Category: Gold

Source: Don Tapscott 03/26/2025

Prolific author and founder co-founder of the Blockchain Research Institute Don Tapscott explains why he thinks gold tokenization could revolutionize the market.

On March 5, President Trump signed an executive order creating a Strategic Bitcoin Reserve (SBR). The SBR will be capitalized initially with cryptoassets obtained by the Department of Treasury through criminal and civil asset forfeiture — worth about $6.9 billion.

However, this could just be the start: Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick, both well-known Bitcoin bulls, are now authorized to develop budget-neutral strategies for acquiring additional BTC, provided that those strategies impose no incremental costs on American taxpayers.

One bold idea floated by Wyoming Senator Cynthia Lummis is to ‘monetize’ the gold being held in Fort Knox and swap some of it for Bitcoin. Right now, gold is being held by the U.S. government at “book value” of about $42/oz, the same price as in 1973, a far cry from the approximately $3,000/oz trading price today. Indeed, Treasury Secretary Scott Bessent has said the U.S. will move to monetize its assets which many interpreted as revaluing gold reserves while selling real estate and other assets.

John Maynard Keynes once called gold a ‘barborous relic’ but its clear that individual investors, institutons and many governments disagree. Gold is on a record -breaking run through $3,000 and has outperformed both the S&P500 and the NASDAQ over the past five years.

Still, despite the dramatic price move, the way most people, and even the U.S. government, buy and store gold is in vaults at banks and other financial institution or under the proverbial mattress (or Fort Knox) , which has not changed much since the days of the horse and buggy.

The gold industry has missed out on the digitally native and newly affluent class of investors who love Bitcoin (and would perhaps love gold if given the chance).

So, gold needs to play a little catch-up. How?

The answer lies in blockchain, the technology behind Bitcoin. Blockchains allow us to program a digital coin or “token” to represent anything of value — stocks, bonds, art, gold — and make them accessible to anyone without the need for intermediaries. Embedded technology like smart contracts can automate functions once handled by brokers, exchanges, and transfer agents, reducing both friction and fees.

The first big application so far for tokens has been U.S. dollars or stablecoins, which have exceeded $200 billion in assets. The next killer app — or asset — may be gold.

Tokenization adds another layer of trust. Worried that the U.S. government is misstating the gold it holds in reserve? If that gold was tokenized, it would be traceable on a blockchain and auditable by anyone, improving trust.

Should the U.S. government look to dump its gold to buy Bitcoin?

We believe that the next generation of financial powerhouses will likely emerge from the tokenization revolution. It’s still early, and the playing field is wide open. Matador and others have the bull by the horns.

No. Instead, it should revalue that gold, tokenize it, and expand the SBR to include gold and other tokenized assets. The best part is that the U.S. government can tokenize its gold holdings on the Bitcoin blockchain, the most secure and trustworthy ledger devised, and monetize it by lending it out on chain or using it as collateral to do other kinds of transactions.

Tokenized gold is already a growing market. Tether’s U.S dollar stablecoin, USDT, is a juggernaut with $140 billion circulating supply, accounting for 70% of stablecoin market. In January 2020 they launched a gold product XAUt, which has a circulating supply of $650 million, comprising of 41% of the onchain gold market.

Paxos is used by a few traditional enterprises like PayPal, Venmo, and MasterCard. Paxos’ PAX Gold (PAXG) was launched in September 2019 and has a circulating supply of $520 million, approximately 33% of the onchain gold market. It is the second largest behind Tether’s XAUt.

One public company, Matador Technologies Inc. (MATA:TSX.V; MTDTF:OTCQB), is trying to do something similar. Matador wants to be one of the first public companies focused on tokenizing real-world assets by leveraging the Bitcoin blockchain, starting with gold. Here’s how it works, according to the company: investors buy gold digitally through Matador, with each transaction recorded on the Bitcoin blockchain using a digital signature called an ordinal. The Bitcoin blockchain is a secure and decentralized ledger that can be used to record transactions in gold and other assets.

Matador then acquires gold through a partnership with Kitco Metals, sourcing directly from the Canadian Mint, where the gold is custodied. The gold product mixes real gold with digital art, similar to how a commemorative gold coin mixed the scarcity of the precious metal with the scarcity of a limited-edition design. The user has a claim on both the physical gold and the digital art. Matador is backed by UTXO and Hive Digital.

