Author: Gold News Club

Source: Streetwise Reports 11/03/2025

Torr Metals Inc. is expanding its inaugural drilling program at its Kolos Copper-Gold Project in southern British Columbia after the successful closure of a previously announced non-brokered private placement. Find out why one analyst says the stock is great exposure to both copper and gold opportunities across Canada.

Torr Metals Inc. (TMET:TSX.V) announced it is expanding its inaugural drilling program at its Kolos Copper-Gold Project in southern British Columbia after the successful closure of a previously announced non-brokered private placement that raised CA$5,341,058, the company said in a release on October 31.

This was achieved through the sale of 6,439,706 flow-through units priced at CA$0.17 each, 12,568,345 non flow-through units priced at CA$0.13 each, and 12,559,729 charity flow-through units priced at CA$0.208 each. Read the release for further details on the placement.

“This financing positions Torr very strongly, with about 70% of the flow-through portion supported by committed long-term backers through the charity component, and the rest from significant participation by key high-net-worth investors,” said President and Chief Executive Officer Malcolm Dorsey. “These funds fully finance our extensive drill program of up to 9,000 meters at our highway-accessible 332 km² Kolos Copper-Gold Project in southern British Columbia. This includes expanding our initial drilling from 1,500 to 2,500 meters, currently underway at the high-potential Bertha Target, followed by a Phase II program of approximately 6,500 meters in Spring 2026, targeting either Bertha or one of our three additional undrilled porphyry systems, two of which are already drill permitted, with one more permit pending at the Sonic Zone.”

Dorsey continued, “With 1,400 meters of drilling already completed in Fall 2025, we look forward to reporting assay results and sharing updates on our recently completed surface geochemical work at Sonic and Bertha South in the coming months.”

One insider of Torr participated in the offering, making this a related party transaction under Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions, the release said.

However, Torr is relying on exemptions from formal valuation and minority shareholder approval requirements as the fair market value of the subscription, in relation to the insider, does not exceed 25% of the Issuer’s market capitalization, as determined under MI 61-101.

Historical Data Reveals Soil Anomaly

Based in Edmonton, Torr Metals is dedicated to uncovering new copper and gold prospects within well-established and easily accessible mining districts throughout Canada. These areas benefit from existing infrastructure and a rising demand for immediate resources. Torr’s wholly owned, district-scale properties are strategically positioned for cost-effective, year-round exploration and development.

Kolos and the strategically optioned 57 km² Bertha Property are located in southern British Columbia’s renowned Quesnel Terrane, just 30 kilometers southeast of the Highland Valley Copper Mine, Canada’s largest open-pit copper operation, and 40 kilometers south of Kamloops along Highway 5.

In northern Ontario, the 261 km² Filion Gold Project spans a largely unexplored greenstone belt with significant high-grade orogenic gold potential. It is situated just off Trans-Canada Highway 11, about 42 kilometers from Kapuskasing and 202 kilometers by road from the Timmins mining camp, home to world-class gold mines like Hollinger, McIntyre, and Dome.

In September, Torr announced results from the analysis of historical soil and rock grab samples at the Sonic copper-gold porphyry target at Kolos. The historical data revealed a 4.5 km² copper-gold soil anomaly extending north of the Sonic Zone within Torr’s 100%-owned land, showing up to 4,510 parts per million (ppm) copper (Cu) and 590 parts per billion (ppb) gold (Au).

Additionally, field reconnaissance in 2025 within the Sonic Zone Cu-Au porphyry target area uncovered a new mineralized outcrop approximately 1 kilometer northeast of Torr’s 2024 discovery, the company said. This outcrop returned 1.1% Cu in a magnetite-rich grab sample along the edges of a highly promising high magnetic anomaly.

The newly discovered outcrop returned 0.42% Cu from a strongly sheared quartz-carbonate vein hosted in Nicola Group volcanics, located near a pyritized monzonite intrusion and a silica-apatite dyke. These features suggest potential vectors toward an alkalic Cu-Au porphyry center with gold enrichment, supported by structural links to nearby epithermal Au-Ag-Cu (gold-silver-copper) systems at the Meadow Creek and Plug targets, where historical trenching yielded 2.24 grams per tonne (g/t) Au and 400.6 g/t Ag over 4.4 meters as well as 20.8 g/t Au over 0.56 meters.

Exposure to Copper and Gold Opportunities Across Canada

As copper exploration gains momentum in British Columbia’s Quesnel Trough, Torr is positioning itself for a potential new discovery, according to analyst John Newell of John Newell & Associates on October 6.1

With several undrilled copper-gold porphyry centers, robust infrastructure, and a streamlined share structure, Kolos is attracting interest as it starts the inaugural drill program, he said.

The Quesnel Trough is “home to some of Canada’s largest and longest-lived copper mines, including Highland Valley (Teck), New Afton (New Gold), and Copper Mountain (Hudbay),” Newell wrote.

The company’s projects give “exposure to both copper and gold discovery opportunities across Canada, with Kolos leading the near-term news flow as the first drill program begins in Q4 2025,” Newell wrote.

For investors looking to gain exposure to a new copper discovery narrative in one of Canada’s safest and most productive mining areas, Newell said Torr Metals was considered a Speculative Buy at the price at the time of writing of CA$0.15. The technical price targets are set at CA$0.24, CA$0.48, and a longer-term target in the range of CA$0.60–CA$0.65, contingent upon a confirmed discovery-driven breakout, Newell said.

The Catalyst: Sparking the Energy Transition

Copper is essential to the energy transition because of its critical role as an electrical conductor.

The metal’s prices are expected to increase this fall, driven by seasonal demand and ongoing supply constraints, presenting traders with lucrative opportunities, Don Dawson reported for Yahoo! Finance on October 6. Home builders are stockpiling copper for spring construction, especially for wiring and plumbing, with demand peaking from September to March. This seasonal trend, along with global economic factors, creates an ideal trading window, he said.

Meanwhile, Dawson reported that the global copper supply is expected to face a 300,000-metric-ton shortfall in 2025 due to production challenges in Chile and Peru, including labor strikes and mine disruptions. Increasing price volatility is exacerbated by low inventories on the London Metal Exchange, sometimes covering less than a day’s demand, Dawson wrote.

The energy transition — driven by electric vehicles, solar power, and AI-driven data centers — continues to boost demand, with copper consumption rising annually since 2020, the story noted.

Gold futures began trading at US$4,001 per ounce on Monday, marking a 0.5% increase from Friday’s closing price of US$3,982.20, wrote Catherine Brock for Yahoo! Finance on November 3. [OWNERSHIP_CHART-11133]

Since October 28, gold prices have fluctuated between US$3,910 and US$4,040.

Over the weekend, China announced a revision to its gold tax policy. Previously, retailers could offset a 13% value-added tax when selling gold acquired from the Shanghai Gold Exchange and Shanghai Futures Exchange. The new policy reduces this offset to 6% for certain retailers, specifically jewelry sellers and those not affiliated with the exchanges.

Following the announcement, share prices for Chinese jewelry companies declined. Some analysts anticipate that this tax change will lead to higher retail prices for gold jewelry in China and potentially worldwide.

