Source: Barry Dawes 11/17/2025

Barry Dawes of Martin Place Securities shares his thoughts on where the gold market is headed and takes a look at a few gold stocks.

Its no fun being a gold bear, but the markets must be heeded.

And if the ‘fundamentals’ are negative, there is no point in throwing in the towel and saying that I have turned bullish.

The major point of the gold bugs is fiscal recklessness in debasing the currency, and the focus is always the US$, because the data is obvious and it is in English.

So the ‘debasement trade’ was in full swing with ‘de- dollarisation’ as the key driver.

‘Get out of US$ because the deficits are going on forever and the Fed will just keep on printin’!’

‘Debt will never be repaid.’

‘That Debt Clock keeps on ticking up!’

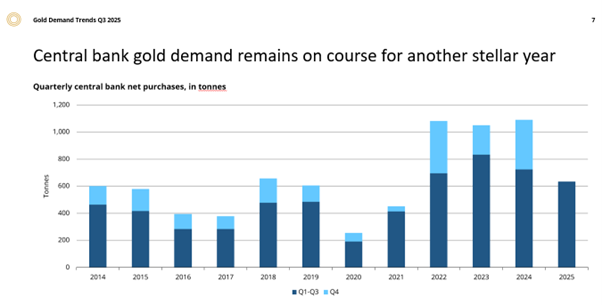

Central banks are buying up gold to offset the falling US$, and are selling their US$ Treasury Bonds so the story goes.

But all this is old news and it is now simply not true. The central bank story is totally debunked by the chart below.

The lowest level of purchase YTD for four years and down 22% from last year.

A Ghana buying another tonne and Poland doing a one-off 67 tonnes means the gold market is running out of big buyers.

Another stellar year! Meh.

Bureaucrats are buying at the top.

How much does gold needs to be bought to support a market currently US$29tn as overhead supply?

The US$12 trillion gain in 2025 alone is the biggest gain in any single market ever!

At US$5,000 this is US$35 trillion.

The US$ is in a long term bull market.

De dollarization. Pfff.

Deficits are out of control!

Pfff there too.

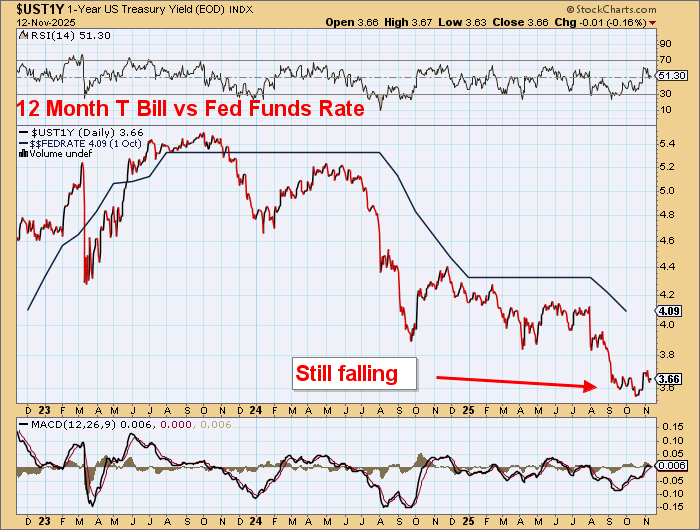

U.S. Federal Outlays are now falling while Receipts are rising. The Federal Deficit came in US$200 billion under and is forecast lower in FY26, with interest rates falling so that the Federal interest expense has peaked and is declining.

They won’t be able to sell any Treasuries!

