- Gold Price Drops Again. What’s Halting Its 9-Week Winning Run. Barron’s

- Gold price today, Friday, October 24: Gold opens at $4,144 after Trump ends trade talks with Canada Yahoo Finance

- JP Morgan sees gold prices averaging $5,055 per ounce by late 2026 Reuters

Author: Gold News Club

Source: Ron Wortel 10/23/2025

Dryden Gold Corp. (DRY:TSXV; DRYGF:OTCQB; FSE: X7W) is well-funded through 2026 for an ambitious gold resource exploration program with district-scale potential, leading to an upgraded target price. Find out how much.

Dryden Gold Corp. (DRY:TSXV; DRYGF:OTCQB; FSE: X7W) is well-funded through 2026 for an ambitious gold resource exploration program with district-scale potential, leading to an upgraded target price, according to a research note by Couloir Capital Analyst Ron Wortel on October 16.

Wortel said multiple stacked high-grade structures have been confirmed across 1 kilometer at the Elora Gold System, expanding the resource footprint.

The Gap Hole discovery validates nine stacked zones over 540 meters, linking the Big Master and Elora systems, with an additional 150 meters to the Paymaster structure from Spyglass, he noted.

Surface sampling at Hyndman yielded 23.32 grams per tonne gold (g/t Au) over 2.8 meters, confirming it as a priority drill target for 2026.

And Sherridon intersected 1.28 g/t gold over 19 meters, indicating bulk-tonnage potential across a 5-kilometer anomaly, he wrote.

Wortel also noted that Red Lake-style structural controls have been confirmed at the Jubilee, Pearl, and Laurentian zones with visible gold; and structural modeling has identified shear-parallel, fold-related, and en-echelon styles, guiding high-grade targeting.

Capital and Institutional Support

A CA$7.82 million LIFE financing has closed, with Centerra Gold maintaining a 9.9% stake, validating the project’s potential, the analyst said.

The financing fully funds a 23,000-meter drill program through mid-2026, enabling aggressive exploration.

Strategic advisors with deep geology and capital markets experience have been added to support resource definition, Wortel said.

These developments position Dryden Gold for sustained exploration momentum and resource growth, supporting a new fair market target of CA$0.85 for the stock going into 2026.

Conclusion

Wortel said Dryden Gold is delivering on the catalysts outlined in Couloir’s initial report on the company, with “results that exceed our estimates in terms of grade and timing for the execution of their plans.”

The company also noted that the program is advancing more quickly than estimated, with the discovery of parallel mineralized structures and extensions in the Gold Rock target area, the analyst wrote.

The support in the market with an upsized financing, including another top-up financing by Centerra Gold, shows that Dryden Gold is a story of interest in the junior exploration sector.

“We are reaffirming our recommendation for the stock, accompanied by an increased share price target, supported by a new budget and our expectations of continued success,” Wortel wrote.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Dryden Gold Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Dryden Gold Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Disclosures for Couloir Capital, Dryden Gold Corp., October 16, 2025:

This report has been prepared by an analyst on contract with or employed by Couloir Capital Ltd. The analyst certifies that the views expressed in this report, which include the rating assigned to the issuer’s shares as well as the analytical substance and tone of the report, accurately reflect his or her personal views about the subject securities and the issuer. No part of his / her compensation was, is, or will be directly or indirectly related to the specific recommendations. Couloir Capital, its affiliates, and their respective officers, directors, representatives, researchers, and members of their families may hold positions in the companies mentioned in this document and may buy and/or sell their securities. Additionally, Couloir Capital may have provided, in the past and may provide, in the future, certain advisory or corporate finance services and receive financial and other incentives from issuers as consideration for the provision of such services.

Couloir Capital has prepared this document for general information purposes only. This document should not be considered a solicitation to purchase or sell securities or a recommendation to buy or sell securities. The information provided has been derived from sources believed to be accurate, but cannot be guaranteed. This document does not consider the particular investment objectives, financial situations, or needs of individual recipients and other issues (e.g., prohibitions to investments due to law, jurisdiction issues, etc.) that may exist for certain persons. Recipients should rely on their own investigations and take their own professional advice before making an investment. Couloir Capital will not treat recipients of this document as clients by virtue of having viewed this document.

Company-specific disclosures, if any, are below:

1 In the last 24 months, Couloir Capital Ltd. has been retained by the subject issuer under a service agreement that includes analyst research coverage.

2 The views of the Analyst are personal.

3 No part of the Analyst’s compensation was directly or indirectly related to the specific ratings as used by the research Analyst in the Reports.

4 The Analyst does not maintain a financial interest in the securities or options of the Company.

5 The principal of Couloir Capital maintains a financial interest in the securities or options of the company through an affiliated hedge fund entity.

6 The information contained in the Reports is based upon publicly available information that the Analyst believes to be correct but has not independently verified with respect to truth or correctness.

( Companies Mentioned: DRY:TSXV; DRYGF:OTCQB; FSE: X7W,

)

Source: Barry Dawes 10/22/2025

Barry Dawes of Martin Place Securities shares why he thinks it is all over now for gold.

It is all over now for gold. Never-ending sell stops hit down to US$2500.

Parabolas do what parabolas do. Classic parabola breach, parabola backtest, then fall

Gold can step back now after its wonderful leadership.

Let the real world go forward.

Industrial metals.

Exploration.

Growth companies are growing.

Next leg in the U.S. stocks bull market.

U.S. Treasuries are now real assets, not liabilities.

It was always going to end like this.

Parabolas do what parabolas do.

The ever-increasing rate of change leads to exhaustion.

This is just another form of a Goodbye Kiss.

Breach, back test, then just falls away!

Elegance!

Parabolas aren’t rare and, no, its not different this time!

Support now at:

- US$3500, not much

- US$3400, a bit

- US$3300, almost nothing

- US$2700

- US$2500

So is this a major long-term high?

Possibly.

But if Gold is the Metal of Prosperity, then probably not.

Let’s wait and see.

This massive new overhang might take years to clear, though. Bureaucrats are buying at the top after selling at the bottom. The massive volume on Friday tipped us off that the Golden Fleece Sting was underway. Some big investment banks will be reporting some massive earnings gains for the Dec Qtr.

US$12 trillion is just laying on the table at US$4,400. Still US$10 trillion at US$4,100. Gold off US$250 sort of overshadows Monday’s US$104 gain that took gold up just US$0.87 to make a new high over Friday.

Silver was hit and is lost down there in the volume section of the chart.

Last week at the Australian Gold Conference in Sydney, we saw and heard Eternal Optimism based on ‘the Vibe’.

