Source: Brian Hicks 04/04/2025

Brian Hicks of Wealth Daily explores how the massive 39-million-ounce Donlin Gold deposit in Alaska represents not just untapped mineral wealth, but a revolutionary opportunity for American prosperity through resource tokenization.

“The fortunes of a nation lie beneath its own soil. Let no republic depend on foreign hands when Providence has stocked its lands with gold.”

— Inspired by Thomas Jefferson

Picture a gold deposit so enormous, so critically valuable to the United States and its people that its full development could permanently alter the global gold supply landscape.

Yet, it remains virtually undiscussed.

Introducing Donlin Gold, a gigantic untouched gold deposit in southwestern Alaska’s remote highlands.

Supported by two mining giants — Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) and NovaGold Resources Inc. (NG:TSX; NG:NYSE.MKT) — this mammoth project contains one of the world’s largest undeveloped gold reserves.

Here’s what makes Donlin exceptional — and why it may soon become central to America’s quest for domestic critical resources.

The Figures are Astounding

We’re not talking about some small explorer with an unproven plot of land.

This is a 39-million-ounce gold deposit (measured and indicated), grading 2.24 grams per tonne — almost twice the grade of typical open-pit gold projects today.

Let that register, friend.

This isn’t low-grade, borderline ore.

This is premium-grade gold in massive quantities, located within United States borders, in a region desperate for secure domestic mineral supplies.

And the surprise?

Only a small portion of the property has been explored.

According to on-site geologists, the surrounding area shows district-scale potential. In other words, it could rival Nevada’s legendary Carlin gold trend in size.

This suggests Donlin could potentially double in size — or more — with additional exploration.

It’s Massive. It’s Valuable. But Why Isn’t It Being Extracted?

The straightforward answer is politics, permitting, and infrastructure.

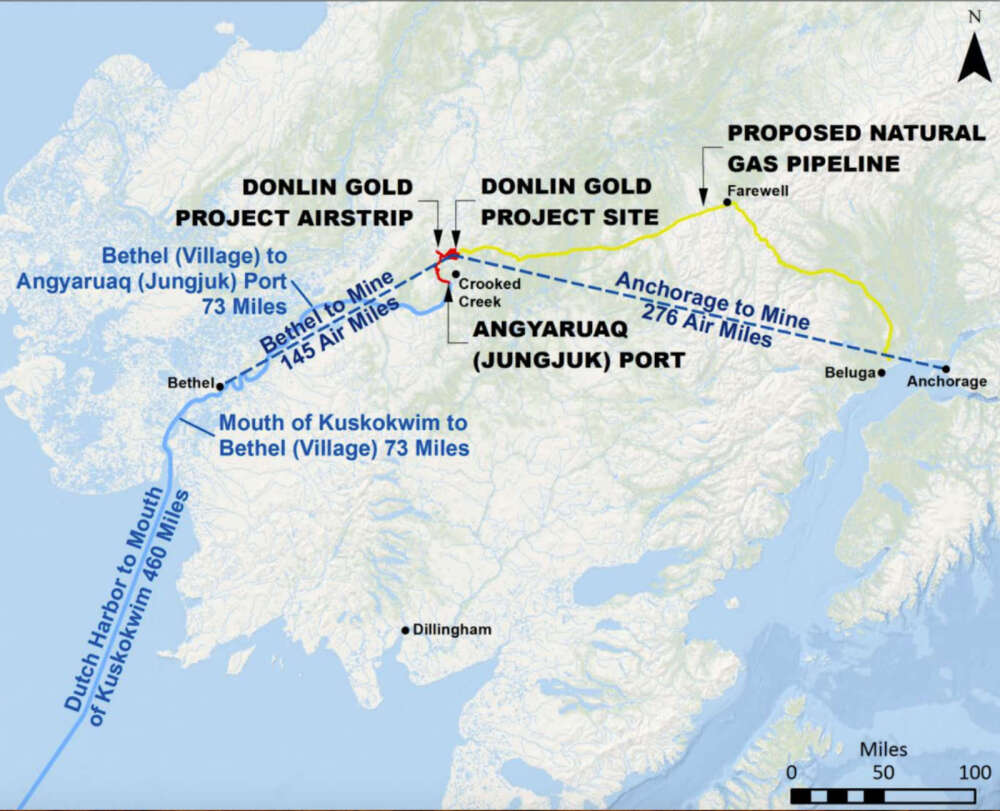

Similar to Northern Dynasty Minerals Ltd.’s (NDM:TSX; NAK:NYSE.MKT) Pebble Creek gold project southward, Donlin is situated deep in Alaska’s remote Yukon-Kuskokwim region — distant from roads, electricity grids, and the bureaucratic comfort zone of the EPA and Army Corps of Engineers.

To bring Donlin Gold into production, a natural gas pipeline stretching hundreds of miles would need construction.

The project has already undergone more than a decade of permitting, tribal consultation, and environmental assessment. It received its final EIS (Environmental Impact Statement) and Record of Decision from the U.S. Army Corps of Engineers in 2018 — a significant milestone.

But like all mega-projects in today’s mining-resistant climate, local lawsuits and appeals have hampered progress. Critics mention concerns about fish habitats, cultural impacts, and environmental risks — particularly regarding waste management.

