Category: Gold

- Gold price forecast 2025: 5 key reasons why gold dropped from $3,500 to $3,211 — will it fall below $3,200 The Economic Times

- Gold heads for weekly loss amid easing trade tensions, strong jobs report Reuters

- Gold Prices Sink as China Dumps Stockpiles Crude Oil Prices Today | OilPrice.com

CDNX Charts of Excitement

Source: Stewart Thomson 05/01/2025

Newsletter writer Stewart Thomson addresses the question: Is the CDNX index chart now the most exciting chart in the world?

It’s an interesting time for markets, with the dollar index arriving at key support of 100 (par), gold in the throes of its first decent pullback since back in 2023, the GDX ETF recoiling from round number $50 resistance, and. . .

The CDNX junior stocks index perhaps looks the most interesting of them all!

First, here’s a look at the USDX (dollar index):

A lot of investors note the “break” of the support zone at 100, but support is generally a zone, not a pinpoint.

A drop into a big support zone like USDX 100 can end above, at, or slightly below 100, but a rally of some size is normal once price stabilization occurs.

I suggested that gold would likely be trading around $3200-$3500 when the dollar hit par, and that’s what has transpired. Now, gold is correcting as expected, and the dollar is rallying.

Here’s a look at gold:

Three zones of interest for buyers are $3150, $3050, and $2950. I’m a buyer of all three if the price goes there.

As far as the senior miners go (as showcased by the GDX ETF), I like the $2950 area for potential investor buying, and gamblers could take a shot at buying them at gold $3150 and $3050.

Here’s a look at GDX on a daily line chart:

Line charts smooth out a lot of noise. Gamblers could buy at the $46 area support zone.

Investors may want to join me and wait to see if gold trades at $2950. We’ll take a good look at the GDX and GDXJ charts at that point. GDX could be trading in the $44-$39 zone of substantial support then, and if so it would be a spectacular time to buy!

Here’s the CDNX week chart:

While the larger miners need a rest, the “raw” CDNX juniors index looks like racehorse that is about to be let out of a massive bull era starting gate!

Here’s a look at a serious CDNX “hot shot” stock, Millennial Potash Corp. (MLP:TSXV; MLPNF:OTCQB):

Eager junior players may want to do a gamble buy on this one, and use an optional mental stop at about 85 cents for all or part of the position.

Mental stops are stop losses that an investor doesn’t actually enter as market orders. They watch the market and enter a sell order if the stop price is hit. This prevents them from being hit on a relatively low volume trade . . . only to see the price shoot right back up again after being stopped out!

Here’s a look at the weekly chart for Benz Mining (BZ:TSXV), which I call a “must own” play for junior mine stock gamblers:

The base pattern is so aesthetic that it looks like it was sculpted by Michelangelo!

The time to take a nap is now, for gold bullion and senior mine stock investors. The time put some space helmets on is also now, for enthusiastic junior mine stock investors around the world!

Special Offer for Streetwise Readers: Please send me an Email to freereports@galacticupdates.com and I’ll send you my free “CDNX Hot Shots: Tactics For Champions” report. I highlight the key buy and sell zones for eight exciting CDNX miners showing bullish breakout action on the charts. Solid tactics for eager investors are included in this report!

I write my junior resource stocks newsletter about twice a week, and at just $199/12mths it’s an investor favourite. I’m doing a special pricing this week of $169 for 14mths. Click this link or send me an email if you want the offer and I’ll get you onboard. Thank you.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Stewart Thomson: I, or members of my immediate household or family, own securities of: GDX. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Stewart Thomson Disclosures

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Source: Dominic Frisby 05/01/2025

With the stock market reacting to tariff turmoil, Dominic Frisby of The Flying Frisby shares his thoughts on how the commodity sector will fare.

I spoke about gold this week to ABC Australia. This little interview may be of some interest. Here it is.

Meanwhile. . .

It’s as though the whole tariff thing never happened, the way stock markets are rallying. I think it’s seven green days in a row now.

Everybody is getting very excited about a rare technical signal we got last Thursday — there have only been 16 of them since the S&P500 was created in 1957, including the latest on April 24, 2025. But this signal has a 100% reliability record, and has been followed by average 6-month returns of 15% and a 12-month returns of 23%.

