- Gold Steady After US Rate-Cut Hopes Spur Biggest Surge Since May Bloomberg.com

- Gold Surges as US Push to End Shutdown Turns Attention to Fed Yahoo Finance

- Gold, stocks upbeat in anticipation of US shutdown deal Reuters

Author: Gold News Club

Source: Mike Kozak 11/06/2025

Coeur Mining Inc. (CDE:NYSE) posts a solid operational third quarter with mixed financial results, noted a Cantor Fitzgerald report.

Coeur Mining Inc. (CDE:NYSE) released its Q3/25 results, reported Cantor Fitzgerald Analyst Mike Kozak in an October 30 research note. Cantor raised its target price by 31% on the precious metals producer and downgraded its rating.

“We characterize Coeur’s Q3/25 results as a neutral on balance, with earnings per share (EPS) and cash flow per share (CFPS) coming in mixed versus consensus but well ahead of our estimates and production and cash costs tracking in line with refined 2025 guidance,” Kozak wrote.

Share Price Exceeds Revised Target

Cantor’s new target price on Coeur is US$16 per share, up from US$12.25 previously, reported Kozak. The new target resulted from one, Cantor incorporating the Q3/25 results into its model, and two, increasing its equally blended target multiple to 2.25x net asset value per share from 1.75x and to 22.5x 2026E CFPS, tracking the peer group, from 17.5x.

At the time of Kozak’s report, the miner was trading at US$18.25 per share, above Cantor’s target price.

Also, Cantor changed its rating on Coeur to Hold from Buy because it viewed CDE as fully and fairly valued after a +208% year-to-date run-up.

The company has 642.2 million shares outstanding. Its market cap is US$11.7 billion, and its 52-week range is US$4.58–23.62 per share.

Production: Silver, Gold Higher QOQ

During Q3/25, Coeur produced 4,800,000 ounces of silver (4.8 Moz of Ag), up 1% quarter over quarter (QOQ). Silver production fell 3% short of Cantor’s estimate. Total silver produced during Q1/25, Q2/25 and Q3/25 was 13.2 Moz, suggesting Coeur will meet revised guidance for full-year 2025 (FY25) of 17.1–19.2 Moz of Ag, previously 16.7–20.3.

The company produced 111,400 ounces of gold (111.4 Koz of Au) during Q3/25, reflecting a 3% increase QOQ and beating Cantor’s estimate by 4%. Total Q1/25–Q3/25 gold production was 306.6 Koz, also indicating Coeur will achieve updated FY25 guidance of 392.5–438 Koz, previously 380–440.

Costs: Silver Up, Gold Down

Coeur’s Q3/25 consolidated silver cash cost was US$14.95 per ounce (US$14.95/oz), up 12% QOQ and 1% higher than Cantor’s estimate. Between Q1/25 and Q3/25, the average silver cash cost was US$14.23/oz. This is consistent with Coeur reaching adjusted FY25 guidance of US$14.01–15.22/oz Ag, previously US$13.97–15.35.

The Q3/25 consolidated gold cash cost was US$1,215/oz, down 4% QOQ but 10% higher than Cantor’s estimate. The average gold cash cost between Q1/25 and Q3/25 was US$1,264/oz. This tracks with the revised FY25 guidance of US$1,236–1,328/oz, previously US$1,240–1,406/oz.

EPS, CPS Results Mixed

Coeur’s Q3/25 headline EPS came in at US$0.41. Adjusted EPS was US$0.23, lower than consensus’ US$0.26 estimate but higher than Cantor’s US$0.15 prediction.

CFPS, before changes in working capital, was US$0.37, consistent with consensus’ US$0.36 forecast and higher than Cantor’s US$0.28 estimate.

Financial Status at Q3/25E

Coeur ended the third quarter with US$266 million (US$266M) in cash, US$364M in debt and US$400M in undrawn borrowing capacity.

