Category: Gold

- Gold, silver rally on some fresh safe-haven demand Kitco NEWS

- Gold, Silver, Platinum Forecasts – Gold Tested New Highs Despite Strong Dollar FX Empire

- Market Turbulence: Gold and Dollar Show Unexpected Resilience Following Jobs Report Kitco NEWS

Source: Streetwise Reports 01/09/2025

Thesis Gold Inc. (TAU:TSXV; THSGF:OTCQX; A3EP87:WKN) engages two companies to complete a Pre-Feasibility Study (PFS) for its Lawyers-Ranch Project in the Toodoggone Mining District of northern British Columbia. Find out why one analyst likes the economics of the project.

Thesis Gold Inc. (TAU:TSXV; THSGF:OTCQX; A3EP87:WKN) announced it has engaged two technical services companies to complete a Pre-Feasibility Study (PFS) in accordance with Nationa Instrument 43-101 for its Lawyers-Ranch Project in the Toodoggone Mining District of northern British Columbia.

The PFS will be completed by Ausenco Engineering Canada ULC and Mining Plus Canada Consulting Ltd. and will build on the “strong project economics outlines in the Preliminary Economic Assessment (PEA) filed in September 2024,” Thesis said in a release.

That PEA “demonstrated an after-tax NPV (5%) of CA$1.28 billion, an IRR of 35.2%, and a payback period of just two years,” the company said.

“We are excited to collaborate with Ausenco and Mining Plus, two highly respected firms recognized for their excellence in engineering and mining studies,” said Dr. Ewan Webster, president and chief executive officer of Thesis Gold. “This milestone represents an important step forward as we continue to unlock the value of the project and advance

towards our goal of building a sustainable and profitable mining operation.”

According to the release, the PFS is scheduled to be completed in Q4 of this be completed in Q4 of this year.

While initiating coverage of the company in a research report last month, Haywood Capital Markets analyst Jamie Spratt emphasized the economics highlighted in the PEA when giving the stock a Buy rating with a CA$3 per share target price.

The analyst emphasized the project’s scale and quality, noting, “Resources have expanded quickly from the maiden resource of 132 koz in 2018 and now place the LR project as one of the largest gold-silver projects in Canada.”

“The LR project would rank in the top 15 of operating Canadian gold mines and the bottom quartile of the cost curve,” Spratt added.

Discovery Highlights Untapped Potential

In December, Thesis announced a new discovery at the Ring Zone in Lawyers-Ranch after drills intersected high-grade mineralization near the surface, “supporting the potential for new, high-grade deposits to compliment those already outlined in the PEA” for the project.

“The discovery at the Ring Zone highlights the untapped exploration potential remaining at Ranch,” Webster said at the time. “With robust PEA results from our 4.7 Moz (million ounce) deposit, these latest results confirm significant exploration upside within the main resource area, which also remains open for expansion. This discovery underscores our technical team’s ability to leverage data to target near-surface, high-grade zones and opens the door to future discoveries across this expansive land package.”

The results released from Ring included Hole 24RNGDD001, which intersected 1.21 grams per tonne gold (g/t Au) over 13.13 meters, including 0.45 meters of 5.92 g/t Au beginning at 28.47 meters. The hole also intersected 3 meters of 2.22 g/t Au beginning at 36 meters downhole. In addition, Thesis said Hole 24RNGDD002 intersected 1 meter of 11.32 g/t Au beginning at 55.20 meters downhole and Hole 24RNGDD003 intersected 1.85 meters of 3.49 g/t Au beginning at 27.15 meters downhole.

Even before the Ring discovery, Analyst Jonathan Guy, director of mining research for Hannam & Partners, wrote in an October research note that results reported by the company “suggest the potential for an expansion in scale of both the open pit and underground resource.” Guy reiterated the firm’s CA$2.48 per share target price on the stock, which was trading at CA$0.65 on Tuesday.

