Category: Gold

- Gold, silver pounded by Fed’s hawkish pivot Kitco NEWS

- Gold ascends as US yields climbed, eyes on US Core PCE FXStreet

- Gold, Bond Yield, US Dollar Technical Analysis Following Upbeat US Data FX Empire

Source: Taylor Combaluzier 12/18/2024

All holes encountered anomalous gold pathfinder elements, and follow-up drilling in all three targets is warranted, noted a Red Cloud Securities report.

Westhaven Gold Corp. (WHN:TSX.V) announced that all six holes drilled in the Certes target at the Shovelnose project intersected anomalous gold pathfinder elements, reported Red Cloud Securities Vice President and Mining Analyst Taylor Combaluzier in a Dec. 13 research note.

“The stage has been set for future drill programs to potentially home in on epithermal mineralization and make additional discoveries,” Combaluzier wrote. “We continue to believe that the Shovelnose property has the potential to eventually become a multimillion-ounce gold camp.”

Possible 1,250% Return

Given the news, Red Cloud reiterated its CA$1.35 per share target price on the Canadian exploration company, trading at the time of the report at about CA$0.10 per share, noted Combaluzier.

The target price implies a potential return for investors of 1,250%.

Westhaven remains a Buy.

‘An Important Step’

Combaluzier presented the results of Westhaven’s recent drilling, comprising two holes in each of three target areas, at the Certes showing at Shovelnose, its flagship gold project in south-central British Columbia. The analyst also indicated what follow-up drilling might encompass.

“The 2024 drill program at Shovelnose was an important step to improve the geological understanding of the 11-kilometer (11 km) corridor that extends across [the] southcentral part of the property,” Combaluzier wrote.

Highlight in Certes 2

The best intercept, the analyst pointed out, came from hole SN24-425 drilled in the Certes 3 target area. It was 0.69 grams per ton (0.69 g/t) gold, 2.76 g/t silver and 5% zinc over 1.74 meters (1.74m), from 286.9m downhole. Drilling there confirmed a potentially preserved epithermal system extending more than 2.1 km in strike length and remaining open at depth.

SN24-424 encountered elevated pathfinder elements and, near the end of the hole, quartz-carbonate veins.

“Follow-up work would target the downdip extent of veining to look for an underlying gold zone, as seen in the Franz-FMN-South zone trend,” Combaluzier wrote.

Westhaven drilled these two holes, SN24-425 and SN24-424, 0.9 kilometers to the southeast of Certes 2, with 150m between them.

Results From Other Targets

As for Certes 2, drilling consisted of holes SN24-422 and SN24-423 placed 440m apart and 1.2 km to the southeast of Certes 1, Combaluzier reported. Both intersected epithermal pathfinder elements and quartz-carbonate veining, suggesting a broad target area exists between the two holes.

“Follow-up work would target the stronger vein zone in hole SN24-422 to test downdip and along strike to the northwest,” wrote Combaluzier.

Regarding the Certes 1 target, drill holes SN24-420 and SN24-421, spaced 150m apart, tested the “surface boulders of banded, mercury-bearing chalcedony sinter/silica cap,” explained Combaluzier.

Results suggested a “high-level, mercury-venting geothermal plume” is present to the northeast. SN24-420 did not intersect the mineralized portion of this system, perhaps because the hole was ended before it could reach it.

As such, the analyst noted, “a drill hole designed to undercut hole SN24-420 would be part of a future follow-up program.”

Looking Forward

It is anticipated the junior explorer will resume drilling at Shovelnose in Q1/25, wrote Combaluzier.

He added, “We also expect Westhaven to continue executing on its parallel plans to advance Shovelnose (both exploration and development) with an updated mineral resource estimate and preliminary economic assessment incorporating the FMN and Franz zones (in addition to the South zone) in Q1/25.”

