Category: Gold

- Gold Falls as Prospect of US-China Trade Talks Cuts Haven Demand Bloomberg.com

- Gold pares losses on rate cut hopes after weaker US economic data Reuters

- Gold retreats as trade tensions ease; US payrolls data on tap MSN

Source: Adrian Day 04/29/2025

Last week, Orogen Royalties Inc. (OGN:TSXV; OGNRF:OTCQX) announced an agreement to be acquired by Triple Flag Precious Metals Corp. (TFPM:TSX; TFPM:NYSE) in a stock and cash transaction valued at CA$2 per share. Global Analyst Adrian Day explains why he thinks this is a big win for shareholders.

Orogen Royalties Inc. (OGN:TSXV; OGNRF:OTCQX) announced it had agreed to be acquired by Triple Flag Precious Metals Corp. (TFPM:TSX; TFPM:NYSE) for CA$2 per share.

TFPM will $342 million in cash and shares (equivalent to $1.70 per share) and spin out to shareholders all assets of the company other than the Expanded Silicon Royalty.

These include a cash balance of over $20 million; a revenue-generating royalty on First Majestic Silver Corp.’s (AG:TSX; AG:NYSE; FMV:FSE) Ermitaño mine; and several other royalties on exploration projects, as well as other generative properties, 100% owned and in partnerships. The “newco” has a pro-forma valuation of 37 cents per share, which I believe is very well supported. This is a big win for shareholders, and I recommend voting in favor when the proxies are sent to shareholders.

To the extent you hold on to the Triple Flag shares received, then the transaction will most likely be tax deferred for U.S. shareholders until the shares are sold. I also recommend holding the “newco.” TFPM will make an investment of $10 million into “newco” to own 11% of the company, and has entered into a generative alliance with Orogen covering much of the Western U.S., which TFPM will fund. Triple Flag shares have actually moved up (marginally) last Tuesday, so to me, Orogen is still a purchase.

At $1.80, most of your purchase price will be returned in the sale, giving a very low valuation to the spin go. Shareholders may opt to receive cash or shares, subject to the totals paid by TFPM being 50/50. The Orogen shareholder vote is expected in late 2025, with closing sometime in the third quarter.

There is a possibility of another company making a higher bid, particularly if a company believes that they will not win any bidding for Altius Minerals Corp.’s (ALS:TSX) larger Silicon royalty. Losers of that process may be prepared to pay up for the Orogen royalty. Once the transaction is complete, there will likely be some selling of the “newco” by shareholders who purchased Orogen solely for the Silicon sale. We shall be very interested in acquiring more if the price is right.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Orogen Royalties Inc. and Altius Minerals Corp.

- Adrian Day: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Adrian Day Disclosures

Adrian Day’s Global Analyst is distributed for $990 per year by Investment Consultants International, Ltd., P.O. Box 6644, Annapolis, MD 21401. (410) 224-8885. www.AdrianDayGlobalAnalyst.com. Publisher: Adrian Day. Owner: Investment Consultants International, Ltd. Staff may have positions in securities discussed herein. Adrian Day is also President of Global Strategic Management (GSM), a registered investment advisor, and a separate company from this service. In his capacity as GSM president, Adrian Day may be buying or selling for clients securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein. This is not a solicitation for GSM. Views herein are the editor’s opinion and not fact. All information is believed to be correct, but its accuracy cannot be guaranteed. The owner and editor are not responsible for errors and omissions. © 2023. Adrian Day’s Global Analyst. Information and advice herein are intended purely for the subscriber’s own account. Under no circumstances may any part of a Global Analyst e-mail be copied or distributed without prior written permission of the editor. Given the nature of this service, we will pursue any violations aggressively.

( Companies Mentioned: OGN:TSXV;OGNRF:OTCQX,

)

The Bull Market Is Still in Place

Source: Barry Dawes 04/29/2025

Barry Dawes of Martin Place Securities shares his thoughts on the gold market and gold stocks.

Gold’s parabolic US$530 spike surge in April 2025 has absorbed vast energy, and unless gold surges again to new highs, it will have created a substantial overhang that will take months to overcome.

The Gold ETF GLD shows the gaps from movements out of U.S. hours, but these will still need to be filled, and US$ Gold should retreat to retest the parabola.

Gold has also exceeded the top channel rail line, so it could pull back to retest the parabola and maybe needs to retest the lower channel rail line.

