Author: Gold News Club

- Gold price today: why is gold rate falling again? gold prices dropped 1.4% to near $4,053; silver also sli The Economic Times

- Strong price pressure on gold, silver, as risk appetite keener KITCO

- Gold (XAUUSD) & Silver Price Forecast: Technical Signals Show Pause Before Next Move FXEmpire

GDXJ & CDNX Stocks at US$4,000 Gold

Source: Stewart Thomson 10/24/2025

Newsletter writer Stewart Thomson addresses the question: How should investors play GDXJ and CDNX resource stocks as gold gyrates around the $4000 mark?

How best to sum up a very wild week for gold, silver, and the miners?

Well, perhaps the wisest move is not to sum it up at all!

The bottom line: contrary opinion investing isn’t just about placing trades. It’s also about dialing down the excitement and analysis when the crowd is dialing it up, which is happening now.

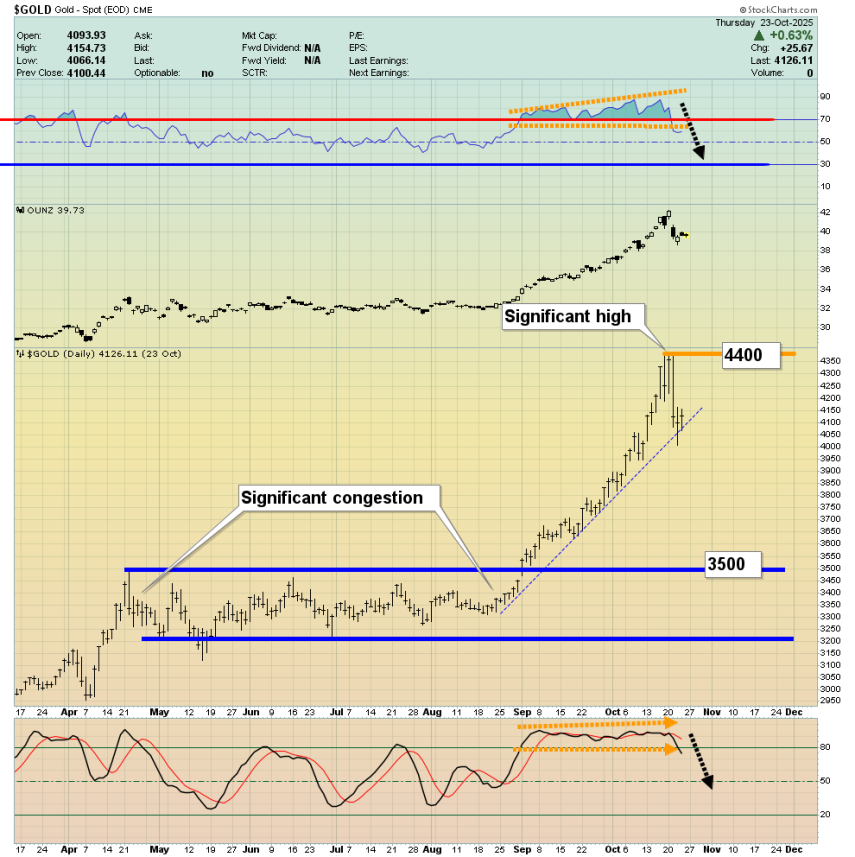

Here’s a look at the current gold price action:

The high near US$4,400 is significant. It corresponds with the big round number of US$4,000, with GDXJ US$100, CDNX 1000, and with the Australian public lined up in the street to buy gold.

Below that, at US$3,500-US$3,200, sits a congestion zone of significance. Everything between US$4,400 and US$3,500 is basically an air pocket zone. If gold were easing into US$3500, it would be a time to get excited and buy. If gold were breaking out over US$4,400 or dipping into it, that would also be a time to get excited.

For gold itself, now is not a time to be excitedly analyzing the price. It’s a time for savvy investors to exhibit substantial patience.

