Source: Maurice Jackson for Streetwise Reports 07/09/2020

Maurice Jackson of Proven and Probable and the CEO of NV Gold discuss the company’s “step-out” into British Columbia, the headliners on its board and the news that will drive the stock in the coming months.

Maurice: Joining us for a conversation is Peter Ball of NV Gold Corp. (NVX:TSX.V; NVGLF:OTC).

It’s a real pleasure to speak with you today to share the unique value proposition of NV Gold and to discuss the company’s latest project acquisition. Mr. Ball, for someone new to the story, please introduce NV Gold and the opportunity the company presents to the market.

Peter Ball: NV Gold is an exploration gold company focused on making gold discoveries in Nevada. What we’ve done is put together what we believe are some of the best technical minds in the industry. We’ve known each other for many years. We’re a very tight company. We own a lot of the shares in the company ourselves. We have a very low burn rate. One specific goal is to find gold, reward our shareholders and keep on moving forward.

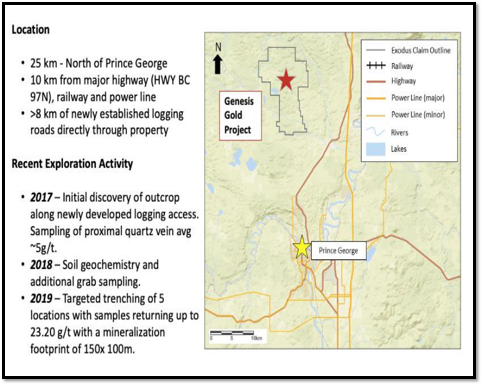

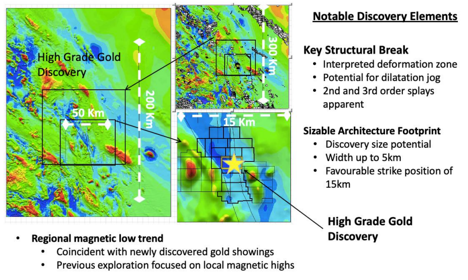

Maurice: NV Gold has a very robust property bank with 16 projects located in Nevada that already have some of the most highly regarded names in the space, such as legendary investor Eric Sprott, committing millions of their capital into the company. But an opportunity has presented itself from British Columbia that looks to expand the upside potential even further for NV Gold. Mr. Ball, take us to British Columbia and introduce us to the Exodus Gold Project.

Peter Ball: This is a bit of a step-out for NV gold. Again, we’re focused in Nevada. But our technical team, of course, consists of Dr. Quinton Hennigh, who is world-renowned in some of his exploration activities and discoveries; we also have another gentleman, Dr. Odin Christensen, who used to head up the global exploration team for Newmont Corp. (NEM:NYSE) out of the U.S., and two other key individuals, John Watson, who’s made several projects into production and some additional other opportunities in the exploration field, and of course, Alf Stewart. Four highly technical geologists.

We always get presented with opportunities, and we’re always willing to look at what may assist the company to reward our shareholders.

At PDAC, one of the top exploration conferences in the world, we ran into a geologist. He had this exciting project, but it was in British Columbia. We’re looking at British Columbia, going, “Okay, well, hang on here. We’re in Nevada. Why would we ever go into British Columbia?”

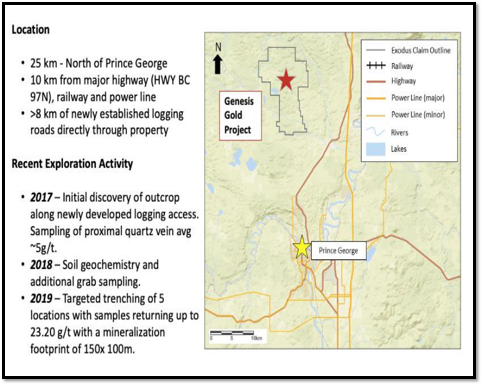

Well, here we have a high-grade gold project sitting right next to a highway in an area never explored, with a logging road put right through the middle of it, and multiple vein systems are sitting right under a one to two meters of overburden. The road’s going to put in another 5, 6, 7, 10 kilometers through this area. No one’s been there.

