Category: Gold

We’re pleased today to grant you access to the Spring 2020 issue of Money Metals Insider – a FREE benefit for you, our valued reader.

The government and central bank response to pandemic fears has ignited retail demand for precious metals like never before, and this special issue tells you all about what’s been happening.

Under these extraordinary circumstances, I’m proud of – and deeply grateful to – our dedicated Money Metals employees who have been able to keep key items in stock and ship orders faster than ALL our industry peers.

Meanwhile, I’m pleased to announce the launch of our Vault Gold and Vault Silver storage offerings – absolutely the best way to get low-cost gold and silver ounces in the current period of high premiums and shortages. You can read all about it on page 7 of your free Money Metals Insider newsletter.

Also, a quick reminder, not only does Money Metals offer super competitive pricing when you want to BUY, but we are also – without a doubt – the #1 place in the country to SELL, STORE, or even GIVE YOU A CASH LOAN AGAINST your precious metals.

Here are the highlights from your free Money Metals Insider newsletter:

- Mine Production Crashes as Silver Becomes “Most Undervalued Asset”

- Q & A: Frequently Asked Questions

- Loan Program: Get Cash Without Selling Your Precious Metals!

- All of the Economic Recovery Models Will be Wrong Too

- Federal Reserve Notes Are Now “Backed” by Junk Bonds

- Easily Switch Some of Your Savings to a Low-Cost Gold and Silver Account

So download the PDF of this fantastic free newsletter right now – and pass it around to your friends! It’s another free benefit for those who have signed up for the Money Metals email list.

Source: Maurice Jackson for Streetwise Reports 04/21/2020

Maurice Jackson of Proven and Probable speaks to CEO John-Mark Staude and geologist Erika Sweeney about Riverside Resources’ Los Cuarentas Project and the company’s spinout, Capitan Mining.

Maurice Jackson: Today we’re going to discuss the highly prospective gold and silver project located in Mexico. Joining us for a conversation is Dr. John-Mark Staude along with Erika Sweeney of Riverside Resources Inc. (RRI:TSX.V; RVSDF:OTCQB). Pleasure to speak with both of you regarding the value proposition of Riverside Resources where knowledge is golden.

Dr. Staude, before we delve into today’s interview, please introduce Riverside Resources and the opportunity the company presents to the market.

John-Mark Staude: Riverside is a prospect generator. We have programs in Canada and in Mexico, and we provide a diversified opportunity for discovery in gold, silver and copper.

Maurice Jackson: Back in January (Interview), Riverside Resources introduced the Los Cuarentas Gold-Silver project, which is located in Sonora, Mexico, between two highly valued mining and development operations. In that interview, Riverside had reported the completion of some preliminary field work and reported some high-grade rock samples, of which the highest sample was nearly 26 grams per ton. Take us to the Los Cuarentas, where I understand Riverside has some more exciting details regarding target mapping, new rock sample results and permitting. What can you share with us?

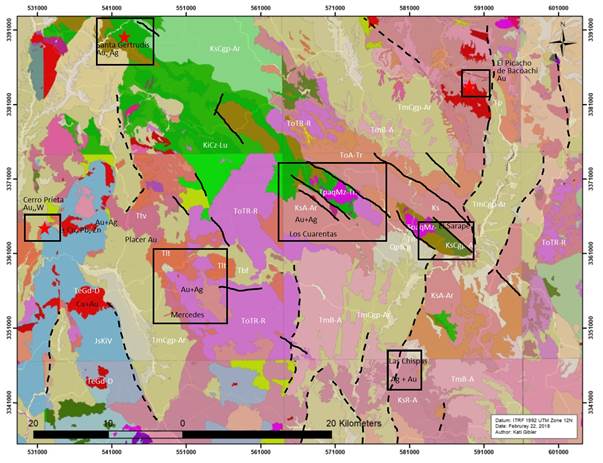

John-Mark Staude: Sonora, Mexico, is a great location for mining; it’s one of the main mining states in Mexico. To the west of Los Cuarentas project is the Mercedes Mining District operated by Premier Gold Mines. To the north we actually have Santa Gertrudis where we have Agnico Eagle, and to the south we have the Las Chispas mine, very high-grade silver that’s going with Silvercrest. For us, Los Cuarentas with this structural zone here is a great area for big discoveries in former mining districts. Immediately to the east of us is a former mining center as well, so we love this location.

Maurice Jackson: Erika, what are we looking at here?

