Category: Gold

Source: Joe Reagor 05/02/2025

MAG Silver Corp. (MAG:TSX; MAG:NYSE American) recently released strong first-quarter production figures, according to a research note from ROTH Capital Markets.

In a recently published research report dated April 28, 2025, ROTH Capital Partners analyst Joe Reagor maintained a Neutral rating on MAG Silver Corp. (MAG:TSX; MAG:NYSE American), with an unchanged price target of US$16.00 per share. With the price at the time of the report being US$15.48, this target price represents an almost 4% implied investor return.

The report highlighted the company’s strong first-quarter production figures but expressed caution about overall market volatility.

MAG Silver, which owns a 44% stake in the Juanicipio Joint Venture (JV) with Fresnillo Plc (56%), announced production results that surpassed analyst expectations for Q1 2025. The JV produced 4.5 million ounces of silver, 10,198 ounces of gold, 10.6 million pounds of lead, and 16.9 million pounds of zinc during the quarter. According to Reagor, this production beat was primarily due to slightly higher throughput and grades at the operation, though recoveries showed mixed results compared to previous estimates.

The precious metals market has experienced significant price increases in 2025, with gold reaching unprecedented heights at US$3,272 per ounce and silver following the upward trend at US$32.89 per ounce as of the report date. Reagor attributes this rally to increased market volatility stemming from policy changes under the Trump administration and renewed inflation concerns, particularly as new tariffs are expected to drive cost increases across numerous industries.

Despite the strong production figures and favorable metal prices, Reagor elected to maintain the US$16.00 price target for MAG shares. The report noted that these positive factors contributed to a US$0.10 per share increase in the company’s discounted cash flow valuation, but this wasn’t sufficient to warrant a target price adjustment. The analyst characterized Juanicipio as “a world-class asset that is relatively fairly valued by the market.”

The financial outlook for MAG projects that 2025 will generate US$0.74 in fully diluted earnings per share, slightly below 2024’s US$0.75, with a further decline to US$0.59 anticipated in 2026. This gradual decrease occurs despite the current favorable precious metals pricing environment.

Reagor’s valuation approach combines an annualized discounted cash flow analysis using a 6.5% discount rate with a sum-of-the-parts methodology. The base DCF value of US$676.1 million is enhanced by a 50% premium (US$338 million) that accounts for potential acquisition by Fresnillo or another producer, as well as recognition of the high quality of MAG’s underlying assets.

Additional value components include US$450 million for production and exploration upside at Juanicipio and US$75 million for other assets such as the Deer Trail and Larder projects. After adjusting for MAG’s year-end 2024 net cash position of US$160.1 million and the company’s 44% share of future estimated JV cash (US$17.6 million), the total calculated value reaches US$1.7 billion or US$16.28 per fully diluted share, which Reagor rounds down to arrive at the US$16.00 target price.

The report also outlines several key risk factors that could impact MAG Silver’s performance, including political risks related to potential regulatory changes in Mexico, commodity price fluctuations (particularly for silver), operational and technical challenges common to mining companies, and broader market risks associated with economic cycles.

As of April 25, 2025, MAG Silver was trading at US$15.48 per share, within its 52-week range of US$11.58 to US$17.99. The company has 103.45 million shares outstanding, giving it a market capitalization of approximately US$1.62 billion. According to the most recent financial reports, MAG held US$162.3 million in cash against just US$2.2 million in total debt.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- MAG Silver Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Disclosures for ROTH Capital Markets, MAG Silver Corp., April 28, 2025

Regulation Analyst Certification (“Reg AC”): The research analyst primarily responsible for the content of this report certifies the following under Reg AC: I hereby certify that all views expressed in this report accurately reflect my personal views about the subject company or companies and its or their securities. I also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Disclosures: ROTH makes a market in shares of MAG Silver Corp. and as such, buys and sells from customers on a principal basis.

Each box on the Rating and Price Target History chart above represents a date on which an analyst made a change to a rating or price target, except for the first box, which may only represent the first note written during the past three years. Distribution Ratings/IB Servicesshows the number of companies in each rating category from which Roth or an affiliate received compensation for investment banking services in the past 12 month. Distribution of IB Services Firmwide IB Serv./Past 12 Mos. as of April 27, 2025 Rating Count Percent Count Percent Buy [B] 366 78.21 111 30.33 Neutral [N] 84 17.95 5 5.95 Sell [S] 0 0.00 0 0 Under Review [UR] 17 3.63 3 17.65

Our rating system attempts to incorporate industry, company and/or overall market risk and volatility. Consequently, at any given point in time, our investment rating on a stock and its implied price movement may not correspond to the stated 12-month price target. Ratings System Definitions – ROTH Capital employs a rating system based on the following: Buy: A rating, which at the time it is instituted and or reiterated, that indicates an expectation of a total return of at least 10% over the next 12 months. Neutral: A rating, which at the time it is instituted and or reiterated, that indicates an expectation of a total return between negative 10% and 10% over the next 12 months. Sell: A rating, which at the time it is instituted and or reiterated, that indicates an expectation that the price will depreciate by more than 10% over the next 12 months. Under Review [UR]: A rating, which at the time it is instituted and or reiterated, indicates the temporary removal of the prior rating, price target and estimates for the security. Prior rating, price target and estimates should no longer be relied upon for UR-rated securities. Not Covered [NC]: ROTH Capital does not publish research or have an opinion about this security. ROTH Capital Partners, LLC expects to receive or intends to seek compensation for investment banking or other business relationships with the covered companies mentioned in this report in the next three months. The material, information and facts discussed in this report other than the information regarding ROTH Capital Partners, LLC and its affiliates, are from sources believed to be reliable, but are in no way guaranteed to be complete or accurate. This report should not be used as a complete analysis of the company, industry or security discussed in the report. Additional information is available upon request. This is not, however, an offer or solicitation of the securities discussed. Any opinions or estimates in this report are subject to change without notice. An investment in the stock may involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. Additionally, an investment in the stock may involve a high degree of risk and may not be suitable for all investors. No part of this report may be reproduced in any form without the express written permission of ROTH. Copyright 2025. Member: FINRA/SIPC.

