Category: Gold

- Gold consolidates above $1800 per ounce Kitco NEWS

- Gold futures pull back from a fresh 9-year peak, but hold above $1,800 an ounce MarketWatch

- Gold Price Forecast – Gold Markets Pullback to Major Area FX Empire

- Gold’s rally loses steam as investors drift towards dollar CNBC

- New Gold Record ‘Likely on Trend Following’ as Silver Tries $19 for 6th Time in 5 Years | Gold News BullionVault

- View Full Coverage on Google News

Is everyone familiar with the bet between Julian Simon and Paul Ehrlich? Ehrlich wrote a book titled The Population Bomb. He held a pessimistic view of the future, in which population growth would outstrip resources (essentially the same as Thomas Malthus).

Simon disagreed. So in 1980, they made a famous bet. Ehrlich thought that the real cost of commodities would be higher in 10 years. Simon said they would be lower.

They picked a group of five metals, to watch their prices. And made their bet, just at the end of the cycle of rising interest rates and rising prices that had begun after WWII.

The majority of the decade occurred under the falling cycle which still prevails today. It is likely that neither of them were aware of the correlation between interest rates and prices observed by Gibson 57 years prior to their bet. In any case, in 1980, all they had experienced for decades was the relentless rise of both. So Paul Ehrlich would seem to have taken a very conventional view. And Simon would be the bold contrarian.

Between 1980 and 1990, three of the metals fell in price. But the bet was not based on what people call the nominal price. This is, you know, the actual price paid by actual buyers to actual sellers who actually mine and smelt actual metal. It’s something else.

Primer in Monetary Pseudoscience

The value of the dollar is falling, and therefore economists seek a way to adjust the dollar. If such a way could be found, then one could compare the inflation-adjusted 1980 dollar to the inflation-adjusted 1990 dollar. Or the 1900 dollar. Or the 2020 dollar.

It seems a simple idea, as pseudoscience often does. It’s tempting and convenient. You just have to design a basket of consumer good. You just presume that these goods are a proper and representative measure of the things people buy.

Never mind that even the advocates of this approach do not agree on which goods should be included and which excluded.

Also, you ignore when, say, horse-drawn buggies are replaced by cars and hence there is no more need for buggy whips. Plus don’t mention improvements in the goods themselves. A 1980 car is not remotely comparable to a 2020 car. The 1980 car was before even that beacon of mediocrity known as the “K Car”.

Anyways, pay no need to this cognitive mess. And heed not your third grade math teacher, who said that you cannot add apples to oranges. Instead, be mesmerized by modern monetary magicians who insist that you absolutely can, if you’re making an index which includes apples and oranges and fuel and cars.

You just need to take a weighted average of the prices of the arbitrarily-chosen goods. Oh, by the way, you have to assume that consumer goods have constant real value. This is necessary to make the next Grand Canyon leap to the notion that consumer goods prices can be used to adjust the unit of measure of value itself.

Oh. Sorry. We forgot one more assumption: that monetary debasement is a scalar; that is, there is only one dimension. One way that debasement affects the dollar. And therefore we need only look at one variable. Consumer prices.

Don’t worry, boys and girls, we are doing science!

With those unwarranted assumptions and bogus inferences behind us, we have a consumer price index (CPI). We’re ready for the part of the science experiment that is guaranteed to amaze the parents and younger siblings of any 8-year old with a science experiment kit. He dips a white strip of paper into a glass containing clear liquid, and… presto chango abracadabra… the strip turns blue!

We look at the year-on-year change of the CPI, and adjust the dollar accordingly. For example, if CPI doubled between 2021 and 2022, then the 2022 dollar is adjusted to be worth half of the 2021 dollar.

The Cash Value

There are two reasons why people promote junk science. One is that it’s easier than doing real science. The other is that it promotes a view they arrived at non-scientifically. They use pseudoscience to bolster their financial interests or political policies.

While it is certainly true that this attempt to adjust the dollar is easy and tempting, that does not fully explain the prevalence and vehemence of this approach. It would be even easier to measure the dollar in gold (but that is the One Thing That Must Not Be Done).

Our monetary central planners—and their court-economists—prefer to redirect everyone’s attention away from the grave harms that come from their relentless counterfeiting of credit, and their endlessly falling interest rate. So monetary criticism is channeled into the relatively harmless pastime of consumer price obsession.

The Switcheroo

The Simon-Ehrlich bet hinged, not on the nominal prices of their selected commodities (metals), but on their real prices. That is, fictitious prices that no one buys or sells, based on the adjustment to the dollar which is based on changes in the CPI.

All five metals dropped in real terms. Simon won the bet. And everyone assumes the bet settled the debate between the two men. Not quite.

In the haste to find an easy way to adjust the dollar, those who would perform monetary science have overlooked a subtle but profound flaw in their methodology. And it fatally undermines the Simon-Ehrlich bet.

