Category: Gold

Source: Streetwise Reports 05/07/2025

Dryden Gold Corp. (DRY:TSXV; DRYGF:OTCQB) confirms 301.67 g/t over 3.90 meters in Ontario’s Gold Rock Camp, spotlighting a major new vein. Find out how this discovery could reshape drilling plans.

Dryden Gold Corp. (DRY:TSXV; DRYGF:OTCQB) announced new drill results confirming a high-grade gold discovery at its Elora Gold System within the Gold Rock Camp in Ontario. The highlight intercept returned 301.67 grams per tonne (g/t) gold over 3.90 meters, including a subinterval of 1,930 g/t gold over 0.60 meters, from a new hanging wall zone identified in drill hole KW-25-003.

The hanging wall structure, described as folded quartz stringer veins hosted in sheared basalts, sits approximately 80 meters from the main Jubilee high-grade zone at a true depth of 250 meters. According to Trey Wasser, CEO of Dryden Gold, in the company’s announcement, “The discovery of this new zone shows the potential for hanging wall and footwall mineralized structures hosting significant gold mineralization similar to our discoveries last year on the Big Master Gold System.” He added that this new find was aided by the company’s 2024 mapping program, which identified a third structural trend known as “D3” at the Gold Rock Camp.

To date, Dryden Gold has completed 12 drill holes totaling approximately 4,083 meters targeting the Elora Gold System between late 2024 and 2025. Initial 2025 results from holes KW-25-001 through KW-25-003 have confirmed sulphide mineralization and shearing in the targeted zones, further supporting the potential of the Jubilee zone at depth.

Maura Kolb, President of Dryden Gold, described the new intercept as “the most significant amount of visible gold that Dryden Gold has intersected to date.” She added, “Hitting this coarse gold in a parallel hanging wall zone to the main Elora mineralized structure is very exciting and shows more potential for additional zones.”

The company plans to follow up with additional drilling northeast along strike at the historic Laurentian Mine and Intersection Target, as well as at the Mud Lake target about two kilometers along strike. The exploration strategy focuses on the intersection of key structural trends, which Dryden Gold believes are crucial for hosting high-grade mineralization.

Dryden Gold also announced the completion of a top-up financing with Centerra Gold Inc. Centerra exercised its right to maintain a 9.99%interest in Dryden Gold, acquiring 1,087,295 common shares at a price of CA$0.1350 per share for total proceeds of CA$146,784.83. In addition, Dryden Gold granted 300,000 incentive stock options to employees, exercisable at CA$0.24 per share over ten years, subject to standard vesting schedules and regulatory approval.

Gold Mining Rides Market Strength

Underlying macroeconomic conditions have helped shape gold’s trajectory. A May 2 analysis posted on FXStreet reported that gold prices touched fresh daily highs in early European trading, supported by a “modest USD downtick” and “prospects for more aggressive policy easing by the Federal Reserve.” The analysis underscored how broader market movements, such as shifts in U.S. dollar strength and economic indicators like the Nonfarm Payrolls report, continue to impact the outlook for gold. Menghani explained that “traders ramped up their bets that the US central bank will deliver four quarter-point rate reductions by the year-end” after a series of economic data pointed to easing inflation and cooling labor markets.

Gold mining stocks have shown notable strength recently, bolstered by rising bullion prices and renewed investor interest. According to a May 6 report from Stockhead, the ASX All Ords Gold Index climbed by more than 4.3%, outperforming broader market benchmarks despite an overall marginal market dip of 0.08%. The report noted that a 2.5% rise in the gold price helped fuel gains across the sector, with the Materials index also seeing an uptick of nearly 0.69%.

Technical Analyst Clive Maund described Dryden Gold as an “Immediate Very Strong Buy.”

The surge in gold prices has been a key driver of this performance. Phoebe Shields of Market Index highlighted that “gold stocks did the heavy lifting on the market today, making strong gains despite a marginal loss on the bourse overall.” The rally translated into tangible market moves for listed companies, reinforcing optimism around the sector’s near-term resilience.

A May 7 article from Junior Stocks explored broader market sentiment, indicating that the gold rally in 2025 had already seen bullion rise by more than 25% year-to-date. Rob McEwen, founder of Goldcorp and CEO of McEwen Mining Inc., emphasized the potential for equities to catch up with bullion’s rise. McEwen stated, “The sector is poised for a violent catch-up… and once it happens, it won’t be gradual – it’ll be explosive.” His commentary focused on the cascading effect typically observed in gold markets, where gains initially concentrate in large producers before spreading to mid-tier and junior miners.

Analysts Underscore Dryden Gold’s Discovery Momentum and Strategic Positioning

Dryden Gold received positive attention from market commentator Chen Lin in the April 9 edition of his newsletter, What is Chen Buying? What is Chen Selling?. Lin highlighted a recent drill intercept as a notable “blind discovery,” explaining that the company encountered visible gold at a depth of approximately 200 meters, around 80 meters ahead of its anticipated target zone. The area had not been previously drilled, and Lin reported that “they hit 2 meters of highly visible gold,” which he described as having potential for a “very high” grade, while noting it was unlikely to match a prior intercept of “5 kg/ton gold.”

Lin remarked that Dryden Gold had delivered “great presentations” at the Metals Investor Forum and stated that the company had remained on his radar since that appearance. The new discovery prompted him to increase his own position in the stock. He also noted that Dryden Gold was working to secure assay results ahead of the next Metals Investor Forum in May and continuing with drilling aimed at defining the extent and orientation of the newly identified mineralized zone.

*In an April 15 technical review, Technical Analyst Clive Maund described Dryden Gold as an “Immediate Very Strong Buy,” pointing to both the company’s chart pattern and broader market conditions in the gold sector. Maund observed that the precious metals market had recently broken out of a five-year consolidation phase, which he characterized as a “Bowl” formation, suggesting the potential beginning of a sustained sector-wide advance. He wrote, “Stocks like Dryden Gold will have the wind at their back as they will be given added impetus by a strongly rising sector.”

Maund noted that Dryden Gold’s shares had been under steady accumulation and appeared poised to break out of a multi-month base. He identified the CA$0.10 level as consistent support, tested multiple times since the company’s market debut, and pointed to recent volume increases and large block trades as indicators of renewed investor interest. Maund stated, “The writing is on the wall,” indicating the stock was positioned to enter a longer-term upward phase. He cited near-term resistance between CA$0.22 and CA$0.24 and set an initial price target of CA$0.40, with further upside possible as exploration advances and additional high-grade zones are delineated.

Building Momentum: Dryden’s Exploration Strategy for 2025

Dryden Gold’s investor presentation outlines a methodical approach to advancing its 702 square kilometer land package, focusing on both resource growth and new discoveries. The company’s 2025 exploration program is fully funded and centers on expanding the Elora Gold System, particularly down plunge and along strike from the Jubilee zone. Additional work is planned at the Mud Lake, Hyndman, and Sherridon targets, where historical samples and previous exploration have confirmed the presence of high-grade gold. [OWNERSHIP_CHART-11012]

The program includes LiDAR mapping, soil and till sampling, detailed geophysical studies, and a multi-phase drill campaign targeting known and newly identified structural intersections. According to Dryden Gold, infrastructure at the site is a key advantage, with access to grid power, major highways, and year-round drilling capabilities.

