Source: Brian Hicks 04/29/2025

Brian Hicks of Wealth Daily takes a look at Paulson’s $1 billion Dolin Gold acquisition, which he believes is poised to revolutionize resource investment through NatGold’s innovative tokenization of its 39 million underground gold ounces.

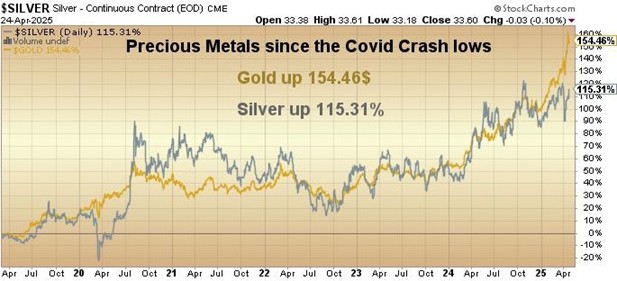

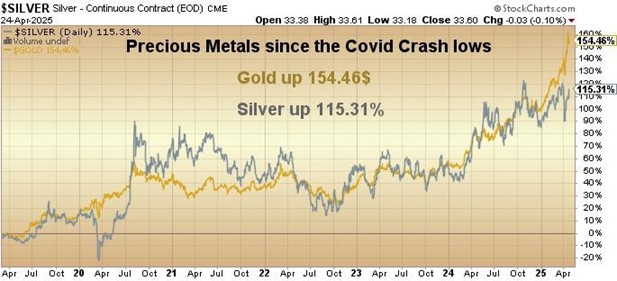

Seeking confirmation that gold has entered a prolonged upward market trend? Look no further than the recent headline-making revelation about Alaska’s Donlin Gold venture.

I mentioned the Donlin Gold venture several weeks back, highlighting how Donlin would transform into a key component of America’s natural resource treasury that Trump intends to establish.

Trump declared it. Savvy investors are acting ahead of the curve.

Here’s the situation. . .

The Wealthy Go Gold Hunting

In a remarkable development highlighting the strategic importance of the Donlin Gold venture, Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) disclosed yesterday its decision to divest its complete 50% interest in the enormous Alaskan reserve for a potential $1.1 billion.

Who’s purchasing?

None other than wealthy financier John Paulson alongside NovaGold Resources Inc. (NG:TSX; NG:NYSE.MKT) — a maneuver that not only transforms the ownership structure of the Donlin venture but also sends powerful ripples throughout the entire gold investment sphere.

According to the agreement, Paulson will secure 80% of Barrick’s share, while NovaGold will claim the remaining 20%, elevating its total venture ownership to 60%. The transaction, encompassing $1 billion in immediate capital plus an option to acquire debt owed to Barrick, should finalize by Q3 2025.

Why John Paulson’s Participation Transforms Everything

Paulson’s entrance into Donlin represents more than mere confidence — it’s a strategic coup by one of contemporary investing’s most accomplished figures.

Renowned for earning $4 billion wagering against American housing markets during the 2008 financial downturn, Paulson subsequently shifted focus toward gold and natural assets, recognizing their fundamental value as safeguards against inflation, currency devaluation, and systemic instability.

In 2009, Paulson introduced the Paulson Gold Fund, which at its zenith managed billions in gold-related holdings.

He ranked among the earliest and most outspoken supporters of gold as a “currency of last resort,” a concept resonating in today’s uncertain global landscape.

Previously, Paulson invested substantially in AngloGold Ashanti Ltd. (AU:NYSE; ANG:JSE; AGG:ASX; AGD:LSE), NovaGold, and additional mid-tier mining enterprises, establishing himself as a long-term optimist regarding physical gold and gold equities.

Now, by obtaining a 40% stake in Donlin — arguably among the final world-class undeveloped gold deposits in a secure jurisdiction—Paulson reaffirms his conviction in gold’s next major growth cycle. This action lends substantial credibility to the Donlin venture and may accelerate both financial investment and regulatory momentum.

Yet there’s additional significance. If timing proves crucial, Paulson’s decision to invest in the Donlin Gold venture suggests he anticipates gold climbing higher . . . substantially higher!

As an established long-term gold investor, his current purchase signals his belief that the bull market for the precious metal has merely begun.