It was now OK for gold to rise with a rising US$, so the de-dollarisation thingy wasn’t important. Falling interest rates just meant real interest rates were falling faster, so just sell the US$, which we just decided was going up!

The Fed was cutting interest rates, which would cause an explosion of inflation because M2 just made a new high.

It was still printing money!

(In reality, the Fed is still running down its overall Balance Sheet of T Bonds and those previously toxic mortgages, so it is actually withdrawing funds from the market.)

No mention of the U.S. Fiscal Repair that saw the U.S. Budget Deficit reduced by US$200 billion after US$198 billion monthly surplus in September.

No mention of the Big Beautiful Bond Rally underway.

No mention of falling energy prices that would follow the US PPI’s -0.1% change for August to something even lower in September.

No.

It was just looking skyward with whoever had the highest target.

And of course, ‘It REALLY is different THIS time’!

Well, it clearly isn’t.

And to think that so many of the ‘Free Market/ Let gold show the way’ crowd have been relying on the cretinous CCP to create their Nirvana by buying up all the gold.

Some people thought it was really cool that China wasn’t really telling the world how much gold it actually had!

So it is OK for the CCP to lie to the World.

And impoverish its citizens at the same time by buying up all that shiny yellow rock.

Wouldn’t it be funny if Russia were part of the Golden Fleece to take down China?

Keep watching the Yuan.

China might get a margin call!

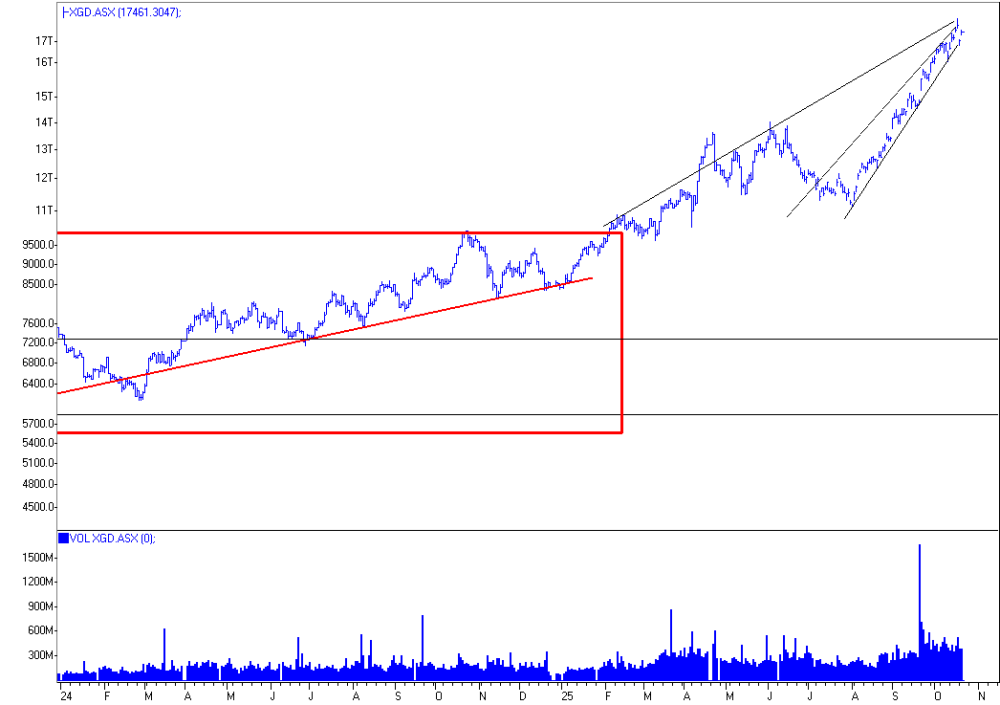

Gold Stocks

Wow. What a performance.

Who was fooling whom?

Sell-offs, non-confirmations, new highs, ‘painting’ the charts.

Overall, you knew price action was phony.

No prisoners in GDX.

Gapped down.

And likewise here in the big stocks.

These are oversold, of course, but these are up substantially in 2025, so lots of gain to sell down to.

Latecomers might be tempted, but you wouldn’t, would you?

Gaps.

Look at Newmont Corp. (NEM:NYSE; NGT:TSX; NEM:ASX).

Look at Barrick Mining Corp. (ABX:TSX; B:NYSE).

Look at Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE).

Look at Kinross Gold Corp. (K:TSX; KGC:NYSE).

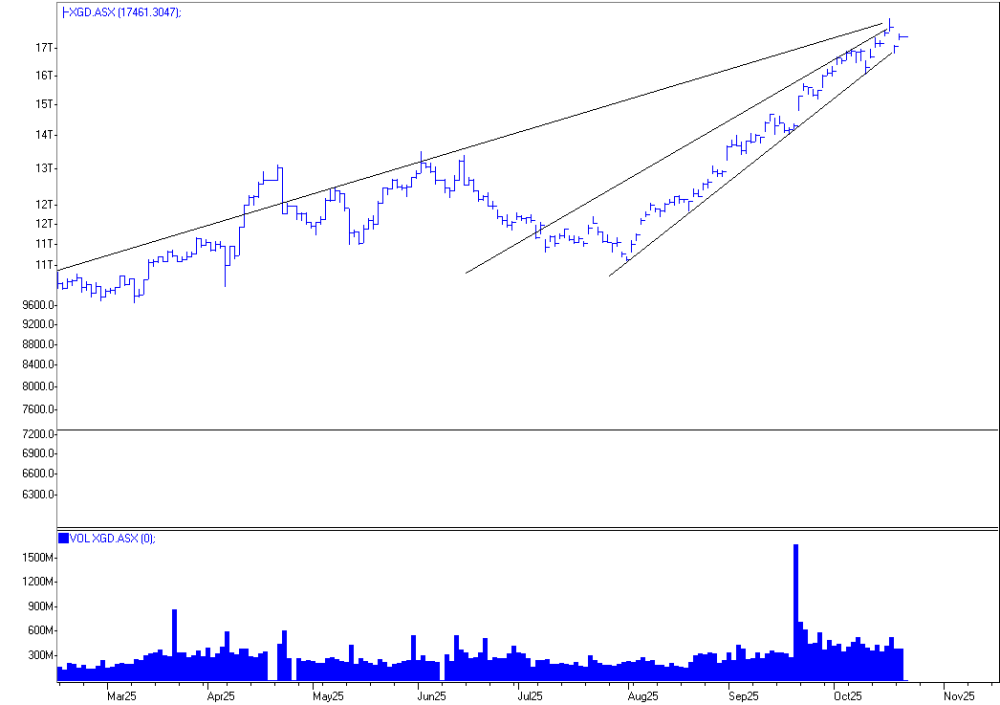

ASX Gold Stocks

You could see that wobbly, wonky, gap-ridden ”B’ Wave ‘ was going to end in tears.

