Author: Gold News Club

Precious Metals: Fade the Rallies

Source: Michael Ballanger 10/27/2025

Michael Ballanger of GGM Advisory Inc. shares his view of the markets, taking at look at precious metals and Tesla Inc. (TSLA:NASDAQ).

By the end of this week, I will have counted (and read) over 200 emails lecturing me on why my call last Tuesday on gold and silver was so drastically off base and how I am going to lead my subscribers into “certain ruin,” along with a jeopardized career destined to be dashed on the jagged rocks of precious metals revenge.

What always amazes me is the vitriol and acidity of the remarks, especially from the silver bulls. They take to the Twitterverse and the digital universe using “cancel culture” as their weapon of choice, as they scour the internet for any record of misdeeds, no matter how trivial. Back in the day, if you ran into a trader shorting one of your deals, you would meet up in a bar, order up a couple of extra-dry martinis, and have a discussion. Sometimes you could turn the seller around, but most times not, as the fairness or ugliness of the deal was back then and is today, truly in the eye of not only the beholder but also the shareholder. That is the beauty and the reality of markets. Bulls and bears see the same set of statistics yet conclude two totally separate outcomes.

Alas, I know full well how aggravating it can be when you run into an early bull that has just turned bearish two nanoseconds after you just went “ALL-IN” on some trade. It has happened to me perhaps a hundred times over the past 47 years, and while there are individuals who are calm and reserved in their being on the opposite side of the trade, there are those really annoying types who enjoy jamming it in your face as if it were a duel in the OK Coral at 90 paces. What these emotional cretins fail to grasp is that the short-term bears like me can also be allies when the particular trade runs its course.

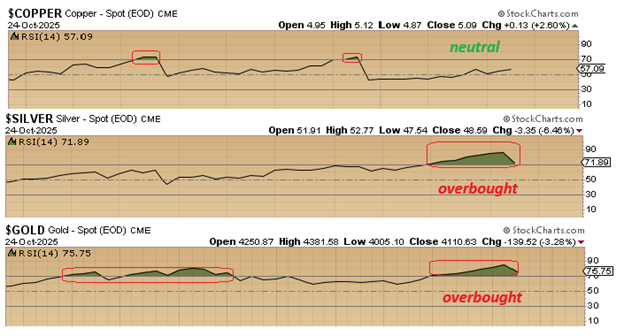

Gold and silver prices closed out the week lower than their closes last Friday, with December gold about $130/ounce below the October 17 close and with silver about $3.50/ounce below its October 17 close. As stated last in last week’s missive, the outside key reversal day a week ago was merely a “signal” telling me that the topping “process” had begun.

It did not mean that gold and silver were going to crash straight through the floorboards to their 200-dma’s in one fell swoop. Tops are a “process,” and after the perfectly normal rally on Monday to test the highs, it was Tuesday that completed the process, where the gold and silver markets both closed below the lows of the prior Friday. It was actually a picture-perfect topping process and fit every prerequisite that I have ever used to define a top. I took advantage of the action to solidify my hedges on gold and silver stocks I own, such that a corrective phase will be a mere annoyance rather than a disaster because at my age, the latter can evoke extreme reactions.

Silver always seems to evoke the most extreme of reactions as the silver “bug” is usually far more radical than the gold “bug,” but during times like this, when they both have been lashed mercilessly by the cat-o’-nine-tails of bullion bank suppression for the past fifteen years, tensions are high, to say the very least.

Silver and gold put in the first weekly red candle after nine consecutive “UP” weeks. It spent the better part of September and October in an “overbought” condition and my experience over the years teaches me that it will experience a corrective phase far longer than “two or three days” as many of the pundits have been extolling.

I get it. Silver is the most exciting of all the metals. It carries a certain luster that accompanies ownership. I love taking the 100-ounce bar set of three out of the vault (usually after a session of adult libation) and shining various lights on them within a black velvet background. It is a haunting experience but thoroughly delightful, especially if my wife is out with her girlfriends or upstairs asleep. She only caught me “admiring the precious” once in my life, and only after some attitudinal adjustment with a five-pound rolling pin did I decide to go “underground” in my worship of the shiny bars. However, I digress. . .

The first support for silver is at the 50-dma around $44.18, although below that is the more likely target of $40.66. If it really gets ugly, the 200-dma is at $36.46, but I seriously doubt we see that. While the 20-dma is rolling over, continued weakness will force the 50-dma to roll as well, so I have to default to my tried-and-true rule that says “no correction is real unless it inflicts maximum pain.“

A minor pullback to the 50-dma is a minor hiccup; traders can meet that margin call by accessing credit lines. A pullback to the 100-dma means you are selling assets to cover the cash call, and a drop to the 200-dma means you have the Mercedes up on eBay looking for a “quick sale.“

My guess (and that is all it is, albeit with calculation) is that the 100-dma holds at around $40, give or take a buck or so. In the meantime, it has been one helluva run in the PMs to the extent that my bank manager and margin clerk are out celebrating my newfound solvency with great gusto and well-deserved elan. . .

Never Short a Cult

“Never short a cult.” was the phrase used by Steve Eisman (of “The Big Short” fame) in an interview I recently watched regarding Tesla Inc. (TSLA:NASDAQ). The most celebrated failing EV manufacturer on the planet reported an earnings “miss” this week, but what grabbed me was this:

- Tesla’s net income for the quarter ending September 30, 2025, was $1.373 B, a 36.64% decline year-over-year.

- Tesla’s net income for the twelve months ending September 30, 2025, was $5.085 B, a 60.65% decline year-over-year.

- Tesla’s annual net income for 2024 was $7.13 B, a 52.46% decline from 2023.

- Tesla’s annual net income for 2023 was $14.999 B, a 19.2% increase from 2022.