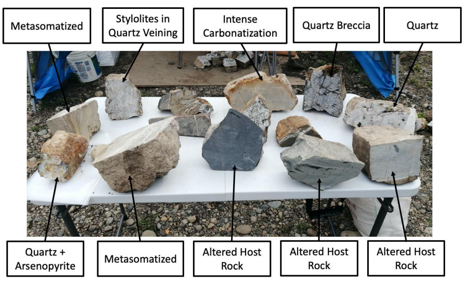

We talked to the geologists, and for the last four months, we’ve been working on taking a look at this project. It’s an extensive gold mineral field that we’ve, to date, after reviewing the project, found multiple vein systems. It’s high-grade gold. They’ve done some trenching. They’ve done some soils since the project’s been at work for about three years. It’s interesting. We had to add it to our pipeline. Here we are.

Maurice: Just to confirm here, this is a greenfields exploration project that has existing infrastructure?

Peter Ball: Yes. It’s been in work since 2017, so there’s nothing around it. It consists of extensive infrastructure within 10 kilometers of a power line, within 40 kilometers of the city of Prince George, British Columbia.

This is interesting. This project in British Columbia we can work every day of the year. We could drive to the site. Some of the projects up in the Golden Triangle, you have to wait for spring to come in, and then you got to get out of there before September, October. We’re good all year-round.

Then there are several other good things about the project. There’s what we call an expiration tax credit we get, so for every dollar we spend, we get $0.30 back, so it’s going to help on minimizing the capital at the project. It’s going to be fun.

Maurice: It certainly sounds like it. Peter, I know that your team is very, very meticulous, and you have an outstanding repute for your business and geological acumen. Why is this an accretive transaction right for NV Gold shareholders, and why now?

Peter Ball: Looking at a project in Canada that we can work all year-round, and when the gold movement. . .whenever you see a project with this high-grade nature that is robust—the land position that comes with this project, I think, is over 110, 115 square kilometers, the package—it makes sense. We want what we can work. We want a project that could deliver a high-grade gold discovery.

We think we’re onto something. For example, from the discovery pit or trench, back in 2017, a new logging road was created over the last winter here 2019–2020. They did a little bit of exploration, walked a kilometer away, found another rock sample, looks interesting. . .Our guys took a look at it, and when Odie Christensen, Quinton Hennigh, John Watson, and Alf Stewart speak, I listen. I’m an engineer, not a geologist, so I go with them. Should be a good start.

Maurice: What are some of the key highlights of the Exodus gold project that has NV Gold excited?

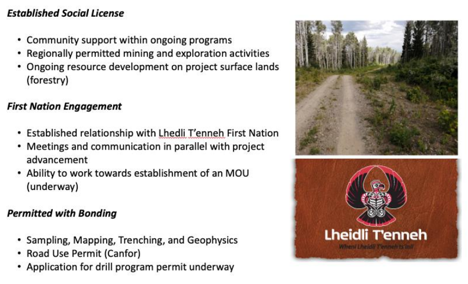

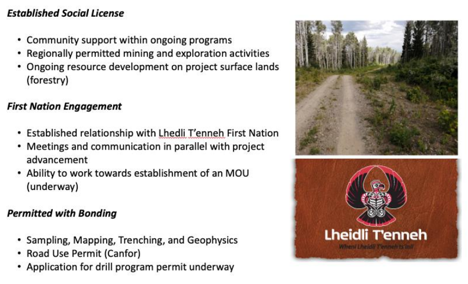

Peter Ball: One of the main things is a brand-new area no one’s ever explored. It allows us to make a virgin discovery. We think we have this discovery from what the vendors that have let us acquire the project have done work over the last two years. When you find a project that has the infrastructure and access, basically next to a highway, basically next to the power lines, next to a community. . .and one of the key things is where, whenever you work on a project, anywhere in the world, you want to work closely with the First Nations and have some social responsibility in the communities.