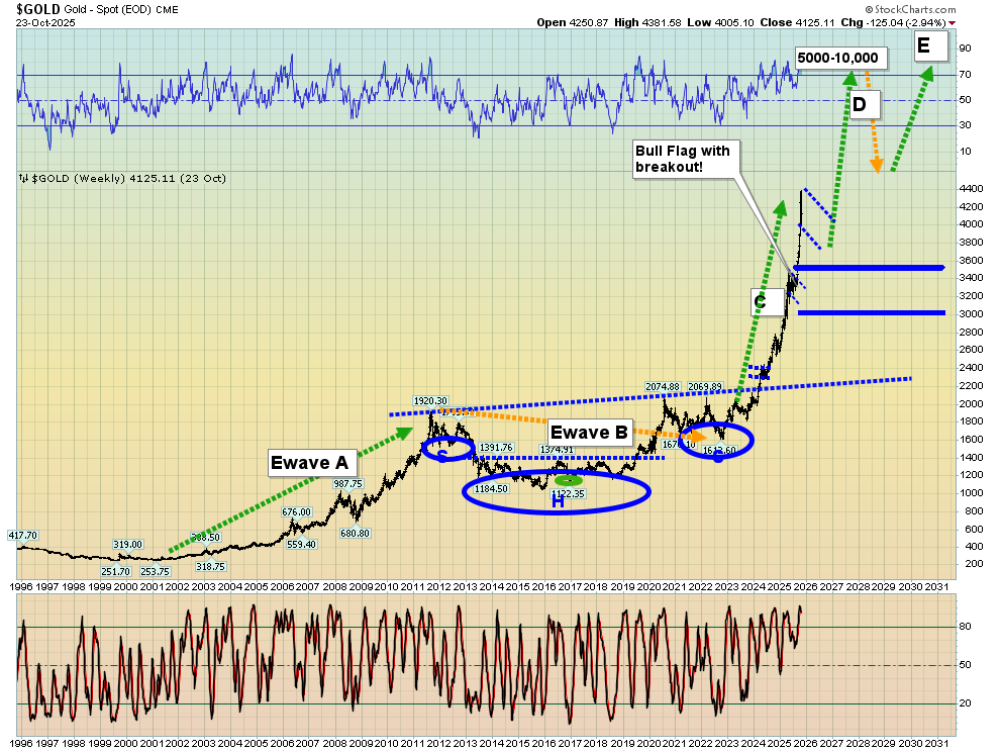

Here’s a look at the weekly chart:

In the coming months, it’s possible that gold forms a huge bull flag and from there leaps to US$5,000+. If the flag does form, it will likely be accompanied by some potentially explosive news.

Here’s a look at the GDXJ chart:

I suggested buying GDXJ and associated stocks basis gold; gamblers can buy now, with gold trading around US$4,000, and conservative investors should be more patient, waiting for US$3,500, a price that may or may not occur.

Aggressive investors could buy these miners at a gold price of about US$3,800, which represents a number of key Fibonacci retracements.

What about the “raw” juniors? Well, here’s a look at the short-term CDNX chart:

There’s a nice bull wedge with a breakout now in play.

Here’s the long-term chart, which is quite simply one of the nicest-looking charts in the history of markets:

A pause at the neckline of this huge inverse H&S pattern was expected, but it could already be over . . . meaning a massive upside breakout is imminent!

Ten baggers will be the norm for a myriad of CDNX and US dual-listed juniors if that breakout occurs.

Here’s a look at one interesting play, San Lorenzo Gold Corp. (SLG:TSXV; SNLGF:OTCMKTS):

It’s acting immune to the sell-off in gold. New players can buy with an optional stop for some or all of the position just under the 67-cent low.