To see the mistake, let’s look at how consumer goods are manufactured. A major ingredient is commodities. Another major ingredient is energy—and the major ingredient in energy production is a commodity (e.g. oil). Consumer prices are heavily dependent on commodity prices.

To calculate the real prices of commodities, they are:

- Starting with the nominal prices of commodities

- adjusting these nominal prices

- by adjusting for inflation the unit of measure itself, the dollar

- which is done by measuring changes in the prices of consumer goods

- that depend heavily on commodity prices!

Let that sink in. They want to calculate the real price of each commodity. So they adjust the dollar. The adjustment is based on the price of the goods made from the commodity.

It’s a self-referential calculation.

It should be clear that if you used a commodity price index to adjust the dollar (instead of the consumer price index), then it would show that real commodity prices are not changing at all.

This is because the dollar would be adjusted by precisely the amount that the nominal prices of the commodities changed, and therefore the new real price would be the same as the original nominal price.

With CPI used as the adjustor, real commodity prices do change. They change because commodities are not 100% of the cost of consumer goods. Generally, manufacturers become more efficient as they keep optimizing their businesses. Parts that were once made of metal, are replaced with plastic. Plastic parts can be made lighter, by making them thinner where strength is not needed.

Manufacturers are also improving their products, adding more features. Just compare a 2020 car to that 1980 car. The 2020 car does not weigh any more (it probably weighs less), so by this rough measure the present-day car does not use more commodities than the 1980 car. However, a much greater quantity of other ingredients go into it, such as engineering labor and manufacturing tools.

Meanwhile, regulators and taxinators are fighting this relentless drive to reduce ingredients and hence costs, by force the inclusion of more and more useless ingredients.

These are ingredients that consumers do not value, and often do not even know about. For example, expanding employee bathrooms to be ADA-compliant. Or the legal fees related to audits, licenses, and regulatory inquiries.

Economists blithely say that the dollar has lost purchasing power, but the dollar is actually buying more than ever before. It’s just buying different things, such as compliance officers.

The Simon-Ehrlich bet hinged on the proportion of the cost of consumer goods that comes from the raw commodity ingredient cost relative to the other ingredients including useless ingredients.

In other words, if useless ingredients forced onto retailers and manufacturers grow into a larger and larger percentage of the consumer price of the goods, then by definition raw commodities are a smaller percentage of the consume price.

And as an artifact of this shift in proportion, the inflation-adjusted price of commodities is reduced from what it would be.

Julian Simon vs Paul Ehrlich

This is not what Julian Simon and Paul Ehrlich believed they were betting on. They thought they were betting on the ancient zero-sum fallacy. They thought they were settling the question of whether man’s reason increases productive capacity at a faster or slower rate than his libido increases the population.

For what it’s worth, we believe that reason wins hands-down. There is no question today that the quality of life is better in 2020 than it was in 1980. Perhaps we do not consume more commodities, or maybe we do, but we eat more and we have better-made and better-functioning products.

We have got to get monetary science out of its Medieval period. Today, most thinking about money is as scientific as thinking about astronomy was prior to Copernicus. In the five centuries since he taught the heliocentric model, the methods of science were developed. They desperately need to be applied to money and credit.

Source: Peter Epstein for Streetwise Reports 07/08/2020

With a promising hit and the rise in prices for both gold and copper—and indications of more to come—Peter Epstein of Epstein Research believes this explorer has potential for “an exciting outcome.”

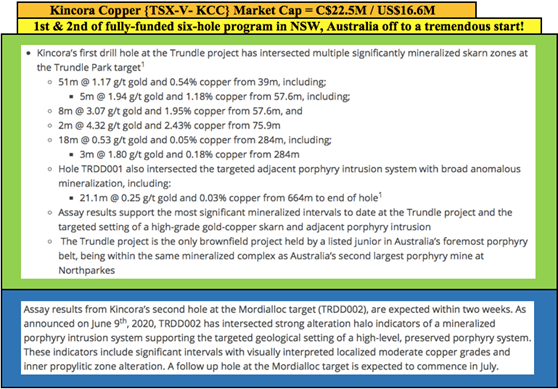

Investors in Kincora Copper Ltd. (KCC:TSX.V) have had to be patient in allowing management to explore for really big prizes in Mongolia and New South Wales, Australia. This week we learned that it was well worth the wait. On July 6, the company announced an excellent drill result intersecting multiple mineralized skarn zones at its Trundle Park target in Australia’s foremost porphyry region [see July corporate presentation].

The results are noteworthy for at least three reasons: there’s considerable near-surface, high-grade mineralization; as the first of six holes, even better assays could follow (leveraging knowledge gained from this result); and further evidence of an adjacent porphyry system was found.

