg Weldon of Weldon Financial. For more information, simply go to Weldon Online where you can sign up for a free trial there. And then be sure to check out Gold-Guru.com. And you heard it right there from Greg. Promo code MIKE and you’ll get half off your first month there. That’s a fantastic thing to be checking out. Do it right now.

And check back here next Friday for our next weekly Weekly Market Wrap Podcast. Until then, this has been Mike Gleason with Money Metals Exchange, thanks for listening and have a great weekend everybody.

Money Metals has lined up a special TRIAL OFFER for all our listeners to Greg Weldon’s Guru on Gold Report. Go to Gold-Guru.com and enter promo code MIKE and you’ll get half off your first month!

Source: Peter Epstein for Streetwise Reports 05/07/2020

Peter Epstein of Epstein Research looks into the Gross Overriding Royalty that just changed hands on the company’s flagship Red Hill project, and discusses what it means for the firm.

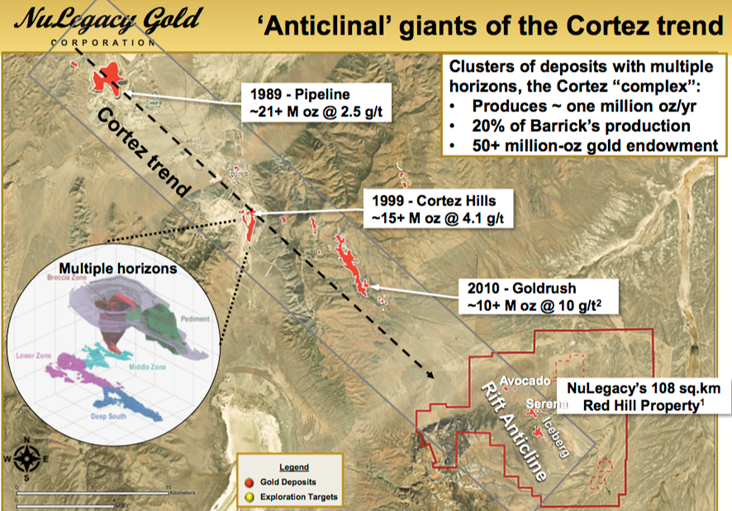

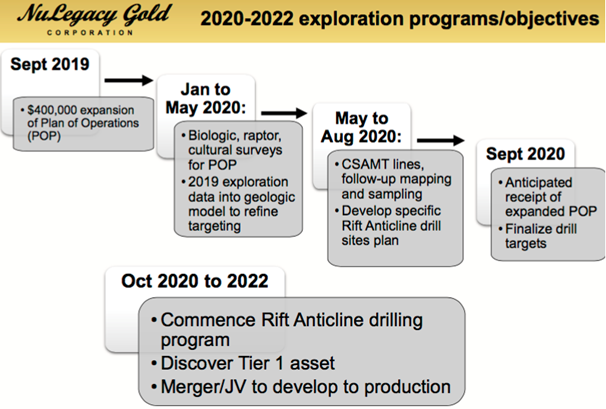

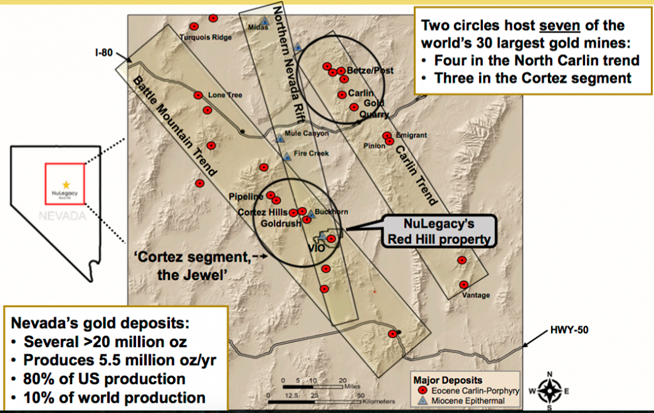

In late April, Metalla Royalty & Streaming acquired two royalties, one of which was a Gross Overriding Royalty (GOR) on NuLegacy Gold Corporation (NUG:TSX.V; NULGF:OTCQX) flagship Red Hill project, a Carlin-style deposit in Nevada’s world-famous Cortez trend.