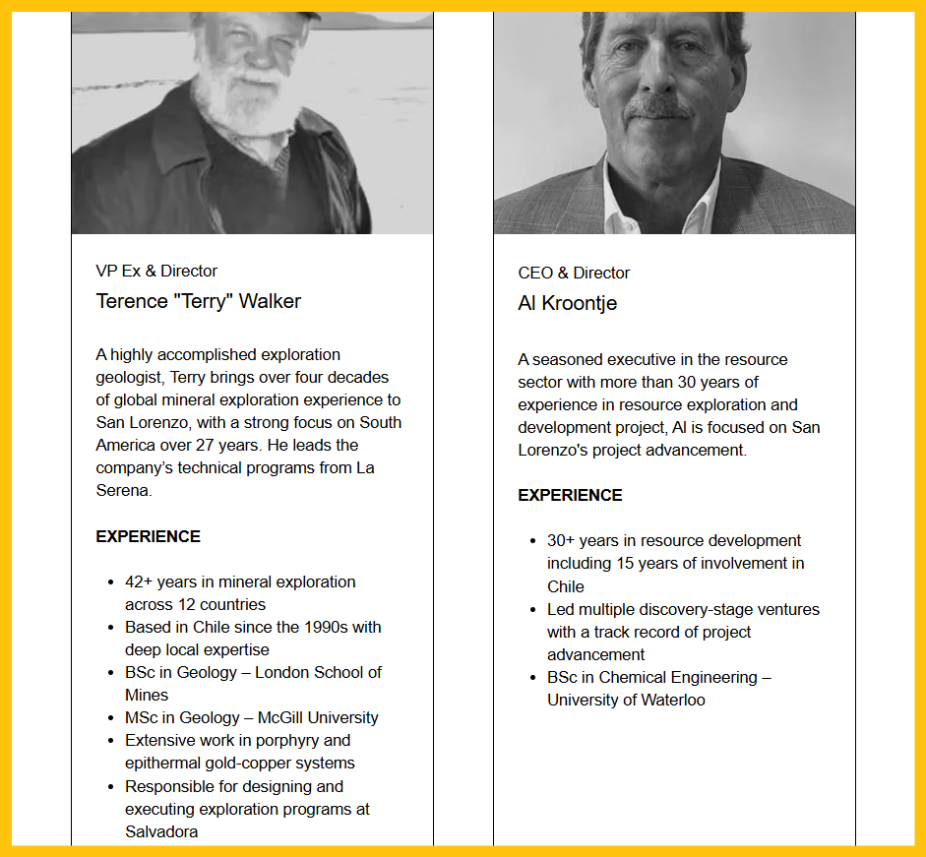

The company’s copper-gold operation is in Chile (note the copper price creeping back up nicely), and the lead directors look solid:

Another interesting South American play is Cabral Gold Inc. (CBR:TSX.V; CBGZF:OTCMKTS):

The chart is absolutely stunning! Stop losses could be used in the 45-cent zone, but the technical action is so firm that investors are unlikely to get stopped out.

What about oil?

U.S. sanctions on Russian oil companies could drive the price higher, and at this point, most U.S. producers are only breaking even . . . making the upside potentially spectacular.

Here’s a look at Trillion Energy International Inc. (TCF:CSE; TRLEF:OTC; 3P2N:FSE):

Look at the mindboggling volume on the stock. A move back to the $2+ highs would make it a hundred bagger.

Investors who like getting in on the ground floor may want to take a close look at this Black Sea natural gas play.

The world likely ended a 40year deflation cycle in the year 2020 and the new inflation cycle has 35 years to run. Along with AI, gold, silver, and energy (both brown and green) plays look set to become the best performing sectors for decades to come!

Special Offer for Streetwise Readers: Please send me an Email to freereports@galacticupdates.com and I’ll send you my free “GDXJ & SILJ: Tactics of Champions!” report. I highlight some of the most exciting component stocks in these key ETFs. Winning buy and sell tactics included for investors! Junior mine stock investing isn’t for everyone, especially with size, but as this gargantuan gold bull era rollout continues, these miners look set to outperform everything! I write my junior resource stocks newsletter 2-3 times a week, and at just $199/12mths it’s an investor favourite. I’m doing a special pricing this week of $169 for 14mths. Click this link or send me an email if you want the offer and I’ll get you onboard. Thank-you!