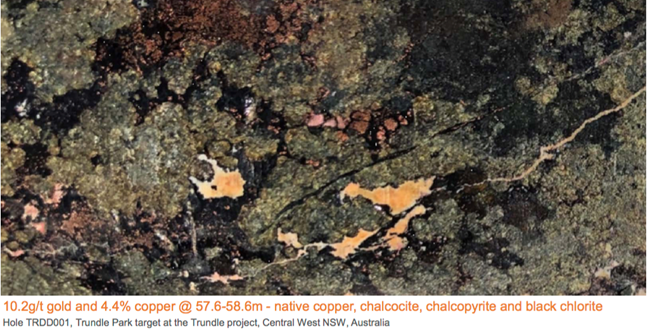

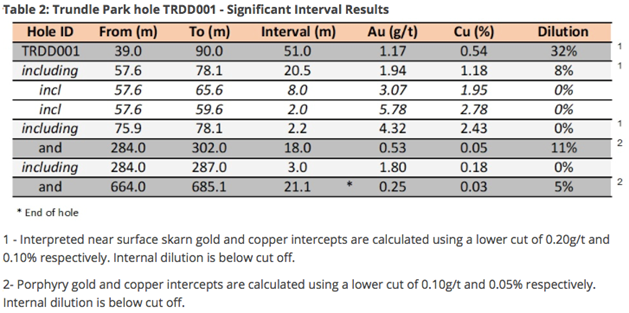

By far the best mineralization is from 39 meters (39m) to 90m depth. This 51m interval hit 1.17 g/t Au + 0.54% Cu. Included in the 51m is one meter, from 57.6m, of 10.4 g/t gold (Au) + 4.4% copper (Cu). See image below.

51m, less than 90m deep: Very good grades + a porphyry teaser at depth

At current gold and copper prices of US$1,793/ounce and US$2.78/lb., this is an in-situ rock value of ~US$100 = ~CA$135.5/tonne. In gold terms, it’s 1.75 g/t Au equivalent (equiv.). In copper terms, 1.64% Cu equiv. Note: these strong grades will not be indicative of the overall deposit. However, this hole suggests the potential for a nearer-term, standalone open pit.

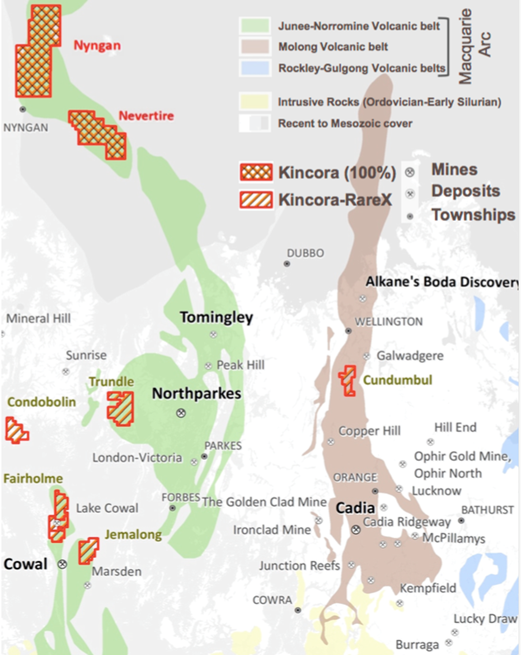

That’s the sexy part of the assay, the hole also intersected a targeted adjacent “porphyry intrusion system” with broad anomalous mineralization. This assay delivered the most significant intervals to date. Management notes that Trundle is the only brownfield project held by a listed junior in Australia’s foremost porphyry district, the Lachlan Fold Belt (LFB).

John Holliday, technical committee chair, and Peter Leaman, senior VP of Exploration commented: “We are extremely pleased and excited by the results of this first hole. It’s not often one sees such high grades near surface within a porphyry environment. Assay results prove previously announced visual interpretations of multiple zones of significant gold and copper mineralization. This supports the skarn being a standalone target at depths and intervals often mined by open cut and underground methods. . .

“. . .These results from this first hole at the Trundle target, plus visual indications from the second hole 8.5 km north at the Mordialloc target, are very encouraging. The Trundle project appears to sit within the interpreted Northparkes Intrusive Complex, placing Kincora in a unique global setting as the only listed junior exploring a large system in a brownfield field setting.”

Breaking: Dr. Copper says “reports of my death are greatly exaggerated”

The timing of the press release could hardly be better. Copper has bounced back strongly from US$2.10/lb. in mid-March to US$2.78/lb., +32%. Dr. Copper has spoken loud and clear. He/she believes that, even if temporarily slowed, the global electric transportation and green energy revolutions are alive and well.

Dr. Copper is leaning toward a V-shaped recovery. Others seem to agree, look no further then Tesla’s >CA$300 billion valuation for evidence of market sentiment on electric vehicles!