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Disclosures for Red Cloud Securities, Westhaven Gold Corp., December 13, 2024

Red Cloud Securities Inc. is registered as an Investment Dealer and is a member of the Canadian Investment Regulatory Organization (CIRO). Red Cloud Securities registration as an Investment Dealer is specific to the provinces of Alberta, British Columbia, Manitoba, Ontario, Quebec, and Saskatchewan. We are registered and authorized to conduct business solely within these jurisdictions. We do not operate in or hold registration in any other regions, territories, or countries outside of these provinces. Red Cloud Securities bears no liability for any consequences arising from the use or misuse of our services, products, or information outside the registered jurisdictions. Part of Red Cloud Securities Inc.’s business is to connect mining companies with suitable investors. Red Cloud Securities Inc., its affiliates and their respective officers, directors, representatives, researchers and members of their families may hold positions in the companies mentioned in this document and may buy and/or sell their securities. Additionally, Red Cloud Securities Inc. may have provided in the past, and may provide in the future, certain advisory or corporate finance services and receive financial and other incentives from issuers as consideration for the provision of such services. Red Cloud Securities Inc. has prepared this document for general information purposes only. This document should not be considered a solicitation to purchase or sell securities or a recommendation to buy or sell securities. The information provided has been derived from sources believed to be accurate but cannot be guaranteed. This document does not take into account the particular investment objectives, financial situations, or needs of individual recipients and other issues (e.g. prohibitions to investments due to law, jurisdiction issues, etc.) which may exist for certain persons. Recipients should rely on their own investigations and take their own professional advice before investment. Red Cloud Securities Inc. will not treat recipients of this document as clients by virtue of having viewed this document. Red Cloud Securities Inc. takes no responsibility for any errors or omissions contained herein, and accepts no legal responsibility for any errors or omissions contained herein, and accepts no legal responsibility from any losses resulting from investment decisions based on the content of this report.

Company Specific Disclosure Details In the last 12 months preceding the date of issuance of the research report or recommendation, Red Cloud Securities Inc. has performed investment banking services for the issuer.

Analysts are compensated through a combined base salary and bonus payout system. The bonus payout is determined by revenues generated from various departments including Investment Banking, based on a system that includes the following criteria: reports generated, timeliness, performance of recommendations, knowledge of industry, quality of research and client feedback. Analysts are not directly compensated for specific Investment Banking transactions. Recommendation Terminology Red Cloud Securities Inc. recommendation terminology is as follows: • BUY – expected to outperform its peer group • HOLD – expected to perform with its peer group • SELL – expected to underperform its peer group • Tender – clients are advised to tender their shares to a takeover bid • Not Rated or NA – currently restricted from publishing, or we do not yet have a rating • Under Review – our rating and target are under review pending, prior estimates and rating should be disregarded. Companies with BUY, HOLD or SELL recommendations may not have target prices associated with a recommendation. Recommendations without a target price are more speculative in nature and may be followed by “(S)” or “(Speculative)” to reflect the higher degree of risk associated with the company. Additionally, our target prices are set based on a 12-month investment horizon.

Dissemination Red Cloud Securities Inc. distributes its research products simultaneously, via email, to its authorized client base. All research is then available on www.redcloudsecurities.com via login and password.

Analyst Certification Any Red Cloud Securities Inc. research analyst named on this report hereby certifies that the recommendations and/or opinions expressed herein accurately reflect such research analyst’s personal views about the companies and securities that are the subject of this report. In addition, no part of any research analyst’s compensation is, or will be, directly or indirectly, related to the specific recommendations or views expressed by such research analyst in this report.

( Companies Mentioned: WHN:TSX.V,

)

Source: Ben Pirie 12/18/2024

This new mineralized area remains open and might connect to another recently identified zone at this asset in Canada, noted an Atrium Research report.

Endurance Gold Corp. (EDG:TSX.V; ENDGF:OTC; 3EG:FSE) encountered, on drilling the deepest hole yet at its Reliance project in British Columbia, a new area of high-grade gold mineralization below an existing zone, reported Ben Pirie, equity research analyst at Atrium Research, in a Dec. 16 research note.

“We are highly encouraged by today’s results and are increasingly bullish on the size potential of this system,” Pirie wrote.

285% Potential Return

On the news, Atrium Research reiterated its CA$0.50 per share target price on the Vancouver-based gold explorer, noted the analyst. From its share price at the time of the report of about CA$0.13, the return to target is 285%.

Endurance remains a Buy.

New Zone Confirmed

Endurance Gold placed drill hole DDH24-106 to test below the previously reported deepest intersection in the Imperial zone, and the result was positive, reported Pirie.

As expected, the hole hit the Imperial zone at 386m downhole, significantly extending it by about 185m downdip. The highlight intercept at this depth was 3.51 grams per ton gold (3.51 g/t Au) over 6.7 meters (6.7m), including 10.34 g/t Au over 1.7m.