That’s a pretty stellar record.

So, I just wanted to offer my 2p.

The indicator — the Zweig Breadth Thrust Indicator (ZBT) — was first observed in the 1986 Martin Zweig book, Winning on Wall Street (which I confess to not having read). It occurs when a market swings from an oversold to an overbought reading within 10 trading days.

Eight of them have occurred since the book was published: in 2004, in 2009 (shortly after the March lows at 666), in 2011 after the taper tantrum, in 2013, 2015, 2018 and in 2023 twice. Now we have one coming off the “tariff tantrum,” as I’ve just dubbed it.

However, before you go out and gamble your entire life savings, note that back in 2015, Technical Analyst Tom McClellan published a detailed study of ZBT signals, which went back much further than the 1957 formation of the S&P500 — all the way to 1928.

During the bear market of the 1930s Great Depression, there were multiple occurrences of the signal — 14 of them — and it was horribly unreliable: 10 led to losses or negligible gains, two preceded strong rallies, and two were flat. It was useless, in other words.

So, in short, it’s been good since 1957, but was rubbish before. A bit like stereos.

There are plenty of reasons to remain cautious. The high levels of volatility we are witnessing are consistent with a bear market not a bull market. There are also high levels of uncertainty: what is actually going to happen with tariffs? Nobody quite knows. I’m not sure even the President.

Plus, we are going into May, which is usually a weak time of year for the stock market.

And it may be that the consequences of Trump’s tariff talk have not yet been felt in the U.S. on the ground. One argument is that there has been a huge drop off in container ships leaving China.

A container would typically take 30 days to reach LA, and another 10-20 days to get to the major cities — Houston, Chicago, New York, etc. So the drop-off in container ships leaving China after Liberation Day won’t be felt until mid-May.

If there is a pickup in shipments, that wouldn’t be felt till another month after that. Some are saying supply shortages are coming to the U.S. Have a read of this and see what you think. Markets usually price this kind of stuff in, but you never know.

Cui bono?

Among the sectors that should benefit from Trump’s America First policies are U.S. domestic mining and manufacturing. Here, the regulatory environment is changing fast. Trump signed an executive order on March 20 with the aim of accelerating the production of critical minerals.

Federal agencies have actually been mandated to look to the U.S. for priority metals — copper, gold, nickel, uranium, and so on — when they previously looked abroad. We are already seeing faster permitting. I hear that formerly dormant projects are seeing activity for the first time in years. Emails are being answered promptly; applications are being processed, even in states like California.

This new environment is positive for oil and gas producers, miners, explorers and developers in the U.S. The problem is that commodity prices have dropped off a cliff. There’s always a catch.

If you’d like to read more from Dominic, you can sign up for The Flying Frisby here.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Dominic Frisby Disclosures: This letter is not regulated by the FCA or any other body as a financial advisor, so anything you read above does not constitute regulated financial advice. It is an expression of opinion only. Please do your own due diligence and if in any doubt consult with a financial advisor. Markets go down as well as up, especially junior resource stocks. We do not know your personal financial circumstances, only you do. Never speculate with money you can’t afford to lose.

Source: Streetwise Reports 05/01/2025

New Found Gold Corp.’s (NFG:TSX.V; NFGC:NYSE.American) gold endowment at its Queensway project is expected to be more on the scale of the Fosterville deposit in Australia. Read on for more about this Canadian asset and analysts’ bullish stance on the company’s stock.

New Found Gold Corp.’s (NFG:TSX.V; NFGC:NYSE.American) recently announced 2,000,000 ounce (2 Moz) gold resource at its Queensway project in Canada’s Newfoundland and Labrador provinces is “absurdly conservative,” said 321Gold Founder Bob Moriarty in a recent interview.

“It’s an extraordinary project. It’s not a flawed project,” Moriarty told Richard Mills of Ahead of the Herd.

Specifically, the maiden Queensway resource, for which a technical report was filed in April, is 1.39 Moz of 2.4 grams per ton gold (2.4 g/t Au), Indicated, and 0.61 Moz of 1.77 g/t Au, Inferred, a news release noted.