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Stewart Thomson: I, or members of my immediate household or family, own securities of: GDX. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Stewart Thomson Disclosures

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Source: Don Blyth 10/24/2025

Cabral Gold Inc. (CBR:TSX.V; CBGZF:OTCMKTS) has secured a US$45 million gold loan to fully fund the construction of the Phase 1 Heap Leach project at Cui Cui, noted Paradigm Capital Analyst Don Blyth in an updated research report on October 22.

Cabral Gold Inc. (CBR:TSX.V; CBGZF:OTCMKTS) recently announced that it has secured a US$45 million gold loan to fully fund the construction of the Phase 1 Heap Leach project at Cuiú Cuiú, noted Paradigm Capital Analyst Don Blyth in an updated research report on October 22.

The company stated that the financial flexibility provided by this gold loan, along with the recent equity raise of CA$14.9 million, will enable it to continue their regional exploration drilling program at Cuiú Cuiú during the project’s construction.

The latest drill results underscore the importance of ongoing exploration efforts, Blyth said. Drilling at the PDM target yielded a standout result of 23.3 meters at 4.7 grams per tonne gold (g/t Au), including 1.0 meter at 91.3 g/t Au starting at 57 meters depth (Hole DDH346).

Hole 346 appears to be an extension of the same mineralized zone intersected by previous drilling approximately 100 meters to the northwest, which returned 8.5 meters at 5.1 g/t Au, Blyth wrote.

CBR Positioned to ‘Substantially Grow’ Resource

Blyth called the developments “positive.”

“The PDM target currently has a defined gold-in-oxide resource, but there is not currently any fresh rock resource at PDM, due to insufficient drilling,” he wrote.

The PDM target currently has a defined gold-in-oxide resource, but there is no fresh rock resource yet due to limited drilling, the analyst said. It is reasonable to anticipate that a fresh rock resource will be defined at PDM, featuring a zone of high-grade mineralization surrounded by broader zones of lower-grade mineralization, the analyst wrote.

“This is exactly what we see at the defined existing hard rock deposits (Central and MG),” Blyth noted. “Furthermore, similar results are occurring at Machichie Main, Machichie NW and the Jerimum Cima targets.”

The current hard rock resources are about 1 million ounces (Moz), which is not sufficient to justify the development of a standalone mill, in Paradigm’s opinion. In a worst-case scenario, this could still be attractive as a satellite deposit for G Mining with its Tocantinzinho (TZ) mine located just a few kilometers away.

“But we believe CBR is positioned to substantially grow this hard rock resource with additional drilling (we think 2 Moz is achievable over the next 12 months) and the momentum of discovery shows no signs of slowing down,” Blyth said.

The Cuiú Cuiú project may not have enough hard rock resources to justify a standalone mill (aka Phase 2) today, but that it is entirely possible, indeed very likely, with additional drilling, according to the analyst.

Conclusion

Blyth has rated the stock Speculative Buy and raised his target price from CA$0.65 per share to CA$0.75 per share on August 4. With a price of CA$0.38 at the time, it would mean a nearly 100% return.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Disclosures for Paradigm Capital, Cabral Gold, October 22, 2025:

The analyst has an ownership position in the subject company.

Paradigm Capital Inc. has assumed an underwriting liability for, and/or provided financial advice for consideration to the subject companies during the past 12 months.

Paradigm Capital Inc. expects to receive or intends to seek compensation for investment banking services from the subject companies in the next 3 months.

Paradigm Capital Inc. has greater than a 1% ownership position in the subject company.

The analyst has a family relationship with an Officer/Director of subject company.

A partner, director, officer, employee or agent of Paradigm Capital Inc. is an officer or director of the issuer.

Paradigm’s disclosure policies and research distribution procedures can be found on our website at www.paradigmcap.com. Paradigm Capital Inc. research is available on Bloomberg, CapitalIQ, FactSet and Thomson Reuters or at www.paradigmcap.com. Issued by Paradigm Capital Inc.