To be clear, this was a transaction between Metalla and a private company; no cash or other remuneration flowed to NuLegacy. However, this news is still exciting and thought provoking as it pertains to a potential (implied) valuation of Red Hill. So much so, that—CEO/director of Finance and Marketing—Albert Matter put out this press release highlighting it. {corporate presentation}

Metalla’s news is applicable to NuLegacy for a number of reasons. Let me start by saying I know the Metalla team, I’ve written about the company several times (although not recently).

This is a smart, hard-working, market-savvy group, with global experience, integrity and expertise. When dealing in streams and royalties, it’s all about industry connections, market knowledge and deal flow. Metalla has that and is up to its eyeballs in deal flow (deals it can make or pass on).

Takeaways on implied valuation of NuLegacy’s Red Hill project?

That’s why this news is so interesting. It represents a reliable, unbiased vote of confidence in NuLegacy’s Red Hill project. I was able to track down the president, CEO and a director of Metalla, Mr. Brett Heath, to ask him about his team’s view of NuLegacy, their management and technical teams, and the Red Hill project,

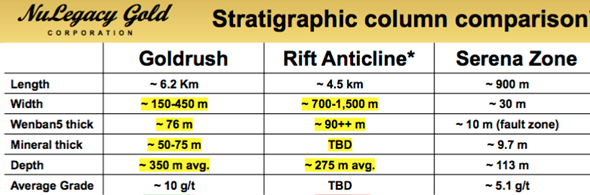

“The Red Hill project is very interesting due to its location & position within the Cortez trend of Nevada that hosts globally significant mines & projects, specifically Cortez Hills, Pipeline & Goldrush. Although many near-surface deposits have been discovered, several blind deposits similar to Goldrush have yet to be found.

“NuLegacy’s Rift Anticline is a promising new drill target, a chance to discover a large, high-grade deposit. The close proximity of Red Hill to Goldrush heavily influenced our understanding of the geology at Red Hill. Specifically, it allowed us to better understand that the Rift Anticline has similar stratigraphy to Goldrush, and similar mineralization events nearby.”

Investors, shareholders and analysts are trying to figure out what (if any) read-throughs there are in terms of the valuation of the Red Hill project.

From the press release:

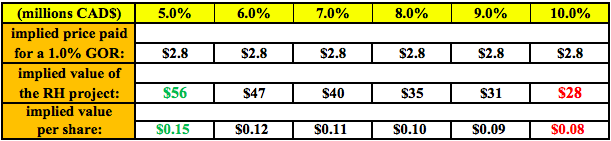

“Valuing Gross Overriding Royalties (“GORs”) is a complicated business made easier in this instance by the straightforward nature of the [transaction] …. prorating the US$4 million purchase price for the total of 2% GOR that was acquired…. values a 1% GOR in the Red Hill project at ~US$2 million.”

What this valuation exercise boils down to is how does the value of a 1% GOR compare to a conventional working interest in the same project? GORs are highly case specific, so I will give a range of possibilities. Many factors make GORs unique, but a rule of thumb is that a 1% GOR equates to a 5% working interest.

However, due to the unknown terms of this particular GOR, let’s assume that the 1% GOR is equal to between a 5% and 10% working interest. By extending the range higher than 5%, more conservative valuations for Red Hull are obtained. In the chart below one can see that the implied ~US$2 million paid for a 1% GOR equals C$2.8 million at the current exchange rate.

Therefore, Red Hill’s indicative valuation could be viewed as C$28 million to C$56 million, or C$0.08 to C$0.15 per share. Currently, the stock’s trading at C$0.07. The company has a cash balance of C$4.5 million. {see corporate presentation}. I believe the C$0.08 to C$0.15/share range is conservative because Metalla’s purchase of the GOR had a built-in profit expectation. The true ascribed value of a 1% GOR on the Red Hill project might be higher than C$2.8 million.

A true vote of confidence in NuLegacy Gold

Perhaps more important than an implied (subjective) valuation of Red Hill are the following takeaways. First, Metalla not only likes Red Hill, it must also feel good about the long-term prospects for Nevada and the U.S. Metalla looks at hundreds of deals a year from all over the world. Management can, and does, invest in dozens of jurisdictions.