We have initiated and have built a good relationship with the local First Nation group; from the vendors there is a good working history on the project over the last three years. Funny thing, I think about June 20, the access road to the project was called, or named, Minesite Road by the local First Nation corporation, which is fantastic. We can hopefully build a great relationship where everyone to have a win.

Maurice: That certainly sounds good. What can you share with us regarding the exploration model?

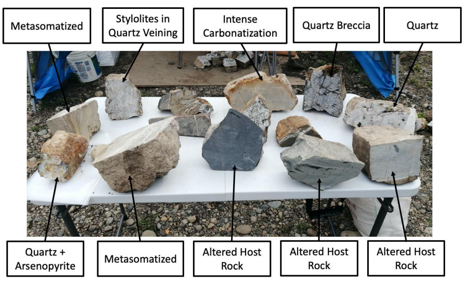

Peter Ball: What’s been happened to date so far is they’ve been a bit of trenching. They’ve done a few soils. They’ve done some rock sampling. They’ve done an initial looking around on the project over the last three years and delivered a lot of really good, interesting results.

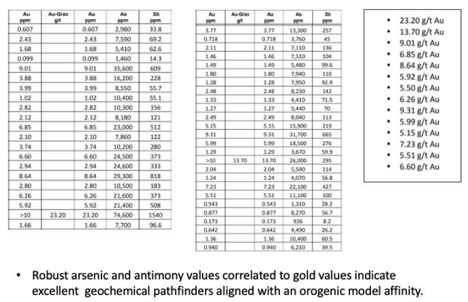

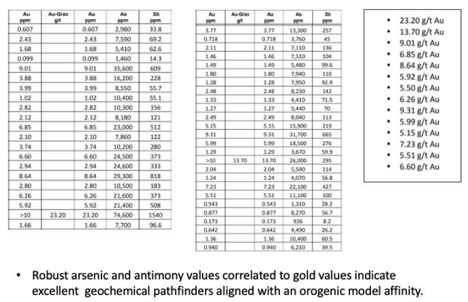

It’s got a lot of the key indicators right now within the story, and what I mean by that is the arsenic and antimony relationship, directly with gold, is correlated perfectly. What you want to find in most gold deposits are some arsenic and antimony, and usually, if you find that, you can lead to some gold. The arsenic and antimony are through the roof, which means we’re onto what we believe a really good system.

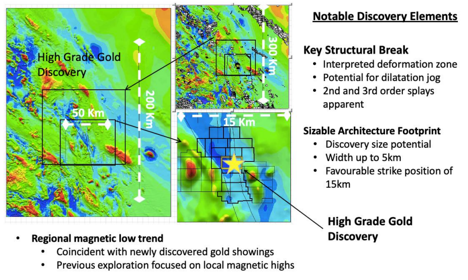

The project is what I consider drill ready, but before the executing the drill program, which we believe will be exciting at the end of the summer, we’re going to do likely a property-wide geophysical program, because from evaluating the project over the last couple of, three years, with the vendors who’ve done a lot of work, there appears to be several key large structures and faults, and they happen to coincide directly across the center of the project, and we control it all. We control what we believe is the entire district.

So we’ll do property-wide geophysics. That’ll hopefully assist us in understanding some of the structures to target, or allow us to vector in later this summer for drilling. We’ll do some structural modeling. We’ll bring in some structure guys to take a look at what’s happening here. We’ll do also some comparative modeling to other projects around the world for what this may be. We’ll do some soils, and of course, a lot of trenching.

What I want to do is prep this project for a good program for the winter, and the good thing about this project, we can drill all year-round. We’re not going to stop after the first drill program. We can get back up there in January, February, and keep going right through the winter. It should be a busy year up there. We’re excited.

Maurice: Leaving the project site, let’s discuss your team, and this is an all-star cast. If you’re intrigued about the value proposition of NV Gold’s property bank, let’s introduce your team, because they’re comprised of legendary investors in geologists that have a proven pedigree of success. Let’s find out who they are, beginning with the CEO. Who is Peter Ball, and what makes him qualified for the task at hand?

