Category: Gold

Source: Streetwise Reports 04/03/2025

Giant Mining Corp. (CSE: BFG; OTC:BFGFF; FWB:YW5) is expanding its 2025 drill program at Majuba Hill in Nevada, guided by AI and rising copper demand. Find out how this strategic move could position the company for future growth.

Giant Mining Corp. (CSE: BFG; OTC:BFGFF; FWB:YW5) has expanded its 2025 diamond core drilling program at the Majuba Hill Copper-Silver-Gold Project in Nevada by adding a fifth drill hole. This new hole was designed using artificial intelligence (AI) modeling developed by Exploration Technologies Inc. (ExploreTech) and will target a high-potential resistivity anomaly in the southern portion of the project area. The decision follows what the company described as “encouraging visual results” from the first hole of the program, MHB-32, which was drilled to a depth of 889.5 feet (271.1 meters).

ExploreTech’s AI system combines geological and geophysical data, running thousands of simulations to pinpoint subsurface anomalies. The system then recommends optimal drill trajectories to intersect these targets. This collaboration marks a notable technological advancement in Giant Mining’s ongoing efforts to delineate mineralization at Majuba Hill, which is located in Pershing County, Nevada, and spans 9,684 acres.

David Greenway, CEO of Giant Mining, stated in a company news release, “We are thrilled with the continued success of the 2025 drill program and encouraged by our team’s recommendation to add an additional hole to the plan — another key step toward advancing Majuba Hill to a new NI 43-101 mineral resource estimate.”

Hole MHB-32 was completed by Big Sky Exploration, LLC of Eureka, Nevada, and the core was quick-logged and tagged on-site. The core samples will be prepped for analysis at ALS Group USA’s facilities in Elko, Nevada. Prepped samples will be tested for copper, silver, gold, and trace elements using a combination of fire assay and ICP-AES methods.

The 2025 drill campaign builds upon prior results, particularly from MHB-30 and MHB-31 in 2024, which intersected high-grade copper mineralization in breccia zones. According to the company, mineralization at Majuba Hill remains open in all directions. In total, over 83,000 feet of drilling have been conducted to date on the property, with a reported historical replacement value of US$10.4 million in development costs.

Majuba Hill has a long production history, with records of 2.8 million pounds of copper, 184,000 ounces of silver, and 5,800 ounces of gold extracted from the site between the early 1900s and the 1950s. Infrastructure at the site includes road access, proximity to power, and logistical support from nearby cities, positioning the project favorably for further development.

Copper Prices Spike as U.S. Tariff Threats Reshape Global Supply Chains

A surge in copper prices and supply chain pressures defined the global copper sector in early April, as U.S. policy shifts and international market dynamics reshaped the metal’s trade patterns and cost structures. A March 29 commentary from Pretiorates highlighted structural challenges in the U.S. mining sector, noting that it now takes “an average of 29 years from discovery to production of a new mine.” This delay places the U.S. second only to Zambia for mine permitting timelines, complicating efforts to increase domestic supply. The analysis described the market’s reaction to pending U.S. tariffs, stating, “On the New York Metals Exchange, copper is already trading over 15% higher than on the London LME,” and added that copper was “rapidly moving from London to the USA.”

According to a March 30 analysis by Ahead of the Herd, commodities traders began redirecting large volumes of refined copper from Asia to the United States in anticipation of potential tariffs. Between 100,000 and 150,000 metric tons of refined copper were expected to arrive in the U.S., prompting companies to reserve additional warehousing space in cities like New Orleans and Baltimore. The analysis emphasized the U.S.’s reliance on imports, noting that “imports account for about half of U.S. copper usage, up from just 10% in 1995.”

Reported by Katusa Research on April 2, the copper price in the U.S. (Comex) surpassed US$5 per pound, compared to about US$4.60 per pound on the London Metal Exchange (LME). This spread reflected increased U.S. demand and fears surrounding tariff implementation. The report explained that “inventories in CME warehouses have jumped to over 85,000 metric tons,” doubling since September 2024, as buyers rushed to build stockpiles. It also noted that “the risk of added costs on imported copper has prompted U.S. buyers to build up stockpiles,” amplifying supply tightness globally. Meanwhile, large withdrawal requests from LME warehouses in Asia signaled copper’s reallocation to higher-priced U.S. markets.

Kitco also addressed this shift on April 2, reporting that copper had recently “invalidated its move to new highs,” interpreting this as a possible technical turning point. The commentary described the market as being in a state of “peak uncertainty” due to impending tariff announcements and noted that copper, alongside gold, had “rallied based on the rumor” of tariff implementation, with potential for a reversal under the “buy-the-rumor-sell-the-fact” pattern.

