Source: Maurice Jackson for Streetwise Reports 04/29/2020

Maurice Jackson of Proven and Probable discusses the latest news from Millrock Resources with the company’s CEO.

Maurice Jackson: Today we will provide an update on Millrock Resources Inc. (MRO:TSX.V; MLRKF:OTCQB), as we will discuss their initial assay results on the Aurora targets located in the prolific Tintina gold province in Alaska. Joining us for our conversation is Gregory Beischer, the CEO of Millrock Resources.

Gregory, for someone new to Millrock Resources, please introduce the exciting opportunity the company presents to the market and, in particular, the 64 North Project.

Gregory Beischer: Millrock Resources is an early-stage generative mineral explorer or early-stage exploration geologist with a multitude of projects that we finance by making agreements with other exploration and mining companies that increases our chance of finding an ore body to the great benefit of our shareholders and reduces the risk involved in early-stage exploration.

A lot of money is spent looking for new gold and copper deposits, but discoveries are pretty rare. But it looks like Millrock might be onto something at the 64North Project where we’re drilling just to the west of the Pogo gold mine.

Maurice Jackson: And speaking of that, can you walk us through the Aurora target?

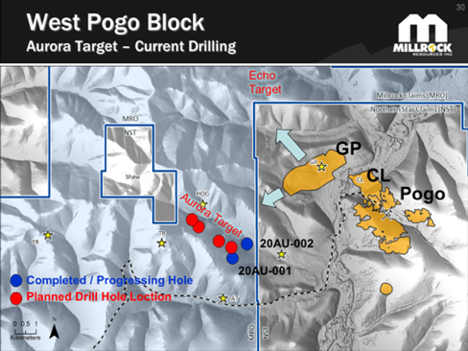

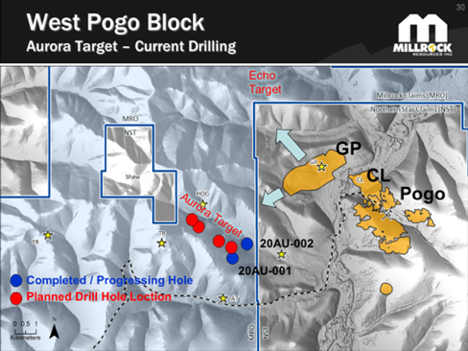

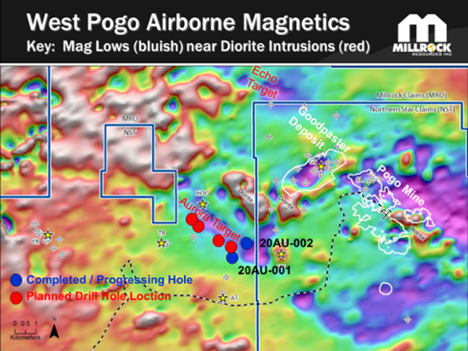

Gregory Beischer: The Aurora target is just to the west of the Pogo gold mine and the Goodpaster deposit. The letters GP indicate the Goodpaster deposit. That’s in our neighbor’s ground, Northern Star Resources Ltd. (NST:ASX), and our ground is shown in blue. The dark blue dots on the map are the approximate locations of the two holes we’ve drilled so far, and the red ones are ones that are planned for the immediate future.

We did complete hole 20AU-001, and we got started on hole 2, but as announced previously, the drill contractor elected to pull off in light of the risks posed by the coronavirus and potential travel restrictions that might have trapped his drillers here in Alaska. They’re from Idaho.

So prudence was the right thing, and so it was best to pull off. But now we know that we can go back soon and we’re quite anxious to drill hole 2 to its planned depth of 600 meters. We stopped that at 194 meters.

Maurice Jackson: Readers should note that Millrock Resources [was] about 25% into the drill program, and then, as COVID-19 approached us, drilling had to stop. So based on that, can you share with us the assay results?

