Author: Gold News Club

The past few weeks have brought unprecedented volatility to the bullion market.

In addition to wild swings in spot prices, Money Metals has experienced a massive surge in demand and extreme strain on supply, leading to a spike in premiums (on both bids and asks).

These are stressful times for everyone, to be sure. But precious metals investors can rest assured physical bullion has always, and will continue to, represent real value during turbulent times.

Case in point, while virtually all other assets have crashed, gold has stayed firm near its recent highs.

Many longtime gold and silver holders – as well as potential new buyers seeking safe haven – have been reaching out to us with questions and concerns. Here we will answer a few of the most pressing ones for the benefit of a larger audience…

Will precious metals dealers be able to operate during this national emergency and remain in business throughout it?

Yes, but… sadly, not all dealers will make it through the crisis. Local coin shops could be ordered to shut down for weeks or perhaps even months in some states.

Meanwhile, national dealers that have failed to properly hedge against extreme market volatility and/or secure enough inventory to fulfill orders could be getting into trouble right now.

At least one major U.S. dealer has stopped taking orders altogether and many others have been outright refusing to accept orders under $300 in response to their operational challenges.

To be fair, this is a challenging environment in which to operate, but it is especially critical during these times that you do your homework on any dealer before placing an order. Check out their reputation on the internet and with the Better Business Bureau.

Make sure a dealer has customer service available online and by phone. Also make sure their order delivery timeframe is reasonable (delays of up to a few weeks on many popular bullion products should not necessarily be cause for alarm until such time as market conditions normalize).

Money Metals Exchange has built an industry-leading reputation for customer service and satisfaction. We have made necessary adjustments to our business during this coronavirus crisis, including beefing up our customer support and order fulfillment infrastructure to handle surging order volumes (more than four-fold!) Our company is well positioned to emerge from this economic turmoil stronger than ever.

How can I buy physical bullion without having to pay an elevated premium over spot prices?

All gold and silver bullion products, except in some cases very large bars, have seen premiums spike due to rising demand and insufficient production from mints.

To reduce the premium you pay over spot, normally you would opt for bars or rounds over American Eagles. However, the U.S. Mint temporarily suspended production on these popular coins, and private mints have also sold out of bars and rounds, resulting in shortages across the board.

To obtain physical metal at the absolute lowest cost currently available, consider Vault Silver and Vault Gold.

Through our new Vault Metals storage program, you can obtain ounces of .999+ pure silver or gold stored securely in your name. Premiums start at just $1/oz for silver and $5/tenth oz ($50/oz) for gold. (For now, we have an order minimum size of 200 silver ounces or two gold ounces.)

What if I need to sell my coins, bars, or rounds?

The bullion market remains liquid. In fact, precious metals dealers are now desperate to acquire inventory and will be happier than ever to buy from customers actually willing to sell.

In recent days, Money Metals has repeatedly raised its buyback prices versus spot prices as a reflection of scarcity-driven premiums on coins, bars, and rounds. So please go to any product page and sell us your items if you wish – or call 1-800-800-1865.

With all assets subject to being liquidated during panic selling sprees, why should we expect precious metals to perform any better than the stock market at this point?

Let’s take a step back and review where stocks and metals stood before the coronavirus crisis got us to this point.

In February, the S&P 500 was trading at a record high in of one of the longest bull markets on record.

Valuations had gotten extremely stretched and stocks were priced for perfection. When the economy suddenly grinded to a halt, stocks were bound to crash.

Gold and silver, on the other hand, haven’t traded at record highs since 2011. Silver in particular was already extremely depressed in price as the stock market began to nose-dive.

When the indiscriminate forced selling subsides, undervalued assets with strong fundamentals will begin to diverge from the broad market and outperform. We saw a bit of that on Monday, with gold and silver each up about 5% on a day when the S&P 500 dipped 3%.

Will the Federal Reserve be able to rescue the economy?

No amount of money printing can rescue an economy that remains shuttered due to an exogenous threat outside of the financial system. But that won’t stop the central bankers from trying!