I may not be reading this one correctly, but my best guess after this extraordinary rise is that the coming ‘C’ wave will go back to the 9888 breakout level and below the August low of around 10,800.

C waves can be nasty.

Note there are 44 gold stocks in the XGD today.

Under the S& P index boffins’ procedures you can expect this index to lose ten stocks by mid 2026. Gold producers with big recent gains are very vulnerable to big falls.

Stick with our explorers and developers.

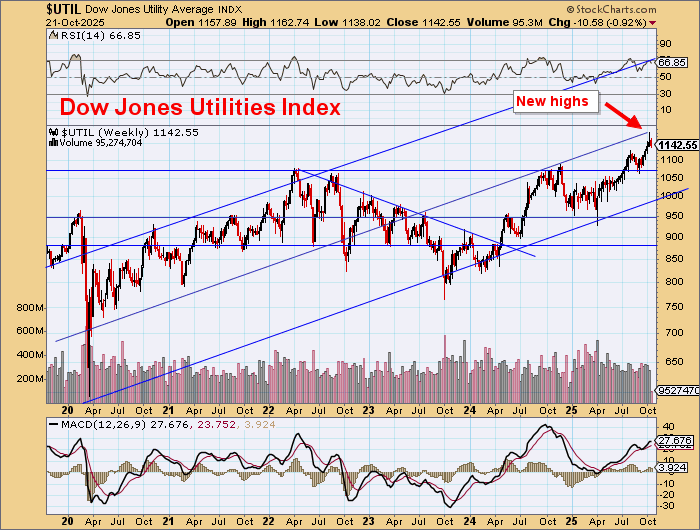

T Bonds

I think I am going to win this!

Best market call of the decade!

Whoda thunk it!

Bonds that everyone hates and no one owns, even though there are US$30tn of them out there!

If you listened to the rabid calls of ‘de dollarization’ and hyperinflation and runaway deficits and Orange Man bad this outcome would be incomprehensible to most.

But not you!

Peaked!

Just love the sight of collapsing bond yields in the morning!

Brings joy to my heart when I wake up!

Even if it is only 4 am.

Means a better world is coming.

Bond prices are up, up, and away!

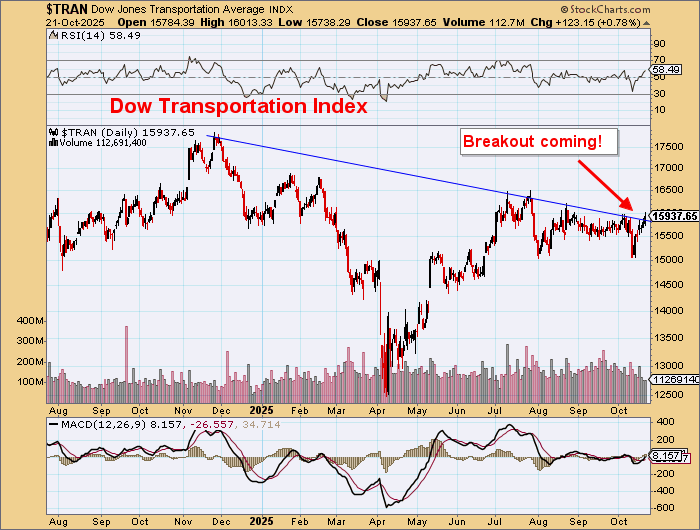

US Stocks

Dow Theory Confirmation is coming up!

Transports are about to break out and head to new highs to confirm a new U.S. stocks bull market! WTIC is down below US58/bbl. Gasoline is still falling.

No inflation.

Yippee!

Currencies

Many out there must be having heart attacks now with their ‘de-dollarization’ strategies.

Gold down, U.S. stocks at record high, T Bonds roaring, and Ray Dalio’s ‘hard currencies’ are collapsing.

US Dollar

It is a big beautiful bull market for the U.S. dollar.

Big Beautiful Bond Bull Market.

Big Beautiful US$ Bull Market.

Big Beautiful U.S. Stocks Bull Market.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barrick Mining Corp. and Agnico Eagle Mines Ltd.

- Barry Dawes: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Source: Streetwise Reports 10/23/2025

Vizsla Copper Corp. (VCU:TSXV; VCUFF:OTCQB) reported 237 meters grading 0.51% CuEq at its Thira discovery in British Columbia. The results confirmed significant copper-molybdenum mineralization and expanded the zone 200 meters south.

Vizsla Copper Corp. (VCU:TSXV; VCUFF:OTCQB) reported assay results from the final four drill holes of its Phase 1 drill program at the Thira porphyry discovery, part of the Poplar Project in central British Columbia. The company said the results confirmed significant near-surface copper-molybdenum mineralization and expanded the mineralized footprint 200 meters to the south.

Drill hole TH25-145 intersected 237.3 meters grading 0.51% copper equivalent (CuEq), including 77.0 meters of 0.55% CuEq. Hole TH25-144 returned 240.0 meters of 0.39% CuEq, including 38.4 meters of 0.53% CuEq. All four holes intersected porphyry-style copper-molybdenum mineralization from near surface, demonstrating an east-west extent of at least 800 meters and north-south continuity of at least 500 meters. Mineralization remains open in all directions.

Executive Chairman and CEO Craig Parry said in a company news release that “Thira has delivered a new discovery of shallow, porphyry-related copper mineralization in an infrastructure-rich area of BC mining country.” Vice President of Exploration Steve Blower added that the first phase of drilling “made clear that this alteration system has significant scale potential,” noting that the team will continue to evaluate the system through further drilling.

The Phase 1 program comprised ten holes totaling more than 4,500 meters, targeting coincident geophysical and geochemical anomalies identified along the 8-kilometer-long Thira alteration corridor. According to the company, expanded soil geochemical and induced polarization (IP) surveys are underway to locate additional porphyry centers. Results will be incorporated into a 3D geological model to guide Phase 2 drilling.

Vizsla Copper’s Poplar Project covers 44,200 hectares in central British Columbia and hosts both the Thira discovery and the Poplar copper-gold deposit. The company holds the option to earn a 100% interest in the property through expenditure commitments and cash payments until 2027. The Poplar deposit itself contains an indicated mineral resource of 152.3 million tonnes grading 0.32% copper and 0.009% molybdenum, and an inferred resource of 139.3 million tonnes grading 0.29% copper and 0.005% molybdenum.

Supply Strains and Shifting Demand Reshape the Global Copper Market

According to Metal Miner on October 6, global copper markets experienced significant strain after a series of mine disruptions curtailed production across major operations. Accidents at the Grasberg mine in Indonesia, El Teniente in Chile, and Kakula in the Democratic Republic of the Congo collectively removed hundreds of thousands of tons of expected copper output.