Giant Mining Targets Resource Growth at Majuba Hill Amid Rising Copper Demand

According to Giant Mining’s April 2025 investor presentation, the company’s primary focus is on the continued delineation and potential expansion of the porphyry copper system at Majuba Hill, which it believes holds significant relevance for the electric vehicle (EV) and renewable energy sectors. With each EV requiring approximately 183 pounds of copper, long-term global demand for the metal remains strong. S&P Global projects a year-over-year copper demand increase of 2 to 3 percent through 2035.

Giant Mining’s 2025 exploration strategy targets an additional 4,400 feet (1,340 meters) of core drilling within an existing exploration target area. The current program is financed and strategically designed to support a future National Instrument 43-101 compliant mineral resource estimate. The application of AI through ExploreTech to optimize drilling targets represents a notable technological differentiator for the company, especially in the context of covered and geophysical complex terrains.

Beyond the current drill program, Majuba Hill’s location in Nevada, a jurisdiction consistently ranked highly by the Fraser Institute for mining investment attractiveness, provides a stable regulatory and operational environment. The company’s ability to leverage its prior drilling database, combined with new geophysical modeling, positions it to make meaningful progress on expanding known mineralized zones. Additional assay results and exploration updates are expected as drilling continues.

Technical Analyst Highlights Bullish Setup for Giant Mining Corp.

On March 5, Technical Analyst Clive Maund offered a positive outlook on Giant Mining Corp., citing a strong chart pattern and supportive market conditions. Maund noted that the company had completed what he described as a “big Cup & Handle base pattern,” a formation typically associated with bullish reversals. He pointed to elevated trading volume during the rally on the right side of the pattern as evidence that “the company is turning the corner.”

Maund identified multiple technical indicators suggesting the potential for a breakout, particularly the convergence of moving averages. He commented that “another upleg from here will quickly result in a bullish cross of the moving averages,” which he believed would signal the start of “an important new bull market.” [OWNERSHIP_CHART-11069]

Beyond technicals, Maund referenced broader policy developments, especially proposed U.S. tariffs on imported copper, as a factor supporting companies with domestic copper exposure. He wrote that “the growing awareness that the tariff barriers will make domestic producers of copper like Giant Mining . . . more important” had started to shape investor sentiment.

In assessing longer-term valuation, Maund pointed out that the company’s stock had previously traded at significantly higher levels. He noted that “as recently as early 2023, it was trading at over CA$4.00, and if you go back further, you will find that it was trading as high as CA$140 early in 2021,” framing the current share price as “an excellent time to buy Giant Mining or add to positions in it.”

Ownership and Share Structure

According to Giant Mining Corp., approximately 15.1% of its shares are held by insiders. The remaining shares are held by retail investors.

Giant Mining Corp. has a market capitalization of approximately CA$29.56 million.

The company’s shares are traded on the Canadian Securities Exchange (CSE) under the ticker BFG, on the Deutsche Boerse AG (DB) under the ticker YW5, and on the OTC Pink Sheets in the U.S. under the ticker BFGFF, with these listings active since December 2017. Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Giant Mining Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Giant Mining Corp.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

( Companies Mentioned: CSE: BFG;OTC:BFGFF;FWB:YW5,

)

Trump Tariffs Crash Global Equities Markets

Source: Michael Ballanger 04/03/2025

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the current state of the market.

