Author: Gold News Club

Gold Fields’ operations and Covid-19

Money Metals has gold and silver! In fact, while other dealers are sold out, we now have both metals at very low premiums (silver for $1 or less over spot, for example).

Here’s what’s happening…

- Recent days’ intense market demand has quickly soaked up virtually all available worldwide supplies of hold-in-your-hand silver – rounds, coins, and bars.

- Gold coins, rounds, and bars have become scarce, too, especially when it comes to Money Metals’ less prepared or under-capitalized competitors.

- These shortages mean that while spot prices are sharply lower on both metals, most precious metals dealers are asking for significantly higher premiums on all products because their cost of sourcing has also risen.

Many precious metals investors have also been forced to endure delays and disappointment, as the most popular products are on backorder, shipping delay, or are simply sold out.

But that is NOT what we want for our Money Metals customers. First, we’re proud to say we have an ample supply of most popular gold and silver coins – and at lower premiums than the others!

And today we are pleased to announce a brand new solution – actual physical gold (.9999 pure) and actual physical silver (.999 pure) in the absolute lowest-premium form that exists anywhere in the retail market, by far.

We’re talking about Money Metals’ new Vault Gold and Vault Silver offerings – allocated fractional interests in exchange-sized bars of 400 troy oz gold and 1,000 troy oz silver. The bars are held in our vault and allocated in your name, in your own Money Metals Depository account.

Let’s be clear why we are doing this – under current market conditions, large commercial bars are the only way in America to get physical gold and silver near the spot price.

No other major precious metals dealer in America offers this easy, low-cost option; it’s the latest example of how Money Metals innovates to serve you, our cherished customer, in any market circumstance.

Your Vault Metals storage account holds the form of metal preferred by financial institutions and mints. They are the raw material from which coins, rounds, and bars are typically fabricated –

It’s actually possible to hold a vault silver bar if you use both hands – and if you can even pick it up. A single 15″ x 6″ x 4″ bar weighs 65 pounds. They are hard to move and are best kept inside a secure depository to prevent the need to re-assay. For these reasons, individual investors generally do not take personal possession.

A 400-ounce gold vault bar is smaller and a bit easier to handle at “only” 25 pounds. But you may want to have a few armed guards nearby if you’re planning to hold one, as a single bar is worth over $600,000!

The substantial size – and per-unit price – of these bars actually work to your advantage in this market. The bars are quite easy for Money Metals Depository to get and store, but not so much for consumers, therefore there are plenty available to us.

That’s why we came up with this new form of precious metals investing – to end the shortage, and to offer you very low premiums.

Simply visit Money Metals now to lock in actual physical Vault Gold in 1/10th ounce increments for as little as $4 over spot – or Vault Silver in one-ounce increments for as little as 90 cents over spot!

This is a storage-only product and you will be prompted to sign a storage agreement with Money Metals Depository, which will involve a minimum $96 annual storage fee.

There are also order minimums of 200 oz of silver or 2 oz of gold. However, you can purchase up to $50,000 online, and there’s virtually no limit if you call 1-800-800-1865.

Instead of taking possession of these large and expensive bars, you’ll obtain titled allocated fractional interests in gold vault bars, silver vault bars – or both – through Money Metals.

You can hold your allocated interest long term, or liquidate it for small bars, coins, or rounds later when premiums finally come down.

So skip the lines, the shortages, and high premiums with our Vault Silver and Vault Gold offerings!

The combination of low spot prices in this market – and ultra low premiums through this new Money Metals offering – mean you’ll pay the lowest price per ounce you’ve seen in years, in decades, or possibly even in your lifetime.

Learn more and place your order by visiting our pages for Vault Gold or Vault Silver.

Or call 1-800-800-1865.

Source: The Critical Investor for Streetwise Reports 03/23/2020

The Critical Investor takes a deep dive into this explorer’s projects, joint venture and financing.

Alianza Minerals Ltd. (ANZ:TSX.V) was ready for its Phase II drill program at its fully owned flagship Haldane silver project, after their Phase I drill target defining program was completed earlier during the summer of last year. The company has been busy raising additional cash for 2020 exploration, and it started out with a small financing of $250,000 at 5 cents per unit on January 30, 2020. This wasn’t really impressive, but the same financing ended up being oversubscribed unexpectedly to no less than $1.1 million during February, which you don’t hear too often for tiny explorers, and provides Alianza with enough cash for Haldane for the remainder of this year.

