Category: Gold

Supply, Demand, and Depreciation

The metals markets are being pulled in multiple directions simultaneously like never before. The global virus-triggered economic freeze has caused industrial demand for all commodities to crater.

At the same time, mining output is also crashing as virus fears force many mines around the world to suspend operations.

What is the “right” equilibrium price for copper, silver, gold, and other metals in an environment of such extreme and unstable supply and demand stresses? The verdict of the market changes – often dramatically – day by day.

In March, hard assets tumbled along with stocks as investors priced in increasingly dire scenarios for the economy. A double-digit contraction in U.S. GDP and double-digit spike in unemployment became inevitable after economic lockdowns spread across the country.

Now hopes are growing for the economy being able to start reopening in May and reverse some of the damage done by the draconian policies prescribed Dr. Fauci and adopted by most state governors.

Still unknowable, however, is how quickly the economy will be able to heal itself… and to what extent demand for raw materials will recover toward pre-virus levels.

The biggest wild card in all this may be the effects of unprecedented fiscal and monetary stimulus.

Already the federal budget deficit is set to explode to an all-time record over $3 trillion (likely closer to $4 trillion) and represent a greater share of the U.S. economy than at any time since World War II. Already the Federal Reserve’s balance sheet has ballooned to $6.1 trillion as central bankers furiously try to prop up everything from mortgages to junk bonds.

All this is leading toward a devaluation of the U.S. dollar. That should naturally make sound money – gold and silver – more valuable in dollar terms.

However, as we saw last month, demand destruction amidst a wrecked economy pull down precious metals prices quite suddenly – if only temporarily. Gold has since rebounded strongly to a new 8-year high while silver is regaining its footing from historically depressed levels.

Drilling Down into Supply and Demand Fundamentals

The Silver Institute had forecasted in early February – back when the economic impact of the virus was thought to be minimal outside of China – that global silver demand would rise by 3% in 2020. The Institute projected supply would nearly keep pace with 2% growth (which would be the first annual increase in five years).

Those forecasts now have to be thrown out the window. Both demand and supply are set to plummet in the near term.

On the plus side, investment demand for silver bullion products spiked last month to levels dealers had never seen before, clearing out inventories of most coins, rounds, and bars.

Bullion buying has receded from the frantic pace seen at the peak of the panic but remains strong. Safe-haven buying could remain a feature of investor psychology for many months ahead until an effective COVID-19 vaccine is widely available – and that figures to be 12-18 months out.

As for mining supply, it’s going to be a long road ahead before mines are fully operational again. Platinum and palladium production is largely offline in South Africa. Mexico’s giant Peñasquito mine, one of the country’s leading sources of gold and silver, suspended operations on Monday.

The silver supply picture is complicated by the fact that few primary silver mines exist. Most silver is produced as a byproduct of mining other metals (copper, lead, zinc, gold).

Base metals producers are shutting down. As Reuters reported, “Copper prices advanced on Tuesday, with London copper touching a four-week high, as more virus-related mining disruptions in key producing countries sparked global supply concerns.”

Best-Case and Worst-Case Scenarios

Given the extreme dynamics setting up in supply, demand, and monetary expansionism, market conditions are likely to remain volatile. We do think we have seen “peak fear” in this cycle – but not the end of uncertainty surrounding the virus and the economic damage it could continue to inflict.

In a best-case scenario, COVID-19’s spread steadily declines into the summer and the economy embarks on a V-shaped recovery. In a worst-case scenario, the virus makes a devastating resurgence in the fall, the economy locks down all over again, and markets descend back into chaos.

If the optimistic outlook prevails, then rising industrial demand for copper, silver, platinum, and palladium can be expected to drive those metals higher. Demand can recover faster than supply, which can’t simply be turned back on like a switch.

If the pessimists prevail, then all bets are off. Rounds of asset deflation will lead to accelerating hyperinflationary monetary responses. Social chaos, martial law, and possibly a postponement of elections could result.

In such a scenario, no investment could be counted on to perform well. But gold, the ultimate money, can always be counted on retain value even during the worst of times.