Bull market is still in place, but over-enthusiasm says enough for now.

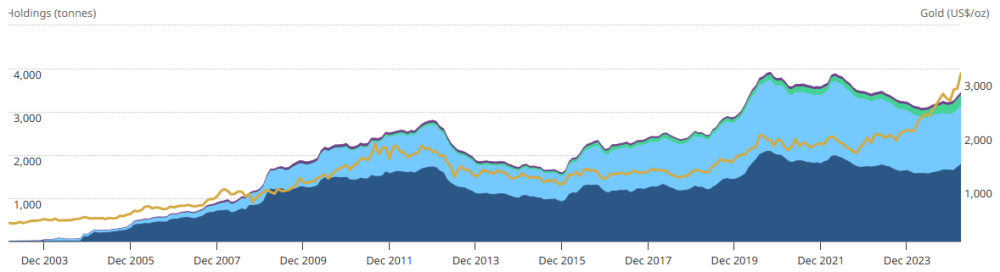

Gold ETFs are picking up in tonnages held but have not again reached the highs of 2020.

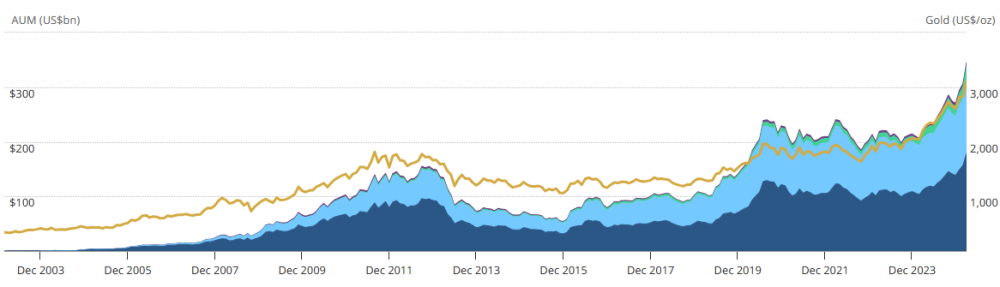

In contrast, they are now more than 50% higher in US$ value.

See below the gold ETF holdings in tonnes of gold.

See below the gold ETF holdings in U.S. dollars.

Gold Stocks

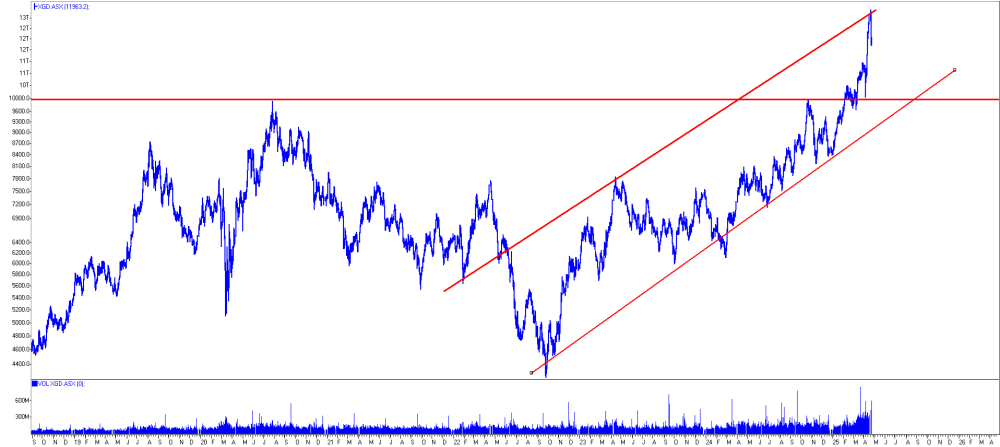

Gold stocks have broken the 2011 Downtrend but appear to be overextended for now.

This Index could retreat about 10% from here.

Keep in mind that gold peaked in 1980, but the ASX Gold index peaked in 1987, seven years later.

Note also that gold stocks versus gold is basing for a very large move over the next few years.

The GDX ETF had 400m shares outstanding a year ago at ~US$26 (= US$10bn) but now has only 307m -down 23% — and market cap US$15 billion.

Despite good earnings reports, neither of these were able to exceed October 2024 highs.

But note some small caps.

The ‘smaller cap’ gold stocks in GDXJ Junior Gold Mining Stocks ETF are starting to turn up vs the largest gold mining companies.

