Category: Gold

Source: Streetwise Reports 01/03/2025

Nevada King Gold Corp. (NKGFF:OTCMKTS; NKG:TSX) continues to advance its Atlanta Gold Project with high-grade discoveries and resource expansion potential. Learn whats driving their success and whats next for this Nevada asset.

Nevada King Gold Corp. (NKGFF:OTCMKTS; NKG:TSX) has reviewed its 2024 achievements and outlined plans for 2025 at its 100%-owned Atlanta Gold Mine project in Nevada. Located in the prolific Battle Mountain Trend, the Atlanta project has seen significant progress, including high-grade gold discoveries, resource expansion potential, and positive metallurgical results, making it a standout asset among junior exploration companies.

As detailed in the news release, the company’s Phase II drilling program concluded in 2024 with 17,007 meters drilled, including 75 reverse circulation (RC) holes and one core hole. Key results included high-grade intercepts, such as 6.28 grams per tonne (g/t) gold over 54.9 meters at the South Quartzite Ridge Target (SQRT) and 7.94 g/t gold over 18.3 meters at the Wild West Zone (WWZ). These discoveries highlight the effectiveness of geophysics as a tool for identifying new gold-mineralized zones. The East Ridge Target (ERT), another 2024 discovery, yielded an intercept of 1.32 g/t gold over 22.9 meters, emphasizing the project’s resource expansion potential.

Stepout drilling showed significant expansion opportunities, with high-grade gold mineralization found north, west, and downdip of the historical resource area. Metallurgical testing validated strong recovery rates, with gold extraction reaching up to 92% for high-grade material using conventional milling methods. This result underscores the viability of processing Atlanta’s oxide-dominated gold system.

The company also strengthened its financial position in 2024, raising US$21.6 million at an average share price of US$0.345, doubling its institutional shareholder base, and ensuring funding for its Phase III drill program. Leadership additions, including John Sclodnick as president, have bolstered Nevada King’s management team, enhancing its institutional relationships and operational expertise.

Digging Into The Gold Mining Industry

According to The Daily Gold on December 27, Jordan Roy-Byrne discussed the underperformance of gold and silver stocks in 2024 compared to gold itself, which gained 28%. He highlighted that gold stocks are “sporting very bullish bases at a time when they are extremely under-owned,” with gold miner ETFs near a 17-year low in market share. Roy-Byrne noted that this setup positions the sector for an explosive breakout once macroeconomic conditions, such as an economic downturn and Federal Reserve easing, align. He concluded that “the gold stocks will explode out of their bases” under the right conditions.

On December 27, Nevada King Gold Corp. received a “Buy” rating with a 12-month price target of CA$0.65 from Roth MKM analyst Mike Niehuser.

On December 31, 321Gold emphasized the gold sector’s significant potential, with Stewart Thomson noting that gold had achieved a “26 bagger” against the dollar index since 1976.

Thomson described the current conditions in gold and mining stocks as particularly favorable, citing oversold indicators such as the BPGDM sentiment index dropping below 40, moving toward a “no-brainer” buy zone. He also highlighted support levels for major gold miner ETFs, including GDX at US$32-$30, and observed strong insider buying trends within the sector.

Also, on December 31, Matthew Piepenburg of GoldSwitzerland analyzed the factors driving gold’s secular rise. He attributed gold’s record nominal highs in all currencies during 2024 to central bank buying and the diminishing appeal of U.S. Treasury bonds. Piepenburg explained that rising debt levels and the debasement of fiat currencies make gold a superior reserve asset. He asserted, “It’s as tragically simple now as ‘inflate or die,’ and sadly, gold, therefore, has nowhere to go but up simply because paper money has no choice but to go down.”

