Category: Gold

- Gold hits record high as US-China trade war intensifies, dollar weakens Reuters

- Gold prices are on fire. Here’s why it’s a favorite investment during market volatility Fortune

- Gold (XAU) Hits Record as Recession Anxiety Has Traders Seeking Havens Bloomberg.com

Source: Streetwise Reports 04/09/2025

Arizona Gold & Silver Inc. (AZS:TSX; AZASF:OTC) intersected 4.91 meters of 9.20 g/t gold at its Philadelphia Project in Arizona, confirming high-grade continuity at Rising Fawn. Read more to see how ongoing drilling and historic results point to strong growth potential.

Arizona Gold & Silver Inc. (AZS:TSX; AZASF:OTC) announced on April 7 the results from drill hole PC25-136 at its Philadelphia Project in northwestern Arizona, revealing a high-grade intercept of 4.91 meters averaging 9.20 grams per tonne (g/t) gold and 9.2 g/t silver. This interval lies within a broader zone of 25.9 meters grading 2.6 g/t gold and 4.2 g/t silver, which is itself part of a 41.9-meter interval averaging 1.6 g/t gold and 3.3 g/t silver. All grades have been confirmed using fire assay and ICP-MS methods, and true widths are estimated to be approximately 50% of the reported drilling thickness.

The Philadelphia Project, located in the historic Oatman Gold Mining District, has been the focus of renewed exploration since Arizona Gold & Silver acquired key claims beginning in 2019. The district is known for its epithermal gold systems, and the Rising Fawn area of the property, where PC25-136 was drilled, is one of the more recent additions to the company’s exploration campaign. Greg Hahn, VP Exploration, stated in the news release, “Drill hole PC25-136 is exciting in that it demonstrates the continuity of high-grade veining and an attendant stockwork system to the east of previously drilled mineralization.”

The company noted that textures observed in the core, including colloform, ginguro banding, and cockscomb quartz, are indicative of high-temperature epithermal processes, which can be associated with significant gold mineralization. These features are similar to those found in the nearby Oatman mines, which produced over 1.5 million ounces of gold historically.

Assays are pending for additional holes (PC25-137 through 139 and PC25-148), with drilling currently ongoing at hole PC25-149. Arizona Gold & Silver is permitted by the Bureau of Land Management (BLM) to drill up to 12,000 meters at the site between 2024 and 2025, testing both high-grade vein and bulk tonnage targets.

Gold and Silver Markets React to Global Tariffs and Rising Industrial Demand

Gold and silver markets experienced heightened volatility in early April following the announcement of sweeping global tariffs by former U.S. President Donald Trump. According to Kitco News on April 2, gold surged to a high of US$3,145 per ounce before stabilizing near US$3,130. Silver followed suit, reaching a session high of US$34.15 before settling near US$33.89 per ounce. Chris Zaccarelli of Northlight Asset Management noted that markets had initially anticipated more moderate tariffs, but “the details were released and they were far worse than expected,” fueling the rally in precious metals.

In a Silver Market Update published April 4, Peter Krauth explained that the tariffs initially sparked concern that precious metals might be included, contributing to recent gains. However, gold and silver were ultimately exempted. He wrote that silver’s recent 6% pullback may reflect “some of that built-in premium” being removed. Despite the decline, silver remained up roughly 10% year-to-date, with junior silver miners showing even greater gains. Krauth emphasized that silver’s industrial role, particularly in solar and electronics, could temper further downside.

On April 4, Stockhead highlighted continued strength in gold equities, especially on the ASX. Analysts at Goldman Sachs reported that gold miners’ margins expanded as prices outpaced costs. “We expect this gold equities cycle to continue,” they stated, citing moderating cost inflation and improved cash flow. The analysts also observed a shift in investor focus from production growth to profitability and free cash flow, noting that average all-in sustaining costs had fallen 4.6% in the December quarter to US$2,051 per ounce.

According to a report by Ahead of the Herd on April 7, the gold-silver ratio had reached 102. This is well above the historical average of 60. The report stated that “silver is significantly undervalued relative to gold at current levels,” and predicted that investors would soon recognize the discrepancy. The analysis cited silver’s dual role as a precious and industrial metal, with 60% of annual demand coming from industries like solar, EVs, and electronics. A study by Oxford Economics, commissioned by the Silver Institute, forecast a 42% increase in industrial demand for silver between 2023 and 2033, while total supply was expected to decline by 1% in 2024. The resulting 215.3 million ounce deficit would mark the second-largest in over two decades.

Richard Mills, writing in that Ahead of the Herd report, added that the silver market appeared to be in its fourth consecutive year of structural deficit. He noted that “precious metals do particularly well when the dollar is weak, the global economy is on the verge of recession, and geopolitical tensions are high,” referencing ongoing conflicts and rising investor demand for safe-haven assets.

Drill Program Advances Along Proven Gold Trend at Philadelphia Project

According to the company’s March 2025 investor presentation, the Philadelphia Project spans a known strike length of at least three kilometers, of which approximately 1.5 kilometers have been drilled to date. The project lies along the Arabian Fault and features a prominent flow dome, favorable geological structures for gold mineralization in epithermal systems.

The company has identified multiple exploration targets, including a high-grade vein system, a broad stockwork zone, and undrilled southern extensions of the mineralized corridor. Historic drill results have included intervals such as 72.5 g/t gold over 1.5 meters and 115.85 meters of 1.34 g/t gold with 5.78 g/t silver. These results suggest the presence of both narrow, high-grade intercepts and wider, lower-grade mineralized envelopes that could be amenable to open-pit mining.[OWNERSHIP_CHART-10692]

Arizona Gold & Silver’s ongoing 2024–2025 drill program includes targeted core drilling at the Rising Fawn and Perry vein systems. The company plans to complete 4,000 meters of drilling at the Rising Fawn zone, with approximately 25% completed to date. An additional 3,000 meters are scheduled for the Perry Gap area. These efforts are designed to follow up on prior intercepts and extend known zones of mineralization along strike and down dip.

Infrastructure at the project is well established, with paved road access and year-round drilling conditions. The company holds 100% control of the project, which includes both patented and unpatented claims. Historically, the Philadelphia mine area produced approximately 40,000 ounces of gold before mining was halted in the 1930s due to infrastructure changes.

Together, the combination of high-grade intercepts, favorable geology, and active drilling positions Arizona Gold & Silver for continued advancement at the Philadelphia Project as additional results become available.

Ownership and Share Structure

Arizona Gold & Silver provided a breakdown of its ownership and share structure, where insiders and advisors own approximately 23% of the company, 9% is held by institutions, Sprott holds 8%, and 44% is with family and friend investors. The rest is retail.

According to Reuters, there are 93.86 million shares outstanding, while the company has a market cap of CA$30.03 million and trades in the 52-week period between CA$0.25 and CA$0.52.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Arizona Gold & Silver and West Point Gold Corp.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

- For additional disclosures, please click here.

( Companies Mentioned: AZS:TSX; AZASF:OTC,

)

Source: Streetwise Reports 04/09/2025

Silver Crown Royalties Inc. (SCRI:CBOE; SLCRF:OTCQX; QS0:FSE) added 1,000 ounces of physical silver to its treasury as part of its metal-backed growth strategy. Learn how this move fits into a broader plan to capitalize on sector deficits and rising demand.

Silver Crown Royalties Inc. (SCRI:CBOE; SLCRF:OTCQX; QS0:FSE) has purchased 1,000 ounces of physical silver in the spot market as part of its broader strategy to align company assets with its silver-focused mandate. The company disclosed the acquisition on April 9, noting that the silver was acquired at an average price of US$30.65 per ounce, consisting of a spot price of US$30.15 and a US$0.50 premium. The total cost of the transaction was US$30,650.