“Coeur is well capitalized with total balance sheet liquidity of US$665M,” Kozak wrote.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Disclosures for Cantor Fitzgerald, Coeur Mining Inc., October 30, 2025

The opinions, estimates and projections contained in this report are those of Cantor Fitzgerald Canada Corporation (“CFCC”) as of the date hereof and are subject to change without notice. Cantor makes every effort to ensure that the contents have been compiled or derived from sources believed to be reliable and that contain information and opinions that are accurate and complete; however, Cantor makes no representation or warranty, express or implied, in respect thereof, takes no responsibility for any errors and omissions which may be contained herein and accepts no liability whatsoever for any loss arising from any use of or reliance on this report or its contents. Information may be available to Cantor that is not herein. This report is provided, for informational purposes only, to institutional investor clients of Cantor Fitzgerald Canada Corporation, and does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. This report is issued and approved for distribution in Canada, Cantor Fitzgerald Canada Corporation, a member of the Investment Industry Regulatory Organization of Canada (“IIROC”), the Toronto Stock Exchange, the TSX Venture Exchange and the CIPF. This report is has not been reviewed or approved by Cantor Fitzgerald USA., a member of FINRA. This report is intended for distribution in the United States only to Major Institutional Investors (as such term is defined in SEC 15a-6 and Section 15 of the Securities Exchange Act of 1934, as amended) and is not intended for the use of any person or entity that is not a major institutional investor. Major Institutional Investors receiving this report should effect transactions in securities discussed in the report through Cantor Fitzgerald USA. Non US Broker Dealer 15a-6 disclosure: This report is being distributed by (CF Canada/CF Europe/CF Hong Kong) in the United States and is intended for distribution in the United States solely to “major U.S. institutional investors” (as such term is defined in Rule15a-6 of the U.S. Securities Exchange Act of 1934 and applicable interpretations relating thereto) and is not intended for the use of any person or entity that is not a major institutional investor. This material is intended solely for institutional investors and investors who Cantor reasonably believes are institutional investors. It is prohibited for distribution to non-institutional clients including retail clients, private clients and individual investors. Major Institutional Investors receiving this report should effect transactions in securities discussed in this report through Cantor Fitzgerald & Co. This report has been prepared in whole or in part by research analysts employed by non-US affiliates of Cantor Fitzgerald & Co that are not registered as broker-dealers in the United States. These non-US research analysts are not registered as associated persons of Cantor Fitzgerald & Co. and are not licensed or qualified as research analysts with FINRA or any other US regulatory authority and, accordingly, may not be subject (among other things) to FINRA’s restrictions regarding communications by a research analyst with a subject company, public appearances by research analysts, and trading securities held by a research analyst account.

Potential conflicts of interest The author of this report is compensated based in part on the overall revenues of Cantor, a portion of which is generated by investment banking activities. Cantor may have had, or seek to have, an investment banking relationship with companies mentioned in this report. Cantor and/or its officers, directors and employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. Although Cantor makes every effort possible to avoid conflicts of interest, readers should assume that a conflict might exist, and therefore not rely solely on this report when evaluating whether or not to buy or sell the securities of subject companies. Disclosures as of October 30, 2025 Cantor has not provided investment banking services or received investment banking related compensation from Coeur Mining, Inc. within the past 12 months. The analysts responsible for this research report do not have, either directly or indirectly, a long or short position in the shares or options of Coeur Mining, Inc. The analyst responsible for this report has not visited the material operations of Coeur Mining, Inc. Analyst certification The research analyst whose name appears on this report hereby certifies that the opinions and recommendations expressed herein accurately reflect his personal views about the securities, issuers or industries discussed herein. Definitions of recommendations BUY: The stock is attractively priced relative to the company’s fundamentals and we expect it to appreciate significantly from the current price over the next 6 to 12 months. BUY (Speculative): The stock is attractively priced relative to the company’s fundamentals, however investment in the security carries a higher degree of risk. HOLD: The stock is fairly valued, lacks a near term catalyst, or its execution risk is such that we expect it to trade within a narrow range of the current price in the next 6 to 12 months. The longer term fundamental value of the company may be materially higher, but certain milestones/catalysts have yet to be fully realized. SELL: The stock is overpriced relative to the company’s fundamentals, and we expect it to decline from the current price over the next 6 to 12 months. TENDER: We believe the offer price by the acquirer is fair and thus recommend investors tender their shares to the offer. UNDER REVIEW: We are temporarily placing our recommendation under review until further information is disclosed. Member-Canadian Investor Protection Fund. Customers’ accounts are protected by the Canadian Investor Protection Fund within specified limits. A brochure describing the nature and limits of coverage is available upon request.

