Category: Gold

Hello again and welcome to another edition of the Money Metals Weekly Market Wrap Podcast, I’m Mike Gleason.

Precious metals markets enter the month of May with some mixed signals near term. But the long-term picture continues to look constructive. All the metals appear to have put in major bottoms during the panic selling of mid to late March.

Barring another wave of virus outbreaks and economic lockdowns, the gradual reopening of state, local, and national economies should start to unleash more industrial and jewelry demand going forward. And the extraordinary fiscal and monetary stimulus being pumped into the financial system will, if nothing else, work toward the debasement of the U.S. dollar.

Earlier this week, the Federal Open Market Committee met and pledged to keep interest rates near zero for as long as necessary. In prepared remarks, Federal Reserve chairman Jerome Powell admitted the economy is contracting at an unprecedented rate but vowed that the Fed would come to the rescue with a “full range of tools.”

Jerome Powell: The forceful measures that we as a country are taking to control the spread of the virus have brought much of the economy to an abrupt halt. Many businesses have closed, people have been asked to stay home and basic social interactions are greatly curtailed. People are putting their lives and livelihoods on hold at significant economic and personal cost.

Overall, economic activity will likely drop at an unprecedented rate in the second quarter. Inflation is also being held down, reflecting weaker demand as well as significantly lower energy prices. Both the depth and the duration of the economic downturn are extraordinarily uncertain. The Federal Reserve’s response is guided by our mandate to promote maximum employment and stable prices for the American people, along with our responsibilities to promote the stability of the financial system. We’re also committed to using our full range of tools to support the economy in this challenging time.

The Fed’s tools have built a gargantuan balance sheet that currently comes in today at a record $6.6 trillion. The ultimate consequences of its unprecedented actions are still unknown. But the huge rallies in the stock market and precious metals markets last month suggest strongly that the central bank has successfully held deflation at bay.

But all the kings men have not been able to put Humpty Dumpty back together again, at least not yet. In fact, the situation in the real economy continues to worsen at a dramatic rate.

This week, the federal government announced that Americans filed another 4.5 million new unemployment claims across the U.S., taking the total to over 30 million jobs lost in the past 6 weeks. This number is set to grow further — and will be slow to recover, even when the lockdowns are loosened.

In fact, as spending behaviors continue to change in our consumption-based economy, it’s unlikely that certain jobs and businesses will ever return. And once the full extent of the carnage sinks in with the American people and policymakers, new financial panics and government interventions could ensue.

Nevertheless, we could see the velocity of the greatly expanded currency supply pick up in the months ahead as some people return to work and spend back into the economy. That would have major inflationary implications.

We can look to precious metals markets for clues about inflation expectations among investors. Last month gold hit an 8-year high just shy of $1,800 an ounce before pulling back. That move was not confirmed by silver or other metals.

However, the more speculative gold mining stocks did record new multi-year highs. The miners led the stock market out of its March crash, becoming the strongest sector of all.

That bodes well for gold and silver prices. Mining stock investors are anticipating a healthier market for metals producers. And key to their ability to grow their profits is being able to sell mined products at higher spot prices.

As for spot prices this week, gold currently checks in at an even $1,700 per ounce after losing 2.5% since last Friday’s close.

On Thursday, the World Gold Council reported that total investment demand for the safe-haven metal surged 80% year-on-year in the first quarter to 540 metric tons. Strong bullion buying and ultra-stimulative monetary policy led Bank of America recently to raise its upside target for gold to $3,000 per ounce while pointing out “the Fed can’t print gold.”

Turning to the poor man’s gold, silver prices are down 2.2% this week to trade at $15.07 an ounce as of this Friday recording.

The best performing metal this week is platinum. It’s sporting a 1.0% gain to trade at $786. And finally, palladium is showing a weekly loss of 4.9% to come in at $1,983 per ounce.

Both platinum and silver have traded at historically large discounts to gold this year. Silver wasn’t able to gain much ground on gold in April. It remains extremely depressed in the paper market – although somewhat less so in the physical bullion market where silver coins continue to command large premiums above spot.

Fortunately, there are more cost-effective alternatives to popular coins such as Silver Eagles that are currently in short supply. Today the lowest premium silver bullion product available for delivery is the 10 oz. silver bar. It is great for stacking large amounts of wealth.

