Category: Gold

Source: Streetwise Reports 04/03/2025

Giant Mining Corp. (CSE: BFG; OTC:BFGFF; FWB:YW5) is expanding its 2025 drill program at Majuba Hill in Nevada, guided by AI and rising copper demand. Find out how this strategic move could position the company for future growth.

Giant Mining Corp. (CSE: BFG; OTC:BFGFF; FWB:YW5) has expanded its 2025 diamond core drilling program at the Majuba Hill Copper-Silver-Gold Project in Nevada by adding a fifth drill hole. This new hole was designed using artificial intelligence (AI) modeling developed by Exploration Technologies Inc. (ExploreTech) and will target a high-potential resistivity anomaly in the southern portion of the project area. The decision follows what the company described as “encouraging visual results” from the first hole of the program, MHB-32, which was drilled to a depth of 889.5 feet (271.1 meters).

ExploreTech’s AI system combines geological and geophysical data, running thousands of simulations to pinpoint subsurface anomalies. The system then recommends optimal drill trajectories to intersect these targets. This collaboration marks a notable technological advancement in Giant Mining’s ongoing efforts to delineate mineralization at Majuba Hill, which is located in Pershing County, Nevada, and spans 9,684 acres.

David Greenway, CEO of Giant Mining, stated in a company news release, “We are thrilled with the continued success of the 2025 drill program and encouraged by our team’s recommendation to add an additional hole to the plan — another key step toward advancing Majuba Hill to a new NI 43-101 mineral resource estimate.”

Hole MHB-32 was completed by Big Sky Exploration, LLC of Eureka, Nevada, and the core was quick-logged and tagged on-site. The core samples will be prepped for analysis at ALS Group USA’s facilities in Elko, Nevada. Prepped samples will be tested for copper, silver, gold, and trace elements using a combination of fire assay and ICP-AES methods.

The 2025 drill campaign builds upon prior results, particularly from MHB-30 and MHB-31 in 2024, which intersected high-grade copper mineralization in breccia zones. According to the company, mineralization at Majuba Hill remains open in all directions. In total, over 83,000 feet of drilling have been conducted to date on the property, with a reported historical replacement value of US$10.4 million in development costs.

Majuba Hill has a long production history, with records of 2.8 million pounds of copper, 184,000 ounces of silver, and 5,800 ounces of gold extracted from the site between the early 1900s and the 1950s. Infrastructure at the site includes road access, proximity to power, and logistical support from nearby cities, positioning the project favorably for further development.

Copper Prices Spike as U.S. Tariff Threats Reshape Global Supply Chains

A surge in copper prices and supply chain pressures defined the global copper sector in early April, as U.S. policy shifts and international market dynamics reshaped the metal’s trade patterns and cost structures. A March 29 commentary from Pretiorates highlighted structural challenges in the U.S. mining sector, noting that it now takes “an average of 29 years from discovery to production of a new mine.” This delay places the U.S. second only to Zambia for mine permitting timelines, complicating efforts to increase domestic supply. The analysis described the market’s reaction to pending U.S. tariffs, stating, “On the New York Metals Exchange, copper is already trading over 15% higher than on the London LME,” and added that copper was “rapidly moving from London to the USA.”

According to a March 30 analysis by Ahead of the Herd, commodities traders began redirecting large volumes of refined copper from Asia to the United States in anticipation of potential tariffs. Between 100,000 and 150,000 metric tons of refined copper were expected to arrive in the U.S., prompting companies to reserve additional warehousing space in cities like New Orleans and Baltimore. The analysis emphasized the U.S.’s reliance on imports, noting that “imports account for about half of U.S. copper usage, up from just 10% in 1995.”

Reported by Katusa Research on April 2, the copper price in the U.S. (Comex) surpassed US$5 per pound, compared to about US$4.60 per pound on the London Metal Exchange (LME). This spread reflected increased U.S. demand and fears surrounding tariff implementation. The report explained that “inventories in CME warehouses have jumped to over 85,000 metric tons,” doubling since September 2024, as buyers rushed to build stockpiles. It also noted that “the risk of added costs on imported copper has prompted U.S. buyers to build up stockpiles,” amplifying supply tightness globally. Meanwhile, large withdrawal requests from LME warehouses in Asia signaled copper’s reallocation to higher-priced U.S. markets.