The timing of this financing was near perfect, as the coronavirus started to wreak havoc on the world directly after this, and is on its way to paralyze the entire world economy now, as countries are shutting down the borders, and entire sectors deemed non-vital in many countries are being shut down at the moment, including mining operations in countries like Peru most recently, which declared a state of emergency. Other countries are likely to follow suit soon.

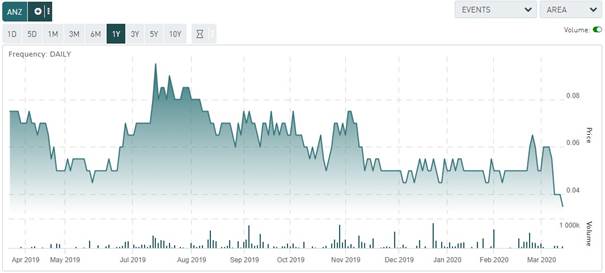

As a consequence, a recession is becoming more and more likely for this year according to many analysts, although a recession already was in the cards based on many indicators. As I believe this myself as well, I see the virus combined with the oil move of Saudi Arabia and Russia as a perfect storm type catalyst for an accelerated initiation of a recession. So far, Alianza Minerals hasn’t been hit directly by the virus, as in staff being infected, although President and CEO Jason Weber and Executive Chairman Mark Brown visited the last PDAC convention in Toronto. The share price has been another story, as hardly any stock has been immune to the latest market meltdown:

Share price Alianza Minerals; source tmxmoney.com

Fortunately fundamentals of the company are only improving, so the opportunity presented keeps getting better in my view. Another development illustrates this further, as the other important news of this new year so far was that Alianza Minerals managed to reel in Coeur Mining in January to do a JV on one of its properties. The option agreement relates to a Letter of Intent where a wholly owned subsidiary of Coeur Mining can earn an 80% interest in the property by (i) funding $3.55 million in exploration over five years and (ii) making scheduled cash payments totaling $575,000 over eight years. Coeur must also fund a feasibility study and notify Alianza of its intention to develop a commercial mine on the property on or before the 8th anniversary from the date of notification of the class 1 exploration permit.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Management was obviously very pleased with the increased raised amount, as Jason Weber, president and CEO, commented: “Management appreciates the support of shareholders and participants in the current financing, enabling us to significantly expand the placement. We are very much looking forward to 2020 and our first drill program in Nevada with our partner Hochschild PLC in April.”

They had no clue the additional amount was coming in, as they tried for months, but were pleasantly surprised.

This 5c round involved a full warrant, which is something I don’t really like to see for dilution reasons, but in these—at the time of the raise—already dire times, a half warrant was too much to ask for apparently. This warrant is valid for three years and is exercisable at 10c.

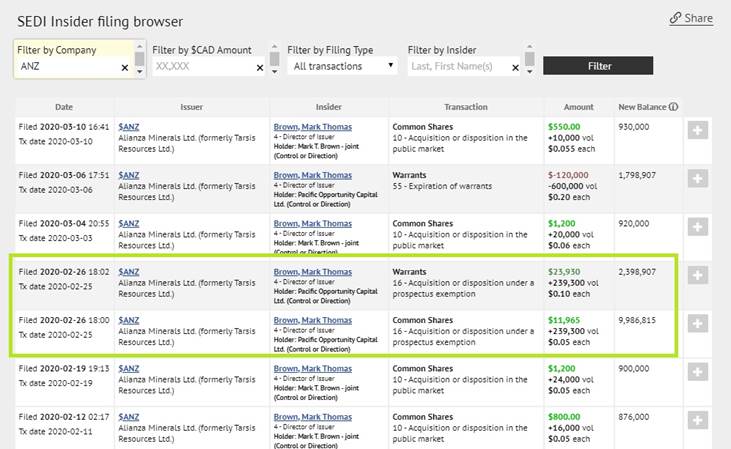

Finder’s fees of 7.5% in cash and 7.5% in finder’s warrants were paid to eligible parties, amounts weren’t disclosed. Mark Brown, one of the largest shareholders, participated a bit in this offering, as can be seen here:

The proceeds of this round will be used for working capital, general expenses and exploration at the Haldane project, as stated by Jason Weber:

“With Alianza’s working capital covered for 2020 and into 2021, we are in an excellent position to build upon the upcoming drill program with Hochschild at our Horsethief Gold Project in Nevada, and advance or option out additional projects. Exploration expenditures in 2020 will exceed $1.5 million with the majority of that funded by our partners.”