The company also emphasized its collaborative relationships with First Nations communities and highlighted support from Centerra Gold as a strategic investor. Dryden Gold reported a cash balance of CA$4.66 million as of May 5, 2025, and is advancing multiple targets through systematic geological modeling, field work, and drilling. The company’s strategic vision aims to confirm high-grade mineralized zones similar in geological setting to the Red Lake Mine, a noted reference point in the region’s gold mining history.

Ownership and Share Structure

According to the company, management and insiders own 7.62%, with strategic entities owning 56.78% of Dryden.

Centerra Gold Inc. (CG:TSX; CADGF:OTCPK) holds 9.37% with Alamos Gold Inc. (AGI:TSX; AGI:NYSE) holding a 14.44% stake in it. Euro Pacific Asset Management LLC owns 4.58%. There are 160 million shares outstanding.

Its market cap is CA$32 million, and it trades in a 52-week range of CA$0.40 and CA$0.095. Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Dryden Gold Corp. are billboard sponsors of Streetwise Reports and pay SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own Dryden Gold Corp. securities.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

* Disclosure for the quote from the Clive Maund article published on April 15, 2025

- For the quoted article (published on April 15, 2025), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing the article quoted. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in the article accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

Clivemaund.com Disclosures

The quoted article represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.

( Companies Mentioned: DRY:TSXV; DRYGF:OTCQB,

)

Source: Clive Maund 05/07/2025

Technical Analyst Clive Maund explains why he thinks Torr Metals Inc. (TMET:TSXV) is a Strong Buy.

Torr Metals Inc. (TMET:TSXV) is at a very favorable entry point now. It is in the latest stages of a giant Cup & Handle base pattern that promises a breakout into a major bull market soon, as we will see when we review its latest charts.

The company could hardly be better positioned, as it has a diversified portfolio of high-potential copper and gold targets, and the fundamentals for both of these metals could scarcely be better, with copper facing a supply crunch and a tidal wave of demand for gold incoming due to the ballooning crisis of the financial system.

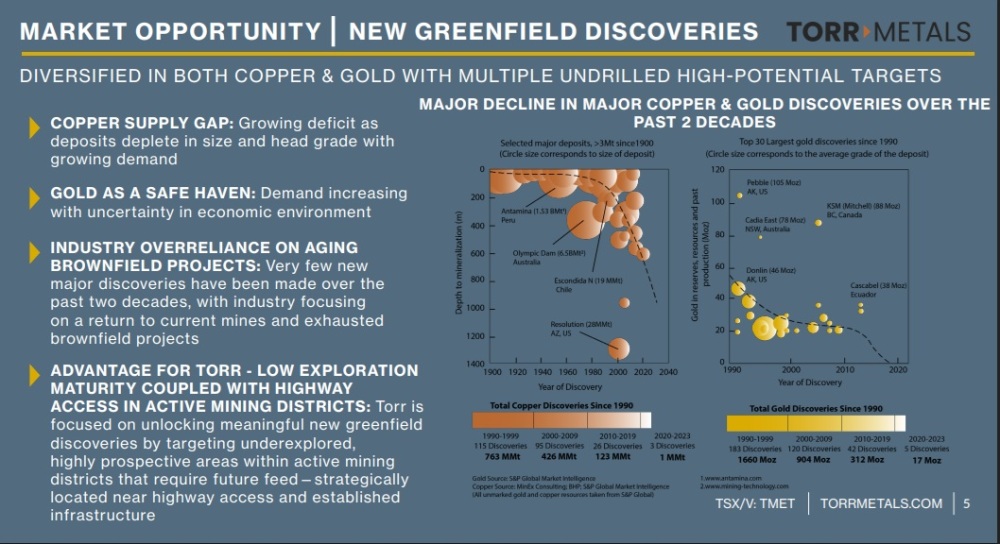

The following page from the April investor deck is very interesting as it makes clear that the discoveries of not just copper but gold have shriveled over the past two decades and with demand for both set to soar, copper for industrial reasons and gold for investment reasons relate to the deepening financial crisis, both metals will be at the center of a perfect storm as ballooning demand collides with shrinking supply.

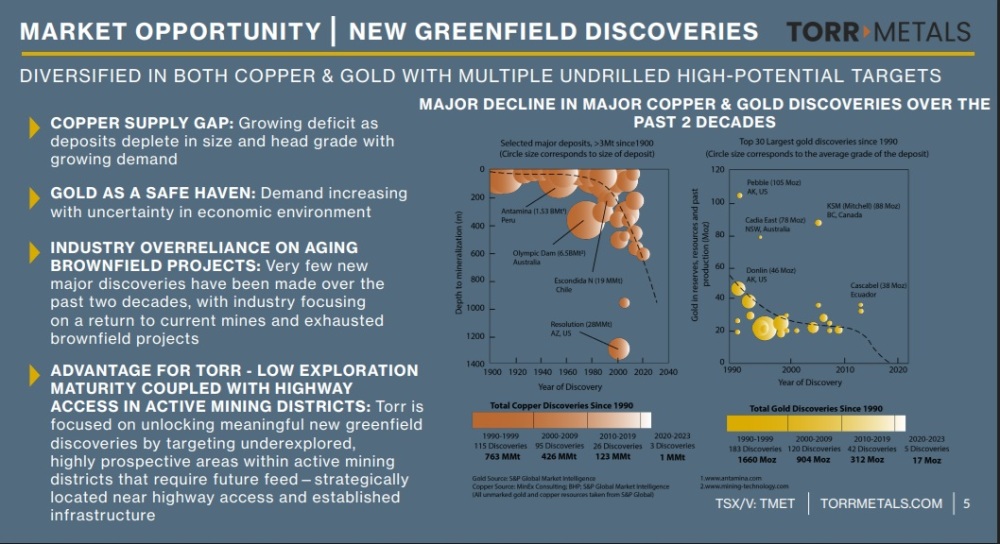

The company is in a very advantageous position, having three District Scale copper / gold properties, two in British Columbia and one in Ontario, whose combined land area totals 1300 square kilometers, which are all in prolific metal-bearing regions.