What This Implies for Donlin

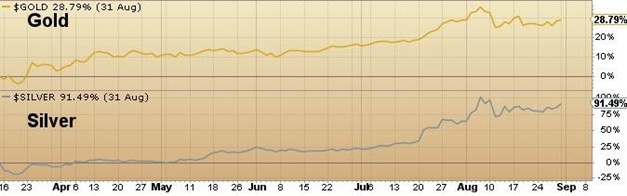

Donlin Gold has consistently been described as a “sleeping giant” within gold circles — containing 39 million gold ounces (measured and indicated) in one of Earth’s most politically stable regions. Nevertheless, its advancement has stalled due to steep capital expenditures, environmental considerations, and shifting corporate priorities.

With Barrick departing and John Paulson arriving, the Donlin narrative could dramatically evolve:

- New funding might flow into feasibility assessments, infrastructure, and community engagement.

- Investor perception surrounding the venture could grow more optimistic, particularly as gold approaches historic peaks.

- Tokenization possibilities might resurface if the venture remains dormant—creating an alternative path to value.

The tokenization aspect appears particularly intriguing.

Paulson has consistently embraced technology and innovation regarding finances and investments.

Tokenizing unmined gold would ideally suit both him and Donlin.

NatGold: Accessing Trillions Without Excavation

Introducing NatGold Digital Ltd.—a forward-thinking framework for a novel gold-backed digital asset.

Rather than extracting physical gold from underground, NatGold proposes something daring yet elegantly straightforward: Tokenize underground, certified gold reserves and provide investors digital ownership of authentic, untouched wealth.

Each token represents a portion of a certified gold ounce, confirmed through independent geological assessments, and recorded on a transparent blockchain registry.

It functions as a contemporary vault — digital, verifiable, and resistant to inflation— supported not by extracted gold but by America’s undiscovered treasure repository.

Donlin represents the perfect inaugural project. With 39 million verified ounces simply waiting, why not tokenize 5 million — or the entire amount — and place it into a new national repository?

That repository carries a designation — and a mission.

Trump’s Sovereign Wealth Fund: Converting Gold Into National Influence

In early 2025, former President Donald Trump issued a groundbreaking executive directive aimed at reestablishing American control over critical mineral supply networks. Yet behind this lay a grander vision — one still not fully comprehended by markets or media . . .

The formation of an American sovereign wealth fund — backed neither by Treasury bonds nor foreign capital but by America’s indigenous natural resources.

Envision a digital, tokenized repository containing:

- Certified gold from Donlin and Pebble Creek

- Rare earth elements from Texas and Wyoming

- Copper, lithium, and antimony spanning Montana to Nevada

All tokenized. All transparent. All supported by geological evidence.

This fund would transcend mere financial assets — becoming a strategic instrument in an era of inflation, de-dollarization, and geopolitical realignment.

NatGold’s infrastructure could deliver the technology. Ventures like Donlin could supply the assets. And America, for once, would leverage existing possessions — instead of soliciting global assistance for its requirements.

Eco-Patriotism: A Contemporary Manifest Destiny

Let’s be forthright: This doesn’t involve environmental exploitation. It’s not about excavation pits and chemical processing.

It concerns eco-patriotism — the conviction that we can preserve our wild and magnificent territories while simultaneously securing economic futures. That we can honor tribal collaborations, protect watersheds, and maintain intact forests while unlocking value through another American resource powerhouse: technological innovation.

Through tokenization, America can finally acknowledge its mineral wealth’s economic significance without necessitating immediate extraction. That’s beyond clever — it’s revolutionary.

This isn’t resource exploitation. It’s resource recognition.

And with Paulson investing, this represents more than ownership transition — it’s a strategic pivot potentially unlocking one of the gold sector’s most undervalued assets.

Stay vigilant. Donlin’s narrative has entered its subsequent chapter — with the world’s most celebrated gold enthusiast drafting the screenplay.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barrick Gold Corp. and NatGold Digital Ltd.

- Brian Hicks: I, or members of my immediate household or family, own securities of: NatGold Digital Ltd. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

( Companies Mentioned: ABX:TSX; GOLD:NYSE,

)