Ownership and Share Structure2

About 13% of the company is owned by insiders and close associates and about 6% by institutions. The rest is retail and high net worth investors.

Top shareholders include Torr Resources Corp. (owned by CEO Malcolm Dorsey) with 7.65%, John Williamson with 5.46%, Sean Richard William Mager with 1.24%, and the CEO Dorsey with 0.11%, Refinitiv reported.

Torr has a market cap of CA$7.05 million and 52.26 million shares outstanding. It trades in a 52-week range between CA$0.08 and CA$0.18 per share.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Torr Metals Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Torr Metals Inc.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

1. Disclosure for the quote from the John Newell article published on October 6, 2025

- For the quoted article (published on October 6, 2025), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- Author Certification and Compensation: John Newell of John Newell and Associates was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it’s advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.

2. Ownership and Share Structure Information

The information listed above was updated on the date this article was published and was compiled from information from the company and various other data providers.

( Companies Mentioned: TMET:TSX.V,

)

Platonic Advice

Source: Michael Ballanger 11/03/2025

Michael Ballanger of GGM Advisory Inc. muses over his interest in Plato’s philosophies as it relates to current events and the market as a whole. Ballanger also shares a new copper pick.

Please do not ask me how I got onto this subject, but ancient philosophy has always intrigued me, which, for many of you, may start in the 1950s, with hula-hoops, fedoras, and skinny ties, and which was also the decade in which I was born and started school. Of all the ancient philosophers, Plato (c. 428/427 – 348/347 BCE) was always the one who drew my attention. An ancient Greek philosopher who, along with his teacher Socrates and his student Aristotle, Plato is today considered a central figure in the history of Western philosophy. His work laid the foundations for much of Western thought, influencing areas from ethics and politics to metaphysics and epistemology.

Many of Plato’s quotes are applicable to the world of trading. He is credited with quotes that cover a range of themes, including wisdom, knowledge, and the human condition.

Popular quotes include “The only good is knowledge and the only evil is ignorance,” “An unexamined life is not worth living,” and “The measure of a man is what he does with power,” with the latter particularly relevant to the Trump presidency and liberal use of the power called “executive order.”

Other notable quotes discuss the importance of education, the nature of love, and the consequences of civic participation, which all have a way of landing in the behavior of traders and investors the world over. Plato described the human soul as having three parts: reason (which should rule), spirit (which loves honor), and appetite (which desires bodily pleasures). Justice in an individual is achieved when these three parts are in harmony.

One particular Plato-ism is “A good decision is based on knowledge and not on numbers,” and for a chap like me, schooled in finance and accounting from a highly-reputed business school like SLU, it carries impact. In the early days of my career, breaking down an income statement or dissecting a balance sheet were important tools to use in analyzing a company’s investment merits. Calculating the debt-equity ratios or performing the “acid test” were important determinants for the actual decision to pull the trigger on a trade.

However, over the years, the rise in the usage of technical analysis muscled out the fundamental analysts’ importance, including the highly advanced form of “T.A.” known as “quantitative analysis,” which is the study of historical money flow by measuring the quantity of buying and selling in any given issue over a set time frame. In this manner, knowledge in the form of experience has replaced numbers in assessing a trade set-up.

Plato further expanded on the theme of fear and greed dominating markets with this famous quote: “Human behavior flows from three main sources: desire, emotion, and knowledge.” These quotes were all recorded on papyrus paper with ancient ink derived from soot (lampblack), gum Arabic, and water, a full 400 years before the birth of Jesus Christ. I find the wisdom of the “ancients” an invaluable tool for dealing with the issues confronting traders and citizens alike, with Plato carrying a distinct edge.

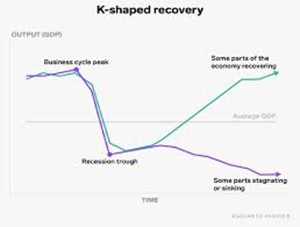

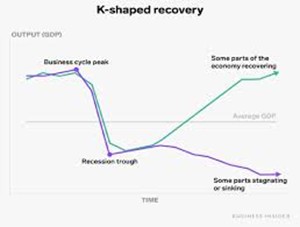

In light of political developments in the past two years around the globe, the statement made to my left is particularly relevant. The “K-Shaped economy” has the upper crust 10% elite growing their wealth while the bottom 90% are struggling to make ends meet, and this is occurring not just in the U.S. but on all continents. The United Kingdom, generally considered the birthplace of democracy with the formation of the Magna Carta in 1215, has had five leaders in the past ten years. Greece has had seven since 2007; Australia has had six prime ministers in the past eight years, while Italy has had five.

In countries where there is a wide discrepancy in living conditions, the populist movement is growing fast and wide as large swaths of needier citizens are exercising their right to vote and rejecting the policy platforms of many candidates whose campaigns were largely financed by the upper classes. The policies of the candidates financed by the elite have become almost confrontational to the interests and welfare of the needy majority, which is why the elite need to have candidates from both ends of the political spectrum that divide the lower class majority as a voting bloc in favor of meaningless issues that are not of concern to the elites.

The time is rapidly approaching where “the measure of a man” is based upon the implementation of policies designed to benefit the capitalist system as opposed to special interest groups on both sides of the aisle.

For example, Canada, until very recently, had a system of social safety nets such as free health care and unemployment insurance that softened the impact of recessions, but with unbridled immigration since the Liberals came to power ten years ago, that system is now creaking under the weight of simply too many people arriving before the increases in capacity could be achieved.

In the case of the Trudeau-Carney leadership, there has been an absence of even the most basic of planning for enhancements to social infrastructure, and this is the root of social unrest that leads to rejection of the status quo. Since the majority of voters in Canada fall into the lower-income brackets, there is a tendency for them to reject the current system (capitalism) in favor of a different, more forgiving one that includes great government guarantees of living standards, including basic necessities.

An even greater example of this fracturing is occurring in the current mayoralty race in the financial capital of the world (New York City) where the leading candidate is Democrat Zohran Mamdani, whose campaign promises include Affordable Housing (bringing down rent and freezing rent for all rent-stabilized tenants, Public Transit (investing in world-class public transit, including increased subway service and a fare-free bus system, Childcare (providing free childcare for every child up to five years old and Enhanced Public Services: (advocating for city-run grocery stores and increased investment in the City University of New York (CUNY).

- Immigrant Background: Born in Kampala, Uganda, Mamdani moved to New York City at age seven and became a naturalized American citizen in 2018.

- Identity: If elected mayor, he would be the city’s first Muslim mayor and first person of South Asian descent to hold the position.

- Career Experience: Prior to running for office, he worked as a foreclosure prevention housing counselor, which he has cited as a formative experience that highlighted the systemic housing crisis.

Mamdani leads in both polls by significant margins (25 points in the Emerson poll and 16 points in the Marist poll), which is clearly the result of increased immigration. New York City’s immigrant population has remained substantial since 2015, generally hovering around 3 to 3.3 million individuals, who comprise roughly 38% of the city’s total population. However, the flow of new legal permanent residents (LPRs) and temporary visa holders slowed significantly due to a combination of more stringent federal immigration policies prior to the COVID-19 pandemic and mobility restrictions during it. A more recent, distinct influx has been that of asylum seekers since the spring of 2022.