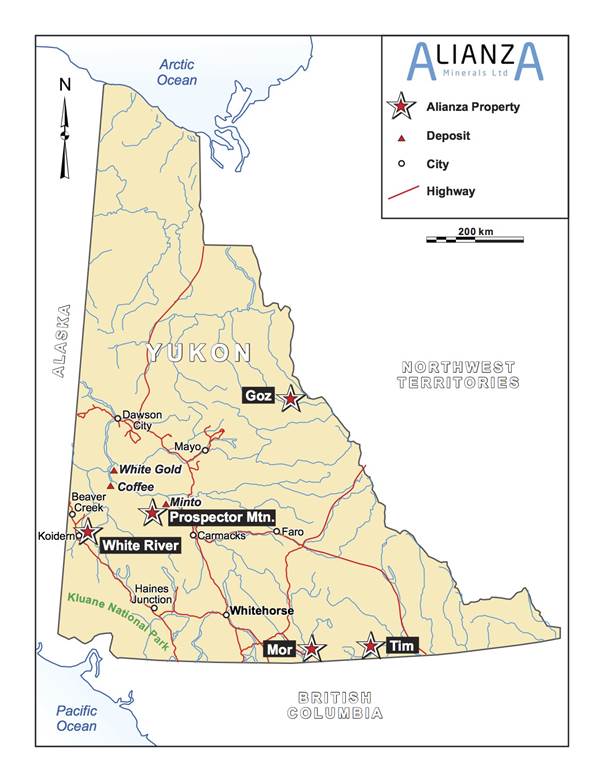

Earlier on at the end of January, Alianza Minerals signed an option agreement relating to a Letter of Intent (LOI) with a wholly owned subsidiary of Coeur Mining, to explore the road-accessible Tim property in the southern part of Yukon. Exploration at Tim is targeting high-grade silver-lead mineralization similar to that being mined by Coeur at its Silvertip operation, located 12 kilometers south of the property.

Coeur can earn an 80% interest in the property by funding C$3.55 million in exploration over five years and making scheduled cash payments totaling C$575,000 over eight years. Coeur must also fund a feasibility study (FS) and notify Alianza of its intention to develop a commercial mine on the property on or before the 8th anniversary from the date of notification of the Class 1 exploration permit.

“We are very pleased to have partnered with Coeur to advance the Tim Silver Property,” stated Jason Weber, president and CEO of Alianza Minerals. “Tim looks to be a Silvertip analog, and the Coeur team is an obvious choice to move the project forward. It will be a great advantage to have Coeur’s geological expertise applied to the project.”

As described in earlier analysis about Alianza, it was basically decided on a coin flip whether Tim or Silvertip was to be explored and developed, because of the similar characteristics. The Silvertip analog isn’t going to be smooth sailing though. The operating high grade Silvertip Mine in British Columbia didn’t immediately turn out to be the valuable asset Coeur thought it would be, as it had to impair Silvertip massively in their Q4 financials:

“- $250.8 million impairment, and temporarily suspending mining and processing activities at Silvertip – Reduction in carrying value to $150.0 million and temporary suspension of mining and processing activities driven by further deterioration in zinc and lead market conditions as well as processing facility-related challenges. The Company plans to (i) double its exploration investment in 2020 to potentially further expand the resource and extend the mine life, and (ii) pursue a mill expansion to improve the asset’s cost structure and its ability to deliver sustainable cash flow.”

Keep in mind the Silvertip Mine was valued by Coeur at US$400 million but acquired for US$250 million (US$200 million in direct payments and US$50 million in milestone payments) from a partnership between Denham Capital and JDS Silver in September 2017. JDS Silver is closely related to JDS Energy and Mining, who did the economic studies, engineering and contracting on this project, as represented on their website:

“JDS, as the general contractor, completed the construction of the Silvertip mine located on the Yukon-British Columbia border. JDS also completed the Preliminary Economic Assessment of the Project which provided the client with preliminary engineering and development plans as well as and economic information that provided an initial view of project viability and a guide for advancement of the project. Consistent with the JDS formula for value addition, the work performed identified the most practical and profitable direction for project development JDS is currently managing all aspects of the mine construction as lead EPCM provider.

JDS is also currently working on providing support for the Silvertip Project paste plant design and construction with the use of equipment from the Diavik Diamond Mine. JDS was also responsible for the teardown and demobilization of the equipment at its prior to transporting to the Silvertip site.”

