The world economic and financial markets have entered into a crippling cannibalization of the system in which few are prepared. While the politicians, financial analysts, and media are providing optimistic forecasts for the future, they continue to underestimate the seriousness of the global contagion. Thus, after a week or two, these forecasts will be revised lower (once again) to reflect a more gloomy, negative and more realistic outlook.

So, in another a few weeks, the world as it pertains to this contagion will look a lot worse than it does today. I’d imagine the Dow Jones Index will likely shed another 5-8,000+ points during this period. Also, the global supply chain disruptions will kick into high gear as month-long lockdowns in various countries finally impact manufacturers and retailers across the world.

I haven’t put out too many new updates and articles over the past few weeks. Rather, I decided to take a step back to research and watch as this global contagion continued to unfold. However, I will be putting out more updates, videos, and articles over the next month as I believe most people are still unprepared for what’s coming.

Although, I have been a bit busy on Twitter recently. You can follow my TWEETS and REPLIES on Twitter here: SRSRocco Report Twitter Feed. When I posted this Tweet on March 15th, the price of oil was $31. I stated that the price would likely fall to $29 the next day… and it did. The relevant sentence in the tweet below is… WE DON’T COME BACK FROM THIS ONE.

Today, in early Asian trading, the oil price is trading in the $27 range. If $31 oil was destroying Shale Oil Companies left and right, $27 is undoubtedly wreaking havoc inside and out. Unfortunately, the worst is still yet to come. I now believe we could see oil reach the low $10s. And, to make matters even worse, the wholesale gasoline price is currently trading at 72 cents a gallon… LOL. If you add state and federal taxes, along with a bit of profit by the gas station, the price at the pump would be approximately $1.40-$1.50 a gallon. It will likely take a few weeks for the lower price to finally make it to the pump.

What happens when the oil price reaches the low $10s?? Gasoline will be selling for 99 cents a gallon or less. Can you imagine? This is partly the reason we are seeing a low PAPER SILVER price. I will get into the details of why this is the case in a video shortly. However, physical silver prices for bullion are $4-$8 higher than the spot price, and the spread may continue to increase going forward.

Physical Silver Buying Surges As Fear, Panic and Common Sense Hit Investors

Investors are buying record amounts of physical silver for very different reasons. If you are a “Seasoned” precious metals investor, you may be adding more silver to your holdings because common sense says it’s a good idea. On the other hand, new investors to the precious metals are likely buying due to Fear and Panic. Many of these investors have thought about buying gold and silver for years, and now that the market is disintegrating right before our eyes… they have finally decided to PULL THE TRIGGER.

Unfortunately, these new investors have started to acquire precious metals at the worst possible time… when an avalanche of people has come into the market. This is like the infamous video now circulating on Twitter showing the extensive long lines at Costco. Click on the video posted by Craig at TFMetals Report if you haven’t seen it yet. This is what panic looks like when people decided to prepare at the last minute.

I see this happening with physical gold and silver buying in the next few weeks-months. As the situation continues to collapse in the Financial and Economic markets, more Americans are going to get PRECIOUS METALS RELIGION. Regrettably, for the new investors, supply will get even tighter as prices rise.