Now, the stock peaked in October 2022 at around $450 an since then has seen earnings cut basically in half, yet it went out this week at $433.72. I am the first to admit that I am no rocket scientist when it comes to the automotive industry (or any other industry for that matter), but I do know a skunk when I see one.

Everything about TSLA, since I first came across it in 2018, reeks of foul play. From Donald Trump saying “We must protect our geniuses!” to the DOJ turning a blind eye to blatant stock manipulation when he announced that he had “secured funding” to “turn Tesla private at $420 per share” back in 2018, Elon Musk is a blatant charlatan.

At best, he should be considered a phenomenal stock promoter. At worst, he should be in jail. However, in today’s day and age, Elon is a Messiah that continues to deliver continual boosts to not only his ego by way of political support for the current U.S. President but also to his net worth statement by way of Tesla trading at $433 per share.

The action on Thursday was vintage Elon. They missed on the Street’s earnings estimate at $.56/share and came in at $0.50 after which the stock cratered 4%. The next morning on Tuesday, the stock opened even lower and was threatening “freefall” when, for some miraculous reason, it reversed upward, closing out the session with an actual gain on the session of 2.28% to $448.98 per share. I was completely gobsmacked.

So the stock has earnings cut in half since 2022 but yet is trading at or near its all-time high?

“Never short a cult,” was the advice given by the guy who pocketed a few billion by shorting the subprime market in 2007. Perhaps I should have listened to him, but I will not. I want to be the heavy metal drummer in the movie “The Big Short” (Michael Burry) who told everyone to get stuffed and walked away with billions. Without Elon, TSLA is a $50 stock (maximum). With Elon, it is the Second Coming of the Messiah.

Ignoring both, it is a pound-the-table short.

Copper

It was on July 30 that Donald Trump decided to pistol-whip we copper bulls by yanking back the tariffs on inbound “raw” copper, sending the Comex December copper price crashing down from the $6.0215/lb. to $4.4055 in a single session. Investors reacted immediately, sending blue-chip names like Freeport-McMoRan Inc. (FCX:NYSE) careening lower along with a bevy of Canadian juniors along with it.

I flattened my senior copper holdings the week before.

Not because I was clairvoyant, but because the RSI had exceeded 70 while the spread between the LME and the Comex was just too great.

(You have to be lucky to be good and vice versa, no?)

Copper has been relegated to the darkened cloakroom of investor disinterest since August 27, when Jerome Powell “hinted” at a Fed rate cut. It has been overpowered by gold and silver, where majors like Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) are ahead 112% YTD, which is unheard of for a blue-chip miner. Compare that to Wall Street darling Nvidia Corp. (NVDA:NASDAQ)up 34.93% YTD. In the absence of any real bullish narrative, copper has surpassed $5.00/pound, which was once considered impossible without the tariffs. Now we have three major copper mines either impaired or disabled (Grasberg, El Cobre, and Kakoa-Kakula), and few people care, just as was the case for uranium in 2018 and the precious metals in 2023. Copper is my number one selection in the metals universe and has been for a long time, with the exception of the June-July spike to $6.00 when I stepped aside in favor of silver and gold. Now, as a trader, I have earned the right to reverse back to copper as the first place to invest capital in 2025-2026.

In the junior space, copper names like Marimaca Copper Corp. (MARI:TSX; MC2:ASX) exploded out of mediocrity by posting impressive drill results, but are ahead 105% YTD. My top pick and largest holding Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) is up 117.65% YTD and too has posted impressive drill results and have recommenced drilling at Caballos with two rigs and a burgeoning treasury (CA$18m).

Subscribers should continue to move cash to the favored copper names but keep some in reserve for the next big one which will be launched next week. I cannot comment yet but suffice it to say, it is in Chile and the players are all very well-known to me.

With an weekly RSI at a neutral 57.09 but in a clearly-defined uptrend, copper will eventually move into the same overbought conditions that occurred with gold and silver over the past 56 consecutive days.

That will occur when the big players finally recognize the “Perfect Storm” of rapidly shrinking supply and broadly accelerating demand.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Tesla Inc., Agnico Eagle Mines Ltd., and Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Tesla Inc. and Fitzroy Minerals Inc. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

( Companies Mentioned: TSLA:NASDAQ,

)

Fortuna’s Next Mine Advances

Source: Adrian Day 10/27/2025

Global Analyst Adrian Day reviews developments at several companies, including looking at preliminary third-quarter results from several.

Fortuna Mining Corp. (FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE) published a preliminary economic assessment (PEA) on its planned next mine, the Diamba Sud project in Senegal, that shows a payback of capital in less than one year. Using a gold price of $2,750, the IRR is 72% and the payback of 0.8 years, with a low capex of $283 million. Low all-in sustaining costs (AISC) estimated at $1,238, will lower the company-wide cost profile.

The company will be well able to fund construction from its cash and existing line of credit. Diamba Sud, anticipated for production in 2Q 2028, with over 100,000 ounces of annual production, will then replace the production lost from the earlier sale of two declining and problematic mines.

This year’s production is guided in the range of 309,000 to 339,000 gold equivalent ounces (GEOs). Fortuna fell sharply, with the gold price decline (its largest drop in nearly three months). The stock tends to be very sensitive to the gold price. But it is undervalued relative to peers, trading at less than six times cash flow (10 times free cash flow).

If you do not own it, take advantage of weakness to buy.

Altius’s Royalty Revenue Jumps

Altius Minerals Corp. (ALS:TSX) reported better-than-expected 3Q royalty revenue across the portfolio; base metals and renewals were particularly strong. Relative to the 3Q last year, every segment saw increased revenue, except iron ore.