Follow-Up Exploration Planning Underway

According to Thesis, the Ring results show a “long-lived hydrothermal system” with multiple stages of fluid flow, highlighting the potential for both near-surface, high-grade mineralization and larger-scale mineralized systems at depth.

The Ring Zone and another exploration zone, Golden Furlong, also show exploration potential in that they are within a 40-square-kilometer area that contains more than 20 targets, many of which have never been drilled, the company said.

Planning was underway to follow-up on the Ring Zone discovery and explore more targets at Ranch with additional drilling.

Analyst Phil Ker of Ventum Capital Markets, in an updated research note on October 23, called earlier results from this year’s 4,100 meters of drilling “positive.”

“High-grade intervals near surface support potential for enhanced economics from shallower horizons expected to be captured within open-pit mining, while deeper high-grade intervals align with anticipated underground mining stopes,” wrote Ker, who rated the stock a Buy with a target price of CA$1.55.

The Catalyst: Gold Hits 4-Week High

After a weaker-than-expected private employment report for December convinced some that the U.S. Federal Reserve may be less cautious raising rates this year, gold hit a near four-week high on Wednesday, Reuters reported.

Spot gold rose 0.3% to US$2,657.38 per ounce Wednesday afternoon, its highest since Dec. 13. U.S. gold futures settled 0.3% higher at US$2,672.40.

Weaker private payrolls are “contributing to gold’s move, because ultimately, weaker employment numbers imply that the economy has been weaker than many had expected,” said Bart Melek, head of commodity strategies at TD Securities, according to Reuters’ Anjana Anil.[OWNERSHIP_CHART-10373]

“The bigger factor will be U.S. nonfarm payrolls on Friday, the market is expecting a change of 163 (thousand); anything significantly above that will be negative for gold,” Melek told Anil.

The price of gold is set to rise further in 2025, say Wall Street analysts. Gold is expected to climb to about US$2,795 per troy ounce by the end of the year, according to the average forecast by banks and refiners surveyed by the Financial Times.

“That is about 7% above current levels,” the Times’ Leslie Hook wrote. “The yellow metal is expected to continue to benefit from buying by global central banks, which have been diversifying away from the dollar since the U.S. imposed sanctions on Russia following its 2022 full-scale invasion of Ukraine.”

Ownership and Share Structure

According to Thesis, about 66% of the company is owned by institutions, and about 4% is owned by insiders. The remaining 30% is retail.

Top shareholders include Franklin Advisers Inc. with 7.82%, Merk Investments LLC with 7.58%, Delbrook Capital Advisors Inc. with 5.5%, Sprott Asset Management LP with 4.63% and Van Eck Associates Corp. with 2.45%. Director Nicholas Stajduhar owns 1.09%.

The company said it has 196 million shares outstanding, 198.9 million fully diluted. At the time of writing, its market cap was CA$113.81 million, and it trades in a 52-week range of CA$1.00 and CA$0.37.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Thesis Gold Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

( Companies Mentioned: TAU:TSXV; THSGF:OTCQX; A3EP87:WKN,

)

Source: Streetwise Reports 01/09/2025

Soma Gold Corp. (TSXV:SOMA; OTC:SMAGF; WKN:A2P4DU) achieved strong gold production in 2024, positioning itself for significant growth through operational expansions and strategic partnerships. Discover how its latest developments could reshape its future.

Soma Gold Corp. (TSXV:SOMA; OTC:SMAGF; WKN:A2P4DU) has announced its gold production for 2024, totaling 27,460 ounces of gold equivalent (AuEq). Sales for the year reached 27,668 AuEq ounces, achieving 92.4% of the company’s budgeted production target for its Cordero mine. Despite challenges, including unplanned mechanical shutdowns and a community blockade, Soma Gold’s production remained steady, underscoring operational resilience.

CEO Geoff Hampson noted in the news release, “We are pleased to have achieved 92.4 percent of our projected 2024 production at the Cordero mine despite several unplanned mechanical shutdowns and a blockade by the local community, which negatively affected production.”