In addition to copper’s irreplaceable role in electric transportation and renewables, copper demand will increase if/when the world’s major economies embark on infrastructure massive spending sprees. Giant infrastructure builds/rebuilds(bridges, tunnels, airports, stadiums, etc.) are highly copper-intensive.

Even if copper demand is tepid, the supply response to the pandemic has been dramatic. Reduced production from countries such as Chile, (where per capita COVID-19 cases are among the worst in the world), Peru, the Democratic Republic of Congo and others, will last several more quarters. Chile is by far the largest producer, larger than the next three copper-producing countries combined in 2019.

It took three paragraphs to sound off on copper, but just one on gold. For years, gold bugs have pointed to fiat currencies, deficit spending, debt issuance, money printing, imminent inflation, etc., pushing gold to US$5,000 or US$10,000/oz. “next year!!” Next year has finally arrived. I’m not predicting US$5,000+/oz. anytime soon, but gold fundamentals are as strong as ever. Bull markets in precious metals last years, not months. Gold is up 31% from its US$1,368/oz. low of March.

A single hole, but a tonne of de-risking as exploration models validated

Turning back to this hole at Trundle, it is the first of two each at three targets in an ongoing 3,800m program. This single assay delivered meaningful de-risking of the Kincora story. Positive visual inspection of the core was verified by strong results that largely confirmed the team’s targeted geological model and exploration strategy. This is critical, because a fear investors have with junior miners is that even talented management teams will run out of money before finding anything promising.

That risk has been moderately reduced (but not eliminated). If results from hole #2 at the Mordialloc target, 8.5 kilometers north of hole #1, are as good or better, Kincora’s valuation might look undervalued compared to peers such as Magmatic Resources (MAG:ASX), Sky Metals (SKY:ASX) and Stavely Minerals (SVY:ASX) that have an average market cap of ~CA$80 million (CA$80M) versus ~CA $25M for Kincora.

To be clear, none of these companies measure up to Alkane Resources Ltd.’s (ALK:ASX; ANLKY:OTCQX) CA$700M market cap, but one cannot rule anything out at this early stage. So far there are just two winners of six holes, but we now know there’s smoke at Trundle. Will any of the next four holes find fire?

Let’s take a step back to revisit the bigger picture. High-grade, near-surface skarn mineralization is exciting, but the pot of gold/copper at the end of the rainbow is one or more porphyry deposits. Results from the first hole, and anticipated results from hole #2, represent a meaningful step closer to the pot of gold/copper.

Director John Holliday has said on the record that he thinks after Alkane’s Boda project, Kincora has the best porphyry play in the district. Likewise, CEO Sam Spring believes Kincora is the leading pure-play porphyry explorer in Australia’s LFB. Make no mistake, they’re biased!

Still, unlike many junior gold/copper districts around the world, there are relatively few juniors active in the area. I mentioned three, there are about a dozen with meaningful flagship projects in the region. By contrast, Canada’s Golden Triangle has three dozen, or more.

Readers are invited to view Kincora’s July corporate presentation. On pages 29 and 30, management places their drill result into context. While the first drill hole at Trundle did not contain the highest grades or widest intercepts, its high-grade mineralized zones are closer to surface than some peers. And, this is just the first hole!

The skarn and porphyry intrusion system setting intersected is common among large porphyry systems. For example, in the Macquarie Arc, the Big and Little Cadia skarns at Cadia were important to the discovery of multiple adjacent “causative intrusions and deposits” that make up the largest porphyry system in Australia. Kincora’s strategy is to drill to depths at which porphyries at Cadia, Northparkes, Cowal and Boda are situated.

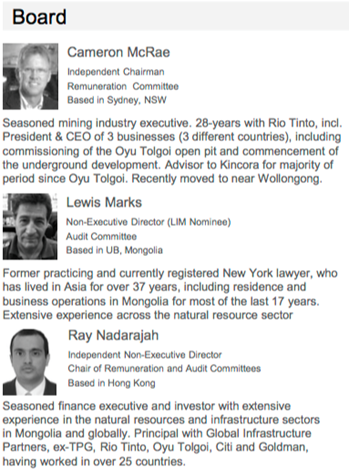

Management, Board and Technical Team: Now the hard part

The management, board, technical team and advisers share in this initial exploration success. But, where does this leave the company? I think the considerable strength of Kincora’s team will be amplified in coming months as it leverages the valuable knowledge gained from the first six holes. Kincora found smoke at Trundle, it’s now trying to locate the porphyry fire.

CEO Spring provided me with this exclusive quote: “What we intersected near-surface in hole #1 is a skarn. What we’re testing for in hole #2, and at the bottom of hole #1, is a porphyry (the presumed source of mineralization in the skarn). At the Mordialloc target, hole #2, we don’t see a skarn—we knew that only a porphyry was the target. What we intersected in hole #2 suggests that we’re closer to the core of a porphyry system (which, if you hit, can easily be a company maker) than in hole #1, without yet hitting it.”