The report stated that analysts forecasted a worldwide copper deficit exceeding 400,000 tons in 2026, with full recovery unlikely before 2027. Following these disruptions, copper futures climbed to US$10,485 per ton, marking a 15-month high. BMI revised its projected 2026 supply shortfall to 400,000 tons, while Citi issued a comparable estimate, emphasizing that supply challenges would remain elevated without substantial price adjustments to incentivize new production.

Jeff Clark of The Gold Advisor said that he remained “overweight the stock” and continued to rate it a “Buy on any weakness.”

Reuters wrote on October 19 that copper demand dynamics were shifting globally as the United States and India emerged as new growth engines while China’s industrial expansion slowed. Analyst Tom Price from Panmure Liberum said that “China will reduce its rate of copper consumption and stockpiling,” adding that traditional drivers such as infrastructure replacement cycles outside China were re-emerging. He expected U.S. demand to reach 2.2 million tons in 2031, up nearly 50% from 2026, and India’s consumption to surpass 1 million tons, representing a rise of more than 30%.

Duncan Hobbs, research director at Concord Resources, noted that “China’s output of manufactured goods, particularly for export, is likely to slow down to some extent as a function of increasing pushback by countries in the West.” The report also cited Benchmark Mineral Intelligence projections showing that copper demand across Asia, excluding China, was expected to rise 25% to more than 9.2 million tons between 2025 and 2030, driven largely by data centers, renewable energy, and power grid modernization.

Bloomberg reported on October 22 that copper prices advanced above US$10,800 per ton after Goldman Sachs highlighted a continued bullish sentiment among traders. The publication attributed the gains to persistent production setbacks and a conservative output forecast from Chilean producers, which added to existing supply concerns.

The metal’s 20% year-to-date rally underscored the combination of constrained output and strong global consumption tied to renewable energy, construction, and electronics demand.

Expert Analysis and Market Perspective

On September 10, Taylor Combaluzier, P.Geo., Vice President and Mining Analyst at Red Cloud Securities, described Vizsla Copper’s Thira drilling update as a confirmation and expansion of the company’s porphyry-related copper-molybdenum-silver-gold discovery at the Poplar project. He wrote that “all the new drill holes returned porphyry-related mineralization, at grades consistent with typical BC porphyries, spanning their entire drill hole lengths.”

Combaluzier noted that the mineralization extended more than 800 meters east-west and remained open in all directions, adding that the consistency of grades along 400-meter drill lengths “suggests that Thira hosts a very large mineralizing system.” He further stated that Red Cloud believed “positive exploration results should help re-rate the stock,” and that Vizsla Copper continued to trade at a discount, with an enterprise value of CA$31.5 million compared with peers averaging CA$79.2 million.

According to Jeff Clark’s Gold Advisor on October 20, Vizsla Copper’s recent drill results at the Thira discovery were described as “another strong hole of copper mineralization,” reinforcing confidence in what he referred to as “a discovery in the making.” Clark pointed to the company’s intersection of 237 meters grading 0.51% copper equivalent and 77 meters of 0.55% CuEq as evidence of meaningful progress. He emphasized that all four final holes of the Phase 1 program demonstrated porphyry-related copper-molybdenum mineralization, expanding at least 800 meters east-west and 500 meters north-south.

Clark also noted that the stock had doubled year to date, attributing the move to investor response following the drill results. He stated that it was “not too late to buy,” given that Vizsla Copper’s market capitalization remained modest at approximately CA$41.8 million. Clark concluded by reaffirming his confidence in the company’s growth trajectory, writing that he remained “overweight the stock” and continued to rate it a “Buy on any weakness.”

Exploring the Scale of a New Copper System

The Thira discovery has emerged as a key driver of Vizsla Copper’s exploration momentum. The company’s September 2025 corporate presentation highlighted Thira as part of a broader 47,000-hectare district-scale copper-gold system at Poplar, located 38 kilometers north of the past-producing Huckleberry Mine. Management described the project as underexplored, with over 45,000 meters of historical drilling focused on less than 2% of the land package. [OWNERSHIP_CHART-11132]

Ongoing surveys at Thira aim to define additional porphyry centers along the 8-by-2-kilometer corridor, building on drill success that first identified 345.3 meters of 0.43% CuEq in July 2025. According to the presentation, Phase 2 exploration will further evaluate new targets while expanding work at the Thira system, supported by proximity to power lines, roads, and deep-sea ports in Prince Rupert, Kitimat, and Stewart.

Vizsla Copper remains focused on its Poplar and Woodjam projects, both within established mining jurisdictions and featuring large historical resource bases. The company’s management team, part of the Inventa Capital group led by Craig Parry and Michael Konnert, has collectively raised over US$1 billion across multiple resource ventures.

Ownership and Share Structure

According to LSEG, 6.8% of Vizsla Copper is held by management and insiders. Of them, CEO Craig Perry holds the most at 4.82%. The rest is retail.

Vizsla Copper has 318.52 million free float shares, a market cap of CA$27.39 million, and a 52-week range of CA$0.05 to CA$0.16.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

( Companies Mentioned: VCU:TSXV; VCUFF:OTCQB,

)

More Drill Results Point to Resource Growth

Source: Phil Ker 10/23/2025

Liberty Gold Corp.’s (LGD:TSX; LGDTF:OTCQX) Rangefront zone at Black Pine is expected to exceed 2,000,000 ounces in resource size and positively impact the upcoming project feasibility study, noted a Ventum Capital Markets report.

Liberty Gold Corp.’s (LGD:TSX; LGDTF:OTCQX) latest results of the expansion drilling underway in the Rangefront zone have positive implications for the Black Pine gold project in Idaho, reported Phil Ker, analyst at Ventum Capital Markets, in an October 15 research note.

“Near-surface oxide mineralization continues to suggest that Rangefront could be a considerable component for Black Pine and could prove to become a starter pit for a future operation,” Ker wrote.

58% Return Implied

Liberty was trading at the time of Ker’s report at about CA$0.72 per share, at a price:net asset value of 0.1x, a discount to the 0.28x peer average, the analyst noted.

The company offers “a deep value proposition for investors seeking high leverage to gold,” Ker wrote.

In comparison to the CA$0.72 share price, Ventum’s target price is CA$1.15 per share, reflecting a 58% potential return for investors.

The Canadian explorer is still rated Buy.

Liberty has 455.2 million shares outstanding, a market cap of CA$287 million, and a 52-week range of CA$0.25–0.75 per share.