The purchase price represents an 8% discount to the company’s 20-day volume-weighted average price (VWAP) for silver and an 11% discount to recent highs. The silver will be stored with Money Metals Depository LLC, with the final location potentially being a designated sub-custodian facility operated by the depository.

According to Silver Crown CEO Peter Bures in the announcement, the decision to hold physical silver was consistent with the company’s long-term view. “We strive to maintain an adequate working capital position of at least six months,” Bures stated in a company news release. “We feel it is only prudent as a silver-only royalty company to convert a portion of that cash to physical silver.” He emphasized the company’s strategic focus, adding, “SCRI’s ultimate vision is to provide a vehicle that serves as a hedge against currency devaluation, and we therefore feel it would be hypocritical to have exposure to 100% fiat money.”

The silver was purchased using a royalty payment received from PPX, effectively converting that payment into bullion held in reserve. Silver Crown currently holds four silver royalties, three of which are revenue-generating. The company’s business model offers investors exposure to silver without direct exposure to mining operations or cost inflation associated with production.

Silver Sector Faces Tight Supply and Rising Demand Amid Historic Undervaluation

The silver sector continued to show signs of structural imbalance, with persistent supply deficits and rising industrial demand defining the landscape entering the second quarter of 2025. On March 30, Ahead of the Herd reported that 2024 marked the fourth consecutive year of silver market deficits, with a projected shortfall of 215.3 million ounces — the second-largest in more than two decades. Richard Mills of Ahead of the Herd noted that total silver supply was expected to decrease by 1%, while industrial demand continued to rise. Approximately 60% of silver consumption was attributed to industrial applications, including solar energy, electronics, automotive components, 5G, and flexible electronics. He cited a study by Oxford Economics forecasting a 42% increase in industrial and fabricated silver demand between 2023 and 2033.

Also on March 30, Clive Maund provided a technical analysis of silver’s recent performance, highlighting its breakout from a long-term Cup & Handle formation. The report stated that silver was “still working its way through considerable overhanging supply,” which was capping further gains despite the breakout. The analysis emphasized that the sector remained early in its bull market cycle, noting a lack of speculative interest and concluding that “the upside for the sector from here is massive — this thing has barely gotten started yet.”

On April 1, Christopher Lewis at FX Empire described the silver market as “noisy,” with ongoing volatility around the US$33–35 range. He noted that gold continued to influence silver’s trajectory and that while short-term movements were difficult to predict, support levels remained intact. “Silver, of course, is being dragged higher by gold overall,” Lewis stated, while cautioning that silver’s volatility could present risks for traders misaligned with market momentum.

In an April 7 update from Ahead of the Herd, Richard Mills reiterated the undervaluation of silver relative to gold, citing a gold-to-silver ratio of 102, well above the historical average of 60. He argued that this imbalance typically preceded periods of silver outperformance and added that silver had posted a 27% gain in 2024, benefiting from physical demand in India and China, as well as rising gold prices. Mills stated, “In our opinion it’s only a matter of days before people realize how undervalued silver is to gold and start hoovering it up.”

Physical Silver Purchase Underscores Silver Crown’s Commitment to Direct Metal Exposure

Silver Crown’s acquisition of physical silver reinforces its investor-facing identity as a vehicle for direct silver exposure and financial stability. The move follows a series of corporate milestones outlined in the company’s Q2 2025 investor presentation, including the deployment of CA$3.3 million in capital and revenue growth that more than tripled over the past year. As of March 28, 2025, the company had 2.7 million shares outstanding and an implied market capitalization of CA$16.8 million.

The company’s current portfolio includes minimum silver delivery obligations that are expected to total 78,250 ounces in 2025, up from 15,180 ounces in 2023. Notable projects include a 90% silver NSR royalty on the Elk Gold Mine, where Silver Crown is entitled to a minimum cash-equivalent delivery of 6,000 ounces of silver per year. A similar 90% silver royalty is in place on Pilar Gold’s PGDM complex, which provides a minimum of 16,000 ounces per year.

In addition to its closed royalty agreements, Silver Crown has entered into two definitive agreements and maintains an active pipeline of over ten additional opportunities. The company targets internal rates of return greater than 20% across its portfolio and has structured investments to include staged payments, bonus provisions for production increases, and minimum delivery thresholds to secure value for shareholders.

Analyst Sees Upside in Silver Crown’s Pure-Play Strategy

In a January 21 research note, Couloir Capital analyst Tim Wright maintained a Buy rating on Silver Crown Royalties Inc., describing it as “the only pure silver royalty play on the market.” Wright set a price target of CA$32.34, noting that the company’s Enterprise Value-to-Equity Ratio stood at 1.0 compared to a peer group average of 5.7, which he cited as indicating significant relative value.[OWNERSHIP_CHART-10873]

The report highlighted several milestones that positioned Silver Crown for long-term growth, including its July 2024 public listing and a 286% increase in revenue from Q3 2023 to Q4 2024. Wright also pointed to Silver Crown’s acquisition of the BacTech royalty, guaranteeing a minimum of 35,000 ounces of silver annually for ten years, and the PPX Mining agreement, estimating the company could generate over US$1 million in revenue in 2025 based on an expected 36,063 ounces of silver.

At the time of the note, the analyst valued the shares at CA$6.70, representing a potential return of over 470% to his target. While the report was issued prior to the company’s April physical silver acquisition, it provided context for investor interest and supported Silver Crown’s positioning as a silver-focused vehicle amid ongoing market deficits and rising industrial demand.

Ownership and Share Structure

Insiders and management hold a total of 21% of the company, institutions own 16%, and private corporations have 6%, noted Wright with Couloir.

“Insider ownership by management aligns management’s interests with those of shareholders, which is a desirable attribute,” he added.

As for share structure, Silver Crown has 2.49M outstanding shares and 2.1M free float traded shares. Its market cap is US$10.6 million. Its 52-week trading range is CA$6.50–9.85 per share. Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Silver Crown Royalties Inc. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver Crown Royalties Inc.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

( Companies Mentioned: SCRI:CBOE; SLCRF:OTCQX; QS0:FSE,

)

- Gold rises, eyes best day since October 2023 as tariff war heats up Reuters

- Gold prices surge over 3% after trump temporarily suspends tariff implementation KITCO

- Gold Edges Up After Levy Chaos Drives Biggest Gain in 18 Months Bloomberg.com

Gold Correction Over and Rio2 is Great Value

Source: Ron Struthers 04/08/2025

Gold has corrected and consolidated in its support zone. Ron Struthers believes this correction provides a good opportunity to buy gold stocks at a cheaper level, and he likes Rio2, which will start production in 2026.

On the weekend I presented a chart on gold and expected it would correct down and consolidate in the support zone shown below, around $3,000 and so far that is what has happened.

I expect we will now head back up again as hedge funds and investors who had to sell gold to meet margin calls will buy back positions. A pattern I have seen many times in the past.

The physical demand for gold will continue at a high pace, and we have been witnessing strong inflows of physical gold from London to the U.S., so U.S. bullion banks and some hedge funds are now joining the party. They are covering shorts and putting physical gold on the books over paper gold as physical gold is a tier one asset under Basel III that has its final effective date on July 1.

Paper gold is actually becoming a liability because banks have to put up a certain percentage of cash or collateral when they hold paper contracts. We should see strong inflows in the U.S. for the next three months. Gold is not consumed; it is the only thing that is eternal. Gold is money; it never rusts or burns and cannot be destroyed. It is nobody’s liability, like fiat money.