Catalysts Supporting Nevada King’s Growth Potential

Nevada King’s Phase III drill program, which commenced in late 2024, is a key focus for 2025, according to the latest Nevada King investor presentation. The program is planned to cover 20,000 to 30,000 meters, targeting resource expansion at SQRT and testing 12 regional anomalies identified through geophysical surveys. These targets, including the Jumbo, Northeast, and Silver Park areas, hold the potential to uncover satellite deposits and extend known mineralization.

Upcoming catalysts include the release of Phase II metallurgical results in mid-2025 and ongoing updates from the Phase III drilling campaign. The company’s ability to efficiently permit new drill sites, demonstrated by the Bureau of Land Management’s approval of its modified operations plan, supports its aggressive exploration strategy.

A Buy-Rated Stock

On December 27, Nevada King Gold Corp. received a “Buy” rating with a 12-month price target of CA$0.65 from Roth MKM analyst Mike Niehuser. Niehuser highlighted the company’s progress at the Atlanta Gold Project, noting that the ongoing Phase III drill program has demonstrated significant potential for high-grade gold discoveries. Niehuser stated that the company has “successfully proven its reinterpretation of the previous geologic resource model,” specifically identifying high-grade gold in dropped-down structures. He further noted that drilling results, such as hole AT23WS-44C grading 3.95 g/t gold over 106.7m, validated the geologic model and suggested an opportunity for a substantial increase in the project’s resources.

Niehuser emphasized the districtwide potential of the Atlanta caldera, supported by comprehensive geophysical surveys and the prioritization of high-grade targets such as the South Quartzite Ridge Target (SQRT). He remarked that ongoing developments, including road construction and resource extension drilling, position Nevada King Gold Corp. to unlock additional exploration upside. [OWNERSHIP_CHART-11124]

The analysis concluded that the company’s efforts could significantly expand its measured, indicated, and inferred resource estimates, contributing to the valuation model predicting an updated gold resource of 1.5 million ounces. This projection underpinned Roth Capital’s maintained price target of CA$0.65 per share, reflecting confidence in Nevada King Gold’s growth trajectory and operational strategy.

Ownership and Share Structure

According to Refinitiv, 36.32% of Nevada King Gold is held by management and insiders. Of this category, Collin Kettell holds 19.68% or 61.99 million shares, Michael A. Parker holds 14.28%, at 45 million shares, and Craig A. Roberts holds 1.46% or 4.6 million shares.

Institutions hold 3.62%. Rothschild & Co Asset Management Europe SCS has the largest out of this category at 2.19%, with 6.91 million shares.

The rest is retail.

Market Watch notes that Nevada King Gold has 378.09 million shares outstanding and 228.88 million free float shares. The stock has a 52-week range of CA$0.20 and CA$0.46.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

1) James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

2) This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

( Companies Mentioned: NKGFF:OTCMKTS;NKG:TSX,

)