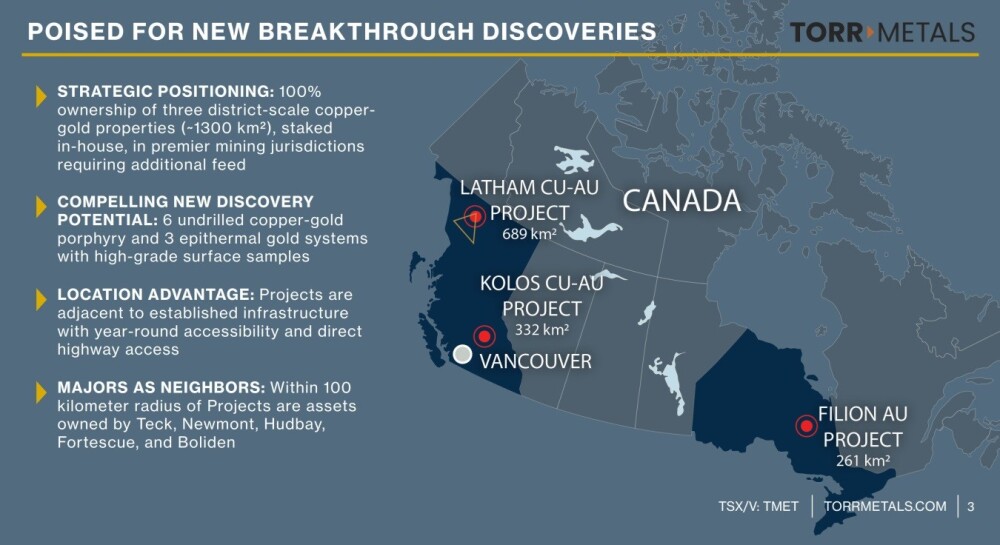

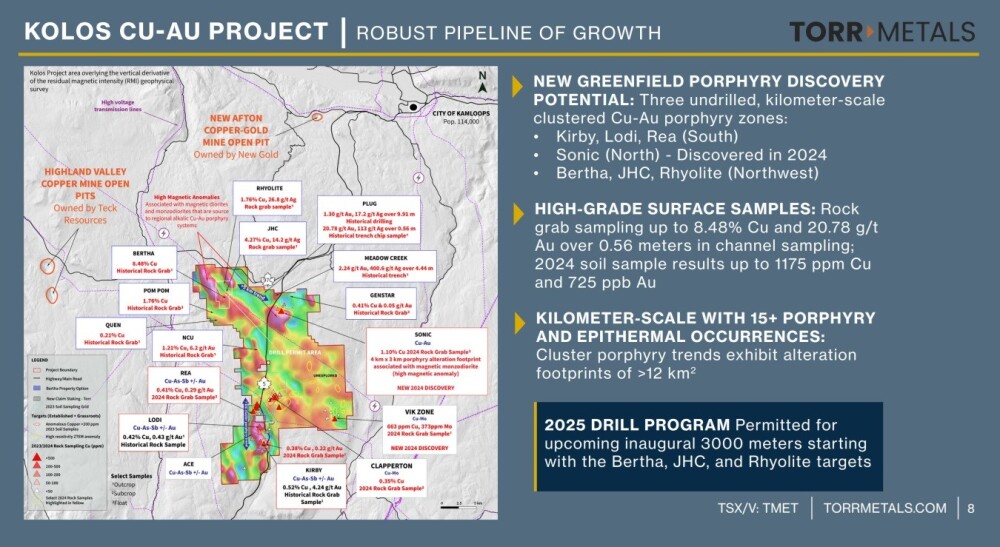

Torr Metals’ Kolos copper-332 square kilometer district scale gold project finds itself in good company next to copper giants as it is surrounded by HudBay Minerals Inc.’s (HBM:TSX; HBM:NYSE) Copper Mountain copper-gold mine, New Gold Inc.’s (NGD:TSX; NGD:NYSE.MKT) New Afton copper-gold mine and Teck Resources Ltd.’s (TECK:TSX; TECK:NYSE) Highland Valley copper-molybdenum mine as can be seen on the following map.

There are a lot of targets at the Kolos Project where significant grades have already been found.

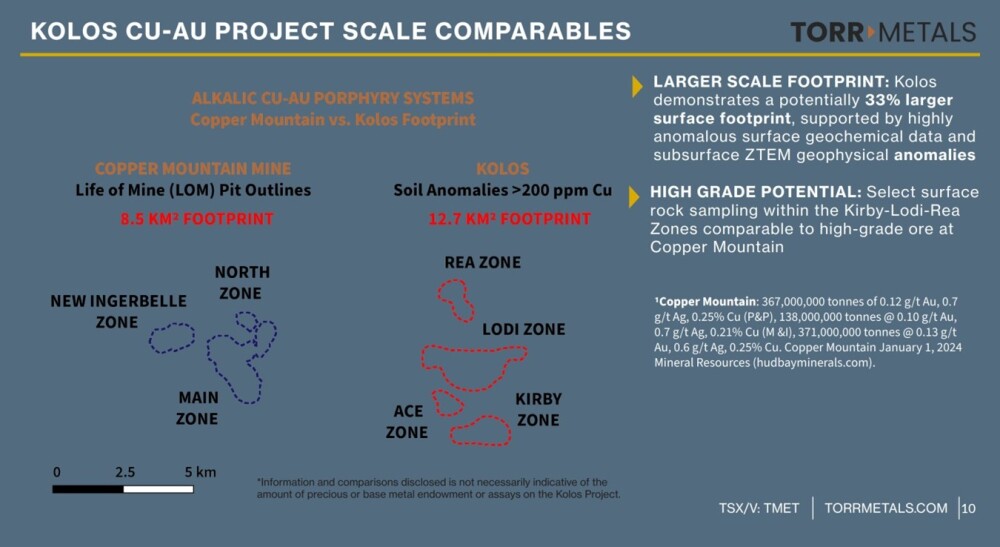

The Kolos Project compares favorably with Hudbay’s Copper Mountain which is not far off where huge amounts of copper have already been found.

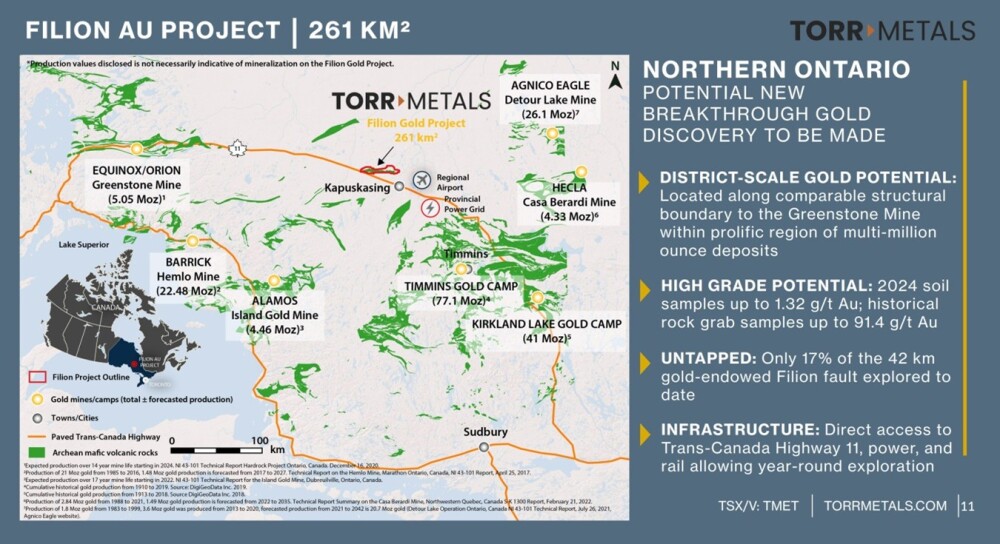

Meanwhile, Torr Metals’ 261 square kilometer District Scale Filion Gold Project in the prolific Greenstone Belt in Ontario has huge discovery potential, especially as it is surrounded by “heavy hitters” including the likes of Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE), Alamos Gold Inc. (AGI:TSX; AGI:NYSE), Barrick Gold Corp. (ABX:TSX; GOLD:NYSE),Hecla Mining Co. (HL:NYSE), and the Kirkland Lake and Timmins Gold Camps.