Peter Ball: No one likes to talk about themselves, but a quick overview of myself, I consider that I’ve been in mining before I was born. My dad was in the mining industry and ran several mining projects. My uncle ran Homestake out of San Francisco, one of the largest gold companies in the world. My grandfather used to work in Africa. My other great-grandfather worked in South America, so it’s in my blood. I love it. I cannot wait to get up in the morning.

I went to school for engineering, so I’m not a geologist, but I took three or four years of this stuff. But I rely on our technical team, which is on our board. I’m an engineer, been in the industry, graduated mining school in 1989, worked for several large companies like Eldorado Gold, Hudson Bay Mining and Smelting, but have been around the juniors for the last number of years. I used to be a broker at RBC Dominion Securities, so kind of a diverse little background. Enough of me.

The main thing to talk about this company regarding our team is our board. The board has been together—except for me and the new board member I brought on, Alf Stewart—the board’s been together since they founded the company because they’ve known each other for years. Their goal as friends was to get together, not to dilute the stock, put some money into their deal, and make the gold discovery, keep the burn rate low, find gold.

We’ll start with the chairman. The good thing about the chairman, the chairman is the largest shareholder of the company. He’s put every single dollar in the company. We didn’t give him free shares. He owns 6.5 million shares. He’s a geologist by trade. He’s been around the industry for 40 years. He is a master’s degree in geology from the Colorado School of Mines. Very smart man. Knows geology. Knows projects, so what’s good.

John Watson, the chairman, is the largest. Eric Sprott is the second largest. On the management team, I’m the third largest of the company and pretty much have the entire shareholder list. We put our money in there.

Let’s dive a little bit deeper into our technical team. Again, one of John Watson’s friends—they’ve known each other for years—is Dr. Quinton Hennigh. Quinton Hennigh is one of the most respected geologists in the industry. Currently, he is the chairman and president of Novo Resources Corp. (NVO:TSX.V; NSRPF:OTCQX). I think it’s about three-quarters of a billion dollars focused in Australia. If you don’t know him, google him.

He’s also one of the leading technical consultants for Irving Resources Inc. (IRV:CSE; IRVRF:OTCBB). He’s a technical leading consultant for Lion One Metals Ltd. (LIO:TSX.V; LOMLF:OTCQX). He’s on several boards because everybody wants to have the opportunity to have him on hand, and he takes ownership of his participation role in NV Gold. Again, he likes the project in BC. He likes the projects in Nevada. He’s always accessible and a great person to have on the board.

Next layer, Dr. Odie Christensen, ex-chief, senior chief geologist globally for Newmont. He led and assisted Newmont globally on expiration projects. He has a PhD from Stanford. He knows his projects. One of the most respected men in North America when evaluating, looking or helping to assist move projects.

Thirdly, Alf Stewart. When I joined the company, I was a board member for a couple of years, but then John asked me to come on and be president/CEO and bring some more energy and get the company ready for the gold market. Alf Stewart is a geologist also, by trade, but he used to be an investment banker, which is great for the capital markets. He used to be one of the leading brokers in Canada, and he used to be head of corporate compliance for the Vancouver Stock Exchange.

In other words, we also wanted Alf to come on board for corporate governance and audit and to make sure everything’s always running smoothly on the financials, and for our compliance and disclosure purposes to our shareholders.

Maurice: I’m smiling and shaking my head here. These are all wealth builders. I don’t know how you’re able to assemble this team, but kudos on you, sir.

Peter Ball: Well, thank you. They’re great. They are great.

Maurice: Who will be carrying out the commercial and technical work?

Peter Ball: Right now, the interesting thing about the project, if we’re talking specifically about British Columbia, the vendors that we are working and have signed an agreement to acquire the project from, are top geologists, very smart. What we’ve come to agree on is that I want them to help us. They know the project. They’ve been on the project for three years. They’re not going away. They’re not going to leave us stranded. They are going to be there from the first moment when we start to get going on the project here in the next couple of weeks. The permits are in place for trenching and exploration work. We’re finalizing the drilling permits.