With the K-shaped economy placing increased stress upon working-class households and with 38% of the NYC population being recent immigrants, the arrival of a Muslim candidate offering free perks to the working classes is an ominous departure from the elite-class candidates, such as Governor Cuomo. Needless to say, a Mandani victory will most certainly trigger watershed changes in the Big Apple. In fact, I can envision major departures of major financial services firms to friendlier locales if things go out of control.

I do not intend to make a positive or negative commentary on immigration because we North Americans are all “immigrants.” My grandparents were immigrants from the U.K. after WWI, and in fact, the vast majority of the little town of Malton was comprised of English, Irish, and Scottish immigrants. The difference between 1918 and 2025 is that the volume of immigrants came to a country without a social safety net, so there was no sudden added stress upon the system.

As investors, we must heed the words of Plato when he wrote: “No man is more hated than he who speaks the truth.” In a 2002 interview, Sun Microsystems CEO Scott McNealy referred to the stock’s price-to-sales ratio of 10 at its peak, when shares were around $64 in early 2000. He famously explained the absurdity of this valuation by outlining the unrealistic assumptions required to justify such a price, including paying out 100% of revenues as dividends for 10 years, having zero costs and expenses, and paying no taxes.

He concluded by asking the interviewer and the audience if they would buy his stock at $64, given these ridiculous assumptions. Now, while that was most certainly not his message in 2000 before the stock peaked, he was reviled by the media and by shareholders for issuing his version of “The Emperor’s New Clothes.”

One wonders if that will ever be repeated by leaders like Elon Musk (Tesla Inc. (TSLA:NASDAQ)) or Jensen Huang (Nvidia Corp. (NVDA:NASDAQ)) any time soon. . .

Gold & Silver

Without mentioning any names, this past week I counted about two dozen gold bulls calling a bottom in the gold miners and more than a few dozen also doubling down on their calls for $200 silver.

Descriptives like “generational buying opportunity,” “massively oversold,” and “London is bare!” plastered the Twitterverse with every Tom, Dick, and Harry with a laptop and a mittful of gold and silver miners now underwater after the bona fide September buying stampede turned into a regurgitation regatta on October 17.

The period of August 27 to October 21 was a classic buying stampede, but it was by no means a “bubble” as in the 1970s version of a “bubble.” The “AI” trade and the “crypto” trade are both in advanced stages of “bubbles” with the one glaring difference being that nobody in the gold camp was taking out advertising space urging the public to “sell Bitcoin and BUY gold!”

The people I know and respect in the gold mining community always compare gold to other financial (mainly “paper”) assets. One often sees charts and graphs off the “Dow-to-gold ratio” or the “gold miners-to-gold bullion ratio” but rarely does one see a “Newmont Corp. (NEM:NYSE; NGT:TSX; NEM:ASX)-to-NVidia ratio” or a “Newmont-to-Bitcoin ratio” because while you can compare price earnings data or price-to-book data for both gold miners and the average S&P component, you cannot compare Bitcoin to any miner because it does not produce anything and never will.

Silver closes the week out well below the $50 breakout level, and judging from the silence of all the crazy-ass silver bugs out there SCREAMING about silver shortages and bullion bank manipulation, silver is coming off the same type of manic buying stampede that afflicted gold in September. However, when silver decides to move, the entire universe of silver bulls all recite in unison at the top of their lungs, “It’s DIFFERENT this time” (followed by fifty exclamation marks) and side-by-side portraits of Eric Sprott, Rick Rule, Peter Schiff, and the premier of Bulgaria, all smiling and holding silver bars up to the camera.

In the category of “Been there, done that, got the T-shirt,” I, too, was one of those wild-eyed maniacs ignoring indicators like RSI and DSI and MACD back in 1980 when I would recite “The Case for Silver” written by Harry Browne with endorsements by Doug Casey and the Hunt Brothers. It is never “different this time” nor will it ever because speculative fever in silver carries two acronyms that are so familiar to anyone who has ever owned a junior mining stock with a brand new discovery — FOMO (“fear of missing out”) and YOLO (“you only live once”).

Just as memories of the Crash of ’29 still haunt investors around the globe (even if no one is alive today from that event), everyone over the age of seventy (like me) can recall vividly the events of January 1980 when silver topped out (intraday) above $50/ounce. One second, it was a bull market, and in the blink of a watering eye, a bear.

1980 Silver Top

After a blistering year-end rally lasting 26 days from December 12 to January 4, the 1979-1980 rally had all the same characteristics as the August-October rally this year. Line-ups at the bullion exchanges, widespread bullish sentiment, and a near-vertical buying panic that was impossible to deny, except for October 17, when $54 silver suddenly became $47 silver.

The one difference between 1980 and 2025 lies in the form of one man — Paul Volcker — the Chairman of the Federal Reserve Board. When compared to current Fed Chairman Jerome Powell, it is “nolo contendere” (no contest). Volcker decided to crush inflationary expectations with the same fervor that the last four Fed Chairpersons protected the S&P 500, only Volcker had to fight both Wall Street and the banco-politico cartel in order to accomplish his objective, and in doing so, he threw the global economy into an upward interest rate spiral and recession that led to the 1981-1982 bear market.

Mind you, he had lots of room to maneuver because in 1980, the U.S. was the world’s largest creditor nation, and in 2025, Jerome Powell is navigating with the U.S. being the world’s largest debtor nation — a huge difference to boot.

The $37.8 trillion debt bomb that is sitting with a lit fuse burning ever so rapidly toward explosion is the only reason why I expect the recent reversal in gold and silver to be a temporary correction to test perhaps the 100-dma and, in the worst case, their respective 200-dma levels. Powell’s hands are tied, preventing him from engineering an 80s-style deflationary recession because he knows that the U.S. economy IS the U.S. stock market and vice versa. To crush inflation is to crush the S&P, which is to crush the economy.

To coin a phrase from the 1988 vice-presidential debate between Lloyd Bentsen and Dan Quayle: “Jerome, I knew Paul Volcker from the 1980s; you, Mr. Chairman, are no Paul Volcker.”

Copper

Copper rebounded from the “hawkish-Fed, weak-China” narrative that caused the Thursday haircut back from $5.25 to $5.05 before going out today at $5.114/lb. There is nary a day that I pick up the paper and fail to read yet another bullish report on copper. It is like watching a Roberto Duran boxing match in the 1970s.

His left hand is copper demand, while his right hand is copper supply, and whenever he fought, both hands moved with lightning speed and terminal velocity, inflicting maximum damage upon the recipient.

Pound for pound, Roberto Duran was the best knockout puncher in the fight game for a decade, leading me to believe that copper will be the one Roberto Duran-style metal for the decade ending in 2030. The unstoppable left-right combinations of shrinking supply and escalating demand are going to make it a champion, and while all the noise is about “AI” and “BTC” and gold and silver, the one metal moving quietly into overdrive is copper.