Royalty revenue jumped to over CA$21 million, up to CA$12.7 million in the last quarter. Interest income was also strong, given the increased cash balance. When Altius reports its financial results, there will be considerable “noise” given the sale of the Arthur royalty as well as the Orogen transaction (Altius was the largest shareholder in Orogen, which also sold its Arthur royalty as a company sale rather than the asset sale that Altius undertook).

Altius is a core holding for exposure to the broad commodity complex, but given the jump in the stock price after the revenue release — the highest in six months — we are holding.

Lara Advancing Its Planalto Project

Lara Exploration Ltd. (LRA:TSX.V) has acquired an additional exploration license adjacent to, and along strike of, its Planalto copper-gold project in the Carajas region of Brazil. There is an initial payment of CA$375,000 in shares, plus success fees for additional resources found with a minimum of US$500,000, and a 2% royalty.

Lara has minimal drill commitments under the agreement. The company is nearing completion of a PEA on the project, expected to be published this quarter. Separately, Lara has assigned an option to acquire its Itaituba Vanadium Titanium project, also in northern Brazil, to a Canadian company. Golcap can earn 90% of the project by issuing Lara 4 million shares and undertaking exploration of $2 million. It can also earn the remaining 10% with a payment of CA$250,000, additional shares, and a 2% royalty, plus a success fee.

Lara has the first to force Golcap to purchase the additional 10% after three years. The terms are attractive to Lara, giving it exposure to any success, and ensuring work on its projects.

Lara is a Strong Buy now, ahead of publication of the PEA.

Orogen Continues Activity

Orogen Royalties Inc. (OGN:TSXV; OGNNF:OTC) continues its frenetic pace of activity with another asset sale, this on the Firenz gold project in Nevada to an Australian company.

Altitude will pay a total of US$430,000 and grant a 3% royalty to Orogen and partner Altius, under whose alliance the project was staked.

US Shareholders Will Get Fully Taxed for Buyout

The Orogen/Triple Flag Precious Metals Corp. (TFPM:TSX; TFPM:NYSE) transaction, whereby Triple Flag acquired Orogen for cash and shares and spun out Orogen without the Arthur royalty, will be fully taxed to U.S. shareholders. It appears that both the cash and the Triple Flag shares will be taxed as a capital gain, while the value of the Orogen spin-out shares will be treated as a dividend (taxed at the taxpayer’s marginal income tax rate).

Canadian shareholders will have an option to elect to defer part of the gain. We are still trying to obtain a different, more favorable opinion on the tax treatment, but it appears unlikely. The company did make every effort to structure the transaction in the most tax-efficient way overall. The structure was clearly better than an asset sale; the company would have paid tax on the proceeds, and then shareholders would have paid tax on any distribution of those proceeds, thus taxing the same proceeds twice in short order.

We are holding, looking for better opportunities to add to our holdings.

Nestlé Makes Some Progress

Nestle SA (NESN:VX; NSRGY:OTC) reported nine-month sales, emphasizing that RIG growth is the company’s top priority. The company said that, along with other moves to reduce costs — targeting Sfr 3 billion by the end of 2027 — it would reduce headcount over this period. Sales rose 3.3% but most of that was due to pricing, with only 0.6% due to real internal growth (“RIG”).

However, the third quarter saw RIG recover to 1.5%. Sales improved across all regions and all segments, though China remains a laggard. The company’s ability to increase prices and still achieve some growth is notable; it was earlier thought that additional price increases would be difficult. The reduction in its global headcount total around 16,000 employees, of which 12,000 are white-collar workers.

This achieved annual savings of Sfr 1 billion, double the earlier targets, though restructuring costs are expected to be equivalent to two years’ savings. The company expects ongoing improvements in RIG, despite macro uncertainties, as it continues to increase investments. The strategy outlined by CEO Philipp Navratil is much the same as that of his predecessor, Laurent Freixe, who was pushed out in a scandal last month. Navratil has not had the time to revamp the strategy, but equally, he emphasized the company’s future success will all be down to delivering on goals. His assertive approach, as well as the 3Q rebound in RIG, saw the shares up sharply to their highest level since early June.

We are holding.

Royal’s Streaming Geos Lower Than Expected

Royal Gold Inc. (RGLD:NASDAQ) reported 3Q streaming GEOs, well up on 2Q, though below analyst estimates; copper was slightly up. Streaming GEOs represent about 70% of the company’s total production.

Separately, final approval has been granted for Royal’s acquisition of Sandstorm and affiliated company Horizon Copper, with the closing anticipated for Monday.

This may see some selling pressure, as often happens on acquisitions, but if you are underinvested in the sector, this will be an opportunity to buy Royal Gold.

100% CLUB When we sent our last complete Current Holdings update (Bulletin #971), I mentioned that 13 of the 22 recommendations had returns over 100%. Now Orogen and Metalla Royalty & Streaming Ltd. (MTA:TSX.V; MTA:NYSE American) join the “100% Club.”

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fortuna Mining Corp., Altius Minerals Corp., Lara Exploration Ltd., Orogen Royalties Inc., Triple Flag, and Metalla Royalty & Streaming Ltd.

- Adrian Day: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Adrian Day Disclosures

Adrian Day’s Global Analyst is distributed for $990 per year by Investment Consultants International, Ltd., P.O. Box 6644, Annapolis, MD 21401. (410) 224-8885. www.AdrianDayGlobalAnalyst.com. Publisher: Adrian Day. Owner: Investment Consultants International, Ltd. Staff may have positions in securities discussed herein. Adrian Day is also President of Global Strategic Management (GSM), a registered investment advisor, and a separate company from this service. In his capacity as GSM president, Adrian Day may be buying or selling for clients securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein. This is not a solicitation for GSM. Views herein are the editor’s opinion and not fact. All information is believed to be correct, but its accuracy cannot be guaranteed. The owner and editor are not responsible for errors and omissions. © 2023. Adrian Day’s Global Analyst. Information and advice herein are intended purely for the subscriber’s own account. Under no circumstances may any part of a Global Analyst e-mail be copied or distributed without prior written permission of the editor. Given the nature of this service, we will pursue any violations aggressively.