More Near-Surface Gold

Liberty’s latest batch of feasibility stage drill results are of 14 holes totaling 2,979 meters (2,979m), part of the company’s 40,000m reverse circulation drill program at Black Pine aimed at expanding the existing resource. Preparation of an updated resource estimate is to begin this quarter, and a feasibility study (FS) is to follow.

The new drill results show additional oxide mineralization occurring near surface at Rangefront. Standout intercepts include:

- 41.4m of 0.41 grams per ton gold (0.41 g/t Au)

- 124m of 0.28 g/t Au

- 71.6m of 0.37 g/t Au

Implications of Results

Ker discussed the new Rangefront drill results. One, he wrote, they continue to demonstrate the potential to expand the Black Pine resource.

Two, more near-surface mineralization suggests that Liberty could alter the current mine sequencing for Black Pine for a more optimal operation.

Three, results of the new stepout holes expanded the width of the known mineralized zone in the current resource pit by more than 150m in a north-south direction and by more than 200m in an east-west orientation.

Resource to Exceed 2 Moz

Ker highlighted that given the amount of drilling done since and excluded from the 2024 Black Pine prefeasibility study (PFS), there remains significant resource upside. Ventum expects Liberty to grow Rangefront beyond the 1,900,000 ounce resource size outlined in the PFS.

The PFS resource excluded the 15,000m of drilling done at Rangefront in 2024 and the 14,000m-plus drilled there so far this year. Plus, Liberty plans to complete another 15,000m at Rangefront by the end of this year. Thus, there will be about 44,000m of drilling whose results will be incorporated into the resource estimate for the first time. This should read through to the FS in a positive way.

Plans for Rest of 2025

This remaining 15,000m of 2025 drilling is to encompass about 50 more reverse circulation and core drill holes at Rangefront. Also, this quarter, Liberty is working to finish additional metallurgical drilling in expanded areas of the project, also to support the upcoming FS.

“We continue to see Liberty unlocking value through ongoing expansion drilling at Black Pine while derisking the project to the feasibility stage,” Ker wrote.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Liberty Gold Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$5,000.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Disclosures for Ventum Capital Markets, Liberty Gold Corp., October 15, 2025

Ratings BUY : recommendation: stock is expected to appreciate from its current price level at least 10-20% in the next 12 months. NEUTRAL : recommendation: stock is expected to trade in a narrow range from its current price level in the next 12 months. SELL : recommendation: stock is expected to decline from its current price level at least 10-20% in the next 12 months. U/R : Under Review N/R : No Rating TENDER: Investors are guided to tender to the terms of the takeover offer. Analyst recommendations and targets are based on the stock’s expected return over a 12-month period or may be based on the company achieving specific fundamental results. Under certain circumstances, and at the discretion of the analyst, a recommendation may be applied for a shorter time period. The basis for the variability in the expected percentage change for a recommendation, relates to the differences in the risk ratings applied to individual stocks. For instance stocks that are rated Speculative must be expected to appreciate at the high end of the range of 10-20% over a 12-month period.

Price Volatility/Risk SPECULATIVE : The Company has no established operating revenue, and/or balance sheet or cash flow concerns exist. Typically low public float or lack of liquidity exists. In addition, companies operating with significant commodity pricing exposure will typically be rated SPECULATIVE. Rated for risk tolerant investors only. ABOVE AVERAGE : Revenue and earnings predictability may not be established. Balance sheet or cash flow concerns may exist. Stock may exhibit low liquidity. AVERAGE : Average revenue and earnings predictability has been established; no significant cash flow/balance sheet concerns are foreseeable over the next 12 months. Reasonable liquidity exists. Price Volatility/Risk analysis while broad based includes the risks associated with a company’s balance sheet, variability of revenue or earnings, industry or sector risks, and liquidity risk.

Analyst Certification I, Phil Ker, hereby certify that all of the views expressed in this report accurately reflect my personal views about the subject securities or issuers. I also certify that no part of my compensation was, is, or will be, directly or indirectly related to the specific recommendations or views expressed in this report. I am the research analyst primarily responsible for preparing this report. Research Disclosures Company Disclosure Liberty Gold Corp. 3, 4 Applicability 1. Ventum Financial Corp. and its affiliates’ holdings in the subject company’s securities, in aggregate exceeds 1% of each company’s issued and outstanding securities. 2. The analyst(s) responsible for the report or recommendation on the subject company, a member of the research analyst’s household, and associate of the research analyst, or any individual directly involved in the preparation of this report, have a financial interest in, or exercises investment discretion or control over, securities issued by the following companies. 3. Ventum Financial Corp. and/or its affiliates have received compensation for investment banking services for the subject company over the preceding 12- month period. 4. Ventum Financial Corp. and/or its affiliates expect to receive or intend to seek compensation for investment banking services from the subject company. 5. Ventum Financial Corp. and/or its affiliates have managed or co-managed a public offering of securities for the subject company in the past 12 months. 6. A director(s), officer(s) or employee(s) of Ventum Financial Corp. is a director of the subject company in which Ventum provides research coverage.6 7. A member of the research analyst’s household serves as an officer, director or advisory board member of the subject company. 8. Ventum Financial Corp. and/or its affiliates make a market in the securities of the subject company. 9. The analyst had an on-site visit with the subject company. For details, refer to the General Disclosure section. 10.The analyst or any partner, director, or officer has been compensated for travel expenses incurred as a result of an on-site visit with the subject company. 11.During the past 12 months immediately preceding the date of the research report or a recommendation was issued, Ventum Financial Corp has provided services by any partner, director or officer of the Dealer Member or analyst involved in the preparation of a report, other than services provided in the normal course investment advisory or trade execution services to the subject company for remuneration. General Disclosure The affiliates of Ventum Financial Corp. are Ventum Financial (US) Corp., Ventum Financial Services Corp., and Ventum Capital Corp. Analysts are compensated through a combined base salary and bonus payout system. The bonus payout is amongst other factors determined by revenue generated directly or indirectly from various departments including Investment Banking. Evaluation is largely on an activity-based system that includes some of the following criteria: reports generated, timeliness, performance of recommendations, knowledge of industry, quality of research and investment guidance, and client feedback. Analysts and all other Research staff are not directly compensated for specific Investment Banking transactions.

None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Ventum Financial Corp. Ventum Financial Corp.’s policies and procedures regarding dissemination of research, stock rating and target price changes can be reviewed on our corporate website at www.ventumfinancial.com (Research: Research and Conflict Disclosure). The attached summarizes Ventum’s analysts review of the material operations of the attached company(s). Analyst Company Type of Review Operations / Project Date Ker, Phil Liberty Gold Corp. Management Review All 08/19/25 Recommendations Number of Recommendations Percentage BUY 70 72.92% NEUTRAL 5 5.21% SELL 0 0.00% UNDER REVIEW 18 18.75% N/R 0 0.00% TENDER 2 2.08% RESTRICTED 1 1.04% TOTAL 96 Stock Rating and Target Changes For reports that cover more than six subject companies, the reader is referred to our corporate website for information regarding stock ratings and target changes. ventumfinancial.com (Research: Research and Conflict Disclosure).