Yet, in April 2020, it chose the U.S., …. Nevada …. the Cortez Trend…. Second, it chose a project that’s pre-maiden resource. Remember, Metalla has paid out ~C$2.8 million, but doesn’t make a penny of that back unless it re-sells some or all of the GOR it acquired, or Red Hill reaches commercial production. Therefore, I argue that investing at this relatively early stage is a stamp of approval in the extensive work done to date at Red Hill.

That Metalla chose to deploy capital in a gold asset rather than a silver asset, despite the gold-silver ratio being near an all-time high (over 110 to 1) seems promising. Finally, it chose the U.S. at a time when the currencies of Mexico, Australia, Canada and others have weakened considerably vs. the U.S. dollar, making exploration cheaper in those countries. One must have conviction to choose Red Hill over dozens of public and private, pre-maiden resource, projects around the globe.

In the end, a good project in a great jurisdiction is only as prospective as its technical/management teams. NuLegacy has prudently advanced Red Hill in good times and bad. For most of NuLegacy’s existence, the gold price traded between about $1,050 and $1,400/oz.

Gold price at $1,730/oz. is a game-changer….

Now gold is hovering around $1,730/oz after almost touching $1,800/oz in March. This is a game-changer for juniors like NuLegacy that have tremendous blue-sky potential, (look at neighboring mines and development projects, some of the best on the planet) but like most juniors, have limited funding to conduct aggressive drill programs in a strong gold price environment.

A savvy company betting on the Red Hill project is yet another indication that the time has come for precious metal players to become more active in M&A.

The day that Barrick commits its deep experience (and deep pockets!) to NuLegacy’s Red Hill, all royalties held on that project would soar in value. Why? The timeline to potential production would be shortened, perhaps by years, (more drilling, less investor hand holding, perhaps skipping a PEA or a PFS). The scope of the project would become larger—more drilling across a wider footprint (a 108 sq. km land package).

The value of the royalties could double, triple, quadruple…. who knows? The share price at which NuLegacy gets taken out could also be meaningfully stronger. After all the company has been through, I don’t think the Board would sell the company below C$0.30/share. At least not with the gold price at $1,730/oz (or higher). Readers are reminded that C$1.5 billon OceanaGold Corp. & giant natural resources fund Tocqueville own a combined 21.5% of the company.

Might there be a bidding war for NuLegacy?

In a best case example then, there could be multiple bidders for NuLegacy. This is not nearly as crazy as it sounds, especially if the gold price keeps going up, or if the next (fully funded) drill program hits the mark. If Barrick were to make a move, OceanaGold, Newmont, or even Tocqueville (they could hold out for higher price) might have something to say about it.

Those entities, and/or other mid-tiers/majors in Nevada or around the world would keep Barrick honest. Over the years NuLegacy has been in touch with several well-known names, but I never know who they’re talking with at any given time. Make no mistake, Barrick is best positioned by virtue of having the most synergies with Red Hill, so it can afford to pay several more pennies per share if need be. That’s how a share price of C$0.30+ becomes possible.

Bottom line, NuLegacy Gold (TSX-V: NUG) / (OTCQX: NULGF) is a high-risk exploration play, but I believe a good speculation. There’s no better time to be buying high-risk exploration than when the prices of the metals being explored for are moving up.

As more attention is drawn to NuLegacy, its team, the undisputed safety of Nevada, the prolific nature of the Cortez Trend, etc., I think there’s compelling relative and absolute value here that readers should consider investigating further.

Corporate Presentation

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University’s Stern School of Business.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about NuLegacy Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of NuLegacy Gold are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, NuLegacy Gold was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein’s disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Metalla Royalty & Streaming and Newmont Goldcorp, companies mentioned in this article.

Graphics provided by the author.

( Companies Mentioned: NUG:TSX.V; NULGF:OTCQX,

)

Source: Streetwise Reports 05/07/2020

While the broader markets have seen sharp declines, Frank Holmes, CEO and chief investment officer of U.S. Global Investors, homes in on gold, gold stocks and bitcoin, and gives his prognosis for the airlines.

Streetwise Reports: Let’s start with gold, which has seen an impressive rise in the last few months as the broader markets have declined on the back of the coronavirus pandemic. What do you think is ahead for the metal?