Those who don’t need to take immediate possession of bars or coins should consider Vault Silver. An exclusive service of Money Metals Depository, Vault Silver and Vault Gold are the lowest cost ways to own physical bullion. Through these programs, you obtain ownership in large bullion bars stored on your behalf in secure vaults.

Well that will do it for this week. Be sure to check back next Friday for our next Weekly Market Wrap Podcast. Until then this has been Mike Gleason with Money Metals Exchange, thanks for listening and have a great weekend everybody.

Cabin Fever and the Price of Gold

Source: Bob Moriarty for Streetwise Reports 04/30/2020

Bob Moriarty of 321gold discusses gold, financial collapse and consequences of quarantining.

I’ve had a few comments lately on the pieces I have been writing about where we stand politically and with the Corona Virus. One complained and said that he loves my comments on markets but I was getting too political.

Of course I am.

I thought we had two totally different crises on our hands today. Most people only see one, that of the Corona Virus. Obviously we need to pay attention to the virus and actions of governments to combat it. The virus has killed a lot of people and will kill more.

There is however what I started predicting a year ago. I believe to be both more deadly and serious than the Corona Virus. That is over the totally dysfunctional world financial system built on a foundation of debt that we all recognize will never be paid. Anyone who didn’t see how out of whack our financial issues are simply isn’t paying attention.

I thought we would start a financial collapse last October but the Fed also saw it coming and began to pour fuel on the fire in mid-September. The rest of the US got to see we had a problem in mid-March when the bottom fell out of the market. I did manage to get a warning out to my readers at the end of February that in hindsight looks like a great call.

But I missed a giant problem swelling up that is also going to kill a lot of Americans and those locked down all over the world. That is of cabin fever. I’m not going to pretend that I am any form of expert on cabin fever. I’m not. However I’ve pretty much been locked down for about six weeks and frankly I’m going stir crazy.

I live in a quiet part of the world in a tiny village surrounded by small farms. We have few social issues and crime is pretty minor. There will always be food around if you like your hamburger on the hoof. The weather is mild. Like everyone else in the world we are ruled by idiots who believe that every problem can be solved only by creating more rules.

I can go to the store if I have my permission slip. I can seek medical care. It’s ok to exercise outside the confines of my abode. So it’s not as if I’m in prison. But I do miss touching and seeing and talking to people. I don’t like living like a hermit. I’m not about to start shooting people but I do wish we could go back to the pre-panic days.

Two doctors who run a clinic in California did a long You Tube video of what they were seeing and how their experiences said the US was doing something very dangerous. Until I saw the video, I hadn’t really realized there are a lot of people going stir crazy.

It, too, can create long-term issues. So locking down society to vanquish the virus makes more and different problems all by itself. The quarantine is dangerous at some point. At last count the video had over six million views on You Tube.

Until this.

Evidently experienced doctors who do a video explaining what can happen when you lock down a society is far too dangerous for us to watch.

It’s not like it’s PG-13, it’s XXXX-1, not suitable for anyone, burn yourself after watching. So I found a Vimeo copy of the same video, it got the same treatment after a couple of days. So here is yet another until it gets yanked.

Being locked down is pretty scary in my experience. But being told how to think and what we can watch is even deadlier.

By now if you have any sense you are asking yourself, what exactly do cabin fever and gold have to do with each other? “This is a gold site; I didn’t come here to read a bunch of bull.”

The same idiots who created the financial mess that finally blew sky high in the middle of March and never saw it coming were also the fools who couldn’t give us an accurate prediction of how many people would die in the US of the virus. They never bothered refilling the PPE supplies at the Federal Government level after they were depleted during the Obama administration.

Congress was far too busy attempting to convict Trump and remove him from office to take any action over what was obviously a serious medical threat. The FBI and DOJ were scurrying around like a cat in a litter box attempting to cover up its crap over their attempt to manage a coup d’état against the legally elected president of the country.

Meanwhile the mainstream media were keeping score of how many times Trump could lie in one sentence. Whoever could guess the closest number to being correct would get a free cup of coffee at Starbucks if they ever open.