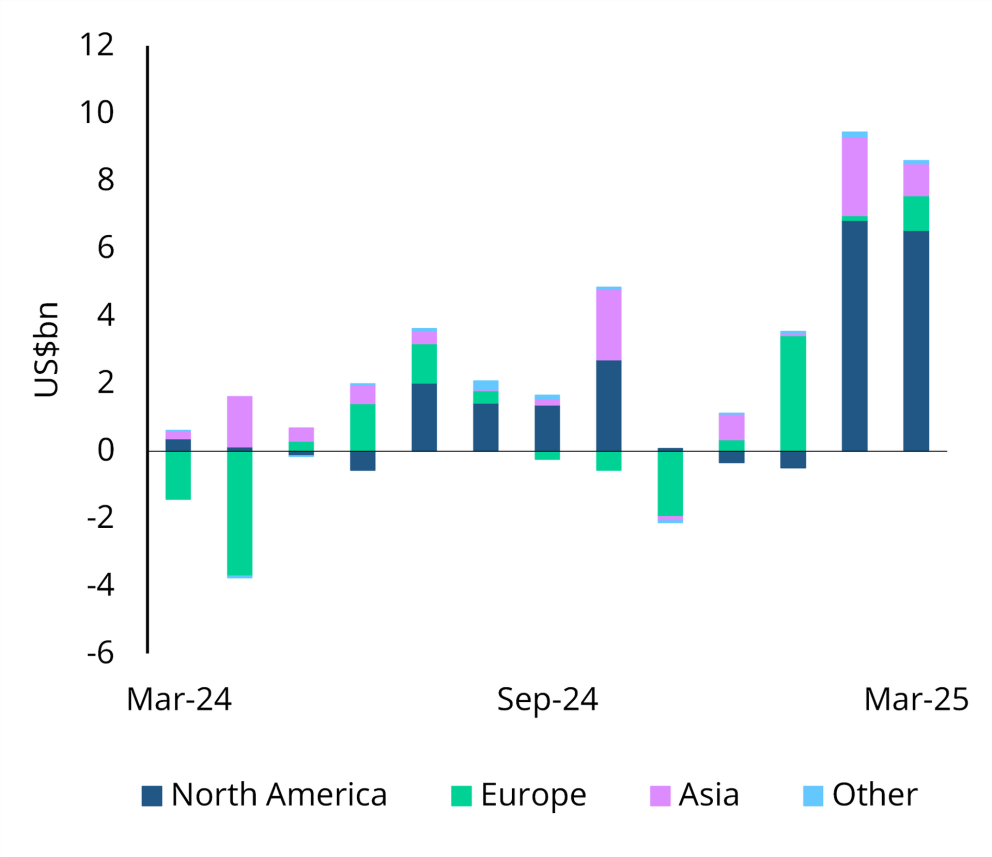

The March ETF data was out this morning, and that is what I was expecting. Global gold ETFs saw US$8.6bn (92t) in March inflows, pushing Q1 totals to US$21bn (226t) — the second strongest quarter on record. North America and Europe led with 83% of flows, while Asia outperformed relative to its 7% AUM share.

Back in 2011, we sold Rio Alto for over a 1,700% gain. We first bought Mexican Silver Mines in 2007 and was renamed Rio Alto Mining. Today I want to tell you about Rio Alto 2, called Rio2 Ltd.

It is much the same team with several directors from Rio Alto, and I highlight below.

Management:

Alex Black, Executive Chairman, has over 40 years of experience in the mining industry, founded Rio2 Limited, and has been Director, President & CEO of the company since 2016. In 2009, after successfully negotiating the acquisition of the La Arena Gold Project from Iamgold Corp, Rio Alto S.A.C. was acquired by Mexican Silver Mines and renamed Rio Alto Mining Limited. In 2014, Rio Alto also completed the successful acquisition of Sulliden Gold and the Shahuindo Gold Project for C$300M. Mr. Black, as President & CEO of Rio Alto Mining Limited and his experienced management team built Rio Alto from a CA$12M company in 2009 to a CA$1.2B company in 2015 at the time of the acquisition by Tahoe Resources Inc.

President and CEO Andrew Cox is based in Lima, Peru, and has over 28 years of experience in mining operations worldwide. Andrew also held various positions at Rio Alto Mining Ltd. from 2011 until acquired in 2015. Following the acquisition of Rio Alto Mining Ltd. by Tahoe Resources Inc., Andrew was the corporate operations manager in Peru until December 2016.

Kathryn Johnson, EVP – CFO & Corporate Secretary, is based in Vancouver and has over 15 years of experience in the mining industry, primarily in Latin America. Kathryn held various senior positions at Rio Alto Mining Limited until it was acquired in 2015. Her last position was Chief Financial Officer and, prior to that, Vice President – Corporate Reporting and Corporate Controller. While at Rio Alto Mining, Kathryn was a key member of the team that successfully completed the acquisition of Sulliden Gold and the Shahuindo Gold Project for $300 million in 2014.

Enrique Garay, Senior VP Geology – MSc P. Geo/FAIG, is a seasoned senior geologist with over 25 years of experience in the precious and base metal resource sector, with a focus on exploration and mine geology. He has worked for a number of leading mining companies including Barrick, Hochschild Mining, Trafigura, Consorcio Minero Horizonte, Rio Alto Mining, and Nexa Resources.

Rio2 Ltd.

Recent price – $0.75

52-week trading range – $0.40 to $0.93

Shares outstanding – 426.6 million

Major shareholders of Rio2 Ltd. (RIO:TSX.V; RIOFF:OTCQX; RIO:BVL) include Eric Sprott 7.46%, Power Corp 5.57%, Gam Holding 4.57%, Chairman Alex Black 4.38% along with some other funds.

I don’t know if we can make a 1,700% gain with Rio2, but it is possible with gold going up to $5,000 to $10,00 as I expect longer term in this bull market.

Rio2 is an advanced-stage development company that is expected to go into production in early 2026. Rio2 is focused on taking its Fenix Gold Project in Chile to production in the shortest possible time frame based on a staged development strategy.

Fenix Gold Project (37,291 ha), Chile

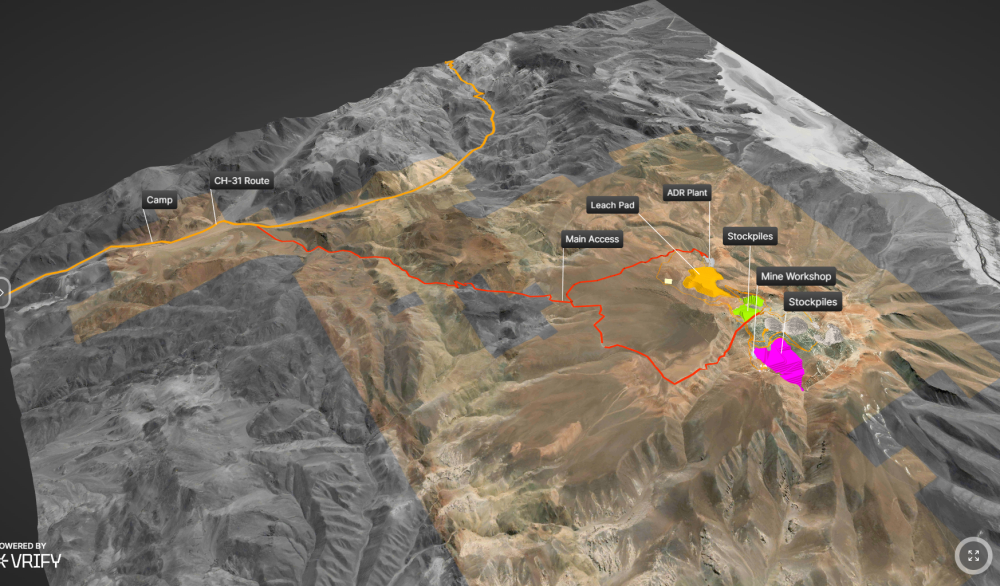

It is located in the Atacama Region, in the Copiapó Province – Chile, specifically in the Maricunga Mineral Belt, approximately 160 kilometers northeast of Copiapó by International Road CH-31.