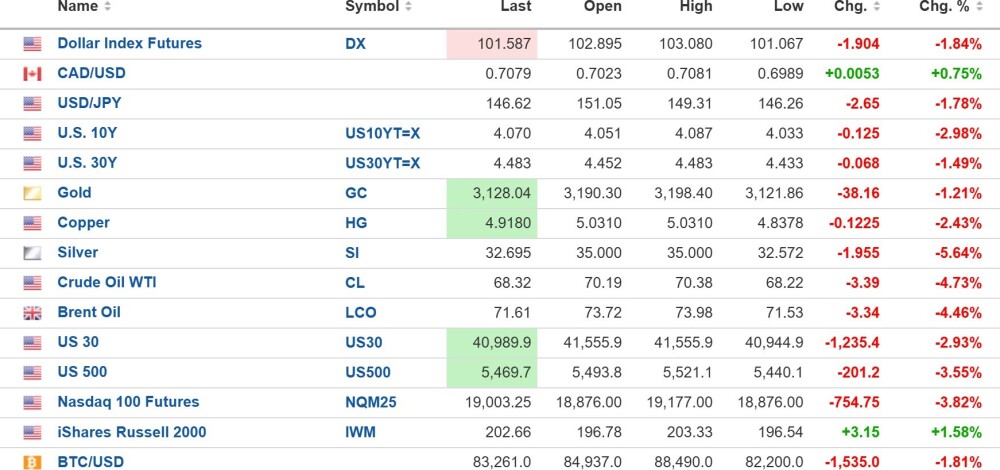

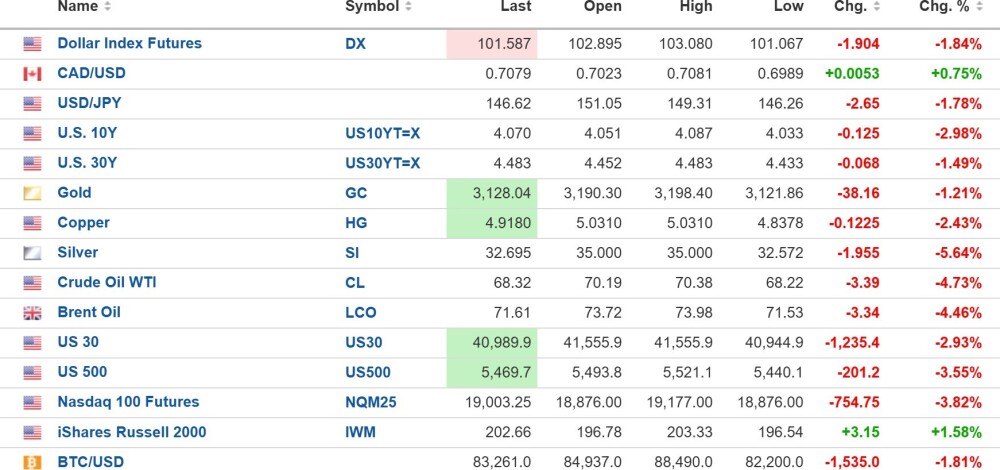

The Trump Tariffs have sent the global equities markets into crash mode as the DJIA futures are down over 1,200 points, with the S&P 500 down 200. Metals are also lower in response to the liquidity squeeze but are still the preferred asset to paper.

The U.S. dollar index futures (-1.36%) are down to 102.895, while the 10-year yield is down 1.42%) to 4.077%, while the 30-year yield is down 1.80% to 4.469%.

Gold (-0.44%), silver (-1.80%), copper (-2.21%), and oil (-3.05%) are all down.

Risk barometer Bitcoin is down 1.12% to $83,674 and remains in bear market territory, down 23.5% from the top.

Stocks

The Trump “Liberation Day” has sent stocks reeling overnight, with the DJIA off over 1,200 points and the S&P 500 down 200. I was rather shocked to learn that Treasury Secretary Scott Bessent was quoted as saying that “the tariffs have little to do with the stock market sell-off” when there isn’t a newspaper article or financial blog that doesn’t lay the blame for the crash directly on the tariffs.

Markets have rallied in the past two sessions as institutional money flow usually enters the fray at the end of the month and during the first few sessions. That has taken the RSI out of oversold status up to the 45 level, but with stocks in full overnight retreat, I am looking for a retest of the lows around $546 for the SPY:US and a move below 30 for the RSI. IF we can find support at the retest, then there is a reasonable chance for a rally. However, simply being in an oversold

condition does not ensure a bounce, and it surely does not prevent the February top at $613.23 from being THE top. Bear markets always arrive like a thief in the night, with most of the valuables seen as “missing” only after you awake in the morning. That is what this market feels like after sixteen years of babysitting by the Fed, and the White House has suddenly reversed from benevolent overseers to vindictive dictators.

Scott Bessent says that the markets are not being affected negatively by the tariff wars. . .

There is an uptrend line going back to the COVID crash lows in 2020 that sits at around $525 for the SPY:US, which is the last line of defense for this market, in my opinion. If it takes out $525, then a band of support around the October 2023 lows at $400 could mark the bottom, but as the chart below would suggest, it could be as low as the $350 level, which would be a range of 34%-42% declines off the February peak. It would also represent a typical bear market — one which we have not had since the 2007-2008 Great Financial Bailout.

Watch for the retest of the lows around $546 first before doing anything drastic. Thus far, this is a normal “correction” (> 10% decline) and has to be treated as a temporary condition unless those levels mentioned above are violated.