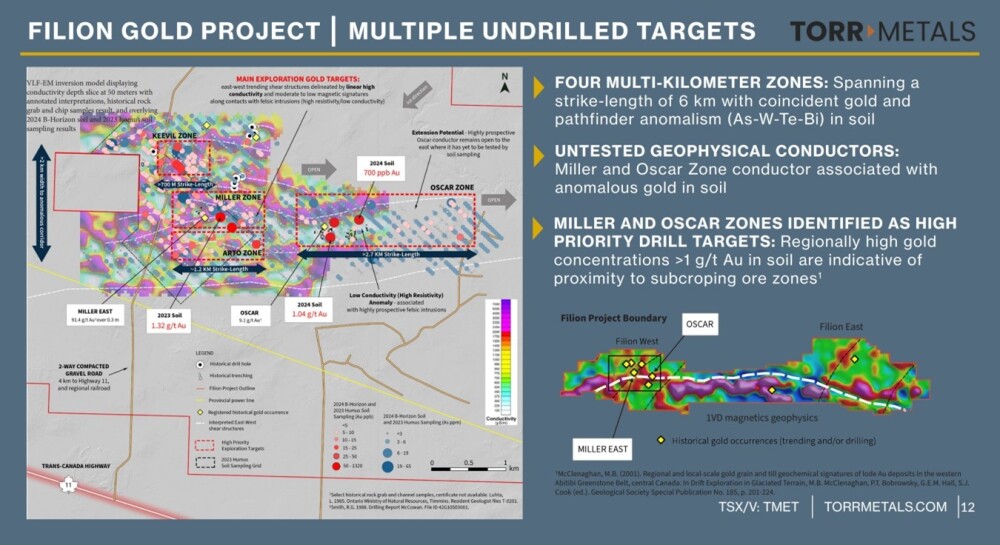

There are multiple undrilled targets at Filion.

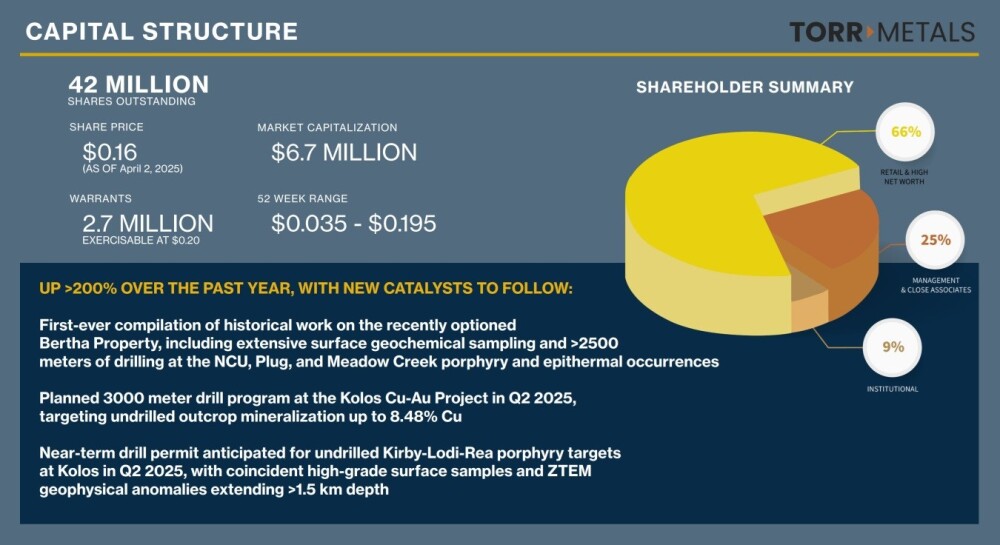

The following page shows the capital structure of the company — there are a relatively modest 42 million shares in issue and of these 24% are owned by management and close associates, with 9% held by institutional investors, leaving about 66% of the stock in the float, so there is plenty of scope for stock appreciation in response to increasing demand.

This last page summarizes why Torr Metals is a compelling investment in the sector now, especially as the stock has reacted back to a “buy spot” and in light of the extraordinarily positive outlook for copper and gold prices going forward.

Now, we will review the latest stock charts for Torr Metals.

Starting with the long-term 6-year chart, we see that after coming to market late in 2019, the price trended gently higher to peak late in 2021 at CA$0.33. It then tipped into a severe bear market that, by the time it had run its course early in 2023, had brought the price down to below CA$0.05. After bouncing back some, it went into another slow downtrend that brought it down to the final low at about CA$0.04 early in 2024, thus completing a Double Bottom with the early 2023 low. It then took off like a rocket on strong volume in the Spring of 2024 with a big spike up being followed by a long reaction that has continued up to the present.

With the benefit of the perspective afforded by this long-term chart, we can see that the entire pattern from early-mid 2022 is a giant Cup and Handle base. That the pattern is genuine is made clear by the persistent strong volume that drove the sharp rally to complete the right side of the Cup, which is a characteristic of this type of base pattern. The psychology behind its development is easy to explain; what happens is that before the sharp rally starts, “Smart Money” realizes that the company is “going to make it,” and that better times are ahead, and that it is seriously undervalued. It buys increasingly aggressively, thus absorbing all the supply at the low level, and the price starts to take off.

Less sophisticated investors then “jump on the bandwagon,” driving the price higher in a spike. This results in the stock “getting ahead of the fundamentals,” which naturally takes time to improve. So the stock then “beds down” in a long consolidation pattern that allows time for the fundamentals to catch up.

Hence, the formation of the Handle of the pattern. The good news is that while the Handle of this pattern has been building out, the fundamentals have been improving in leaps and bounds, as not only has the company been advancing towards its objectives, but the prices of its future products, copper and gold, have been racing ahead, especially this year. This means that the time is nigh for the stock to break out of this giant base, which it will achieve by breaking out above the band of resistance that marks its upper boundary, which is at the CA$0.18 – CA$0.20 level. Once it gets above this level, we can expect it to accelerate to the upside, very possibly in a dramatic manner, and it won’t be held in check for long by the limited resistance approaching the old highs in the CA$0.30 – CA$0.33 area.

The 18-month chart shows the latter part of the Cup & Handle base in much more detail. Of particular interest is the strong volume driving the rally to complete the right side of the Cup, and we can more readily see here how “Smart Money” began to mop up available supply before this break higher occurred.

The duration of the Handle consolidation has allowed time for the earlier overbought condition to unwind and for the 200-day moving average to catch up to the price, the better to support renewed advance and late in March we saw another bullish moving average cross which means that another upleg will quickly swing both moving averages into strongly positive alignment. The volume pattern remains strongly bullish with generally light volume as the Handle has formed, with upside volume building nicely this year, which is why the On-balance Volume line has recently been making new highs. So all in all, this is a very positive picture and we can expect renewed advances shortly.

The 6-month chart enables us to zoom in on recent action. It shows the latter part of the Handle of the Cup & Handle base and how, within it, a gentle uptrend from December has been followed by a normal reaction back to a support level.

It also makes clear that, from a timing standpoint, we are at an excellent point to buy the the stock for the recent reaction has more than fully unwound the earlier overbought condition thus restoring upside potential and thanks to the predominance of upside volume, the Accumulation line has even risen as the price has reacted back in recent weeks, a positive divergence that points to renewed advance.

The conclusion must be that the case for a major bull market in Torr Metals is overwhelming, on both fundamental and technical grounds, as has been demonstrated here, and with the stock at an excellent entry point after its recent dip.

The question may fairly be asked, “What’s not to like?”

It is therefore rated a very Strong Buy for all time horizons. The first target for an advance is CA$0.18 – CA$.20. The second target is CA$0.31 – CA$0.33, with the stock expected to advance to much higher levels later.

Torr Metals’ website.

Torr Metals Inc. (TMET:TSXV) closed for trading at CA$0.12 on May 6, 2025.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Agnico Eagle Mines Ltd. and Barrick Gold Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.