JDS Silver began construction in December 2015 and began production in October 2016, which was halted in 2017 due to ramp-up issues. After the acquisition by Coeur, production efficiency was improved and commercial production restarted again at the end of 2018, but problems started to surface during 2019 as production remained below target primarily due to extended planned downtime, which was implemented to complete key projects targeting improved mill availability. It all didn’t really work out, as an impairment analysis generated the massive devaluation conclusion based on a slow ramp-up, weaker-than-forecast zinc and lead prices, and significantly higher treatment charges for zinc and lead concentrates. A new plan for increased production and resource expansion has been launched by Coeur, showing the invalidity of both resource and mine plan from earlier stages.

As the new owner of Silvertip, which has a relatively limited resource and likewise mine life, Coeur could have an interest in Tim to develop it as a backup resource, if Silvertip exploration doesn’t generate the desired resource expansion. If Tim results in an economic resource, it could at the very least serve as an extra source of ore for the Silvertip mill and processing plant. Of course the hypothetical Tim resource would need to have the same metallurgy otherwise Coeur would have to install a different flow sheet at the processing plant, increasing sustaining capex further. According to Weber, the potential for likewise metallurgy is one of the reasons Coeur is keen on Tim, as it sees the same units and style of mineralization so it feels the metallurgy has a good chance to likely be similar.

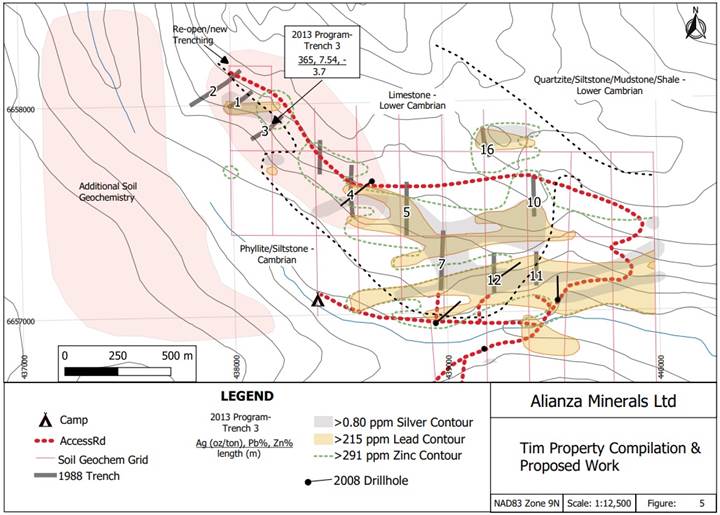

The 2020 exploration program at Tim is expected to target high-grade silver-lead-zinc Carbonate Replacement Mineralization (“CRM”), similar to that found at Coeur’s Silvertip operation. Coeur’s tentative exploration plans are in-line with those recently announced by Alianza, and will consist of detailed mapping, soil geochemical surveys and reopening old trenches, which date back to 1988.

As the corona—or COVID-19—virus is impacting mining operations everywhere, I asked CEO Jason Weber if exploration programs for his projects would be affected. He answered the following: “At this point in time we are proceeding with plans for our projects. The length and degree to which business and travel is limited by the virus mitigation methods enacted by the U.S. and Canadian governments is the largest factor, but we want to be ready to start projects as soon as is safe to do so.”

Alianza Minerals already worked on the Tim project in the past, as early as 2008 in a JV with International KRL Resources, and never lost interest in it, despite silver prices crashing from US$30-45/oz levels since then. Besides this, silver got hit extremely hard the last few weeks, and is trading in the US$12/oz range now, which is a level not seen since 2009.

Unfortunately, drilling by KRL in 2008 didn’t hit any interpreted carbonate-replacement style mineralization associated with identified IP anomalies, and the property was returned to the predecessor of Alianza Minerals later that year.

In 2013, Alianza funded a small program to complete a focused work program and re-evaluated a historical zone of silver-lead rich Carbonate Replacement Mineralization (CRM) originally exposed by mechanized trenching in 1988. Historical chip sampling across the zone returned 352 g/t silver and 9.12% lead across 4.00 meters. In addition to this exposure, similar mineralization was also reported in adjacent trenches. This zone has never been tested with drilling. Alianza resampled the central trench in 2013, returning 3.7 meters assaying 365 g/t silver and 7.5% lead from a channel sample, which was a decent sampling result.

