Source: Peter Epstein for Streetwise Reports 06/01/2020

Peter Epstein of Epstein Research profiles an explorer in Colombia with a project on the same prolific gold belt as Buriticá.

The importance of good community relations and avoiding serious outcomes from bad environmental stewardship is paramount. Moreover, in the age of COVID-19 and a 7-year high in the gold price, investors are increasingly interested in countries with abundant mineral resources, that are not among the top producers, countries like Colombia. At the same time, due to COVID-19, local communities will be in need of good, longer-term, high-paying jobs.

Although Colombia remains riskier than the U.S., Canada or Australia, most of the country is considerably less risky than at least three of the world’s top six gold producing countries—China, Russia and Indonesia. Colombia has a globally significant endowment of potentially mineable metals, yet has been woefully under-explored.

The ability of foreign firms to safely conduct mining activities in Colombia is improving. The newly elected federal government is pro-resource development as a means of accelerating government royalty revenue. For example, it is spearheading a national US$25 billion infrastructure program building roads, highways, bridges and tunnels to improve logistics throughout the Andes.

It doesn’t hurt that giant Zijin Mining recently acquired Canadian junior Continental Gold for US$1.05 billion = ~C$1.5 billion (at today’s C$ exchange rate) in cash (share price tripled in year leading up to takeout) outbidding Newmont Corp. for a truly world-class Colombian asset. Continental discovered and developed Buriticá, one of the highest grade, pre-production projects in the world.

Buriticá had 5.67 million Measured and Indicated ounces at ~11 g/t Au Eq, + 6.46 million Inferred ounces at ~9.2 g/t Au Eq. At US$1,200/oz gold, this project had an after-tax NPV(5%) of US$860 million and an internal rate of return (IRR) of 31.2%, and a whopping US$1.6 billion NPV & 48% IRR at today’s spot price of ~US$1,722/oz. An estimated All-In Sustainable Cost (AISC) of ~US$600/oz places it in the bottom decile of the global cost curve.

Newmont wanted Buriticá. AngloGold Ashanti is active in Colombia. B2Gold has an open pit JV with AngloGold that’s expected to deliver a BFS within nine months. Gran Colombia is the largest underground gold-silver producer in the country (until the Buriticá mine starts later this year). Gold-heavy juniors include; Caldas Gold, Royal Road Minerals, Outcrop Gold, Antioquia Gold, Cordoba Minerals and FenixOro.

FenixOro Gold Corp. (FENX:CSE) is a company that readers should take a closer look at. Shareholders believe it could be the next Continental Gold, that its Abriaqui project could be another Buriticá. Even if one considers this view an exaggeration (we need to see some drill results), many critical factors suggest the claim is within the realm of possibility.

Led by CEO John Carlesso, a 25-year veteran of the international business world and founder/director of a number of companies. John was VP Corporate Development for Desert Sun Mining when it was acquired by Yamana Gold for $750 million. Over the past 18 years, Mr. Carlesso has focused on LATAM deals.