Further downhole at about 608m, the drill bit intersected a new, high-grade zone about 210m below Imperial, which the company is calling Lower Imperial. The highlight from Lower Imperial’s lower contact zone is 7.18 g/t Au over 8.3m, including 28.08 g/t Au over 1.7m, within a wider intersection of 4.47 g/t Au over 15.3m. The upper contact zone returned a standout 4.35 g/t Au over 2m.

The newly identified zone is hosted in a coarse-grained gabbro intrusive, demonstrating “gold-bearing crackle breccia and veinlet textures associated with arsenopyrite,” described Pirie. The entire gabbro body assayed at 4.47 g/t Au over 15.3m from 608–623m downhole.

“The drill hole was stopped at 650m with potential for mineralization to continue at depth,” the analyst wrote.

Lower Imperial remains open and could potentially extend updip toward surface, parallel to Imperial. Were this the case, Lower Imperial would extend shallower and possibly connect to the recently discovered Lower Crown zone.

Also, Lower Imperial shows that the Royal Shear fault structure hosts mineralization over a vertical distance of 1.1 kilometer (1.1 km) and remains open.

“This new discovery supports the orogenic nature of the system by growing the vertical extent to over 1 km and opens significant new potential at depth along the ~1.5 km strike length of the Royal Shear,” wrote Pirie.

Also of note, Endurance intersected gold mineralization between Imperial and Lower Imperial. Of the six high-grade intercepts encountered, the highlights were:

- 4.76 g/t Au over 3.5m, including 31.5 g/t Au over 0.4m

- 7.79 g/t Au over 0.5m

- 1.97 g/t Au over 5m, including 20.1 g/t Au over 0.4m

News Flow Expected

Pirie noted the upcoming events that could boost Endurance’s share price. These include the release of drill results for the last 10 holes of the completed 2024 program, spanning 7,303m, are expected; updates on surface exploration work on the Olympic claims; and progress on a maiden mineral resource estimate.

Compelling Investment

In his report, Pirie also presented the key reasons why Atrium Research likes Endurance. One is the location of Reliance, in a historical mining camp and 10 km from the past-producing Bralorne mine that boasted 4,000,000 ounces of 17.7 g/t Au. Another positive is easy access to infrastructure from Reliance.

Further, Reliance boasts an epizonal orogenic gold system, wrote Pirie, a “multimillion-ounce, high-grade deposit in the making,” showing “consistent and best-in-class drill results.”

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Disclosures for Atrium Research, Endurance Gold Corp., December 16, 2024

Analyst Certification Each authoring analyst of Atrium Research on this report certifies that (i) the recommendations and opinions expressed in this research accurately reflect the authoring analyst’s personal, independent and objective views about any and all of the designated securities discussed (ii) no part of the authoring analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the research, (iii) to the best of the authoring analyst’s knowledge, she/he is not in receipt of material non-public information about the issuer, (iv) the analyst does not own common shares, options, or warrants in the company under coverage, and (v) the analysts adhere to the CFA Institute guidelines for analyst independence.

About Atrium Research Atrium Research provides institutional quality issuer paid research on public equities in North America. Our investment philosophy takes a 3-5 year view on equities currently being overlooked by the market. Our research process emphasizes understanding the key performance metrics for each specific company, trustworthy management teams, unit economics, and an in-depth valuation analysis. For further information on our team, please visit https://www.atriumresearch.ca/team.