So we’re going to have them, and also we’ll bring in a few other consultants. This is a consultant-driven property project. As we get into the geophysics, we’ll hire a physical team and go from there through the summer, and help minimize the burn. We don’t want to just hire a bunch of people and waste our capital. Every part of this project will require specific key professionals, and we’ll engage them at that time.

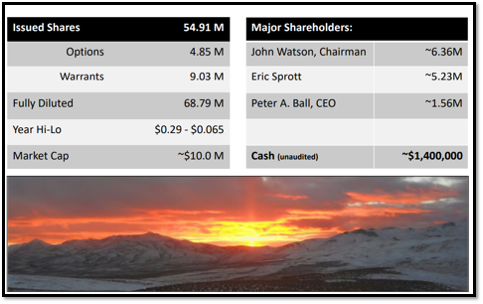

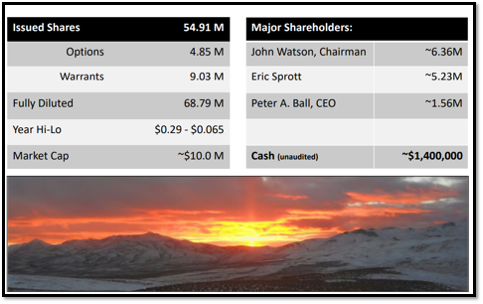

Maurice: Let’s look at some numbers. Mr. Ball, please provide us with the current capital structure for NV Gold.

Peter Ball: As we run through the share structure, we currently have about 54 million shares outstanding. Then the next part of it, we have the warrants. We have 9 million warrants outstanding. They’re all at $0.20. What that means is they’re all in the money. I think we’re trading in the high 20s, $0.27, $0.28 recently. All the money’s in the warrant, so we have approximately $2 million of the warrants in the money. Options are about 4.5 million, and they’re allocated according to the consultants or part of the team as we do it.

The last two options that we issued to the management team were at a premium to the market. The last one, issued about a month, two months ago, was at a 25% premium. We didn’t try and discount it for ourselves. The one before that, I believe, was issued at a 40% premium.

In other words, we’ve got targets to get to. We didn’t want to get a bunch of cheap shares. If we’re going to get options like most companies, let’s put them at a premium. Let’s hit a goal.

So outstanding, fully diluted if you include the 54 issued, the 9 million warrants that are all in the money, and the options, we have a total of 68 million shares outstanding. Again, as we mentioned, the top shareholders are not only the chairman, not only Eric Sprott, not only myself, but we have some industry investors out there like a good friend of mine Bob Moriarty.

Maurice: Yes.

Peter Ball: Bob Moriarty has put a lot of money in this company. He knows our team. He believes in our team. Again, he understands our goal is to find it, make a discovery. I guess we’ll hopefully make him a lot of money. It’s good to have Bob as a shareholder.

Maurice: Very commendable on the responsible action on the options there. You had a spike this week in the share price. Any comments?

Peter Ball: Yeah, it’s interesting. The markets pushed here over the last few weeks up to the highest price in Canadian history for gold at US$1,800 US or CA$2,200–2,300, whatever the math is. That was one of the reasons.

The market does believe or understand that we are moving into our summer exploration. If you go to our website and under investors area, there’s the bottom tab, we have a quick facts area. It shows each year we’ve had really good success in looking for projects, and our stock price goes up. We’re just starting to get the summer program started.