Queensway boasts a deposit like Fosterville in Australia, Moriarty explained. Fosterville is one of the world’s highest-grade, most profitable gold mines, mining consulting firm AMC Consultants noted in a project history.

What is more, Moriarty pointed out, while Fosterville is deep, Queensway is shallow so should contain even more, significantly more, gold.

Economic Geologist Dr. Quinton Hennigh expressed a view similar to Moriarty’s, when Jay Taylor of Hotline and Gold, Energy & Tech Stocks interviewed him recently.

“The resource that was published, in my view, did not honor the geology of this type of system,” Hennigh said. “My hunch is they are grossly understating the likely gold.”

This underestimation, Hennigh purported, is due to New Found Gold block modeling the mineralization as if it were a big disseminated system, resulting in dilution of the high grades. With block modeling, a deposit is divided into a grid of blocks, and the grade and tonnage of each block are estimated. For instance, one might use 5x5x5 meter blocks to model veins that are, say, about 1 or 2m wide and wider in some places.

“I would love to see a three-dimensional model that includes the drill data and the wireframing that was done,” Hennigh said. With wireframing, boundaries of ore bodies are delineated.

Hennigh told Taylor he still believes Queensway could be “several Fostervilles.”

In its most recent news, New Found Gold, headquartered in British Columbia, announced positive results of drilling outside of the existing resource area at Queensway, reported BMO Capital Markets Analyst Andrew Mikitchook in an April 30 research report. These results showed the potential to expand the resource and confirmed the gold system’s depth potential.

“We view the 2 Moz resource (in all categories) as only the starting point for advancing the project,” Mikitchook wrote.

Highlight intercepts among the newly announced data included:

- 6.55m of 38.7 g/t, including 2m of 99 g/t, in the Dome zone

- 8.2m of 10.3 g/t, including 2m of 38 g/t, in the Keats South Deep zone

- 3.1m of 6.16 g/t, including 0.5m of 18.4 g/t, in the Keats-AFZ Deep area

Since 2020, New Found Gold has drilled more than 600,000m at its 175,600-hectare project, and in doing so, outlined multiple near-surface, high-grade gold discoveries over a 22-kilometer strike length, according to the company’s corporate presentation.

Gold Equities Now Attractive

Gold’s recent historic surge is “unlocking value” in gold mining stocks, and accordingly, they are “drawing renewed attention for their potential to amplify returns,” noted an April 30 article on Benzinga.

According to Jay Taylor of Hotline, “There has never been a more bullish time than now for gold mining stocks.”

Brien Lundin of Gold Newsletter pointed out on recently that mining equities are outperforming, meaning that increasingly Western investors increasingly are putting money into these still undervalued companies. The trend began with the major producers and in recent weeks has extended to the junior companies, or explorers, like New Found Gold.

“Now that the money is flowing, results are also starting to flow in,” Lundin wrote on April 24. “That’s why I think this may be the best opportunity we’ve seen in the history of gold as an investible asset. The hard part, getting the gold price up, has already been done for us. Now all we have to do is make sure we’re positioned in the best leveraged juniors.”

According to Technical Analyst AG Thorson, gold is deeply overbought. After a year-long upleg, the metal’s price has started moving into a warranted consolidation period.

“We now expect a sharp, multi-month decline of at least 20%, a move that could be swift and jarring,” Thorson wrote in an April 25 FXEmpire article. “Our work supports a multi-month decline back to the US$2,800 per ounce (US$2,800/oz) region.”

Participants in the latest of Reuters’ quarterly poll forecast an average annual gold price above US$3,000/oz for the first time, the news service wrote in an April 30 article. Specifically, the 29 analysts and traders who responded collectively forecasted an average gold price for 2025 of US$3,065/oz and for 2026, US$3,000/oz. These are increases from the last poll’s results, showing US$2,756/oz and US$2,700/oz, respectively.

In the longer term, certain factors support gold price stability, wrote John Zadeh in an April 28 DiscoveryAlert article. Despite renewable energy and tech sectors using 12% of global gold supply, production remains stuck at 3,500 tons per year.

