Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

Coming up Axel Merk of Merk Investments joins me to discuss why he’s watching developments in China and with the coronavirus so closely and how it may affect the global economy and the financial markets. Axel also offers some very good advice about the importance of understanding why it is that you own gold and the danger of letting short-term dynamics affect your long-term investment strategy. So, stick around for another great interview with Axel Merk, coming up after this week’s market update.

Well, it’s been a bad week for Democrats and a terrible week for Nancy Pelosi. It’s been a good week for Republicans – unless you’re Mitt Romney – and a great week for President Trump.

It has also been a great week for the stock market. The S&P 500 surged from the depths of the coronavirus scare to record a new record high on Thursday.

As for precious metals markets, it’s shaping up as a negative week overall but with some silver lining. Gold and silver each rallied off their weekly low points on Thursday and have the potential to put in a bullish reversal with a strong close on Friday.

Gold prices closed Thursday at $1,568 per ounce, down about 1% since last Friday’s close. Silver finished Thursday at $17.89 an ounce, gaining 1.3% for the day but also settling about 1% lower for the week.

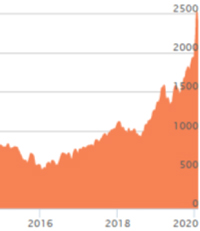

Platinum and palladium, meanwhile, each sold off on Thursday to erase most of their gains from earlier this week. Platinum currently checks at $967 and palladium at $2,365 by the ounce… again all of these prices are as of this Thursday evening recording.

Precious metals markets stand to benefit from ongoing central bank stimulus measures.

In the wake of the China virus outbreak, the Chinese central bank injected the equivalent of $173 billion into the financial system to help prop up equity markets. Central banks in Thailand and the Philippines moved to cut rates. Australia may soon follow suit.

The U.S. Federal Reserve appears likely to cut rates later this year. And in any event, it will continue pumping liquidity into Treasury and repo markets.

The problem for gold and silver investors is that all this stimulus is being accompanied by upbeat sentiment on Wall Street. The metals can rise in tandem with stocks, but they likely won’t show real leadership until the optimism toward mainstream financial assets fades.

Gallup’s latest “Mood of the Nation” poll was released on Thursday. It showed a record 90% of Americans satisfied with their lives. The positive national mood reflects confidence in the economy and bodes well for President Donald Trump’s re-election prospects.

Trump’s approval ratings hit a new high during his impeachment trial, suggesting Democrats not only failed to make their case to the public but ended up helping Trump make his. He was easily acquitted on a party-line vote in the Senate, with Utah Senator Mitt Romney being the only defector.

Democrats appear to be melting down as typified by House Speaker Nancy Pelosi’s spiteful theatrics during the State of the Union address. They now appear likely to nominate an unelectable candidate to square off against Trump in the general election – if they can even figure out how to count the results of their caucus and primary contests.

If the Democrats continue to self-destruct, they could lose the battle for the White House in a landslide and perhaps even lose control of Congress.

Of course, a lot can happen between now and November. The extreme economic optimism now boosting Trump and powering Wall Street will eventually reverse. In fact, these kinds of extreme readings in sentiment are usually markers of major tops.

But tops can drag on for months or even years – especially when we have the unprecedented situation of fiscal and central bank stimulus being rolled out to extend an expansion rather than dig out of a recession.

The next President will likely run up trillion-dollar deficits in each year of his four-year term even assuming the economy doesn’t slip into recession. The Federal Reserve will be in a box, with conventional tightening and easing policies out the window. The Fed will be in accommodation mode seemingly forever – or until all of its easing and QE/no-QE programs trigger a crisis of confidence in the currency.

Well now, without further delay, let’s get right to this week’s exclusive interview.

Mike Gleason: It is my privilege now to welcome in Axel Merk President and Chief Investment Officer of Merk Investments and author of the book Sustainable Wealth. Axel is a well-known market commentator and money manager and is a highly sought-after guest at financial conferences and on news outlets throughout the world and it’s always great to have him on with us here on the Money Metals Podcast.

Axel, it’s a pleasure to have you back and thanks for joining us again. Welcome.

Axel Merk: Good to be with you.