The real unknown is what happens when the economy finally does restart with trillions of newly printed dollars having just been pumped into the financial system.

We have never seen a Quantitative Easing this fast and this furious attempted before.

The potential exists for a massive demand surge, with too many dollars chasing too few goods. In other words, the recent deflation scare could reverse violently and leave the economy with a massive inflation problem.

But until we “flatten the curve” of COVID-19 infections and get the world working, traveling, and consuming again, the inflation created by the Fed will stay mostly bottled up in government and now also corporate bond markets.

Precious metals can be expected to serve as a leading indicator of future inflation. Gold and silver prices can begin rising well ahead of a recovery in the real economy.

Source: Clive Maund for Streetwise Reports 03/25/2020

Technical analyst Clive Maund considers the opportunities posed by recent market and fiscal news.

In recent days the Fed has made it plain that it is prepared to buy anything and everything to prevent imminent total collapse, and you don’t have to join many dots to see that this will extend to buying stocks. It’s not that hard for them—all they have to do is enter a few keystrokes, add a few 0s and it’s sorted—and as Gregory Mannarino repeatedly points out, the more debt they issue the more powerful they become.

Right now sentiment is “end of the world” negative, and any positive development will be enough to trigger a gargantuan, self-feeding, short-covering rally. Gold’s huge recovery is a sign that this may be about to start.

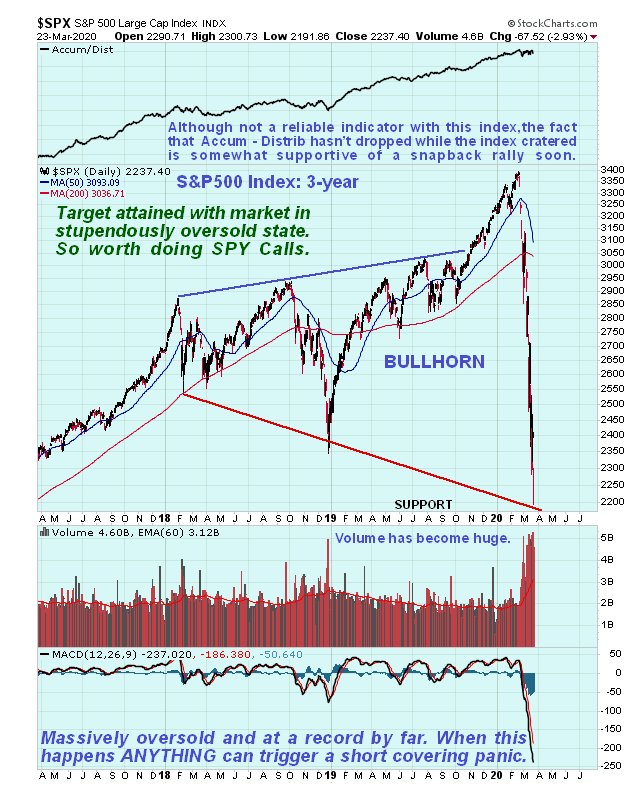

It is, therefore, most interesting to observe on our 3-year chart that the S&P500 index has just hit our long-held target at the bottom of its giant bullhorn pattern, and it has done so with the market in a stupendously oversold condition—at a record, by far.

The conditions are therefore believed to be ripe for a screaming, short-covering rally, and the only question is whether it happens immediately or after some volatile zigzagging around in the vicinity of these lows. Action in gold suggests that it will happen almost immediately. Anything that causes a shift in investor perception could trigger it, and once it starts it could be unstoppable for a while, as shorts race for cover.

The conclusion to all this is that this may be an excellent time to “put our best foot forward” and do calls in the broad market, for which purpose we can use the S&P500 proxy (SPY), whose chart is shown below for the same time frame. On this occasion it may be worth doing the trade in reasonable size, but again, don’t go overboard and bet the farm.

Look at it this this way—there is considered to be 50% chance of a sudden, scorching, snapback rally, and if it works, the options we are looking will rise about fourfold or more. The whole thing could burn out and reverse to the downside again quickly, but by that time we will be out, if things go to plan.