Source: James Kwantes for Streetwise Reports 04/15/2020

James Kwantes, editor of Resource Opportunities, outlines the potential upside as this project generator moves forward on its property in the Yukon.

Well-run project generators are brick houses in a speculative corner of the market, where the winds of commodity prices and dilution are often house wreckers. Their share prices are typically backstopped by healthy treasuries, royalties and equity stakes, as well as extensive claims holdings. They are businesses, not cash-burning lottery tickets like most junior explorecos.

But for many speculators, that level of diversification is a knock. Those bricks provide stability but weigh down the “rocket ship” when a junior exploration company hits a bona fide high-grade gold discovery. Project generators typically retain only limited exposure to discoveries through royalties or small equity stakes.

The picture changes completely, however, when project generators make a high-grade discovery on a wholly owned project. Azimut Exploration Inc. (AZM:TSX.V) proved it in January, with its Patwon gold discovery at the Elmer property in Quebec. Azimut is Quebec’s largest claims holder, diversified across metals and known for its technical savvy. On Jan. 14, the project generator announced multiple high-grade gold intercepts at the James Bay project, including 12.43 g/t Au over 6 meters and 27.36 g/t Au over 4.7 meters.

The day before the discovery was announced, Azimut shares closed at $0.50 (at a $31 million [$31M] market cap). The stock rocketed to $1.50 the following day, and remains at about that level despite the uncertainty and tough market conditions that persist in the junior mining complex. COVID-19 forced the suspension of Azimut’s follow-up 6,000-meter diamond drill program at Patwon.

Azimut closely resembles another project generator with a wholly owned gold project that will be drilled this summer: Strategic Metals Ltd. (SMD:TSX.V). Strategic, Yukon’s largest claims holder, is cashed-up to drill its Mount Hinton high-grade gold prospect in the Yukon Territory’s Keno Hill district. Strategic plans to spend about $3 million to explore Mount Hinton this season, including up to 6,000 meters of drilling (diamond and rotary air blast [RAB]). The program, of course, is dependent on how the coronavirus pandemic plays out in the coming weeks and months.

Strategic shares currently trade at about $0.35, for a $34M market capitalization. It’s a far cry from the $4.35 level ($381M market cap) that the stock hit in 2011. That share price was propelled by gold’s rise to US$1,900 an ounce—less than $200 an ounce higher than current levels—as well as ATAC Resources Ltd.’s (ATC:TSX.V) high-grade gold discoveries at the Rackla property in Yukon (ATAC is part of the Strategic Exploration Group).

Doug Eaton, Strategic’s CEO and principal of Archer Cathro, the storied Yukon geological consultancy, was in the thick of it during ATAC’s high-grade discoveries.

Strategic Metals CEO Doug Eaton

But the veteran geologist says he’s more excited about Mount Hinton because of the volume of high-grade gold found at surface at such an early stage, during what appears to be a perfect storm for the gold price.

“Mount Hinton is the same kind of setup, but the project is much more readily accessible than Rackla, and it’s earlier stage,” Eaton said. “It’s much more exciting than ATAC was at this stage. We have a chance in there of a major gold discovery under the till or talus.”

Eaton’s comments about Mount Hinton’s possibilities sound like fairly typical Howe Street-style promotion. But a couple of key differences make his observations worth a closer examination:

- His comments say much more about Mount Hinton’s prospectivity than they do the potential of ATAC’s Rackla project. Strategic holds a 6.4% stake in ATAC and is incentivized to see the company succeed. Eaton remains a believer that the Rackla deposits will one day produce tens of millions of ounces of gold.

- Eaton, a geologist, has been working in the Yukon for almost 50 years. He has an almost-encyclopedic knowledge of Yukon mining projects, which helps Strategic snap up forgotten but highly prospective projects. Eaton has been involved in several of the Territory’s major discoveries, including the Casino copper-gold porphyry (now being developed by Western Copper and Gold Corp. [WRN:TSX; WRN:NYSE.MKT]).