( Companies Mentioned: CDE:NYSE,

)

Tariff Troubles and Gold

Source: Stewart Thomson 11/07/2025

Newsletter writer Stewart Thomson addresses the question: Are Trump’s tariffs in trouble and what could this mean for gold?

Gold has been in corrective mode since October 21, when it double-topped at about $4380, and investors are asking. . .

What are the drivers of this pullback? Well, from a technical standpoint, oscillators were overbought, and sentiment was a bit frothy.

The big catalyst was sudden concern about the prospect of more rate cuts from the Fed. The “good news” for gold bugs is that job growth appears to have turned negative, and that makes a December cut more likely than it was just days ago.

Also, the U.S. Supreme Court ruling on Trump’s tariffs is upcoming. If the court kills the tariffs, there could be a huge stock market rally . . . initially.

If Trump folds on his tariffs from that point, money managers will begin to focus on the government’s horrific debt situation again. It’s been papered over since Musk left DOGE, and there has been hope that the tariff revenues could help with the debt.

A renewed focus on the debt would be very positive for gold.

On the other hand, if Trump pushes ahead with new tariffs to make up for the cancelled ones, this could create more uncertainty, and of course, uncertainty is good for gold!

Here’s a look at a key daily chart for this fantastic monetary metal:

Stochastics is finally overbought and close to a buy signal, after experiencing one of its longest overbought situations ever. $3900 is becoming support, and a big rally appears imminent.

Here’s a look at the weekly chart, which is stunning:

It’s possible (and arguably probable) that this current correction is going to create a huge bull flag that targets the $6500 area for gold. That was my original long-term target for gold.

It’s a target I’ve since revised to $15,0000-$20,000 due to the global loss of confidence in all fiat money.

What about the miners? Well, here’s an interesting chart of the important GDXJ ETF:

Bullish Stochastics is doing battle with a pesky H&S top pattern.

Elliott Wave analysis would suggest this has been a minor five-wave decline, and a significant rally probably would have started today if the U.S. jobs report had been released.

The bottom line: The computer age created millions of jobs, and AI may destroy them even faster than they were created!

It’s a time to begin averaging into GDXJ and SGDJ, and into their component stocks.