It is the largest undeveloped gold oxide heap leach project in the Americas. The Maricunga Mineral Belt is a well-known mining district that contains over 70 million ounces of gold and hosts the La Coipa and Refugio mines, as well as the Volcan, Caspiche, Lobo Marte, and Cerro Casale deposits. Some of you may remember a number of these mines from the old Bema Gold days.

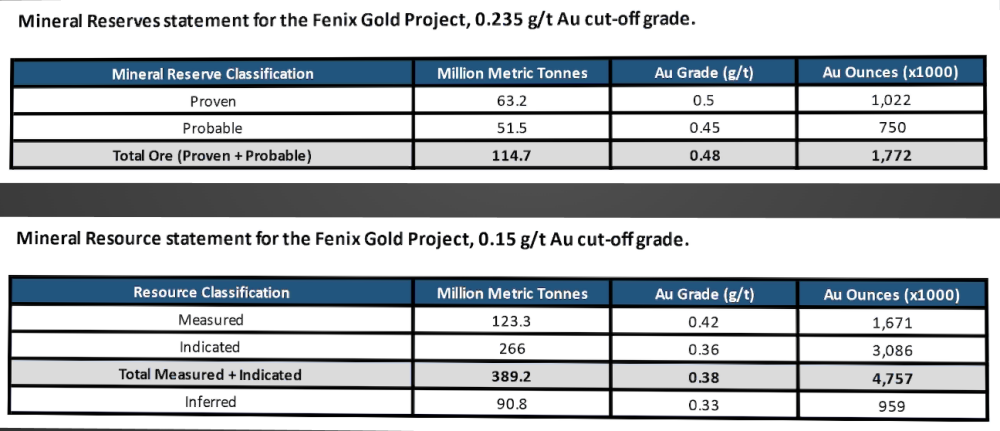

The project has 4.8 million ounces Measured and Indicated, with another 1 million inferred. The feasibility was completed in 2023 and highlights a 17-year mine life with 91,000 ounces per year for the first 12 years. The strip ratio is low at 0.85, and gold grade to heap leach is 0.48 g/t. The initial CAPEX is only US$235 million with Initial sustaining capital. All in Sustaining Costs are estimated at $1,237 per ounce so this is going to a very profitable mine at today’s gold price. The mine being contemplated will be a run-of-mine heap leach operation. No crushing or tailings storage facilities are required, thereby minimizing the overall impact and footprint of the project.

The project began official construction at the beginning of February; the projected construction capital expenditure for 2025 is estimated to be $ 122 million (U.S.) (excluding Chilean VAT tax, which is refundable), with construction expected to be completed in November 2025. First gold production is currently guided for January 2026.

This is an excellent view of the mine setup. I would encourage you to view their presentation, which is all in 3D and gives an excellent understanding of the project and how mines are built.

Financial

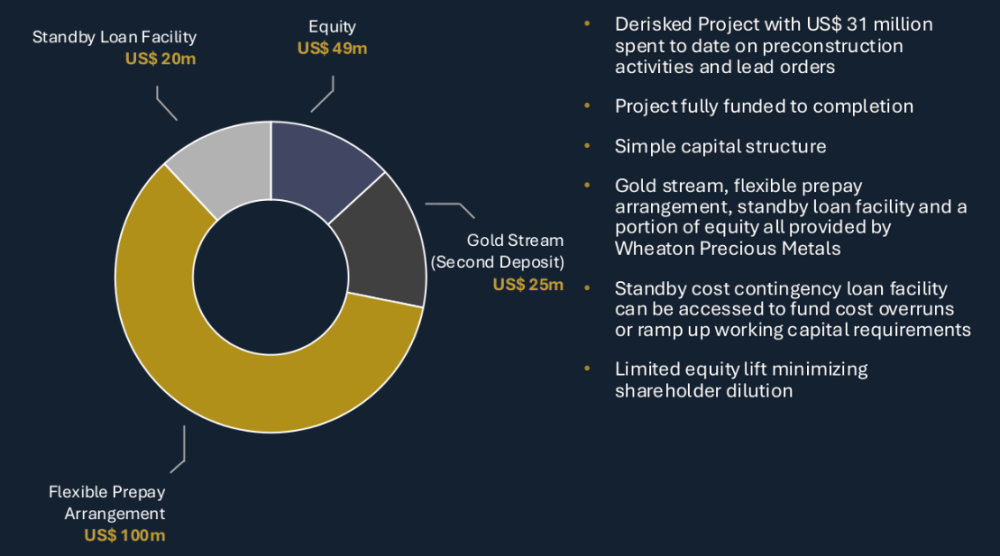

The project is fully financed for production, and this slide shows its components.

Conclusion

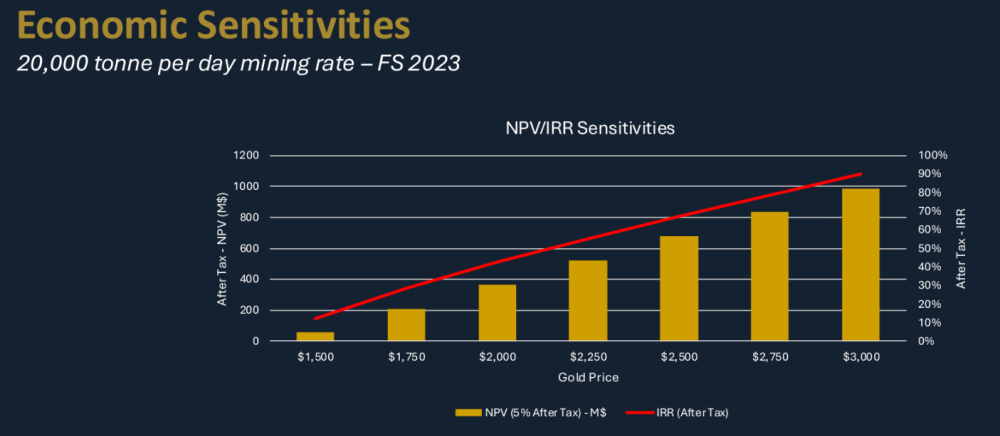

Since Rio2 started to develop this project, the gold price has increased significantly, and you can see at $3,000 a very high IRR of 80%.

This will be a real cash cow for the company.

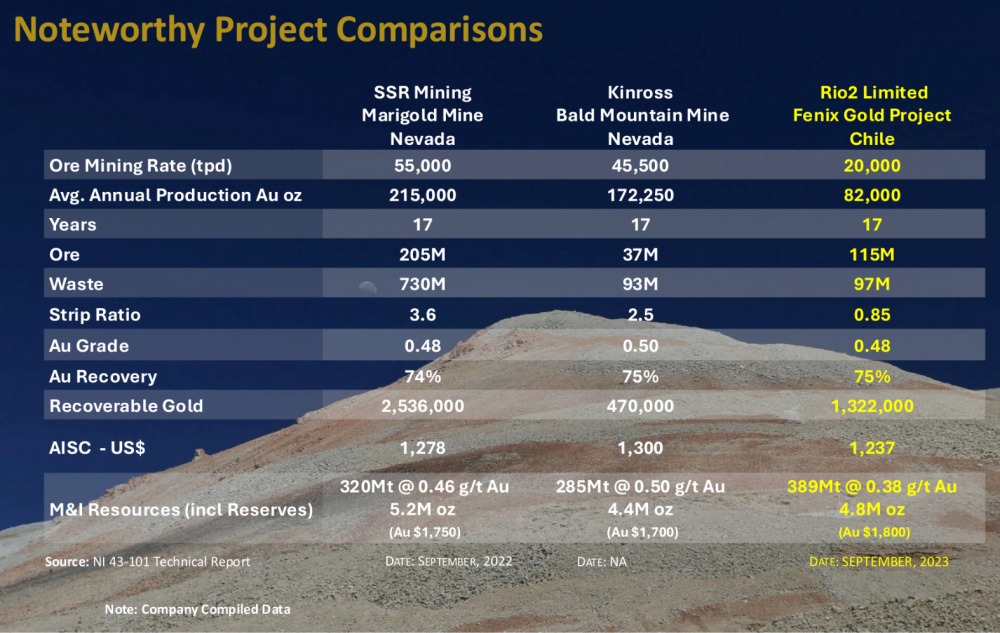

This company slide does a comparison to a couple of similar mines that I am familiar with as I followed SSR and Kinross.