General Information Atrium Research Corporation (ARC) has created and distributed this report. This report is based on information we considered reliable; we have not been provided with any material non-public information by the company (or companies) discussed in this report. We do not represent that this report is accurate or complete and it should not be relied upon as such; further any information in this report is subject to change without any formal or type of notice provided. Investors should consider this report as only one factor in their investment decisions; this report is not intended as a replacement for investor’s independent judgment. ARC is not an IIROC registered dealer and does not offer investment-banking services to its clients. ARC (and its employees) do not own, trade or have a beneficial interest in the securities of the companies we provide research services for and does not serve as an officer or Director of the companies discussed in this report. ARC does not make a market in any securities. This report is not disseminated in connection with any distribution of securities and is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. ARC does not make any warranties, expressed or implied, as to the results to be obtained from using this information and makes no express of implied warranties for particular use. Anyone using this report assumes full responsibility for whatever results they obtain. This does not constitute a personal recommendation or take into account any financial or investment objectives, financial situations or needs of individuals. This report has not been prepared for any particular individual or institution. Recipients should consider whether any information in this report is suitable for their particular circumstances and should seek professional advice. Past performance is not a guide for future results, future returns are not guaranteed, and loss of original capital may occur. Neither ARC nor any person employed by ARC accepts any liability whatsoever for any direct or indirect loss resulting from any use of its research or the information it contains. This report contains “forward looking” statements. Forward-looking statements regarding the Company and/or stock’s performance inherently involve risks and uncertainties that could cause actual results to differ from such forward-looking statements. Such statements involve a number of risks and uncertainties such as competition, technology shifts, market demand and the company’s (and management’s) ability to correctly forecast financial estimates; please see the company’s MD&A “Risk Factors” Section for a more complete discussion of company specific risks for the company discussed in this report. ARC is receiving a cash compensation from Endurance Gold Corp. for 12-months of research coverage. ARC retains full editorial control over its research content. ARC does not have investment banking relationships and does not expect to receive any investment banking driven income. ARC reports are primarily disseminated electronically and, in some cases, printed form. Electronic reports are simultaneously available to all recipients in any form. Reprints of ARC reports are prohibited without permission. To receive future reports on covered companies please visit https://www.atriumresearch.ca/research or subscribe on our website. The information contained in this report is intended to be viewed only in jurisdictions where it may be legally viewed and is not intended for use by any person or entity in any jurisdiction where such use would be contrary to local regulations or which would require any registration requirement within such jurisdiction.

( Companies Mentioned: EDG:TSX.V;ENDGF:OTCPink; 3EG:Frankfurt,

)

Source: Christopher Ecclestone 12/18/2024

Next for this asset is a feasibility study, likely to show enhanced economics over those in the second prefeasibility study, noted a Hallgarten & Co. report.

AbraSilver Resource Corp. (ABRA:TSX.V; ABBRF:OTCQX) is rapidly advancing Diablillos in northern Argentina, now positioned “as one of the most important silver projects coming down the pike at a global level” due to several converging events, reported Hallgarten & Co. Mining Strategist Christopher Ecclestone in a lengthy Dec. 16 coverage update.

“The rise of silver (and gold) to new record trading ranges combining with the onset of the Milei Administration (bringing Argentina in from the cold), the burgeoning of infrastructure on the altiplano (prompted by the lithium brine boom) and the publishing of two preliminary feasibility studies (PFSes) in 2024 (each better than the prior one) have collectively given AbraSilver the impetus to move into development mode,” Ecclestone explained.

100% Target Upside

AbraSilver was trading at the time of the report at about CA$2.45 per share, noted Ecclestone. Hallgarten & Co. assigned a target price on the Canadian mineral developer of CA$4.90 per share.

The difference in these prices reflects a potential return for investors of 100%.

AbraSilver remains rated Long.

Project Takeout Potential

According to the analyst, Diablillos, the largest precious metals project available in Argentina, is a prime candidate for miners needing to supplement their project pipeline. Spanning 7,919 hectares, Diablillos consists of 15 contiguous and overlapping mineral leases.

Its estimated Proven and Probable mineral reserves contain 210,000,000 ounces of silver equivalent (210 Moz of Ag eq), or 42,300,000 tons of 91 grams per ton silver (91 g/t Ag) and 0.81 g/t gold (Au).

“Frankly, our target price is predicated upon an offer being received in the next 12 months,” Ecclestone wrote. “In any case, the management are not waiting for predators to appear and are looking to develop the project under their own steam.”

Catalysts To Watch For

The next step for Diablillos is a feasibility study (FS). It will include phase four results from the in-progress, 20,000-meter resource expansion and stepout drill program started in early H2/24, wrote Ecclestone.

From results already available from this campaign, AbraSilver identified multiple new prospective mineralized zones. One is near the JAC zone, identified through stepout hole DDH 24-018, which intersected 31.5m of 277 g/t Ag, including 13.7m of 455 g/t Ag. This intercept confirmed a new significant high-grade mineralized structure at an angle to the main JAC zone, now a top-priority exploration target.

AbraSilver could further enhance Diablillos’ economics in the FS in two other ways, Ecclestone noted. It could include the low-cost processing of waste, mineralized material below the cutoff grade, via, say, heap leaching. It could incorporate the sulfide mineralization encountered below the oxide material.