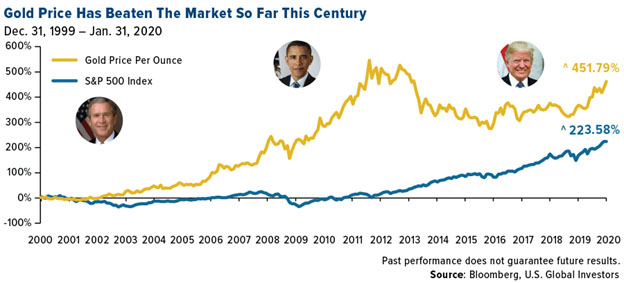

Frank Holmes: There is a short-term view and a long-term view. What’s really hard for so many investors and asset allocators to recognize is that gold bullion since 2000 has far outperformed the S&P 500. In fact, of the last 20 years, in 16 of those years gold has been positive. So if we look at the numbers, it’s double what the S&P 500 has done for the past 20 years.

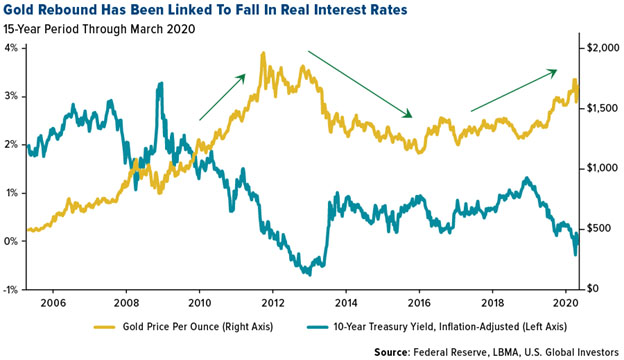

With gold, there’s the fear trade and the love trade. The love trade is 60% of the demand and it is long-term demand. The fear trade is short-term demand, and it’s about 40%. Right now, we’re living with fear that’s really dominating the markets. The two factors that go with that are negative real interest rates and the amount of debt being printed by the government. So whenever you have the combination of a rising Fed balance sheet with Quantitative Easing 1, 2 and 3, buying junk bonds, whatever they’re doing in the stock markets to try and provide liquidity, as that flows dramatically so does the price of gold.

Typically and most significant, in every country in the world we have found that when you have negative real interest rates, gold goes up in that country’s currency. Take the yield on 10-year government bonds and subtract the monthly Consumer Price Index (CPI) number; if it’s a positive return, gold is not attractive as an asset class. But if it’s a negative real rate of return, gold appreciates in that country’s currency.

When gold went to $1,900 in September of 2011, the 10-year government bond had a negative real rate of return of -300 basis points. Then five years later, the price of gold went down to $1,100 and real interest rates were +2% over the CPI number. So you had a variant swing from -3 to +2, which is 500 basis, and that’s why gold corrected. Since then, we’ve had these periods now, and particularly in the past year, of negative real interest rates in America. That’s how gold started staging a rally, which started about this time last year, peaked in August, sold off and now it’s coming back again.

The Federal Reserve said recently it’s going to keep rates basically at 0. The CPI is still running more than 1%. In fact, we could get big food inflation, the way it looks, for beef, chicken, etc. Inflation could have a big impact on negative real interest rates, and gold is moving higher.

So short term, it’s all about real negative interest rates. As long as they stay negative, then we’re going to see gold go up in the U.S. dollar. It could go up against the euro, against any country’s currency.

I mentioned earlier that 60% of gold demand is love, and it predominantly comes from China and India. China and India are 40% of the world’s population, and if you throw in the Middle East and Southeast Asia, we’re now talking about 50% of the world’s population. They give gold for weddings and for birthdays, and there’s a strong correlation of rising gross domestic product (GDP) per capita in those countries for the past 20 years, and rising gold consumption.

China and India comprise approximately 50% of the world’s gold demand GDP per capita. Indian women wear six times the amount of gold on their bodies than what is in Fort Knox, and they predominantly wear 24 karat, minimum 22 karat, gold jewelry. It’s protected them from bad governments and bad government policies.

SR: What do you see happening with silver?

FH: Silver has more industrial applications than gold, so silver is like a warrant on gold. If a stock takes off and there’s an option or a warrant in the money, it explodes and goes up much more percentage-wise. It has greater volatility. Every 10% move in gold usually translates to a 15% move in silver, up or down. And with this fear that’s been taking place with negative interest rates and the calamity of money printing around the world, what we see now is that silver didn’t move at first. Silver has always lagged.