( Companies Mentioned: MAG:TSX; MAG:NYSE American,

)

Source: Clive Maund 05/02/2025

Technical Analyst Clive Maund explains why he thinks Kobrea Exploration Corp. (KBX:TSX; KBXFF:OTCQB; F31:FSE) is an Immediate Strong Buy.

For both fundamental and technical reasons, Kobrea Exploration Corp. (KBX:TSX; KBXFF:OTCQB; F31:FSE) is looking most attractive at this juncture. The company’s stock has dropped heavily in recent weeks. There is no news out of the company to account for this and the drop is thought in large part to be due to the 4-month hold coming off a large block of stock that was issued as a financing last December being lifted on April 21 This decline is now believed to have run its course and the stock is viewed as a strong buy here for technical reasons that we will cover when we look at the charts below.

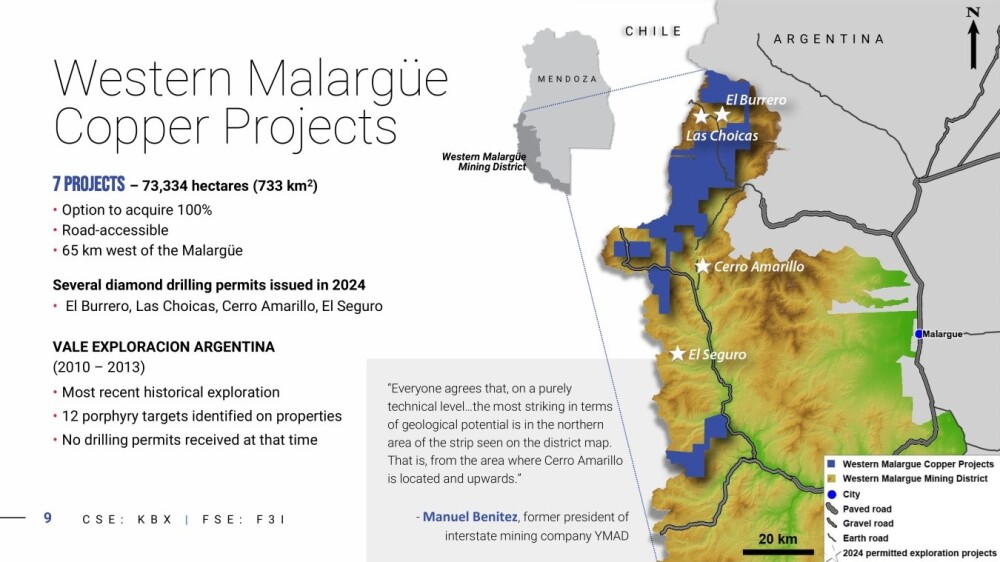

Fundamentally, Kobrea Exploration is regarded as a very interesting story and is viewed as an outstanding opportunity for investors. There are two key reasons for this. The first is that the company holds the option to acquire a 100% interest in a huge District Scale property in which 12 porphyry copper targets have already been identified in the past by mining giant VALE.