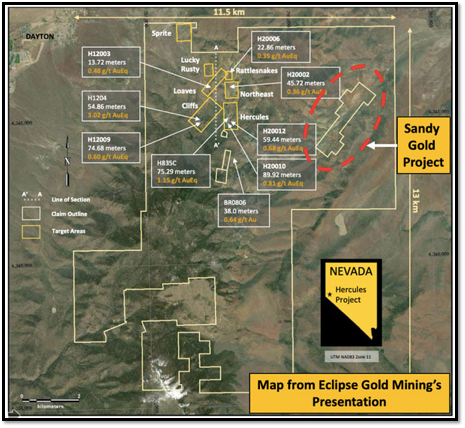

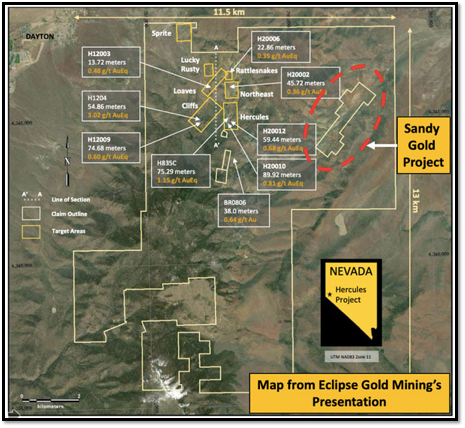

In Nevada, before this British Columbia project, which will hopefully bring some eyes to the story today, is the fact that we have two projects, which is called Slumber Gold Project and another project called Sandy. Both are ready for the summer. Both we anticipate looking to do a drill program on.

Out of those two, I want to focus on, just one for a second, our Sandy Gold Project, just over to the southeast of Reno, Nevada. We have a big database. We went into the database, found a project. No one had it. We staked it for basically—we acquired it for staking costs. Think it cost us $2,000. Got a good land package based on there was some historical drilling that had good results on it. We staked it.

The next day, a group called Eclipse Gold Mining (EGLD:TSX.V], run by a very reputable group, ended up staking the entire valley the same day we were, except we got our piece first.

A couple of weeks ago, they drilled their project, and they had some good results, but who’s sitting right next to the right, inside their claim block, is our Sandy project. Here we are sitting with an interesting project we got for free. We’re going to take a little look at this one, because it’s sitting right next to their drills. I think that brought some eyes to our story of what’s happening at Sandy.

Maurice: What is the float?

Peter Ball: If you start adding up, out of our entire 54 million shares, I would probably say 30% or 40% is probably the float right now. It’s a very tightly held, controlled company, a lot of investors in our story. Some play for the summer, but a lot of our shareholders are in for the long run.

Again, a lot of the shares are controlled by us, by key people, by key brokers, by key fund managers. We recently had two groups, one out of Boston, in the United States, and one out of Denver, Colorado, pick up a significant portion of our stock, based, again, on our management team, on our structure and our recent financing. We are pleased to have these new groups. These groups are here for the long run.

Our team has expertise. They have experience. They have previous discoveries. People buy our stock for that opportunity.

Maurice: How much cash do you have in the treasury?

Peter Ball: Well, I would say we probably have just over $1 million in the treasury. We just recently completed our financing. We’re fully funded for our Nevada story. We can look at a potential—which we haven’t discussed yet—potential flow-through financing, which we historically know you can do at a premium, and the flow-through dollars would be allocated toward British Columbia, which got a lot of interest in our story. So that’s something we’ll look at, but again, otherwise, we’ve got enough cash because we don’t have an office. We don’t fly in fancy planes. We don’t stay in fancy hotels, and really, there’s hardly anybody on the payroll. When we get active, the burn rate goes up, but our burn rate is extremely low.

Maurice: Which was one of my next questions: what is the burn rate—but you addressed that. How about this: how much debt do you have?

Peter Ball: Zero. My goal, whenever running a company, our payables are paid every two weeks. We don’t hold people off on the bills that we get from people. We have no debt.

Maurice: Well, Mr. Ball, I’ve heard nothing but virtues. I haven’t heard one vice yet. All right. Looking forward, multilayered question: What is the next unanswered question for NV Gold? When can we expect a response, and what determines success?

Peter Ball: Good questions, Maurice. This is going to be a very busy exploration a year for NV Gold. Let’s talk a little bit about Nevada, and we’ll dive into BC.

