Source: Clive Maund for Streetwise Reports 05/04/2020

Technical analyst Clive Maund charts the markets and discusses what he believes is ahead for stocks, the dollar and commodities.

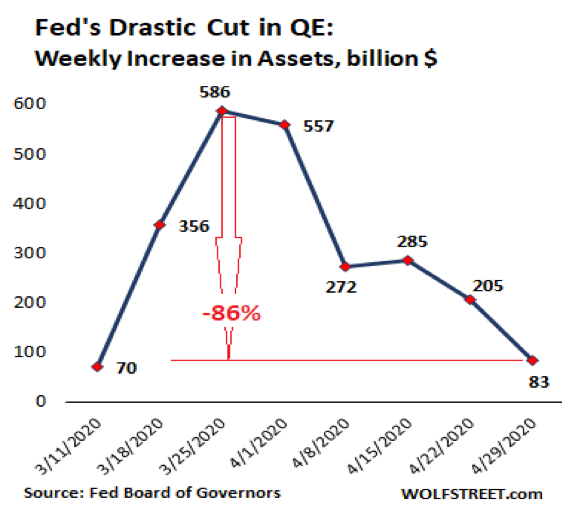

Notwithstanding the Fed’s seemingly limitless ability to create money to throw at the stock market, which has caused it to rally in recent weeks in the face of a dead economy and apocalyptic jobs data and earnings, etc., all the charts we are going to look at here point to another severe downleg soon.

My attention was drawn to a bearish Rising Wedge completing in the London FTSE index by a colleague in England. So I took a look at it, and sure enough it is. So, I thought I’d take a look at a couple of other European indices, the CAC 40 in France and the German DAX Composite, which showed a very similar picture. Their charts are shown below and as you will see, they are both very bearish, and point to a break lower soon leading to a severe decline.