Rio2’s best advantage to these two is the low strip ratio of 0.85. Further down the road, it would not take much for Rio2 to expand to 30,000 to 40,000 tpd.

The enterprise value per M&I ounces is only around US$45 which I believe is very very low for a mine fully financed to production and $3,000 gold prices.

The stock has been a bit of a roller coaster ride that maybe helps explain some of the bargain price.

In 2022, the stock got whacked when the EIA was rejected in a regional vote as not having supplied sufficient information to eliminate possible negative impacts on three species of fauna.

After more information was provided and a review, the EIA was approved, and the stock continued to grow higher in 2024 with higher gold prices, and the mine financing was completed.

I believe the stock is way undervalued for the asset and stage it is at. A stock usually sees a big move higher when production starts with cash flow and earnings. The recent correction is an excellent entry point.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Ron Struthers: I, or members of my immediate household or family, own securities of: Rio2 Ltd. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author’s control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

( Companies Mentioned: RIO:TSX.V;RIOFF:OTCQX;RIO:BVL,

)

Source: Clive Maund 04/08/2025

Technical Analyst Clive Maund reviews Pasofino Gold Ltd. (VEIN:TSX.V; EFRGF:OTCQB; N07:FSE) to explain why he thinks the company is very undervalued.

Although Pasofino Gold Ltd. (VEIN:TSX.V; EFRGF:OTCQB; N07:FSE) drifted lower since we last looked at it at the end of December due to lack of action on the takeover front, the value of its primary asset has continued to appreciate as the gold price has continued to trend strongly higher, making the company more and more attractive to a JV partner or partners or as a takeover candidate.

It is thus interesting to observe that, despite the broad stock market caving in last week, the price of Pasofino stock surged on the news that Pasofino entered a support deal with Hummingbird, Nioko. This sharp move higher on good volume caused the stock to break out of the intermediate downtrend it had been stuck in since last October, as we will see when we look at its latest stock charts. First, we will overview the company’s fundamentals using slides from its latest investor deck (March).

Recently, Pasofino Gold Ltd. Chief Executive Officer Brett A. Richards made the following observations: “Over the past two or three years, Pasofino Gold and its Dugbe Gold Project have been a secondary focus to Pasofino’s major shareholder — Hummingbird Resources plc. Now that Hummingbird has been acquired by Nioko Resources, all parties and shareholders recognize the strategic significance of such a large, highly economic gold project in one of the most (if not the most) attractive geo-political jurisdictions in West Africa. I think that is obvious from the numerous interested parties that we have engaged with in the past six months, who had an interest to acquire the project for value.

This recent Co-operation Agreement signed between Nioko Resources, Hummingbird Resource and Pasofino Gold, represents a re-birth of the Dugbe Gold Project, now having a strongly aligned partnership, committed joint funding and an operating plan to create transformational value for all shareholders over the next eighteen (18) months.

In this current and forecasted gold price environment, Pasofino represents probably the most under-valued gold junior in the market today, given the size, scale, quality, and economic voracity of the current feasibility study. To that end, we have developed a joint path with our major shareholder to unlock that value and build on the already robust nature of the project.”