( Companies Mentioned: ALS:TSX,

FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE,

LRA:TSX.V,

NESN:VX; NSRGY:OTC,

OGN:TSXV;OGNNF:OTC,

RGLD:NASDAQ,

)

Source: Streetwise Reports 10/27/2025

American Tungsten Corp. (TUNG:CSE; TUNGF:OTCQB; RK9:FSE) has completed rehabilitation of the D level adit at its IMA Mine in Idaho and is preparing for a 5,000-foot underground drill program. The company is also evaluating a transition from direct shipping ore to onsite milling as part of its long-term development strategy.

American Tungsten Corp. (TUNG:CSE; TUNGF:OTCQB; RK9:FSE) announced it has completed rehabilitation of the D level adit at its flagship IMA Mine in Idaho and has initiated underground development in preparation for an upcoming diamond drilling campaign. The underground work supports a 5,000-foot drilling program set to commence in mid-November. According to the company, approximately 1,000 feet of the D level have been rehabilitated, including portal stabilization, track removal, scaling, and installation of water and air lines. Crosscut excavation for drill stations is underway, and mobilization of the drill rig is in progress.

Concurrently, American Tungsten has begun consultations with engineering firm WSP to explore the potential shift from a Direct Shipping Ore (DSO) model to a full-scale onsite milling operation. A conceptual process flow summary has been prepared to support this effort. The flowsheet development program includes metallurgical testwork. That includes gravity separation, flotation, and X-ray sorting, as well as preliminary engineering elements like process flow diagrams and early capital expenditure estimates.

CEO Ali Haji stated in the release, “We remain on track to commence diamond drilling in November 2025. This program is designed to validate and expand upon historical high-grade intercepts through systematic underground drilling. The shift in our development plan — from a DSO model to establishing our own mill onsite — reflects our commitment to unlocking greater long-term value. The flowsheet program outlined by WSP will be a critical step in that journey, laying the technical foundation for engineering, economic modeling, and full-scale production.”

The company also reported the start of a historical data validation program. Select samples from the 2008 Gentor Resources campaign will be re-assayed, and a new underground channel sampling effort is underway to confirm earlier results from the No. 5 and No. 7 vein systems.

Tungsten’s Role Strengthened by Supply Realignment and End-Use Demand

Recent developments have underscored tungsten’s strategic importance as global markets and governments reorient supply chains to reduce reliance on foreign-controlled sources. On October 13, Chemanalyst reported that Chinese tungsten prices remained stable despite limited trading activity, supported by policy-driven supply constraints and steady industrial demand. The report cited resource scarcity and consistent end-use applications as contributing factors to a “cautiously optimistic view for tungsten prices.”

As part of broader U.S. efforts to strengthen domestic supply chains, the Department of Defense awarded a US$6.2 million grant under the Defense Production Act to advance the Pilot Mountain project in Nevada. The move aligns with upcoming restrictions that will prevent the Pentagon from sourcing tungsten and other critical materials from adversarial countries, including China and Russia, with regulations set to begin at the mining level by January 2027. The report also noted a rise in tungsten shipments from Rwanda and highlighted expanded U.S. processing activity, including deliveries to Global Tungsten and Powders’ facility in Pennsylvania.

A market analysis published by Maximize Market Research on October 21 valued the global tungsten market at US$5.55 billion in 2023 and projected growth to US$9.51 billion by 2030, representing a compound annual growth rate of 8%. The study attributed demand growth to tungsten’s high density, hardness, and thermal resistance, making it essential for aerospace, automotive, electronics, and cutting tool applications. The report also pointed to tungsten’s recyclability and longevity as factors enhancing its industrial appeal, alongside rising investment in powder metallurgy and tungsten-based composites.

Separately, Bloomberg reported on October 23 that the U.S. government was supporting initiatives to help a domestic firm secure access to major tungsten deposits in Kazakhstan. According to the report, China continues to maintain significant control over the global tungsten supply chain, from extraction to export. Kazakhstan’s reserves, estimated to exceed 2 million tons, have positioned the country as a potential key supplier. U.S. support reportedly includes financing assistance, though no ownership interest in any resulting project is being pursued.

Expert Commentary Underscores Strategic Position and Development Potential

American Tungsten Corp. has attracted attention as it advances the redevelopment of the past-producing IMA Mine in Idaho. In a research report published on August 20, Dave Storms of Stonegate Capital Partners described the company as “strategically positioned to become a domestic supplier of a metal essential for defense, semiconductors, and electric vehicles,” citing China’s 2024 export restrictions and a tightening global supply environment. Although no formal rating or target price was issued due to the company’s stage of development, Storms noted several positive attributes.

Among these were the historical production profile of the IMA Mine, which included 198,000 standard units of tungsten trioxide (WO₃) and more than 2 million pounds of copper. Storms described the asset as “significantly derisked already,” referencing prior investment from earlier operators and the presence of existing infrastructure. Highlighted historical intercepts included 0.82% WO₃ over 30 feet and 0.247% molybdenum disulfide (MoS₂) over 475 feet.

Storms noted that the company had begun rehabilitation of the underground workings in preparation for over 6,000 feet of drilling, which is intended to support an updated NI 43-101 technical report. He also referenced American Tungsten’s CA$7 million private placement and its pursuit of U.S. government-backed non-dilutive funding. The management team was described as having a “balanced mix of operational, technical, and financial expertise.”