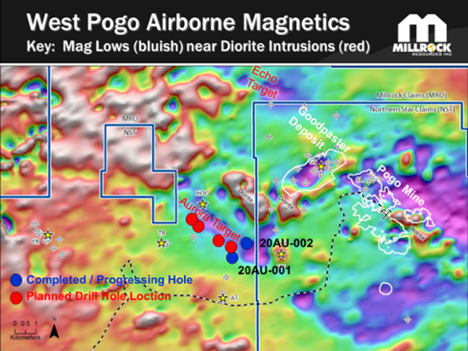

Gregory Beischer: Yes. We did produce the assay results for the top two-thirds of Hole 1, and I’ll be frank and say, Maurice, that we had hoped for better. Honestly, looking at the drill core, it was quite well altered with dolomite and cerussite, telling us that a lot of fluid had moved through the rock and we’d seen the typical pathfinder minerals, pyrite and arsenopyrite, and eased within a little bit of bismuth sulfide—which is a very good indicator, next door at Pogo, that you’re in or close to a gold deposit.

We had rather expected higher gold values but we didn’t get them. So it’s a geological problem that we have to solve and we do know a couple of things.

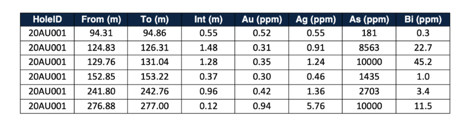

In many ways this hole, even though it didn’t have the gold grades that we all hoped for, did have a lot of good signs. We know now that the shear zone that we targeted is the same shear zone, we believe, that hosts the Pogo mine and the Goodpaster deposit next door. It comes over on to Millrock’s claims. It’s a shallow, northwest-dipping fault zone, which we thought we had detected through geophysical methods and now that’s confirmed. We drilled through the conductive zone, observable through the geophysical survey, and sure enough, the rocks were faulted and were mineralized with a little bit of quartz and pyrite and arsenopyrite. We know now that this geophysical tool works and we can, therefore, plan our hole depths accordingly, and we can work our way drilling holes, piercing that fault sound in various places and thereby get a vector toward the gold-bearing part of the system.

Maurice Jackson: You somewhat alluded to my next question. Based on the results, are there any changes that will be made in the drill program based on what we know right now?

Gregory Beischer: Not as it stands right now, no. We’ll continue with the plan. These holes are spaced out a little ways. The next one we’ll drill actually is one immediately to the north of Hole 1 that’s about 450 meters away, and it’s closer to a potential heat source—a magmatic intrusion that perhaps would have some control on where gold is deposited. So it’ll be interesting if we get a vector. If the gold grade starts to increase as we drill holes for the two north, that’ll be a good sign and we’ll continue to follow up that way. So that’s the plan and the plan is to get back to work pretty soon.

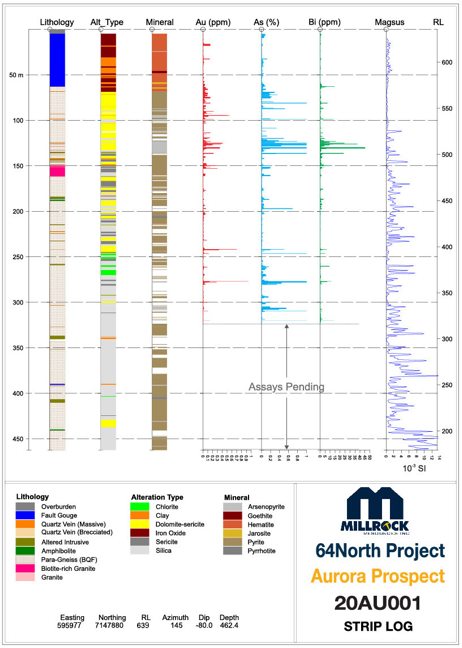

Maurice Jackson: Can you walk us through the strip log?