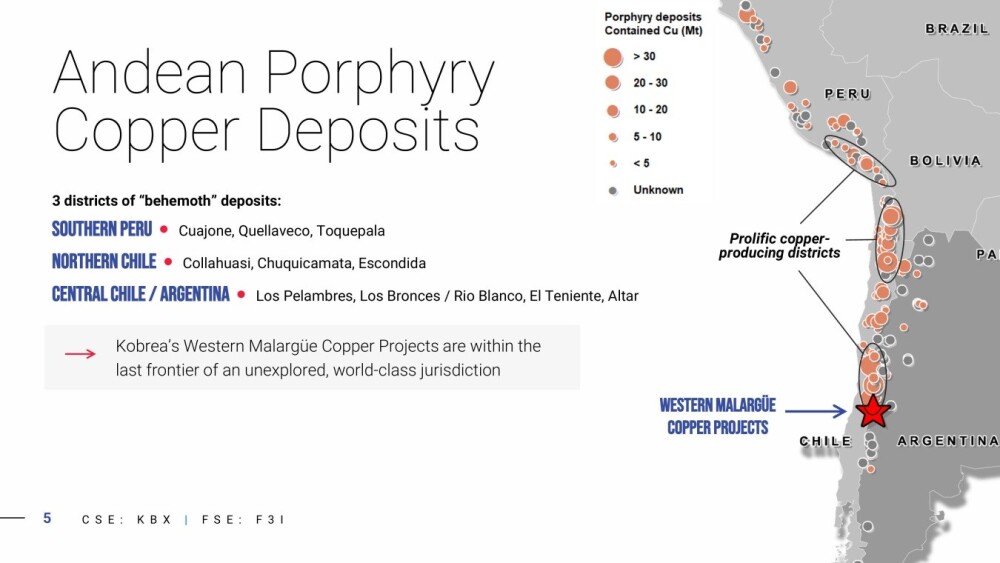

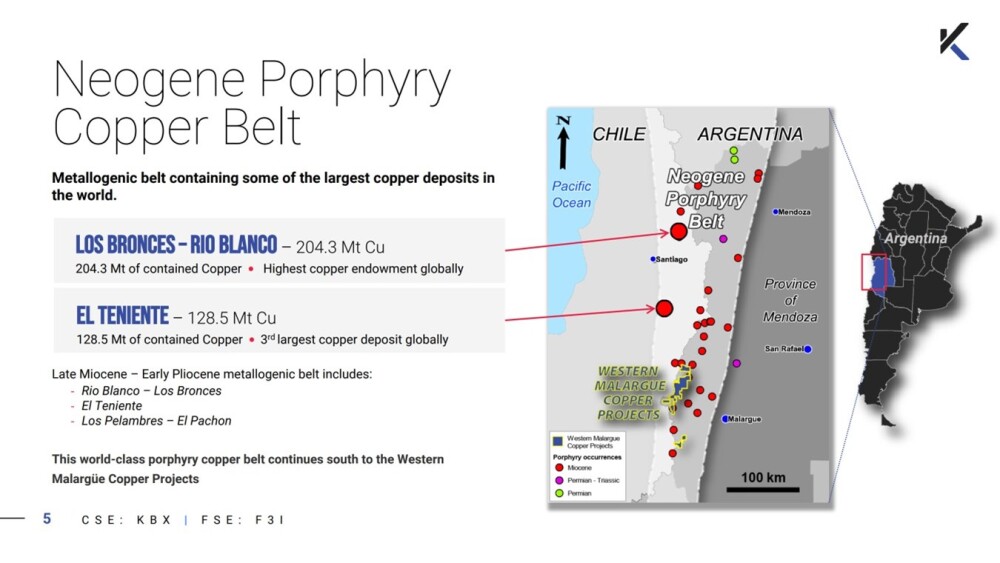

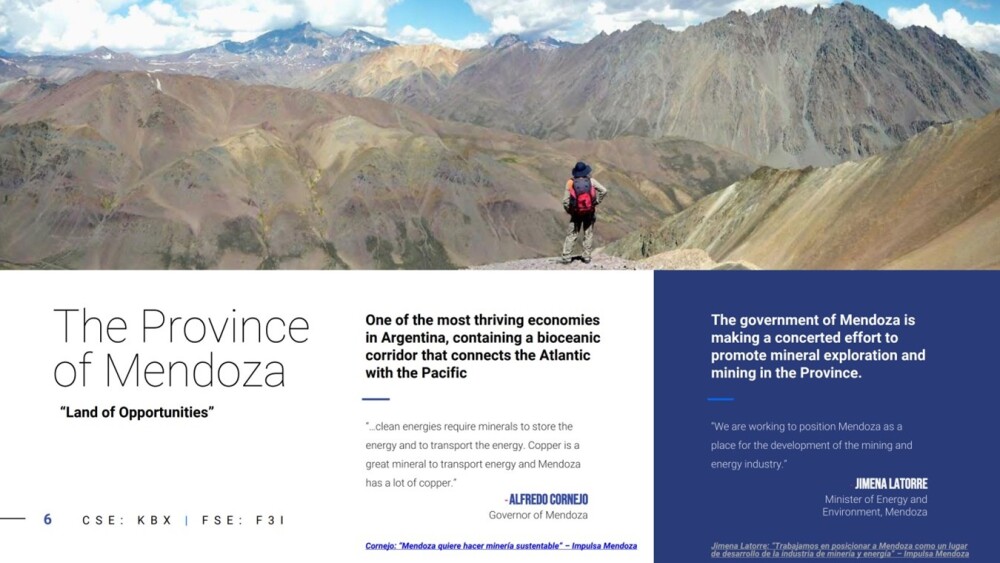

This property is located in the prolific Neogene porphyry Copper Belt in the west of Argentina. The other key reason is that Mendoza Province where the property is situated, has become much more mining friendly and is working to promote the project with the Western Malargüe Mining District being designated by the government of Mendoza Province in April of last year and, in addition, a serious copper supply crunch is imminent that is expected to drive its price much higher. The great opportunity thus being presented to the company and its shareholders is set out on this introductory slide from the company’s latest investor deck.

The company also has a 100% interest in the 5,300-hectare Upland Copper Project in British Columbia, which has a lot of potential.

Western Malargüe is located in the southern part of the most southerly of the three districts of “behemoth” copper deposits in the Andes, which contain some of the biggest and most famous copper mines in the world, such as Chuquicamata, Escondida, and El Teniente.

And it is located in the world-class Neogene Porphyry Copper Belt, not far south of the big El Teniente copper deposit across the border in Chile.

Mendoza province is renowned for its wines, but with its opening up to mining, it could soon also be well known for its copper mining. . .

As part of its efforts to promote mining in the province, in April 2024 the government of the Province of Mendoza created the Western Marlague Mining District and it has undertaken studies to promote mining exploration.

The Western Malargüe projects are very extensive, amounting to 73,334 hectares on the western border of the province, adjacent to Chile, and have vast discovery potential.

This map shows their extent and exact geographic location:

A range of diamond drilling permits were issued last year. In contrast, the main reason that VALE didn’t advance the projects in the past was that, in the very different environment that existed back then, it did not receive the necessary permits.

The potential of the Western Malargüe projects becomes more apparent when we learn that the seven main targets are not just targets, but are projects in their own right that each cover a large land area.

Please go to the investor deck, mentioned above, for more extensive information on the individual projects.