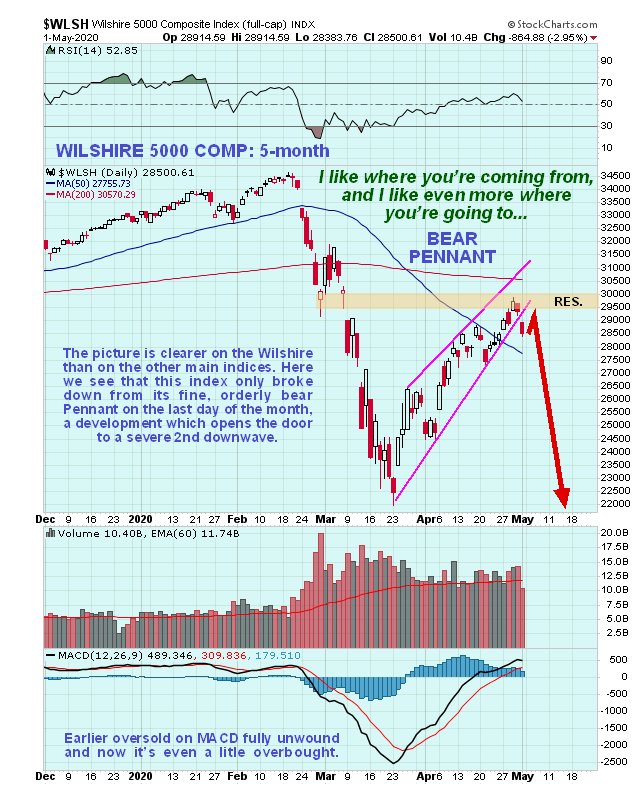

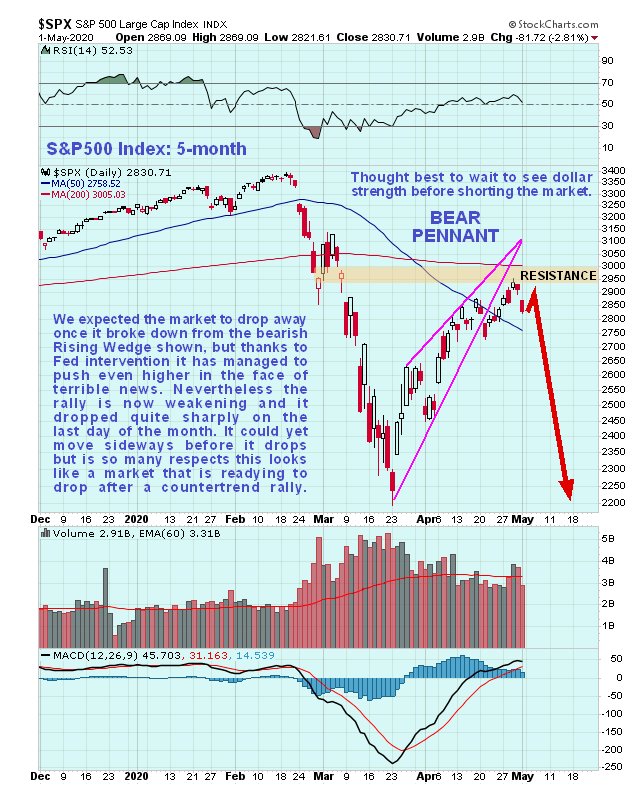

You will recall that we were thrown somewhat a week or two ago, when the main U.S. indices, the Dow Jones Industrials and the S&P500 index, broke down from their bearish Rising Wedges but then didn’t follow through, and instead rose to new highs for the rally from the March lows, which caused us to dump our Puts and then bide our time to see what transpired. The sharp drop at the end of the month—this past Friday—jolted me into action and prompted me to hunt around in a quest for greater clarity regarding what is going on, and it has turned out to be a rewarding search.

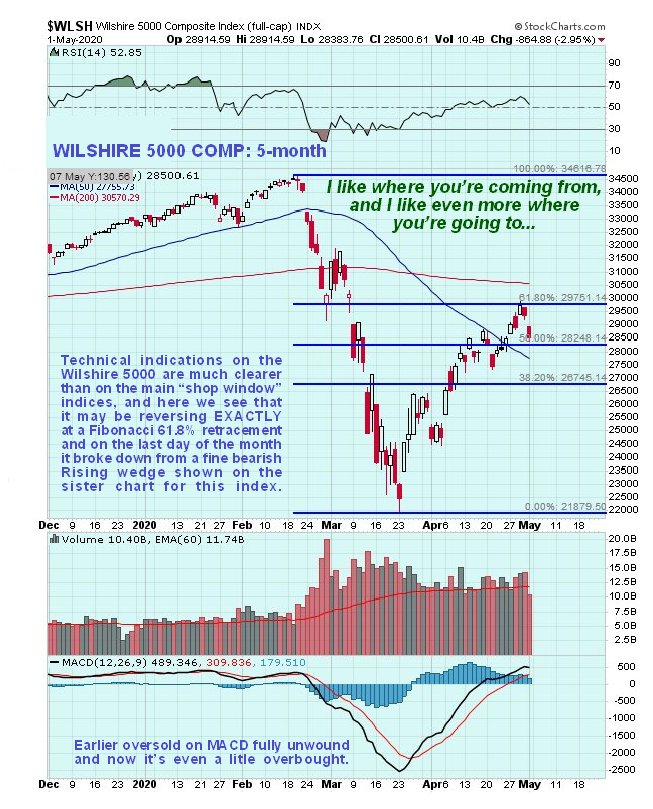

While it’s not exactly clear what is going on with the main U.S. indices, the picture becomes much clearer when we look at the broader but much less used Wilshire 5000 index. Take a look at this first of all—it’s a 5-month chart for the Wilshire 5000 that reveals that it didn’t break down from its Rising Wedge about 10 days ago, unlike the Dow Industrials and the S&P500 index, but it did last Friday, which happened to be the end of the month, by a significant margin. This is regarded as an ominous development that probably marks the start of the second major downleg of this bear market. We can also see that the countertrend rally got stopped by the important resistance level shown.