Erika Sweeney: As a geologist, this is a very exciting map. Here, we actually found out that we’re able to double our targets from 3 to 6. What is unique is that all six targets are on different structures. What’s very important to note is that all of them have very high-grade samples. Whether we are discussing historicals or the recent Riverside samples, all are very high grade. We’re looking at a high-grade sample reporting at 25.7 grams per ton, 18 grams per ton, and we have historical samples up to 29 grams per ton, which was parallel to the main mine site and it’s all continuous. There is just so much to see out there, and we want to move forward with drilling it because there was a mine here before that produced maybe 100,000 tons of ore. I think there is a lot more to go and see based on our findings.

For the Santa Rosalia target, you’re looking at at least one kilometer in strike length of high-grade mineralization. When you get to Santa Rosalia Sur you actually have almost two-kilometers of length of high grades and alteration that can be pretty significant for upside.

Maurice Jackson: John Mark, what is the next unanswered question for Los Cuarentas? When can we expect a response and what will determine success?

John-Mark Staude: For us, as a prospect generator, the next unanswered question is drilling and exploration. We actually have the drill permit; next we need to find a partner. If we can get a partner, perhaps a mid-tier gold or silver producer, that would be ideal. They have the skills to carry the project forward. We have done the work generating, working together, consolidating, so for us the next unanswered question is how big can this be? Can we expand the former resources and come up with more discoveries on this really endowed piece of land?

Maurice Jackson: Switching gears, John Mark, how does a strong gold price and low ore costs impact Riverside resources?

John-Mark Staude: My gosh, it is excellent. For us, owning gold in the ground has been our objective. Now with a rising gold price, we’re very active. We can see the potential of a portfolio of projects. We have projects in Canada and in Mexico and for us a rising gold price is ideal. We also have royalties on our projects, so as they get developed for the shareholders of Riverside the sky’s the limit. It’s a wonderful time and we’re very excited, super active right now and trying to get more properties and more partners and really moving ahead. It’s making a big difference.

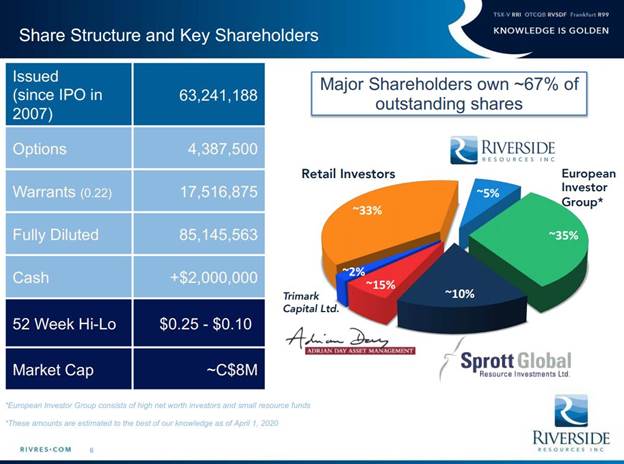

Maurice Jackson: Speaking of costs, sir, can you provide us an update on the share price and the capital structure?

John-Mark Staude: Riverside’s in a very strong financial position. For us we really see good upside potential and are very excited about the next coming months for Riverside. Our current share prices are 11 cents US or about 15 cents Canadian. That for us is a low. In fact, I’m buying more shares at these levels. The share structure continues to be tight at 63 million shares. We have a good cash position as well of over $2 million cash and we have $0 debt.

Maurice Jackson: John Mark, before we close here, there was a recent spinout, was there not, with Riverside?

John-Mark Staude: Thank you for asking! During the first half of this year we’ve received approval through the plan of arrangement on our spinout company called Capitan Mining. Current shareholders of Riverside will get about one share of Capitan Mining for every four shares of Riverside. That’s progressing well and right now we’re financing Capitan. Even with the advent of COVID-19, Riverside’s resolve to increase shareholder value remains a constant and very core of our day-to-day operations.

We have a fabulous CEO in Alberto Roscoe, and we have a great team in Mexico. For us, the shareholders of Riverside, this is a time that we can really, really be excited about the great upside and great potential of both Capitan Mining and Riverside Resources.

Maurice Jackson: In closing, sir, what keeps you up at night that we don’t know about?

John-Mark Staude: For us, one of the key things right now is the COVID and how long is this going to last? For us, we have to make sure that we always manage the company carefully, follow through with what’s needed. For us, we see the future is bright because we do see we’re getting through it but that’s very important that we don’t want anyone to get ill and we want to really look out after all the people in the communities that we live in and work.