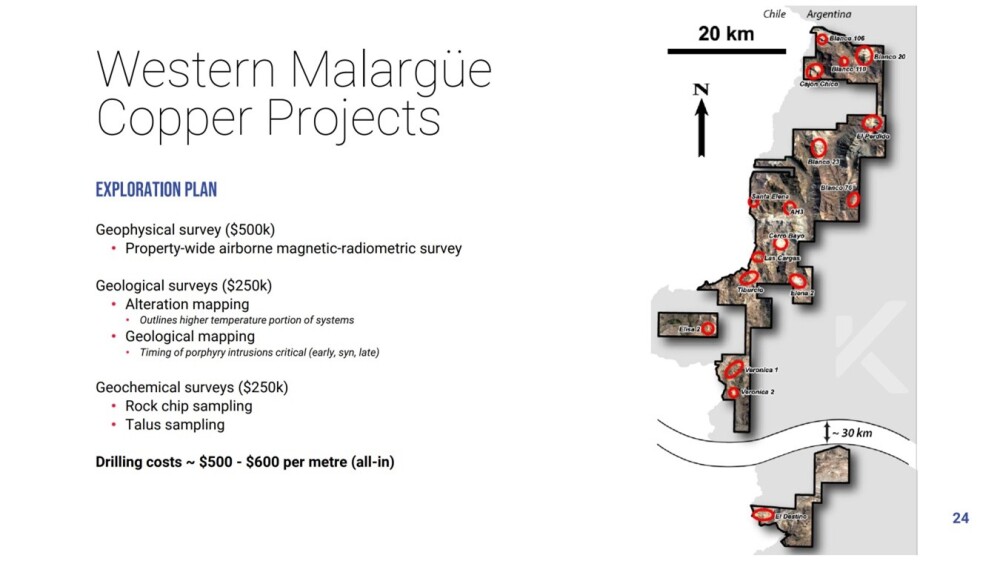

The next page sets out the exploration plan for the projects, which includes a property-wide magnetic-radiometric survey and geochemical and geological surveys.

Now, we will review the stock charts for Kobrea Exploration to see why it is viewed as an Immediate Strong Buy here.

Starting with the 6-month chart, we can see how the stock broke sharply lower early in April to commence a steep drop, which was punctuated halfway down by a classic bear Flag. This drop has resulted in the stock becoming heavily oversold on its MACD indicator, on its RSI indicator, and relative to its 200-day moving average, with which it has opened up a huge gap. It has been critically oversold on its RSI for weeks now, since early April, a situation that often leads to a big “snapback” rally.

Thus, the big volume buildup in recent days looks like a classic case of “capitulation” or panic selling at a bottom, and at the time of writing, the morning of the 2nd, volume has become climactic with today’s candle thus far being a bullish “inverted hammer.”

On the longer-term 17-month chart which shows all of the history of the stock, we can immediately see why this is a good point for it to reverse back to the upside, which is that the steep decline has brought it back into a zone of strong support approaching its cyclical lows of January and August last year.

The current very heavy volume indicates panicky “weak hands” passing their stock to “Smart Money” buyers who are only too happy to relieve them of it.

The conclusion is that this is an excellent point to buy Kobrea Exploration or add to positions in it, and it is therefore rated an Immediate Strong Buy for all time horizons. The first target for an advance is the CA$0.45 area where there is a band of resistance, with a second target being the CA$0.64 – CA$0.67 zone.

Kobrea Exploration’s website.

Kobrea Exploration Corp. (KBX:TSX; KBXFF:OTCQB; F31:FSE) closed for trading at CA$, US$ on May 2, 2025.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Kobrea Exploration Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.

( Companies Mentioned: KBX:TSX; KBXFF:OTCQB; F31:FSE,

)

Source: Streetwise Reports 05/02/2025

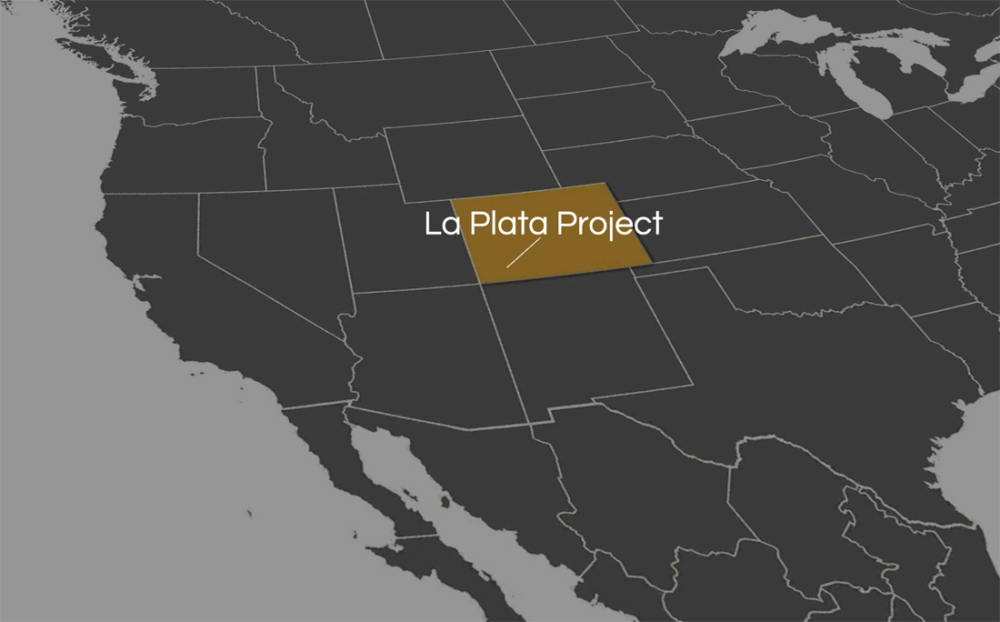

Metallic Minerals Corp. (MMG:TSX.V; MMNGF:OTCQB) on Thursday announced that “significant potential” exists for co-product critical minerals at its flagship La Plata copper-silver-gold-platinum group elements (PGE) project in southwestern Colorado. Read why one newsletter writer thinks the stock is gaining momentum.

Metallic Minerals Corp. (MMG:TSX.V; MMNGF:OTCQB) on Thursday announced that “significant potential” exists for co-product critical minerals at its flagship La Plata copper-silver-gold-platinum group elements (PGE) project in southwestern Colorado.

“Recent exploration and geochemical analyses have demonstrated elevated levels of critical minerals including light rare earth elements (REEs) with lanthanum (La) and heavy REEs with yttrium (Y),” the company said in a release. “In addition to light and heavy REEs, the company has also discovered significant concentrations of fluorine (F), gallium (Ga), scandium (Sc), tellurium (Te), and vanadium (V).”