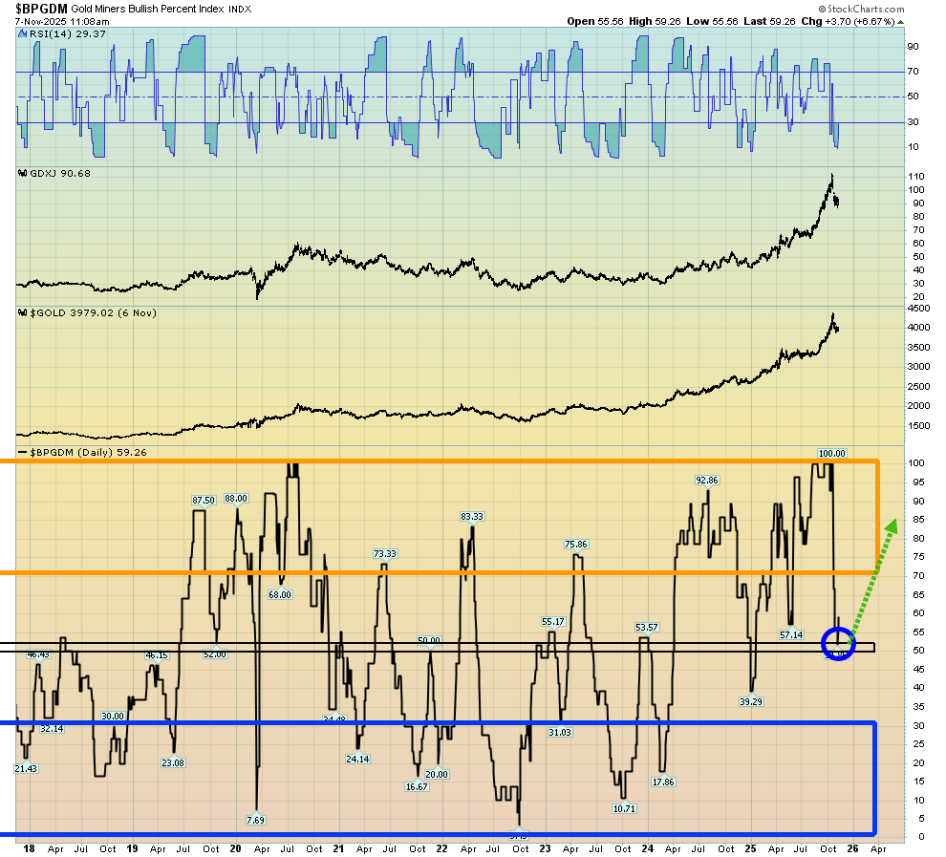

Sentiment? Here’s a nice sentiment chart, the BPGDM:

It’s bouncing off the 50 line, where momentum-oriented rallies often begin.

CDNX-listed junior stocks are the darling of many Western gold bugs. Finding gold is a difficult task, and when the going gets tough, the tough must get going!

One exciting explorer that is ignoring the pullback in the CDNX is Searchlight Resources Inc. (SCLT:TSXV; SCLTF:OTCQB). Here’s a snapshot of this Saskatchewan-focused high-risk and high-potential-reward junior stock:

Here’s an enticing chart:

The key to investor success in a correction is to keep the mood “peppy.” A huge saucer bottom is in play for Searchlight, and a blast into resistance at 25 cents seems highly likely to be the next order of business for this stock.

To sum up the overall market, there could be a bit more corrective price action for the miners over the next six to eight weeks, but now is the time to average into those of interest and get ready for “multi-bagger” fun in the year 2026!

Special Offer for Streetwise Readers: Please send me an Email to freereports@galacticupdates.com and I’ll send you my free “GDXJ: It’s Time For Buy-Side Play! report. I highlight some of the most exciting component stocks in this incredible index, with winning buy and sell tactics included for investors! Junior mine stock investing isn’t for everyone, especially with size, but as this gargantuan gold bull era rollout continues, these miners look set to outperform everything! I write my junior resource stocks newsletter 2-3 times a week, and at just $199/12mths it’s an investor favourite. I’m doing a special pricing this week of $169 for 14mths. Click this link or send me an email if you want the offer and I’ll get you onboard. Thank-you!

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Stewart Thomson: I, or members of my immediate household or family, own securities of: GDX. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Stewart Thomson Disclosures

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Source: Streetwise Reports 11/07/2025

Allied Critical Metals Inc. (ACM:CSE; ACMIF:OTCQB; 0VJ0:FSE) confirmed high-grade tungsten zones at its Borralha Project in northern Portugal. The discovery strengthens Allied’s position amid rising global demand and tightening supply chains.

Allied Critical Metals Inc. (ACM:CSE; ACMIF:OTCQB; 0VJ0:FSE) has reported additional assay results from its 2025 reverse circulation drilling campaign at the Borralha Tungsten Project in northern Portugal. The company announced that holes Bo-RC-27/25 and Bo-RC-28/25 confirmed a continuation of high-grade tungsten mineralization within the Santa Helena breccia (SHB), supporting and expanding on earlier results from the northwestern dip area.

Hole Bo-RC-27/25 returned 46.0 meters of 0.22% tungsten oxide (WO₃), including 22.0 meters of 0.35% WO₃ and a high-grade interval of 6.0 meters at 1.02% WO₃ from 228.0 meters depth. This intercept is among the most continuous and grade-consistent drilled to date in this zone. According to CEO Roy Bonnell in the announcement, “Borralha continues to exceed expectations… validating our interpretation of a broad, steeply dipping feeder system.”

Hole Bo-RC-28/25, collared 50 meters northeast of a previous drill site, intersected multiple tungsten-bearing lenses. It returned 8.0 meters of 0.68% WO₃ from 90.0 meters depth, including 2.0 meters at 0.94% WO₃. An additional interval of 4.0 meters grading 0.42% WO₃ was encountered at 210.0 meters. These results confirmed the updip continuity of mineralization, indicating potential for shallow resource zones.