These are all the same chumps who just opened the floodgates at the Federal Reserve. They are going to print money until they make Robert Mugabe a leading candidate for the Nobel Memorial Prize in Economic Sciences.

I want to see a correction in gold and silver and the mining stocks. I get twitchy when everyone is talking about how high gold is going to go and how Comex is about to default.

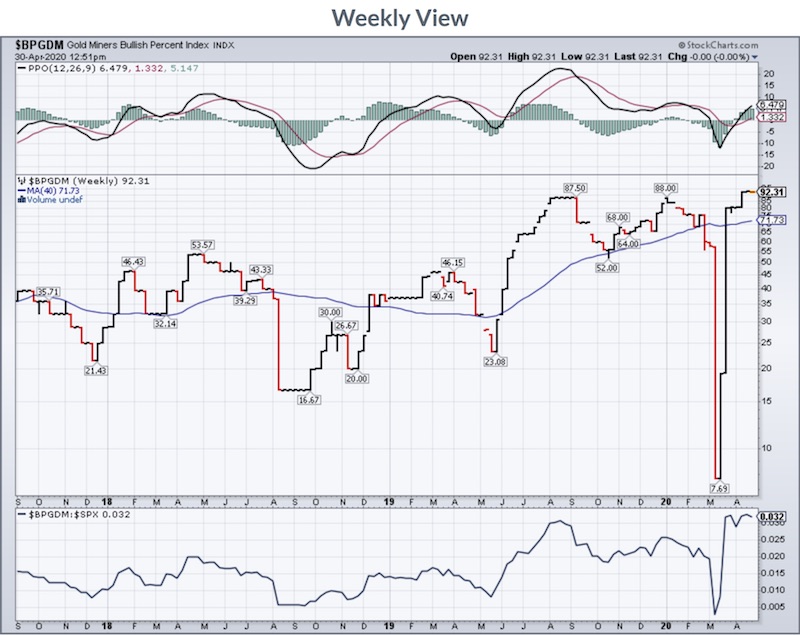

There is a measure named the Gold Miners Bullish Percent Index. Right now it is exactly as bullish as it was bearish in mid-March at the very bottom after the biggest decline in stock market history. People are way too bullish for my blood. They are more bullish than they were in July of 2017 after a monster gold stock rally. We can’t have that.

If I were worth a penny as a forecaster, which I am not, I’d say the June/July timeframe would make a great time for a low if we had a nice and necessary correction.

But the idiots pulling all the levers have guaranteed gold and silver are going to go places even the bulls cannot imagine. All that the President and VP, and most of the doctors and the media, and the Fed, and the FBI/DOJ, and YouTube/Vimeo have accomplished is to prove just how useless and clueless they are at heart.

It would be a great time to own some gold and silver because after they f$#k it up fourteen times and fail at every effort, someone is going to suggest, “You know, what we really need is a jubilee and to go back to a gold and silver standard.”

Then we will be fine.

That is if we survive the virus, the depression and cabin fever.

Bob Moriarty

President: 321gold

Archives

321gold

Bob Moriarty founded 321gold.com, with his late wife, Barbara Moriarty, more than 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of Bob Moriarty and not of Streetwise Reports or its officers. Bob Moriarty is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Bob Moriarty was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Fun on Friday: My Trip from Joy to Rage

These closures, Tyson’s Stouffer warns, will have consequences for consumers… by Franz Walker via Natural News (Natural News) Nearly 900 workers have tested positive for the coronavirus (COVID-19) at a Tyson Foods meatpacking […]

The post Almost 900 workers test positive for coronavirus at Tyson’s meatpacking plant in Indiana appeared first on Silver Doctors.

The tables are turned. Will jail time be given to the perpetrators of this crime? Greg Hunter gives The Weekly News Wrap-Up for Friday, May 1st, 2020 Newly released documents […]

The post Greg Hunter: Flynn Framed, China Blamed, Economy Maimed appeared first on Silver Doctors.

SD Friday Wrap: The “markets” are returning to normal, but little do participants know that patience on Main Street is about to boil over… Things are getting interesting. That’s for […]

The post Is It Really This Easy, Or Will The Re-Opening Be Served With A Side Of Riots Or Worse? appeared first on Silver Doctors.