Soma is also advancing its partnership with Denarius Metals Corp. to source up to 200 tonnes per day (TPD) of mineralized rock from the Zancudo mine for processing at Soma’s El Limon mill. This facility, located in Zaragoza, has a capacity of 225 TPD, permitted to expand to 400 TPD. Currently undergoing recommissioning, the El Limon mill is expected to resume operations in the coming months. According to Hampson, “There are a lot of synergies between Soma and Denarius that make sense for both companies to fully utilize El Limon’s capacity while Soma ramps up production at the company’s mines.”

Soma’s operational progress aligns with its goal of ramping up milling capacity to 1,400 TPD by 2028, supported by investments in exploration and strategic partnerships. The company’s financial highlights for the first half of 2024 include revenue of US$42.03 million and adjusted EBITDA of US$13.87 million, reflecting the strength of its Colombian operations.

Sector Highlights: Trends and Insights in Gold Mining

On January 4, Mining.com reported that global gold production increased by 0.5%, reaching approximately 87.3 million ounces. The outlet projected a further 1.5% increase, bringing total output to approximately 88.6 million ounces. Jeffrey Christian of CPM Group noted, “Gold prices averaged US$2,391 per ounce, 23% higher than the previous year.” Christian also projected an additional 13% increase in average gold prices to US$2,730 per ounce.

On December 27, Clive Maund, a technical market strategist, provided an in-depth analysis of Soma Gold, describing it as an “Immediate Strong Buy.”

On the same day, Ahead of the Herd highlighted the undervaluation of gold mining stocks relative to their profits. Adam Hamilton remarked, “Gold-stock prices need to normalize with underlying profits, which is likely.” He emphasized that despite gold’s 27.2% price gain, the major gold mining ETF, GDX, increased by only 9.4%, significantly lagging its historical leverage to gold prices. Hamilton attributed this disconnect to investors underestimating gold miners’ record earnings.

In a January 6 post, Reuters discussed the relationship between gold prices and macroeconomic factors. Nitesh Shah, a commodity strategist at WisdomTree, stated, “We expect a US$3,050 per ounce target based on a ‘consensus’ economic view of dollar depreciation and falling bond yields.” Shah added that heightened geopolitical tensions, such as those in the Middle East, could further elevate prices. Meanwhile, rising U.S. Treasury yields placed temporary pressure on gold, with spot prices settling at US$2,647.40.

The following day, on January 7, 321Gold presented a bullish outlook for gold miners. Stewart Thomson commented, “A range trade for gold could see the miners and silver stage numerous 20% surges.” He noted that the current economic environment, including elevated debt levels and geopolitical uncertainty, creates a favorable setup for sustained demand in the mining sector. Thomson also highlighted that while gold itself remains strong, “it’s silver bullion and the mining stocks where the big profits can be made in a relatively short period of time.”

Catalysts Supporting Soma Gold’s Future Development

Soma Gold’s strategic initiatives position the company for significant growth, according to the company’s investor presentation. Key near-term catalysts include the recommissioning of the El Limon mill, which is expected to enhance cash flow by processing ore from the Zancudo mine. Additionally, the company plans to increase its production capacity to 650 TPD by restarting the mill and integrating ore from its Machuca deposit, a fully permitted site that requires minimal capital expenditure.

Longer-term, Soma aims to expand its gold production to 85,000 ounces annually by 2028 through a combination of resource expansion at existing properties and operational upgrades. The Cordero mine, with its ongoing exploration program, is expected to double its current resource base of 260,000 ounces. Similarly, the Nechi and Aurora deposits are undergoing development and permitting processes, with both projects targeting resource increases exceeding 250,000 ounces.

Soma’s commitment to sustainability further supports its competitive positioning. The company operates renewable hydroelectric power at its mills and has received environmental awards in Colombia. As Soma formalizes small-scale miners and integrates advanced ore-sorting technology, it is well-positioned to achieve cost reductions and operational efficiencies, supporting long-term profitability.