Maurice Jackson: Finally, what did I forget to ask?

John-Mark Staude: Why is Erika here talking about the project? It’s because we’re so excited to these great young people to be a part of our team, and having taken the lead on our projects. Erika and peers are valuable additions in helping us to grow. Also, this is one of the first times you hear us talking about Mexico because we’re growing a lot in Canada this past year. Riverside continues to go strong in Canada. So we’re very excited by this but in Canada you’ll also see continued news flow coming out from Riverside.

Maurice Jackson: Riverside Resources (www.rivres.com) trades on the (TSX.V: RRI | OTCQB: RVSDF). Riverside Resources is a sponsor of Proven and Probable and we are proud shareholders of Riverside resources for the virtues conveyed in today’s message.

Before you make your next bullion purchase, make sure you call me. I’m a licensed representative for Miles Franklin Precious Metals Investments where we provide a number of options to expand your precious metals portfolio from physical delivery, offshore depositories, and precious metal IRAs. Call me directly at 855.505.1900 or you may email maurice@milesfranklin.com.

Finally, we invite you to subscribe to www.provenandprobable.com, where we provide Mining Insights and Bullion Sales.

Dr. John-Mark Staude and Erika Sweeney, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Riverside Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Riverside Resources is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Riverside Resources, a company mentioned in this article.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.

( Companies Mentioned: RRI:TSX.V; RVSDF:OTCQB,

)

Source: Adrian Day for Streetwise Reports 04/21/2020

Money manager Adrian Day discusses a general approach to the market, as well as recent developments at several companies on his list, including some buy recommendations, despite being overall cautious.

Most markets have enjoyed a meaningful rally off their lows of three to four weeks ago. The S&P is up nearly 30%, with the Business Development Companies up 50% and more, while global markets have also rallied, though typically less; the XAU index of gold stocks has risen over 40%. It is not unusual to see an initial strong bounce after sharp market declines, but what often follows is a retreat to the lows—perhaps new lows—with a more selective and more delayed recovery after that. When stocks hit their lows again, we should avoid the temptation to immediately load up indiscriminately expecting another sharp rally.

Looks for sales in you added last month

Because of these rallies, we would be buying very little right now, waiting for a pullback to start buying again. (See “Top Buys” near the end of this letter.) Indeed, we would look for possible sells, but so much depends on individual circumstances. If, for example, you managed to buy more Ares Capital Corp. (ARCC:NASDAQ) at a good price, maybe under $9, you could sell some of that additional purchase for a better-than 30% gain. I am most definitely not suggesting you sell all your Ares; I am just looking at possibilities depending on individual circumstances.

This general advice applies to gold stocks as well. If you doubled your position in, say, Wheaton Precious Metals Corp. (WPM:TSX; WPM:NYSE) under say, $26—you had seven trading days last month to do so—you could cut back over $34. Remember, be alert to tax-loss consequences. Since any sales of add-on positions at last month’s lows will not be outside the 30-day wash-sale rule, decide whether you want to sell shares in which you have a gain and preserve any tax losses for later sales; or avoid paying tax now but give up the tax loss. (You can designate which shares you are selling; talk with your accountant if it’s a meaningful amount.)

Evrim’s royalty gets more valuable

Evrim Resources Corp. (EVM:TSX.V, 0.28) announced that First Majestic had upgraded the resource at the Ermitano Project, which Evrim discovered and subsequently sold to First Majestic in exchange for a 2% royalty. The operator announced a 345% increase in the silver-equivalent ounces, and a 15% increase in grade, for an indicated resource of 311,000 ounces of gold and 4,730,000 ounces of silver. A pre-feasibility study is expected by year-end. Production, and revenues to Evrim, are estimated to commence in early 2021.

Separately, Evrim has regained 100% of the Cerro Cascaron project after Harvest Gold completed two seasons of exploration including drilling with promising results. Much of the project remains unexplored, and Evrim will seek another partner.

Although the stock price has recently moved up, at 28 cents, the market cap is C$24 million, about the same as the cash and value of the its Ermitano royalty, so it remains undervalued. If you do not own it, Evrim is a strong buy.

Fortuna’s mines all closed down, but stock cheap

Fortuna Silver Mines Inc. (FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE, US$2.36), like other mining companies, withdrew its production guidance for this year, following the closing of both of its operating mines, and the suspension of construction activities at its Lindero project, nearing completion in Argentina, all the result of the Covid virus. As a result, the commencement of operations and production has been pushed back again, with no new date announced.