According to Matador CEO Deen Soni, “Tokenizing Fort Knox gold on the blockchain could boost transparency and trust,” adding “the owernship of every ounce could be immutably tracked, reducing the potential for discrepencies. This increased visibility would not only bolster public confidence in our reserves but also enable innovative financial mechanisms, such as lending tokenized gold to friendly regimes, generating returns.”

Let’s take it a step further: why do we spend billions of dollars extracting gold only to bury it again in bank vaults? Resource companies could use secure geological data to identify and prove the size and value of gold deposits and then tokenize them and make available for trading as a gold derivative. NatGold Digital Ltd., for example, is tokenizing gold in the ground and making it available to investors as a compliant token, with the added benefit of meeting ESG standards due to the no-carbon footprint.

The growth of this technology ecosystem around Bitcoin is something I have written about and hoped to see developed since Blockchain Revolution. It just makes sense — Why not use the world’s most secure decentralized network to secure the world’s largest and oldest store of value asset? Or, for that matter, titles and deeds to property, securities, licenses, contracts, and even votes!

It remains to be seen if Tether, Paxos, or Matador can win in this market. Other players like Polymath and Securitize.io are making inroads in the tokenization of stocks, bonds, and other financial assets, which collectively are known as “security tokens.” We believe that the next generation of financial powerhouses will likely emerge from the tokenization revolution. It’s still early, and the playing field is wide open. Matador and others have the bull by the horns.

Don Tapscott is author of 16 widely read books about technology in business and society, including the best-seller Blockchain Revolution, which he co-authored with his son Alex. He is Co-Founder of BRI, an Adjunct Professor at INSEAD, Chancellor Emeritus of Trent University in Canada and a Member of the Order of Canada.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Matador Technologies Inc. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Matador Technologies Inc. and NatGold Digitial Ltd.

- Don Tapscott: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

( Companies Mentioned: MATA:TSX.V; MTDTF:OTCQB,

)

Copper Breaking Out to a Record High

Source: Michael Ballanger 03/26/2025

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the current state of the market and what moves he will be making.