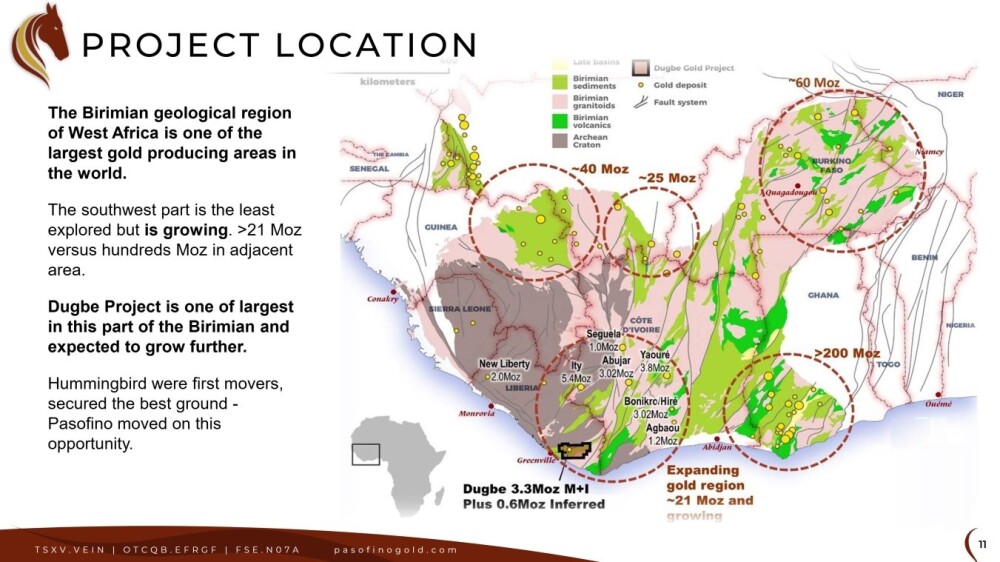

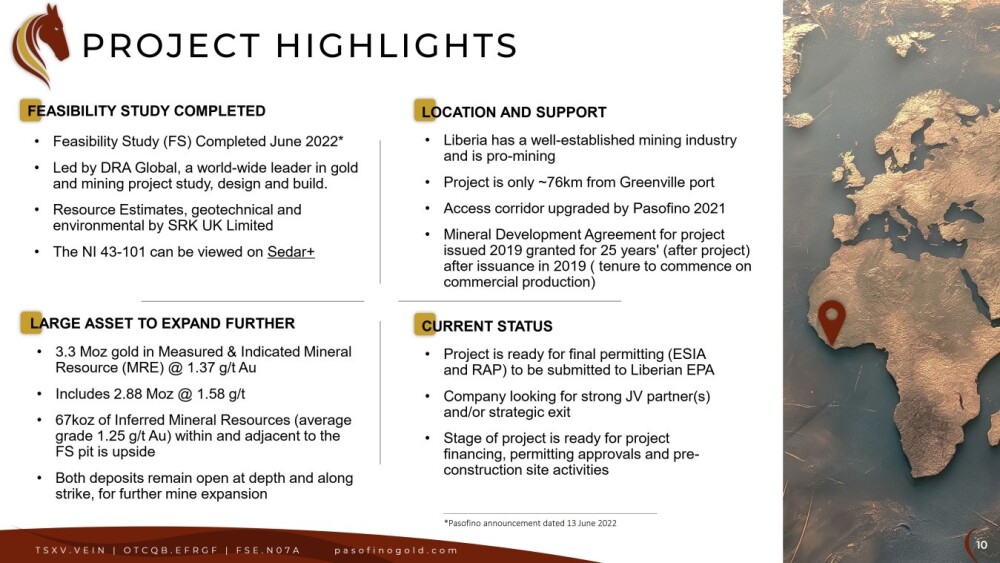

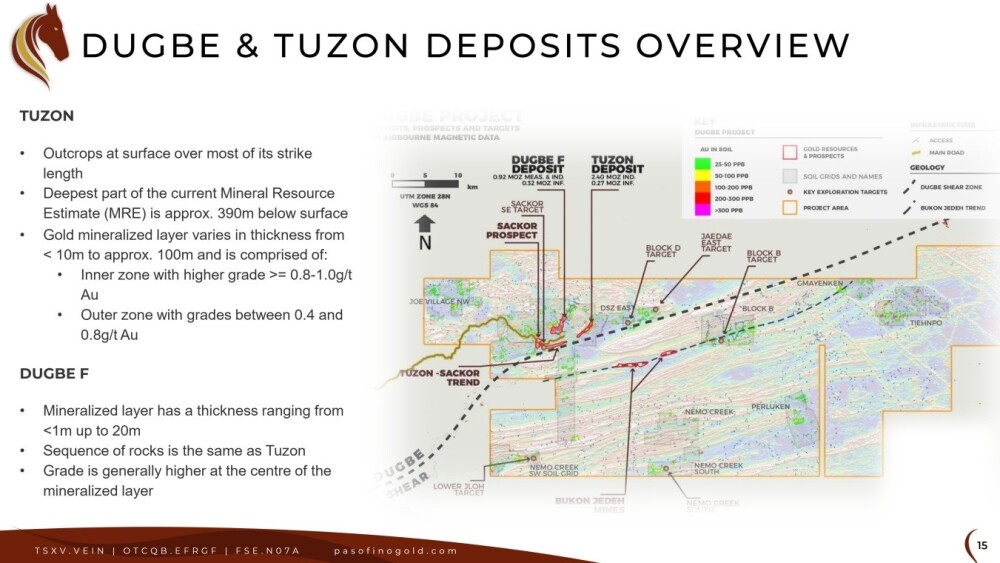

Pasofino Gold is developing its 100% owned Dugbe Gold Project in mining-friendly and now politically stable Liberia in West Africa. The following map shows the location of the project in Western Liberia. It is at the western end of the prolific Birimian Gold Belt, which extends to the north and east of Liberia into the Ivory Coast, Ghana, Burkina Faso, and Senegal. The presence of other large impressive deposits within this belt bodes well for further discoveries in and around Dugbe.

Liberia is now a good place for mining.

Here are the project highlights:

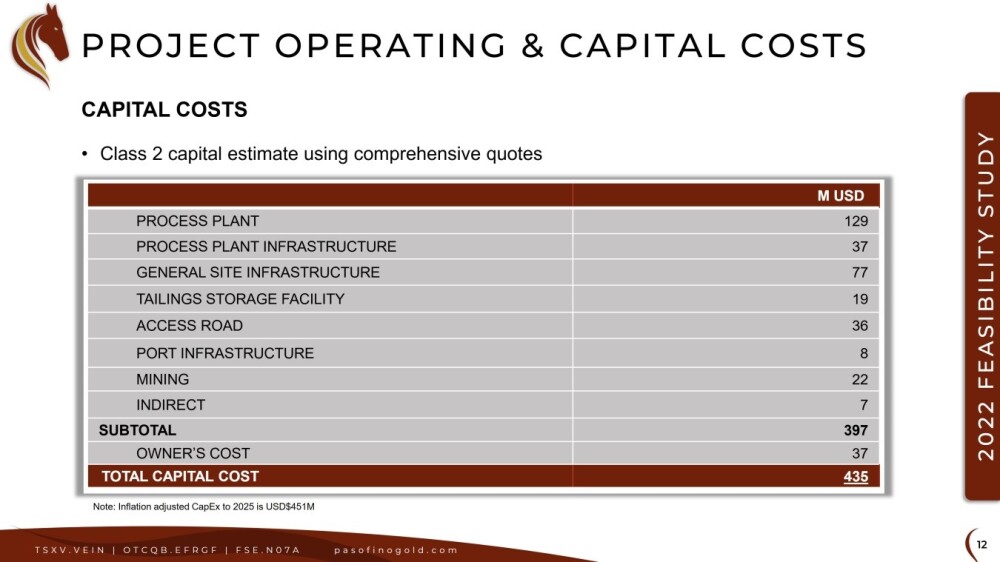

Capital Costs of the Project are estimated as follows.

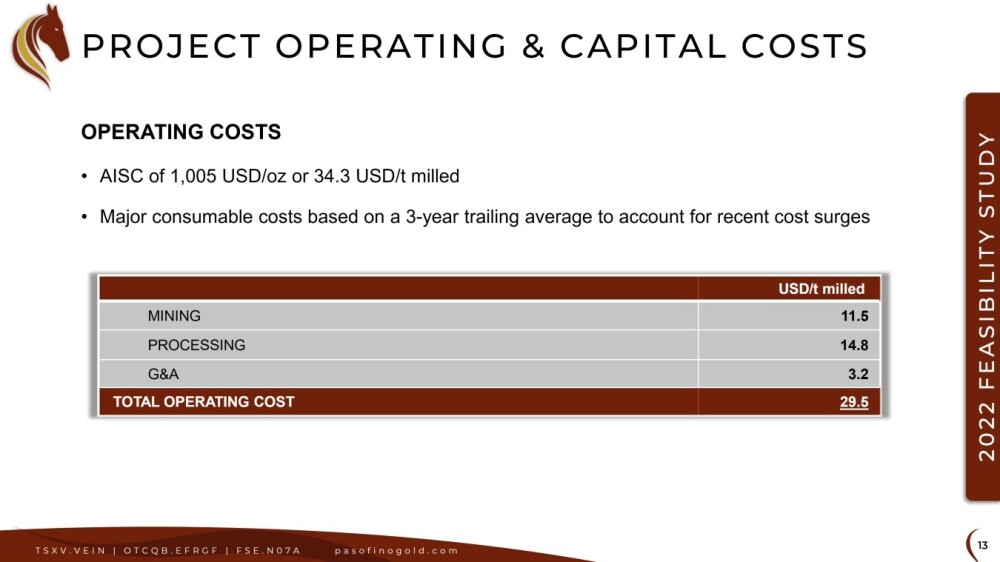

The operating costs of the project are listed here:

The following map overviews the Dugbe and Tuzon deposits.

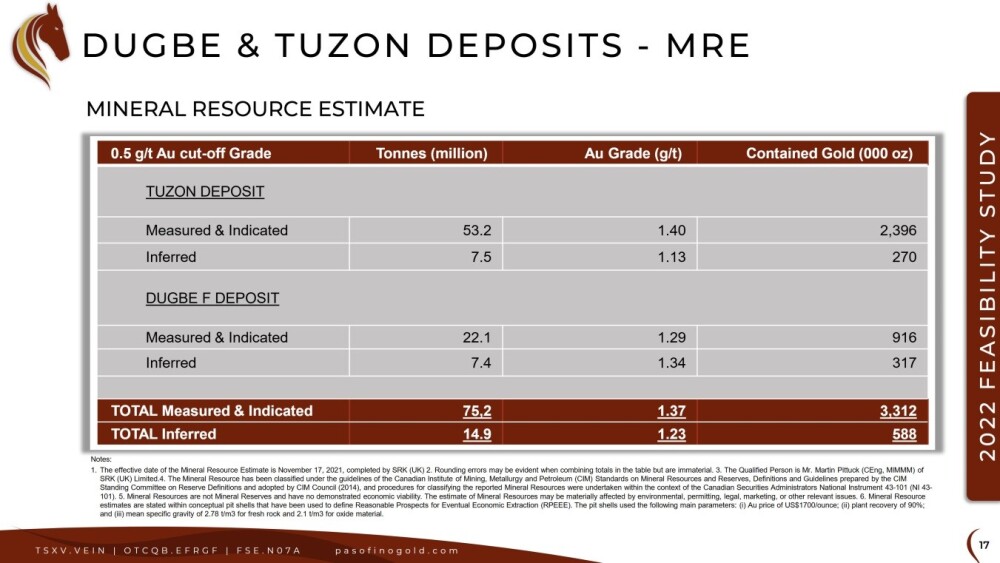

The Dugbe and Tuzon MREs (Mineral Resource Estimates) are below.