Just because the market rallies here or soon won’t mean the bear market is over. Although the rally could happen immediately, it might be preceded by some base-building, which is why we should go out a few weeks with the options.

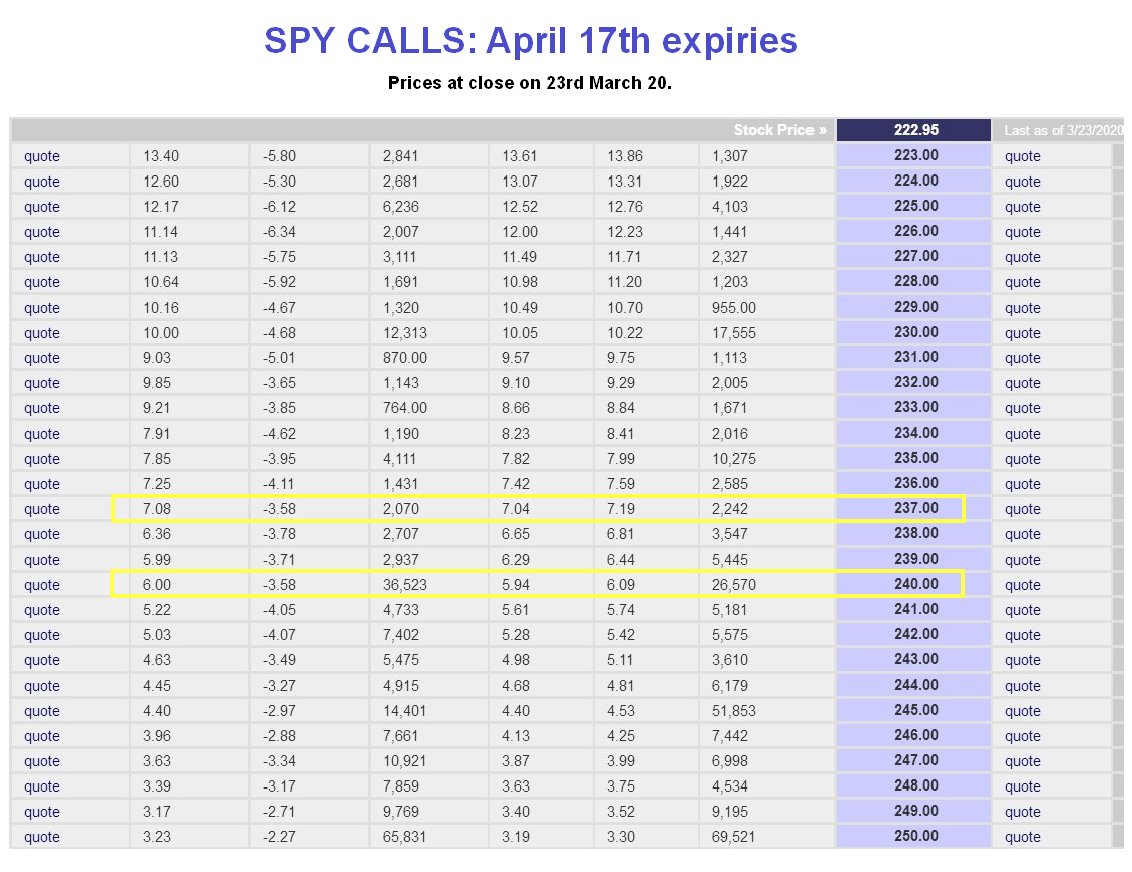

An SPY March 17 expiry options table is shown below, and you can choose any series to suit yourself, if interested. A couple of suggestions have been highlighted on it.

Table courtesy of bigcharts.com

With futures showing the Dow set to open up about 930 points, it may be best to buy some soon after the open, and then wait for an intraday dip to do more, bearing in mind that there may not be a dip.

End of update. Posted on clivemaund.com at 9:20 a.m. EDT on March 24, 2020.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years’ experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

With Heroes Like This, Who Needs Villains?