Three series of sawn channel samples were taken across the exposure at approximately 1 meter spacing between channels. Weighted average assays for each of the channel series are shown below and are interpreted to be near true width:

|

Channel |

Interval (m) |

Silver (g/t) |

Lead (%) |

|

Central |

6.40 |

220 |

4.74 |

|

Including |

3.70 |

365 |

7.54 |

|

including |

0.70 |

976 |

8.32 |

|

West |

2.70 |

269 |

8.23 |

|

including |

0.70 |

829 |

7.94 |

|

East |

2.50 |

280 |

10.28 |

Drilling on the property targeted IP geophysical anomalies again, but unfortunately didn’t return any economic results. However, according to management, at least some of the holes appear to be drilled parallel to mineralization. Further mapping and soil geochemical work is required to gain a better understanding of the structural and stratigraphic setting and how that relates to both IP and soil geochemical data. Ideally, that would lead to the identification of thick receptive carbonate horizons interacting with structure to produce potentially economic CRD mineralization. With a better understanding of the geology of the nearby Silvertip Mine, mapping may allow for a reinterpretation of the geology in the context of Silvertip.

I was wondering how Tim and its sampling/IP results resembled Silvertip, how exploration progressed Silvertip from discovery into a resource, if and how this strategy could be useful (or not) for Tim, and what Alianza hopes to find when drilling Tim out further. Jason Weber stated that he is planning a tour of the Silvertip Mine and surrounding exploration targets this summer. This will help tie together the geology at Tim and the Silvertip Mine. Coeur has been very pleased with their brownfields exploration on site and believes there is excellent potential to add significantly at the Silvertip Mine and find a resource at Tim. The exact specifics of comparable geology aren’t ready to be disclosed to the public yet.

I am looking forward to exploration programs at Tim, and according to Weber Coeur was planning to get on site this spring. Coeur is the operator.

Until recently, the Haldane project in the Yukon has seen the most work. According to Weber, exploration programs for this project will likely consist of some additional groundwork including soil geochemistry and trenching and later drilling and this will start in the summer. Plans are still in the initial phase as the 2019 program data is still being evaluated. Besides Haldane, the company also had a JV with Hochschild in Nevada, initially involving three projects. The Horsethief property is considered the most prospective and remains active, the BP and Bellview projects were recently returned.

When I talked to Jason Weber the last time, he stated that Horsethief hosts five primary drill targets, of which four target areas are defined by surface exposures of altered carbonate rocks and one target at depth, interpreted from induced polarization (IP) and resistivity geophysical surveys. Management has been working with Hochschild’s technical team to prioritize these targets for a 2,500 meter drilling program in 2020. The original plan was to start drilling Horsethief in October/November of this year, but this plan was already deferred into Q1, 2020 as Hochschild was re-prioritizing exploration programs across the board, and now the coronavirus is kicking in, things have changed again. According to Jason, they are still targeting a spring startup but may be affected by the virus mitigation efforts. The plan is for a 3,000 meter program in 10 holes starting in May. The company intends to have logistics in place to commence the program as soon as it safe to do so if startup is indeed delayed.

Conclusion

Alianza Minerals did very well to raise C$1.1 million in February, much more than anticipated and right before the coronavirus outbreak, effectively crippling all money-raising efforts for most companies. Of interest is the new Coeur JV regarding the Tim project, which has all the hallmarks of a Silvertip analogy, notwithstanding the fact that Coeur has issues to optimize operations over there, not helped by a lowering silver price lately. Exploration at Tim will start at this spring. The company is also preparing step out drilling after the winter break at Haldane, and the Horsethief project is awaiting a drill program in May if conditions permit, with Alianza being the operator. So despite the corona pandemic, Alianza doesn’t seem to be hampered a lot, and their JV partners simply continue operations and exploration programs, of course by following precautionary measures wherever applicable, as health of staff is a primary concern. Results of the various programs should start to come in around June/July, and although sentiment for anything equity-related is at a low right now, Alianza Minerals has two good chances of hitting economic intercepts.

I hope you will find this article interesting and useful, and will have further interest in upcoming articles on mining. To never miss a thing, please subscribe to The Critical Investor’s free newsletter, http://www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer: The author is not a registered investment advisor, and currently has a long position in this stock. Alianza Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.alianzaminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor’s disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Coeur Mining, a company mentioned in this article.

Charts and graphics provided by the author.

( Companies Mentioned: ANZ:TSX.V,

)

The Depravity of the False Flag

Source: Michael Ballanger for Streetwise Reports 03/23/2020

Sector expert Michael Ballanger describes what he believes is really behind the market crash.

“Never let a good crisis go to waste.” —Sir Winston Churchill

My late older brother Donnie was a quasi-anarchist tax collector for the Canadian government who self-educated himself and then morphed from a grumbling, cynical security guard/starving artist to a very successful 20-year career auditor with the Canada Revenue Agency (CRA) before his untimely passing in 2014. Within weeks of the 9/11 terrorist acts that brought down the Twin Towers in New York City in 2001, he summoned me for a beer conference at the local suds parlor in the West End of Toronto. Holding court for around an hour and a half and three pitchers of local stout, he set about to convince me that all those aircraft slamming into major American landmarks of symbolic importance could only have been a “false flag” operation that was the design and execution of the American government.