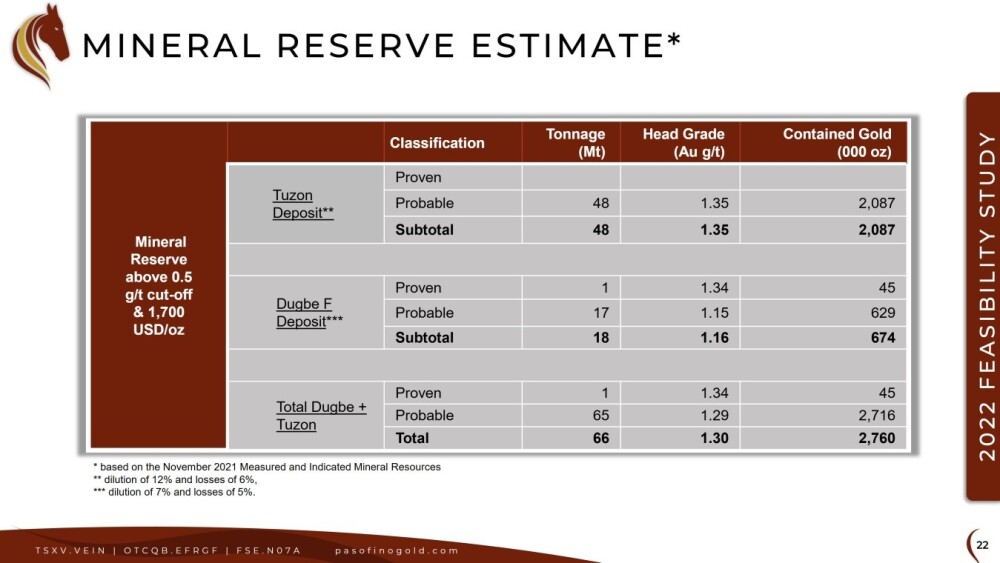

The Dugbe and Tuzon Reserve Estimate is below.

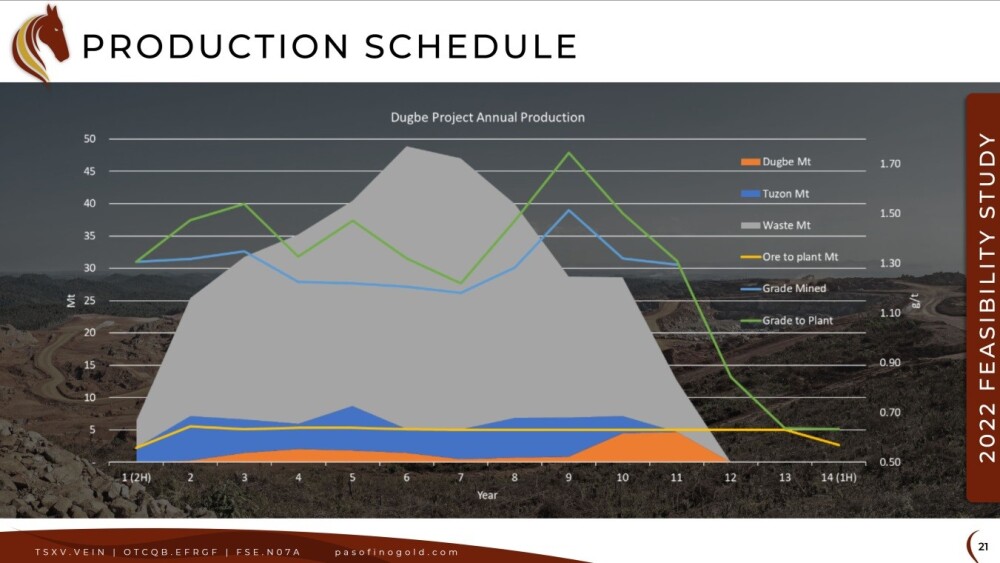

Here is the production schedule:

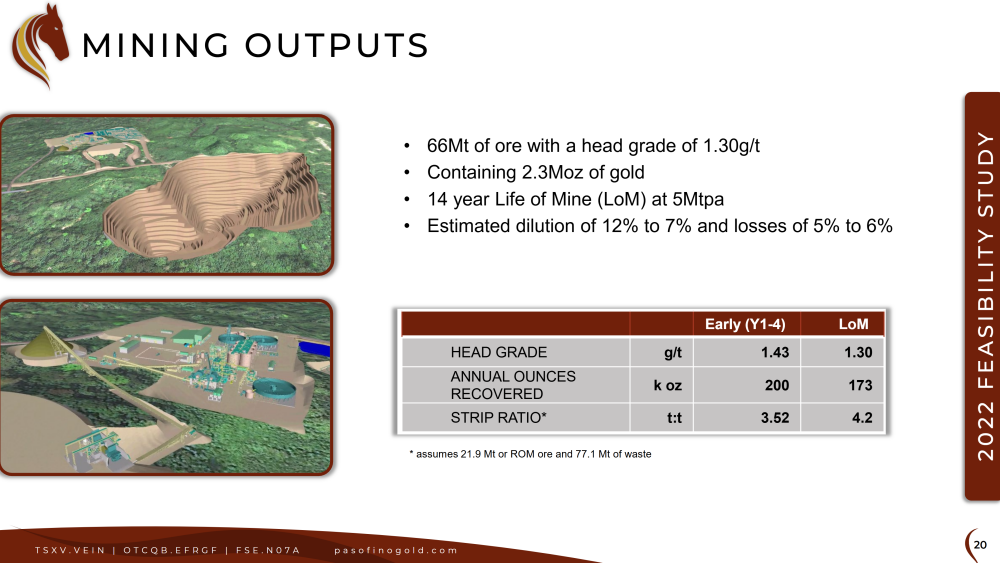

Here are the mining outputs:

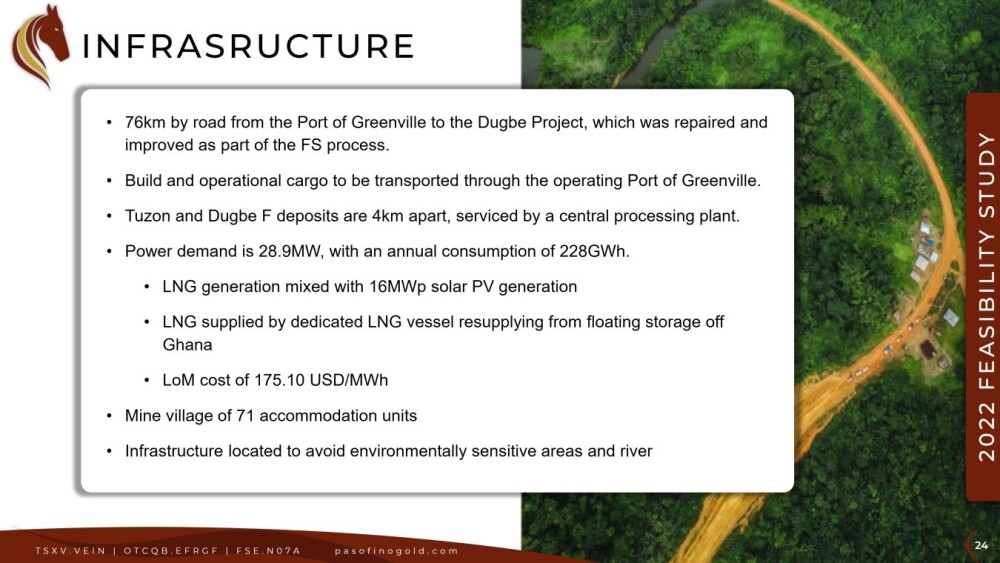

The infrastructure is good.