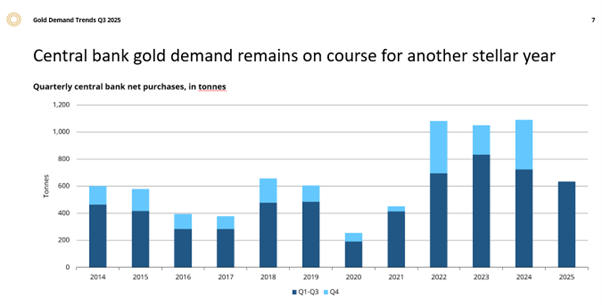

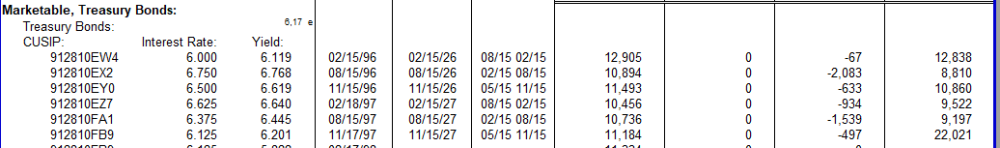

So far since 30 June 2025, the U..S Treasury has rolled over a total of US$5.66 trillion ( ~US$4.88 trillion T Bills (ave historic rate of ~4.2%) and US$0.77 trillion in Treasury Notes(Ave ~3%) and US$11 billion in T Bonds (6.9%)) at rate of sub 4.0% with the latest down to 3.445%.

The T Bill auctions were 3x oversubscribed.

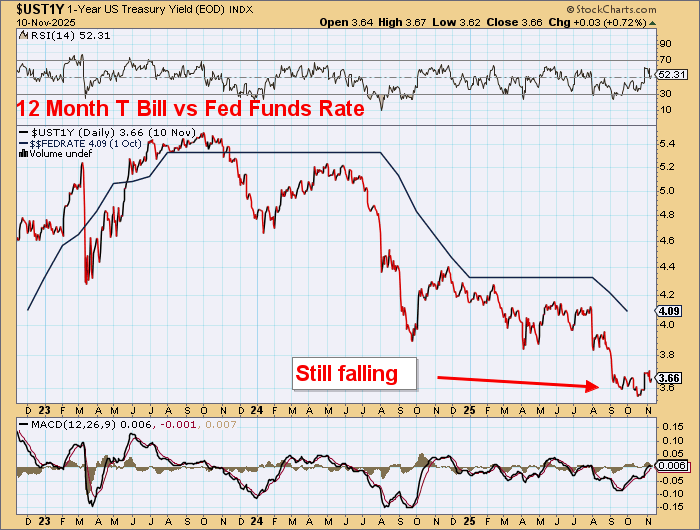

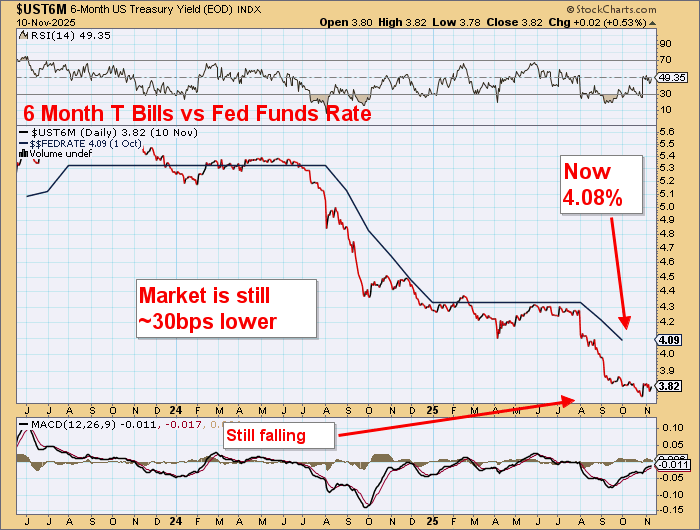

These are the latest (mostly) 6-and-12-month T Bills:

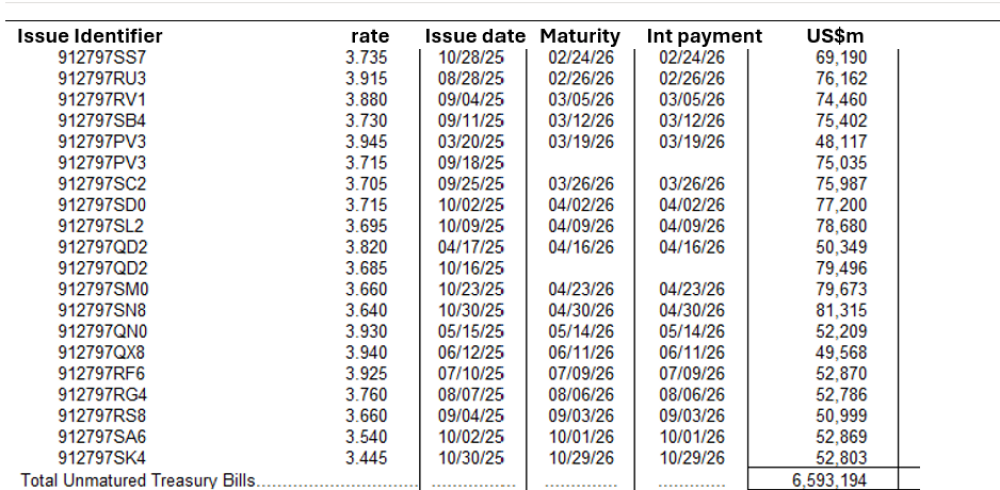

The 2025 and 2026 columns will merge in six weeks:

Note that from January 1, 2026, there will be only US$28 billion 10-year bonds on issue (on present data) and US$38 billion for each of 11 and 12 years.

Did you note the failure of the auctions and the blow out in yields as the Treasury sold US$5.66 trillion of T Bills?

No?

I didn’t either.

Because US$5.66 trillion says it all.

No one told you either.

However, if you listened to the Gold Bugs it would have been the opposite.

Look how these short term rates are falling:

It was pointed out that the September interest expense was US$91 billion, but only US$36 billion was a cash interest payment.

US$55 billion in T Bills sales that were accrued and no cash required. Issuing T Bills defers the interest payment to the maturity date which is mostly 12 months away. US$55 billion non cash for say eight months is US$440 billion in T Bills that don’t need to be sold, and so the selling pressure is reduced even further.

US$440 billion out of the forecast US$1.6 trillion FY26 Budget Deficit is a modest but helpful gain, and whilst it is only temporary, the roll over interest rate in six months is likely to be much lower.

It also has been buying back high coupon bonds, so the need to pay cash coupons on bonds with these +6% coupons is reduced.

This is important because switching to discounted T Bills removes the coupons and coupon payments.

Foreign ownership of U.S. Treasuries is now at record levels.

So, that graph you see with gold bigger than U.S. Treasuries will unwind quite soon.

That is a charlatan’s graph.