A new copper explorer that I am now accumulating is Grafton Resources Inc. (GFT:CSE; PMSXF:OTC), whose Alicahue Copper Project in Chile is scarily close to the Caballos copper-molybdenum discovery made earlier this year by another GGM Advisory favorite Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB).

Fire me an email at miningjunkie216@outlook.com for a copy of the report covering the project. They are participating in a highly sophisticated geophysical survey later in November, followed by a deep drilling program designed to identify high-grade copper-gold porphyry targets at depth. The entire area is underexplored due in large part to a geological survey carried out by a French government group a number of years ago that essentially threw cold water on the vicinity because of what they deemed rocks that were “too young” to be considered “highly prospective.”

What debunked that was the reported discovery by Fitzroy of a 200m interval of .81% Cu-Eq (copper-moly) within a perfectly preserved sulphide body of mineralization. This means the entire region carries “District-scale” potential, and with drilling having commenced at Caballos and about to commence at a second location called “Cerro las Mulas” (“Mule Hill”), the two big copper-bearing footprints at Alicahue are of great interest to me and all subscribers.

Happy Days

We close out the month to the sound of “Happy Days are Here to Stay” (sung to the tune of “Happy Days are Here Again”) as all the averages closed at or near all-time highs. Excluding the precious metals, the only risk assets failing to tap new highs this week were Bitcoin , trading 13.28% off the previous all-time high, and the unweighted S&P 500 (SPXEW:US), trading 2.32% off its record high on October 2.

Since Bitcoin is closely correlated to the NASDAQ and SPXEW:US is a symbol of market breadth, I would say that this week has had a number of bearish divergences, but not enough to convince me that Santa Claus will be replaced by The Grinch this year.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Tesla Inc. and Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Tesla Inc., Grafton Resources, and Fitzroy Minerals Inc. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

( Companies Mentioned: FTZ:TSX.V; FTZFF:OTCQB,

GFT:CSE;PMSXF:OTC,

)

Source: Streetwise Reports 11/03/2025

Irving Resources Inc. (IRV:CSE; IRVRF:OTCQX) reported broad, near-surface gold-silver intercepts with high silica content at its Omu Project in Hokkaido, Japan. The results support Irving’s focus on discovering smelter flux-compatible mineralization alongside earn-in partner JX Advanced Metals.

Irving Resources Inc. (IRV:CSE; IRVRF:OTCQX) has reported encouraging drill results from its ongoing exploration at the Omui and Omu Sinter targets, located within the Omu Gold-Silver Project in Hokkaido, Japan. The company, alongside its earn-in partner JX Advanced Metals Corporation, has completed multiple shallow diamond drill holes targeting silica-rich, gold-silver mineralization suitable for use as smelter flux in the Japanese base metal industry.

At the Omui target, five low-angle core drill holes defined a mineralized corridor approximately 200 meters long. These intercepts occur within 50 meters of surface and returned notable gold-silver values along with high silica content, making the material potentially amenable to small-scale open-pit extraction. Highlights from the 2025 drill campaign include hole 25OMI-002, which returned 26.38 meters grading 2.50 gpt gold, 22.03 gpt silver, and 78.9% silica, including a 2-meter interval grading 24.22 gpt gold and 173.40 gpt silver. All mineralized intervals show silica contents mostly ranging from 80% to above 90%, which aligns with the company’s objective of finding smelter flux-compatible ore.

A separate shallow vertical hole, 25OMS-001, drilled at the nearby Omu Sinter target, intersected 41.81 meters averaging 0.54 gpt gold, 8.7 gpt silver, and 96.6% silica. The mineralized body lies only a few meters below surface and is characterized as a flat horizon deposited by ancient hydrothermal activity, with potential for lateral continuity.

Commenting on the results, Dr. Quinton Hennigh, director and technical advisor to Irving, stated in the news release, “We are very pleased to see expansive, shallow deposits of gold-silver-bearing silica emerge at both Omui and Omu Sinter. Our recent drill results indicate we are headed in the right direction.”

Drill core samples were analyzed by ALS Global, and the company reported that standard industry quality control protocols were followed, including the use of blanks and standards.

Precious Metals Exploration and Smelter Flux Supply

According to a report from Excelsior Prosperity published on October 26, precious metals producers had been generating “cartoonish cashflow” amid high gold and silver prices. The report noted that “gold development projects . . . are seeing eye-popping Net Present Values (NPVs)” at price sensitivities around US$4,100 per ounce. Although equities had seen recent pullbacks, the article described gold at US$4,126.50 as “still historically an amazing price,” supporting operational strength across the sector. The silver market also experienced a significant breakout, with futures peaking at US$53.765 before settling back to US$48.388. While silver stocks corrected sharply, closing above the 50-day exponential moving average was viewed as maintaining a bullish technical posture.

On October 29, Dominic Frisby reflected on longer-term retail sentiment in the metals space, pointing out that the current environment did not mirror past tops. In contrast to historical selloffs, Frisby stated that “we are not there yet” in terms of retail divestment of physical metals. He recalled that in previous peaks such as 1980 and 2011, retail activity was marked by large-scale selling of family gold and silver, noting, “Even today, 45 years on, the silver price is lower than it was then — that’s how insane that spike was.”

A separate report from Pretiorates on October 29 addressed structural investment trends in the mining industry. The publication wrote that while gold and silver prices had risen sharply since the spring of 2024, passive investment vehicles such as ETFs had not followed suit, leaving many mining equities “chronically undervalued, no matter how strong their fundamentals.”

The report emphasized the importance of using the price-to-cash flow ratio (P/CF) over earnings-based metrics, as mining company profits are significantly affected by fluctuating commodity prices. It added that central banks had increased their gold reserves from 30,000 to over 36,000 tons over the past 15 years, now comprising about 20% of their balance sheets — a trend signaling renewed interest in precious metals as part of the global financial system.

Pretiorates also discussed potential changes in the silver market, including a report suggesting that India may allow silver to be used as collateral in the banking system at a 10:1 ratio with gold. The analysis described the current 80:1 silver-gold market ratio as “unsustainable,” given silver’s geological abundance and production frequency. The publication concluded that such policy shifts could represent “a new chapter in the silver market.”

Analyst Highlights High-Grade Gold and Strategic Smelter Relationship

On October 31, newsletter writer Chen Lin of What’s Chen Buying? What’s Chen Selling? shared a favorable assessment of the recent drill results from the Omui target. He wrote, “IRV.cn released excellent news from Omui. Remember the Omui project is in the process of permitting with Japan’s largest smelter. Every gold discovered there means a lot of extra profits into the bottom line as the smelter is looking for silica.”

Chen emphasized the significance of the grades encountered in multiple holes, adding, “There is high-grade gold in multiple holes. 2 meter of 24g/t gold and 173 g/t silver in hole 002 and 2.3 meter of 5.1g/t gold and 61g/ton silver in 003. It seems they hit high grades in most of the holes, this is quite impressive.”

He concluded by pointing to the broader implications of the company’s permitting process, stating, “They are working on a mining license with its partner, Japan’s largest smelter. Once they start mining, this gold will generate very good free cash flow.”