Storms emphasized tungsten’s broader market relevance, pointing to demand projections of US$5.55 billion in 2023 with expectations to reach US$9.51 billion by 2030, driven by its use in defense, industrial manufacturing, and technology sectors.

1 On September 9, John Newell of John Newell & Associates issued a “Speculative Buy” rating on American Tungsten, identifying the IMA Mine as offering “a credible route to restart U.S. tungsten output on patented Idaho ground.” He estimated the project could represent up to 8% of future domestic demand.

Newell highlighted infrastructure advantages at the site, including road and rail access, water rights, and low-cost grid power. He noted that the company’s proposed Direct Shipping Ore (DSO) model could reduce upfront capital requirements to approximately US$20 million and cited additional upside from the molybdenum porphyry system underlying the tungsten mineralization.

The report also emphasized the strength of American Tungsten’s leadership team, referencing CEO Ali Haji, President Murray Nye, CFO Dennis Logan, and VP Exploration Austin Zinsser, as well as board and advisory members with experience at major producers. Newell wrote that the team had “the mining and financial depth to execute.”

From a technical analysis standpoint, Newell observed that the company’s shares had “broken out of a long downtrend,” surpassing an initial resistance level of CA$1.20. He identified CA$2.15 as the next technical level, with CA$3.50 noted as a longer-term upside threshold if momentum continued. As of this writing, the company has already reached Newell’s first two targets.

Catalysts Section: Building Toward Domestic Tungsten Processing

American Tungsten’s current initiatives at the IMA Mine represent a potential pivot point for domestic critical metals development. The company is working to re-establish tungsten production within the United States, a country currently lacking any domestic producers of the metal. According to the company’s investor materials, the IMA Mine is a past-producing project located on patented mining claims in Idaho’s porphyry belt, with historical output of tungsten, silver, copper, lead, and zinc. [OWNERSHIP_CHART-11409]

As the company advances toward drilling and metallurgical testing, American Tungsten continues to pursue non-dilutive financing and strategic partnerships, including with U.S. government agencies. A key focus is on securing support from the Department of Defense and Department of Energy, both of which consider tungsten a critical metal due to its role in aerospace, defense, and industrial applications.

According to the company’s investor presentation, only limited underground drilling is anticipated to delineate near-term production volumes, and Idaho’s permitting framework may allow a more streamlined development path for underground operations. By initiating design consultations for onsite processing at an early stage, the company is laying the groundwork that could facilitate future production decisions supported by internal processing capabilities.

With a long history of development dating back to the early 20th century and a technical team experienced in tungsten projects, American Tungsten’s ongoing work at the IMA Mine aims at establishing a secure, domestic supply of a metal deemed essential for national defense and technological applications.

Ownership and Share Structure2

2.36% of American Tungsten is held by management and insiders. The rest is retail.

The company has approximately 40.46 million free float shares, a market capitalization of about CA$114.5 million, and a 52‑week trading range of CA$0.025 to CA$4.90.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of American Tungsten.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

1. Disclosure for the quote from the John Newell article published on September 9. 2025

- For the quoted article (published on September 9, 2025), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it’s advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.

2. Ownership and Share Structure Information

The information listed above was updated on the date this article was published and was compiled from information from the company and various other data providers.

( Companies Mentioned: TUNG:CSE; TUNGF:OTCQB; RK9:FSE,

)

Source: Streetwise Reports 10/27/2025

Sierra Madre Gold and Silver Ltd. (SM:TSX.V; SMDRF:OTCQX) has launched a US$3.5 million exploration program in Mexico’s historic Temascaltepec district. The campaign targets high-grade silver and gold zones across the underexplored East District of the Guitarra project.

Sierra Madre Gold and Silver Ltd. (SM:TSX.V; SMDRF:OTCQX) has initiated a US$3.5 million exploration program at the East District of its Guitarra silver-gold project in Estado de Mexico. This district, part of the historically significant Temascaltepec mining area, marks a renewed focus on underexplored territory following the successful restart of operations at the Guitarra and Coloso mines earlier this year.

The exploration work will unfold in two stages. The first, estimated to last nine months, will involve detailed geological surface mapping, sampling of historical workings, and structural analysis to define drill targets. The second stage proposes a 20,000 to 25,000 meter drilling campaign to evaluate the economic potential of identified targets. Fieldwork has already begun, and new senior-level geologists and support personnel have been brought on to assess the condition of existing infrastructure, with access regained to the Santa Ana vein system’s Rampa Carolina, a 300-meter underground development dating back to 2007.

The company referenced historical estimates from a 2023 NI 43-101 report indicating East Disctrict resources at Mina de Agua of 761,000 tonnes grading 159 grams per tonne silver and 0.19 grams per tonne gold, and inferred resources of 545,000 tonnes grading 178 grams per tonne silver and 0.13 grams per tonne gold.

According to Chief Operating Officer Greg Liller in the news release, “The East District is the last of the six major Spanish Colonial production centres in Mexico that has not been systematically mapped, drilled, and evaluated using modern tools and methods.” Chief Executive Officer Alex Langer added that the program will be funded through treasury and cash flow, supported by a CA$19.5 million private placement completed in July 2025.

Precious Metals Market Maintains Strength Amid Volatility

Peter Krauth of The Gold Advisor wrote on October 22 that silver had reached a record high of US$54 per ounce before undergoing what he described as a healthy correction. He noted that “even with the pullback of the last few days, silver [was] still up a whopping 64% this year alone.” Krauth explained that strong industrial demand, tight supply conditions, and a “silver squeeze” caused by short covering had all contributed to the surge.

He added that buyers had been willing to pay premiums for immediate delivery due to tight inventories, a condition known as backwardation, though he said this extreme tightness had since eased. According to his commentary, the correction that followed such gains was “normal behavior for these assets” and reflective of a market undergoing consolidation rather than decline.