Now take a look at this. The following chart shows that the breakdown from the Wedge happened just two days after the Wilshire 5000 had arrived at an upper range Fibonacci target at a retracement level of 61.8% of the preceding first leg down of the bear market. This is normally as far as a retracement following the first leg down of a bear market gets, and the same happened following the Tech bubble peak in 2000 and the start of the 2007–2008 meltdown.

If we now compare the Wilshire charts above with the S&P500 index chart we realize that the breakdown by the latter about 10 days ago was a false breakdown, inasmuch as, as we have just seen, the Wilshire did not break down at that time.

If we see another heavy drop in the broad stock market shortly, it is of course reasonable to presume that it will coincide with a strong rally in the dollar, so how does that look now? On the following 5-month chart for the dollar index, which has the S&P500 index placed above and gold below for direct comparison, there are several very important points to observe. The first is that when the market tanked into mid-March, the dollar soared just as we would expect it to and as happened in 2008. Then it dropped back sharply later in March as the market rebounded, but it has since been tracking sideways in a trading range marking time as the stock market continued to ascend to complete its relief rally. Right now it is at the support at the bottom of this range where a doji candle formed on Friday suggesting that it is about to start higher again. If the market now proceeds to tank in a second major downwave then we can expect the dollar to soar again, bust out of the top of the current range and probably exceed its mid-March highs.

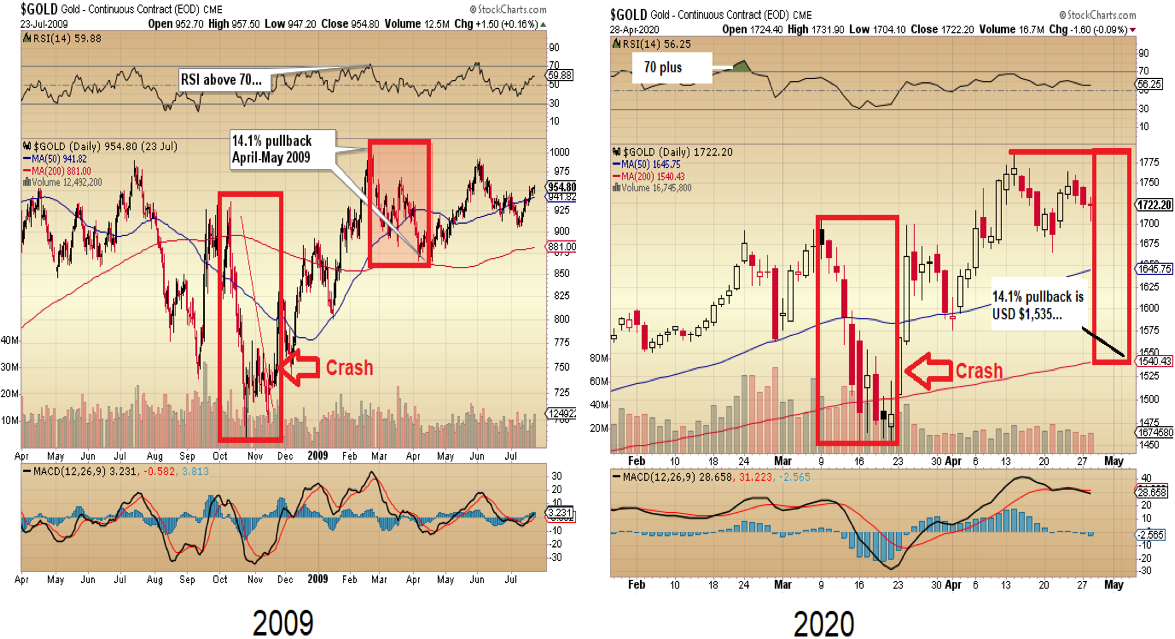

If the dollar soars then commodities are likely to take another broadside, just as in the first half of March, and just as in 2008, and gold and silver are unlikely to be spared—the Gold Miners Bullish Percent Index is now at an extreme reading of 92% bullish. Copper in particular looks like it will get crushed by another downwave that should take it to new bear market lows by a wide margin.

Originally posted on CliveMaund.com at 4.35 pm EDT on 2nd May 2020.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years’ experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.