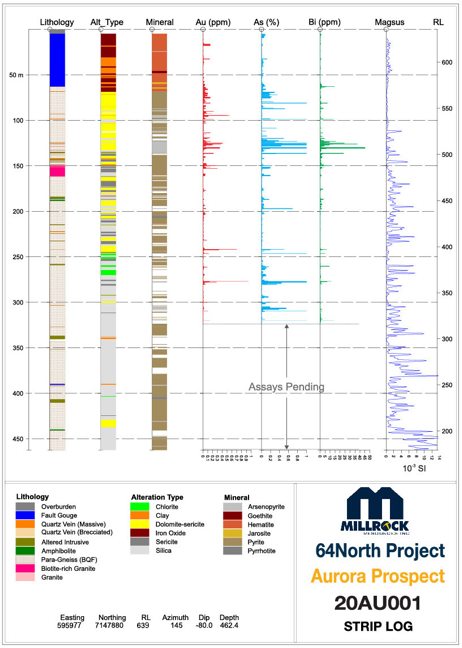

Gregory Beischer: Sure, sure, I could. Yes. It’s quite interesting to see the correlations on this log. You’ve got lithology, or rock type, on the far left, alteration on the next column, presence of minerals in the next, and then the values of gold, then arsenic, and then bismuth on the next three histograms. And then, finally, the magnetic susceptibility of the rock. And you can see some particularly interesting correlations between gold and arsenic and bismuth, in particular. We don’t have it on this one, if you were to plot tellurium up as well, you would see it in anomalous concentrations, and that’s a good sign. Sometimes, if we were to see just arsenic and bismuth together but no gold, then that would be a good indication that we’re close by to something.

In this case, we did get some gold, you can see from those histograms. But it would have been better if it was a substantially higher gold content. Nevertheless, it tells us we’re in the right area, and you can see from those histograms that there’s at least three distinct levels below surface. The depth is indicated on the far left side, depth below surface. And so you can see there’s at least three zones where there’s pathfinder elements, plus some gold mineralization.

These are interesting patterns that we’ll chase out. But right now we’ve only got part of the very first hole in the program to learn from. We’re getting a lot out of it, but it’s not possible to get a vector from just one point. And so it’s a good start and we will look forward to continuing.

Maurice Jackson: I like to share with my children that when you’re drilling it’s like playing hide-and-go-seek, and right now you’re very warm, but you want to be hot.

Gregory Beischer: Exactly. That’s the goal.

Maurice Jackson: Sir, any updates on when drilling may resume?

Gregory Beischer: Sure. It’s an evolving process, but we’ve established a way to proceed that we believe will be perfectly safe and protective of the drill contractors’ employees and Millrock’s own employees. We’ve got those protocols and procedures planned out, and honestly, we’d already be back drilling right now except in Alaska, we’re right in the middle of the spring thaw and the snow is melting away quickly. Everything’s really soaking wet. The new drill road that we installed last fall is a mucky mess right now and it’ll take a couple more weeks for it to dry out and become usable again. And so we’re just waiting impatiently for that, and then we’ll make an effort to get back drilling again. We’re targeting the last week in May for the resumption.

Maurice Jackson: All right. In closing, Mr. Beischer, what would you like to say to shareholders?

Gregory Beischer: Well, I think we’ve got a great start here, and stay tuned for further news. We’ve got more assay results coming from the holes. We’ve drilled the bottom part of the first hole, and the part that we did complete out of the second hole. We’ll hope for some good surprises there. But then the next round of results will probably be coming in June or early July.

Maurice Jackson: And what does that say about Millrock Resources, when you had trading volume probably at a historic high when the news release came out, but the share price really remained resilient?

Gregory Beischer: It’s possible the market got a bit ahead of itself, and I thought, well, it’ll pull back strongly since these results aren’t as strong as we’d hoped they’d be in terms of gold content. The price didn’t pull back too much. A lot of shares traded, but that means a lot of new shareholders bought at $0.16 or $0.18, and I hope and think that those new shareholders are going to do very well.

Maurice Jackson: And, just for the record, we have not sold our position in Millrock Resources. We look to add to our positions. If we see a decline in the price any further, we will try to be as aggressive as we can. Mr Beischer, for someone listening that wants to get more information on Millrock Resources, please share the contact details.

Gregory Beischer: By all means. Just check our website, www.millrockresources.com, and you can get in touch with Melanie Henderson at investor relations, and she can answer many questions of current and future potential shareholders. If there’s anyone that has direct questions of me, I’d be glad to provide answers.

Maurice Jackson: Millrock Resources trades on the TSX.V:MRO | OTCQB:MLRKF. Millrock Resources is a sponsor of Proven and Probable, and we are proud shareholders for the virtues conveyed in today’s message.

And as a reminder, I’m a licensed representative for Miles Franklin Precious Metals Investments where we provide a number of options to expand your precious metals portfolio from physical delivery, offshore depositories and precious metal IRAs. Call me directly at (855) 505-1900, or you may email maurice@milesfranklin.com.

Finally, please subscribe to http://www.provenandprobable.com where we provide mining insights and bullion sales; subscription is free.

Gregory Beischer of Millrock Resources, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Millrock Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Millrock Resources is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Millrock Resources, a company mentioned in this article.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.

( Companies Mentioned: MRO:TSX.V; MLRKF:OTCQB,

)