“We are increasingly encouraged by the growing evidence that La Plata is not only an exceptional copper and precious metals system but may also be a strategically significant U.S.-based source of critical minerals,” said Chief Executive Officer Greg Johnson. “As the U.S. government continues efforts to secure domestic supply chains for essential and critical minerals necessary for advanced technology, clean energy and defense, we believe La Plata is uniquely positioned to support this national economic and geopolitical priority.”

The U.S. Geological Survey has designated the La Plata Mining District as a Critical Minerals Resource Area under the bipartisan Earth Mapping Resources Initiative. Prior sampling work by the U.S. Bureau of Mines at La Plata had shown enriched REEs and other critical minerals in the system.

Among the 55 critical minerals identified by the USGS as vital to U.S. national security and economic resilience, five of the most important dependent elements — along with both light and heavy REEs — have now been confirmed at La Plata, Metallic Minerals said.

“With current domestic sources for many of these elements nearly nonexistent, La Plata represents a rare, combined critical mineral and base/precious metal system within the U.S.A.,” the company noted.

Minerals Co-Occur With Other Base, Precious Metals

The U.S. government’s Critical Minerals Strategy was first announced in 2017 and expanded in 2022. It emphasizes building secure, domestic supply chains for these essential materials and providing strong policy support for the exploration and advancement of U.S. based critical minerals projects like La Plata.

The U.S. Senate Energy and Natural Resources Committee and the House Natural Resources Committee have demonstrated bipartisan support for securing a stable, competitive domestic critical minerals supply chain.

“To that end, proposed legislation on critical mineral exploration permitting aims to establish clearer, more consistent administrative practices, reduced bureaucracy, better defined permitting timelines, and enhanced transparency — all key components necessary to support modern, responsible resource development,” Metallic noted.

At La Plata, these critical minerals co-occur with and add to the project’s already well-established essential and critical mineral endowment of base and precious metals.

“These findings underscore La Plata’s potential to emerge not only as a significant copper and precious metal (Ag, Au, Pt and Pd) resource, but also as a strategic source of critical minerals in the U.S. that are essential for supply chains to support advanced technologies, clean energy and defense applications,” the company said.

Expert: Stock Gaining Momentum

According to a March 26 report from Peter Krauth of Silver Stock Investor, Metallic Minerals Corp. appeared to be gaining momentum as investor recognition increased.

Krauth stated that “Metallic Minerals Corp. shares are up about 50% year to date, aided by metals prices and value recognition.” He also noted that the company’s shares “look undervalued and attractive to add on minor weakness,” highlighting the potential for continued upside based on current valuation and sector trends.

The Catalyst: Reducing Foreign Dependence for Important Minerals

According to the International Energy Agency, critical minerals are essential for a range of clean energy technologies and have “risen up the policy agenda in recent years due to increasing demand, volatile price movements, supply chain bottlenecks, and geopolitical concerns.”

According to Ahead of the Herd, the U.S. has taken steps to reduce its reliance on foreign sources by invoking the Defense Production Act and other measures to bolster domestic production. However, as noted in the same report, China’s dominance in processing critical minerals continues to pose a strategic challenge. Recent Chinese restrictions on exports of materials like gallium and graphite further underscore the vulnerability of supply chains.

According to CleanTechnica, the growing demand for critical minerals, driven by the global shift toward clean energy, has positioned the sector as a crucial player in the energy transition.

Gavin Mudd, director of the Critical Minerals Intelligence Center at the British Geological Survey, emphasized the need for responsible and sustainable mining practices, highlighting the essential role these minerals play in technologies like electric vehicles and renewable energy infrastructure.

Reporting for S&P Global last summer on an IEA report on critical minerals investment, Jacqueline Holman wrote that “higher and more diversified investments into critical minerals mining and production is required to support the energy transition and help reach energy and climate goals.”

“The IEA said that critical minerals markets were currently relatively well supplied, leading to a fall in prices — which was good for affordability, but not good for new investments,” Holman wrote. “This does not bode well for future supply, it added.”[OWNERSHIP_CHART-9081]

Production of lithium, cobalt, copper, nickel, zinc, and aluminum and other nonferrous metals is estimated to account for more than US$4 trillion this year, according to report by Carla Selman, Chris Rogers, and Sergio A. Hernandez for S&P Global. Batteries and accumulators are estimated to surpass the US$1 trillion mark by the next decade, they said.

Ownership and Share Structure

About 17% of Metallic Minerals is owned by management and insiders, including CEO Greg Johnson with 4%, Independent Director Gregor Hamilton with 0.93%, and the president, Scott Petsel, with 0.48%.

About 34% is owned by strategic investors, including Newmont’s 9.5% and mining financier Eric Sprott, who owns 14.5%.

About 22% is owned institutionally. The rest, 27%, is retail.

Its market cap is CA$47.29 million, with 178.91 million shares outstanding and 130.31 million free-floating. It trades in a 52-week range of CA$0.40 and CA$0.13.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Metallic Minerals Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

( Companies Mentioned: MMG:TSX.V; MMNGF:OTCQB,

)

Source: Clive Maund 05/02/2025

Technical Analyst Clive Maund explains why he believes it is a good point to add to a position in Giant Mining Corp. (CSE: BFG; OTC:BFGFF; FWB:YW5).