Stocks Are Bouncing

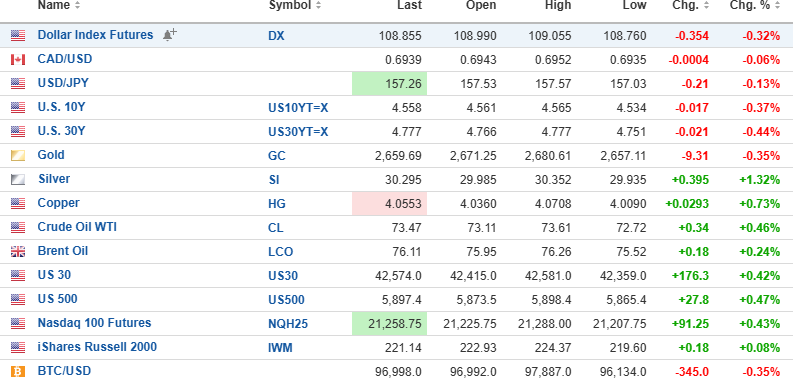

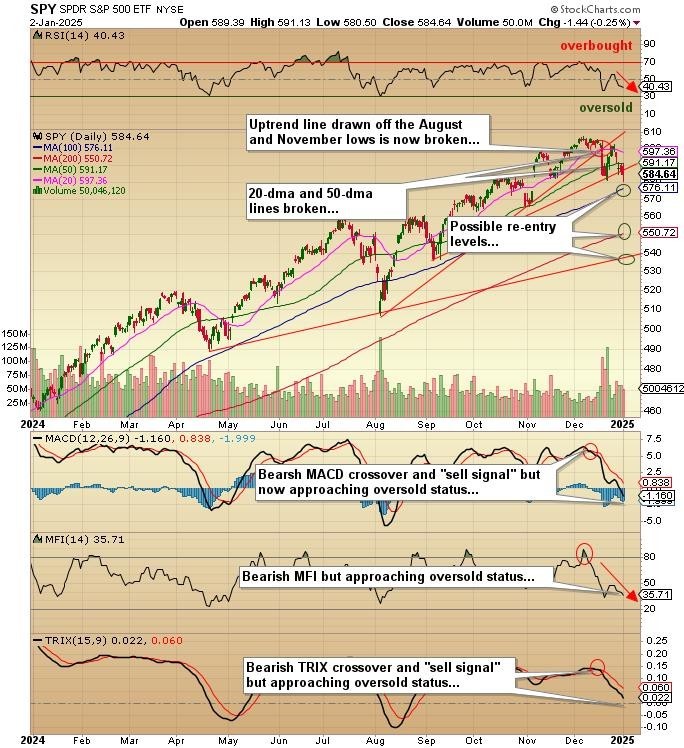

The USD Index futures are down 0.354% to 108.855 with the 10-year yield down 0.37% to 4.558% and the 30-year yield down 0.44% to 4.777%.

Gold (-0.35%) is down, while silver (+1.32%) and copper (+0.73%) are higher. Crude oil (+0.46%) is higher by $0.34 to $73.47/bbl.

Stock index futures are moderately higher, with the DJIA futures up 176.30, the S&P is up 27.8, and the NASDAQ up 91.25. Risk barometer Bitcoin is lower this morning, down 0.35% at $96,998.

Santa Claus Rally

This morning, stock index futures are again pointing to a higher opening, but that was also the case on Tuesday and Thursday, and given that this is the last day of the week and the final tracking session for the SCR, it is unlikely that it will turn out to be a strong “up” day. We need a 594.63 (1.4%) advance in the DJIA to turn the SCR positive.

For the NASDAQ, a 484.09-point (2.5%) advance would flip the SCR positive, while the S&P 500 needs a 105.52-point (1.8%) gain to provide the first of two legs of a positive early warning signal for the January Barometer.

The Wall Street cheerleaders are pointing to last year’s failed SCR and FFD that did not portend a down market but with several trillion dollars in liquidity pumped into the economy and markets by both the Fed and the Biden Treasury, these were “extenuating circumstances,” the opposite of which are being promised by the Department of Government Efficiency under Musk and Ramaswamy.