Investors can expect additional drill results in the near term, completion of the FS in H1/26, and possibly an expanded resource in the interim.

Exploration targets close to the planned Oculto-JAC open-pit that warrant additional drilling include Oculto, JAC, Fantasma, Laderas, JAC North, Alpaca. Plus many other targets exist elsewhere within the concession block.

Two Studies Compared

Ecclestone highlighted that the second Diablillos PFS, done in November 2024, shows improved economics due mostly to higher precious metals prices and the impact of Argentina’s new Promotional Regime for Large Investment, or RIGI. According to AbraSilver’s management, the latest PFS increases confidence in the project’s significant upside potential. The second PFS reflects an optimized mine plan, updated capital and operating costs.

Specifically, the second PFS shows “a massive uplift” in the after-tax net present value discounted at 5% (NPV5%) at US$747 million (US$747M), an internal rate of return (IRR) of 27.6% and a payback period of 2 years, using the updated base case pricing, US$25.50 per ounce (US$25.50/oz) Ag and US$2,050/oz Au.

This compares to the first PFS, indicating a US$494M NPV5%, a 25.6% IRR and a 2.4-year payback period, using the prices, $23.50/oz Ag and US$1,850/oz Au.

Ecclestone pointed out that at today’s spot prices, the after-tax NPV5% would be US$1,291M, the IRR 39.3%, and the payback period 1.5 years.

Costs in the second PFS are US$544M of initial preproduction capex plus another US$77M in sustaining capital over the life of mine (LOM) versus in the first PFS, US$373M and US$65M, respectively.

The average all-in sustaining cost (AISC) in the second PFS is US$12.67/oz Ag eq over the LOM and US$11.23/oz Ag eq over the first five years of full mine production. This compares to the average AISC in the first PFS of US$12.40/oz Ag eq over the LOM.

The second PFS outlines an open-pit mine producing an average annual production of 16.4 Moz Ag eq over the first five years of full mine production versus 11.07 Moz in the first PFS. The processing plant has been designed for a nameplate capacity of 9,000 tons per day and targets high-grade silver and gold mineralization in the mine plan’s early years.

Tangible Effects of RIGI

When the financial benefits of Argentina’s new RIGI program are applied to Diablillos, the effect is “dramatic for AbraSilver, in a way that few outside investors seem to have grasped,” Ecclestone purported.

RIGI benefits, the analyst reiterated, include a reduction of corporate taxes to 25% from 35%, elimination of export duties, removal of all foreign exchange restrictions, and provision of value-added tax reimbursement on capital expenditures and tax stability throughout the LOM. Accordingly, in the second PFS, the updated taxes, royalties, and export duties amount to US$536M versus US$965M in the previous PFS.

EIA Already Done

Following the first PFS, AbraSilver completed and submitted an environmental impact assessment of Diablillos in early fall. Along with project details from the initial PFS, it included complete environmental baseline studies, air quality, hydrological modeling, flora and fauna characterization, and impact evaluation. It also encompassed an analysis of mitigation, controls, and benefits “that will be present over the LOM of the project, from construction to final closure.”

Hot Mining Location

Diablillos is in Argentina’s Salta province, a booming mining region, and sits on the border with the Catamarca province, Ecclestone reported. Also in Salta is First Quantum Minerals Ltd.’s (FM:TSX; FQM:LSE) Taca copper-molybdenum-gold project, which helps expose the potential for precious and base metals projects in the area.

This location, in the Puna region, is the southern extension of the altiplano, or high plateau, of southern Peru, Bolivia, and northern Chile, which separates the Cordillera Oriental to the east and the Andean Cordillera (Cordillera Occidental) to the west.

The Diablillos concessions cover highly prospective porphyry occurrences. Also, they abut and cover two lithium salt pans, the Salar de Hombre Muerto and the Salar de Diablillos.

“The proliferation of lithium projects in the zone has brought a wealth of infrastructure which mitigates some of the capex that AbraSilver would otherwise have to install,” Ecclestone wrote.

Two Strategic Investors

Earlier this year, AbraSilver gained two strategic investors, Kinross Gold Corp. (K:TSX; KGC:NYSE) and an affiliate of Central Puerto SA (CEPU:NYSE), a local privatized power generator, when each invested CA$10M. As a result, each of these two companies has a 4% interest in AbraSilver.