About Paradigm Capital Inc.

Paradigm Capital Inc. (PCI) is a research-driven, independent, institutional equity investment dealer focused on sectors and companies that have attractive long- term secular growth prospects. PCI’s research is available on our website at www.paradigmcap.com. Please speak to your Sales or Trading Representative if you require access to the website.

The analyst (and associate) certify that the views expressed in this report accurately reflect their personal views about the subject securities or issuers. No part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendations expressed in this research report. Analysts are compensated through a combined base salary and bonus payout system. The bonus payout is determined by revenues generated directly or indirectly from various departments including Investment Banking, based on a system that includes the following criteria: reports generated, timeliness, performance of recommendations, knowledge of industry, quality of research and investment guidance and client feedback. Analysts are not directly compensated for specific Investment Banking transactions.

The opinions, estimates and projections contained herein are those of PCI as of the date hereof and are subject to change without notice. PCI makes every effort to ensure that the contents herein have been compiled or derived from sources believed reliable and contain information and opinions, which are accurate and complete. However, PCI makes no representation or warranty, express or implied, in respect thereof, and takes no responsibility for any errors and omissions that may be contained herein and accepts no liability whatsoever for any loss arising from any use of or reliance on this research report or its contents. Information ay be available to PCI, which is not reflected herein. This research report is not to be construed as an offer to sell or solicitation for or an offer to buy any securities. PCI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. PCI may act as financial advisor and/or underwriter for certain of the corporations mentioned herein and may receive remuneration for same.

PCI is a member of The Toronto Stock Exchange, The TSX Venture Exchange and The Investment Industry Regulatory Organization of Canada (IIROC).

Any products or services mentioned on this website are made available only in accordance with local law (including applicable securities laws) and only where they may be lawfully offered for sale. PCI will not open accounts except in jurisdictions in which it is registered.

To U.S. Residents: This report was prepared by PCI which is not subject to U.S. rules with regard to the preparation of research reports and the independence of analysts. PCUS, affiliate of PCI, accepts responsibility for the contents herein, subject to the terms as set out above. Any U.S. person wishing to effect transactions in any security discussed herein should do so through PCUS.

Gold and Precious Metals

Don Blyth, Analyst 416.903.3461

OFFICES

Toronto

95 Wellington Street West, Suite 2101, PO Box 55

Toronto, Ontario M5J 2N7

General Line 416.361.9892

Fax Line 416.361.6050

( Companies Mentioned: CBR:TSX.V; CBGZF:OTCMKTS,

)

Source: John Newell 10/24/2025

John Newell of John Newell & Associates explains why he thinks McEwen Mining Inc. (MUX:TSX; MUX:NYSE) is a long-term Buy.

This short article is an update to an article on McEwen Mining Inc. (MUX:TSX; MUX:NYSE) that I wrote in early July 2025, which can be found here. I wrote it when it looked like the company had turned the corner both fundamentally and technically and was beginning to fire on all cylinders.

This was especially refreshing after the gut-wrenching pullbacks the shares had suffered in recent years, despite the tremendous efforts being put in to turn the company around. However, it became clear that the long-term technical share structure turned up decisively in 2024–2025. Price cleared a multi-year downtrend and pushed through the neckline of an inverse head-and-shoulders base. That move unlocked our three measured targets on the weekly / daily charts.

The first target near CA$16.50 was met and exceeded, and then corrected far more than we thought, but eventually found support at the 0.618 support level. The second target of around CA$22.50 has also been met. The third target near CA$44.10 remains open, with a longer-term “big picture” objective around CA$47.50 based on the full depth of the base and prior back-price resistance.

Our short-term targets laid out an initial sequence at CA$13.80, CA$19.50, and CA$21.75.

All three were achieved during a decisively bullish advance on expanding volume, confirming trend strength and strong momentum sponsorship. MACD turned positive ahead of the breakout, and RSI pressed into overbought, consistent with early-stage leadership rather than exhaustion at the time.