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre – Vancouver. Estimates and projections contained herein are our own and are based on assumptions which we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its aೀiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a ೃnancial advisor, ೃscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an oೀer to sell, or the solicitation of an oೀer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited. Ventum Financial Corp. is a Canadian broker-dealer and is not subject to the standards or requirements of MiFID II. Readers of Ventum Financial Corp. research in the applicable jurisdictions should make their own eೀorts to ensure MiFID II compliance. For further disclosure information, reader is referred to the disclosure section of our website.

( Companies Mentioned: LGD:TSX; LGDTF:OTCQX,

)

Chen’s High-Grade Gold, Silver Plays for Q4

Source: Streetwise Reports 10/23/2025

It has been quite a year for precious metals such as gold and silver, and Chen Lin’s top stock picks for the quarter bear that out. Which companies have the most upside?

It has been quite a year for precious metals such as gold and silver, and the top stock picks for the last quarter of 2025 by Chen Lin, author of the What is Chen Buying? What is Chen Selling? newsletter, bear that out.

After hitting new record highs, the metals experienced their steepest single-day drops in years, halting a months-long rally fueled by inflation worries and central bank purchases, according to Arslan Ali reporting for FX Empire on October 22.

Spot gold fell over 6%, marking its largest intraday decline since 2013, while silver plummeted more than 8%, its worst performance since 2021. This pullback was triggered by a stronger U.S. dollar and easing trade tensions between Washington and Beijing, leading traders to unwind their safe-haven positions.

“Gold had several attempts to break higher last week, but resistance near the upper range held firm,” said David Morrison, senior market analyst at Trade Nation, according to Ali. “This correction may represent a healthy reset after an overextended run.”

However, that doesn’t mean the ride is over, as most major banks remain optimistic about gold’s trajectory. Goldman Sachs forecasts gold reaching US$4,900 per ounce by the end of next year, while Bank of America maintains a long position with a US$6,000 per ounce target by mid-2026, the article noted. JPMorgan projects similar highs by 2029, citing persistent global debt and currency debasement concerns.

Silver, meanwhile, continues to benefit from strong industrial demand, particularly from the solar energy and electronics sectors, providing a partial cushion against market volatility. While short-term volatility may persist, analysts say both metals remain underpinned by macroeconomic uncertainty and investor hedging. As Michele Schneider of MarketGauge.com observed, according to Ali, “What would truly end gold’s run is a world of fiscal discipline and peace — neither of which seems imminent.”

Chen’s picks take these considerations into mind with two gold companies and one silver company. Rounding out the picks are a company with major critical mineral reserves and two biotech companies.

Canary Gold Corp.

The first pick, Canary Gold Corp. (BRAZ:CSE; CNYGF:OTC), is “one of these juniors with super upside,” Chen said. “They are just starting to drill, and they are looking for 20-30 million ounces (Moz), hoping for 100 Moz, maybe even 1 billion ounces!”[OWNERSHIP_CHART-11442]

Earlier this month, the company updated on its exploration activities at the Madeira River Project in Rondônia, Brazil, along with recent corporate achievements that set the stage for the Company’s next growth phase.

Since its successful IPO a year ago, Canary has concentrated on establishing a strong foundation for long-term success, including setting up a fully operational exploration team and an in-house sample preparation facility in Porto Velho. With this infrastructure in place, the Company has completed two initial drilling campaigns that support the targeted geological concepts across its extensive landholding.

A 1,950-meter aircore drilling program was conducted over a small section of the vast tenement package, intersecting the target stratigraphic horizon known to host the auriferous Mocururu layers, the company said.

Meanwhile, a 457-meter sonic drilling program tested conceptual geophysical targets while providing continuous intact samples through the unconsolidated and semi-consolidated target stratigraphic horizon from the surface.

Panning of selected samples revealed visible gold particles in heavy mineral concentrates. It should be noted that visual observations of gold in pan concentrates are not indicative of grade or volume and should not be considered representative of economic mineralization.

These observations are seen as an early, qualitative indicator that warrants further quantitative analysis.

Encouraged by these early results and leveraging its first-mover advantage in this underexplored yet promising region, Canary said it was committing to a major drilling investment across its expanding tenement portfolio. Simultaneously, the Company continues to actively pursue the identification of additional high-potential targets within the Madeira River Region.

“With a strong team and infrastructure in place, and supported by early exploration results, Canary is progressing into the next phase of its program,” President Mark Tommasi said. “Our objective is to further assess the potential of this underexplored gold province.”

Chen told Streetwise, “I would suggest watching the results closely” for a possible “home run.”

About 4% of the company is owned by insiders and management, according to LSEG data. Inclination Earth Sciences Inc. also owns 5.64%. Other top shareholders include Andrew Lee Smith with 3.05%, Hein Poulus with 0.6%, and Al Kanji with 0.15%.

Its market cap is CA$23.61 million with 65.64 million shares outstanding. It trades in a 52-week range of CA$0.19 and CA$0.48.

Torq Resources Inc.

A “sleeper just about to wake up” is Torq Resources Inc. (TORQ:TSX-V; TRBMF:OTCQB), according to Chen.[OWNERSHIP_CHART-11454]

On October 20, the company announced that an affiliate of Gold Fields Ltd. has decided to proceed with the second stage of its USD$48 million earn-in option for Torq’s Santa Cecilia gold-copper porphyry project, situated in the renowned Maricunga belt in Chile’s Atacama region. This phase will involve an anticipated expenditure of approximately USD$11 million, covering all project costs, with the majority allocated to diamond drilling at Santa Cecilia and a USD$1 million property payment.

Work is expected to begin in early to mid-November, utilizing two drill rigs. Preparations are underway, and with favorable weather conditions, the company expects to adhere to this timeline. Details of the program will be shared closer to the start of the planned work.

“We are eager to resume drilling at Santa Cecilia, where we have previously discovered long intercepts of continuous gold and copper mineralization at three separate targets, with grades improving with each phase of drilling,” Chief Executive Officer Shawn Wallace said. “We have only drilled 11 holes so far and are excited about the follow-up drilling of these holes, which are designed to vector towards the mineralizing intrusion and test additional targets.”

The decision by Gold Fields to continue with the USD$48 million earn-in option ensures that this work is well-funded and, importantly, will cover the next property payment due this month.