( Companies Mentioned: TMET:TSXV,

)

Source: Streetwise Reports 05/07/2025

American Pacific Mining Corp. (USGD:CSE; USGDF:OTC) expects a catalyst-rich year as it starts a 3,000-meter drilling program at its 100%-owned Madison Copper-Gold Project in Montana and looks at selling a large Alaska project. Experts grill the company for answers.

American Pacific Mining Corp. (USGD:CSE; USGDF:OTC) just started a 3,000-meter drilling program at its 100%-owned Madison Copper-Gold Project in Montana, has CA$15 million in the bank, and is looking to sell one of its major projects for even more cash, Chief Executive Officer Warwick Smith told a group of experts gathered on video on Doug Casey’s Experts Roundtable on April 28.

The CEO said the company planned to sell its Palmer VMS project in Southeastern Alaska and is open to new deals involving its other projects — Ziggurat, Tuscarora, and Gooseberry in Nevada.

“We like all of these projects, if we had all of the capital in the world, we would drill them all,” Smith told the group, part of Casey’s due diligence series featuring experienced investors like Casey, Mickey Fulp, Adrian Day, and Brent Cook. “But we want to be smart with what we’re doing. So, we’re actually looking at” turning them into joint ventures.

The Palmer VMS Project is a significant copper-zinc-gold-silver exploration project located 60 kilometers from the Haines deep seaport. It includes defined NI 43-101 mineral resources and has seen over US$116 million in investments to date.

The Palmer VMS Project is a significant copper-zinc-gold-silver exploration project located 60 kilometers from the Haines deep seaport. It includes defined NI 43-101 mineral resources and has seen over US$116 million in investments to date.

Madison is also 100%-owned by the company and is permitted for exploration. It produced 2.7 million pounds of copper with grades ranging from 20% to more than 35% copper (Cu) and 7,570 ounces of gold (Au) at 16.1 grams per tonne (g/t). It’s also 48 kilometers from the Butte mine, which produced 21 billion pounds Cu, 715 million ounces (Moz) silver (Ag), and 2.9 Moz Au.

Smith started his presentation by noting that American Pacific is focused on high-grade assets in the western United States, another reason for the company to look at transacting on the Palmer project in Alaska.

“We think it’s the smartest move for us that this ends up with an Alaska-based company and has the opportunity to stand on its own,” Smith told the experts. He said the company is the midst of having conversations with possible new owners. Smith said it was probable that a transaction could happen in the next 12 months.

“We’re in the midst of having those conversations to move that asset to a new home,” Smith said.

‘Huge Catalysts’ in 2025

American Pacific started its drilling campaign earlier this month. It is designed to test five priority target areas identified through extensive analysis, the company said. These targets include porphyry concepts and multiple skarn extensions both laterally and down plunge of known mineralization.

The 17-hole program will also focus on near-mine extension drilling at the Broadway mine area, where historic production totaled 144,000 ounces Au from surface oxide mineralization between 1880 and 1950.

“No drilling has been done in the area since mining operations concluded and sulfide mineralization, which was not considered economic during the historical mining period, has never been tested,” the company said in a release on April 22.

Between those results coming this summer and the possible sale of Palmer and the company’s other JV options, Smith said he believes there will be “huge catalysts” for the company this year.

“I think we’d be hard pressed to drill 17 into this area and not get some joy,” he said.

Smith said even after the possible sale of Palmer, the company could possibly still find itself in the M&A game.

We’re always kind of looking; we’ve been successful on the M&A front for the most part,” he said. “We’ll continue to review projects, and if something makes sense, we’re not afraid to go and snap something up.”

He also noted that American Pacific and its stock have received some acknowledgement, including being ranked the No. 1 performing stock globally in 2021 by The Wall Street Journal; being nominated by S&P Global Platts for Rising Star Company, CEO of the Year, and Deal of the Year; and being nominated by Mines and Money for Collaboration of the Year.

Juniors Will Soon Get ‘Terrific Run’

Nick Giambruno of Financial Underground asked Smith about rising gold prices that haven’t filtered down to many of the junior explorer stocks.

“We’re starting to see it at the majors,” Smith noted, but he said the juniors will soon “get a terrific run.”

“It’s been a frustrating time for sure, but what we’ve done is kept our head down corporately, to make sure that we have cash, and that we have significant assets,” Smith said. “When the time is ready and the markets are better, we can strike.”

Fulp of the Mercenary Geologist asked about environmental concerns with the Madison project since it is close to the Jefferson River and fly-fishing grounds in Montana.

“You can’t throw a rock across a valley without hitting three (rivers)” in that area, Director and Managing Director of Exploration Eric Saderholm said. “It’s something that has been baked into the cake a little bit, sure it will take some due diligence, some effort to get it into production, but I don’t see that it will be a real big problem.”

But Smith told the panel that American Pacific was committed to its new direction with Madison and finding a new home for the Palmer project.

We really like this Madison asset, and we’re going to let this drill program show us what’s there,” he said.

Byron King said it seemed like American Pacific really has “this thing wrapped up.”

“I’m frankly intrigued by what you’re doing out there,” King said. “With the right couple of drill holes, you could really explode this thing in a good way.”

Moderator Matt Smith said that with all the catalysts, it seemed like there were a lot of things that could make or break the company this year.

The Catalyst: Conductor of the Energy Transition

According to a report by Sayantan Sarkar for Invezz on May 6, signs of a deepening copper supply crunch outside the United States, especially in China, spurred a rapid recovery in prices this week, erasing losses from the prior week.

“Beyond the noteworthy surge in copper stockpiles observed on the COMEX, supplementary information released by the data provider Markit on the preceding Friday also indicated robust demand originating from the US,” Sarkar wrote. “This confluence of factors, a substantial increase in available copper alongside evidence of strong consumption within a major economy, presents a potentially complex scenario for market analysts.”

The rising inventory levels on the COMEX could typically suggest a cooling of demand or an oversupply situation, potentially leading to downward pressure on copper prices, according to the report.

Much of the energy transition depends on copper and its importance as an electrical conductor, and the hunt for the red metal “has been accelerating, as companies involved in all parts of the copper supply chain realize the structural supply deficit,” wrote Rick Mills, author of the newsletter Ahead of the Herd. [OWNERSHIP_CHART-9545]

“They understand the need to find sources — existing mines, expansions, brownfield projects, greenfield projects, etc. — and are making deals to acquire the base metal, which is not only essential to electrification and decarbonization but industry in general,” Mills wrote.

The Swiss bank UBS estimates that the copper supply deficit will exceed 200,000 tons by 2025, she wrote. The International Energy Forum adds that, to meet the growing demand, more than a billion tons of new copper mining capacity will be needed annually until 2050.

Ownership and Share Structure

According to the company, strategic junior mining investor Michael Gentile owns approximately 14% of the company, and about 8% is owned by insiders and management. About 15% is with institutions, the company has said. The rest is retail.

Refinitiv noted that major shareholders include Merk Investments LLC with 1.37%, Chief Executive Officer and Director Warwick Smith with 0.46%, Managing Director of Exploration and Director Eric Saderholm with 0.24%, and Palos Management Inc. with 0.23%.

The company’s market capitalization is CA$48.2 million, based on 219.09 million shares outstanding. Its 52-week trading range spans from CA$0.11 to CA$0.28

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- American Pacific Mining Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of American Pacific Mining Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

( Companies Mentioned: USGD:CSE; USGDF:OTC,

)

Source: Streetwise Reports 05/07/2025

Giant Mining Corp. (CSE: BFG; OTC:BFGFF; FWB:YW5) smashes drilling targets, revealing native copper near a major sulfide zone. Find out why analysts see big upside in this copper play.