After such an extended run, the shares could go through a natural “backing and filling” phase. Think consolation of the move higher, not long-term damage or a top. The first area of interest sits in the mid CA$25 area, which lines up with the second long-term target, prior breakout, and a rising 20–50 day moving average band on your work.

A deeper shakeout toward the 0.618 retracement of the most recent up leg would still be constructive within the new uptrend, provided volume contracts on down days and expands on subsequent reversals higher.

Context matters. This base resolved after years of underperformance and a long period of accumulation. The “same way down, same way up” symmetry we’ve flagged is playing through once back-price resistance gave way, price moved quickly to re-price toward prior congestion zones.

From a fundamental viewpoint, holders still have a call option on McEwen Copper’s embedded value alongside the gold business, which helps explain the willingness to pay up during the re-rating. Leadership and alignment also count. Under Rob McEwen’s guidance, the company leaned in at the lows and then delivered catalysts into a strengthening physical metals market. The market is acknowledging that with this strong upward momentum in the share price.

Bottom line

While McEwen Mining has had a big run, we expect near-term volatility as the stock digests gains. Pullbacks into the mid-CA$20s would be normal and could offer secondary entry points if momentum resets, without heavy distribution. As long as the neckline break holds and weekly momentum remains positive, the path of least resistance points toward the open third target near CA$44 and, over time, the high-CA$40s.

Given this setup, I rank McEwen Mining Inc. (MUX:TSX; MUX:NYSE) a long-term Buy for patient investors who are comfortable with some volatility, which is part of the precious metal sector.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of McEwen Mining Inc..

- John Newell: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it’s advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.

( Companies Mentioned: MUX:TSX; MUX:NYSE ,

)

Source: Streetwise Reports 10/24/2025

Cabral Gold Inc. (CBR:TSX.V; CBGZF:OTCMKTS) announces results from a recently completed diamond drill hole at the Pau de Merena (PDM) within the Cui Cui district in Brazil. Find out why experts like the stock, and why gold could still climb further.

Cabral Gold Inc. (CBR:TSX.V; CBGZF:OTCMKTS) announced results in a release on October 22 from a recently completed diamond drill hole at the Pau de Merena (PDM), situated 2.5 kilometers northwest of the Central gold deposit within Brazil’s Cuiú Cuiú district.

Diamond drill hole DDH346 intersected 23.3 meters at 4.7 grams per tonne gold (g/t Au) from a depth of 57 meters in hard rock beneath the gold-in-oxide blanket. This includes 1 meter at 91.3 g/t Au and 1 meter at 8.1 g/t Au, the company said.

“The results from diamond drill hole DDH346 at the PDM at Cuiú Cuiú highlight the presence of several very high-grade structures in the intrusive rocks below the gold-in-oxide blanket at PDM,” said President and Chief Executive Officer Alan Carter. “These four discrete structures remain open along strike and down-dip.”

Carther continued, “Whilst a significantly larger gold-in-oxide occurs at PDM than previously envisaged, there is increasing evidence of down-dip and along strike continuity of the four known zones of primary mineralization within the intrusive rocks below the gold-in-oxide blank. Additional drilling is planned to determine the size of the hard rock gold resource at PDM, which is located only 2.5 kilometers northwest of the central gold deposit.”

It is likely the strike extension of the zone intersected in DDH22, which returned 8.5 meters at 5.1 g/t gold, including 0.7 meters at 30.4 g/t gold, the company said. This is one of four zones identified so far in intrusive rocks beneath the gold-in-oxide blanket at PDM.

Drill results are still pending for the Mutum and Machichie NE targets, and diamond drilling is currently underway at the Machichie Main and Jerimum Cima targets, Cabral said.

Carter said the results came soon after the recent announcement of US$45 million construction financing for the Phase 1 operation at the project, which is aimed at the heap leach processing of the near surface gold-in-oxide material at the MG, Machichi Main and Central gold deposits.

“The oxide mater at PDC was not of this PFS study, but these results and more recent drilling at PDM in both the oxide material and the underlying intrusive rocks augurs well for expansion of the global resource base at Cuiú Cuiú,” Carter noted.