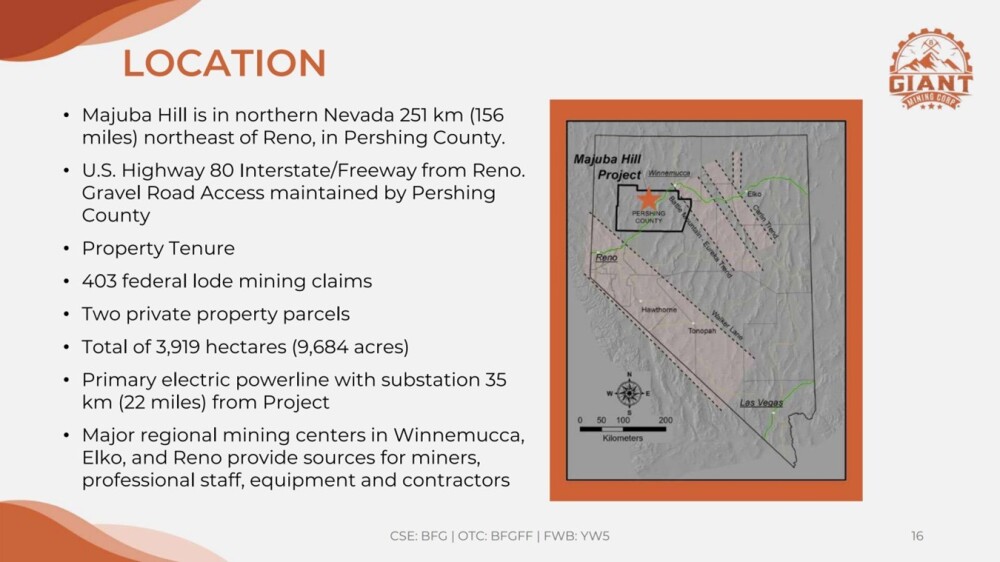

Giant Mining Corp. (CSE: BFG; OTC:BFGFF; FWB:YW5) is moving forward with the exploration and development of its Majuba Hill copper-gold-silver project in Nevada and its stock is arriving at strong support above its cyclical lows of last November and December as we will proceed to see later when we review its stock charts and is thus at a very point to buy as it is expected to form a Double Bottom with its November and December lows and reverse to the upside soon against the background of continued progress by the company and the ongoing bull market in copper.

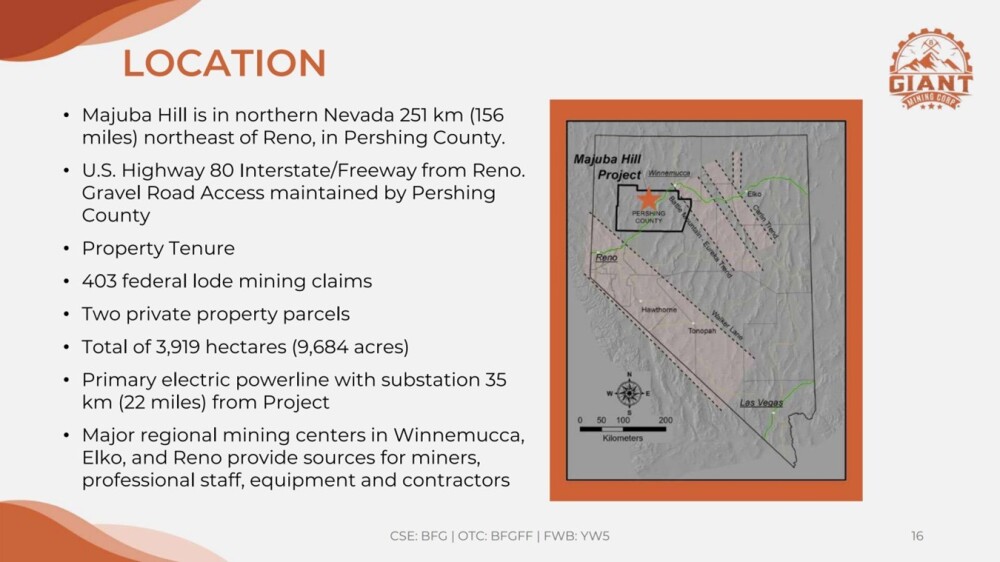

The company has a big flagship copper project, the Majuba Hill Project, that also contains gold and silver and is located northeast of Reno in the north of Nevada, as shown on the following page from the investor deck.

Being in Nevada, the local infrastructure is more than adequate.

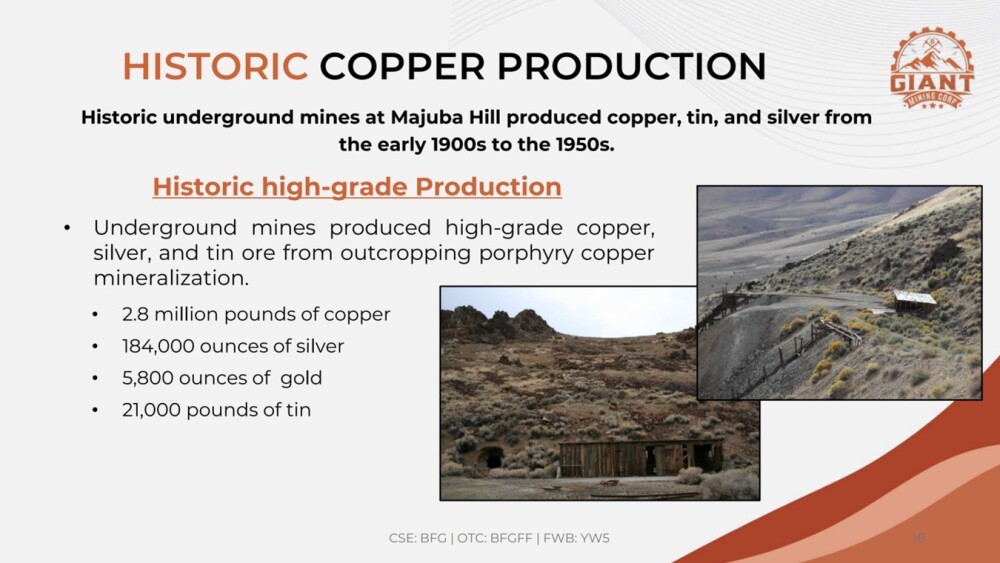

There is a history of high-grade production at Majuba Hill going back many years that was largely artisanal, which means that, using more efficient modern mining techniques, there are clearly economic deposits there, especially given that metal prices are now much higher. . .