“The company is fully funded and believes it could have a Filo-type discovery based on their prior experience,” Chen said, referring to the Filo del Sol project in Chile’s Atacama region.

According to a piece on Mining.com on May 4, a new resource estimate shows its potential to be a part of one of the world’s largest copper, gold and silver resources, says the project’s new joint owner Lundin Mining (LUN:TSX).

In August, the company reported drill results from the Phase III diamond drilling campaign at Santa Cecilia. The campaign included five diamond drill holes totaling 4,061.5 meters.

The Pircas Norte and Gemelos Norte targets are located within 1 to 2 kilometers of the Caspiche gold-copper deposit, owned by Norte Abierto (a partnership between Newmont and Barrick), which is estimated to contain 1.29 billion tonnes grading 0.54 grams per tonne gold (g/t Au) and 1.17 billion tonnes grading 0.21% copper (Cu) in measured and indicated resources, with additional inferred resources.

Three drill holes at the Gemelos Norte target confirmed a new copper-gold porphyry discovery within the Santa Cecilia project, including 450 meters of 0.51 g/t Au and 0.155% Cu. Additionally, step-out drilling at Pircas Norte extended mineralization at depth, revealing 206 meters of 0.99 g/t Au and 0.109% Cu within a broader interval of 266 meters grading 0.81 g/t Au and 0.097% Cu.

According to LSEG data, about 11% of Torq is owned by insiders and management, and about 11% by strategic corporate entities. Less than 1% is owned by institutions. The rest is retail.

Some top shareholders include Gold Fields with 11.13%, Shawn Wallace with 5.43%, Michael Kosowan with 4.6%, Steven Cook with 1.05%, and U.S. Global Investors with 0.48%.

Its market cap is CA$21.35 million with 185.84 million shares outstanding. It trades in a 52-week range of CA$0.05 and CA$0.15.

Cerro de Pasco Resources Inc.

Another of Chen’s picks, Cerro de Pasco Resources Inc. (CNSX:CDPR; OTCMKTS:GPPRF), is expecting metallurgical results in the coming weeks, Chen said.[OWNERSHIP_CHART-10400]

Its Quiulacocha Project in Peru is a large-scale initiative focused on reprocessing tailings, targeting around 75 million tonnes of silver-rich material accumulated over 90 years from the historic Cerro de Pasco open-pit and underground mine, the company said.

These tailings are estimated to hold 423 million ounces of silver equivalent, including silver, zinc, lead, copper, and gold. Since all the material is located at the surface, the project enjoys exceptionally low mining costs. A long-awaited easement was recently granted, allowing CDPR to begin its first significant drilling and development program in more than 10 years.

Situated 4,400 meters above sea level in Peru’s Andes, Cerro de Pasco’s 67,000 people are perched atop what Chief Executive Officer Guy Goulet has described as “the largest above ground mineral resource on the planet,” according to a piece written by Ryan Charles on June 2 for Crux Investor. Discovered by the Spanish in 1630, this vast deposit has been continuously mined ever since. “I don’t know one mine on the planet that has such a statistic,” Goulet notes, emphasizing the unique 400-year operation that attests to the resource’s quality and consistency.

The modern era of Cerro de Pasco began in 1906 when J.P. Morgan made what historians still refer to as “the greatest investment of the 20th century in Peru.” Morgan’s Cerro de Pasco Copper Corporation transformed the site into a global hub of excellence, attracting “the best geologists, the best engineers, the best metallurgists, best equipment” to what became known as “the school of all the mines on the planet.” Under Morgan’s leadership, Cerro de Pasco became “the largest gold, copper, silver mine on the planet” and “the cash cow of the country.” Over the years, operators extracted 300 million tons of material, with some processed into concentrates and the rest stockpiled as tailings, creating today’s remarkable opportunity.

On October 20, the company announced a private placement for up to CA$15 million.

CDPR could become “one of these hot rare earth and gold/silver plays potentially worth billions of dollars,” Chen noted. “Right now, its market cap is only a fraction of it. They just announced a financing, and I think it is a good opportunity for new investors to get involved using the liquidity.”

About 8% of the company is held by insiders and management, according to LSEG. About 30% is held by other strategic entities, and about 8% is held by institutions. The rest is retail.

Top shareholders include 2176423 Ontario Ltd. with 16.21%, Gordaldo Ltd. with 5.81%, LH Financial Services Corp. with 5.32%, Steven Zadka with 4.68%, and Guy Goulet with 1.8%.

Its market cap is CA$251.84 million with 493.39 million shares outstanding. It trades in a 52-week range of CA$0.21 to CA$0.60.

Energy Fuels Inc.

Another Chen pick heads Down Under for critical minerals. The United States and Australia have each committed to investing US$1 billion in such projects over the next six months, as announced by Australian Prime Minister Anthony Albanese during a joint press briefing at the White House Tuesday, a move directly affecting his first pick, Australian rare earths developer Energy Fuels Inc. (EFR:TSX; UUUU:NYSE.American)[OWNERSHIP_CHART-636]

According to a White House fact sheet, the total investment is expected to exceed US$3 billion, indicating that the details are still being finalized, reported Madhurima Das for Zacks Investment Research on October 21.

The statement said “shovel-ready projects” would benefit.

“That puts UUUU’s Australian fully permitted heavy rare earth project, the Donald Project, on top of the list,” Chen told Streetwise Reports.

Albanese mentioned that these investments are part of a “US$8.5 billion pipeline of projects that we have ready to go.”

Additionally, the White House noted that the Export-Import Bank of the United States “is issuing seven letters of interest for more than US$2.2 billion in financing” to support critical minerals and supply-chain security projects. The U.S.-Australia agreement indicates that Trump is somewhat embracing a “friendshoring” strategy to counter China’s restrictions on rare earth exports, the article said.

Energy Fuels and Astron Ltd. have received a non-binding and conditional letter of support from Export Finance Australia (EFA), the country’s export credit agency, Das reported. This letter pertains to up to AU$80 million in senior debt project financing for the development of the Donald project, which is fully permitted and features a world-class Heavy Mineral Sands (HMS) deposit with a high concentration of “mid” and “heavy” rare earth element (REE) oxides.

The total funding needed for the project’s development is currently estimated at AU$520 million, Das wrote.

The EFA’s letter of support represents a significant milestone in Astron’s and Energy Fuels’ broader funding efforts. The United States and Australia have signed an agreement to enhance the supply of rare earths and other critical minerals, aiming to reduce China’s market dominance. This development could help accelerate financing for the Donald Project. A positive final investment decision is anticipated in December 2025, with production expected to commence in the second half of 2027, once financing is secured.