Metals

I find it hilarious that the gold bugs are all laughing hysterically at the stockroaches who are all gnashing and gnarling their teeth over “Markets in Turmoil,” which is what we have yet to see on the bottom of the CNBC screen that always marks the bottom for every correction since 2002. To their horrifying surprise, gold is due to correct because it is overbought on every chart I follow — daily, weekly, and monthly — and with the liquidity squeeze being exerted by the correction in equities, gold is particularly vulnerable on a near-term basis. Also impeding the movement of the entire PM complex is silver, which has yet to close on a 2-day basis above that $35.07 peak of last May.

The new reaction high is now $35.265, which was the intraday peak back on March 28, but it did not hold for more than a sip of coffee and then plummeted back down to a low of $34.50. It keeps banging into the resistance zone and getting rejected, and that is a classic non-confirmation of the move in gold and the miners. While I still see $38-45 as a target, the longer it takes to happen, the less likely it becomes.

Copper is correcting sharply this morning and has knifed down through my $4.95 support level to a low of $4.82 in the overnight session. It has bounced back to $4.92 as this is being written but these tariff wars have caused the “risk-off” sentiment to engulf everything as a mad scramble for liquidity ensues. We see this behavior all the time now because these funds are addicted to the extreme leverage that can enhance returns in bull markets but also vapourize those same players when things go south.

The bull case for copper will remain intact due to the fundamentally positive outlook for demand and the strikingly negative outlook for new supply chains. It does not mean that price cannot correct, but the 2025-2026 outlook remains powerfully bullish. Also, a factor is the breakdown in the U.S. dollar index. It certainly appears as though the much-vaunted “dollar milkshake theory” being trumpeted by USD bulls the world over has been shelved by the negative impact of the Trump Tariffs. If the dollar continues to melt away, the inverse correlation to the metals will be ultimately bullish for all hard assets, which rhymes nicely with the Stagflation 70s where paper assets like stocks and bonds went nowhere and commodities enjoyed a decade-long bull move. The transition from paper to hard assets will create havoc among the major asset allocators but once the transition is made, a serious revaluation in the mining stocks should occur.

Juniors

There has been a lot of whining and wailing about the failure of Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) to respond appropriately to the spectacular drill results at Caballos, but realizing that it is still ahead 64.71% YTD despite tremendous seasonal pressure on the junior resource issues, I would say that it is in very good shape on a relative basis. Fully-funded on all projects and with CAD $10 million in warrant money, the bulk of which is in-the-money along with a major new discovery under their belts, this company is going to be generating a boatload of drilling news, and from what I am hearing, there are some very large “eyes” on Caballos after one drill hole.

Near-term, I see $.25 as a logical point to add to holdings which intend to do this week IF it trades there. The rig will be returning to the property next week which means that there will be three active drill programs generating a ton of news.

It is one thing to be disappointed in the market’s response to the drill hole which was truly spectacular but one should not lose sight of the bigger picture here. When markets settle down, FTZ/FTZFF will be front-and-centre as one if the top copper juniors on the planet with a great portfolio of projects and superb management team. Hang on to your positions for dear life and add where and when you are able.

As for the rest of the list, which includes Nevada-based junior Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB), the company is actively pursuing a drill program for the Spring at Fondaway Canyon, and with the price of gold now threatening to punch through US$3,200, it shouldn’t be long before the 2.317 million ounces gets revalued upwards. I still find it astonishing that the junior developers have yet to get any real love from the investment community and that the seniors included in the

GDX:US are trading a mere 9% higher than the 2024 lows when gold was under $2,500/ounce. If you had told me a year ago that gold would be pressing up against $3,200 in April 2025, I would have pegged the GDX:US at $80-100 instead of the $45.76 level at which it closed yesterday. I would have pegged GTCH/GGLDF at $1.25-1.50 or at least USD $150 per in-ground ounce. Gold miners are dirt cheap, still relative to gold and relative to the S&P500.

The rest of the juniors I hold are rated as “Hold” until these markets can find their footing but it is those that are fully-funded that are going to be the first to recover and you all know which they are.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp. and Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Source: Streetwise Reports 04/03/2025

AbraSilver Resource Corp. (ABRA:TSX; ABBRF:OTCQX) continues to define high-grade silver zones at its Diablillos project in Argentina, with standout drill results and rising investor interest. Read more about how a mid-2025 resource update and feasibility study could reshape the outlook.

AbraSilver Resource Corp. (ABRA:TSX; ABBRF:OTCQX) has released new assay results from its recently completed Phase IV drill program at the Diablillos silver-gold project in Salta Province, Argentina. The latest drilling targeted the JAC Extension and Oculto Northeast zones and yielded multiple high-grade silver intercepts beyond the existing conceptual open pit limits. These results are expected to contribute to an updated Mineral Resource estimate slated for mid-2025, which will support a Definitive Feasibility Study already underway.