Giant Mining Corp. (CSE: BFG; OTC:BFGFF; FWB:YW5) has announced that drilling at its Majuba Hill copper-silver-gold project in Nevada has advanced significantly, with Hole MHB-34 surpassing 1,850 feet (563.88 meters). The company reported the presence of native copper, cuprite, and chalcopyrite, which are key copper minerals, and suggested proximity to a primary copper sulfide zone.

According to Larry Segerstrom, board member in the news release, “The strong presence of cuprite, native copper, and chalcopyrite in MHB-34 suggests we may be on the edge of the primary copper sulfide zone. We look forward to receiving the assays.”

CEO David Greenway added, “With visible native copper extending beyond 1,600 feet, we’ve blown past our original drilling expectations.”

The Majuba Hill project, located in Pershing County, Nevada, spans 9,684 acres and benefits from strong infrastructure, including nearby roads, power, and transportation routes. Historical production at Majuba Hill includes approximately 2.8 million pounds of copper, 184,000 ounces of silver, and 5,800 ounces of gold. Giant Mining has completed more than 80,000 feet of drilling to date, with the 2025 program aiming to extend known high-grade copper zones and support a future mineral resource estimate. Core samples are processed at the company’s secure facility in Elko, Nevada, and analyzed by ALS Labs using industry-standard methods such as fire assay and inductively coupled plasma mass spectrometry (ICP-MS). The company has emphasized its focus on quality assurance, maintaining a strict chain of custody, and using commercial standard reference materials to ensure assay accuracy.

The project is positioned as a U.S. critical minerals asset, reflecting broader market dynamics. Copper demand, driven by the electric vehicle (EV) sector, renewable energy infrastructure, and global electrification trends, is forecasted to rise steadily through 2035. As of May 2025, copper prices are approximately US$4.33 per pound, with the global EV industry alone expected to require more than 1.7 million tonnes of copper by 2027. Nevada’s ranking as the top global mining jurisdiction further supports the project’s development outlook.

Copper Industry Trends and Dynamics

Proactive Investor reported on April 29 that China’s copper stockpiles were falling quickly, with Shanghai Futures Exchange data showing a decline of almost 55,000 metric tons to 116,800 metric tons in just one week. According to Mercuria experts cited in the report, “at the current pace of draws, those Chinese inventories could deplete [to zero] by the middle of June.” This surge in demand has been partly driven by U.S. buyers looking to secure supply ahead of anticipated trade tariffs, helping copper prices rise to US$4.89 per pound. Proactive noted that copper had climbed from below US$4 at the start of the year to above US$5.20 in late March, reflecting strong market momentum despite recent short-term volatility.

On April 29, 321 Gold emphasized the broader macro environment supporting commodities, noting that global market pressures such as inflation, tariff dynamics, and fiscal policies were reshaping investment strategies. The report suggested that while attention often turns to precious metals, industrial metals like copper benefit from these same global forces, especially as governments and industries invest in critical infrastructure and clean energy transitions.

Maund updated his view, assigning a Strong Buy rating. He identified an initial price target of CA$0.30 for Giant Mining, which the company reached that day, and set a second target at CA$0.60.

Bloomberg News wrote on April 30 that U.S. copper prices had briefly dipped as traders squared positions before China’s Labour Day holiday, with futures on New York’s Comex touching US$4.524 per pound before recovering.

While some weakness in China’s manufacturing data tempered short-term optimism, Bloomberg acknowledged that earlier optimism remained valid, pointing to “narratives of a significantly tighter copper market in China as stockpiles plunged and import premiums rebounded.” This backdrop reinforces the ongoing strength in copper’s global demand outlook.

According to a May 5 analysis by SMM, copper markets showed signs of resilience and recovery following the holiday period. SMM reported that LME copper rebounded above US$9,300 per metric ton after a brief dip to US$9,088, supported by continued inventory drawdowns and steady demand. Domestic copper cathode production in China increased in April to 1.1257 million metric tons, up 0.32% month over month and 14.27% year over year, while social inventories fell by nearly 200,000 metric tons, driving apparent consumption to nearly 1.5 million metric tons — a potential record. SMM highlighted that global copper concentrate supply remained tight, with overseas disruptions and shifting trade flows reinforcing a positive long-term sector outlook.

Technical Signals Highlight Strong Buy Rating

In a March 5 report, Technical Analyst Clive Maund provided a positive assessment, describing it as “an excellent time to buy or add to positions.” He explained that the stock had completed a major Cup and Handle base pattern on its 10-month chart, which is widely considered a bullish indicator. Maund emphasized Giant’s “highly bullish volume pattern,” pointing out that the strong volume rally on the right side of the cup signaled increasing investor confidence that the company was “turning the corner,” especially given the supportive backdrop of tariff barriers for domestic U.S. copper firms.

*By May 2, Maund updated his view, assigning a Strong Buy rating. He identified an initial price target of CA$0.30 for Giant Mining, which the company reached that day, and set a second target at CA$0.60, underscoring his sustained optimism about the technical momentum and the stock’s potential.

Path to a New Resource Estimate and Growing Exploration Upside

According to the company’s May 2025 investor presentation, Giant Mining is actively advancing its 2025 drill program, which launched in March and includes five planned holes totaling approximately 4,400 feet (1,340 meters). Four of these holes follow up on prior drilling, while a fifth, designed using ExploreTech’s artificial intelligence, targets a high-potential southern resistivity anomaly. This exploration is focused on expanding mineralization zones and advancing the project toward a new mineral resource estimate, building on more than five years of drilling campaigns. [OWNERSHIP_CHART-11069]

The company also holds a 20% stake in the Friday Gold Project in Idaho, where a historical resource estimate indicates 1.237 million ounces of gold. Management reported a fully diluted share count of approximately 116.1 million shares as of May 1, 2025, with a market capitalization of CA$13.4 million and a 52-week share price range of CA$0.11 to CA$1.78. Giant Mining’s strategic location within a top-tier jurisdiction, combined with its experienced leadership team and focus on the electric vehicle and renewable energy sectors, positions it to benefit from increasing demand for copper and gold. Management expects continued progress on drilling milestones, environmental assessments, and updated technical reporting to drive the project’s momentum in the coming quarters.

Ownership and Share Structure

According to Giant Mining Corp., approximately 15.1% of its shares are held by insiders. The remaining shares are held by retail investors.

As of May 5, 2025, Giant Mining Corp. has a market capitalization of approximately CA$22.77 million, based on a closing share price of CA$0.305.

The company’s current share structure includes 74,664,097 shares issued and outstanding, 38,231,865 warrants, 850,000 options, and 2,400,000 restricted share units.

The company’s shares are traded on the Canadian Securities Exchange (CSE) under the ticker BFG, on the Deutsche Boerse AG (DB) under the ticker YW5, and on the OTC Pink Sheets in the U.S. under the ticker BFGFF, with these listings active since December 2017.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Giant Mining Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Giant Mining Corp.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

* Disclosure for the quote from the Clive Maund article published on May 2, 2025

- For the quoted article (published on May 2, 2025), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing the article quoted. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in the article accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

Clivemaund.com Disclosures

The quoted article represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.

( Companies Mentioned: CSE: BFG;OTC:BFGFF;FWB:YW5,

)

The Fall of the House of Gold

Source: Rick Mills 05/07/2025

Rick Mills of Ahead of the Herd once again interviews Bob Moriarty of 321Gold, speaking about current events and sharing some investment ideas.