The Borralha project is one of the largest past-producing tungsten operations in Western Europe, with historic output of over 10,000 tonnes of wolframite concentrate at an average grade of 66% WO₃ between 1904 and 1985. The current drill campaign is focused on expanding the National Instrument 43-101 mineral resource estimate and informing an upcoming preliminary economic assessment.

As of the latest update, 4,210 meters of the planned 5,625-meter phase 1 drill campaign had been completed. Sampling and assay procedures were conducted using reverse circulation methods with stringent quality control, including the use of certified reference materials and duplicates.

All analytical work was performed by ALS Laboratories in Spain and Ireland, using methods including lithium borate fusion with inductively coupled plasma mass spectrometry (ICP-MS) and X-ray fluorescence (XRF) for overlimit tungsten assays. The data and geological interpretations were reviewed and approved by Vitor Arezes, Vice-President of Exploration, who is a qualified person under NI 43-101.

Tungsten Market Maintains Steady Demand as Governments Strengthen Supply Security

Recent activity across the tungsten sector underscores its growing importance in global supply chain strategy as countries seek to reduce dependence on single-source suppliers. On October 13, Chemanalyst reported that tungsten prices in China held steady amid limited trading volumes, supported by consistent industrial demand and ongoing supply restrictions linked to national policy. The publication described a “cautiously optimistic view for tungsten prices,” citing stable consumption alongside constrained availability.

In the United States, the Department of Defense awarded a US$6.2 million grant under the Defense Production Act to advance the Pilot Mountain tungsten project in Nevada. The funding is part of broader initiatives aimed at strengthening domestic access to critical minerals in advance of new procurement rules taking effect in 2027. These rules will restrict the Pentagon from sourcing tungsten and other key materials from nations classified as adversarial, including China and Russia.

Chemanalyst also noted increased tungsten exports from Rwanda and expanding U.S. processing activity, including deliveries to Global Tungsten and Powders’ facility in Pennsylvania.

A separate analysis by Maximize Market Research, published on October 21, valued the global tungsten market at US$5.55 billion in 2023, projecting growth to US$9.51 billion by 2030. The report linked this expansion to tungsten’s high density, hardness, and heat resistance, which underpin its use in aerospace, automotive, electronics, and cutting-tool manufacturing. It further identified durability, recyclability, and growing adoption in powder metallurgy and composite materials as long-term market drivers.

On October 23, Bloomberg reported that the U.S. government is backing efforts to help a domestic firm secure access to tungsten resources in Kazakhstan. The initiative reportedly includes financing assistance rather than direct ownership, reflecting U.S. efforts to diversify its supply base. Kazakhstan is estimated to contain more than 2 million tonnes of tungsten reserves, representing a potential alternative to Chinese production, which continues to dominate global output.

Targeting a Strategic Role in Europe’s Tungsten Supply Chain

The Borralha Tungsten Project continues to advance amid broader geopolitical and industrial shifts that have increased global focus on securing critical mineral supply. With China currently accounting for approximately 84% of global tungsten mine production and the United States no longer producing tungsten domestically, Allied’s position in Portugal, within the European Union and NATO, offers strategic advantages, as outlined in the company’s investor presentation.

Tungsten is classified as a defence-critical raw material under the EU’s Critical Raw Materials Act (2024/1252). It plays an essential role in the production of semiconductors, electric vehicles, cutting tools, and military-grade armor and munitions. According to the company, recent pricing for tungsten ammonium paratungstate (APT) reached as high as US$685 per metric ton unit, reflecting rising demand and constrained supply.

Allied Critical Metals has also reported progress on environmental permitting, with the Borralha project currently under review by the Portuguese Environmental Agency and the Directorate-General for Energy and Geology. The company holds a mining concession license and is permitted to bulk sample up to 150,000 tonnes per year pending full mining approval. [OWNERSHIP_CHART-11251]

Beyond Borralha, the company is advancing its Vila Verde Tungsten-Tin Project, which has a historical resource of 7.3 million tonnes. A pilot plant at Vila Verde is expected to begin construction in Q4 2025, with a design capacity of 150,000 tonnes per year. A letter of intent for tungsten concentrate offtake has been signed with Global Tungsten & Powders in Pennsylvania, supporting future commercialization.