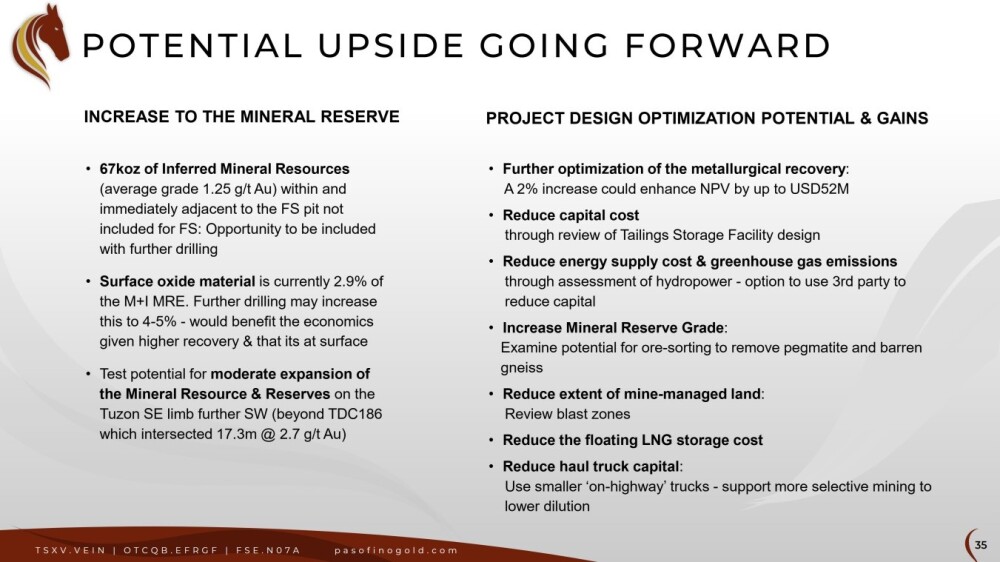

There is upside going forward arising from possible increases to the Mineral Reserve and Project Optimization.

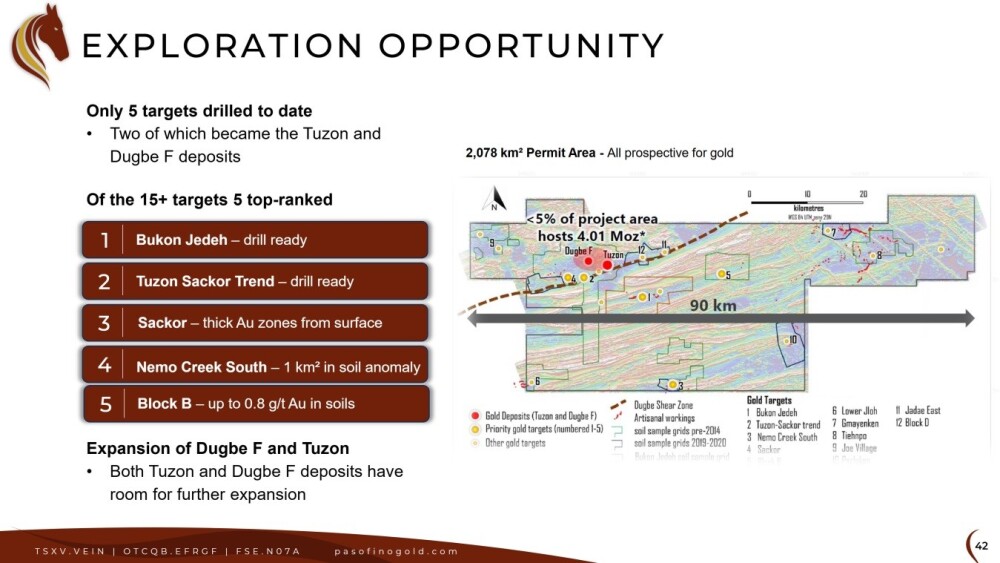

Only five of the 15+ targets have been drilled to date, so there is plenty of exploration opportunity.

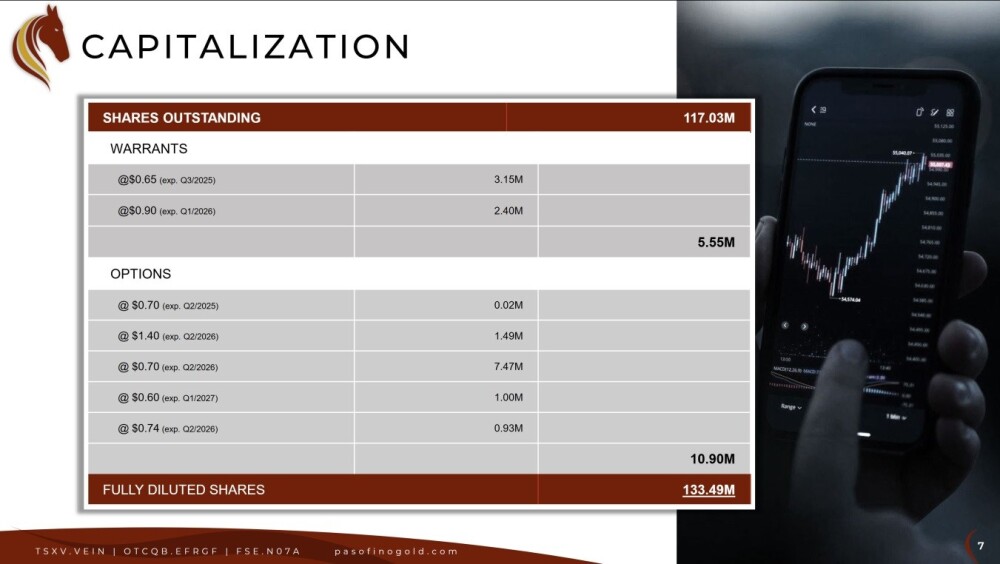

The capital structure of the company is as follows, with 117 million shares outstanding.

Turning now to the latest stock charts for Pasofino Gold, we see on the latest 8-month chart that, after continuing to drift lower in light volume on lack of interest from the New Year, it suddenly came to life last week, breaking out of the intermediate downtrend in force from last October on the news mentioned above.

This breakout was portended by almost all volume from the start of the year being upside volume and the relatively strong Accumulation line that resulted from this.

In conclusion, Pasofino Gold looks very undervalued here and like it is now starting a new bull market, and with a high and growing probability of a buyout soon on favorable terms for shareholders, it is rated an Immediate Strong Buy.

The first target for an advance is the CA$0.75 – CA$0.80 area at resistance at the highs of last September – October. The next target is CA$5.00 – CA$6.00 with higher targets possible.

Pasofino Gold’s website.

Pasofino Gold Ltd. (VEIN:TSX.V; EFRGF:OTCQB; N07:FSE) closed for trading at CA$0.435, US$0.382 on April 7, 2025.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Pasofino Gold Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Pasofino Gold Ltd.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.

( Companies Mentioned: VEIN:TSX.V;EFRGF:OTCQB;N07:FSE,

)