Rewind: In the summer of 2017, Strategic sold six properties, including Mount Hinton, to a private company called Territory Metals. The terms of the deal hinted that Mount Hinton was no ordinary prospect—in addition to a 2% net smelter return (NSR), the agreement included a 10% NSR on any small-scale high-grade gold production and a $1.5-million milestone payment if Territory identified a one-million-ounce gold-equivalent resource on any of the properties.

Territory’s go-public plans fizzled and Strategic got the property back. Archer Cathro geologists hit the ground hard in summer 2018. They extended a large geochemical soil anomaly and found multiple rock samples with high-grade gold samples that assayed greater than 9 g/t gold.

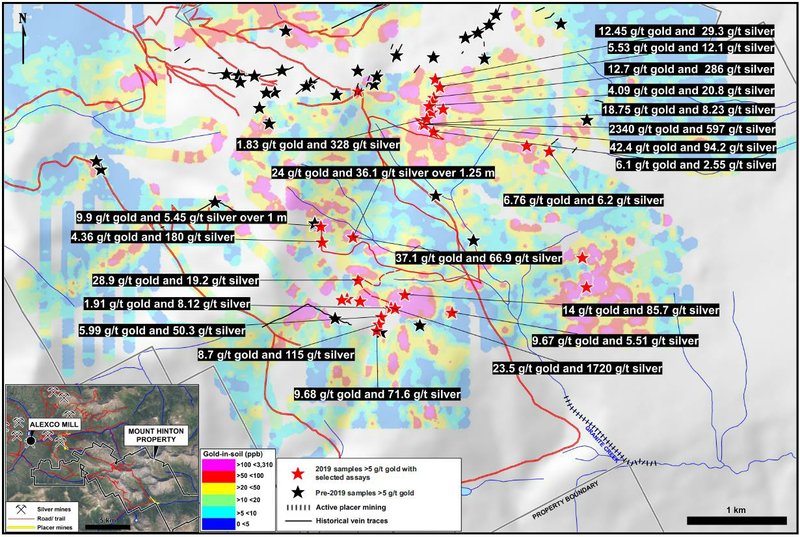

Last summer, Strategic hit pay dirt with a prospecting program focused on the 3.5×1.5-kilometer, gold-in-soil anomaly. One rock sample came back with a bonanza-grade assay: 2,340 g/t gold and 597 g/t silver. Follow-up prospecting discovered visible gold at this site (the first reported native gold on the property), and subsequent samples containing visible gold were not assayed. Other chip samples also carried high gold and silver values, including:

- 42.4 g/t gold and 94.2 g/t silver

- 9.9 g/t Au and 5.45 g/t Ag over 1 meter

- 24 g/t Au and 36.1 g/t Ag over 1.25 meters

- 23.5 g/t Au and 1,720 g/t Ag

- 202.0 g/t Au and 2,020 g/t Ag

Map of Mt. Hinton property

The property has not seen much exploration, despite its proximity to Alexco Resource Corp.’s (AXU:NYSE.MKT; AXR:TSX) Keno Hill project—Mount Hinton is just three kilometers south of Alexco’s Bellekeno deposit. That’s largely because of road access difficulties. But the situation has improved dramatically in recent years, thanks to the thriving Granite Creek placer gold camp, located at the base of Mount Hinton. Two placer operators are pulling out multi-ounce gold nuggets and the Granite Creek drainage has become one of Yukon’s hottest gold camps.

Granite Creek placer operations, one of Yukon’s hottest mining camps, with Mount Hinton in the background.

Strategic brought in excavators last year to build a road network on the property, an effort that will continue this year once the snow melts. The planned 6,000-meter drill program is a large one for Strategic, but so is the size of the potential prize. “To find this material at surface is remarkable,” Eaton remarked.

Strategic geologist Steve Israel has now mapped three separate phases of mineralization on the property. More phases mean higher volumes of mineralizing fluids, which can lead to more gold.