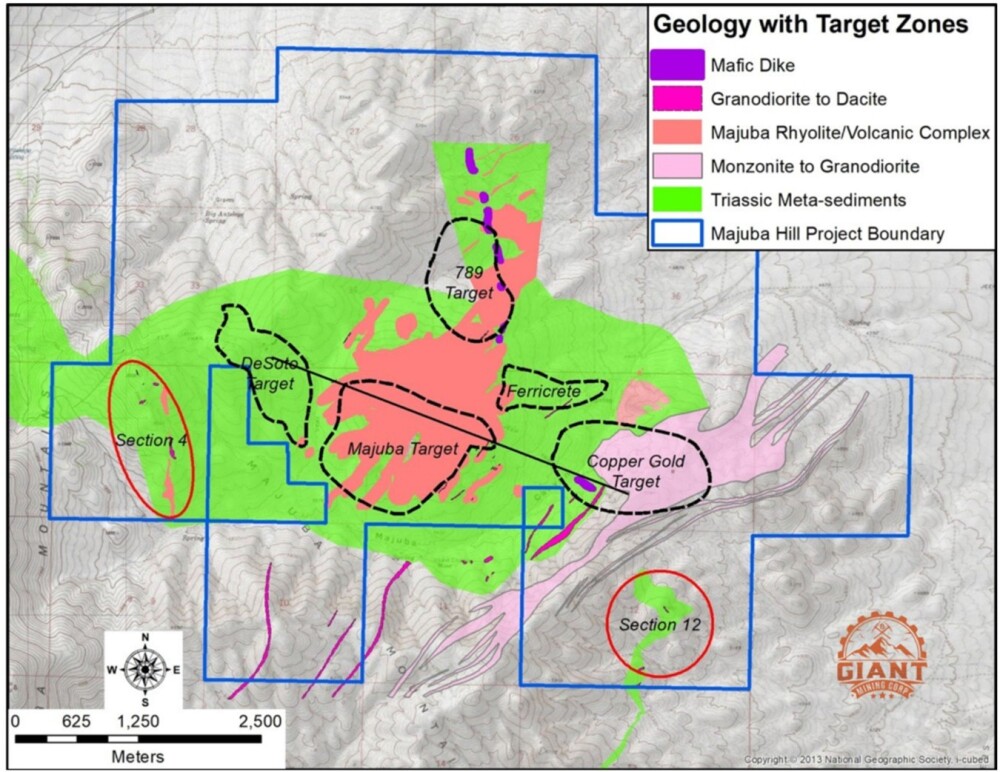

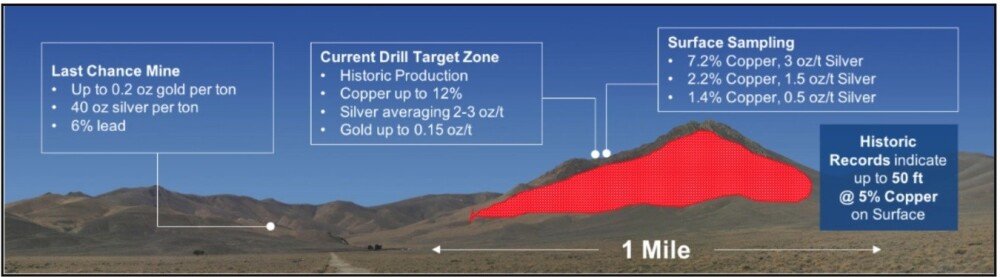

The following map shows the basic geology of the Majuba Hill Project and also the target zones:

Below you will see the profile view of Majuba Hill:

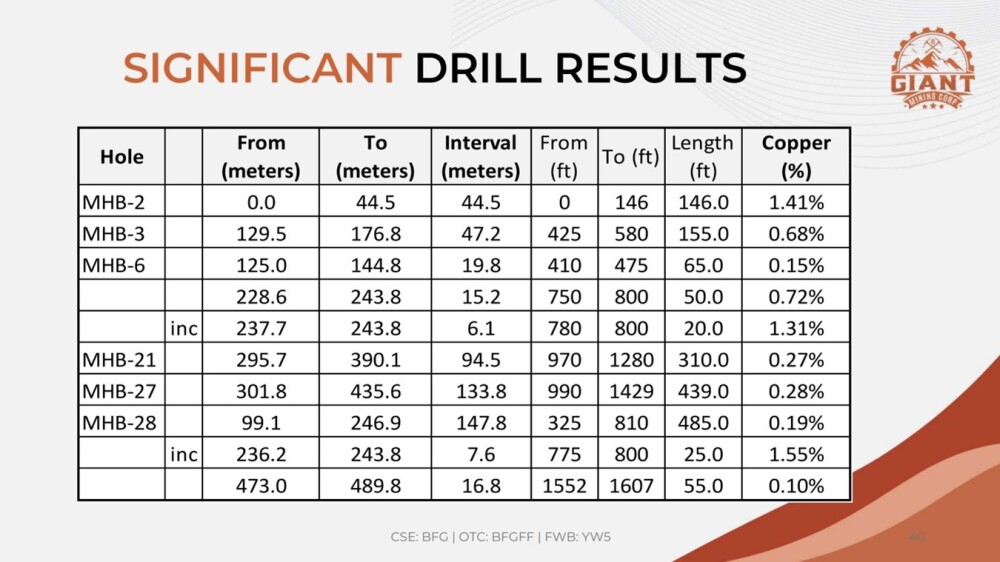

Significant drill results have been returned.