Significant intercepts from the JAC Extension zone include hole DDH 24-084, which returned 63.5 meters grading 190 grams per tonne (g/t) silver, including 9.0 meters at 341 g/t silver, and hole DDH 24-088, which intercepted 70.0 meters at 147 g/t silver, including 9.0 meters at 331 g/t silver. Drill hole DDH 24-074 at Oculto Northeast intersected 10.0 meters grading 1.49 g/t gold and 56 g/t silver in oxides, 100 meters beyond the known resource boundary.

“These intercepts continue to confirm the presence of additional mineralization across Diablillos,” said John Miniotis, President and CEO, in a company news release. “We look forward to incorporating these results into our upcoming Mineral Resource estimate.” Chief Geologist Dave O’Connor noted the consistency of near-surface mineralization in the press release, adding that Phase V drilling will further test extensions across the Diablillos system.

The Diablillos property, acquired by AbraSilver in 2016, comprises 15 contiguous concessions and has seen over 150,000 meters of drilling to date. It includes multiple known mineralized zones, including Oculto, JAC, Laderas, Fantasma, and Sombra. The most recent Mineral Reserve estimate, dated March 7, 2024, outlines 42.3 million tonnes of Proven and Probable reserves averaging 91 g/t silver and 0.81 g/t gold, containing 123.5 million ounces of silver and 1.1 million ounces of gold.

According to the December 2024 pre-feasibility study, the Diablillos project has a net present value (NPV) of US$747 million (using a 5% discount rate and base-case prices of US$25.50/oz silver and US$2,050/oz gold) with an internal rate of return (IRR) of 28% and a two-year payback period. Average annual production over the first five years is expected to reach 13.4 million silver-equivalent ounces, with an all-in-sustaining cost (AISC) of US$12.67 per silver-equivalent ounce.

The Diablillos site benefits from year-round access and infrastructure, with easements in place for water supply and future energy solutions under evaluation. The project is also fully eligible for Argentina’s RIGI program, which offers reduced corporate tax rates and export duty exemptions for large-scale investments. AbraSilver estimates RIGI could generate up to US$430 million in savings.

Persistent Deficits and Undervalued Supply Support Exploration Activity

Writing on March 26, Hubert Moolman analyzed long-term historical patterns between stock market peaks and silver rallies, noting that “after all of these peaks of the Dow there were significant silver rallies that followed.” He identified 1929, 1966, 1973, and 1999 as key Dow Jones peaks that preceded extended growth periods for silver. In each case, silver began a strong upward trajectory within two years, with price peaks occurring roughly six to seven years after the Dow highs. He stated that the most recent nominal Dow peak in December 2024 could signal the early stages of a similar silver rally.

In a March 30 report for Ahead of the Herd, Richard Mills wrote that 2025 marked the fifth consecutive year of silver market deficits, citing a projected supply shortfall of 149 million ounces. He explained that only 40% of global silver is available for investment, with the remainder used in industrial applications, such as solar power, electronics, and automotive components. He added, “Spot silver gained 27% in 2024,” largely due to strong physical demand from India and China. Mills also pointed to the gold-to-silver ratio, which remained elevated at 91, stating that “silver is currently at one of its most undervalued levels in history.”

Peter Krauth of the Silver Stock Investor wrote, “AbraSilver Resource Corp.’s top-notch, globally significant project is about to get bigger and may even reveal new discoveries . . . I see massive additional potential despite the company’s already significant market cap of CA$500M.”

Also, on March 30, Technical Analyst Clive Maund suggested that speculative interest in silver remained minimal compared to gold despite bullish technical indicators. The report stated that “silver has struggled to make further progress as it has battled its way through more overhanging supply,” but noted that a long-term cup-and-handle formation was in place, with resistance originating from 2011 highs around US$50. It emphasized that the silver-to-gold ratio remained near historical lows, suggesting the sector had only begun its current bull cycle.

On April 1, Christopher Lewis of FX Empire described the silver market as volatile but technically supported, citing recent price levels around US$33 to US$35 per ounce. He observed, “Silver, of course, is being dragged higher by gold overall,” and noted that ongoing macroeconomic uncertainty and fluctuating global trade conditions had contributed to market instability. However, he also stated that dips were being viewed as potential entry points for cautious buyers.

Ongoing Exploration and Upcoming Milestones Support Development Path at Diablillos

According to AbraSilver’s March 2025 investor presentation, the company is advancing its 20,000-meter Phase V drill campaign with a focus on expanding high-grade mineralization in several target zones across the Diablillos project. Priority areas include JAC South Extension, Sombra, Oculto East, and West, Laderas, and the Cerro Viejo gold target within the northeast epithermal-porphyry complex.