Mike Gleason: Well, I’d like to start by getting your take on the coronavirus since that has been dominating headlines in recent days. There is an awful lot of speculation about how markets might be impacted. Some people think it is a tempest in a teapot, others think the apocalypse is upon us. Everyone has to rely on data coming out of China, which is always a dodgy proposition, but what are your thoughts about the virus and what it could mean for financial markets in the weeks and months ahead?

Axel Merk: Well, you’re in luck, I got my crystal ball here so I’ll tell you exactly how it’s going to play out. I mean basically none of us have a clue. More importantly, people are afraid of the unknown. We don’t know many, many of the parameters. What we do know is that historically we kind of get used to these things and in particular we get used to crises. And so whichever way this plays out, we’ll probably find a way of dealing with it. Now at the same time, it doesn’t mean it can’t be quite disruptive. And so that said, just like many others, every day I punch into my little spreadsheet, the new known cases and infections and whatnot and I try to look at a consistent source. And so I’m trying to look at is there a change in the rate of change that impacts something.

And then if I kind of look at something more on a micro level, the U.S. economy is a much more closed one. And so we haven’t seen us consumer spending change. We do know that the various governments take this very, very seriously, which should impact the distribution as well as the spreading of the virus. And so overall, I am more in the camp that says, well, yeah, this is a shock. If it’s a most severe shock, it’s going to have an impact, but if it’s not a more severe shock, we’ll get through this and so I’m more on the glass half full camp, but that doesn’t mean that I’m convinced on that. That is just my best-case scenario.

Mike Gleason: The old saying goes, when the U.S. sneezes, the rest of the world gets a cold. I guess you could say the same thing about China based on how large that economy’s gotten over the last several years. If we go back to August 2015 we had major shockwaves in the Chinese stock markets and that nearly started a global financial crisis there, that was averted. But nonetheless, China’s impact there had some major ramifications for the rest of the world financial markets. Talk about how that may affect things here. Are we starting to see any implications there that the Chinese economy is really starting to feel this?

Axel Merk: Well, we do know that until the coronavirus was known, we had tailwinds coming in with that phase one trade deal, things were turning around. Indeed, if you look at the global manufacturing industries that are taken before the news of the virus, they were all positive. Now we also know that the Chinese government has a very strong hand and so they can isolate a town if they want to. Now we do know that they were slow to react in the beginning, but if you’re not in a free society, you can impose things that you couldn’t impose in other countries. So in many ways, I do think they will be able to get a handle on it. Now will that necessarily be pleasant for everybody? I don’t know. Will that impact the economy in parts? Yeah, quite likely.

And so, in the short term it’s going to be a shock. Now markets obviously are a discounting mechanism on what’s going to happen in the future and so it’s in that context that I think that they’ll figure out a way forward. I don’t see a revolution coming from this. I don’t see that the system in China is going to change completely and so it is a disruption. I’m very closely monitoring some of the big manufacturers there to see what they can do. And ultimately it’s probably the same thing as with any crisis. If you’re a big business you probably find a way to deal with it and if you’re a small business you might be out of luck. Now obviously that can impact economic growth and yes, if they sneeze the rest of the world could have a cold. And a fear not, an interest rate cut can probably cure this virus as well. That’s cynical by the way. Just as a side note, in case you didn’t get that.

Mike Gleason: Yes, got it. We last spoke in September, since then, Boris Johnson managed to win a crucial vote on Brexit and he is leading the UK out of the EU. After being stalled for years, the Brexiteers finally prevailed there. Those who are opposed to Brexit argued it would be a disaster for the UK economy. Anti-EU people thought Brexit might represent the dam breaking, that it would be the beginning of the end of the EU as other nations would follow suit. Now that Brexit is officially underway, I’d like to get your thoughts on what Brexit will mean and have you seen any meaningful impact on markets thus far? Give us your take their Axel, as I know you follow events in Europe quite closely.

Axel Merk: Well sure, it depends again I think on your perspective on your horizon. As we speak there are some stories out how MiFID, that’s a wonderful acronym for regulation on Europe is going to get revised. It’s, amongst others, how the UK can trade financial instruments that are really EU instruments and so they could get shut out from a market. And so there’s a short term concern about that. In the long run, again, if you are big business in the UK, you will have set up subsidiaries in the EU and you’re probably going to be doing just fine. On a small scale, yes, there are a whole bunch of obstacles to be overcome. And so we have to see how it goes.