While some investors are rightfully congratulating the team, I suggest that their jobs have only just begun. Now that we know there’s probably something meaningful (although not necessarily economic) at Trundle, the pressure is on to advance the project efficiently and cost effectively. This is where tremendous experience and skill sets come into play.

In looking at the bios, we have Mr. McRae, with nearly 30 years’ at Rio Tinto Plc (RIO:NYSE; RIO:ASX; RIO:LSE; RTPPF:OTCPK), president and CEO of three of Rio’s segments. Mr. Lehman has >40 years’ experience, mostly with BHP Billiton Ltd. (BHP:NYSE; BHPLF:OTCPK), including Tier 1 discoveries under his belt. He’s a world-renown expert in copper and gold deposits. Mr. Holliday, based in New South Wales (NSW), has >30 years’ with BHP and Newcrest Mining Ltd. (NCM:ASX)—a principal discoverer of the world-class Cadia copper-gold porphyry in NSW. Very few, if any, are better suited to lead Kincora’s technical team.

CEO Sam Spring has been a senior exec at Kincora for eight years. Prior he held a number of positions including lead mining/metals analyst at Goldman Sachs and various roles evaluating, advising or negotiating merger and acquisition (M&A) activities in multiple jurisdictions. Readers are encouraged to also review the bios of other highly talented contributors above and below. This is a group who have done this before; discovered, developed, permitted, constructed, funded and commissioned mines.

I doubt Kincora is going to ride this horse across the finish line, but the experts working on Trundle, and Kincora’s other high-profile targets in NSW, understand exactly what potential acquirers are looking for. They’ve created vast shareholder wealth in past endeavors. With continued successes they’re on track to potentially deliver another exciting outcome for Kincora Copper stakeholders.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University’s Stern School of Business.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Epstein Research Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Kincora Copper, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Kincora Copper are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Kincora Copper was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts and financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events and news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein’s disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Graphics provided by the author.

( Companies Mentioned: KCC:TSX.V,

)

Source: Streetwise Reports 07/08/2020

GoldMining’s new entity and its potential benefits are outlined in a ROTH Capital Partners report.

In a June 24 research note, ROTH Capital Partners analyst Jake Sekelsky reported that GoldMining Inc. (GOLD:TSX; GLDLF:OTCQX) noted Gold Royalty Corp., a gold royalty entity that “represents an opportunity for long-term value creation.”

“We are supportive of management’s proactive approach to unlocking value from its portfolio of gold assets and expect Gold Royalty Corp. to provide GoldMining shareholders with optionality going forward,” Sekelsky added.

Sekelsky described the new vehicle. It will hold 14 newly created royalties that will range from 0.5–2% on the same number of GoldMining’s projects. Two of the royalties will be 2%, 11 will be 1% and one will be 0.5%. With all of the royalties, Gold Royalty has exposure to 14.3 million Measured and Indicated ounces and 16.6 million Inferred ounces of gold equivalent.

The analyst presented two ways in which Gold Royalty could offer GoldMining shareholders value. One is through its valuation because royalty companies tend to trade at a premium to explorers and developers, GoldMining for instance. Thus, Gold Royalty could “command a premium to the net asset value multiple received for GoldMining’s existing asset base,” wrote Sekelsky. He noted that ROTH assigned a value of $10 million to Gold Royalty.

The second way is through future exploration on the 139,000 hectares of land that GoldMining holds in the Americas and that the 14 royalties will cover.

ROTH has a Buy rating and a CA$5.75 per share price target on GoldMining, the current share price of which is now about CA$2.33.

“In our view, GoldMining is well-funded to execute on its stated

objectives for 2020 and believe the company should continue to provide

investors with leverage to rising gold prices,” Sekelsky concluded.

Read what other experts are saying about:

- GoldMining Inc.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: ?????. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of ?????, a company mentioned in this article.

Disclosures from ROTH Capital Partners, GoldMining Inc, Company Note, June 24, 2020

Regulation Analyst Certification (“Reg AC”): The research analyst primarily responsible for the content of this report certifies the following under Reg AC: I hereby certify that all views expressed in this report accurately reflect my personal views about the subject company or companies and its or their securities. I also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report.

Shares of Goldmining, Inc. may be subject to the Securities and Exchange Commission’s Penny Stock Rules, which may set forth sales practice requirements for certain low-priced securities.

ROTH Capital Partners, LLC expects to receive or intends to seek compensation for investment banking or other business relationships with the covered companies mentioned in this report in the next three months.