The updated Mineral Resource estimate, expected in mid-2025, is a key milestone and will underpin the ongoing Definitive Feasibility Study. Additional catalysts anticipated within the next twelve months include approval of the Environmental Impact Assessment (EIA) and eligibility certification under Argentina’s RIGI investment framework, both of which could enhance project economics and reduce capital expenditure requirements.

AbraSilver is fully funded through to a construction decision, supported by an estimated CA$65 million in cash. As of late March 2025, the company had a market capitalization of approximately CA$530 million, based on a share price of CA$3.50. Strategic investors, including Central Puerto and Kinross Gold, hold a combined 25% stake.

The company reports that since 2020, its Measured and Indicated resource base at Diablillos has doubled at a low discovery cost of just US$0.11 per silver-equivalent ounce. This trend is expected to continue as drilling expands into new zones and tests depth extensions below existing oxide deposits, where copper and gold sulphide mineralization has already been identified.

With additional results from the Phase IV drill program still pending and exploration efforts accelerating, AbraSilver remains focused on delineating new mineral zones and optimizing the Diablillos development plan.

Analysts Cite Diablillos as Top Silver Development Asset in Updated Outlook

On March 14, Craig Stanley, an analyst with Raymond James, reiterated his Outperform rating on the stock and maintained a target price of CA$5. At the time, this represented a potential return of approximately 60% from the then-trading price of CA$3.13. Stanley pointed to promising new stepout drill results from the company’s Phase IV program, which are expected to be incorporated into a revised Mineral Resource estimate scheduled for mid-2025. He cited strong assays from multiple zones, including intervals of 30 meters grading 237 grams per tonne (g/t) silver and 22 meters at 168 g/t silver. Commenting on the underexplored Sombra zone, Stanley stated, “Only five holes have been drilled to date at Sombra, where mineralization is covered by only approximately 40m of unconsolidated colluvium.”

In a follow-up note on March 17, Stanley referred to Diablillos as “one of the best-undeveloped silver projects not held by a producer.” He highlighted the results of the updated prefeasibility study, which showed a US$747 million after-tax Net Present Value using a 5% discount rate, a 28% internal rate of return, and a projected two-year payback period, based on base case metals prices of US$25.50/oz silver and US$2,050/oz gold. He also emphasized the potential financial impact of Argentina’s RIGI investment program, which could provide an estimated US$430 million in savings through reduced taxes, royalties, and export duties. [OWNERSHIP_CHART-9164]

Stanley identified several areas of potential upside not yet reflected in his valuation model, including drill results from the ongoing 20,000-meter program, alternative power strategies, and a possible heap-leach circuit for low-grade ore. He also commented on the strength of the company’s leadership, referencing CEO John Miniotis’ background in capital markets and Chief Geologist David O’Connor’s 40-year track record, which includes founding multiple public exploration companies in South America.

On March 26, Peter Krauth of the Silver Stock Investor wrote, “AbraSilver Resource Corp.’s top-notch, globally significant project is about to get bigger and may even reveal new discoveries . . . I see massive additional potential despite the company’s already significant market cap of CA$500M.”

Ownership and Share Structure

AbraSilver’s major shareholders, reported Stanley, are insiders (management and board members) with 3%, Central Puerto SA with 9.9% and Kinross Gold Corp. (K:TSX; KGC:NYSE) with 4%. (In AbraSilver’s recent CA$58.5M financing, Central Puerto invested CA$25M and Kinross invested CA$3M.)

AbraSilver has 152.7 million shares outstanding. Its market cap is CA$517M. Its 52-week range is CA$1.33–3.58 per share. Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- AbraSilver Resource Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

( Companies Mentioned: ABRA:TSX; ABBRF:OTCQX,

)

Pasofino Gold Ltd. (VEIN:TSX.V; EFRGF:OTCQB; N07:FSE) entered into a cooperation agreement to settle some pending issues with its 50.8% shareholder, gold producer Hummingbird Resources Plc (HUM:AIM) and the latter’s parent company, Nioko Resources Corp., a West African investment group, noted a news release.

“Pasofino can now move forward for the benefit of all shareholders and emerge from what has been a static number of years development-wise,” said Pasofino Board Member Stephen Dattels in the release. “This should represent a turning point in the company’s future for the benefit of all shareholders.”