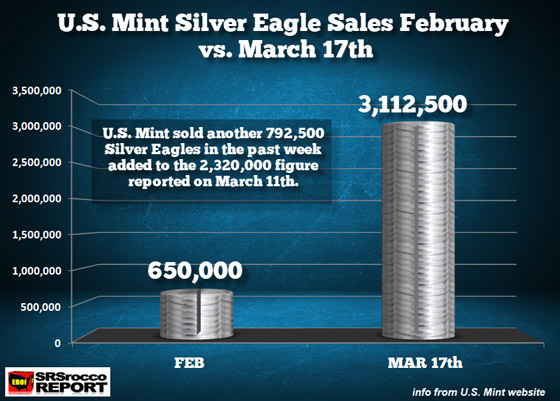

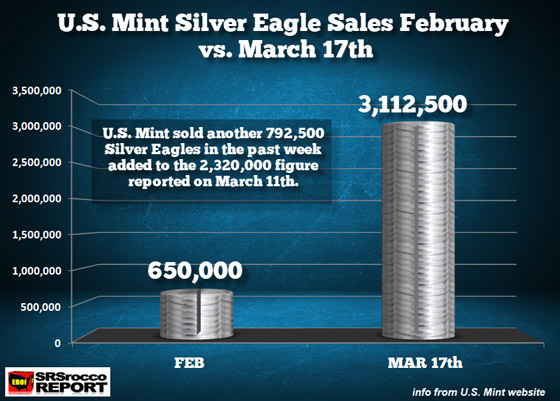

I have heard from precious metals dealers that the past two days have been the busiest in 30-40 years. The result has pushed U.S. Mint Silver Eagle Sales to a new monthly high not seen in years, excluding sales for January (typically higher each year due to restocking of the latest issue). According to the U.S. Mint’s recent update today, sales of Silver Eagles as of March 17th reached 3,112,500:

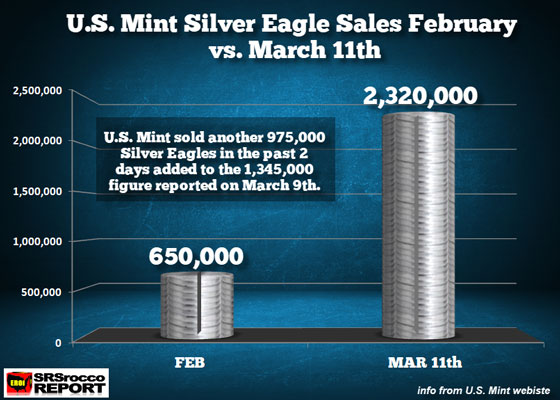

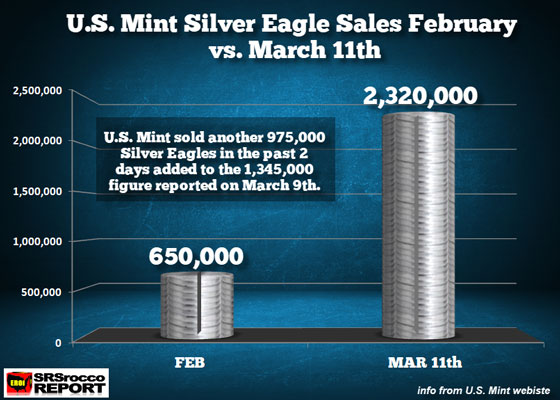

Now compare that to my last update on March 11th:

In the past week, the U.S. Mint sold another 792,500 Silver Eagles. What’s interesting is that several precious metals dealers stated that the U.S. Mint had suspended sales last week. Well, it looks like they continued to sell more these past few days. It will be interesting to see if the U.S. Mint can ramp up production to 4-5 million a month as they were doing back in 2015-2016. But what happens if there are more lockdowns? There are a lot of unknowns moving forward.

Regardless, the U.S. Mint sold more Silver Eagles in March, that we have to go back to 2016 to find monthly sales 3-4 million.

So, here’s what’s really fascinating about the retail SILVER BULLION MARKET. The Buy-Sell spread on Silver Eagles in four various large online dealers averages about $9.00 a coin!!! This means, if you want to sell your Silver Eagles to one of these Dealers, you are going to get $9 less than what they are selling them currently.

Here are the BUY & SELL prices from four large online dealers as of 3 pm MST on March 17th:

The BUY price is shown in the SILVER COINS, while the RED COINS displays the SELL price. So, if you wanted to purchase a Silver Eagle from this first dealer in the chart, you would pay $22.98. But, if you wanted to sell, they would buy it from you for $8.85 less at $14.13. The last dealer with the $19.70 price (*) did not have any in stock and likely didn’t update its prices to the $22-$23 range. These prices are based on buying the largest number of Silver Eagles. If you wanted to only buy 1-19 Silver Eagles from the first dealer in the chart, you would pay $24.88

Of course, you weren’t going to get your Silver Eagles shipped right away because these dealers sold out most of their stock and are currently selling based on new stocks to arrive later… in most cases, Mid-April.