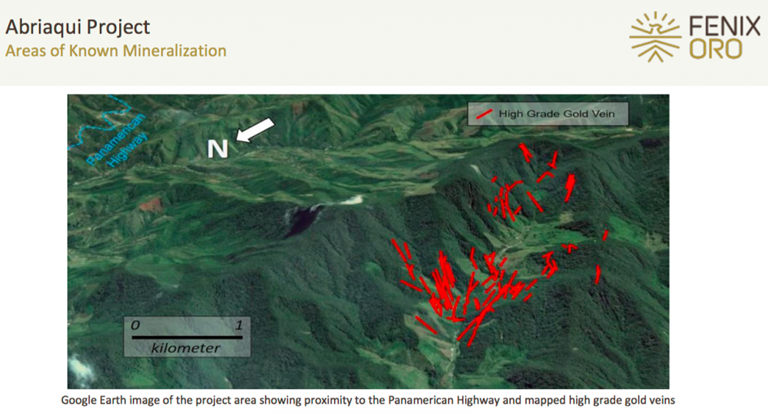

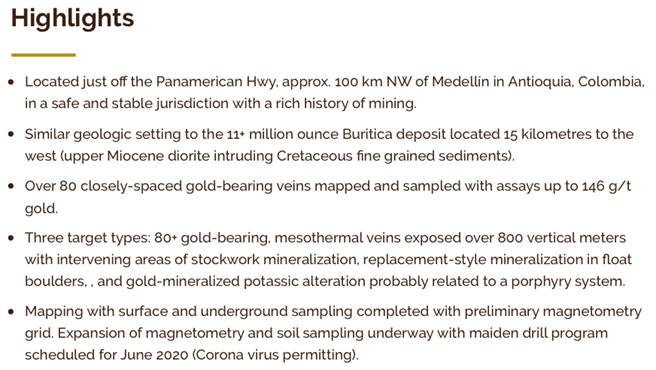

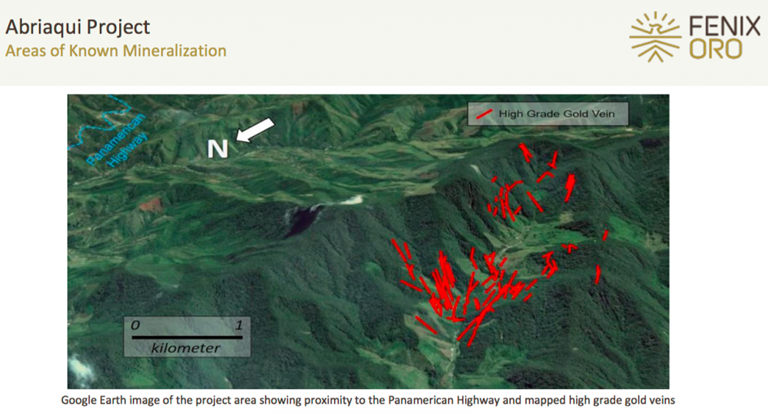

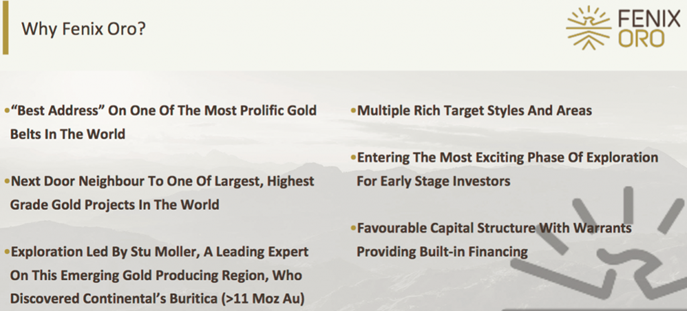

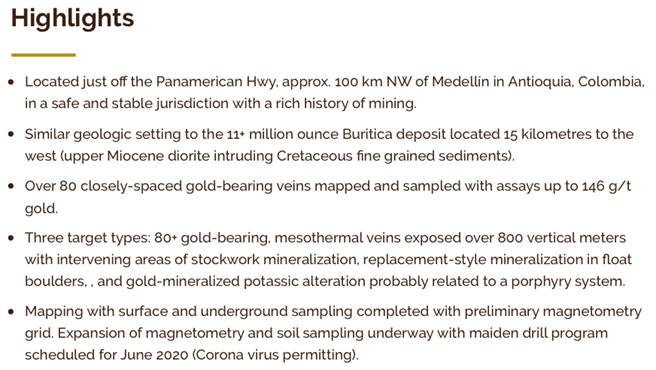

Since 2007, >80 million ounces of gold have been discovered on the 200 km long Middle Cauca gold belt (one of the most prolific in the world) hosting Buriticá and FenixOro’s Abriaqui projects. AngloGold Ashanti has two 20+ million ounce deposits in the belt. Notably, Abriaqui at ~550 hectares is packed into a much smaller footprint than Buriticá at 75,000+ hectares.

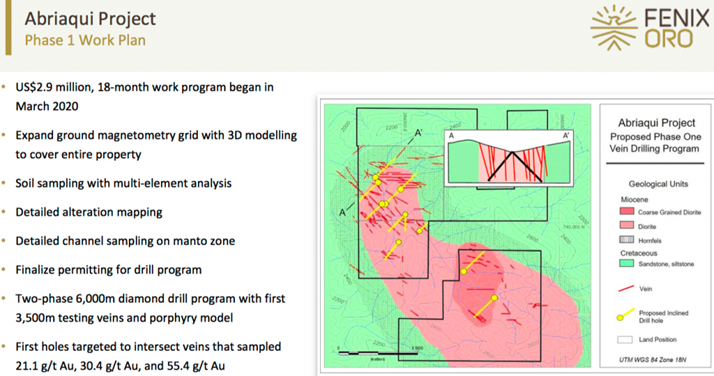

How is it possible that Abriaqui could potentially host a multi-million ounce deposit on just a 5 sq km surface footprint? For an answer, I asked newly appointed VP of Exploration (and a director) Stuart Moller (more on him later). He turned me to slide 8 of the May 2020 corporate presentation, explaining that the entirety of Buritica’s resource fits onto roughly one quarter (1/4) of the area of the Abriaqui project. Moller said,

“As shown in the inset of slide 8, the entire Buriticá resource is contained within the 100-hectare red box, shown at the same scale as the Abriaqui map in the figure. Comparing the outcrop area and dense spacing of the Abriaqui veins with Buriticá’s footprint, we believe we have plenty of room for a sizable orebody within our licenses.”

I invite readers to continue reading and to consider the risk-reward proposition here. FENX’s Enterprise Value (EV) [market cap – cash + debt] of ~C$14 million is less than 1/100 (< 1%) the size of Continental Gold’s takeout value. Although admittedly an apples to oranges comparison until/unless a significant discovery is made by FenixOro, investors should know in a matter of months, not years, if there’s something exciting that warrants further drilling.

The secret to the blue-sky potential at Abriaqui, and Buriticá’s existing 12M+ Au Eq resource, is the depth and continuity of mineralization across each company’s project areas. The technical team at FenixOro has already traced high-grade gold veins over ~900 meters of vertical extent, from gold outcrops at ~2,800 meters elevation, to workings at ~1,800 meters. Buriticá has greater than 1,200 meters of vertical extent and remains open at depth.