Brett Richards, the company’s chief executive officer (CEO), commented that the agreement “represents a rebirth of the Dugbe gold project, now having a strong partnership, committed funding, and a strategic direction to create transformational value for all shareholders.” Dugbe is Pasofino’s flagship asset.

These are the topics and the terms the companies agreed to for each:

Board Reconstitution: Pasofino’s board now will comprise three Hummingbird nominees (Oumar Toguyeni, Geoff Eyre, and a yet-to-be-named person), Pasofino CEO Richards, and two people nominated by the board pre-reconstitution (Krisztian Toth and Emre Kayışoğlu).

Shareholder Rights Termination: Pasofino is to do what it can to ensure no shareholder rights are exercised and no common Pasofino shares are issued, bought, or distributed, under the rights plan the company adopted in November 2024. The current agreement outlines what is to happen if shares get issued. Also, Pasofino is to cancel the special meeting of rights holders scheduled for April 30, 2025.

Funding Responsibility: For the rest of 2025, Pasofino has a 2-year lead order on financings, and a guaranteed pro-rata funding from its majority shareholder Hummingbird. Pasofino will use the proceeds to update the Dugbe Gold Project feasibility study and start certain preconstruction activities.

“Our joint funding commitments will help ensure further derisking of the project as we seek to realize the project’s full potential for the benefit of all shareholders,” Hummingbird CEO Geoff Eyre said in the release.

Strategic Review: Pasofino will terminate the strategic review process that is now underway. When the feasibility study is done, the board will consider the various options in the company and shareholders’ best interests. This could include revisiting the strategic review process or starting to plan how to finance the advancement of Dugbe into production.

Standstill Period: Until October 31, 2026, Hummingbird will vote its shares in favor of management nominees at each of Pasofino’s annual general meetings. Also, through this future date, Hummingbird will abide by a standstill covenant favoring Pasofino, to include not acquiring beneficial ownership of any Pasofino securities, not making a takeover bid for Pasofino, and not transferring or otherwise disposing of its Pasofino shares.

Royalty: Regarding the net smelter returns royalty deed held by Aus No. 5 Pty. Ltd., if this holder exercises its right to terminate the royalty given Nioko’s acquisition of Hummingbird, Hummingbird-Nioko will pay the US$15 million (US$15M) termination fee, after which it may refinance or resell the royalty at a fair and reasonable price. If resold, proceeds up to US$15M will go to Hummingbird-Nioko, and any amount above that will go to Pasofino. If the resale proceeds are less than US$15M, Pasofino will grant Hummingbird-Nioko an equivalent royalty, the maximum amount of which will equal the shortfall.

Board Member Resignations: Director Robert Metcalfe and Deputy Chairman Stephen Dattels will be resigning. A senior partner at Fasken Corp., a mining industry law firm, will take Dattels’ place.

Committed To Advancing Project

Headquartered in Ontario, Canada, Pasofino Gold Ltd. owns Dugbe through its subsidiary ARX Resources Ltd. and is advancing this 2,078-square-kilometer project in southern Liberia. The mineral explorer’s priority is to update the 2022 feasibility study of the Dugbe Gold Project. The base case gold price used in that assessment was US$1,700 per ounce (US$1,700/oz).

“In this current and forecasted gold environment, and given the 2022 dated feasibility study, we are going to quickly engage the necessary resources to update all aspects of the study with respect to cost(s) and gold price assumptions, as well as optimizing all processes to maximize recoveries and project economics,” Pasofino’s CEO Richards said in the latest release.

“With a high and growing probability of a buyout soon on favorable terms for shareholders, [VEIN] is rated an Immediate Strong Buy,” wrote Maund.

Pasofino has a mineral development agreement (MDA) for Dugbe in place with the Liberian government, which outlines secured mining rights and terms for 25 years, according to Pasofino’s Investor Presentation. Under the MDA, the royalty rate on gold production is 3%, the income tax rate payable is 25% (with credit given for historic exploration expenditures), the fuel duty is reduced by 50%, and the Liberian government gets a free 10% carried interest in the project. This MDA derisks the mining license application for Dugbe, the company said.

Already one of largest gold projects in the southwestern part of West Africa’s Birimian geological region, Dugbe has a Measured and Indicated resource of 3,300,000 ounces averaging 1.37 grams per ton gold.

*Its proximity to other major gold deposits in the prolific Birimian bodes well for further discoveries, noted Technical Analyst Clive Maund in a December 2024 report. The Birimian Supergroup, a collection of rich gold-bearing rocks, is a major source of gold in West Africa, according to Africa Mining IQ.

As for Liberia itself, it has a well-established and growing mining industry, particularly with respect to gold. Mining contributes significantly to the country’s gross domestic product.