The company is in a strong position, with $123 million cash, which includes $40 million just drawn on its credit facilities. As part of its response, the company said that senior executive compensation was being reduced.

At its current price, Fortuna is trading at only 6 times last year’s cash flow, 14 p/e, and 60% of book value. These are very low numbers for a mining company. Although clearly the impact of the shut downs in three countries on at least this quarter’s revenues will be significant, once the mines reopen and Lindero starts production, revenue will move up sharply. Fortuna is a very strong buy at this level. It traded as low as $1.80 last month, so if you already own a meaningful allocation, you might wait for an additional pullback to add to positions.

Royal well positioned to withstand closures

Royal Gold Inc. (RGLD:NASDAQ; RGL:TSX, US$107.81) said its gold and silver sales in the first quarter were in line with previous guidance, though it ended the quarter with lower inventory. Several of the mines at which Royal earns its royalties and streams have temporarily closed because of the virus, including its principal earner Mt. Milligan.

The company drew another $200 million on its credit facility, bringing to just over $300 million the amount outstanding on its $1 billion credit facility, The drawdown was a “prudent precautionary measure,” the company said. Separately, CEO William Heissenbuttel said he has complete confidence in the revised mining plan for Mt Milligan put out by owner Centerra. We are holding.

Reopening, purchase and dividend continues

Osisko Gold Royalties Ltd. (OR:TSX; OR:NYSE, CA$8.31) received good news when the Quebec government announced mines were “essential,” and many mines, including Malartic (Osisko’s largest royalty earner) and Eleonore announced plans to resume operations, the latter on a “phased” schedule. Hold.

Reservoir Capital Corp. (REO:TSX.V, 0.04) has completed the previously announced acquisition of Olocorp Nigeria, which holds shares in an operating Nigerian hydro company. The final 40% of Olocorp was purchased for Reservoir shares. Hold.

Gladstone Investment Corp. (GAIN:NASDAQ, 9.96) said it was proactively engaged with its portfolio companies, providing assistance and support as necessary. These companies have been affected by Covid and the shutdowns to various degrees, depending on sector and location. It announced the monthly dividend would remain the same as last quarter, with a special extra 9 cents per share payment in June. If these payments continue, it would equate to a 12% in the year ahead. Hold.

TOP BUYS As per the discussion above, in addition to stocks mentioned herein, top buys right now include Altius Minerals Corp. (ALS:TSX.V, 7.88) and Kingsmen Creatives Ltd. (KMEN:SI, 0.22).

Originally posted on April 19, 2020.

Adrian Day, London-born and a graduate of the London School of Economics, heads the money management firm Adrian Day Asset Management, where he manages discretionary accounts in both global and resource areas. Day is also sub-adviser to the EuroPacific Gold Fund (EPGFX). His latest book is “Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks.”

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Adrian Day: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Ares Capital, Evrim Resources, Gladstone Investments, Royal Gold, Osisko Gold Royalties and Altius Minerals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Funds controlled by Adrian Day Asset Management hold shares of the following companies mentioned in this article: All. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Evrim Resources, Royal Gold, Osisko Gold Resources and Altius Minerals, companies mentioned in this article.

Adrian Day’s Global Analyst disclosures: Staff may have positions in securities discussed herein. Adrian Day is also President of Global Strategic Management (GSM), a registered investment advisor, and a separate company from this service. In his capacity as GSM president, Adrian Day may be buying or selling for clients securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein. This is not a solicitation for GSM. Views herein are the editor’s opinion and not fact. All information is believed to be correct, but its accuracy cannot be guaranteed. The owner and editor are not responsible for errors and omissions. © 2020.

The Fed Can’t Print Gold

Peter Schiff: The Great Inflation Debate

Negative commodity prices are never legitimate, regardless of the stories concocted to explain them away… by Ted Butler of Butler Research via Silver Seek Monday’s spectacular and unprecedented collapse of […]

The post Ted Butler: Crude Oil, Common Sense, And The CME Group appeared first on Silver Doctors.

US state and local (municipal) governments are collapsing as no economic activity means no cash flows in the economy. And cash flows are… by Jason Burack of Wall St For […]

The post CONgress Passes The Next Round of SBA Loan Bailouts…Are More Bailouts Coming? appeared first on Silver Doctors.