The one thing we know with the Johnson government is, not so unlike some other governments closer to home, is they love spending money. I mean Johnson has promised just about every social program there is in the book. And so the question is what will be the side effects, what will be the ripple effect? But by all means, those sort of things are economic stimuli. So we’ll get the tailwinds from that. The question is are we going to be concerned about inflation? But apparently we are told that inflation is dead and we never ever going to have a problem with inflation again. So I guess we shouldn’t worry about that.

Mike Gleason: I do want to get into inflation here in a minute. But another topic we discussed when we last spoke was about your outlook for the U.S. economy and how it was a bit of a mixed bag, but positive signals outweighed the negative and you were expecting the expansion to continue for a while yet. Has anything changed since September in your view, Axel? Summarize your current outlook if you would?

Axel Merk: Well before the virus, I would have said that unlike what most people are arguing, is be aware of a potentially overheating economy. Let’s think about it. We have a near record low unemployment and we have an accommodative monetary policy. And we have wages, well they’re not exploding, but they have been at a reasonable high level. President Trump has been touting how the less skilled workers are now having much higher wage gains than the top 1%. Well those are signs of a potentially overheating economy. And we’re pushing the accelerator as we go. So, we are quote unquote bailed out potentially from headwinds like a coronavirus. But if we keep this going and keep staying in this mode, at some point nobody knows when that will be, we will have an issue.

And so, we do have an election coming up in case somebody doesn’t know this in the U.S. later this year. And so it’s in the president’s interest not to escalate trade tensions. That’s why the phase one trade deal has been sealed now and that’s why there is a ceasefire, so to speak, with France, there was a threat of imposing sanction on France. And so there is an incentive here to keep things going and unless we have an outside shock, like the coronavirus that’s going to derail everything, my base case scenario continues to be that this economy is going to be doing actually reasonably strong. And if indeed we do have more of a fallout from the virus, and the yield curve inverts and stays inverted, then we may even get another interest rate cut as this year’s progressing.

Mike Gleason: I’d like to get your outlook for precious metals in particular. In 2019, metals performed fairly well with gold up about 18% and silver up about 15%, but the equity markets did outperform. To us it appears the Fed is working hard to keep stock prices inflated. Wall Street has been the major beneficiary of monetary policy. That has given stocks quite a leg up on metals, which are definitely a favored asset among the central planners, as we know. What is your take on the performance of metals versus the equity markets? Are stocks likely to continue outperforming and what is the scenario where the metals can start moving ahead there?

Axel Merk: Well last year just about every asset class did well. And if you’re just there in equities, the gold miners actually did particularly well last year because finally some of the leverage that people want in that space is coming to fruition. Now that said, if my scenario unfolds, keep in mind the Fed is all but promised not to raise rates, even if inflation does tick up. And so I would guess we’re going to have quite a volatile environment. Usually when you have indicators that should signal the Fed to do something, well they don’t, they wait. Because they have to look at incoming date on all that fun stuff.

And then the kind of the proof is going to be in the pudding. Will they actually do the right thing? Do they do what they say that’s necessary? And right now, it’s completely priced out that they would actually tighten, especially with the virus that’s obviously a scenario that’s not on the table. But, but, but if we do have a scenario that inflation or pressures creep up, the initial reaction might be, okay, the Fed has to be tougher now, and then they won’t be. And so in that sort of environment, it’s going to be volatile.

But what we do see is that one of the reasons why people have diversified to precious metals, is precisely for that point. In every bear market since the early ’70s, gold has done very well with the one key exception when Volcker raised real interest rates to quite a high level. That’s when gold couldn’t compete. But it’s for that diversification purpose, I think that people look at gold as a diversifier. And gold miners, similarly. Gold miners are obviously extremely volatile. And people want to have their cake and eat it, right. In an environment where quote unquote everything has been going up, they don’t want to diversify to cash because they’d have to sell things and possibly pay taxes. And so instead they’re rather like to add something volatile like precious metals to get them diversification. I’m not suggesting that this is what everybody should be doing, but that’s what we see people doing.

Mike Gleason: Obviously with Volcker, raising the interest rates were a little bit more tenable considering the major difference in the debt that we had back then versus now. You’d have to think that those sorts of interest rate hikes would be totally off the table, at least to that degree nowadays.