By balancing production growth with sustainable practices, Soma Gold continues to establish itself as a key player in Colombia’s gold mining sector.

Positive Evaluations Position Soma Gold as a Strong Buy

*On December 27, Clive Maund, a technical market strategist, provided an in-depth analysis of Soma Gold, describing it as an “Immediate Strong Buy.” According to Maund, the company is poised to benefit from its extensive property in Colombia, located on the same trend as significant deposits, which “augurs well for further important discoveries.” He highlighted the company’s flagship Cordero Mine, which began production in early 2023, as a critical revenue driver. Maund also noted Soma’s plan to bring the El Limon Mill back online to accommodate increased production, further supporting the company’s growth trajectory.

Maund emphasized Soma’s impressive technical setup, stating, “The case for buying Soma Gold at this juncture could not be clearer — it is at the tail end of a giant base pattern and looking set to break out into a new bull market.” He underscored the bullish accumulation of volume and a strong Accumulation line, which suggested robust investor confidence. He concluded that Soma Gold is “close to starting higher and breaking out of a very large base pattern into a major bull market.”

Ownership and Share Structure

[OWNERSHIP_CHART-10919]

Headquartered in Vancouver, B.C., Soma Gold Corp. has a market cap of US$40.19 million and trades in a 52-week range of CA$0.30 and CA$0.74. As of September 30, 2024, it had CA$3.0 million in the bank, with a monthly exploration budget of CA$330,000.

As a profitable company, it has no burn rate.

According to Reuters, 67.45% of the company is held by management and insiders.

CEO and Chairman Geoffrey Hampson has 0.15% and 17.66% through his wholly owned companies Hampson Equities Ltd. and Lake Forest Development Corp., Vice President Jean-Francois Meilleur has 0.52%, Director Glenn Walsh has 0.31% directly and 44.02% through his wholly owned company, Conex Services Inc., and CFO Greg Hayes has 0.12%.

A further 0.70% of control is vested in institutions.

Palos Management Inc. has a 0.27% stake, and Marmite Capital AG has one comprising 0.33%. Strategic investor Eric Sprott owns 750,000 shares bought in a private placement (0.82%).

2.26% is with strategic investors.

The rest is with retail investors.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Soma Gold Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, Soma Gold Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Soma Gold Corp.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

* Disclosure for the quote from the Clive Maund article published on December 27, 2024

- For the quoted article (published on December 27, 2024), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing the article quoted. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in the article accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

Clivemaund.com Disclosures

The quoted article represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.

( Companies Mentioned: TSXV:SOMA; OTC:SMAGF; WKN:A2P4DU,

)

Source: Michael Ballanger 01/09/2025

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the current state of the market and one gold stock he has been quietly accumulating.

Markets are closed in memoriam for the recently deceased former president Jimmy Carter, but futures remain open.