“Bernstein & Co. projects a 7% annualized return through 2030, citing dedollarization trends and climate-driven industrial demand,” Zadeh added.

For the global gold market, growth is forecasted through at least 2030, at a 5.1% compound annual growth rate, according to Research and Markets. By then, the market’s size is projected to reach 6,300 tons (6.3 Kt), up from 4.7 Kt in 2024.

The Catalysts: PEA and Drill Program

Major near-term events for New Found Gold, as noted in its corporate presentation, include the start of a 2025 drill program at Queensway, for which plans are now being finalized, and the company is well-funded. The campaign will include resource conversion drilling, infill drilling in the mineral resource area, and exploration drilling targeting recent high-priority discoveries, such as Dropkick, Dome and Golden Dome, noted Mikitchook.

Also on the horizon, due out later this quarter, is completion of the preliminary economic assessment (PEA) of Queensway. Results of phase three metallurgical testing, now in progress, to support the PEA, are to be released soon, too.

Analysts Bullish on Stock

Don MacLean, Paradigm Capital senior analyst, believes the Queensway PEA “will be a pleasant surprise,” he wrote in an April 30 research report. Further, he expects it will outline a high-quality, mid-sized project producing 168,000 ounces per annum during the first five years at an all-in sustaining cost in the lowest quartile, less than US$1,000/oz. MacLean forecasts a project internal rate of return, using US$3,000/oz gold, of 38%.

About the company, the analyst wrote, “Within the recent share price range of CA$1.50–$1.75, we believe New Found Gold offers investors a high-quality, mid-sized project within a mining-friendly environment with outstanding logistics, a project that is likely to be fast-tracked with support from the Newfoundland government.”

Mike Niehuser, managing director and senior research analyst at ROTH Capital Partners, believes the PEA will show investors that Queensway, with existing data, could support a high-grade, low-cost, economic gold mine that could produce cash flow and mitigate shareholder dilution, he wrote in a March 31 research report. The report should pinpoint areas with the greatest potential for increasing grade, scale and credibility, he added, thereby “resulting in further optimization and providing confidence to investors.” [OWNERSHIP_CHART-9988]

Completion of the PEA, Niehuser wrote, is “essential to provide directions to re-establish investor confidence and to focus on mine development.”

This analyst has a Buy rating on New Found Gold and a target price suggesting a 376% uplift from the current share price.

BMO’s Mikitchook rates the gold explorer Outperform. His target price implies a 161% return.

Ownership and Share Structure

According to Refinitiv, strategic entities own 43% of New Found Gold. These include Palisades Goldcorp Ltd. (PALI:TSX.V; PLGDF:OTCMKTS) with 22%, Eric Sprott with 17% and New Found Gold management with 4%.

Institutional ownership amounts to 5%. The rest is in retail.

The company has 200.71 million (200.71M) basic shares outstanding and 114M free float traded shares. Its market cap is CA$222.06 million. Its 52-week range is CA$1.34–5.35 per share.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

( Companies Mentioned: NFG:TSX.V; NFGC:NYSE.American,

)

Source: Brian Hicks 05/01/2025

Brian Hicks of Wealth Daily explains the opportunity within Idaho’s Stibnite project.

Hidden within the rugged crests of Idaho’s Salmon River Range sits one of America’s most disputed — and potentially priceless — extraction locations.

A place bearing a moniker that whispers of enigma and might: Stibnite.

Previously, it enabled America’s wartime victory. Now, it could secure America’s forthcoming triumph. Since what rests under Stibnite’s gusty hillsides transcends mere gold — despite abundant deposits existing.

It’s antimony — an uncommon strategic element considered so crucial for American defense interests that military officials publicly identify it as indispensable for everything from anti-armor munitions to fire-retardant materials and electronics components.

The challenge?

China dominates more than 75% of worldwide antimony distribution.

America’s contribution? Zero production. Precisely. Nothing.

Except potentially through Stibnite’s revival.

Stibnite’s Role in Defeating Fascist Forces

During the 1940s, America’s Defense Ministry sought Idaho’s assistance. Imperial Japan had seized antimony-yielding territories throughout Southeast Asia, eliminating Allied resource access.