Subsequently, AbraSilver and Kinross formed a regional partnership to jointly explore and acquire new silver, gold, and copper-focused projects in Argentina.

“This could have relevance back to the porphyry element of the Diablillos concession area,” added Ecclestone.

Other Company Data

As of Sept. 30, 2024, reported Ecclestone, AbraSilver had CA$14M in cash. Added to this is the CA$3.7M of warrant proceeds it generated since.

On the date of the analyst’s report, the company had 128.3 million shares outstanding and a CA$314.34M market cap. Its 52-week share price range was CA$1.30–3.58.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- AbraSilver Resource Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor/employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Disclosures for Hallgarten & Co., AbraSilver Resource Corp., December 16, 2024

I, Christopher Ecclestone, hereby certify that the views expressed in this research report accurately reflect my personal views about the subject securities and issuers. I also certify that no part of my compensation was, is, or will be, directly or indirectly, related to the specific recommendations or view expressed in this research report. Hallgarten’s Equity Research rating system consists of LONG, SHORT and NEUTRAL recommendations. LONG suggests capital appreciation to our target price during the next twelve months, while SHORT suggests capital depreciation to our target price during the next twelve months. NEUTRAL denotes a stock that is not likely to provide outstanding performance in either direction during the next twelve months, or it is a stock that we do not wish to place a rating on at the present time. Information contained herein is based on sources that we believe to be reliable, but we do not guarantee their accuracy. Prices and opinions concerning the composition of market sectors included in this report reflect the judgments of this date and are subject to change without notice. This report is for information purposes only and is not intended as an offer to sell or as a solicitation to buy securities. Hallgarten & Company or persons associated do not own securities of the securities described herein and may not make purchases or sales within one month, before or after, the publication of this report. Hallgarten policy does not permit any analyst to own shares in any company that he/she covers. Additional information is available upon request. Hallgarten & Company acts as a strategic consultant to AbraSilver and as such is/was compensated for those services but does not hold any stock in the company nor does it have the right to hold any stock in the future. © 2024 Hallgarten & Company Ltd. All rights reserved. Reprints of Hallgarten reports are prohibited without permission. Web access at: Research: www.hallgartenco.com 60 Madison Ave, 6th Floor, New York, NY, 10010

( Companies Mentioned: ABRA: TSX.V;ABBRF:OTCQX,

)