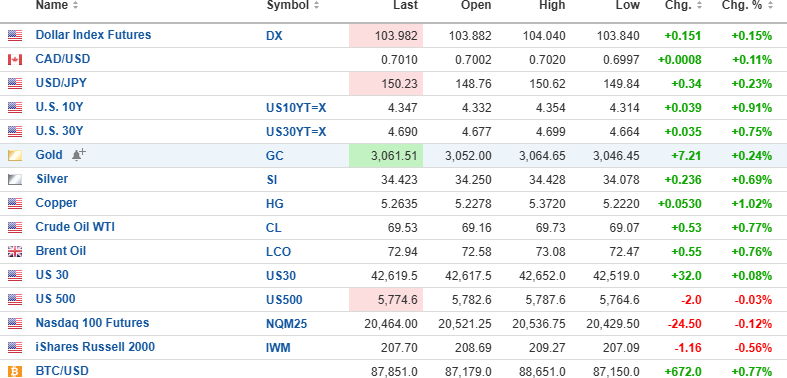

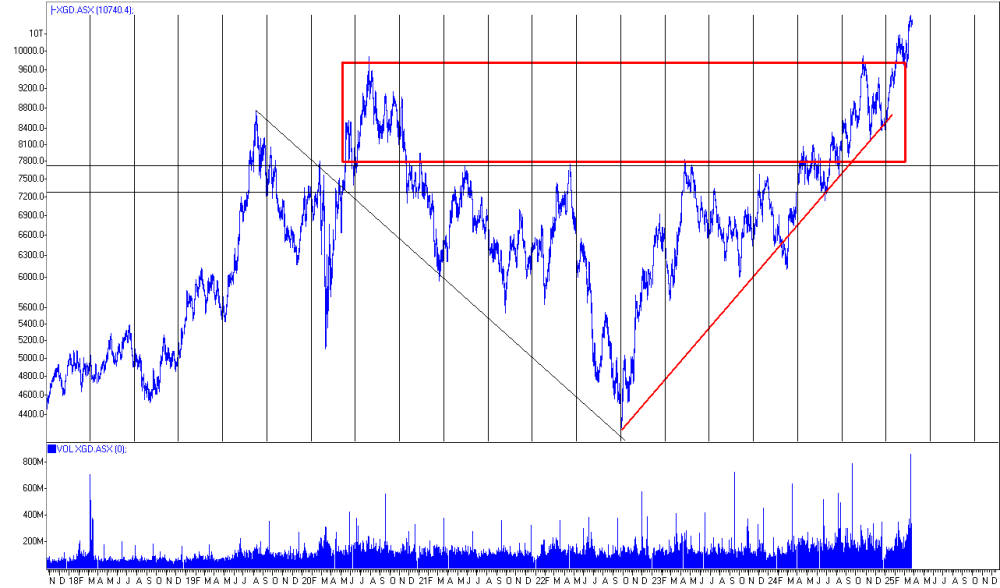

U.S. Dollar Index futures are up 0.15% to 103.982, while the 10-year bond yield is up 0.91% to 4.347% and the 30-year bond yield is up 0.75% to 4.690%.

Gold (+0.24%), silver (+0.69%), copper (+1.02%), and oil (+0.77%) are all higher.

The DJIA futures (+0.08%) are higher by 32 points, while the S&P 500 futures (-0.03%) are down 2 points, and the NASDAQ 100 futures (-0.12%) are down

24.50 points. Risk barometer Bitcoin is up 0.77% to $87,851 and barely out of bear market territory, down 19.7% from the top.

Copper

As much as I have been banging the table for the past few months on copper, it is the dynamic duo of copper (Cu) and gold (Au) that have led the rally in the metals, with gold breaking out to record highs through $3k on March 13 followed by copper yesterday and again today. The prior high of US$5.199/lb. is now history, and if you do a count of the percentage drop from May 20, 2024, to the bottom in August of last year, it was 25%. I now estimate that the breakout will result in an upward move roughly the same in amplitude as last year’s correction, which puts my target for the near term at $6.20/lb.

Headlines in ZeroHedge yesterday had one of the bigwigs at Trafigura calling for US$12,000/mt Cu ($5.446/lb.), which means that at the highs of earlier this morning ($5.374/lb.), we were almost there. However, with the RSI approaching the high 70s, a pullback is probably warranted, so I am refraining from any further purchases of the copper names with the exception of Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) where potentially explosive news is pending.

As for Freeport-McMoRan Inc. (FCX:NYSE), I will hold my shares, which are now on the books in the GGMA 2025 Trading Account at $39.97, but will probably offer the June $40 calls at $5.50 where the $15,000 profit covers the hit I took last week on the March $40 calls ($12,500).

In the GGMA 2025 Trading Account

- Sell 50 calls FCX June $40 at $5.50

I find that when the RSI moves into sharply overbought territory, taking a bit of risk off the table is generally a good move.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Gold Co. Releases 2025 Exploration Plans

Source: Ben Pirie 03/26/2025

Endurance Gold Corp (EDG:TSX.V; ENDGF:OTCQB; 3EG:Frankfurt) recently released its 2025 exploration plans. Read on to see why Atrium Research rates this company as a Buy.

On March 25, 2025, Atrium Research analysts Ben Pirie and Nicholas Cortellucci maintained a Buy rating and CA$0.50 target price on Endurance Gold Corp (EDG:TSX.V; ENDGF:OTCQB; 3EG:Frankfurt), following the company’s announcement of its 2025 exploration plans for the Reliance Gold Project, which include up to 7,000 meters of diamond drilling and preparations for an inaugural mineral resource estimate.

Endurance Gold announced that its 2025 exploration program is expected to commence in early May, notably ahead of its British Columbia peers due to the project’s favorable location. The drilling program has three main objectives: expanding new gold zones identified during the 2024 campaign, further testing two new drill discoveries at the Crown Zone, and conducting infill drilling to support the company’s inaugural mineral resource estimate.

The first objective focuses on expanding zones discovered in 2024, including testing the up-dip potential of the Lower Imperial Zone, which previously returned intercepts such as 7.18 grams per tonne gold (g/t Au) over 8.3 meters. The company also plans to test for potential stacked mineralized zones below the Imperial Zone and between the Imperial and Lower Imperial Zones. The second objective involves further investigation of the Upper Crown Zone, which yielded 74.29 g/t Au over 2.0 meters in hole DDH24-093, and the Lower Crown Zone, which returned 7.61 g/t Au over 5.7 meters in hole DDH24-103.