( Companies Mentioned: GOLD:TSX; GLDLF:OTCQX,

)

Source: Ron Struthers for Streetwise Reports 07/08/2020

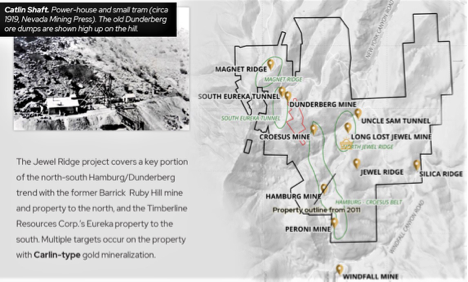

Ron Struthers of the Struthers Resource Stock Report spotlights Golden Lake Exploration and its flagship, Jewel Ridge.

I wanted to see a solid breakout for gold above $1,800/ounce, but we have traded several days at new highs so I am convinced another breakout is underway. This is exactly like the trading action we had in January, where we eventually went through $1,600 up to $1,700. We are essentially trading at the 2011 highs. My next target is $2,000; that will continue the uptrend channel (ignores the March anomaly).

As I mentioned last month, to get maximum benefit from this new bull market, my plan is to buy a basket of quality juniors in good jurisdictions like Mexico, Canada, Australia and Nevada. And Nevada is a state that is a gold country in its own right. Consider this about Nevada:

- Gold is the state’s top overseas export by value, accounting for $4.9 billion, or 44%, of the state’s $11 billion of exports in 2018. A year earlier, gold accounted for more than half the total. The top destinations are Switzerland and India, where Nevada-mined gold is refined.

- The state produces more than 80% of the gold mined annually in the United States. If it were a separate country, Nevada would be the world’s fifth-largest producer, behind China, Australia, Russia and Canada.

- Over the past decade, gold production has averaged about 5.5 million ounces/year. The value of that production in 2018 was just over $7 billion, representing 84% of all mining production in the state.

I have come across another hidden gem in Nevada. This is a new company with a low number of shares out, top-notch management and a Nevada property with all kinds of gold but only drilled to shallow depths.

Golden Lake Exploration Inc. (GLM:CSE)

Recent price: $0.20/share

52-week trading range: $0.07–0.22

Shares outstanding: 27.8 million

Highlights:

- Very low market capitalization

- Top notch management and technical team

- Jewel Ridge project, a great location in Nevada

- Advance stage with over 300 historic drill holes

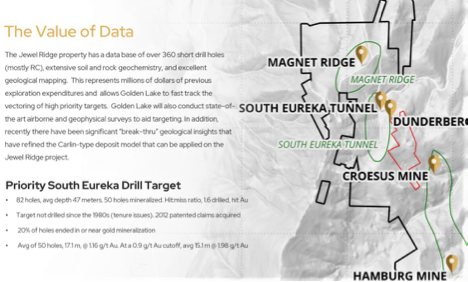

- South Eureka zone has not had much drilling since 1980s, with 50 shallow holes (average depth: 47.5 meters)

- Historic holes returned an average thickness of 17.1 meters (17.1m) assaying 1.16 g/t gold

Management (sourced from the company website)

Michael B. England, CEO and president, is an astute team builder and has been involved in the public markets since 1983. Since 1995, Mr. England has been directly involved with public companies in various roles, including investor relations, directorships and senior officer positions. To date, Mr. England has been directly responsible for raising in excess of $60 million for mineral exploration and acquisitions.

Vic Bradley, chairman, has more than 50 years’ experience in the mining industry, including more than 15 years with Cominco Ltd. and McIntyre Mines Ltd. in a wide variety of senior financial positions from Controller to COO. Over the past 30 years Vic has founded, financed and operated several mining and advanced-stage exploration and development companies, including the original Yamana Gold Inc., Aura Minerals Inc. and Nevoro Inc. (sold to Starfield Resources). Vic founded the original Yamana in early 1994, and served as president and CEO and then chairman of the board and lead director until 2008. He served as chairman of Osisko Mining Corp. from November 2006 up to its sale for $4.1 billion to Agnico Eagle and Yamana in June 2014. He served as a director of Osisko Gold Royalties Ltd. (spun out of the Osisko Mining sale) from June 2014 to May 2018 and as chairman of Nevada Copper Corp. from February 2012 to February 2017. He now serves as chairman of Osisko Bermuda Ltd., Osisko Gold Royalties’ offshore subsidiary that controls all of its assets outside of North America.

Robert Weicker, chief geologist, is an associate of Ross Beatty and has extensive mining experience, including a five-year stint at the famous Hemlo mine and including the role of chief geologist at the Williams Mine. Bob also has extensive exploration experience in the Hemlo, Thunder Bay area, and Abitibi greenstone belts, for gold and VMS (volcanogenic massive sulfide) deposits. In the U.S., Bob was with Equinox Resources Ltd. (taken over by Hecla Mining Co.) and involved with the exploration, permitting and underground development of the Rosebud gold deposit in Nevada, which was successful mined by Hecla and Newmont.