According to a Kitco Media report published October 23 by Gary Wagner, gold was also showing “early indications of recovery after experiencing its most severe single-day correction in over eighteen years.” The report detailed how spot gold and December Comex futures had both formed doji candlestick patterns, a sign that traders viewed the correction as a technical retracement following months of strong appreciation. Wagner wrote that “the pullback appear[ed] technically sound given gold’s remarkable 57% year-to-date appreciation,” with buyers re-entering the market at lower prices and lifting gold US$95 above its intraday low.

On October 24, Morris Hubbartt of 321Gold stated that conditions in the precious metals market had created what he called a “blast-off zone” for many junior miners. He noted the rebranding of his service to “Super Gold Signals,” reflecting what he described as “the growing global importance of gold.” His comments underscored ongoing investor enthusiasm for gold-focused equities amid volatile but resilient price movements across the broader metals sector.

Analysts Highlight Strong Growth Potential at Sierra Madre

On September 8, VSA Capital analyst Oliver O’Donnell reaffirmed a Buy recommendation on Sierra Madre Gold and Silver Ltd., maintaining a target price of CA$1.40. At the time of the report, the stock was trading at CA$1.03. O’Donnell cited the company’s production growth plan to scale from 760,000 to 2.1 million silver-equivalent ounces annually by 2027. He noted that the expansion would be supported by the CA$19.5 million capital raise completed in July and projected capital expenditures of US$21 million through 2028, including investments in a paste fill plant and a new tailings facility. O’Donnell forecasted that unit costs could decline to US$16 per silver-equivalent ounce and estimated revenues of US$73 million and EBITDA of US$37 million by 2028. He added, “The company’s operational milestones, including equipment procurement and permitting, position it well to execute the expansion timeline.”

Dominic Frisby of The Flying Frisby described Sierra Madre as his “favorite silver play” and largest position in the sector.

Later that month, on September 18, Ted Butler of The Gold Advisor commented on the development of the Nazareno mine, calling it “a significant contributor” to future production. Butler pointed out that the 700 tonnes of material already delivered to the plant were not part of the 2023 resource estimate and wrote, “The rock coming out of Nazareno is richer than expected,” citing silver grades 40% higher and gold grades 30% higher than previously modeled. Butler stated that the use of portable drill rigs would reduce costs and improve access to tightly spaced mineralized zones.

In a September 30 follow-up, Butler reiterated his firm’s full weighting in the company and added that Sierra Madre was “building momentum across its operations.” He highlighted the adoption of long-hole mining techniques at Nazareno and expressed confidence in the company’s ability to maximize value from unmodeled resources.

In an October 1 research note, Oliver O’Donnell further remarked that Sierra Madre had brought a third mine, Nazareno, into production within the La Guitarra complex. He stated, “The company’s expansion strategy is taking further shape, and the addition of another high-grade production zone will support near-term production and earnings.”

Thibaut Lepouttre of Caesars Report offered additional insight on October 10, observing that Sierra Madre had begun underground development at the Nazareno mine. He wrote, “The Nazareno project is interesting as several silver- and gold-bearing veins appear to merge, creating a mineralized zone up to 8 meters wide.”

In an October 15 contribution, Dominic Frisby of The Flying Frisby described Sierra Madre as his “favorite silver play” and largest position in the sector. He credited the company for meeting development targets ahead of schedule and explained that production costs, initially estimated at US$30 per ounce, were expected to decline to US$20 per ounce within two years due to equipment upgrades and operational improvements.

“Production costs are coming down, meaning profits should double,” Frisby stated. He also noted the company’s plans to increase daily throughput to 750–800 tonnes by the second quarter of next year, with a longer-term target of reaching 1,500 tonnes per day by the third quarter of 2027. Citing CEO Alex Langer, Frisby added that Sierra Madre had acquired what could be “the largest undeveloped silver district in Mexico.”

Mapping a New Frontier in a Historic District

The East District’s exploration marks a pivotal expansion in Sierra Madre’s district-wide development strategy. While the West District has been the site of modern production at the Guitarra, Coloso, and Nazareno mines, the East District has remained largely untouched by contemporary exploration methods despite hosting numerous historical mines and vein systems spanning over 39 kilometers.

With the West District already producing and plant expansion plans underway to increase capacity by up to 100% by 2027, the East District offers a significant upside. The newly launched drill program is intended to build on historic findings from Luismin and others, which suggest silver grades between 440 and 670 grams per tonne and gold grades of 2.4 to 3.6 grams per tonne across several veins. [OWNERSHIP_CHART-10135]

Sierra Madre’s management has emphasized that the current expansion and exploration initiatives, including this East District program, will be internally funded. As of June 30, 2025, the company held US$5.9 million in current assets, and the July 2025 private placement added an additional CA$19.5 million in working capital.

With full commercial production at the Guitarra mine underway since January 1, 2025, and exploration beginning in previously untested zones, Sierra Madre continues to advance its district-scale strategy in Mexico’s prolific silver belt.

Ownership and Share Structure1

Management and founders own approximately 21.4% of the company. According to LSEG, President and CEO Alexander Langer owns 2.68% of the company, Executive Chairman and COO Gregory K. Liller owns 1.77%, Director Jorge Ramiro Monroy owns 1.32%, Director Alejandro Caraveo owns 1.26%, Director Kerry Melbourne Spong owns 0.57%, and Director Gregory F. Smith owns 0.14%.

Institutional investors own 24.3% of the company. Commodity Capital A.G. owns 4.4%, Refinitiv reported. Strategic investors hold 37.7%. The rest is retail.