SR: Do you recommend that the individual investor hold gold bullion?

FH: Yes. I think the easiest way is the SPDR Gold Trust (GLD). Or if you want to buy the physical gold insured, go to a reliable site like Kitco, and you can take physical delivery.

There is a company called Mene Inc. (MENE:TSX.V; MENEF:OTCMKTS) at mene.com. It sells 24-karat gold jewelry with only a 10% markup. And it will buy back your gold jewelry at a 10% discount to the price of gold if you ever want to sell it back. That’s the business model. It will deliver throughout the U.S., I think using Brinks for delivery of simple gold jewelry.

SR: Let’s talk about bitcoin for a moment and how that fits into a portfolio.

FH: I am the chairman of HIVE Blockchain, which became the first real cryptomining company. We are mining using green energy, surplus energy in Iceland, Sweden and now Quebec, which sells electricity to New York state. Quebec has a surplus of it. So we started mining these coins.

What I found is that the Bitcoin is very different than Ethereum. Bitcoin is going to become, to me, like Andy Warhol’s art. If you look at the original paintings of Marilyn Monroe or Elvis Presley, when he came out with his prints in different colors, they came out at $1,000, went up to $10,000, fell, went up to $50,000, fell, went up to $100,000 and went to $125,000—because there are just more people, widened GDP, over time, and then they become art collectors. I think that if you have an original Bitcoin that’s never been traded, it’s going to be in that space.

The other part is that cryptocurrency is very new, and digital money is going to only grow. Blockchain technology is a superior piece of technology. What we saw was that Bitcoin bottomed a little over a year ago. Then it rallied, it went up to $14,000. All the central banks got worried. They knocked it down, and it’s making a comeback.

Bitcoin, in mid-May, is going to halve production. There’s a limited number of Bitcoins allowed to be ever created. The methodology when you mine them is you get new Bitcoins. They’re called genesis or virgin coins. The number of coins you get every time you mine is going to halve. So the supply is going to shrink dramatically. A thought process with that is that Bitcoin will trade higher, probably above $10,000. Bitcoin is very speculative, just like buying Andy Warhol’s art early.

I think that anyone who looks at Bitcoin or Ethereum must recognize that the daily volatility is four times the S&P 500 and gold. Thirty percent of the time gold or the S&P can go up or down 1%. For Bitcoin and Ethereum, it’s 4–5%. Cryptocurrency is a huge secular trend, but it’s going to be volatile.

SR: How do you feel about gold stocks? Are you looking at seniors or juniors or both? What should investors be looking at?

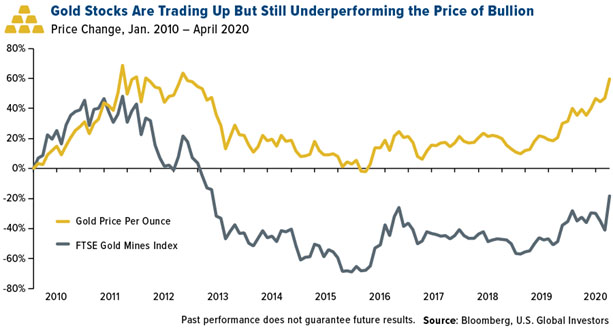

FH: For the first time in a long time, I’m becoming very bullish on gold stocks. I’ve been very negative on gold mining companies for over a decade now, for raising capital and actually destroying value per share. But over the decade, new boards of directors and new chief executive officers have come on, and there’s become a greater discipline on cash flow returns rather than on cash flow, revenue per share growth, cash flow per share growth, rising dividends, all the normal things you buy a Starbucks or any great company for. It’s the capacity to have revenue growth. Mining companies did a lot of silly mergers and acquisitions work, with which they destroyed capital, but that has changed.

During this past decade I’ve been a big advocate of royalty companies, such as Franco-Nevada Corp. (FNV:TSX; FNV:NYSE), Wheaton Precious Metals Corp. (WPM:TSX; WPM:NYSE), Royal Gold Inc. (RGLD:NASDAQ; RGL:TSX). These three had the highest revenue per employee in the world.