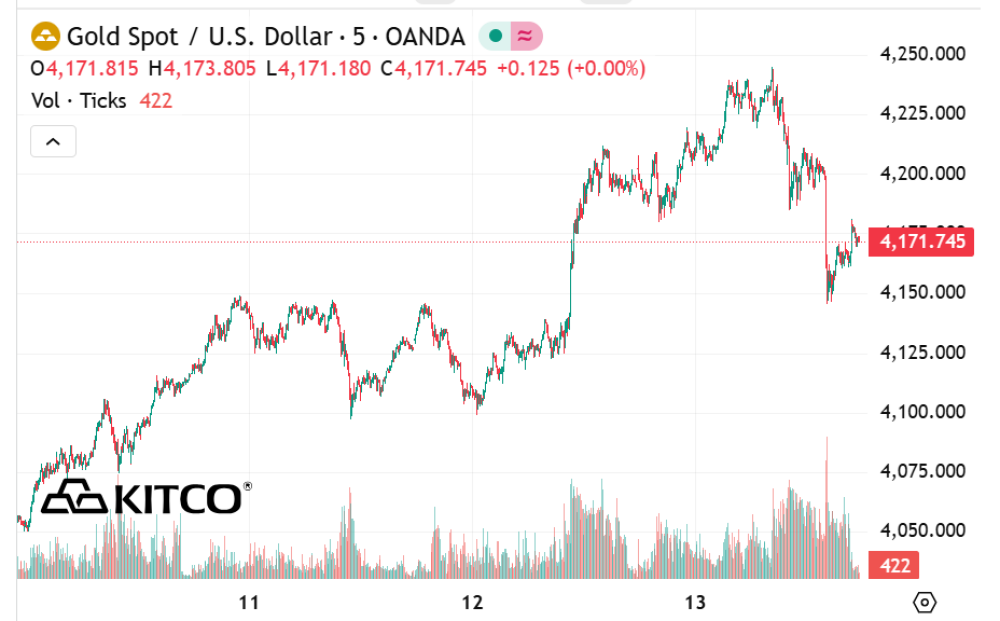

Gold made a new rally high overnight but closed lower in a Reversal.

You would have noted that gold gapped up US$112 on Monday and more on Wednesday and also overnight on Thursday.

Bear market rallies are always sharp and full of emotion, just like bull market pullbacks .

Island reversal coming up:

Another parabola breach:

Gold Stocks

Another last gasp parabolic surge that is also exhausted.

Everyone is so excited for the next upleg, and then FOMO takes over, and then there is no buying power left.

And then the stops get hit . . . Ugly.

Market leader gold stocks earnings have failed to provide upward momentum. The parabolic blowoffs are very obvious here.

Wave 3 down should be very savage next week.

Look at Newmont Corp. (NEM:NYSE; NGT:TSX; NEM:ASX), Barrick Mining Corp. (ABX:TSX; B:NYSE), Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE), and Kinross Gold Corp. (K:TSX; KGC:NYSE).

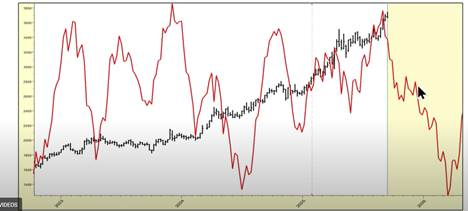

Some gold cycles are suggesting a savage decline coming up in the C wave.

Several months to run its course yet.

Cycles that influence gold:

8-year cycle for gold:

Most of you are familiar with the sentiment for bull markets:

Disbelief, Pessimism, Optimism. Opportunity and Euphoria.

On the way down, we get the opposite.

The first move lower is just a correction, so its OK. The next move is Euphoria, because yay here we go, then its Denial and down the slope of Hope hoping for the turn.

And then Pessimism.

And BUY TIME!

T-Bonds

Yields are heading lower.

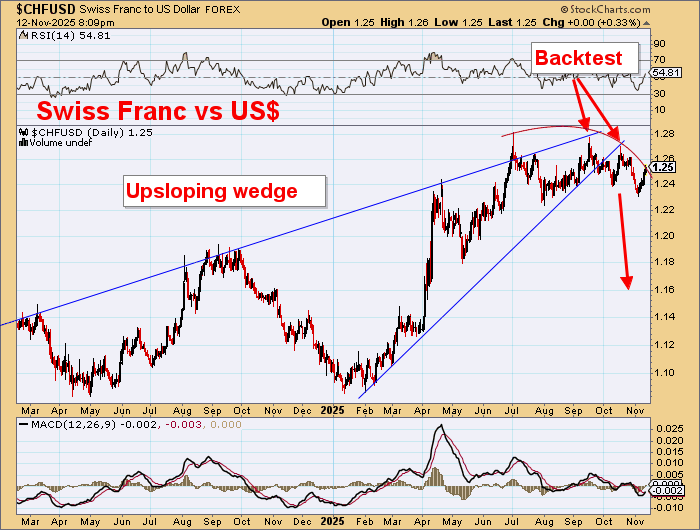

Currencies

Currencies are heading lower.

These suggest a BIG EVENT is coming soon.

Heed the markets.

[NLINDERT]

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barrick Mining Corp. and Agnico Eagle Mines Ltd.

- Barry Dawes: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.