Additionally, the company announced the discovery of a new 500-meter-long soil anomaly located approximately 700 meters south of the Eagle Zone and within the current drill permit area. This discovery is significant as it may indicate an offset extension of the Royal Shear Eagle trend or possibly a new subparallel structure with similar geochemical characteristics.

Beyond drilling, Endurance Gold will conduct geochemical surface sampling and prospecting at the Enigma and Olympic areas to derive new targets, continue geological and metallurgical studies, and update its 3D model in preparation for the inaugural mineral resource estimate. The company has also successfully upgraded from the OTC Pink Market to the OTCQB Venture Market, with its common shares now trading under the symbol “ENDGF.”

The analysts highlight that the Eagle Zone, which will be a focus of exploration, hosts some of the best drill results across the property, with 40 diamond drill holes over 550 meters of strike yielding a weighted average grade of 4.70 g/t Au and an average drill composite length of 15.7 meters, all within 100 meters of surface.

With the share price at the time of the report of CA$0.13, the CA$0.50 target price represents a potential return of 300%.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Disclosures for Atrium Research, Endurance Gold Corp., March 25, 2025

Analyst Certification Each authoring analyst of Atrium Research on this report certifies that (i) the recommendations and opinions expressed in this research accurately reflect the authoring analyst’s personal, independent and objective views about any and all of the designated securities discussed (ii) no part of the authoring analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the research, (iii) to the best of the authoring analyst’s knowledge, she/he is not in receipt of material non-public information about the issuer, (iv) the analyst does not own common shares, options, or warrants in the company under coverage, and (v) the analysts adhere to the CFA Institute guidelines for analyst independence.

About Atrium Research Atrium Research provides institutional quality issuer paid research on public equities in North America. Our investment philosophy takes a 3-5 year view on equities currently being overlooked by the market. Our research process emphasizes understanding the key performance metrics for each specific company, trustworthy management teams, unit economics, and an in-depth valuation analysis. For further information on our team, please visit https://www.atriumresearch.ca/team. General Information Atrium Research Corporation (ARC) has created and distributed this report. This report is based on information we considered reliable; we have not been provided with any material non-public information by the company (or companies) discussed in this report. We do not represent that this report is accurate or complete and it should not be relied upon as such; further any information in this report is subject to change without any formal or type of notice provided. Investors should consider this report as only one factor in their investment decisions; this report is not intended as a replacement for investor’s independent judgment. ARC is not an IIROC registered dealer and does not offer investment-banking services to its clients. ARC (and its employees) do not own, trade or have a beneficial interest in the securities of the companies we provide research services for and does not serve as an officer or Director of the companies discussed in this report. ARC does not make a market in any securities. This report is not disseminated in connection with any distribution of securities and is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. ARC does not make any warranties, expressed or implied, as to the results to be obtained from using this information and makes no express of implied warranties for particular use. Anyone using this report assumes full responsibility for whatever results they obtain. This does not constitute a personal recommendation or take into account any financial or investment objectives, financial situations or needs of individuals. This report has not been prepared for any particular individual or institution. Recipients should consider whether any information in this report is suitable for their particular circumstances and should seek professional advice. Past performance is not a guide for future results, future returns are not guaranteed, and loss of original capital may occur. Neither ARC nor any person employed by ARC accepts any liability whatsoever for any direct or indirect loss resulting from any use of its research or the information it contains. This report contains “forward looking” statements. Forward-looking statements regarding the Company and/or stock’s performance inherently involve risks and uncertainties that could cause actual results to differ from such forward-looking statements. Such statements involve a number of risks and uncertainties such as competition, technology shifts, market demand and the company’s (and management’s) ability to correctly forecast financial estimates; please see the company’s MD&A “Risk Factors” Section for a more complete discussion of company specific risks for the company discussed in this report. ARC is receiving a cash compensation from Endurance Gold Corp. for 12-months of research coverage. ARC retains full editorial control over its research content. ARC does not have investment banking relationships and does not expect to receive any investment banking driven income. ARC reports are primarily disseminated electronically and, in some cases, printed form. Electronic reports are simultaneously available to all recipients in any form. Reprints of ARC reports are prohibited without permission. To receive future reports on covered companies please visit https://www.atriumresearch.ca/research or subscribe on our website. The information contained in this report is intended to be viewed only in jurisdictions where it may be legally viewed and is not intended for use by any person or entity in any jurisdiction where such use would be contrary to local regulations or which would require any registration requirement within such jurisdiction.