Details of Results

The PDM target is situated 2.5 kilometers northwest of the Central gold deposit at Cuiú Cuiú within a prominent northwest-trending gold-in-soil anomaly exceeding 0.1 g/t Au, which has been traced for over 5 kilometers along strike and remains open, Cabral said in the release. This trend includes the Central gold deposit, as well as the Central SE, Central North, PDM, and Mutum targets. The current drilling program at PDM aims to increase the gold-in-oxide resource base and establish an initial resource for the mineralized zones in the underlying primary intrusive rocks.

Previous results from initial diamond-drill holes in the granitic basement rocks beneath the gold-in-oxide blanket at PDM include: 22.4 meters at 4.8 g/t gold, featuring 1.35 meters at 62.0 g/t gold, and 11.9 meters at 3.3 g/t gold, including 0.5 meters at 16.1 g/t gold, and 1.2 meters at 16.0 g/t gold in DDH239; and 18.0 meters at 2.5 g/t gold from 92.0 meters, including 3.0 meters at 10.5 g/t gold, in DDH275, according to the company. These higher-grade intercepts occur within brecciated structural zones and mostly remain open at depth and along strike.

Recent drilling at the PDM target expanded the surface area of the gold-in-oxide mineralized blanket by 50%, from 0.26 km² to 0.39 km², and confirmed the existence of four northwest-trending and parallel mineralized zones in the underlying granitic intrusive rocks.

Blyth has rated the stock Speculative Buy and raised his target price from CA$0.65 per share to CA$0.75 per share.

Results were recently received for diamond drill hole DDH346 at PDM, drilled on section 9346907N at a 60-degree angle and an azimuth of 227 degrees, the release said. The hole was designed to test the down-dip continuation of the mineralized zone intersected in DDH237, which returned 1.3 meters at 1.9 g/t gold and 2 meters at 2.4 g/t gold.

Drill hole DDH346 returned 8 meters at 0.3 g/t gold within the colluvial blanket, as well as 22.3 meters at 4.7 g/t gold from 57.2 meters depth, including two higher-grade intervals of 1 meter at 91.3 g/t gold from 57.2 meters depth, and 1.1 meters at 8.1 g/t gold from 72.0 meters depth in highly altered fractured granite intrusive, the company said.

This mineralization occurs in hydrothermal breccia with intense quartz-sulfide veining. The hole also returned 3 meters at 1.2 g/t gold from 92.0 meters depth and 1.6 meters at 0.6 g/t gold from 114.0 meters depth.

The mineralized zone intercepted in DDH346 is almost certainly the same zone intercepted 100 meters to the northwest in hole DDH22, which returned 8.5 meters at 5.1 g/t gold, including 0.7 meters at 30.4 g/t gold. It also suggests that grades are increasing with depth on section 9346907N at PDM, according to Cabral.

Finally, and perhaps most importantly, it suggests the presence of narrow zones of higher-grade mineralization that may be continuous within the underlying intrusive rocks at PDM, the company said. Continuous zones of higher-grade mineralization at Cuiú Cuiú are frequently surrounded by lower-grade envelopes and have also been identified at the MG and Central gold deposits, as well as at the Machichie Main, Machichie NE, and Jerimum Cima discoveries. The mineralized zone intersected in DDH346 remains open down dip and along strike to the southeast and northwest.

Results from drilling at the Mutum and Machichie NE targets are still awaited, while diamond drilling is currently underway at the Machichie Main and Jerimum Cima targets, Cabral noted.

Co. Has ‘All the Right Qualities’

In a October 22 flash note on the company, Paradigm Capital Analyst Don Blyth noted that Cabral recently announced that it has secured the US$45 million gold loan to fully fund the construction of the Phase 1 of the project.

The company stated that the financial flexibility provided by this gold loan, along with the recent equity raise of CA$14.9 million, will enable the company to continue its regional exploration drilling program at Cuiú Cuiú during the project’s construction, Blyth said.