ASX Gold Sector

A pull back to 10,000 is likely — mostly in the big caps.

NST/DEG merger to be digested.

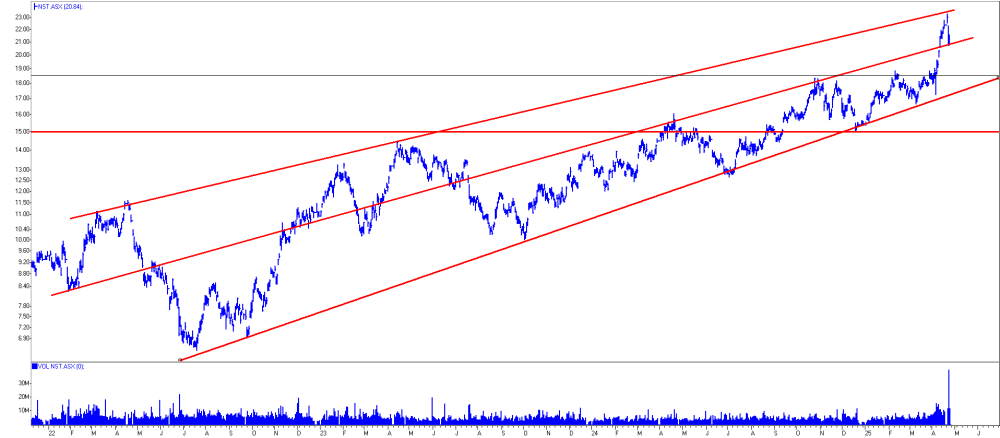

Most of these have hit the top channel rail line and are pulling back 15-20%

NST:

EVN:

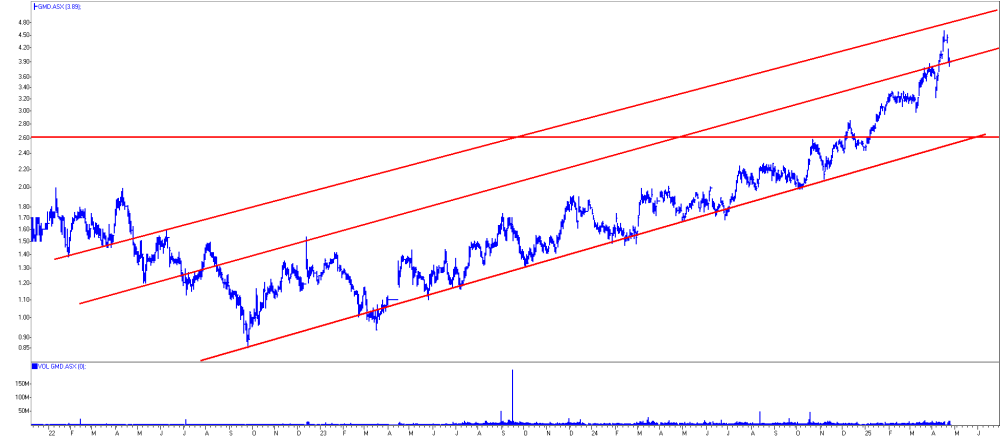

GMD:

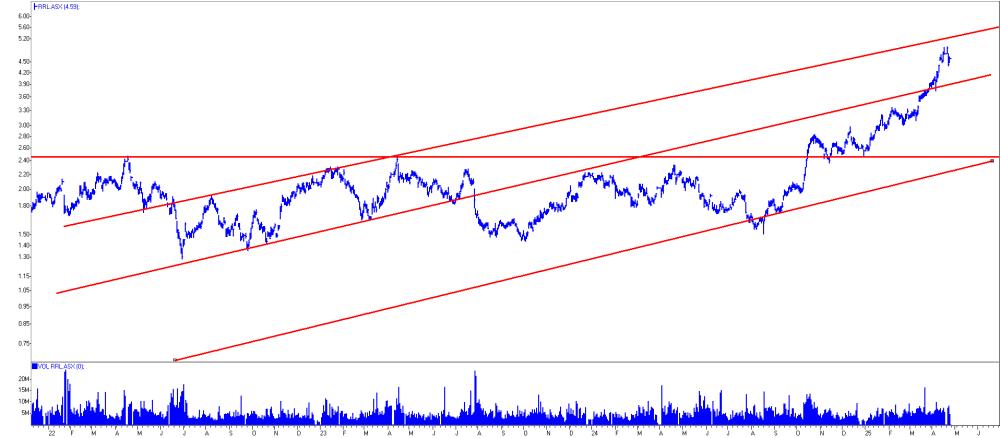

RRL:

Head the markets, not the commentators.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barrick Gold Corp.