Catalysts Section: Expanding Smelter Flux Opportunities with High-Silica Intercepts

The recent drilling has expanded the known footprint of silica-rich gold-silver mineralization at both Omui and Omu Sinter, supporting Irving’s long-term strategy of identifying shallow deposits for smelter flux use. High silica content, often exceeding 80%, is essential for this industrial application, and the latest results suggest significant near-surface volumes of suitable material, as outlined in the company’s investor presentation. [OWNERSHIP_CHART-9140]

The company highlighted that discussions are underway with JX Advanced Metals Corporation to plan next steps for the Omui target. Additionally, further drilling is continuing at Omu Sinter to assess groundwater conditions and test the continuity of the silica horizon. The mineralized zones at both sites remain open for extension.

With multiple broad, shallow intercepts and strong alignment with industrial-grade silica requirements, Irving’s Omu Gold-Silver Project may contribute to Japan’s domestic smelter flux supply.

Ownership and Share Structure 1

Management and directors own about 9.3% of Irving, and strategic investors Newmont and Sumitomo own 17.63% and 4.78%, respectively.

Yahoo! Finance said about 1% is owned by institutions. The rest is retail.

According to Refinitiv, top insiders include President and Chief Executive Officer Akiko Levinson with 4.88% and Hennigh with 3.1%.

Irving Resources Inc. has CA$21.67 million in market capitalization and approximately 83.36 million shares outstanding. The company’s 52‑week trading range is CA$0.1450 at the low and CA$0.40 at the high.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Irving Resources Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Irving Resources Inc.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

1.Ownership and Share Structure Information

The information listed above was updated on the date this article was published and was compiled from information from the company and various other data providers.

( Companies Mentioned: IRV:CSE; IRVRF:OTCQX,

)

Source: Philip Ker 11/03/2025

Liberty Gold Corp.’s (LGD:TSX; LGDTF:OTCQX) first batch of definition drill data from the Discovery zone at its Black Pine project shows “continuous oxide gold mineralization being intercepted over broad widths,” noted a Ventum Capital Markets report.

Liberty Gold Corp.’s (LGD:TSX; LGDTF:OTCQX) latest drill results from its Black Pine gold project in Idaho put the Discovery zone back in the spotlight, according to Phil Ker, analyst at Ventum Capital Markets, who wrote in an October 29 research note.

“New assays from ongoing drilling at Liberty’s Black Pine project once again delivered excellent results,” Ker wrote.

69% Gain Possible

Ventum Capital reiterated its CA$1.15 per share target price on the Canadian explorer, noted Ker. At the time of the analyst’s report, Liberty was trading at about CA$0.68 per share, at a price:net asset value of just 0.15x, a discount to the average of its peer group (other gold developers under Ventum’s coverage), 0.25x.

The difference between the target and current prices implies a potential return of 69%.

Liberty remains a Buy.

“The company continues to impress with excellent results via the drill bit, with derisking initiatives unlocking further value and supporting ongoing feasibility-level studies,” Ker wrote. “With high sensitivity to an elevated commodity price, we continue to see increasing value for shareholders of LGD.”

The company has 455.2 million shares outstanding, a market cap of CA$310 million and a 52-week range of CA$0.25–0.78 per share.

Data at a Glance

Liberty’s new results are for the first nine drill holes of a 35–40 hole program targeting Black Pine’s Discovery zone, Ker reported. Most of the existing drill results for Discovery are historical and include some of the highest grades ever reported from Black Pine.

Among the fresh results are the following standout intercepts:

- 85.3 meters (85.3m) of 1.53 grams per ton gold (1.53 g/t Au), including 9.1m of 5.19 g/t Au

- 59.4m of 1.17 g/t Au, including 15.2m of 3.44 g/t Au

Interpretation of Results

Ker explained that these new results show continuous oxide gold mineralization, comprised of a series of stacked lenses, intercepted over broad widths. Within these lenses are “impressive” higher-grade mineralized zones.

“Today’s results now confirm the continuation of previously mined high-grade shoots in the historic B pit area,” wrote Ker.

They also emphasize the significant resource upside at Black Pine and its potential overall.

Ker pointed out that these new data from Discovery will be integral to defining several components of the feasibility study, including mine design, metallurgical domain models, and early production planning.

Definition Drilling Continues

Liberty’s feasibility definition drill program continues, and in an aggressive fashion, reported Ker.

Four rigs, one core, and three reverse circulation, are operating 24 hours a day. They are active in the Discovery and Rangefront zones, carrying out metallurgical, hydrological, geotechnical, and resource conversion drilling.

A fifth rig is expected to be started up next month. Its drilling will yield data to be collected for necessary soil engineering works, Ker relayed.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Liberty Gold Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$5,000.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Disclosures for Ventum Capital Markets, Liberty Gold Corp., October 29, 2025

Ratings BUY : recommendation: stock is expected to appreciate from its current price level at least 10-20% in the next 12 months. NEUTRAL : recommendation: stock is expected to trade in a narrow range from its current price level in the next 12 months. SELL : recommendation: stock is expected to decline from its current price level at least 10-20% in the next 12 months. U/R : Under Review N/R : No Rating TENDER: Investors are guided to tender to the terms of the takeover offer. Analyst recommendations and targets are based on the stock’s expected return over a 12-month period or may be based on the company achieving specific fundamental results. Under certain circumstances, and at the discretion of the analyst, a recommendation may be applied for a shorter time period. The basis for the variability in the expected percentage change for a recommendation, relates to the differences in the risk ratings applied to individual stocks. For instance stocks that are rated Speculative must be expected to appreciate at the high end of the range of 10-20% over a 12-month period.

Ratings BUY : recommendation: stock is expected to appreciate from its current price level at least 10-20% in the next 12 months. NEUTRAL : recommendation: stock is expected to trade in a narrow range from its current price level in the next 12 months. SELL : recommendation: stock is expected to decline from its current price level at least 10-20% in the next 12 months. U/R : Under Review N/R : No Rating TENDER: Investors are guided to tender to the terms of the takeover offer. Analyst recommendations and targets are based on the stock’s expected return over a 12-month period or may be based on the company achieving specific fundamental results. Under certain circumstances, and at the discretion of the analyst, a recommendation may be applied for a shorter time period. The basis for the variability in the expected percentage change for a recommendation, relates to the differences in the risk ratings applied to individual stocks. For instance stocks that are rated Speculative must be expected to appreciate at the high end of the range of 10-20% over a 12-month period.