Franco-Nevada has a royalty on Newmont Goldcorp Corp. (NEM:NYSE) and Barrick Gold Corp.’s (ABX:TSX; GOLD:NYSE) joint venture assets in Nevada. The revenue per employee at Franco-Nevada is over $20 million. For Barrick or Newmont, it’s $500,000 of revenue per employee. Goldman Sachs has $1 million of revenue per employee. So these royalty firms are very efficient companies. If you look at the past decade, Franco-Nevada has far outperformed Berkshire Hathaway. It has far outperformed any gold stock. It’s because it’s showing revenue per share growth, cash flow per share growth, over the rolling one year over three years on a consistent basis.

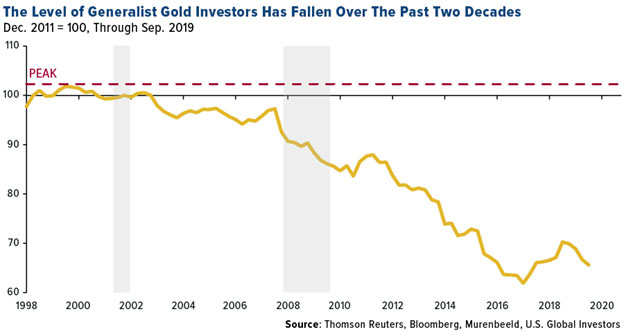

What’s now happening is we have new management for these other gold stocks. The big move in gold stocks occurs when the generalists start to buy the sector. They’ve not been owning the underweight gold stocks because of the bad discipline by management and boards or silly acquisitions. Now what we’re seeing, for the past three years, through the end of March, we’re going to see the one year revenue growth over two years strong. Now you get 36 months of a strong growth in revenue and cash flow from the industry, and all of a sudden, generalists show up. When you start seeing more and more of the stocks in that industry showing free cash flow, the generalists start to show up.

The coronavirus this past quarter hurt the S&P 1500 stocks because the majority of them had free cash flow yields of about 4%, and they got evaporated, obliterated, because of this global shutdown. But the gold stocks didn’t. They actually have rising free cash flow. They’re going to show this quarter the price of gold is up, some of them had shut-ins for very temporary periods of time but their revenue, their cash flow, as a whole is going to truly outshine the overall industry. And when the quants and the fundamentalists start looking at where their growth is, these stocks are going to show up.

I did an analysis of only looking at free cash flow and picked the 10 gold stocks every quarter that had the highest free cash flow yield. And I sold them and bought them every quarter. I far outperformed any gold index. So that discipline shows up as a key metric to attract the quant fund or the generalist. When I look at my data—the two-year number is so important—I’m becoming very bullish on gold stocks.

When we talk about the names, my bias is U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU). I launched this several years ago as a smart quant approach to picking gold stocks. It has three royalty companies that we talked about, Franco-Nevada, Wheaton Precious and Royal Gold. They’re 30% of that ETF. They rebalance every quarter.

Then all the other names, they go down to a $200 million market cap but they have to be able to show the highest cash flow returns on invested capital. Once they do something silly or stupid, they’re thrown out. Back testing, that model has outperformed the VanEck Vectors Gold Miners ETF (GDX) and the VanEck Vectors Junior Gold Miners ETF (GDXJ) just on a basket of 60 gold stocks. This only has 28 names. Since I launched it, it’s far outperformed on a rolling 12-month basis. It’s smart data, and it dynamically recalibrates every quarter.

If you want to buy the individual names, then I would focus on those three big royalty companies. Thereafter, I would focus on those companies that have this metric I talk about, free cash flow yields. Out of the 100 gold stocks in the world that we follow, there are only about 14 of them that really have attractive free cash flow yields. What’s interesting is that Barrick and Newmont—and Newmont’s part of the S&P 500—does have a free cash flow yield that is positive, so you’re seeing it has really done exceptionally well this past quarter because it has an attractive free cash flow yield and has not been hurt by the coronavirus.

SR: Let’s switch gears for a moment. U.S. Global Funds runs the Jets ETF, an airline ETF. Obviously, the airlines have been battered. Do you see them coming back? Do you see bankruptcies?