Below is an interview by Rick Mills, the editor and publisher of Ahead of the Herd, with Bob Moriarty of 321Gold.

Rick Mills (RM): As someone with a military intelligence background from Vietnam, what’s your take on recent Pentagon controversies? The Defense Secretary apparently has makeup facilities in his office, uses unsecured communications for classified discussions with family members, and appointed his blogger brother to a liaison position. Have you encountered anything comparable?

Bob Moriarty (BM): An apt description would be “embarrassing.” From my perspective, we’re witnessing the empire’s twilight years. Historical patterns repeat — during Rome’s decline in the 300-400s AD, leadership positions were filled with incompetents. Our recent presidential lineup demonstrates this pattern. The current administration surrounds itself with self-important figures. Installing cosmetic services within the Defense Department seems particularly bizarre.

RM: Leadership quality seems to deteriorate with each election cycle in North America.

Nuclear Diplomacy and Regional Conflicts

Regarding Iran’s nuclear situation, Obama established the 2015 nuclear agreement, Trump withdrew in 2018, and imposed sanctions. Recent talks between the countries occurred last Wednesday, with more scheduled. Have you reconsidered your prediction about potential military action by the U.S. and Israel against Iran?

BM: The situation is straightforward. Netanyahu claimed in 1992 that Iran was near nuclear capability. Trump canceled the agreement preventing Iranian nuclear weapons development, and now argues that attacking is necessary to prevent them from developing such weapons. Meanwhile, his own intelligence director recently confirmed what 18 other American intelligence agencies report — Iran has no active nuclear weapons program.

Confronting superior firepower unprepared guarantees defeat. Israel has repeatedly threatened Iran, while Trump attempts to please multiple constituencies. He demands Iran abandon all defense capabilities to eliminate a non-existent nuclear program — an unreasonable expectation.

Two factors should prevent American and Israeli military action: petroleum prices would skyrocket as the Strait of Hormuz closes, and Iran possesses hypersonic missiles capable of devastating Israeli territory.

RM: There’s been significant pushback when discussing Israel’s Gaza campaign — critics are instantly labeled anti-Israeli or antisemitic. Free discussion should be permitted. The continued bombing of civilians, hoping to eliminate militant targets, seems counterproductive. The civilian-to-combatant casualty ratio creates more extremists with each incident. This approach won’t break the cycle.

Trump recently suggested Russia’s willingness to halt expansion short of conquering all of Ukraine represents a “significant concession.” Does this indicate America abandoning Ukrainian support?

BM: Effectively, yes. Trump now recognizes that Western powers initiated this conflict, which ends either with Ukraine’s elimination or Western withdrawal.

Recent developments are alarming — France’s president discussing nuclear protection for Europe, Germany’s chancellor promoting long-range strikes against Russia, Britain offering limited troop deployment. Something unreported elsewhere that I can document: military personnel from France, Germany, Canada, America, and Britain are currently dying in Ukraine. This isn’t merely Ukraine versus Russia but an American-initiated conflict that continues until America terminates it.

President Trump could earn peace recognition immediately by informing Ukrainian leadership the conflict ends now, then telling Netanyahu American financial support for “stupidity” has ceased. America enables these situations through unlimited backing. American policy, not Israeli actions, created these problems. Both conflicts end when American funding stops.

RM: Agreed. Trump presently has leverage to negotiate with Putin — establish current positions as permanent boundaries.

BM: Putin has no incentive to negotiate from a winning position. Russian forces eliminate hundreds or thousands of Ukrainian soldiers daily. Western powers broke promises from December 2021 security guarantees, the Minsk-2 agreement, and NATO’s 1990 pledge against eastward expansion. America, Germany, Britain, and Ukraine failed to honor commitments. Why should Putin halt his successful campaign?

RM: Despite his battlefield success, economic considerations might sway Putin. Removing sanctions, encouraging corporate reinvestment, and mineral development partnerships with Trump might motivate a settlement preserving current territorial gains, preventing Ukrainian NATO membership, while establishing mutually beneficial economic projects.

BM: Trump suggesting American management of nuclear facilities equals the absurdity of transforming Gaza into vacation properties. Russia consistently prioritized secure borders. This isn’t about energy resources — European nations purchase more Russian energy now than before 2022.

RM: Sanctions against Russia and Iran seem ineffective, particularly regarding commodities, due to circumvention methods.

BM: Precisely, sanctions fail. I identified them as European economic suicide immediately after hostilities began. The German chancellor authorized the Nordstream pipeline destruction, damaging European interests by $30 billion while claiming to harm Russia. Instead, they devastated their own economy.

RM: Interestingly, returning that power plant represents virtually the only condition imposed on Russia in recent proposals. This suggests Trump still desires control.

BM: Russia has no motivation to relinquish it.

RM: Russia might concede certain points for sanctions relief and economic partnerships. Their situation isn’t advantageous either. They face severe interest rates exceeding 20%, food scarcity issues, inflation above 10%, and population exodus, avoiding conscription. Their economy struggles significantly, they’ve depleted Cold War-era military stockpiles, and increasingly rely on conscripts rather than professional forces or prisoners. North Korean personnel have increased, and Chinese representatives have appeared on battlefields. Russia resembles North Korea, sustained by commodity exports.

BM: Ukraine should prioritize peace negotiations. Reports suggest between 1.2-1.5 million Ukrainian military casualties, significantly higher than America’s 425,000 losses during five years of World War II. The conflict devastates Ukraine.

Regarding Ukraine’s peace commitment, their recent treatment of a Russian general demonstrates their position. Meanwhile, Zelensky and associates siphon foreign assistance funds. Post-conflict investigations will reveal substantial percentages of aid disappeared into oligarchs’ accounts.

RM: Ukraine cannot achieve victory and should salvage remaining assets. Trump’s approach resembles protection rackets — damage before offering terms.

Let’s discuss India-Pakistan tensions.

BM: Those nations approach potential conflict, both possess nuclear weapons, and might employ them. Global accountability for aggressive actions seems absent.

Similar patterns appear in Gaza, the West Bank, Syria, and Iran. Ukrainian forces just killed a Russian general while Trump claims to pursue peace. Does this combination of Ukrainian assassination activities and peace rhetoric make sense?

RM: Both countries maintain nuclear arsenals. The current flare-up follows militant actions killing 26 people in Kashmir.

India blames Pakistan, resistance fighters claim responsibility, while India attributes this to Pakistani military-supported militants. They’ve disputed the Himalayan territory in Kashmir for generations.

Water access represents their primary dispute. India controls Pakistan’s water supply and recently threatened restrictions, which Pakistan considers a justification for warfare. Conflict appears imminent without mutual support systems.

BM: India has already restricted Pakistan’s freshwater access, prompting Pakistan’s declaration of a potential military response. Imminent air strikes or nuclear exchanges remain possible. Global destabilization continues while Trump’s administration exacerbates conditions without prospects for improvement.

Economic Rivalry: US-China Trade Relations

RM: Regarding US-China trade disputes, Trump claims productive discussions while China denies any communication or agreements.

Economic relationships between these nations are significant – together they represent 43% of global GDP and produced 48% of global manufacturing output last year. China holds approximately $760 billion in American treasury bonds, making it the second-largest foreign creditor after Japan.

Complete economic separation seems implausible. China maintains several advantages: demonstrated population resilience during pandemic restrictions, alternative trading partners beyond America, and established diversification efforts reducing American dependence. China’s critical mineral dominance provides additional leverage.