His cynicism could be aggravating at times, but it was never, ever without argumentative substance. It was only until after the second Gulf War and subsequent confiscation of Iraqi oil fields, and the almost twenty-year “War Against Terror,” that evidence has come to light that in retrospect makes Donnie look somewhat clairvoyant.

Saudi terrorists carrying out multiple terrorist missions invoking massive retaliation against Iraq and Afghanistan might appear somewhat “misdirected,” but that is a discussion for the beer tent and not today’s microphobic maelstrom. The point is that all one sees may not be what it appears to be, and with markets melting down in a conflagration of fund redemption and debt liquidation, it is important to ask whether or not the arrival of a viral pandemic was the actual source of the financial implosion.

Could it not have been something else?

If one turns the pages in the Book of Bond Insolvency back to last September, every single release from the U.S. Department of Commerce was upbeat; everything coming from the Fed was positive; and stocks around the world were shrugging off the Trump Trade War, the woes of Deutsch Bank, the ever-ballooning U.S. deficit, and the extreme overvaluation (by all measures) of the global markets. In what I penned as “the greatest fiscal policy about-face in history,” I asked in October 2019 “what exactly it was that Jerome Powell saw that spooked him into a sudden series of multibillion- (then trillion) dollar liquidity injections?”

We now know that these “liquidity problems” originated, once again, in the C-Suites of the Wall Street banks, because we know now from statements from JPMorgan CEO Jamie Dimon that banks were having a few “issues” lending to one another. A booming economy with stocks at record levels and a president firing off numerous self-congratulatory tweets with deal flow booming and the banks are having “issues” lending to one another?

As followers of this missive know all too well, I am a full-on cynic of the highest order and not without justification. My lifelong hero of history, Sir Winston Churchill, underscored peak cynicism by offering the quote “Never let a good crisis go to waste,” in reference to taking of advantage of voter anxiety in order to advance a silent agenda or “false flag.” The actions of the Fed last fall were baffling to me, and as REPO ops began to balloon in the final days of January, it was the bond market’s crashing yields that I addressed in my February e-mail alert, not some Asian flu, that accelerated my shorting campaign that was looking really quite foolish until late February.

So, when I look at the slag heap of failed dreams and faulty assumption lying in ruin and despair on the floor of the New York Stock Exchange, I am today asking whether it was really the COVID-19 outbreak that caused the meltdown or is it the cover story that now allows the banco-political alliance to plead in the bended-knee style of Hank Paulson back in 2008 for a legislated bailout of the global banking system, not to combat the global pandemic of viral infection but the more insidious global pandemic of debt, as in “way too much of it.”

Now, with people dying and people close to my place of residence infected, I am not suggesting that this tragic outbreak is to be understated or dismissed. What I am raising is the manner in which the media and the governments around the globe have handled this crisis. Secretary Mnuchin’s first statement pledging action by the Trump Administration was “to support the U.S. economy,” with nary a mention of the health of its citizens. It would seem to me that you help the ill first, the unemployed second and the profit and loss statements of your Wall Street pals last.

Further, just as the banker-politico alliance opted to bail out the banks rather than the citizens losing their homes in 2008, it seems that history is once again rhyming, but not pleasantly nor with the numbing calm of a Robert Frost soliloquy.

After a week of total and complete market mayhem and monetary madness from the banco-politico alliance, I feel the same today as I did in 1987, 2001, 2009 and December 2018. Most importantly, I feel the same way I did in April 2011, when the central banking interventionists took down the gold and silver market in what is still, to date, the singular most blatant example of “free market” abuse ever.

That feeling is one of violation, but the odd part about it this time is that we, in the precious metals fraternity/sorority, have had to live through financial armageddons before, such that our emotional coping mechanisms are more conditioned to external violation than the current generation of stock junkies that have been day-trading the “Spoos” with “the Fed at their back” for over twelve years. Only now are they discovering the horror of financial loss at the hands of an external perpetrator. Only, for them, it is a microbe, while for us it was, and is, an entity. Nemesis arrives in different disguises.

Navigating the current investment landscape is not unlike “shooting the rapids” in a kayak, and the important tip in doing so is to keep the paddle perfectly balanced in order to keep the upper body out of the water. In terms of trading, I take position sizes down and try to avoid leverage where possible, but I go into a trade or a theme knowing full well that these are not normal times.