The infrastructure near Dugbe is “good,” according to Maund. The project has road access. About 70 kilometers away from Dugbe is the Greenville seaport, through which supplies get to the project and product will be exported. Power at Dugbe will consist of electricity generated by liquefied natural gas primarily and solar secondarily.

Maund also pointed out that Pasofino’s management team has significant experience in developing projects to the point of being attractive takeout targets. He also noted the company is far long in the permitting process, which could be concluded by about year-end 2025.

Gold In Powerful Uptrend

Growth is forecasted for the global gold market through 2030 at least, according to a March Research and Markets report. Between now and then, the market is projected to expand in size at a 5.1% compound annual growth rate. Cited growth drivers include economic volatility and uncertainty, technological advancements, expansion of the middle class in emerging economies, new uses for gold, global trade policies and geopolitical tensions.

According to Adrian Day of Adrian Day Asset Management, the factors now at play in pushing up the gold price are expected to persist for some time. These include central bank buying of gold, Chinese consumers worried about the loss of purchasing power and a fragile banking system and Western investors concerned about political uncertainty given many governments’ unsustainable high debt.

“None of this is likely to change, and gold thus is likely to be higher a year from now, notwithstanding the possibility of a pullback at some stage,” Day wrote in his Q1/25 Portfolio Review. “Gold, which has actually gained more than the S&P Index over the past four years, may continue to shine; it responds well to uncertainty, whether geopolitical, economic or monetary.”

Despite touching an all-time high of US$3,194.40/oz on April 2, experts still believe the gold price has upside left. Technical Analyst Maund is one of them. Recently, he wrote that gold remains way down on its 2011 highs when compared to the stock market and is in a “powerful and thus far orderly uptrend.”

“This thing has barely gotten started yet,” he added. “There is clearly scope for massive gains.”

Investing Haven wrote in a March 14 article that its gold price predictions for the coming years are “firmly bullish”: US$3,265/oz in 2025, near US$3,805 in 2026, and peaking at US$5,155 by 2030. Also, during this period, some periods of weakness are expected in which the gold price retreats.

Perhaps Analyst Avi Gilburt’s take is more realistic. “One of the most accurate market prognosticators of the past two decades,” as described by The Gold Newsletter’s Brien Lundin, Gilburt recently wrote, “While I do think we can still see higher levels over the coming year or so in the gold market, I am starting to see signs that we are moving into the final stages of this decade-long rally.”

Ronald Stewart, Red Cloud Securities Mining Analyst, advised in a March 31 sector update, “Investors should be prepared to add to positions on any short-term pullback in the price.”

Those positions should be in junior mining stocks, according to Lundin, as investments in this sector is one of the best ways to capitalize on the current, or any, secular metals bull market.

“The mining stocks remain near long-term lows,” he noted. “Again, this is a generational opportunity, and one that should not be wasted.”

The Catalysts: Project Milestones

Pasofino has at least two key events due to happen in the medium term that could boost its share price, as noted in the news release. One is the completion of the Dugbe feasibility study, expected in about a year.

The other is having reached a construction decision for the project, which the company aims to achieve within 18 months. [OWNERSHIP_CHART-11178]

Stock Undervalued, A Strong Buy

Pasofino’s stock was looking quite undervalued when Technical Analyst Maund reviewed it, he wrote in a December 2024 report . On the charts, VEIN looked about to start moving higher soon, after a long, severe bear market and subsequent base building, he noted. At the time, Pasofino’s share price was CA$0.58 per share, and today it is a couple of cents lower.

“With a high and growing probability of a buyout soon on favorable terms for shareholders, [VEIN] is rated an Immediate Strong Buy,” wrote Maund.

Ownership and Share Structure

According to Refinitiv, eight strategic entities own 67.37%, or the lion’s share, of Pasofino. Of these investors, the Top 3 are Hummingbird with 50.8%, ESAN with 9.6% and Stephen Dattels with 3.97%.

The rest is in retail.

Pasofino has 117.03 million (117.03M) outstanding shares and 38.19M free float traded shares. Its market cap is CA$45.83M. Its 52-week trading range is CA$0.375–0.80 per share.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Pasofino Gold Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Pasofino Gold Ltd.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

* Disclosure for the quote from the Clive Maund article published on December 31, 2024

- For the quoted article (published on December 31, 2024), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing the article quoted. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in the article accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

Clivemaund.com Disclosures

The quoted article represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.

( Companies Mentioned: VEIN:TSX.V;EFRGF:OTCQB;N07:FSE,

)