Sierra Madre has a market cap of CA$235 million and a 52-week range of CA$0.345 to CA$1.60.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Sierra Madre Gold and Silver is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Sierra Madre Gold and Silver.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

1. Ownership and Share Structure Information

The information listed above was updated on the date this article was published and was compiled from information from the company and various other data providers.

( Companies Mentioned: SM:TSX.V; SMDRF:OTCQX,

)

Co. Pays Last Tranche for Silver Royalty

Source: Tim Wright 10/27/2025

Silver Crown Royalties Inc. (SCRI:CBOE; SLCRF:OTCQX; QS0:FSE) has had a busy 12 months of “impressive growth,” and this achievement is one of several made during the period, noted a Couloir Capital report.

Silver Crown Royalties Inc. (SCRI:CBOE; SLCRF:OTCQX; QS0:FSE) announced the closing of the final tranche of the silver royalty on PPX Mining Corp.’s (PPX:TSX.V) Igor 4 project in Peru, reported Couloir Capital Analyst Tim Wright in an October 17 research note. Silver Crown paid the final US$637,000 due to acquire the remaining 3.9% balance of the 15% cash equivalent royalty.

“This paves the way for Silver Crown Royalties to receive an annual royalty covering 56,250 ounces a year for the next four years, which is equivalent to US$2.81 million (US$2.81M) per year,” Wright wrote. “At current silver prices, the company is set to receive US$11.25 million in royalty payments over the next four years, on a royalty which it paid US$2.5 million for.”

628% Upside Implied

Couloir Capital maintained its CA$44.40 per share fair value target price on this pure play silver royalty company, trading at the time of Wright’s report at about CA$6.10 per share, the analyst noted.

From this share price, the return to target is 628%. Silver Crown remains a Buy.

Recap of Year’s Events

Wright presented Silver Crown’s other key developments since September 2024, when Couloir Capital initiated coverage on the company. In addition to completing payments for the Igor 4 project royalty, they are:

Another Royalty: Silver Crown acquired and closed the EDM Resources Inc. (EDM:CVE) royalty agreement, on 90% of net silver proceeds or a minimum of 7,000 ounces (7 Koz) of silver production per year at the past-producing Scotia mine in Nova Scotia. The term of the royalty, to begin with the start of commercial production, is for 10 years. For the royalty, Silver Crown paid CA$500,000, issued 60,000 units of SCRI shares and issued an equivalent number of share purchase warrants.

A Royalty Setback: Silver Crown will not have money coming in from its royalty with Gold Mountain Mining Corp. in the near term. This is because on Aug. 1 it became known that Gold Mountain Mining Corp. and its two subsidiaries, Bayshore Minerals Inc. and Elk Gold Mining Corp., were to be placed into receivership for an unpaid outstanding balance of CA$11.2M owed to Nhwelmen Construction.

All is not lost, however, for Silver Crown, Wright noted, because this royalty is secured to the asset not the operating company. This means that if a new operator restarts the project, either the royalty would kick in with production or an agreement would be made to buy Silver Crown out of the royalty, “either of which would be favorable,” the analyst added. The royalty is for a minimum of 6 Koz of silver equivalent cash per year, with the potential for more with greater production.

A Successful Financing: Earlier this month, Silver Crown closed an oversubscribed financing for gross proceeds of CA$3.3M. It used the funds to finalize the PPX Mining and EDM Resources royalty deals.

Added Technical Expertise: Silver Crown appointed Christian Aramayo, a chartered engineer, as an adviser to the company. Now chief operating officer and director at Kuya Silver (with which Silver Crown Royalties signed a letter of intent for a silver royalty), Aramayo has nearly 20 years’ experience at many projects in varied jurisdictions, including Pueblo Viejo, Paracatu, Fruta del Norte and Tasiast.

Achieved Growth: Since founding, Silver Crown averaged 31% quarter-over-quarter growth in royalty silver ounces and in revenue.

Investment Highlights

Along with this “impressive growth,” there are two other key highlights of the Silver Crown investment story, Wright wrote and reviewed them. One is the company’s status as the only pure-play silver royalty company in the market and its related benefit of first mover advantage. The company acquires royalties from mines where silver is produced as a byproduct and the metal typically accounts for less than 2% of total revenue.

According to management, an estimated 350,000,000 ounces of total silver production globally are unreported each year, and capturing even just 10% of this amount could yield more than US$100M in potential royalty revenue.

Also noteworthy is Silver Crown’s strategic approach to royalty dealmaking, which aims to minimize risk and “return metrics of investments,” Wright pointed out. The company stages its investments and ensures capital tied to its royalty agreements is deployed in tranches when certain project-related milestones are reached.

Capital Structure and Ownership

Wright reported that with respect to ownership of Silver Crown, management holds 20%, friends and family have 8% and institutions hold 23%.

The company’s capital structure is tight with only 3.8M common shares outstanding. It has 1.99M warrants outstanding, at a weighted average exercise price of just under CA$13, most of which expire in 2028. Because the exercise prices are significantly higher than SCRI’s share price, the warrants likely will not be exercised now. However, when they are, they will cause shareholder dilution but also bolster the company’s treasury by CA$25.7M, much more than the total of any of Silver Crown’s previous capital raises.

What to Expect

Silver Crown will continue to expand its silver royalty portfolio, noted Wright. Because it has a pipeline of projects for royalty agreements and has shown it can raise the required capital, Couloir Capital expects more deals to happen and thus more growth in the months ahead.

“We expect the firm to turn cash flow positive in the next six to 12 months,” the analyst wrote.