Allied Critical Metals closed a CA$5.1 million financing in Q3 2025, following previous funding rounds and a listing on the Canadian Securities Exchange. An updated mineral resource estimate and preliminary economic assessment for Borralha are expected by Q1 2026.

Ownership and Share Structure1

Insiders own approximately 16% of Allied. About 10% is held by institutions and institutional investors, and the rest is held by retail shareholders.

The company has 128 million common shares issued and outstanding and 134.05 million common shares on a fully diluted basis. Approximately 39.5 million shares are considered part of the public float and are available for trading. Its market cap is CA$92 million. Its 52-week range is CA$0.20–CA$0.89 per share.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Allied Critical Metals Inc. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Allied Critical Metals Inc.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

1. Ownership and Share Structure Information

The information listed above was updated on the date this article was published and was compiled from information from the company and various other data providers.

( Companies Mentioned: ACM:CSE; ACMIF:OTCQB; 0VJ0:FSE,

)

Source: Streetwise Reports 11/07/2025

West Point Gold Corp. (WPG:TSXV; WPGCF:OTCQB) intersected 24.4 meters of 1.63 g/t gold at its NE Tyro zone, with drilling extending near-surface mineralization by 100 meters. The 2025 campaign is part of a fully funded 10,000-meter program at the Gold Chain Project in Arizona.

West Point Gold Corp. (WPG:TSXV; WPGCF:OTCQB) reported additional assay results from its 2025 drill campaign at the Gold Chain Project in Arizona, highlighting continued expansion of near-surface gold mineralization at the NE Tyro zone. The company intersected 24.4 meters grading 1.63 grams per tonne (g/t) gold in hole GC25-77, including a higher-grade intercept of 3.0 meters at 7.14 g/t gold. Nearby hole GC25-78 returned 22.9 meters of 1.56 g/t gold. These results extend mineralization approximately 100 meters northeast of previously mined stopes.

According to Executive Chairman Derek Macpherson in the announcement, “The shallow drill holes establish that the Tyro Main zone displays continuity of mineralization both vertically and along strike.” He added that current efforts are also aimed at testing the extension of a high-grade zone at depth, following up on earlier intercepts such as 28.96 meters at 6.02 g/t gold (GC25-48) and 30.48 meters at 9.05 g/t gold (GC25-49).

West Point Gold’s ongoing 10,000-meter drill program has now completed 1,177 meters across 15 holes at the Tyro Main Zone. Six assay results remain pending. Drilling is also underway at depth in the NE Tyro area beneath holes GC25-47 through GC25-60, targeting the zone’s projected plunge toward the Frisco Mine Fault, a structural boundary within the region’s broader epithermal gold system.

The Gold Chain property hosts over 3.4 kilometers of vein structures with multiple mineralized zones, including Tyro East and Tyro South. Historic small-scale mining occurred at the site during the 1980s, and West Point Gold is currently working toward a maiden mineral resource estimate expected in 2026.

Gold Sector Supported by Demand and Market Uncertainty

Bloomberg reported on November 3 that major U.S. financial institutions were showing renewed interest in the physical gold business. The outlet wrote that banks were considering returning to bullion storage “because clients increasingly want to hold gold as a portfolio hedge.” According to the report, this represented a “decades-long commitment,” which suggested that large market participants believed “high gold prices are here to stay.” Bloomberg added that gold buying “rose 3% to a record of 1,313 metric tons for the third quarter,” with a noted 17% increase in bar and coin investment as investors continued to seek precious metals exposure.

On November 4, Stewart Thomson commented that market conditions had continued to support interest in hard assets. He wrote that “significant funds should then flow out of the U.S. market and into both the Asian stock markets and gold.” Thomson stated that “inflation, tariffs, the 2021 to 2025 war cycle, a wildly overvalued stock market, debt ceiling horror, and empire transition dominate the investing landscape.” He also observed that gold experienced “the biggest rally in years,” describing the sector as offering opportunities for traders within a broad price range.