Well, I’ll ask you to pull out your crystal ball here again, Axel, and I wanted to talk more about inflation. You’ve alluded to that in a couple of your previous answers. A lot of us have been waiting for inflation to really take off, but it continues to be muted or at least it is if you look at the official, albeit flawed, government-reported inflation figures. So will 2020 be the year that inflation finally kicks into overdrive or will it be more of what we’ve seen?

Axel Merk: I suppose it’s a process. But what, again, we do know is that we’ve been pulling people from the sidelines to join the labor market. We know just mathematically there has to be a limit to that. And we have numerous charts that we look at and we think we’re not there yet, but odds are pretty high we’ll get there this year. Unless again, we get quote unquote bailed out by a slowdown induced by a supply shock like the coronavirus, or we should be getting there. And if we do get there as you pointed out, right, we can’t do the Volcker thing, or I don’t think we should necessarily go quite as far. But we have a lot of debt out there in the corporate world. That’s very low to kind of at the near the junk level or in junk territory and everybody says, “Hey, the Fed can’t raise rates.” And so you cannot apply the tools of yesteryear to fix those sorts of things.

And the Fed says if we do have a problem with inflation, they know how to fix it. I don’t think inflation is ever a good thing if you do get inflation that spills over from the labor market… one of the reasons people don’t think we’ll get it is because we have all this global competition with a global labor force. And so yes, with that it’s been delayed. It’s been substantially delayed and maybe it will continue to be delayed. To me, investing is not so much having a crystal ball to know exactly what’s going to happen tomorrow. It’s about the risks of what might happen and then cross checking with one’s portfolio, if one has taken those risks into account. Can I afford to ignore certain risks? And to me as we progress in this, it’s ever more difficult to ignore the risks that yes, inflation might eventually be an issue that we should be concerned about.

Mike Gleason: Well, as we begin to close here, Axel, as we usually like to do, give us any final thoughts you may have for us today on some topics or events that maybe we haven’t talked about yet or perhaps give us a sense of what it is that you’re going to be watching most closely that you believe will impact financial markets moving forward.

Axel Merk: Well the one thing I guess to keep in mind is how short our memory is. Remember World War III was supposed to break out at the beginning of the year. Nobody talks about that strike in Iran anymore. And so similarly, we have so much news happening, we’ll be concerned and wrapped up with the election. And eventually I wouldn’t be surprised if the coronavirus is an issue for China, but in the U.S. our focus is going to be different. And then suddenly we’re going to be concerned about yet another shock. And it really depends, if one is a short term trader, by all means focus on that.

And you mentioned gold before. Do you hold gold because of the government deficits? Do you hold it for diversification purposes? Do you hold it because of a potential fall out of the virus? Keep in mind why one invests in a certain way and then stick to that. Obviously reassess on whether the ingredients were reasonable, but it makes no sense to switch from being a long-term investor in something and then being derailed by short-term phenomenon. Either one, as a short-term trader or a long-term investor, or focus is on technical analysis and fundamental analysis, but being swayed by the daily news flow is going to derail any good investment strategy. I guess that’s the only food for thought I have here.

Mike Gleason: Yeah, that’s very well put. If you’re going to be a long-term investor, be a long-term investor. If you’re going to be a day trader or a short term investor, then by all means do that. But yeah, don’t go back and forth. That’s actually great advice.

Well, thanks Axel. We appreciate the time as always and I enjoyed the conversation. Once again, before we let you go, please tell folks a little bit more about you and your firm and your services and then also how they can follow you more closely, please.

Axel Merk: Sure. MerkInvestments.com is our website, kind of the portal way to get to what we do. Follow me on Twitter, I’m quite prolific there musing about what’s happening and putting out food for thought. We do publish research reports. We do have several investment products including a physical gold and a gold mining product. We can’t talk specifically about our products here, but visit our website and take it from there and look at all of the wonderful things that we do there.

Mike Gleason: Excellent. Well thanks again Axel. I hope you have a good weekend and I look forward to catching up with you down the road here in 2020 and thanks for the time. Take care.

Axel Merk: My pleasure.

Mike Gleason: Well that will do it for this week. Thanks again to Axel Merk, President and Chief Investment Officer for Merk Investments and manager of the Merk Funds. For more information, be sure to check out MerkInvestments.com.

And check back here next Friday for our next weekly Weekly Market Wrap Podcast. Until then, this has been Mike Gleason with Money Metals Exchange, thanks for listening and have a great weekend everybody.