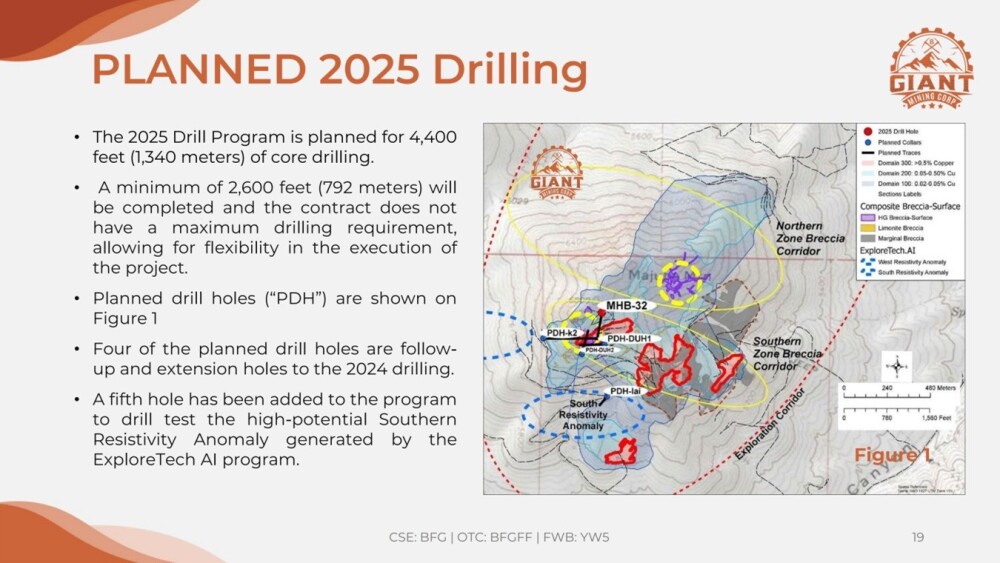

The next image presents details of this year’s planned drilling program.

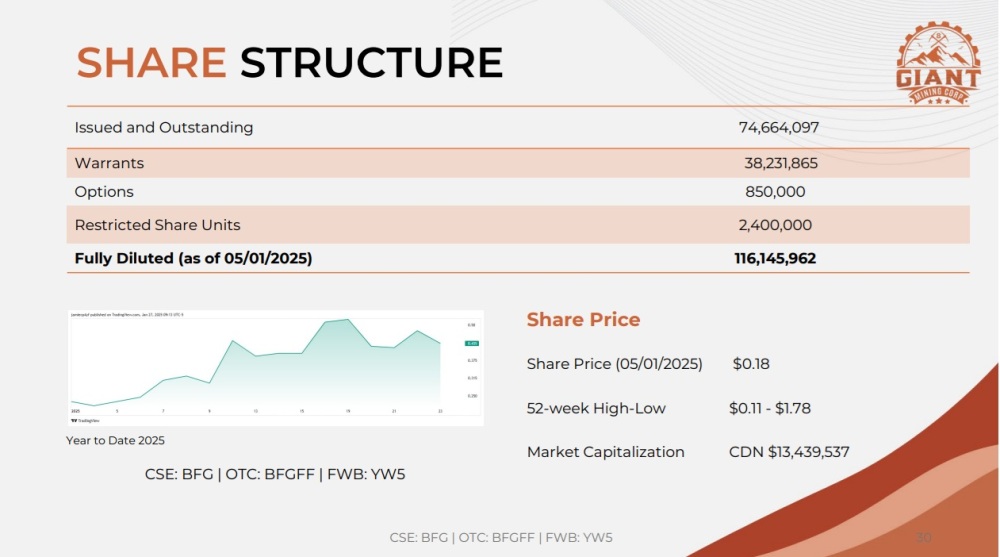

The last page shows the company’s share structure. According to the company itself, at the time of this article, there are 69.5 million shares outstanding.

Now, we will review the latest stock charts for Giant Mining.

We start with the long-term 5-year chart to remind ourselves that Giant Mining is historically very inexpensive here. It got almost to $140 early in 2021, probably adjusted for splits, and is now trading at around 17 cents. This obviously means that there is very little downside from here and potentially a lot of upside.

Although this chart is otherwise of limited use technically, we can see a big volume buildup over the past year which is interpreted as bullish because it shows that a lot of stock has changed hands during this period, which is viewed as positive because the sellers are mostly old stale holders of stock who, having understandably grown discouraged, have dumped their holdings at a loss but they have been replaced by new owners who generally will be much less inclined to sell until they have turned a profit, which has the effect of “locking up” stock, reducing the quantity available to buyers who have to bid the stock up.

On the 1-year chart, we can see that, early in the year, the setup looked positive with the Saucer pattern shown looking set to lead to a new bull market, especially as the advance away from the Saucer boundary in January had been driven by strong volume.

However, the pattern aborted late in February and in March for capital markets reasons, leading to the decline to its current price, and it now looks like the stock will make a Double Bottom with its November and December lows before advancing anew, and if so, we are at a very favorable point to buy now. Drill results are believed to be pending, and if favorable, they could, of course, get the stock moving higher.

Giant Mining is therefore rated a Strong Buy here, and this is a good point to add to positions. The first target for an advance is CA$0.30, and the second is CA$0.60, with much higher targets once the latter is attained.

Giant Mining Corp.’s website.

Giant Mining Corp. (CSE: BFG; OTC:BFGFF; FWB:YW5) closed for trading at CA$0.175, US$0.1186 on May 1, 2025.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Giant Mining Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Giant Mining Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.

( Companies Mentioned: CSE: BFG;OTC:BFGFF;FWB:YW5,

)

- Peru kidnapping leaves 13 dead in gold mine BBC

- 13 security guards kidnapped from a Peruvian gold mine found dead CBS News

- Bodies of 13 workers kidnapped from a Peruvian gold mine are found Financial Times

- Tragic Ending for 13 Security Guards Kidnapped From Gold Mine Men’s Journal

- Security guards kidnapped from gold mine found dead as 13 bodies are discovered in ‘spiral of uncontrolled violence’ The Sun