Idaho’s Stibnite workforce responded decisively. During peak operations, Stibnite supplied 90% of antimony utilized by American military forces throughout WWII, plus substantial tungsten volumes — another essential military material.

No overstatement: This operation helped win the war.

Post-conflict, Stibnite deteriorated into abandonment. Decrepit structures. Waste accumulations. An incomplete excavation dubbed the “Yellow Pine Pit” disrupting formerly robust salmon pathways.

Currently, Stibnite remains uninhabited.

Yet, revival approaches.

The $1.5 Billion Renaissance

An emerging corporation named Perpetua Resources Corp. (PPTA:TSX; PPTA:NASDAQ) possesses Stibnite’s restoration potential. Supported by major investors — notably America’s Defense Department — Perpetua envisions an ambitious $1.5 billion initiative targeting historic mine reopening, environmental restoration, plus extraction of:

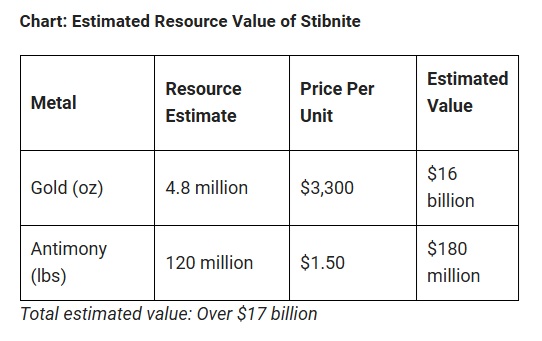

- 4.8 million gold ounces

- 120 million antimony pounds

- Forward-looking resource chains are urgently desired by federal authorities

Present calculations indicate Stibnite’s aggregate mineral worth surpasses $16 billion — using contemporary valuations.

Should antimony prices maintain upward trajectories amid Chinese trade limitations and escalating international friction, this overlooked highland might eventually challenge Earth’s premier gold-antimony deposits.

With Perpetua positioned advantageously.

Western Hemisphere’s Sole Antimony Operation?

These remain the possibilities. With regulatory approval, Stibnite would emerge as the exclusive primary antimony-generating location throughout Western territories.

Consider this reality.

While financial markets pursue technology shares and digital currency excitement, an essential defense mineral — lacking domestic sources — awaits extraction from Idaho terrain. . .

Through an enterprise valued substantially below its potential worth.

Benefiting from federal backing.

Defense authorities recently allocated $24.8 million to Perpetua via Defense Production Act provisions for accelerated advancement.

Translation?

Military leadership rejects ongoing Chinese mineral dependency.

Domestic Antimony’s Growing Strategic Importance

Per recent documentation from Defense One, China is intensifying restrictions regarding specialized minerals: Military strategists acknowledge potential vulnerabilities should Chinese authorities restrict antimony alongside other fundamental materials. Without antimony availability, American defense capabilities encounter increased expenses, production constraints, plus precarious dependencies affecting:

- Anti-armor projectiles

- Batteries and semiconductors

- Missile propulsion systems

Simply stated, antimony represents necessity, not preference. Currently, America contains a singular supply potential: Stibnite.

Environmental Opposition Meets Restoration Vision

Naturally, approval faces obstacles. Conservation resistance remains substantial. Various advocates assert that mining threatens essential watersheds, ecosystems, and recreational spaces. Legal challenges persist. Authorizations experience delays.

However, Perpetua attempts something unusual among extraction enterprises: Promising historical contamination remediation within operational planning.

Their blueprint encompasses:

- Restoring salmon corridors obstructed since the 1940s

- Eliminating millions of toxic waste

- Rehabilitation following contemporary protocols

Idaho’s Nez Perce Tribe, historically skeptical, recently initiated collaboration discussions. This transcends traditional extraction approaches. This represents extraction amid geopolitical considerations and ecological responsibility — potentially America’s initial genuinely modern, multipurpose mining endeavor.

From Abandonment to Strategic Resource

This exceeds precious metal operations.