Peter Mah, director, is a mining engineer with 30 years of global mining industry experience. He is currently the COO of McEwen Mining Inc. Mr. Mah’s past positions include president of Avanti Kitsault Mines Ltd., chief operating officer (COO) of Alloycorp Mining Inc., COO and executive vice president (VP) of Luna Gold Corp., and group executive, Newmont Mining Corp. At Newmont, he led the early-stage exploration study teams defining over 15 million ounces (15 Moz) of gold resources for development in Canada, Nevada, Ghana and Peru. Most notable were the Leeville underground mine expansion in Nevada and the new Subika underground mine in Ghana.

Giulio Bonifacio, director, has over 30 years of experience in senior executive roles in the mining industry, many associated with Ian Telfor. Mr. Bonifacio is the founder and former director, president & CEO of Nevada Copper Corp., since its inception in 2005 until his retirement in February 2018. Among his many accomplishments, Mr. Bonifacio has raised directly over $700 million through equity and project debt financings for projects of merit as well as been involved in corporate transactions aggregating in excess of a billion dollars. Mr. Bonifacio has held previous senior executive roles with Getty Resources Ltd., TOTAL Energold Corp. (an energy and gold producer) as well as with Vengold Inc. (a gold producer) prior to founding Nevada Copper in 2005. Mr. Bonifacio is currently chairman and director of CopperBank Resources; CEO and director of Kerr Mines and independent director of Candente Copper Corp.

Richard Reid, technical advisor, is a senior geologist with over 39 years in the mining business, working for major mining companies, with a focus throughout Nevada. His roles with Newmont Mining Corp., now Newmont Goldcorp Corp., the largest producer of gold in the world, included Nevada District exploration manager, exploration business development manager and chief geologist for North America.

Projects—Jewel Ridge, Nevada

Jewel Ridge is located on the south end of Nevada’s prolific Battle Mountain–Eureka trend, strategically along strike and contiguous to the former Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) two-million-gold-ounce Archimedes/Ruby Hill mine to the north and Timberline Resources Corp.’s (TLR:NYSE.MKT) advanced-stage Lookout Mountain project to the south. The property claims cover approximately 728 hectares (1,800 acres). There is year-around road access to the property and it is 3.2 kilometers (3.2 km) south of Eureka.

The Jewel Ridge property contains several historic small gold mines that align along a north-south-trending stratigraphic contact of lower Paleozoic sedimentary rocks, as well as several other gold-mineralized zones with a variety of structural and lithological controls.

Historical drilling

The Jewel Ridge Project has been drilled by General Mineral Development LLC, Homestake Mining Co., Tenneco Minerals, Norse-Windfall Ventures, Rainbow Resources and Greencastle Resources (VGN:TSX.V). A total of 89,484 feet (89,484 ft) in 315 reverse circulation or rotary drill holes have been completed at Jewel Ridge. Most of the drilling was done in the 1980s and drill hole locations are approximate, but it is excellent information to guide exploration.

The most recent drilling included Greencastle, which completed three drilling campaigns after acquiring the property. In 2004 the drilling program totaled 11,210 feet in 22 reverse circulation holes. The best intercept was in HRC-11, 135 ft @ 2.1 g/t Au beginning at 310 ft depth, in bleached, decalcified Hamburg dolomite. It is encouraging that this was one of the few deeper holes and had very good results.

In 2006–2007 the drilling program totaled 8,860 feet in 18 reverse circulation holes, testing the Magnet Ridge, North Jewel Ridge, Silica Ridge and Hamburg-Croesus targets. The best intercept is 45 ft @ 0.950 g/t Au in hole GR-07-15. Intercepts in 2012 by Rainbow Resources (lessee) in its drilling program were DH12-5, with 35 ft @0.91 g/t Au; DH12-6 with 15 ft @1.95 g/t Au; and DH12-4 with 5 ft @1.67 g/t Au.

The South Eureka is the first priority drill target. It has 82 historic drill holes and 50 hit mineralization. The last drilling on this target was in the late 1980s and has not been drilled/explored since because tenure issues with the claims, which was resolved in 2012 with the purchase of 13 patented claims. This will be the first time in decades that this priority target will see modern exploration techniques and deeper drilling.

Financials

Last financials, as of Feb. 29, 2020, show $291,936 cash and no debt. Since then GLM closed a non-brokered private placement. The company issued 8,166,667 common share units at a price of $0.15 per unit for aggregate gross proceeds of $1,225,000. The shares and warrants comprising the units are subject to a four-month hold period expiring Oct. 10, 2020.