- Barry Dawes: I, or members of my immediate household or family, own securities of: NST. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Source: Alina Islam 04/29/2025

Silver X Mining Corp. (AGX:TSX.V; AGXPF:OTC) continues its ramp-up to, first, its targeted rate of 620 tons per day (620 tpd) then its fully permitted rate of 720 tpd, noted a Red Cloud Securities report.

Silver X Mining Corp. (AGX:TSX.V; AGXPF:OTC) posted a net loss for full-year 2024 (FY24) and for Q4/24, but financials in the year’s last quarter show operational improvement at its Nueva Recuperada mine in Peru, reported Alina Islam, mining analyst at Red Cloud Securities, in an April 24 research note. Red Cloud lowered its target price on the Canadian miner due to a slower ramp-up to 2,000 tons per day (2 Ktpd) and higher operating cost assumptions.

“Overall, these are slightly negative results, but we believe performance should start turning around at Nueva Recuperada over the next two to three quarters,” Islam wrote.

341% Return Implied

Red Cloud’s new target price on the Canadian producer is CA$0.75 per share. In comparison, Silver X’s share price at the time of the report was about CA$0.17 per share. The new target suggests a potential return for investors of 341%.

The company remains a Buy.

Its market cap is CA$37.8 million (CA$37.8M). Outstanding shares total 222.2 million. The 52-week range is CA$0.12–0.38 per share.

Headwinds in 2024

Islam described what set back Silver X last year. For FY24, it posted a net loss of US$4.5M, or US$0.02/share, worse than Red Cloud’s US$0/share forecast. The entire year’s production, averaging 470 tons per day (470 tpd), also was a miss.

During Q4/24, Silver X processed fewer tons than previously due to unexpected stoppages at the plant. This raised costs and resulted in a quarterly operating loss of US$439,000 (US$439K). The total net loss in Q4/24 was US$900K, or US$0 per share (US$0/share), but it was better than Red Cloud’s US$0.01/share estimate.

On the plus side, noted Islam, Silver X performed better in Q4/24 than it had during the previous part of the year, with improved grades and silver recoveries. However, Islam pointed out, the producer is “still some ways away from” operating at its targeted 600 tons per day (600 tpd) mill throughput rate and further away from its fully permitted rate of 720 tpd.

More Changes Needed

To reduce cost pressure, noted Islam, the company will need to improve operations further and increase throughput to full capacity, purported Islam. It will need to be able to spread costs over more ounces.

A new operating team, already on site, should bolster productivity and efficiency.

“Ramp-up to full production and plans for further expansion could lead to a rerating of the stock,” the analyst commented.

Red Cloud revised its model on Silver X, raising expected production costs during the next few quarters based on recent results, Islam reported. As production increases, costs are expected to decrease. The all-in sustaining cost potentially could drop to as low as US$20 per ounce of silver equivalent by Q1/28.

What To Watch For

Islam listed the catalysts lined up for Silver X in 2025 and 2026. This year, the miner should complete the in-progress ramp-up to 720 tpd at Nueva Recuperada and release a combined preliminary economic assessment for the Tangana and Plata Mining Units.

Next year, the start of mining at Plata is anticipated, as is expansion of mill capacity to 2 Ktpd.

“We expect production, after the construction of a US$60M mill in 2026, to ramp up to a stable level of 2 Ktpd in Q1/28.”

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Silver X Mining Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver X Mining Corp.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Disclosures for Red Cloud Securities, Silver X Mining Corp., April 24, 2025