( Companies Mentioned: EDG:TSX.V;ENDGF:OTCQB; 3EG:Frankfurt,

)

Gold Edging Higher

Source: Barry Dawes 03/26/2025

Barry Dawes of Martin Place Securities takes a look at the gold market to explain where he believes it is headed.

Gold is moving quietly ahead and should soon start accelerating. This is unlike earlier bull markets in gold, where price rises were sharp and volatility high.

The slow rise is probably indicative of just the early stages. The corporate action in the gold sector is showing that the capital markets are freeing up in the resources sector and this should be just the beginning.

Producing companies are being bought for operating cashflows now, so it is the price of buying gold production.

Soon, it will be the price of gold resources in the ground.

Silver is moving higher, and its parabolic move is now proceeding. Gently for now. Accelerating soon.

Spike intraday high:

Held on to intraday spike again:

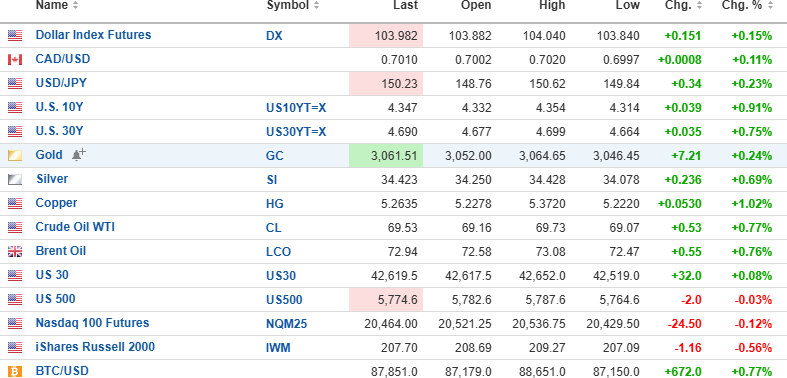

Gold is back-testing on both the trendline and the parabola.

You can see the parabola developing here.

Gold and Silver Stocks

Silver stocks are leading gold stocks. No silver producers in Australia yet outside of S32.

Broken Hill Mines is coming up soon, though.

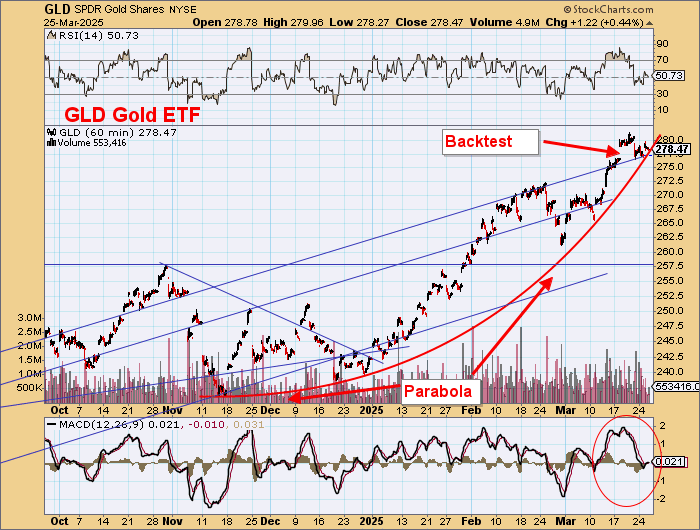

Gold stocks made a new rally high here and are just breaking out.

Silver stocks have already broken out of the box.

ASX Gold Index

It won’t be long to 11,000.

US$

Backtest and island reversal:

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Source: Streetwise Reports 03/26/2025

Endurance Gold Corp (EDG:TSX.V; ENDGF:OTCQB; 3EG:Frankfurt) has kicked off its 2025 exploration campaign at the Reliance Project with up to 7,000 meters of drilling planned. New high-grade hits and a 500m anomaly could reshape the Royal Shear. Here’s what’s next.