With Mount Hinton a potential near-term catalyst, Strategic’s share price—and downside—is backstopped by a healthy treasury of $6.8 million and large equity stakes, as well as its extensive Yukon claims portfolio. Significant equity stakes include:

- ATAC Resources (6.4%): high-grade gold deposits on the Rackla property

- Rockhaven Resources Ltd. (RK:TSX.V) (36.3%): h-g 1.2M oz Au/28M oz Ag deposit, on a road

- Terra CO2 (62.6%): pending patent on non-CO2-generating cement replacement

- Precipitate Gold Corp. (PRG:TSX.V; PREIF:OTCBB) (24.3%): Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) just signed a 70% earn-in agreement for Precipitate’s Pueblo Grande project beside Barrick’s Pueblo Viejo mine in Dominican Republic

- Silver Range Resources Ltd. (SNG:TSX.V) (17.7%): project generator focused on h-g in Nevada, the Northwest Territories, Nunavut

Mount Hinton showing

With gold moving in the right direction, the Mount Hinton drill program positions Strategic to capture the shareholder value that can result from a high-grade discovery. It’s an outcome Eaton has seen before—and why he kept Mount Hinton in the portfolio when it came back, rather than optioning it.

“We’ve turned down some pretty good offers for Mount Hinton,” he remarked. “That’s because everybody wants 100% of it.”

Gold is on the move as governments around the world fire up currency printing presses to counter the economic effects of COVID-19. That lift has not yet translated to the junior sector, despite gold hitting all-time highs in most major world currencies. Eaton believes the malaise of the past several years is partly a generational phenomenon—younger retail investors simply haven’t experienced the large multi-bagger wins that tend to drive money into the junior space.

“You have a generation of investors who have done well in mining but who are too old,” Eaton said. “The generations of younger investors haven’t benefited the way people who are older did in prior bull markets.” That may be about to change.

A high-grade gold discovery at Mount Hinton could trigger a rush to get into Strategic shares, if the action on Aug. 21, 2019, is any indication. That day, Strategic announced high-grade assays, including the bonanza-grade rock sample. The stock shot from $0.39 to $0.47 on multiples of average volume. It could be just a taste of what’s to come if Strategic drills a high-grade gold discovery at Mount Hinton this summer.

Strategic Metals (SMD: TSX.V, SMDZF: OTC)

Price: $0.35/share

Shares out: 96.6 million (108.85 million fully diluted)

Market cap: $33.8 million

James Kwantes is the editor of Resource Opportunities, a subscriber supported junior mining investment publication. Kwantes has two decades of journalism experience and was the mining reporter at Vancouver Sun, the city’s paper of record.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure: I own Strategic Metals shares and Strategic is one of three Resource Opportunities sponsor companies. This article is not intended as financial advice and all investors need to conduct their own due diligence and/or consult an investment advisor.

Streetwise Disclosure:

1) James Kwantes’ disclosures are listed above.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Resource Opportunities Disclaimer: Readers are advised that this article is solely for information purposes. Readers are encouraged to conduct their own research and due diligence, and/or obtain professional advice. The information is based on sources which the publisher believes to be reliable, but is not guaranteed to be accurate, and does not purport to be a complete statement or summary of the available data.

( Companies Mentioned: SMD:TSX.V,

)

We’re Not Going Back to Normal

Peter Schiff: This Is a Financial Crisis

Right on cue, a pair of Democrats are now proposing universal basic income, but just long enough to ‘get us through’ the pandemic… by JD Heyes via Natural News (Natural News) […]

The post Dems Propose Endless Helicopter Money During Pandemic, Paying People To Stay Home Isn’t An Economy appeared first on Silver Doctors.

It’s once again the financial power elite and corporate boardroom bigwigs who are receiving immediate and complete relief from the consequences of their actions… by Chris Martenson of Peak Prosperity […]

The post Abuse, Fraud & Inequity: Standard Operating Procedure In The Unfairness Economy appeared first on Silver Doctors.

The price of a great many assets will crash, out of proportion to the decline in demand… by Charles Hugh Smith via Of Two Minds The price of a great […]

The post Overcapacity / Oversupply Everywhere: Massive Deflation Ahead appeared first on Silver Doctors.