So, here’s the important question? While the paper silver price is low, why haven’t precious metals dealers raised their SELL TO price to get more inventory?? Good question. Why on earth would anyone sell their Silver Eagles for $14 when the dealers are selling at $23?? However, we can’t blame the dealers because they get their bullion and price quotes based on the few large wholesalers-suppliers.

Crazy, isn’t it?? The market is totally distorted. Also, you also can’t blame the wholesalers for this huge BUY-SELL spread because their silver bullion stock was built upon prices of silver in the $17-$18 range. Why would they sell Silver Eagles at $14??

What we are seeing in the physical precious metals market is the same disruptions taking place in the Financial Markets. The Bid and Ask spreads for the most liquid financial asset in the world, U.S. Treasuries, have been upwards of 200 basis points (2%) for the 30-year treasury. The same thing is taking place in the Stock Market, especially in ETFs. Due to the collapse in prices, no one is willing to buy close to the ASK price because the stock market could collapse even further. So, if an ETF is trading at say $25.00, the Bid-Ask Spread might be 5-10 cents in a normal market. But now, spreads are $1-3 at times… LOL.

And again… THE WORST IS STILL YET TO COME.

For all of the silver investors who are worried about the low paper price… DON’T BE. I didn’t expect to see such a dramatic sell-off in silver, but now that it has arrived, investors really can’t buy physical silver at $12.50-$13. Even Silver Rounds are selling at $15-$16 apiece… BUT you still can’t get them for WEEKS or a MONTH.

As I stated at the beginning of the article, I will be doing more extensive VIDEO UPDATES on the Precious metals and the global contagion. For example, if the oil price has fallen 50% in just the past month, then the COST OF PRODUCTION for the primary silver miners has also dropped considerably. According to my analysis, the primary silver miners’ average cost of production was about $14.50-$15 in Q4 2019. Thus, if we are basing silver as a “Commodity” ONLY, then it isn’t surprising that the price fell lower due to the decline in Industrial demand and energy prices.

Furthermore, silver tends to get Whacked more than gold on the way down. But, what’s a bit strange is to see that copper is only down 19% versus 33% for silver from their peaks in 2020:

As we can see, while the silver price is down 33%, copper lower by 19%, and gold is only off by 9% from their peaks in 2020. When gold and silver corrected from their highs in 2008, silver fell 60% while gold fell 30%. Here, silver is down a lot more in percentage terms than gold and even the king industrial metal, copper.

Even though copper is down 19%, I see it dropping like a rock to $$1.50 or lower. Currently, copper is trading at $2.33 a pound. Why isn’t copper lower…LOL?? Gosh, with the world shutting down its global engine, who the hell needs much copper?? Moreover, with many dealers selling Copper Rounds at 99 cents and higher, FOR a 1 OUNCE COIN, who in their right mind would purchase them when you can buy a pound of copper for $2.50???

Here’s the DEAL… we are headed for SERIOUS TROUBLE ahead. I would not get too focused or worked up about the paper silver prices. We are just in the beginning phase of this global contagion. If you think Toilet paper is a hot commodity now, wait until more Americans wake up about Gold and Silver.

In Conclusion… we have entered into a collapse function of our Highly Leveraged Debt-Based Fiat Monetary System that was going to happen sooner or later. This global contagion just moved up the time-clock and speed.

WE WILL NOT COME BACK FROM THIS ONE. Rather, we will enter into a new world that will be very chaotic and tumultuous. While the precious metals won’t solve all our problems, at least they will protect wealth during this time when many financial assets get wiped out.