Reuters reported on November 5 that gold prices rose more than 1% as investors moved out of risk assets. Independent metals trader Tai Wong said the performance “should give comfort to bulls who were surprised that metals fell along with risky assets yesterday.” Reuters noted that stocks retreated due to concern “that equity markets might have become overstretched.” Jim Wyckoff of Kitco Metals stated that “some safe-haven demand has surfaced” as investors assessed market risk. The report added that traders saw a 63% probability of an additional U.S. interest rate cut in December, a macroeconomic factor that often supported non-yielding assets such as gold.

Analyst Views Point to Key Project Metrics

On September 17, Don MacLean, Senior Analyst at Paradigm Capital, identified West Point Gold Corp. as one of the firm’s “favorite new ideas.” He focused on the company’s flagship Gold Chain Project in Arizona, where drilling at the Tyro Main Zone had outlined a mineralized trend based on 6,227 meters of work.

MacLean noted that a fully funded 10,000-meter drill campaign had commenced in September, targeting the higher-grade northeast Tyro zone along with adjacent areas. He referenced a conceptual exploration target at Tyro Main of 19.5 to 31.2 million tonnes grading 2.0 to 3.0 grams per tonne gold, concentrated within a one-kilometer portion of the broader 3.4-kilometer structural corridor.

Drill results released on April 22 included key intercepts such as 30.5 meters at 9.05 g/t, 33.5 meters at 5.46 g/t, and 29.0 meters at 6.02 g/t. MacLean highlighted subsequent drilling that extended the northeast Tyro strike length to 250 meters. One of the deeper holes intersected 32.05 meters at 3.51 g/t gold. Additional results reported on July 8 included intercepts of 59.4 meters at 1.25 g/t and 68.6 meters at 0.90 g/t in the central and southern portions of the zone.

Preliminary metallurgical testing showed gold recoveries ranging from 32% to 86%, with grind size identified as a key control on recovery. Further testing has been initiated and is expected to continue into early 2026.

MacLean concluded that with a market capitalization of approximately CA$37 million and around CA$9 million in cash, “West Point’s shares appear to be attractively priced for the project’s size, quality and jurisdictions.”

Targeting Depth and Continuity at a Key Arizona Gold Trend

West Point Gold’s 2025 drill campaign has prioritized the Tyro Main Zone, a 1.4-kilometer mineralized structure within the Gold Chain Project. With mineralization open along strike and at depth, the company is focusing on validating and expanding known gold-bearing zones that could underpin a future resource estimate. [OWNERSHIP_CHART-11225]

The ongoing reverse circulation program, supported by a US$9.1 million working capital position as of June 2025, continues to test new extensions and deepen earlier intercepts. Drilling now targets the NE Tyro deep zone, based on interpreted structural controls and previously reported high-grade results at depth. According to the company’s November 2025 investor presentation, the vein system appears to widen with increasing grade below surface, suggesting potential for continuity across plunge directions.

Beyond drilling, upcoming catalysts include additional metallurgical testing results anticipated in the first quarter of 2026, along with continued assay releases from remaining holes. A maiden resource estimate remains targeted for 2026, with exploration ongoing across multiple zones of the property, including the Banner-Sheep Trail trend and Frisco Graben area, both of which have shown historical high-grade potential.

Ownership and Share Structure1

About 6.4% of West Point Gold is owned by insiders and management, and about 17.2% by institutions. The rest is retail.

Top shareholders include Executive Chairman Derek Macpherson with 2.27%, Director Anthony Paterson with 1.7%, U.S. Global Investors Inc. with 1.08%, Mai with 0.17%, and Ehsan Agahi with 0.01%.

Its market cap is CA$28.96 million with 87.78 million shares outstanding, and it trades in a 52-week range of CA$0.21 and CA$0.68.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of West Point Gold.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

1. Ownership and Share Structure Information

The information listed above was updated on the date this article was published and was compiled from information from the company and various other data providers.

( Companies Mentioned: WPG:TSXV; WPGCF:OTCQB,

)