Disclosure Requirement Red Cloud Securities Inc. is registered as an Investment Dealer and is a member of the Canadian Investment Regulatory Organization (CIRO). Red Cloud Securities registration as an Investment Dealer is specific to the provinces of Alberta, British Columbia, Manitoba, Ontario, Quebec, and Saskatchewan. We are registered and authorized to conduct business solely within these jurisdictions. We do not operate in or hold registration in any other regions, territories, or countries outside of these provinces. Red Cloud Securities bears no liability for any consequences arising from the use or misuse of our services, products, or information outside the registered jurisdictions. Part of Red Cloud Securities Inc.’s business is to connect mining companies with suitable investors. Red Cloud Securities Inc., its affiliates and their respective officers, directors, representatives, researchers and members of their families may hold positions in the companies mentioned in this document and may buy and/or sell their securities. Additionally, Red Cloud Securities Inc. may have provided in the past, and may provide in the future, certain advisory or corporate finance services and receive financial and other incentives from issuers as consideration for the provision of such services. Red Cloud Securities Inc. has prepared this document for general information purposes only. This document should not be considered a solicitation to purchase or sell securities or a recommendation to buy or sell securities. The information provided has been derived from sources believed to be accurate but cannot be guaranteed. This document does not take into account the particular investment objectives, financial situations, or needs of individual recipients and other issues (e.g. prohibitions to investments due to law, jurisdiction issues, etc.) which may exist for certain persons. Recipients should rely on their own investigations and take their own professional advice before investment. Red Cloud Securities Inc. will not treat recipients of this document as clients by virtue of having viewed this document. Red Cloud Securities Inc. takes no responsibility for any errors or omissions contained herein, and accepts no legal responsibility for any errors or omissions contained herein, and accepts no legal responsibility from any losses resulting from investment decisions based on the content of this report. Red Cloud Securities Inc. takes no responsibility for any errors or omissions contained herein, and accepts no legal responsibility for any errors or omissions contained herein, and accepts no legal responsibility from any losses resulting from investment decisions based on the content of this report.

Company Specific Disclosure Details Company Name Ticker Symbol Disclosures Silver X Mining Corp. TSXV:AGX 3

The analyst has visited the head/principal office of the issuer or has viewed its material operations. 2. The issuer paid for or reimbursed the analyst for a portion, or all of the travel expense associated with a visit. 3. In the last 12 months preceding the date of issuance of the research report or recommendation, Red Cloud Securities Inc. has performed investment banking services for the issuer. 4. In the last 12 months, a partner, director or officer of Red Cloud Securities Inc., or an analyst involved in the preparation of the research report has provided services other than in the normal course investment advisory or trade execution services to the issuer for remuneration. 5. An analyst who prepared or participated in the preparation of this research report has an ownership position (long or short) in, or discretion or control over an account holding, the issuer’s securities, directly or indirectly. 6. Red Cloud Securities Inc. and its affiliates collectively beneficially own 1% or more of a class of the issuer’s equity securities. 7. A partner, director, officer, employee or agent of Red Cloud Securities Inc., serves as a partner, director, officer or employee of (or in an equivalent advisory capacity to) the issuer. 8. Red Cloud Securities Inc. is a market maker in the equity of the issuer. 9. There are material conflicts of interest with Red Cloud Securities Inc. or the analyst who prepared or participated in the preparation of the research report, and the issuer. Analysts are compensated through a combined base salary and bonus payout system. The bonus payout is determined by revenues generated from various departments including Investment Banking, based on a system that includes the following criteria: reports generated, timeliness, performance of recommendations, knowledge of industry, quality of research and client feedback. Analysts are not directly compensated for specific Investment Banking transactions.

Recommendation Terminology Red Cloud Securities Inc. recommendation terminology is as follows: • BUY – expected to outperform its peer group • HOLD – expected to perform with its peer group SELL – expected to underperform its peer group • Tender – clients are advised to tender their shares to a takeover bid • Not Rated or NA – currently restricted from publishing, or we do not yet have a rating • Under Review – our rating and target are under review pending, prior estimates and rating should be disregarded. Companies with BUY, HOLD or SELL recommendations may not have target prices associated with a recommendation. Recommendations without a target price are more speculative in nature and may be followed by “(S)” or “(Speculative)” to reflect the higher degree of risk associated with the company. Additionally, our target prices are set based on a 12-month investment horizon. Dissemination Red Cloud Securities Inc. distributes its research products simultaneously, via email, to its authorized client base. All research is then available on www.redcloudsecurities.com via login and password. Analyst Certification Any Red Cloud Securities Inc. research analyst named on this report hereby certifies that the recommendations and/or opinions expressed herein accurately reflect such research analyst’s personal views about the companies and securities that are the subject of this report. In addition, no part of any research analyst’s compensation is, or will be, directly or indirectly, related to the specific recommendations or views expressed by such research analyst in this report.

( Companies Mentioned: AGX:TSX.V;AGXPF:OTC,

)