Analyst Certification I, Phil Ker, hereby certify that all of the views expressed in this report accurately reflect my personal views about the subject securities or issuers. I also certify that no part of my compensation was, is, or will be, directly or indirectly related to the specific recommendations or views expressed in this report. I am the research analyst primarily responsible for preparing this report. Research Disclosures Company Disclosure Liberty Gold Corp. 3, 4 Applicability 1. Ventum Financial Corp. and its affiliates’ holdings in the subject company’s securities, in aggregate exceeds 1% of each company’s issued and outstanding securities. 2. The analyst(s) responsible for the report or recommendation on the subject company, a member of the research analyst’s household, and associate of the research analyst, or any individual directly involved in the preparation of this report, have a financial interest in, or exercises investment discretion or control over, securities issued by the following companies. 3. Ventum Financial Corp. and/or its affiliates have received compensation for investment banking services for the subject company over the preceding 12- month period. 4. Ventum Financial Corp. and/or its affiliates expect to receive or intend to seek compensation for investment banking services from the subject company. 5. Ventum Financial Corp. and/or its affiliates have managed or co-managed a public offering of securities for the subject company in the past 12 months. 6. A director(s), officer(s) or employee(s) of Ventum Financial Corp. is a director of the subject company in which Ventum provides research coverage.6 7. A member of the research analyst’s household serves as an officer, director or advisory board member of the subject company. 8. Ventum Financial Corp. and/or its affiliates make a market in the securities of the subject company. 9. The analyst had an on-site visit with the subject company. For details, refer to the General Disclosure section. 10.The analyst or any partner, director, or officer has been compensated for travel expenses incurred as a result of an on-site visit with the subject company. 11.During the past 12 months immediately preceding the date of the research report or a recommendation was issued, Ventum Financial Corp has provided services by any partner, director or officer of the Dealer Member or analyst involved in the preparation of a report, other than services provided in the normal course investment advisory or trade execution services to the subject company for remuneration.

General Disclosure The affiliates of Ventum Financial Corp. are Ventum Financial (US) Corp., Ventum Financial Services Corp., and Ventum Capital Corp. Analysts are compensated through a combined base salary and bonus payout system. The bonus payout is amongst other factors determined by revenue generated directly or indirectly from various departments including Investment Banking. Evaluation is largely on an activity-based system that includes some of the following criteria: reports generated, timeliness, performance of recommendations, knowledge of industry, quality of research and investment guidance, and client feedback. Analysts and all other Research staff are not directly compensated for specific Investment Banking transactions.

None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Ventum Financial Corp. Ventum Financial Corp.’s policies and procedures regarding dissemination of research, stock rating and target price changes can be reviewed on our corporate website at www.ventumfinancial.com (Research: Research and Conflict Disclosure). The attached summarizes Ventum’s analysts review of the material operations of the attached company(s). Analyst Company Type of Review Operations / Project Date Ker, Phil Liberty Gold Corp. Management Review All 08/19/25 Recommendations Number of Recommendations Percentage BUY 68 70.83% NEUTRAL 6 6.25% SELL 0 0.00% UNDER REVIEW 18 18.75% N/R 0 0.00% TENDER 2 2.08% RESTRICTED 2 2.08% TOTAL 96 Stock Rating and Target Changes For reports that cover more than six subject companies, the reader is referred to our corporate website for information regarding stock ratings and target changes. ventumfinancial.com (Research: Research and Conflict Disclosure). Liberty Gold Corp. Rating History

( Companies Mentioned: LGD:TSX; LGDTF:OTCQX,

)

Source: Rabi Nizami 11/03/2025

Perpetua Resources Corp. (PPTA:TSX; PPTA:NASDAQ) receives this in the form of a US$255 million strategic investment, a better financing alternative to the previously planned royalty or stream sale, noted a National Bank of Canada report.

Perpetua Resources Corp. (PPTA:TSX; PPTA:NASDAQ) agreed to receive US$255 million (US$255M) in the form of a strategic equity investment by Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) and JP Morgan Chase & Co. (JPM:NYSE), reported Rabi Nizami, analyst in National Bank of Canada’s Capital Markets division (NBCCM), in an Oct. 27 research note. The private placement is slated to close in the next day or so.

“The private placement and premium-priced warrants offer a vote of confidence and a better financing alternative than the previously anticipated, up to 3.9% net smelter return (NSR) royalty or stream structure,” Nizami wrote.

53% Return Implied

NBCCM maintained its CA$50 per share target price on the Idaho-based mining developer, noted Nizami.

“We expect Perpetua to advance through a steady price:net asset value rerate over the near-term construction period, with the potential for a more significant valuation rerate towards the later years of the build, given the project’s potential to generate over US$1 billion (US$1B) annual EBITDA,” the analyst wrote.

Compared to the CA$50 per share target, Perpetua was trading at the time of Nizami’s report at about CA$32.60 per share. From this price, the return to target is 53%.

Perpetua remains rated Outperform.

Terms of the Arrangement

Nizami provided the details of Perpetua’s financing deal with Agnico Eagle and JPMorgan & Chase. The two companies’ total investment comprised US$255M in a private placement and up to US$142M in warrants having one-, two-, and three-year maturity at premiums of 35% (US$31.46/share), 50% (US$34.95/share), and 65% (US$38.45/share). In the private placement, Perpetua issued a total of 10.94 million (10.94M) shares at US$23.30 apiece, the company’s price at last close. Both AEM and JPM entered into Investor Rights Agreements with Perpetua, meaning they may participate, on a pro rata basis, in future equity offerings to maintain their respective degree of ownership.

With respect to Agnico Eagle, it acquired 7.73M Perpetua shares at US$180M total for a 6.5% stake, to thereby become Perpetua’s second-largest shareholder. Warrants for AEM amounted to 2.86M, and when fully exercised, Agnico’s interest in Perpetua will rise to 8.6%.

As part of AEM’s investment, the mining major and Perpetua agreed to form a joint technical and exploration advisory committee.

“Agnico’s participation also highlights the Stibnite project’s attractive scale and economics that we believe are of interest to all senior gold producers in a future mergers and acquisitions scenario,” wrote Nizami.

As for JPMorgan & Chase’s component of the private placement, the banking and financial services firm purchased 3.22M Perpetua shares for US$75M at terms equivalent to AEM’s. This garnered JPM a 2.7% stake, which will increase to 3.6% when all warrants have been exercised.

JPM’s investment was a vote of confidence in Perpetua, given that it is the first tied to the bank and financial services firm’s US$1.5 trillion Security and Resiliency Initiative. Under this program, JPM intends to facilitate, finance, and invest in industries critical to national economic security and resiliency over the next 10 years. JPM’s investment in Perpetua also showed “the urgency and relevance of the Stibnite project to the national strategic narrative,” wrote Nizami.

Prior to the placement involving AEM and JPM, the analyst reported, Perpetua’s Q3/25 share count totaled 107.57M. The private placement will add 10.94M shares, and the warrants, if exercised in full, will add another 4.05M shares. The overall effect will be a diluted 122.56M shares.

More Palatable Financing

The US$255M private placement is a better form of financing than Perpetua’s previously planned, up to 3.9% NSR royalty or stream deal, according to Nizami. The latter would have encumbered life-of-mine revenues to the tune of US$654M, at a US$4,000 per ounce gold price, and exploration upside as well.

Additionally, there already are two NSR royalties on Stibnite, a gold one for 1.7% and a silver one for 100%. Any further royalties would have complicated the setup.

Renewed Focus on Exploration

While working to get the various permits required for Stibnite, Perpetua invested little in exploration. Now that federal permitting is done and construction is underway, NBCCM expects the mining company to shift its focus to exploration at its flagship project over the coming months, Nizami wrote. The analyst also pointed out that the official, existing 4,200,000 million ounce gold reserve estimate for Stibnite is “under-represented” and outdated.