Recent developments suggest that Trump is facing setbacks in this economic confrontation. Your perspective?

BM: Absolutely. An overlooked factor — Chinese soybean purchases from America were essentially goodwill gestures. Brazil leads global soybean production, offering China alternative supplies. Without military action, China could bankrupt thousands of American farmers simply by redirecting purchases.

Agricultural planting follows strict seasonal windows — current decisions affect this year’s planting. Farmers don’t decide when to plant in January or July — preparations begin months earlier. China has effectively canceled billions in soybean orders.

Their actions severely impact American industry — restricting exports of tungsten, antimony, various minerals, rare earth elements, and specialized magnets. These limitations devastate American manufacturing capabilities.

Your question about tariff conflicts deserves consideration — who ultimately prevails in any conflict? Having experienced warfare personally, I’d suggest differently.

RM: Nobody wins; only survivors remain to rebuild.

BM: Precisely, minimal damage becomes the objective. World War II devastated Europe extensively. During my first European visit while on leave from Vietnam in 1969, French citizens still relied on bicycles 25 years after hostilities ended.

Conflict inevitably harms all participants, and there is a powerful motivation to avoid initiating hostilities. Trump’s outsized self-importance leads him to believe presidential authority guarantees success, but power has limitations he’s discovering.

I recently reviewed a significant analysis suggesting bond markets now control global geopolitics. Trump’s actions are intended to reduce interest rates instead of increasing them. Tariffs function as taxes — they reduce economic activity.

Has American tariff policy been misguided for 75 years? Certainly. Do foreign nations exploit America? Only through systems that America established. Either global cooperation prevails or universal failure results. Declaring economic warfare against your primary trading partner defies comprehension, comparable to opening borders completely with extensive financial incentives for all arrivals.

RM: Canada follows similar policies with higher benefits and healthcare coverage.

BM: Tariff rationalization makes sense, but replacing income taxes with tariffs remains impossible. When tariffs provided primary government revenue, the government represented 3% of the economy versus today’s 25%. Income taxes cannot be replaced through tariff systems.

RM: The government efficiency initiative headed by Musk lacks substance. He admits maximum savings of $150 billion total, which doesn’t offset revenue losses from reduced tax enforcement staffing.

BM: Another overlooked metric — comparing final Biden administration spending versus initial Trump administration expenditures reveals troubling patterns.

RM: Interesting comparison, though Trump largely operates under Biden’s established budget during his first year.

BM: We’re exceeding Biden’s budget significantly. Trump increased defense spending by 11% beyond Biden’s allocations. Our financial situation has deteriorated since Biden’s administration, though Biden-era spending contained egregious corruption. Specific amounts matter less than fundamental reality — America faces insolvency.

Everyone with basic economic understanding recognizes America cannot meet $200 trillion in unfunded obligations over five decades. Musk acknowledged Social Security operates as a Ponzi scheme — a reality Congress accepts but considers untouchable. Resolving these issues requires civil unrest, revolution, or catastrophic military defeat to prompt actions we should have taken 50 years ago. Judy Shelton’s brilliance would benefit the Federal Reserve tremendously.

Investment Ideas

RM: Let’s discuss promising gold investments.

Regarding your upcoming recommendation, I previously advised purchasing three specific stocks during winter for exceptional returns the following year — Underworld, Atac and Kaminak during the White Gold Area Play. Your current recommendation shares connections with Kaminak’s team.

BM: My recommendation is Tectonic Metals Inc. (TECT:TSX.V; TETOF:OTCQB; T15B:FSE). They control significant Alaskan territory with historical placer gold production exceeding several million ounces. Their drilling program has achieved 100% success rates, discovering gold in every attempt.

A relevant market observation from Rambus Chartology: “Presently, there are just a few micro-caps that are starting to show some light, which is normal at the beginning of a bull market. In previous strong bull markets in the PM complex when the microcaps come to life, it’s an expression that went something like this.

Microcaps are like listening to popcorn popping, first one kernel pops, then another, until the popping is finished. Most of the kernels popped, but there were always a few kernels that didn’t. And that will be pretty much how the microcaps will trade when their time comes, which is why you need a basket of them. The ones that pop will more than make up for the ones that don’t. This is where you get the five and 10-baggers.”

For months, I’ve explained junior resource underperformance resulted from capital flowing into broader equities and cryptocurrencies — a pattern now reversing. Major mining companies like Newmont Corp. (NEM:NYSE) and Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) show upward momentum, followed by mid-tier producers, with juniors showing early recovery signs.

TECT controls the extensive Flat Gold Project with drilling resuming next month. Their primary Chicken Mountain target shows 86 successful drill holes, with 46 ending in mineralization. Their current $5 million fundraising fully finances this year’s exploration. Recently valued at a market capitalization of nearly $25 million, this opportunity appears exceptional.

Trump’s January 20th executive order, “Unleashing Alaska’s Extraordinary Resource Potential,” supports mining development. Wealth creation fundamentally derives from three sources: mining, manufacturing, or agriculture. Having outsourced manufacturing to China and damaged agricultural markets through tariffs, mining represents America’s primary remaining wealth generation mechanism. Expect increased mining sector support under this administration. TECT remains attractively priced with Crescat Capital’s backing. Alaskan and Yukon projects generally should perform well in the coming months.

RM: My recommendation also targets Alaska’s critical mineral sector: Graphite One Inc. (GPH:TSX.V; GPHOF:OTCQX)

Aluminum and graphite represent the most crucial military metals. Graphite remains essential for modern economies, yet America lacks domestic supply, depending entirely on Chinese sources.

Graphite One offers comprehensive solutions — mining, manufacturing, and recycling capabilities domestically. Their mine near Nome, Alaska complements manufacturing facilities in Ohio — previously represented by now-Vice President Vance.

Within 2.5 years, their manufacturing plant should process 25,000 tonnes of synthetic graphite into finished products, planning six additional production modules thereafter. Initial module revenues are projected at US$200 million annually, generating substantial early cash flow.

Their exceptional high-grade graphite deposit ranks among the world’s largest, capable of supplying American requirements for generations, with surplus for strategic reserves.

They’re establishing domestic capabilities in a market currently dominated by Chinese imports. Providing American graphite supply security represents tremendous strategic value.

Their feasibility study indicates a highly viable mining operation targeting a 2030 production start, with companion studies demonstrating manufacturing profitability in Ohio. At Canadian $0.95 per share, significant growth potential exists given the security of supply imperative.

BM: My previous graphite sector research confirms your assessment. Graphite serves hundreds of applications as a genuinely critical mineral, positioning Graphite One ideally.

RM: Let’s continue our discussion next week.

BM: Looking forward to it.

You can view more from Rick and Bob at Ahead of the Herd and 321Gold.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Tectonic Metals Inc. is a billboard sponsor of Streetwise Reports.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Tectonic Metals Inc. and Agnico Eagle Mines Ltd.

- Rick Mills: I, or members of my immediate household or family, own securities of: Tectonic Metals Inc. and Graphite One Inc. My company has a financial relationship with Graphite One Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Bob Moriarty: I, or members of my immediate household or family, own securities of: Tectonic Metals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

- This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.

For additional disclosures, please click here.

Ahead of the Herd Disclosures

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

( Companies Mentioned: GPH:TSX.V;GPHOF:OTCQX,

TECT:TSX.V; TETOF:OTCQB; T15B:FSE,

)