He called that development and the new results “positive” for the company.

“The PDM target currently has a defined gold-in-oxide resource, but there is not currently any fresh rock resource at PDM, due to insufficient drilling,” he said. “The Cuiú Cuiú project may not have enough hard rock resources to justify a standalone mill (aka Phase 2) today but that it is entirely possible, indeed very likely, with additional drilling.”

Blyth has rated the stock Speculative Buy and raised his target price from CA$0.65 per share to CA$0.75 per share on August 4. With a price of CA$0.38 at the time, it would mean a nearly 100% return.

On August 11, Bob Moriarty of 321gold.com reviewed the company, which he said “has all the right qualities.”

“The company recently unveiled an updated prefeasibility study, regarding the possibility of beginning a mine on the surface oxide resource,” Moriarty wrote. “Cabral employs an intriguing funding strategy. Rather than facing repeated private placement fundraising every year or so, they plan to implement a modified technique reminiscent of alluvial mining operations.”

He continued, “By focusing on the easily accessible and processable oxide gold directly at surface, they can commence production for approximately US$38 million, with annual processing capacity around 1 million tonnes, offering capital recovery within 10 months plus an NPV on the oxide component of US$74 million, and a post-tax IRR of 78%. The AISC figure sits at US$1,210, based on projections assuming gold is priced at US$2,500.”

Moriarty said he greatly appreciated the company’s “gradual production approach.”

“I’ve witnessed countless promising junior miners get cornered over recent years, forced into fundraising during unfavorable market conditions, and consequently punishing their most dedicated shareholders,” he said. “Their presentation is excellent, and potential investors should review it carefully.”

Stewart Thomson of Galactic Updates also shared a positive view on the stock, saying in an October 24 posting, “The chart is absolutely stunning! Stop losses could be used in the 45-cent zone, but the technical action is so firm that investors are unlikely to get stopped out.”

The Catalyst: Optimistic Outlook for Gold Despite Volatility

JP Morgan analysts on Thursday reiterated their optimistic outlook for gold, predicting that prices could average US$5,055 per ounce by the fourth quarter of 2026, according to a report by Reuters on October 23.

This forecast is grounded in “demand assumptions that see investor demand and central bank buying averaging around 566 tons a quarter in 2026,” according to a note from the bank, the report said.

“Gold remains our highest conviction long for the year, and we see further upside as the market enters a Fed rate-cutting cycle,” stated Natasha Kaneva, Head of Global Commodities Strategy at JP Morgan.

After reaching new record highs, metals saw their steepest single-day declines in years, bringing a halt to a months-long rally driven by inflation concerns and central bank buying, as reported by Arslan Ali for FX Empire on October 22. [OWNERSHIP_CHART-9314]

This downturn was prompted by a stronger U.S. dollar and easing trade tensions between Washington and Beijing, causing traders to unwind their safe-haven positions.

“Gold had several attempts to break higher last week, but resistance near the upper range held firm,” said David Morrison, senior market analyst at Trade Nation, according to Ali. “This correction may represent a healthy reset after an overextended run.”

However, this doesn’t mean the rally is over, as most major banks remain optimistic about gold’s future. In addition to the JP Morgan prediction, Bank of America maintained a long position with a target of US$6,000 per ounce by mid-2026, the article noted.

Ownership and Share Structure1

About 7% of the company is owned by insiders and management, while institutions own about 15%. The rest is retail.

Major shareholders include AMS Asset Management with 5.89%, Aegis Financial Corp. with 4.83%, the CEO Carter with 4.73%, and Director Lawrence Lepard with 1.13%.

It has 276.21 million shares outstanding and a market cap of CA$151.75 million. It trades in a 52-week range of CA$0.17 and CA$0.62.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

1. Ownership and Share Structure Information

The information listed above was updated on the date this article was published and was compiled from information from the company and various other data providers.

( Companies Mentioned: CBR:TSX.V; CBGZF:OTCMKTS,

)