Nevertheless, unlike Pebble Creek, Donlin enjoys crucial backing from Native corporations owning the surface and subsurface rights: Calista Corporation and The Kuskokwim Corporation (TKC). That’s not merely symbolic. It’s essential.

These Alaska Native groups have openly endorsed Donlin’s development, citing its employment potential, community infrastructure plans, and economic advantages for some of Alaska’s most underserved communities.

In Brief, Donlin Isn’t Battling Against Alaska — It’s Championing It

Valued over $80 billion at current prices, the unmined gold isn’t speculation. It’s not theoretical. It’s authentic, verified, and permitted.

And yet . . . billions in precious metal remains untouched.

But that’s changing — because a powerful convergence of technology, politics, and patriotism is forging a bold new approach. A method to unlock Donlin’s value without disturbing the earth.

And it begins with NatGold Digital Ltd. and a revolutionary proposal to secure America’s future with what lies beneath our soil.

I’ll elaborate shortly. . .

But first, let’s discuss facts.

Donlin: The Hidden Treasure Nobody’s Discussing

The Donlin Project is equally owned by NovaGold Resources and Barrick Gold, two mining industry powerhouses.

Both NovaGold and Barrick have invested tens of millions into the Donlin Gold project.

So this isn’t some distant speculative venture.

So what’s causing the delay?

The usual culprits are environmental litigation, infrastructure challenges, and a glacially slow permitting process.

In fact, efforts to advance the Donlin Gold project suffered another courtroom defeat last September. According to Courthouse News Service:

In a world where capital is limited, fuel is costly, and ESG concerns dominate headlines, constructing a $7 billion mega-mine in remote Alaska has become nearly impossible.

That’s why digitizing Donlin’s unmined gold reserves could be the breakthrough we’ve awaited.

Like Pebble Creek, Donlin’s gold was discovered in the 1980s. And just like Pebble Creek, Donlin’s immense wealth remains underground, trapped in bureaucratic complexities with no clear path forward.

NatGold: Freeing Trillions Without Breaking Ground

Introducing NatGold — a visionary framework for a new type of gold-backed digital asset.

Instead of extracting physical gold, NatGold proposes something daring and elegantly simple: Digitize in-ground, certified gold reserves and provide investors electronic ownership of genuine, undisturbed wealth.

Each token represents a fraction of a certified gold ounce, confirmed by independent geological reports and recorded on a transparent blockchain ledger.

It’s a contemporary vault — digital, verifiable, and inflation-resistant — backed not by extracted gold but by America’s buried treasure.

Donlin is the perfect pilot project. With 39 million verified ounces waiting, why not tokenize 5 million — or the entire deposit — and place it in a new national reserve?

That reserve has a name — and a purpose.

Trump’s Sovereign Wealth Fund: Converting Gold Into National Strength

In early 2025, former President Donald Trump signed a groundbreaking executive order aimed at reclaiming U.S. control over critical mineral supply chains. Behind this was a grander vision — one the markets and the media haven’t fully grasped. . .

The establishment of a U.S. sovereign wealth fund — backed not by Treasury bonds or foreign investment but by America’s natural resources.

Envision a digital, tokenized vault containing: Certified gold from Donlin and Pebble Creek, Rare earths from Texas and Wyoming Copper, lithium, and antimony from Montana to Nevada.

All tokenized. All transparent. All supported by geological evidence.

This fund wouldn’t merely be a financial asset — it would be a strategic tool in this era of inflation, de-dollarization, and geopolitical shifts.

NatGold’s platform could supply the technology. Projects like Donlin could provide the assets. And America, for once, would be leveraging its existing resources — instead of seeking what it needs elsewhere.

Eco-Patriotism: A Modern Manifest Destiny

Let’s be direct: This isn’t about environmental exploitation. It’s not about excavation and chemical processing.

It’s about eco-patriotism — the belief that we can preserve our wild landscapes while securing economic prosperity. That we can honor tribal partnerships, protect watersheds, and maintain forests while unlocking value through America’s other resource powerhouse: technological innovation.

Through tokenization, America can finally recognize its mineral wealth’s economic value without immediate extraction. That’s not just intelligent — it’s revolutionary.

It’s not resource exploitation. It’s resource recognition.

Final Thoughts

The Donlin Gold project symbolizes more than buried treasure. It represents a choice.

A choice between continuing down a path of debt, dependency, and decline — or boldly harnessing our natural abundance to restore national vigor.

And with that in mind, let’s conclude:

“Wealth consists not in having great possessions but in having few wants — and the wisdom to use what you already own.”

— Inspired by American frontier philosophy

America already possesses the gold.

Now, we need the wisdom to utilize it.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barrick Gold Corp., Northern Dynasty Minerals Ltd., and NatGold Digital.

- Brian Hicks: I, or members of my immediate household or family, own securities of: NatGold Digital and Northern Dynasty Minerals Ltd. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

( Companies Mentioned: ABX:TSX; GOLD:NYSE,

NDM:TSX; NAK:NYSE.MKT,

NG:TSX; NG:NYSE.MKT,

)