In Chen’s October 2025 newsletter, he offered bullish commentary after visiting the White Mesa Mill. He noted, “I was with top bankers from Goldman, JPM etc. . . . there will be reports, likely very positive, from top banks like Goldman, JPM.”

Lin added that Energy Fuels is preparing a feasibility study to double throughput at the mill and suggested that the company is “on the path to achieve heavy rare earth independence by 2028,” stating that “UUUU is at least [two to three] years ahead of their competition.”

LSEG reports that 63.84% of Energy Fuels is held by institutions, with Sprott Asset Management LP holding the most with 6.96%, followed by Alps Advisors with 5.84% and Mirae Asset Global Investments with 4.76%.

Management and insiders hold 1.74%. The rest is retail.

The company currently has a market cap of US$1.75 billion with 230.67 million shares outstanding.

Rezolute Inc.

Biotechnology company Rezolute Inc.’s (RZLT:NASDAQ) ongoing Phase 3 study (upLIFT) of ersodetug for treating hypoglycemia caused by tumor hyperinsulinism (HI) should have long-awaited results by the end of the year, Chen said.[OWNERSHIP_CHART-10278]

On September 2, the company said it reached an agreement with the FDA on a significantly streamlined clinical development path for the drug.

During a meeting with the FDA on August 19, 2025, the agency approved modifications to the study design, including the removal of the requirement for a double-blind randomized placebo-controlled trial. The revised study will involve as few as 16 participants and will focus solely on the single-arm open-label portion of the upLIFT study, which has been the main focus of the company’s patient recruitment efforts, the company said in the release.

The FDA also confirmed that Rezolute’s pivotal sunRIZE trial in congenital HI, which is expected to report topline results in December, will serve as confirmatory clinical evidence, demonstrating the FDA’s recognition of ersodetug’s broad applicability in various forms of HI.

“We are absolutely delighted with this regulatory outcome,” said Nevan Charles Elam, chief executive officer and founder of Rezolute. “The FDA’s staff and leadership have been very vocal about the desire to responsibly simplify clinical development for rare diseases, particularly when there is real-world evidence of benefit combined with mechanistic plausibility. We believe that the alignment we have achieved with the agency exemplifies this innovative approach and is substantially based upon the favorable outcomes that we have observed over the last two years treating more than 10 patients with tumor HI under our Expanded Access Program.”

Dr. Brian Roberts, chief medical officer at Rezolute, added, “This revised and simplified plan for the upLIFT study and approval pathway marks an important development for us as well as the community of healthcare providers, patients, and families living with serious hypoglycemia caused by tumor HI. By focusing on an open-label study in upLIFT, while building upon the robust clinical foundation established in the congenital HI indication, we are expediting development with the goal of making this therapy available as efficiently as possible.”

The Phase 3 registrational study is a single-arm, open-label, pivotal trial involving approximately 16 participants with insulinoma or non-islet cell tumors who have uncontrolled hypoglycemia caused by tumor hyperinsulinism (HI), the company said.

Tumor hyperinsulinism (HI) is a rare disease caused by two distinct types of tumors: islet cell tumors (ICTs) and non-islet cell tumors (NICTs), both of which lead to hypoglycemia due to over-activation of the insulin receptor. Insulinomas are the most common type of ICT and cause hypoglycemia by stimulating excessive insulin production.

“Based on interim readout and compassionate uses, I am confident (the trial’s outcome) will be positive,” Chen said. “I expect the stock to jump well into double digits on the positive results.”

According to Stock Titan, about 90.03% of the company is owned by institutions and about 9.68% is held by insiders and management. The rest is retail.

Top shareholders include Federated Hermes Global Investment with 15.45%, Fidelity Management & Research Co. with 13.74%, Handok Inc. with 9.27%, Invus Public Equities LP with 5.36%, and The Vanguard Group with 4.43%.

Its market cap is US$804.74 million with 90.83 million shares outstanding. It trades in a 52-week range of US$2.22 and US$9.72.

FibroGen Inc.

Finally, Chen picked another biotech, FibroGen Inc. (FGEN:NASDAQ), which he said should report its Q3 results soon.[OWNERSHIP_CHART-11455]

“It will likely show its cash level at ~US$30/share while the stock is trading at ~11, huge discount to the cash level and negative enterprise value,” he said. “It will have a promising Phase 2 candidate and a new Phase 3 candidate and be fully funded into 2028.”

In September, the company announced the launch of a Phase 2 monotherapy, dose-optimization trial for FG-3246, a potential first-in-class antibody-drug conjugate (ADC) targeting CD46-expressing cancer lesions in patients with metastatic castration-resistant prostate cancer (mCRPC).

This trial will also evaluate the diagnostic and predictive capabilities of FG-3180, a companion PET imaging agent that shares the same CD46-targeted antibody as FG-3246. The study will assess FG-3180’s ability to identify mCRPC lesions and predict responses to FG-3246.

“With the transformation of FibroGen to a U.S.-focused organization now complete and a robust cash runway into 2028, we are excited to advance our FG-3246 program and initiate the Phase 2 monotherapy trial with the activation of the University of California San Francisco (UCSF) site,” said Chief Executive Officer Thane Wettig. “FG-3246 demonstrated compelling clinical activity in patients that were heavily pre-treated, with a competitive radiographic progression-free survival benefit in the Phase 1 monotherapy study. We are confident that the dosing regimen of FG-3246, use of prophylactic G-CSF, and the enrollment of patients in earlier lines of treatment of mCRPC set us up to further demonstrate the potential of this program.”

Wettig said the company anticipates results from the interim analysis of its Phase 2 study in the second half of 2026.

“We also look forward to reporting the results from the ongoing investigator-sponsored study of FG-3246 in combination with enzalutamide in the fourth quarter of this year,” he said.

Prostate cancer is the second most common malignancy in men, significantly contributing to male mortality rates, the company noted.

About 2% of the company is owned by insiders and management and about 26% by institutions, according to LSEG data.

Top shareholders include Armistice Capital LLC with 8.31%, The Vanguard Group Inc. with 4.4%, Acadian Asset Management LLC with 3.44%, PRIMECAP Management Co. with 2.22%, and BlackRock Institutional Trust Co. with 2.08%.

Its market cap is US$45.09 million with 4.04 million shares outstanding. It trades in a 52-week range of US$4.50 and US$21.94.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Energy Fuels Inc.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

( Companies Mentioned: BRAZ:CSE;CNYGF:OTC,

CNSX:CDPR; OTCMKTS:GPPRF,

EFR:TSX; UUUU:NYSE.American,

FGEN:NASDAQ,

RZLT:NASDAQ,

TORQ:TSX-V; TRBMF:OTCQB,

)