Endurance Gold Corp (EDG:TSX.V; ENDGF:OTCQB; 3EG:Frankfurt) announced plans to commence its 2025 exploration program in early May at the wholly owned Reliance Gold Project, located near Gold Bridge, British Columbia. The program builds on consistent exploration progress since 2020 and recent drill successes across a 1.5-kilometre mineralized corridor known as the Royal Shear. The company reported that it has now expanded the Royal Shear surface potential by 500 meters, with the mineralized trend remaining open along strike and at depth.

The 2025 program includes up to 7,000 meters of diamond drilling focused on the Royal Shear trend. The company intends to expand mineralized zones discovered in the 2024 season, including the Lower Imperial, Upper Crown, and Lower Crown zones, and complete infill drilling to support an inaugural mineral resource estimate. In 2024, drill hole DDH24-106 intersected 7.18 grams per tonne (gpt) gold over 8.3 meters, including 28.08 gpt gold over 1.7 meters, in a previously unrecognized zone below the Imperial Zone. The Upper Crown Zone returned 147.5 gpt gold over 1.0 meter in DDH24-093, while the Lower Crown Zone yielded 7.61 gpt gold over 5.7 meters in DDH24-103.

As per the announcement, Endurance Gold also plans to expand exploration beyond the Royal Shear. The company will conduct surface sampling at the Enigma and Olympic soil anomalies, discovered in 2023, with gold values up to 25.1 gpt and antimony up to 11.9%. A new 500-metre anomaly identified in 2024, approximately 700 meters south of the Eagle Zone, may represent an offset extension of the Royal Shear or a parallel structure. The company expects to receive a new drill permit for these additional targets in 2025.

The Reliance Gold Project is interpreted to host a shallow-level, or “epizonal,” orogenic gold system — a type of mineral deposit formed in brittle structural regimes and often associated with high-grade, narrow vein gold. Mineralization consists of sulphide replacement and breccias containing pyrite, arsenopyrite, and stibnite, commonly accompanied by silicification and quartz stockwork.

In a corporate update, Endurance Gold also announced that its common shares began trading on the OTCQB Venture Market in the United States under the symbol “ENDGF” as of March 24, 2025. Shares will continue to trade on the TSX Venture Exchange under “EDG.V” and on the Berlin Open Market under “3EG.”

Gold Sector Update: Institutional Demand Surged as Prices Reached New Highs

The gold sector saw continued momentum in March, with analysts highlighting robust demand and rising prices amid macroeconomic uncertainty. According to Stewart Thomson in a March 18 commentary for Kitco, institutional interest in gold mining equities increased as inflation concerns deepened and global markets showed signs of stress. He noted that “gold stocks are poised to get an ongoing institutional tidal wave of capital,” pointing to a potential reallocation of assets away from traditional equities during stagflationary conditions.

The same report emphasized parallels with the 1970s market, stating that “in the 1970s, American stock markets tumbled. Gold stocks soared as that occurred because money managers sold traditional stocks and invested in the miners.” Thomson argued that many gold investors had underestimated the scale of institutional flows that could move into mining equities under current economic conditions, driven by escalating tariff tensions and weakened earnings projections in other sectors.

Atrium Research analysts Ben Pirie and Nicholas Cortellucci maintained its Buy rating and CA$0.50 target price for Endurance Gold Corp., representing a 300% return to target based on the share price at the time of the report.

Also, on March 18, Stockhead reported that the price of gold had surpassed US$3,000 per ounce, setting a new record and contributing to gains in large-cap and junior mining stocks. The news came amid renewed geopolitical tensions, which spurred safe-haven demand. The article emphasized that the rising gold price played a critical role in supporting equity valuations in the mining sector.

The technical setup for junior gold miners was also analyzed in a March 20 report from Excelsior Prosperity, which observed that the VanEck Junior Gold Miners ETF (GDXJ) had reached a new intraday high of US$57.65 before closing at US$56.54. This was well above its October 2024 peak of US$55.58. Although the report highlighted some overbought indicators on momentum metrics like the Commodity Channel Index and Slow Stochastics, it confirmed that “overall gold and the gold stocks have been shining brightly and making solid moves to the upside.”