Continually Moving Forward

Nizami reported Perpetua’s recent achievements, and they prove the company is advancing Stibnite relentlessly. Last week, Perpetua commenced early works construction and posted the required financial assurance bond. Also, it engaged ATCO Ltd. (ACO.X:TSX) to build a housing facility at Stibnite for US$130M to accommodate 1,052 workers. ATCO will do preparation work throughout the rest of this year, kick off facility construction in 2026, and complete the project in Q1/27.

In the spring of 2026, Perpetua should get a final determination from the Export-Import Bank of the United States on its application for up to US$2B in debt financing for the construction of Stibnite.

“We would not be surprised to see PPTA receive further U.S. government-backed funding,” wrote Nizami. “Given recent precedents in the critical minerals space, direct equity participation by the U.S. is a possibility and would represent a strong catalyst.”

In the meantime, Perpetua will continue with early construction work.

Upcoming Catalysts

Nizami listed the many upcoming events that could catalyze Perpetua’s stock. NBCCM expects the company to announce an offtake agreement sometime this quarter. The major catalyst, expected in spring 2026, is EXIM’s final decision on debt financing for Stibnite. If positive, a full construction decision will follow, another possible stock-lifting event.

Other potential positive catalysts include news pertaining to the remaining state ancillary Idaho Pollutant Discharge Elimination System permit, such as a resolution or the start of a court proceeding; the start of exploration work with results to follow; and updates on Perpetua’s collaboration with the U.S. Department of Defense on high-purity antimony test work.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Perpetua Resources Corp is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Perpetua Resources Corp. and Agnico Eagle Mines Ltd.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Disclosures for National Bank of Canada Capital Markets, Perpetua Resources Corp., October 27, 2025

RISKS: Commodity Price Risk. Once producing, Perpetua would have the majority of its revenues tied to the sale of gold. Any decline in the price of gold may materially affect the company’s development and mining activities in the future. Other commodity price risks include antimony, although at a much lower significance vs. gold. Regulation Risk. The mining, processing, development and mineral exploration activities of Perpetua are subject to various laws governing prospecting, development, production, taxes, labour standards and occupational health, mine safety, toxic substances, land use, water use, land claim of local people and other matters. Permitting/Environmental Risk. The Stibnite project is subject to environmental regulation in the state of Idaho as well as regulations at a U.S. Federal level. These regulations require the project to operate within certain levels to maintain permits and advance the project. These regulations mandate the maintenance of air and water quality standards and land reclamation. The site requires a substantial cleanup of prior mining activities and an extensive 25-year reclamation plan. As the project is yet to achieve a fully permitted status, delays could occur in the granting of the final permits and or outright refusal to grant one or more of the final permits without more work carried out by the company to meet additional requirements and/or address new concerns raised by the permitting issuing government departments. Financial Risk. We assume that financing required to fund the development of Stibnite should come in the form of mostly debt, with the bulk of it assumed to be granted by EXIM at competitive interest rates, which is not guaranteed to be achieved on both the scale granted and the interest rate. Assuming this level of debt is granted, a portion of Perpetua’s future cash flows will be required to service this debt. ADDITIONAL COMPANY RELATED DISCLOSURES Perpetua Resources Corp. 2, 3, 4, 7 Agnico Eagle Mines Ltd. 6, 382 LEGEND FOR COMPANY RELATED DISCLOSURES: 2. NBF has provided investment banking services for this issuer within the past 12 months. 3. NBF or an affiliate has managed or co-managed a public offering of securities with respect to this issuer within the past 12 months. 4. NBF or an affiliate has received compensation for investment banking services from this issuer in the past 12 months. 5. The research analyst responsible for the report received compensation within the prior 12 months that was based upon NBF’s investment banking revenues. 6. NBF or an affiliate has a non-investment banking services related relationship during the past 12 months. 7. The issuer is a client, or was a client, of NBF or an affiliate within the past 12 months. 8. NBF or its affiliates expects to receive or intends to seek compensation for investment banking services from this issuer in the next 3 months. 9. As of the end of the month prior to the issuance date of this research report (or as of the end of the second most recent month if the report issuance date is less than 10 days after the end of the prior month), NBF or its affiliates beneficially own 1% or more of any class of common equity securities of this issuer. 10. NBF makes a market in the securities of this issuer at the time this report was published. 11. A partner, director, officer of NBF or the research analyst involved in the preparation of this report has, during the preceding 12 months, provided services to this issuer for remuneration other than services provided in the normal course of investment advisory or trade execution services. 12. A research analyst, its associate or any person directly involved in the preparation of this report holds or is short any of the issuer’s securities, directly or indirectly. 13. is a partner, director, officer, employee or agent of NBF and is a partner, an officer, director, or employee of, or serves in any advisory capacity to Perpetua Resources Corp..14. The research analyst or an associated person of NBF with the ability to influence the content of a research report knows or has reason to know any other material conflict of interest at the time of the publication or distribution of this report. 15. A redacted draft version of this report has been shown to the issuer for fact checking purposes and changes may have been made to the report before publication 382 An NBF Analyst attended a tour of Agnico Eagle’s Macassa mine and Upper Beaver Project in Kirkland Lake, Ontario on June 17, 2025. A portion of the analyst’s expenses were paid by the issuer. RATING DISTRIBUTION Outperform Sector Perform Underperform Coverage Universe Ratings Distribution 65% 31% 1% % of Rating with Investment Banking Relationship 78% 75% 100% DISCLOSURES GENERAL: This Report was prepared by National Bank Financial Inc. (NBF), a Canadian investment dealer, a dealer member of the Canadian Investment Regulatory Organization (CIRO) and an indirect wholly owned subsidiary of National Bank of Canada. National Bank of Canada is a public company listed on the Toronto Stock Exchange. The particulars contained herein were obtained from sources which we believe to be reliable but are not guaranteed by us and may be incomplete and may be subject to change without notice. The information is current as of the date of this document. Neither the author nor NBF assumes any obligation to update the information or advise on further developments relating to the topics or securities discussed. The opinions expressed are not to be construed as a solicitation or offer to buy or sell the securities mentioned herein, and nothing in this report constitutes a representation that any investment strategy or recommendation contained herein is suitable or appropriate to a recipient’s individual circumstances. In all cases, investors should conduct their own investigation and analysis of such information before taking or omitting to take any action in relation to securities or markets that are analyzed in this report. The report alone is not intended to form the basis for an investment decision, or to replace any due diligence or analytical work required by you or your advisers, if needed, in making an investment decision. The value of investments, and the income derived from them, can go down as well as up and you may not get back the amount invested. Neither past performance nor forecasts are a reliable guide to future performance. If an investment is denominated in a foreign currency, rates of exchange may have an adverse effect on the value of the investment. Investments which are illiquid may be difficult to sell or realize; it may also be difficult to obtain reliable information about their value or the extent of the risks to which they are exposed. Certain transactions, including those involving futures, swaps, and other derivatives, give rise to substantial risk and are not suitable for all investors. NBF makes no representation as to the proper characterization of the investments for legal, regulatory or tax purposes, or as to the ability of a particular investor to invest or transact in the investments under applicable legal restrictions. Differences in the legal and regulatory regimes in different jurisdictions may significantly impact the legal and regulatory risks affecting the investment sector and / or investment. It is your responsibility to assess any such differences and associated risks. This report is for distribution only under such circumstances as may be permitted by applicable law. This report is not directed at you if NBF or any affiliate distributing this report is prohibited or restricted by any legislation or regulation in any jurisdiction from making it available to you. National Bank of Canada Capital Markets is a trade name used by National Bank Financial Inc. and National Bank of Canada Financial Inc. CANADIAN RESIDENTS: NBF or its affiliates may engage in any trading strategies described herein for their own account or on a discretionary basis on behalf of certain clients and, as market conditions change, may amend or change investment strategy including full and complete divestment. The trading interests of NBF and its affiliates may also be contrary to any opinions expressed in this report. NBF or its affiliates often act as financial advisor, agent, lender or underwriter or provides trading related services for certain issuers mentioned herein and may receive remuneration for its services. NBF is a member of the Canadian Investor Protection Fund. UK RESIDENTS: This report is a marketing document. This report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and it is not subject to any prohibition on dealing ahead of the dissemination of investment research. The report is only for distribution to Eligible Counterparties and Professional Clients in the United Kingdom within the meaning of the rules of the Financial Conduct Authority (FCA). The investments contained in this report are not available to retail customers and this report is not for distribution to retail clients (within the meaning of the rules of the FCA). Persons who are retail clients should not act or rely upon the information in this report. As required by the FCA, we have a policy in place to identify and manage the conflicts of interest which may arise in the production of non-independent research as contained and distributed in this report.