Source: Streetwise Reports 12/18/2024

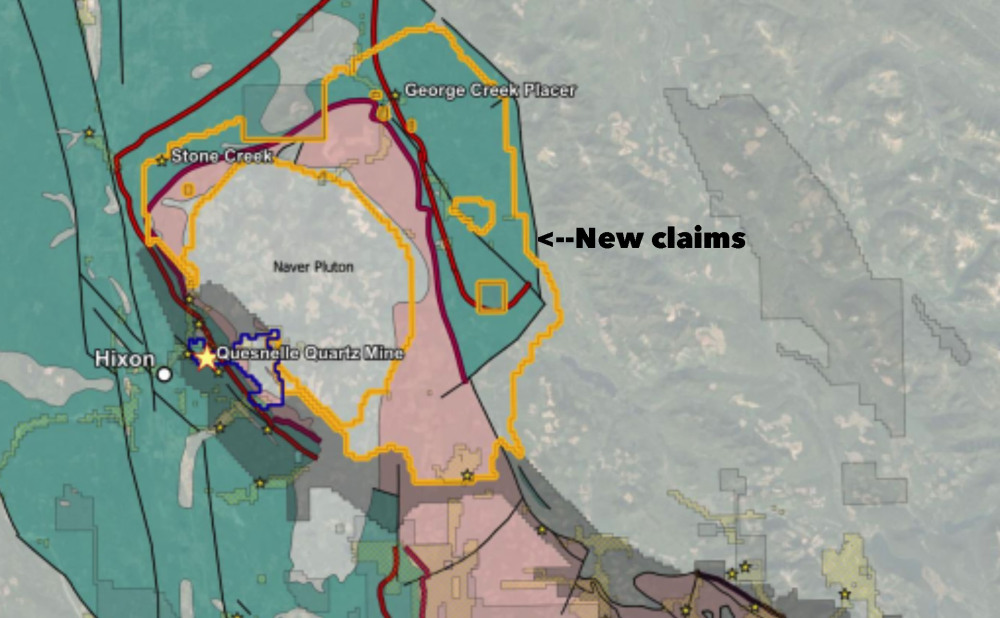

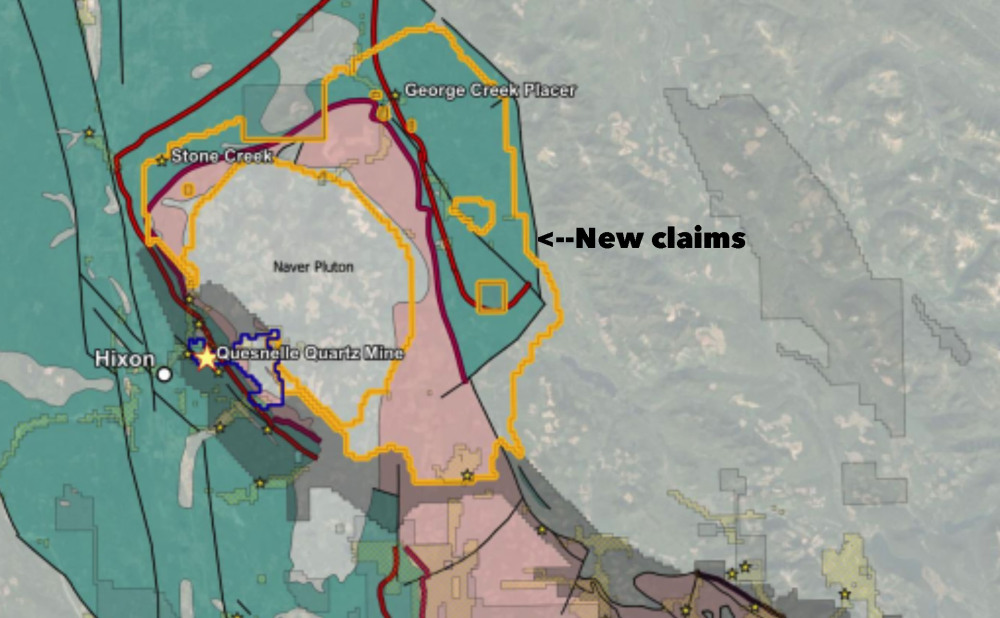

Just one week after Golden Cariboo Resources Ltd. (GCC:CSE; GCCFF:OTC; A0RLEP:WKN; 3TZ:FSE) announced a significant expansion of its Halo discovery at its Quesnelle Quartz Mine, the company has staked more than 90,000 hectares of contiguous mineral claims. Read why one analyst says the stock is a Buy.

Just one week after Golden Cariboo Resources Ltd. (GCC:CSE; GCCFF:OTC; A0RLEP:WKN; 3TZ:FSE) announced a significant expansion of its Halo discovery at its Quesnelle Quartz Mine in British Columbia, the company said it had staked 90,898 hectares (ha) of contiguous mineral claims.

The company now holds 95,122 ha at the project, making it the third-largest claim holder in the historic Cariboo Gold District, Golden Cariboo said in a release.

“The first thing we did after making the Bonanza Ledge discovery in the Wells-Barkerville camp nearly 25 years ago was to stake most of the entire belt surrounding it,” President and Chief Executive Officer Frank Callaghan said, noting his earlier success advancing another project in the district. “It is hard to fathom that the opportunity has presented itself to do it over again this past fall.”

Callaghan said the Halo discovery “redefined the gold potential this far north in the Cariboo,” leading the company to secure more than 900 square kilometers of prospective ground over a parallel belt to our discovery and our project.

Callaghan said the Halo discovery “redefined the gold potential this far north in the Cariboo,” leading the company to secure more than 900 square kilometers of prospective ground over a parallel belt to our discovery and our project.

The new claims cover an area with a similar geological setting to that of Quesnelle, as well as having a history of placer gold production. The company said it has seen limited modern exploration for lode gold.

‘Key Ingredients for a Productive Mineral System’

The potential for significant orogenic gold systems in the northern region of the Cariboo district was identified by the company’s recent discovery of the Halo zone, from which 1.77 grams per tonne gold (g/t Au) over 136.51 meters was intersected in diamond drill hole QGQ24-13.

“Following the discovery, the company staked a geological belt encircling a regional-scale intrusion known as the Naver pluton,” Golden Cariboo said in a release. “This belt contains key geological criteria encountered on the project, and at major gold deposits in the Cariboo Gold District.”