It represents confluence within broader narratives:

- The collapse of American mineral independence

- The weaponization of global supply chains

- The rise of resource nationalism in a fractured world

These dynamics currently manifest within Idaho’s central forests. Gold. Antimony. Conflict. Environment. Independence. Stibnite encompasses everything.

While Perpetua Resources trades below $14.

The NatGold Connection: Owning the Future of Precious Metals

During Perpetua’s campaign securing national mineral priorities, investors encounter another remarkable development: NatGold Digital Ltd.

NatGold transforms precious metal ownership through combining historical gold value with distributed ledger innovation. Each NatGold unit represents authenticated, unexploited reserves — deposits remaining underground — avoiding conventional extraction’s environmental consequences.

Within circumstances elevating physical asset security, NatGold provides:

- Real, verifiable gold backing

- A sustainable, eco-friendly investment alternative

- A new monetary standard merging gold’s ancient wealth with tomorrow’s digital economy

Like Stibnite symbolizes strategic metal renewal for defense purposes, NatGold embodies gold’s restoration as reliable financial cornerstone. For those positioning themselves within America’s emerging resource expansion, Stibnite alongside NatGold represent complementary elements within an identical historic narrative.

Rather than observing history’s creation, participate directly. This might represent America’s subsequent remarkable recovery narrative. . . Or frontlines within mineral confrontation, we cannot forfeit.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Perpetua Resources Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of NatGold Digital Ltd.

- Brian Hicks: I, or members of my immediate household or family, own securities of: NatGold Digital Ltd. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

( Companies Mentioned:

PPTA:TSX; PPTA:NASDAQ,

)

Source: Streetwise Reports 05/01/2025

Thesis Gold Inc. (TAU:TSXV; THSGF:OTCQX; A3EP87:WKN) announced it completed a private placement of 9.9% of its issued and outstanding common shares to Centerra Gold Inc. for gross proceeds of more than CA$24 million. Find out why analysts see “deep value” in the security.

Thesis Gold Inc. (TAU:TSXV; THSGF:OTCQX; A3EP87:WKN) announced it has completed its private placement of 9.9% of its issued and outstanding common shares to Centerra Gold Inc. for gross proceeds of more than CA$24 million.

Toronto-based Centerra operates, develops, and explores gold and copper properties worldwide, including in North America and Turkey. It acquired 23,460,160 common shares of Thesis at a price of CA$1.03 per share, Thesis said.

Thesis said it would use the proceeds for working capital and general corporate purposes, including work related to technical studies underway at the company’s Lawyers-Ranch Project in British Columbia’s Toodoggone Mining District.

Hannam & Partners has a CA$2.90 per share price target on Thesis Gold, now trading at about CA$0.88 per share, according to a February research report by Analyst Jonathan Guy.

“We expect the shares to be driven by ongoing exploration, especially [at] Ranch,” Guy wrote. He described Thesis Gold as “a highly attractive acquisition target with a scalable resource in a low-risk jurisdiction.”

Earlier this year, the company announced the final drilling results from its 2024 program at the Ranch area of the project.

The company is working toward the completion of the Prefeasibility Study (PFS), which it said remains on track for the fourth quarter of this year.

Hannam & Partners has a CA$2.90 per share price target on Thesis Gold, now trading at about CA$0.88 per share, according to a February research report by Analyst Jonathan Guy.

“The 2024 drill program played a critical role in positioning us to commence both the PFS and the EA (Environmental Assessment) process — key milestones that will drive project development and permitting decisions,” President and Chief Executive Officer Ewan Webster has said. “Positive results from near-resource exploration have encouraging implications for the potential to expand and upgrade our confidence on the mineral resource defined in the 2024 PEA (preliminary economic assessment).”

That PEA demonstrated strong project economics highlighted by an after-tax NPV (5%) of CA$1.28 billion, an IRR of 35.2% and a payback period of two years.

“This shows that the Ranch area of the larger project still provides significant potential for resource growth and, in turn, improved project economics,” Webster said.

Thesis Gold has granted Centerra certain financing and other participation rights to enable Centerra to maintain its shareholding interest in the company, including a board nomination right in the event that Centerra acquires 19.9% of the company’s issued and outstanding common shares and technical committee appointment rights.