In respect of the distribution of this report to UK residents, NBF has approved the contents (including, where necessary, for the purposes of Section 21(1) of the Financial Services and Markets Act 2000). NBF is authorized and regulated by the Financial Conduct Authority with registration number FC009503 and has its registered office at 70 St. Mary Axe, London, EC3A 8BE. U.S. RESIDENTS: With respect to the distribution of this report in the United States of America (the U.S.), National Bank of Canada Financial Inc. (NBCFI) is registered with the Securities Exchange Commission (SEC) as a broker-dealer and is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). NBCFI operates pursuant to a 15 a-6 Agreement with its Canadian affiliates, NBF and National Bank of Canada. NatWealth Management (USA) Inc. (NatWealth) is a SEC-registered investment adviser. This report has been prepared in whole or in part by research analysts employed by non-U.S. affiliates of NBCFI that are not registered as broker-dealers or investment advisers in the U.S. These nonU.S. research analysts are not registered as associated persons of NBCFI and are not licensed or qualified as research analysts with FINRA or any other U.S. regulatory authority and, accordingly, may not be subject (among other things) to FINRA restrictions regarding communications by a research analyst with the subject company, public appearances by research analysts and trading securities held in a research analyst account. NBF is a Participating Affiliate of NatWealth, and as such each research analyst who provides services to that constitute acting as an investment adviser under U.S. law and regulation is deemed an associated person of NatWealth as part of the participating affiliate regime established by SEC Staff no-action letters. If you make “hard dollar” payments in respect of NBF research services, then such services, including this report, are provided to you by NatWealth under the U.S. Investment Advisers Act of 1940 (the Advisers Act). If you do not make “hard dollar” payments in respect of NBF research services, then such services, including this report, are provided to you via intermediation of NBCFI under Rule 15a-6, and are not subject to the Advisers Act. Because the views of research analysts may differ, members of NBF Group may have or may in the future issue reports that are inconsistent with this report, or that reach conclusions different from those in this report. To make further inquiry related to this report, U.S. residents should contact their NBCFI registered representative or NatWealth associated person, as applicable. HK RESIDENTS: With respect to the distribution of this report in Hong Kong by NBC Financial Markets Asia Limited (NBCFMA) which is licensed by the Securities and Futures Commission (SFC) to conduct Type 1 (dealing in securities) and Type 3 (leveraged foreign exchange trading) regulated activities, the contents of this report are solely for informational purposes. It has not been approved by, reviewed by, verified by or filed with any regulator in Hong Kong. Nothing herein is a recommendation, advice, offer or solicitation to buy or sell a product or service, nor an official confirmation of any transaction. None of the products issuers, NBCFMA or its affiliates or other persons or entities named herein are obliged to notify you of changes to any information and none of the foregoing assume any loss suffered by you in reliance of such information. The content of this report may contain information about investment products which are not authorized by SFC for offering to the public in Hong Kong and such information will only be available to those persons who are Professional Investors (as defined in the Securities and Futures Ordinance of Hong Kong (SFO)). If you are in any doubt as to your status you should consult a financial adviser or contact us. This material is not meant to be marketing materials and is not intended for public distribution. Please note that neither this material nor the product referred to is authorized for sale by SFC. Please refer to product prospectus for full details. There may be conflicts of interest relating to NBCFMA or its affiliates’ businesses. These activities and interests include potential multiple advisory, transactional and financial and other interests in securities and instruments that may be purchased or sold by NBCFMA or its affiliates, or in other investment vehicles which are managed by NBCFMA or its affiliates that may purchase or sell such securities and instruments. No other entity within the National Bank of Canada group, including National Bank of Canada and National Bank Financial Inc., is licensed or registered with the SFC. Accordingly, such entities and their employees are not permitted and do not intend to: (i) carry on a business in any regulated activity in Hong Kong; (ii) hold themselves out as carrying on a business in any regulated activity in Hong Kong; or (iii) actively market their services to the Hong Kong public. EU RESIDENTS: With respect to the distribution of this report in the member states of the European Union (EU) and the European Economic Area (EEA) by NBC Paris, the contents of this report are for information purposes only and do not constitute investment advice, investment research, financial analysis or other forms of general recommendation relating to transactions in financial instruments within the meaning of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 (MiFID 2). This report is intended only for professional investors and eligible counterparties within the meaning of MiFID 2 and its contents have not been reviewed or approved by any EU/EEA authority. NBC Paris is an investment firm authorized by the French Prudential Control and Resolution Authority (ACPR) to provide investment services in France and has passported its investment services throughout the EU/EEA under the freedom to provide services and has its registered office at 8 avenue Percier, 75008 Paris, France. “NBC Financial Markets, a subsidiary of National Bank of Canada” is a trade name used by NBC Paris S.A. NBF is not authorized to provide investment services in the EU/EEA COPYRIGHT: This Report may not be reproduced in whole or in part, or further distributed or published or referred to in any manner whatsoever, nor may the information, opinions or conclusions contained in it be referred to without in each case the prior express written consent of NBF. RESEARCH ANALYSTS: All of the views expressed in this research report accurately reflect the research analyst’s personal views regarding any and all of the subject securities or issuers. No part of the analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this research report. The analyst responsible for the production of this report certifies that the views expressed herein reflect his or her accurate personal and technical judgment at the moment of publication. NBF compensates its research analysts from a variety of sources. The Research Department is a cost centre and is funded by the business activities of NBF including Institutional Equity Sales and Trading, Retail Sales, the correspondent clearing business, and Corporate and Investment Banking. Since the revenues from these businesses vary, the funds for research compensation vary. No one business line has a greater influence than any other for research analyst compensation.