FH: I think that the government agencies and the politicians have learned a lot from two big corrections: the 9/11 correction and 2008–2009. When you look at this industry, the Federal Aviation Administration says that 1 in 15 people is associated with the airline industry. That’s huge. When you look at the multiplying effect of the airline industry, it’s massive, just as housing is. One dollar for housing is worth $16 approximately. So when it comes to airlines, we’re talking a double digit number of multiplying effect.

What’s happened is that the government has been very smart this time to say we must make sure that we don’t unwind this industry as we’ve done in previous times. So I think there’s going to be a faster turnaround from the bailout policies.

What’s happened with the airlines is they have ancillary revenue that has been very significant in the past five years. Some $20 billion of revenue then went to $100 billion of revenue, which covers a lot of costs. It aggravates you and me when we fly: change fees, baggage fees, but all these fees have let the airlines not be victimized by the price of oil because every time the price of oil went up, airline stocks fell. Every time oil went down, airlines went up. It was this inverse relationship that took place. Oil has represented less and less of ancillary fees. Now what’s happened on this correction is not only the ancillary fees and everything have fallen, but oil has crashed. So airlines’ biggest cost is way, way down. That means when they turn, and they come out of this correction, they have huge upside. Not only do they have the support of the government, they have the ability to start adding on these fees.

Because of the bailouts, airlines are not going to be able to buy back their stocks and they’re not going to be increasing their dividends in this process. But that doesn’t matter. Their revenue capacity per share is explosive. So I think that that’s a very big difference.

SR: Anything else that you would like to talk to our readers about in this period of extreme volatility and uncertainty?

FH: Yes, bad news is good news. There’s the optimism of trying to find who’s going to be the solution to the problem. Had the U.S. Food and Drug Administration and the Centers for Disease Control and Prevention used Google and Amazon technology, they probably could’ve adapted faster to this coronavirus. Amazon hired 100,000 people. It’s amazing that in all that negative news, it adapted the fastest. It’s trying to understand how capital markets morph. There are certain industry leaders. I love Clorox. I don’t think that stock is going to be given away. I think it’s one of those just steady dividend payer and growing dividend stocks. So it’s in the negative news where you can find opportunities besides airlines, besides gold. You can turn around and find these other pockets.

SR: Thank you, Frank. I appreciate your time today.

Frank Holmes is CEO and chief investment officer at U.S. Global Investors, which manages a diversified family of funds specializing in natural resources, emerging markets and gold and precious metals. In 2016, Holmes and portfolio manager Ralph Aldis received the award for Best Americas Based Fund Manager from the Mining Journal. In 2011 Holmes was named a U.S. Metals and Mining “TopGun” by Brendan Wood International, and in 2006, he was selected mining fund manager of the year by the Mining Journal. He is also the co-author of The Goldwatcher: Demystifying Gold Investing. More than 30,000 subscribers follow his weekly commentary in the award-winning Investor Alert newsletter, which is read in over 180 countries. Holmes is a much sought-after keynote speaker at national and international investment conferences. He is also a regular commentator on the financial television networks CNBC, Bloomberg, BNN and Fox Business, and has been profiled by Fortune, Barron’s, The Financial Times and other publications.

Disclosure:

1) Patrice Fusillo conducted this interview for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this interview are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Frank Holmes: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: N/A. I, or members of my immediate household or family, are paid by the following companies mentioned in this article: HIVE Blockchain Technologies. My company has a financial relationship with the following companies mentioned in this interview: N/A. Funds controlled by U.S. Global Investors hold securities of the following companies mentioned in this article: Mene Inc., Franco-Nevada Corp., Royal Gold Inc., Wheaton Precious Metals, Newmont Mining, Barrick Gold Corp. I determined which companies would be included in this article based on my research and understanding of the sector. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Franco-Nevada and Newmont Goldcorp, companies mentioned in this article.

( Companies Mentioned: FNV:TSX; FNV:NYSE,

MENE:TSX.V; MENEF:OTCMKTS,

RGLD:NASDAQ; RGL:TSX,

WPM:TSX; WPM:NYSE,

)

Shutdowns have left the industry in the worst state it has ever been, and now a program to aid in the relief of restaurants is “desperately needed”… by Franz Walker […]

The post Largest Food Service Distributor In US Warns Of Hard Times As Coronavirus DECIMATES Restaurant Industry appeared first on Silver Doctors.