The performance of the gold miner exchange-traded funds (ETFs) run by Van Eck has been a disgrace, with massive swings in discount-to-net-asset-value (NAV) settlement prices and shoddy rebalancing. I must assume that I could lose everything if my judgment is off by as much as a blink, so while prudence is of the utmost importance, paralysis is not.

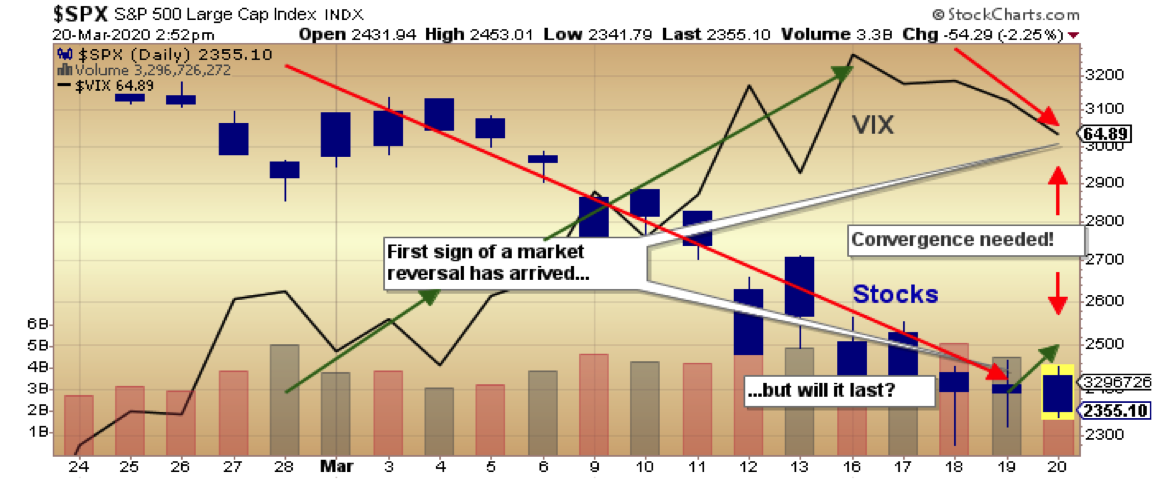

At the top of most advances there usually occurs a divergence, whereby stocks advance and volatility advances—a most unusual condition. At bottoms, there occurs an opposite divergence, and we are getting just that. Much as I detest the term “green shoots,” the first of them are beginning to poke their heads above the receding snow cap with the action in the SPX/VIX relationship. The chart below shows a definite divergence between stocks and volatility, and that has always been the first signal that a turn is possible.

Similarly, silver outperformed gold on Friday (gold up 0.26% versus silver up 2.07%), in what may yet another positive divergence in our favor.

Over the weekend, we will all be reading dozens of apocalyptic prophesies by various market gurus, complete with pointed fingers, raised hands, bulging eyes and crocodile tears everywhere. While I like to pore through their rationales for whatever investment thesis they currently hold, in the end, the question I ask is, “Did they see the crash coming?” I did, and I gave the reasons why in the Jan. 12 missive. But that, my friends, is “old news.” I am now flat; covered way too early; own no shorts or puts; and am looking for a trade-able rally in the senior and junior gold miners (GDX/GDXJ) to new highs by the end of the summer.

Further, unlike the past two months, those miners are now undervalued relative to the metals they produce. The big gains will in the shares.

Lastly, the weekly gold-silver comparison chart shown below starts in December 2015, at the onset of the current (yes, I said current) bull market in gold. In the singular largest deflationary crash in financial market history, gold is down 2.53% year to date, versus declines of 28.66% and 23.33% in the S&P and NASDAQ, respectively. Gold has done its job of protecting one’s assets from those lifestyle-ending drawdowns from which it is so difficult to recover. The important points to observe in this chart are as follows:

- Gold remains in an uptrend;

- The gold-to-silver performance differential is an astonishing 51.58%;

- Being a weekly, note the negative crossover in the gold MACD lines circled in red;

- Note the weekly relative strength index (RSI) at 45.67; oversold (bottoming area) is under 30;

- The uptrend line for gold remains around US$1,425. Gold must hold that long-term support line;

- The silver market remains an enigma to all metals analysts that I know. It is either supernaturally cheap right now or something fundamental to its long-term pricing mechanism has changed. Whether or not to buy it here remains the biggest singular investment decision of my 43-year career, and I must tell you in all candor, this is a really tough one. My heart is saying “Buy it!” but something ain’t quite right.