FenixOro’s Abriaqui project is directly on trend, and ~15 km west of Buriticá. Closeology is nice, but there’s a lot more to this story. First and foremost, there’s VP of Exploration/Director Stuart Moller. With 40 years’ experience in international mineral exploration, he held senior roles with Barrick and Pan American Silver.

As VP of Exploration at Continental Gold, Mr. Moller led the team that discovered Buriticá and was in charge of the first 270 drill holes. Few, if any, geologists on the planet are better suited to find the next Buriticá deposit than Mr. Moller. He and his technical team are anxious to conduct the very first meaningful, modern drill program on FenixOro’s property.

Armed with a great team, 40 years’ exploration under his belt and invaluable experience from drilling a giant discovery just 15 km away, Mr. Moller is understandably quite excited and optimistic. At the same time, he’s realistic. He told me that as bullish as he sounds over the phone, one never knows what a deposit holds until you drill it. The time has come to show the world what’s hidden below surface, not just talk about it.

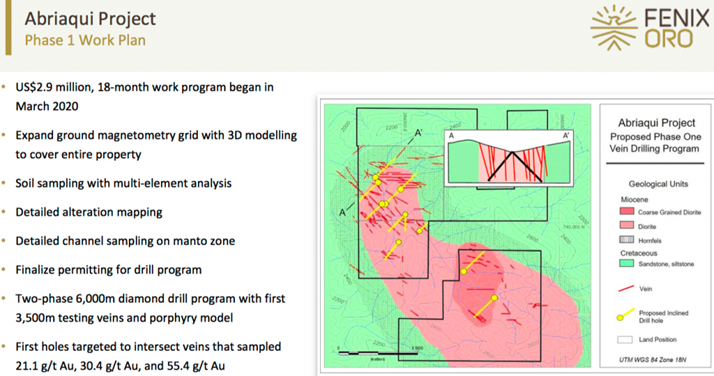

Second, a fully funded [6,000 meters, 18–20 holes] phase 1 drill program is expected to start in about two or three months. Unlike giant exploration properties where there can be hundreds of drill holes before a large discovery is made, management expects to identify a lot of mineralization in phase 1. Readers should note, FenixOro has already delineated >100 narrow, high-grade veins.

Readers should note, it’s not just narrow (~30–150 cm wide, tightly spaced, several meters apart) high-grade and possibly ultra-high-grade veins (>50 g/t). Equally important is the grade of mineralization between the veins. Investors will get a sense of this from phase 1 drill results starting in late summer or early fall.

Third, the gold price at US$1,722/oz is a spectacular development. Until recently, I never mentioned strength in the gold price as an investment merit. This year is different. I believe gold will stay strong at least through January 2021, due to the economic fallout from COVID-19, global debt-fueled stimulus programs/money printing and U.S. elections. If Trump loses, some fear his departure from office in January could be contentious.

Fourth, not only is Colombia well-endowed with minerals, it’s a low-cost jurisdiction to explore and develop. Fifth, as mentioned, the Colombian government is spending up to US$25 billion on infrastructure projects. A major 4-lane highway, complete with new power lines, from Medellín will come within 4 km of the Abriaqui project, cutting travel time in half to under two hours.

Despite not having drilled yet, a great deal is already known about the Abriaqui project. Over 300 chip or channel samples have been taken with assays of up to 146 g/t gold. More than 15% were >20 g/t gold. Hundreds of soil samples are in the lab awaiting assays. Greater than 100 high-grade veins have been mapped.

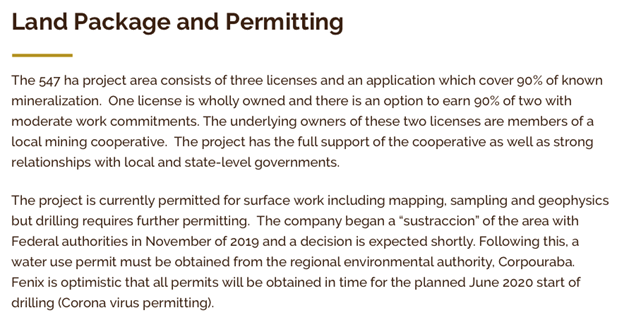

We can be reasonably sure that water, labor and power availability will not be a problem. Mr. Moller has lined up a well-known Canadian drill contractor, at very low cost. Community relations are strong. FenixOro has prudently partnered with a third generation local mining cooperative.

As mentioned, strong continuity and upwards of 1,000 meters of vertical extent support the possibility of a large or very large gold deposit. The gold is “free-milling,” as can be seen in the production from small water-driven gravity separation mills on the property.

FenixOro Gold Corp. (CSE: FENX) is fully funded well into next year. Therefore, evidence of something potentially worth much more than the company’s current EV of just C$14 million could come by the fall, well before the need to raise additional equity capital.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University’s Stern School of Business.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about FENIXORO GOLD., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of FENIXORO GOLD CORP. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, FENIXORO GOLD CORP. was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein’s disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Graphics provided by the author.

( Companies Mentioned: FENX:CSE,

)