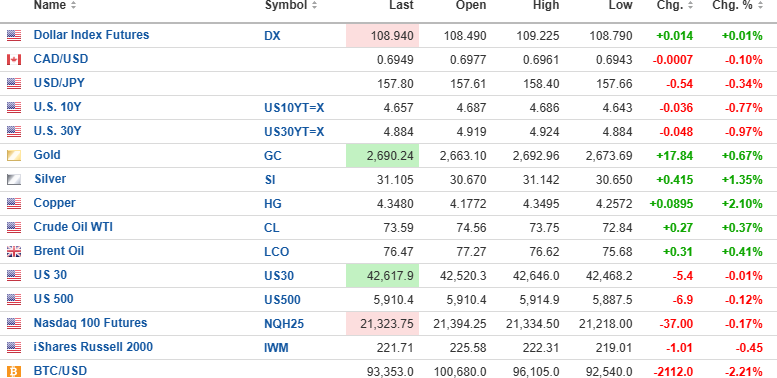

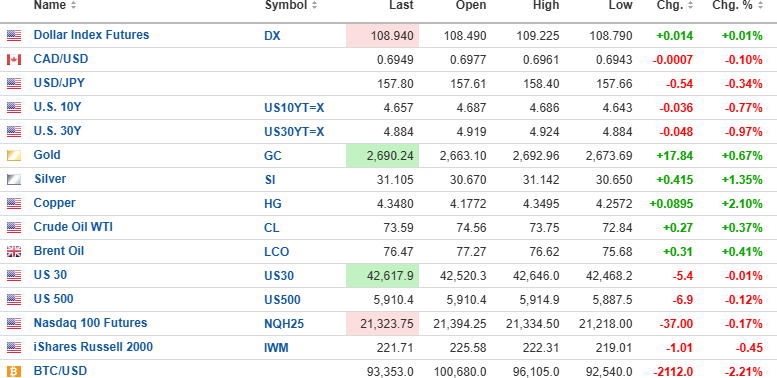

The USD index futures are ahead 0.01% to 108.940 this morning with the 10-year yield down 0.77% to 4.657 and the 30-year yield down 0.97% to 4.884%.

Gold (+0.67%), silver (+1.35%), copper (+2.10%), and oil (+0.37%) are all higher.

Stock futures are mixed, with the DJIA down 5.4 points, the S&P 500 futures down 6.9 points, and the NASDAQ down 0.17%. Risk barometer Bitcoin (-2.21%) is down $2,112 to $93,353.

First Five Days Indicator

The First Five Days indicator tracks market performance for the period and ends this afternoon at 4:00 pm. With the S&P 500 closing yesterday at 5,909.03, it is a mere 27.4 points above the 2024 closing level of 5,881.63. If it holds that level today, it eliminates the likelihood of a down January (and failed January Barometer). If it closes below that level, it increases the odds of 2025 being a down year or, at best, sharply reduced gains.

Statistically, if any one of the SCR, FFD, or JB has a negative outcome, the failed “trifecta” results in a 59.5% probability of an up year (versus 90.6% for a full “Trifecta”) with an average gain of just 2.9%. Richard Russell used to say that the FFD only provided a clue to the outcome for January and not for the full year. He placed far greater emphasis on the JB.

December Seasonality Trades

In early December, I suggested that year-end rebalancing would favour bonds over stocks and that a “Long TLT/Short SPY” set-up would benefit from portfolio managers selling stocks and buying bonds in order to get the portfolio weightings back to 60% stocks-40% bonds. Well, one half of that trade worked beautifully with the SPY:US down 1.8% for the month.

Conversely, the bond market get walloped as bonds were sold off with the 10-yr. and 30-yr. yields rising 50 basis points in December.

We bought the combination at the following prices:

- TLT January $90 calls: $4.35

- SPY January $600 puts: $6.10 Total: $10.45

As of month end, prices went out at:

- TLT January $90 calls: $0.06

- SPY January $600 puts: $15.09 Total: $15.15

Profit: $4.70 44.98% return

We also provided a year-end strategy whereby small-cap stocks outperform large-cp stocks due to excessive tax-loss selling in the more speculative small-cap issues. That, too, failed to adhere to historical norms.

In early December, we put on the following trade:

- SPY January $590 puts at $3.75

- IWM January $245 calls at $5.00 Net debit: $8.75

As of month end, prices went out at:

- SPY January $590 puts at $15.09

- IWM January $245 calls at $.03 Net debit: $15.12

Profit: $6.37 72.8% return

These trades worked well, but to be brutally honest, it was totally for reasons that were far removed from my expectations. That bonds and small caps went wonky in a seasonally strong period is extremely bearish.

Getchell Gold Corp.

Getchell Gold Corp.’s (GTCH:CSE; GGLDF:OTCQB) widely-expected PEA is due out shortly, and I for one, am speculating that it will result in a rerating and higher prices.

I have been quietly accumulating more stock at current prices and looking for a pop-by month-end.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Getchell Gold Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.