To sum up this past meteor storm of a week, I remain a staunch bull and grateful to have been overweight gold rather than the miners (or anything else) during the crash. I am now moving aggressively to replace all of the positions sold at or near the peak in February and last August. There are numerous names that have moved down to multiyear lows due to this forced liquidation from the EFTs and other funds, and surprisingly, there are juniors (that I own) that are actually up year to date

If there is one dominant investment theme to which I am adhering, right now, it is to focus on those microcap juniors with defined ounces. If I am right, we have now entered a new paradigm where preservation of value will be paramount. Since counterparty risk fears were what triggered the REPO explosion last fall, those same fears place gold (and ounces in the ground) front-and-center in this value proposition. Accordingly, a basket of companies producing or developing gold resources are going to be reconsidered, reranked and revalued.

It was a difficult week for all, and it is my sincere wish that everyone stays safe and rides out the current storm in the company of healthy family and friends.

Article written on March 20.

Follow Michael Ballanger on Twitter @MiningJunkie.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

The Fed and the Gold Price

Source: Rudi Fronk and Jim Anthony for Streetwise Reports 03/23/2020

Seabridge founders Rudi Fronk and Jim Anthony provide an update on the Fed’s actions and the gold price.

Many times a day, we are asked what we think will be the impact on gold prices of the enormous money-printing by the Fed. We think the impact is much greater than you might imagine because it is in combination with huge fiscal stimulus. In a nutshell, we think the current path leads to a new all-time high in gold this year and a crisis of confidence in the dollar. It’s baked in the cake, in our view.

Please note, this is an opinion not investment advice.

Two points need to be made. First, most of the monetary stimulus to date is repo… money that must be returned in time certain and does not add to bank reserves. Repos unfreeze short-term liquidity but it’s the POMO…Permanent Open Market Operations or QE… that grows the balance sheet and bank reserves. There is much more QE to come, in our view, to keep mortgage rates down and bank balance sheets healthy (two Fed priorities). Repos have not satisfied the markets. To date, the Fed has announced $500 billion in new POMO Treasury purchases since COVID-19 of which more than half was used in the first few days. We expect new QE to total $4 trillion+ before the Fed is done.

Second, and most important, the fiscal stimulus is even greater and far more problematic than the monetary stimulus. Fiscal stimulus requires an enormous increase in an already huge deficit. If the Treasury seeks to borrow the extra $2 trillion or more that is sure to be authorized, the issuance would drive up Treasury yields which are already rising at the long end. The Fed will attempt to prevent this by purchasing the newly issued debt. The Fed is already funding about 70% of the current deficit (just follow the cusip numbers). So, QE this time around is not only going into financial markets like it did in 2009…a huge amount of it is going to flow through the Treasury and into the economy (payments to businesses and individuals, the real helicopter money), adding artificial demand at a time when the economy is producing less. This is very damaging to dollar confidence and highly inflationary.

We think the Fed and the Treasury have decided to sacrifice the dollar. We think they will be successful. Gold’s price will reflect this.

Written March 21, 2020.

This article is the collaboration of Rudi Fronk and Jim Anthony, cofounders of Seabridge Gold, and reflects the thinking that has helped make them successful gold investors. Rudi is the current Chairman and CEO of Seabridge and Jim is one of its largest shareholders.

Disclaimer: The authors are not registered or accredited as investment advisors. Information contained herein has been obtained from sources believed reliable but is not necessarily complete and accuracy is not guaranteed. Any securities mentioned on this site are not to be construed as investment or trading recommendations specifically for you. You must consult your own advisor for investment or trading advice. This article is for informational purposes only.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures:

1) Statements and opinions expressed are the opinions of Rudi Fronk and Jim Anthony and not of Streetwise Reports or its officers. The authors are wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the content preparation. The authors were not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the authors to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

2) Rudi Fronk and Jim Anthony: we, or members of our immediate household or family, own shares of the following companies mentioned in this article: Seabridge Gold. We personally are, or members of our immediate household or family are, paid by the following companies mentioned in this article: Seabridge Gold.

3) Seabridge Gold is a billboard sponsor of Streetwise Reports. Click here for important disclosures about sponsor fees.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Federal Reserve Announces QE Infinity

What will become of our jobs, homes, earnings, savings, investments, pensions, retirement accounts, and our freedoms, now and in the future? Jerry Robinson interviewed by Dunagun Kaiser on Reluctant Preppers FULL […]

The post Is China Accelerating The Bankruptcy Of The United States? appeared first on Silver Doctors.