According to the company, some of those criteria include:

- The presence of the Nicola Group (Quesnel terrane), which contains the host rock formations to the project and several others in the Cariboo Gold District, including the 4.7-million-ounce (Moz) Spanish Mountain Deposit.

- The Snowshoe Group (Barkerville subterrane), which contains the host rock formations to the 5.3 Moz Cariboo Gold Project currently under construction by Osisko Development Corp.

- Major thrust faults on the terrane boundary between Quesnel terrane and the Barkerville subterrane, namely the Eureka and Spanish thrusts, which are the inferred deep-seated crustal faults that produced orogenic gold systems across the Cariboo Gold District.

- Presence of placer gold occurrences situated at the confluence of the above faults.

“The newly staked ground contains the key ingredients for a productive mineral system, highlighted by deep-seated structures and receptive host rocks, which come together right next door to the Quesnelle Gold Quartz Mine property,” said Dr. Sarah Palmer, consulting structural geologist for the company. “That, along with placer gold surface indicators, provides a strong technical framework for an underexplored geological belt.”

Visible Gold

The Quesnelle Gold Quartz Mine Property is located 4 kilometers northeast of Hixon in central British Columbia. It is accessible year-round via an industrial road. Historic mining in the area dates back to the 1860s, with placer and hard rock operations contributing to a long-standing legacy of gold production.

During its exploration, Golden Cariboo has continued to find multiple occurrences of visible gold in its core results.

“Visible gold in current drilling indicates potential for high-grade assays from mineralized targets,” Couloir Capital Senior Mining Analyst Ron Wortel wrote of the project in a recent research report.

Couloir Capital assigned a “Buy” recommendation to company’s stock, citing Golden Cariboo’s exploration initiatives as a unique opportunity for exposure to gold resource discovery in a Tier 1 jurisdiction.

Even before the release of recent assay results expanding the Halo Zone, Couloir assigned a fair value of CA$0.40 per share to the stock, projecting an upside of 286% from the current share price at the time of the report.

The Catalyst: Gold Market Waits Out Fed

Gold prices were modestly down in quieter early trading Tuesday, just ahead of the key U.S. data point of the week, the Federal Reserve meeting that could lead to another interest rate cut, according to Kitco News.

Reuters reported that spot gold was down 0.5% Tuesday morning at US$2,638.16 per ounce. U.S. gold futures shed 0.6% to US$2,652.90, the wire service said.

“Investors are preparing themselves for tomorrow’s rate announcement from the U.S. Federal Reserve’s FOMC,” David Morrison of Trade Nation wrote in an email dispatch, according to Kitco. “There’s currently a 96% probability of a 25 basis-point rate cut. So, investors will be paying more attention to the FOMC’s quarterly summary of economic projections, which provides forecasts for GDP growth, unemployment, inflation, and the fed funds rate for 2025 and beyond.”

Gold may also see buying interest limited in part by concerns of U.S. stagflation, with the potential for a slowing labor market meeting higher inflation, constraining the Fed’s ability to cut interest rates, Kitco noted.

But most experts agree gold is still in a bear market. FX Empire’s A.G. Thorson recently predicted a run towards US$3,000-plus by next March or April.[OWNERSHIP_CHART-11131]

Writing for Money on December 4, Marc Guberti noted that gold was up by more than 31% in 2024 and delivered more than an 82% gain over the past five years. “Many big banks believe that gold is set to continue its rally in 2025 and beyond,” he wrote.

Ownership and Share Structure

According to Golden Cariboo, management and insiders own 30% of Golden Cariboo Resources.

President and CEO Frank Callaghan owns 16.45% or 6.93 million shares; Elaine Callaghan has 0.97% or 0.41 million shares; Director Andrew Rees has 0.79% or 0.33 million shares; and Director Laurence Smoliak has 0.3% or 0.13 million shares.

Retail investors hold the remaining. There are no institutional investors.

The company said it has 50.3 million shares outstanding, 24.83 million warrants, and 3.8 million options.

Its market cap is CA$9.66 million. Over the past 52 weeks, Golden Cariboo has traded between CA$0.08 and CA$0.36 per share.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Golden Cariboo Resources Ltd. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Golden Cariboo Resources Ltd.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

( Companies Mentioned: GCC:CSE; GCCFF:OTC; A0RLEP:WKN;3TZ:FSE,

)