Kitco also addressed this shift on April 2, reporting that copper had recently “invalidated its move to new highs,” interpreting this as a possible technical turning point. The commentary described the market as being in a state of “peak uncertainty” due to impending tariff announcements and noted that copper, alongside gold, had “rallied based on the rumor” of tariff implementation, with potential for a reversal under the “buy-the-rumor-sell-the-fact” pattern.

Giant Mining Targets Resource Growth at Majuba Hill Amid Rising Copper Demand

According to Giant Mining’s April 2025 investor presentation, the company’s primary focus is on the continued delineation and potential expansion of the porphyry copper system at Majuba Hill, which it believes holds significant relevance for the electric vehicle (EV) and renewable energy sectors. With each EV requiring approximately 183 pounds of copper, long-term global demand for the metal remains strong. S&P Global projects a year-over-year copper demand increase of 2 to 3 percent through 2035.

Giant Mining’s 2025 exploration strategy targets an additional 4,400 feet (1,340 meters) of core drilling within an existing exploration target area. The current program is financed and strategically designed to support a future National Instrument 43-101 compliant mineral resource estimate. The application of AI through ExploreTech to optimize drilling targets represents a notable technological differentiator for the company, especially in the context of covered and geophysical complex terrains.

Beyond the current drill program, Majuba Hill’s location in Nevada, a jurisdiction consistently ranked highly by the Fraser Institute for mining investment attractiveness, provides a stable regulatory and operational environment. The company’s ability to leverage its prior drilling database, combined with new geophysical modeling, positions it to make meaningful progress on expanding known mineralized zones. Additional assay results and exploration updates are expected as drilling continues.

Technical Analyst Highlights Bullish Setup for Giant Mining Corp.

On March 5, Technical Analyst Clive Maund offered a positive outlook on Giant Mining Corp., citing a strong chart pattern and supportive market conditions. Maund noted that the company had completed what he described as a “big Cup & Handle base pattern,” a formation typically associated with bullish reversals. He pointed to elevated trading volume during the rally on the right side of the pattern as evidence that “the company is turning the corner.”

Maund identified multiple technical indicators suggesting the potential for a breakout, particularly the convergence of moving averages. He commented that “another upleg from here will quickly result in a bullish cross of the moving averages,” which he believed would signal the start of “an important new bull market.” [OWNERSHIP_CHART-11069]

Beyond technicals, Maund referenced broader policy developments, especially proposed U.S. tariffs on imported copper, as a factor supporting companies with domestic copper exposure. He wrote that “the growing awareness that the tariff barriers will make domestic producers of copper like Giant Mining . . . more important” had started to shape investor sentiment.

In assessing longer-term valuation, Maund pointed out that the company’s stock had previously traded at significantly higher levels. He noted that “as recently as early 2023, it was trading at over CA$4.00, and if you go back further, you will find that it was trading as high as CA$140 early in 2021,” framing the current share price as “an excellent time to buy Giant Mining or add to positions in it.”

Ownership and Share Structure

According to Giant Mining Corp., approximately 15.1% of its shares are held by insiders. The remaining shares are held by retail investors.

Giant Mining Corp. has a market capitalization of approximately CA$29.56 million.

The company’s shares are traded on the Canadian Securities Exchange (CSE) under the ticker BFG, on the Deutsche Boerse AG (DB) under the ticker YW5, and on the OTC Pink Sheets in the U.S. under the ticker BFGFF, with these listings active since December 2017. Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Giant Mining Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Giant Mining Corp.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

( Companies Mentioned: CSE: BFG;OTC:BFGFF;FWB:YW5,

)

Trump Tariffs Crash Global Equities Markets

Source: Michael Ballanger 04/03/2025

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the current state of the market.