Next thing’s going on in Nevada, we are focused on getting our Slumber Gold Project through what we call the CSAMT survey, which is going to help us vector in and allow us to have our drill program better positioned in August. In July, geophysical survey is likely for Slumber, and we push into August for a potential drill program at Slumber.

Also in Nevada, I mentioned Sandy a few minutes ago. Sandy’s on our radar. We want to stick a few holes in there and maybe do also a CSAMT survey, so we’ll allocate that also for the summer. A lot of news flow on that and mobilizing and preparing for the season in Nevada.

Again, one last thing—in Nevada, we have several projects. NV Gold is focused on drilling two to three projects a year, and we dive into our portfolio, our data bank, grab another project, and we’ll do that in another year. We own 100% of them all. We do have some interest in some potential sales of assets to other mining companies, so we’re working on that, so they may add a little bit of extra news flow.

Moving up into BC: BC’s going to go pretty quick. We’re going to look to get on the site here very shortly in July. We’ll be doing site-wide geophysics. We’ll be doing soils, structural review, and again, modeling to lead up to what we will believe a drill program in the latter part of the summer—likely September. We’ll get results from that project probably in October, November, and get the drill rig turning.

Our goal, or my goal, when I spoke to the vendor, is at PDAC next year, in Toronto, which is the Prospectors Developers Association in Canada, is to have drill core highlighting what we believe is the next big discovery in British Columbia.

The great thing about this project—I ran into the vendor at PDAC in March accidentally. He looked like a geologist. I asked him what he had, and he said, “Well, I got a project.” Took a look at the project. Here we are today. I should have never run into him because he was looking for somebody else, with a much bigger name than mine, but I got him, and we’re excited.

Maurice: It was destined to happen.

Peter Ball: Absolutely. Yes.

Maurice: What keeps you up at night that we don’t know about?

Peter Ball: I don’t know. I mean, as a shareholder, large shareholder, of NV Gold myself, my number one goal is to work hard to ensure that we deliver value for our shareholders. I love the market. I wake up at 4:00 a.m., get ready. I’m taking calls from Europe first thing, and I’m into Toronto. I want action on our company. I want to deliver. I do not want to over-promise. I just want to deliver, so every night, going to bed, I can’t wait to get up the next day and see what we can get done.

I’m here for the energy for the company. I got a great technical team. The gold market is strong. We know cycles come and go. I believe that we’re into a good, robust sector for the next couple of, three, years. I believe we’re going to get close to the $2,000/ounce mark or more. The market mentality wants us to go there, so we’re going to get there, and then we’ll see what happens after that. I’ve been in the industry for 30 years myself. I’ve seen a few cycles, and when it’s hot, you got to hit it and get going.

Maurice: These are mutual ethos that we subscribe to here at Proven and Probable. Peter, last question. What did I forget to ask?

Peter Ball: I don’t think you forgot to ask anything.

Maurice: Mr. Ball, if investors want to get more information about NV Gold, please share the contact details.

Peter Ball: Absolutely. My e-mail is peter@nvgoldcorp.com or you may call me at 1 (888) 363-9883.

Maurice: Mr. Ball, it’s been an absolute delight to have you on the program. Wishing you and NV Gold the absolute best, sir.

NV Gold trades on the (TSX.V: GVX | OTC: GLVLF). NV Gold is a sponsor of Proven and Probable, and we are proud shareholders for the virtues conveyed in today’s message.

Before you make your next bullion purchase, make sure you call me. I’m a licensed representative for Miles Franklin Precious Metals Investments, where we have several options to expand your precious metals portfolio. From physical delivery, off-shore depositories, and precious metal IRAs. Call me at (855) 505-1900, or you may e-mail maurice@milesfranklin.com. Finally, please subscribe to Proven and Probable for mining insights and bullion sales. Subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: NV Gold. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: NV Gold is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Lion One. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Newmont, Irving Resources and Lion One, companies mentioned in this article.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.

( Companies Mentioned: NVX:TSX.V; NVGLF:OTC,

)