Analyst Sees ‘Deep Value’ in Company

Haywood Capital Markets Analyst Jamie Spratt emphasized the economics highlighted in the PEA, giving the stock a Buy rating with a CA$3 per share target price when he initiated coverage for the firm recently.

The analyst emphasized the project’s scale and quality, noting, “Resources have expanded quickly from the maiden resource of 132 koz in 2018 and now place the LR project as one of the largest gold-silver projects in Canada.”

“The LR project would rank in the top 15 of operating Canadian gold mines and the bottom quartile of the cost curve,” Spratt added.

Guy from Hannam & Partners reiterated the results of the PEA that outlined an open-pit and underground operation producing an average of 215 Koz per year. He also highlighted the project’s low costs. For a 12,600 ton per day plant, initial capex was estimated at CA$598 million and sustaining capex at CA$547 million. This equates to a capital requirement of CA$2,251 per ounce (CA$2,251/oz), which Guy pointed out is less than the Canadian average of CA$3,596/oz. The all-in sustaining cost was forecasted at US$1,013/oz, and this too is below the industry’s most recent quarterly average of US$1,510/oz.

“We calculate a net asset value of CA$1,670M for Lawyers-Ranch using the PEA outputs, a US$2,100/oz gold price and a 5% discount rate,” Guy wrote.

Meanwhile, Ventum Capital Markets Analyst Phil Ker noted the “impressive” success the company has had with the drill bit.

“We continue to see deep value in Thesis Gold,” Ker wrote.

The Catalyst: Gold Stumbling, But Not Falling

Gold demand remained lower than normal on Wednesday during an Indian festival when buying gold is considered lucky as the rally in prices to a record high prompted retail consumers to reduce purchases, according to Rajendra Jadhav reporting Wednesday for Reuters.

Indians were celebrating Akshaya Tritiya, the second-biggest gold-buying festival after Dhanteras, Jadhav wrote.

“Footfalls in jewelry stores improved from evening, but still in volume terms demand was around 15% lower than normal,” Surendra Mehta, secretary at the India Bullion and Jewellers Association (IBJA), told the author.

Gold fell nearly 1% on Tuesday as signals that U.S.-China trade tensions could ease reduced some safe-haven demand, reported Anjana Anil and Sarah Qureshi for Reuters.

However, writing for CBS Money Watch on Monday, Aly J. Yale noted that experts did not see gold’s overall bull market failing anytime soon.

“While there is likely a ceiling for gold prices at some point in the future, many experts are predicting further growth in the near term. But just how high could they climb? Could gold prices reach the $4,000 price point?” Yale asked. [OWNERSHIP_CHART-10373]

According to an April 10 post on Goldfix, Goldman Sachs revised raised the upper boundary of its forecast range for gold for the end of the year to US$3,520 an ounce and even introduced a “tall-risk scenario” as high as US$4,500 an ounce.

“The revision stems primarily from upside surprises in ETF inflows and persistent, large-scale central bank gold purchases,” the article noted.

Ownership and Share Structure

According to Thesis, about 66% of the company is owned by institutions, and about 4% is owned by insiders. The remaining 30% is retail.

Top shareholders include Franklin Advisers Inc. with 7.82%, Merk Investments LLC with 7.58%, Delbrook Capital Advisors Inc. with 5.5%, Sprott Asset Management LP with 4.63%T. Director Nicholas Stajduhar owns 1.09%.

The company has 236,971,268 million shares outstanding. At the time of writing, its market cap was CA$222.7 million, and it trades in a 52-week range of CA$1.04 and CA$0.51.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Thesis Gold Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

( Companies Mentioned: TAU:TSXV; THSGF:OTCQX; A3EP87:WKN,

)

Understanding The Gold-Silver Ratio

A Historical Perspective and Current Insight As gold continues to soar, spiking to $3,400/oz, the gold world is abuzz with growing interest in precious metals. But what about its companion, silver? When gold prices are high, investors tend to focus on the gold-to-silver ratio as an indicator of silver’s value. The gold-silver ratio is the […]

The post Understanding The Gold-Silver Ratio first appeared on CMI Gold & Silver.