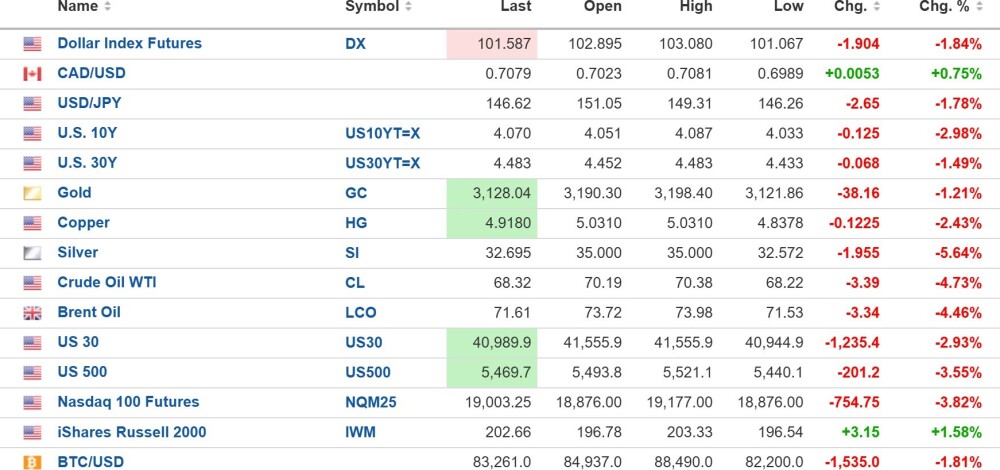

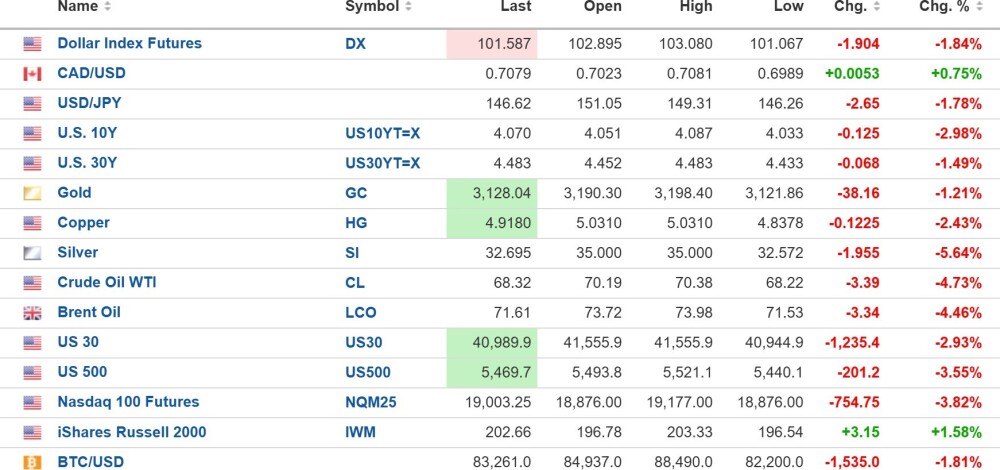

The Trump Tariffs have sent the global equities markets into crash mode as the DJIA futures are down over 1,200 points, with the S&P 500 down 200. Metals are also lower in response to the liquidity squeeze but are still the preferred asset to paper.

The U.S. dollar index futures (-1.36%) are down to 102.895, while the 10-year yield is down 1.42%) to 4.077%, while the 30-year yield is down 1.80% to 4.469%.

Gold (-0.44%), silver (-1.80%), copper (-2.21%), and oil (-3.05%) are all down.

Risk barometer Bitcoin is down 1.12% to $83,674 and remains in bear market territory, down 23.5% from the top.

Stocks

The Trump “Liberation Day” has sent stocks reeling overnight, with the DJIA off over 1,200 points and the S&P 500 down 200. I was rather shocked to learn that Treasury Secretary Scott Bessent was quoted as saying that “the tariffs have little to do with the stock market sell-off” when there isn’t a newspaper article or financial blog that doesn’t lay the blame for the crash directly on the tariffs.

Markets have rallied in the past two sessions as institutional money flow usually enters the fray at the end of the month and during the first few sessions. That has taken the RSI out of oversold status up to the 45 level, but with stocks in full overnight retreat, I am looking for a retest of the lows around $546 for the SPY:US and a move below 30 for the RSI. IF we can find support at the retest, then there is a reasonable chance for a rally. However, simply being in an oversold

condition does not ensure a bounce, and it surely does not prevent the February top at $613.23 from being THE top. Bear markets always arrive like a thief in the night, with most of the valuables seen as “missing” only after you awake in the morning. That is what this market feels like after sixteen years of babysitting by the Fed, and the White House has suddenly reversed from benevolent overseers to vindictive dictators.

Scott Bessent says that the markets are not being affected negatively by the tariff wars. . .

There is an uptrend line going back to the COVID crash lows in 2020 that sits at around $525 for the SPY:US, which is the last line of defense for this market, in my opinion. If it takes out $525, then a band of support around the October 2023 lows at $400 could mark the bottom, but as the chart below would suggest, it could be as low as the $350 level, which would be a range of 34%-42% declines off the February peak. It would also represent a typical bear market — one which we have not had since the 2007-2008 Great Financial Bailout.