Finally, a March 24 analysis from Fundamental Research Group contextualized recent merger and acquisition activity within the gold sector, noting that elevated prices had intensified strategic consolidation. The report linked the activity to “gold prices hitting record highs above US$3,000/oz,” which had led to a premium offer being rejected by a mid-tier producer on grounds of undervaluation. This trend pointed to a broader re-rating in the sector as market participants reassessed long-term asset values in light of sustained high bullion prices.

Analysts Back Endurance Gold’s High-Grade Potential With Strong Rating and 300% Upside Target

On March 25, Atrium Research analysts Ben Pirie and Nicholas Cortellucci maintained its Buy rating and CA$0.50 target price for Endurance Gold Corp., representing a 300% return to target based on the share price at the time of the report. According to Atrium, the company’s 2025 exploration campaign at the Reliance Gold Project had “several key initiatives,” including up to 7,000 meters of diamond drilling aimed at expanding known mineralized zones and supporting the company’s inaugural mineral resource estimate. The analysts described the Reliance project as a “multi-million-ounce high-grade deposit in the making” and emphasized that the Eagle Zone had returned “best-in-class drill results” with a weighted average of 4.70 g/t gold over 15.7 meters, all within 100 meters of surface.

Atrium also highlighted recent discoveries in the Lower Imperial and Crown Zones, noting that these demonstrated potential for stacked mineralization. The report cited a standout intercept from the Upper Crown Zone where drill hole DDH24-093 returned 147.5 g/t gold over 1.0 meter, including 74.29 g/t over 2.0 meters with coarse visible gold. The Lower Crown Zone showed similarly encouraging results, including 7.61 g/t gold over 5.7 meters and 49.1 g/t over 0.3 meters.

The analysts pointed to a new 500-meter soil anomaly discovered in 2024 approximately 700 meters south of the Eagle Zone as a potentially significant extension of the Royal Shear trend or a new subparallel structure. They described the anomaly as having “surface geochemical and gold-bearing characteristics similar to the Royal Shear.” Atrium viewed this as a compelling development to support additional drill targeting.

Endurance Gold’s Catalysts and Competitive Positioning

Endurance Gold’s 2025 exploration plans position the company to advance the Reliance Gold Project toward an initial mineral resource estimate. According to the company’s March 2025 investor presentation, 73 of the 108 diamond drill holes completed between 2021 and 2024 intersected “significant” gold grades (defined as over 3.4 gpt gold over more than 3 meters), while 19 returned “excellent” results. Notably, the Eagle Zone alone has produced 40 such intersections across a 550-meter strike length and remains open at depth.

The company reported a working capital of approximately CA$4.36 million as of September 30, 2024, and maintains full ownership of the Reliance Project, adjacent to a past-producing gold mine with more than 4 million ounces of historic production. Management believes the epizonal mineral system at Reliance bears similarities to successful models such as Fosterville in Australia and new discoveries in Newfoundland, with potential for continuity at depth.

Endurance Gold’s strategic approach includes extending its geochemical and geological understanding of the region, with updated 3D modeling and metallurgical studies already underway. The company has also indicated that a drill permit application for the Olympic anomaly area is in process, alongside ongoing environmental baseline studies and community consultations. [OWNERSHIP_CHART-5015]

With a strong track record of exploration results and a fully permitted flagship project in a historically productive jurisdiction, Endurance Gold has positioned itself as a focused exploration-stage company with near-term deliverables. Results from the upcoming drill season will be central to establishing a maiden resource estimate and determining the broader potential of the Royal Shear trend and surrounding anomalies.

Ownership and Share Structure

According to Refinitiv, 56.01% of Endurance is held by management and insiders. Of those, Richard Gilliam holds the most at 32.32%, H Ross Arnold owns 15.91%, and Robert Boyd owns 5.58%.

Of strategic investors, Cunniah Lake Inc has 3.85%. The rest is retail.

Endurance has 70.77 million free float shares and a market cap of CA16.62, Their 52 week range is US$0.10 – 0.23.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

1) James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

2) This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

( Companies Mentioned: EDG:TSX.V;ENDGF:OTCQB; 3EG:Frankfurt,

)

- Gold slips as dollar, Treasury yields tick higher Reuters

- U.S. strategy is fueling gold price climb: will gold get caught in the tariff net? Here’s what we know – Joseph Cavatoni Kitco NEWS

- BofA raises gold price forecasts for 2025, 2026 Yahoo Finance