Once this happens and portfolio revenues increase, Silver Crown “will be able to raise debt on the back of those cash flows, which will substantially reduce their cost of capital and further boost revenue growth,” Wright added.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Silver Crown Royalties Inc. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver Crown Royalties Inc.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Disclosures for Couloir Capital, Silver Crown Royalties Inc., October 17, 2025

This report has been prepared by an analyst on contract with or employed by Couloir Capital Ltd. The analyst certifies that the views expressed in this report, which include the rating assigned to the issuer’s shares as well as the analytical substance and tone of the report, accurately reflect his or her personal views about the subject securities and the issuer. No part of his / her compensation was, is, or will be directly or indirectly related to the specific recommendations. Couloir Capital, its affiliates, and their respective officers, directors, representatives, researchers, and members of their families may hold positions in the companies mentioned in this document and may buy and/or sell their securities. Additionally, Couloir Capital may have provided, in the past and may provide, in the future, certain advisory or corporate finance services and receive financial and other incentives from issuers as consideration for the provision of such services. Couloir Capital has prepared this document for general information purposes only. This document should not be considered a solicitation to purchase or sell securities or a recommendation to buy or sell securities. The information provided has been derived from sources believed to be accurate, but cannot be guaranteed. This document does not consider the particular investment objectives, financial situations, or needs of individual recipients and other issues (e.g., prohibitions to investments due to law, jurisdiction issues, etc.) that may exist for certain persons. Recipients should rely on their own investigations and take their own professional advice before making an investment. Couloir Capital will not treat recipients of this document as clients by virtue of having viewed this document. Company-specific disclosures, if any, are below: 1 In the last 24 months, Couloir Capital Ltd. has been retained under a service agreement by the subject issuer. This service agreement includes analyst research coverage. 2 The views of the Analyst are personal. 3 No part of the Analyst’s compensation was directly or indirectly related to the specific ratings as used by the research Analyst in the Reports. 4 The Analyst does not maintain a financial interest in the securities or options of the Company. 5 Couloir Capital does maintain a financial interest in the securities or options of the Company. 6 The information contained in the Reports is based upon publicly available information that the Analyst believes to be correct but has not independently verified with respect to truth or correctness.

Investment Ratings—Recommendations Each company within an analyst’s universe, or group of companies covered, is assigned: 1 A recommendation or rating, usually BUY, HOLD, or SELL; 2 A 12-month target price, which represents an analyst’s current assessment of a company’s potential stock price over the next year; and 3 An overall risk rating which represents an analyst’s assessment of the company’s overall investment risk. These ratings are more fully explained below. Before acting on a recommendation, we caution you to confer with your investment advisor to determine the suitability of our recommendation for your specific investment objectives, risk tolerance, and investment time horizon. Couloir Capital’s recommendation categories include the following: Buy The analyst believes that the security will outperform other companies in their sector on a risk-adjusted basis or for the reasons stated in the research report the analyst believes that the security is deserving of a (continued) BUY rating. Hold The analyst believes that the security is expected to perform in line with other companies in their sector on a risk-adjusted basis or for the reasons stated in the research report the analyst believes that the security is deserving of a (continued) HOLD rating. Sell Investors are advised to sell the security or hold alternative securities within the sector. Stocks in this category are expected to under-perform other companies on a risk-adjusted basis or for the reasons stated in the research report the analyst believes that the security is deserving of a (continued) SELL rating. Tender The analyst is recommending that investors tender to a specific offering for the company’s stock. Research Comment An analyst comment about an issuer event that does not include a rating. Coverage Dropped Couloir Capital will no longer cover the issuer. Couloir Capital will provide notice to clients whenever coverage of an issuer is discontinued. Following termination of coverage, we recommend clients seek advice from their respective Investment Advisor.

Under Review Placing a stock Under Review does not revise the current rating or recommendation of the analyst. A stock will be placed Under Review when the relevant company has a significant material event with further information pending or to be announced. An analyst will place a stock Under Review while he/she awaits enough information to re-evaluate the company’s financial situation. The above ratings are determined by the analyst at the time of publication. On occasion, total returns may fall outside of the ranges due to market price movements and/or short-term volatility. Overall risk ratings Very High Risk: Venture-type companies or more established micro, small, mid or large-cap companies whose risk profile parameters and/or lack of liquidity warrant such a designation. These companies are only appropriate for investors who have a very high tolerance for risk and volatility and who can incur a temporary or permanent loss of a very significant portion of their investment capital. High Risk: Typically, micro or small-cap companies which have an above-average investment risk relative to more established or mid to large-cap companies. These companies will generally not form part of the broad senior stock market indices and often will have less liquidity than more established mid and large-cap companies. These companies are only appropriate for investors who have a high tolerance for risk and volatility and who can incur a temporary or permanent loss of a significant portion of their investment capital. Medium-High Risk: Typically, mid to large-cap companies have a medium to high investment risk. These companies will often form part of the broader senior stock market indices or sector-specific indices. These companies are only appropriate for investors who have a medium to high tolerance for risk and volatility and who are prepared to accept general stock market risk including the risk of a temporary or permanent loss of some of their investment capital Moderate Risk: Large to very large cap companies with established earnings who have a track record of lower volatility when compared against the broad senior stock market indices. These companies are only appropriate for investors who have a medium tolerance for risk and volatility and who are prepared to accept general stock market risk including the risk of a temporary or permanent loss of some of their investment capital.

COULOIR CAPITAL SUBSCRIBE TO RESEARCH is a research-driven investment dealer focused on emerging companies in the natural resources sector Vancouver 604 609 6190 • Toronto 416 460 2960 • admin@couloircapital.com We employ a fundamental-based analysis with the goal of discovering a company’s fair value in the context of Macro factors facing each company. In doing so we generate actionable ideas in underfollowed companies where a small number of market participants can rapidly close the gap between price and fair value. Our research reports are disseminated through Bloomberg, S&P Capital IQ, Thomson Reuters, FactSet, and larg

( Companies Mentioned: SCRI:CBOE; SLCRF:OTCQX; QS0:FSE,

)