Watch for the retest of the lows around $546 first before doing anything drastic. Thus far, this is a normal “correction” (> 10% decline) and has to be treated as a temporary condition unless those levels mentioned above are violated.

Metals

I find it hilarious that the gold bugs are all laughing hysterically at the stockroaches who are all gnashing and gnarling their teeth over “Markets in Turmoil,” which is what we have yet to see on the bottom of the CNBC screen that always marks the bottom for every correction since 2002. To their horrifying surprise, gold is due to correct because it is overbought on every chart I follow — daily, weekly, and monthly — and with the liquidity squeeze being exerted by the correction in equities, gold is particularly vulnerable on a near-term basis. Also impeding the movement of the entire PM complex is silver, which has yet to close on a 2-day basis above that $35.07 peak of last May.

The new reaction high is now $35.265, which was the intraday peak back on March 28, but it did not hold for more than a sip of coffee and then plummeted back down to a low of $34.50. It keeps banging into the resistance zone and getting rejected, and that is a classic non-confirmation of the move in gold and the miners. While I still see $38-45 as a target, the longer it takes to happen, the less likely it becomes.

Copper is correcting sharply this morning and has knifed down through my $4.95 support level to a low of $4.82 in the overnight session. It has bounced back to $4.92 as this is being written but these tariff wars have caused the “risk-off” sentiment to engulf everything as a mad scramble for liquidity ensues. We see this behavior all the time now because these funds are addicted to the extreme leverage that can enhance returns in bull markets but also vapourize those same players when things go south.

The bull case for copper will remain intact due to the fundamentally positive outlook for demand and the strikingly negative outlook for new supply chains. It does not mean that price cannot correct, but the 2025-2026 outlook remains powerfully bullish. Also, a factor is the breakdown in the U.S. dollar index. It certainly appears as though the much-vaunted “dollar milkshake theory” being trumpeted by USD bulls the world over has been shelved by the negative impact of the Trump Tariffs. If the dollar continues to melt away, the inverse correlation to the metals will be ultimately bullish for all hard assets, which rhymes nicely with the Stagflation 70s where paper assets like stocks and bonds went nowhere and commodities enjoyed a decade-long bull move. The transition from paper to hard assets will create havoc among the major asset allocators but once the transition is made, a serious revaluation in the mining stocks should occur.

Juniors

There has been a lot of whining and wailing about the failure of Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) to respond appropriately to the spectacular drill results at Caballos, but realizing that it is still ahead 64.71% YTD despite tremendous seasonal pressure on the junior resource issues, I would say that it is in very good shape on a relative basis. Fully-funded on all projects and with CAD $10 million in warrant money, the bulk of which is in-the-money along with a major new discovery under their belts, this company is going to be generating a boatload of drilling news, and from what I am hearing, there are some very large “eyes” on Caballos after one drill hole.

Near-term, I see $.25 as a logical point to add to holdings which intend to do this week IF it trades there. The rig will be returning to the property next week which means that there will be three active drill programs generating a ton of news.

It is one thing to be disappointed in the market’s response to the drill hole which was truly spectacular but one should not lose sight of the bigger picture here. When markets settle down, FTZ/FTZFF will be front-and-centre as one if the top copper juniors on the planet with a great portfolio of projects and superb management team. Hang on to your positions for dear life and add where and when you are able.

As for the rest of the list, which includes Nevada-based junior Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB), the company is actively pursuing a drill program for the Spring at Fondaway Canyon, and with the price of gold now threatening to punch through US$3,200, it shouldn’t be long before the 2.317 million ounces gets revalued upwards. I still find it astonishing that the junior developers have yet to get any real love from the investment community and that the seniors included in the

GDX:US are trading a mere 9% higher than the 2024 lows when gold was under $2,500/ounce. If you had told me a year ago that gold would be pressing up against $3,200 in April 2025, I would have pegged the GDX:US at $80-100 instead of the $45.76 level at which it closed yesterday. I would have pegged GTCH/GGLDF at $1.25-1.50 or at least USD $150 per in-ground ounce. Gold miners are dirt cheap, still relative to gold and relative to the S&P500.

The rest of the juniors I hold are rated as “Hold” until these markets can find their footing but it is those that are fully-funded that are going to be the first to recover and you all know which they are.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp. and Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.