Conclusion

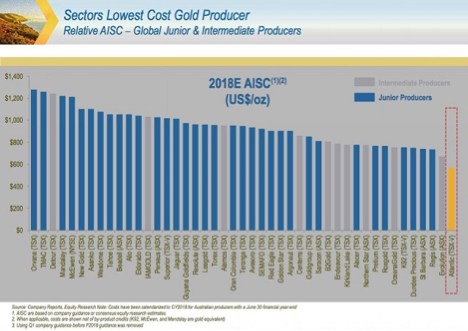

The average gold grade at the South Eureka target in 50 historic drill holes is 1.16 g/t Au. This is a very good grade for an oxide, heap-leach, open pit mine in Nevada, and indications are this gold is near surface. For example, Atlantic Gold was among the lowest cost producers in the world with their open pit Moose River mine in Nova Scotia. It was bought out by an Australian company, St Barbara Ltd.

Based on this comparison chart of 2018 costs, it highlights Atlantic Gold’s very low costs. As of March 25, 2019, the Atlantic Gold operation had a combined estimated 1.9 million ounces of gold in reserves at a grade of 1.12 grams per tonne. For full details, refer to the compliance documents at stbarbara.com.au/exploration/.

A recent new and low-grade gold mine that is providing strong cash flow is Victoria Gold Corp.’s (VGCX:TSX; VITFF:OTCMKTS) Eagle mine in the Yukon, grading 0.65 g/t Proven and Probable reserves. They just declared commercial production on July 1, and the mine is projected to have AISC of US$774 per ounce gold. Costs are higher in the Yukon compared to Nevada.

An example of a low-cost, high-margin Nevada producer is the Marigold Mine. Owned by SSR Mining Inc. (SSRM:NASDAQ; SSRM:TSX), Marigold stands out for its ultra-low grades of 0.46 g/t. In production since 1989, Marigold is a large run-of-mine operation. After blasting the ore, it doesn’t need to be crushed or ground and can go directly onto the leach pad, which significantly reduces costs.

The famous deposits in Nevada contain microscopic gold but it is found in almost every rock. The gold is low grade (under one gram per tonne) but plentiful. Between 1835 and 2008 a whopping 152 million ounces were pulled from the Carlin Trend and other gold trends in Nevada, including Cortez and Walker Lane, mostly through open-pit mining.

At GLM’s Jewel Ridge, the average historic grades would make for a robust mine if a large enough quantity of gold can be proven. This is historic data so we have to assume some risk with these numbers, but there is room for a margin of error. Deeper drilling might find higher grades as well; only time will tell. The key point is that this data represents $millions in exploration expenditures and provides a headstart on GLM’s exploration, as well as de-risking the project. The gold is there. GLM only needs to find enough to make a deposit.

On June 26 Golden Lake reported that its geological team has confirmed previous reported results on the Radio Tower target (source: press release May 14, 2020) and also has sampled a new mineralized zone designated as the A&E target (historic results up to 29.49 grams per tonne gold, 333.0 g/t silver):

Radio Tower target: Sampling by company personnel of dumps from adits, shafts, old trenches and outcrop have returned a median (based on gold values) of seven samples of 1.93 grams gold per tonne Au (g/t), 44.8 g/t silver (Ag), and 0.04% copper, 0.72% lead (Pb) and 1.18% zinc (Zn).

A & E target: Based on a compilation of the recently acquired historic third-party rock-chip database and geological reconnaissance by company personnel, another prospective target has been identified. Highlights include values up to 29.49 g/t Au, 333.0 g/t Ag, 1.35% Cu, 4.00% Pb and 9.53% Zn. The median (based on gold values) of nine samples on the two patented claims is 2.30 g/t Au, 47.4 g/t Ag, 0.18% Cu, 0.20% Pb and 0.62% Zn.

The A & E target has no known drill holes, but the area has been recently visited by company personnel to determine the logistics of accessing the area during the company’s forthcoming RC (reverse circulation) drill program, planned for July 2020. Samples comprise grab rock samples from dumps of old mine workings and rock outcrop exposures. Grab rock samples are not representative of the grade of mineralization of an occurrence, but are useful in determining prospectivity, and geological features.

As mentioned in the June 26 press release, drilling is expected to start this month, so I would suggest getting position as soon as possible.

You can see on the chart that the stock has been trading less than a year and volume just started picking up in April. The stock has recovered from the March panic selloff, but has yet to break resistance around $0.19. It looks like it was going to but the attempt failed. This pullback provides a good entry price closer to the bottom of the uptrend channel.

Ron Struthers founded Struthers’ Resource Stock Report 23 years ago. The report covers senior and junior companies with ample trading liquidity. He started his Millennium Index of dividend stocks in 2003 – $1,000 invested then was worth over $4,000 end of 2014 and the index returned 26.8% in 2016. He retired from IBM after 30 years in customer service, systems and business analyst, also developing his own charting software. He has expertise in junior start-ups and was a co-founder of Paramount Gold and Silver.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Golden Lake Exploration. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: Golden Lake Exploration is a paid advertiser at playstocks.net. Additional disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and images provided by the author.

Struthers Disclosure: All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author’s control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

( Companies Mentioned: GLM:CSE,

)