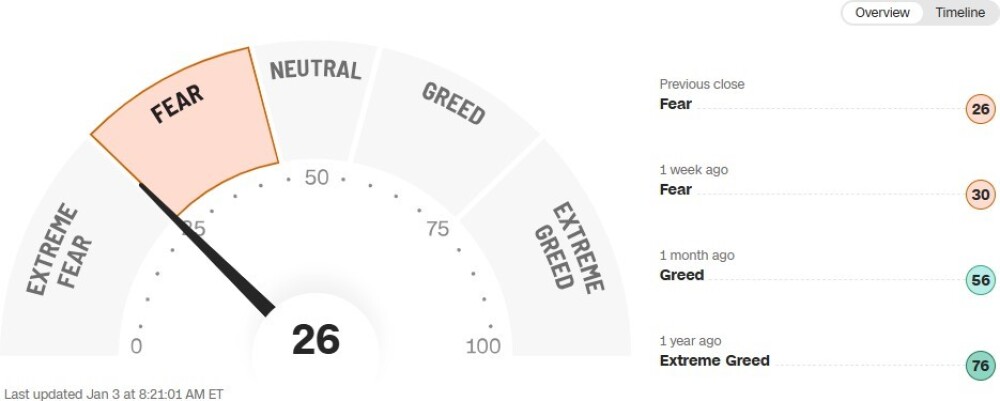

I added to the UVIX:US yesterday but will refrain from any further hedging as the SPY:US is now sporting oversold readings on MACD and MFI, and with the RSI just above 40, it is a sub-optimal time to begin shorting or hedging despite the poor tape action since the start of December.

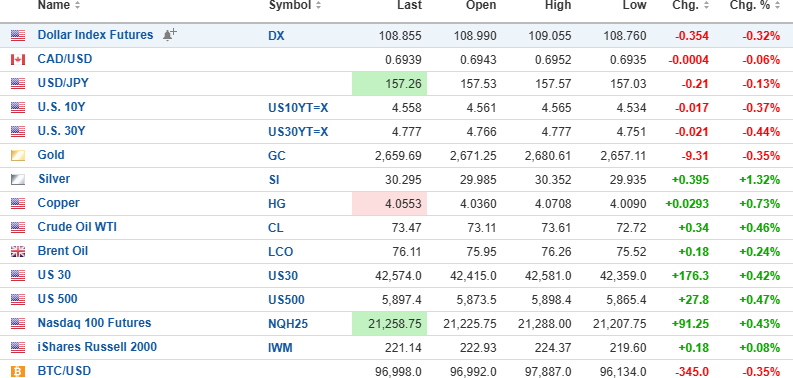

One look at the CNBC Fear-Greed index confirms that sentiment has shifted from the post-election euphoria that juiced stocks in November.

The SPY:US is shown below with a clear picture of how much short-term technical damage has been done, keeping very much in mind that the longer-term technical picture is still in a clear uptrend with little evidence of a top. At best, a corrective move to deflate the excessive bullishness that is seen everywhere would be a welcome event for most seasoned market players. Everyone hates it when markets correct because the majority of new-generation investors have never experienced a secular bear market.

To be sure, there have been big drawdowns like December 2018, March 2020, and August 2024, but never anything resembling the 1973-1974 bear (“Papa Bear”) or the 1929-1933 bear (the “GrandDaddy Bear”) or even the 1981-1982 bear that crushed inflation thanks to 20% interest rates in Canada and 16% in the U.S.

The SPY:US (now at $584.64) has given up the uptrend line drawn off the August-November lows as well as the 20-and-50-dma lines with the next support at the 100-dma (at $576.11) then the 200-dma (at $550.72). If the SPY:US closes back above the 50-dma (at $591.17 today, I will be looking to close out the SPY January $575 puts with a view to re-establishing the position with the March series. Fifteen days to expiry is a very short leash, especially with a few of the indicators approaching oversold status.

Getchell Gold Corp.

Technical analysis is not terribly useful when looking at the junior resource sector, but it is an interesting exercise to observe the tape action when you know that a big “tail event” (the upcoming PEA) is expected in a couple of weeks. You always have to assume that “someone knows something” best described by the immortal words of my great and kind mentor, James Biddell, “the tape never lies.”

I find it interesting that recent tape action in Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) has established a modest but definable uptrend that has drawn off the lows of October 2023 and October 2024. If the stock can grind its way up through CA$0.22 and then CA$0.26 by mid-month, it sets up a possible momentum play in the event that the PEA is “robust.”

I do not want the stock to suddenly “spike” to CA$0.26-0.30; I want a slow advance on escalating volume, clearly spelling out “accumulation” by parties comfortable with the story.

Gold is acting extremely well as we enter 2025, and considering that all the headlines are still on large-cap names like those in the Mag Seven, gold has done pretty much what I expected and wrote about after the Trump victory in early November. Gold hit a low on November 14 at $2,541.50 versus mid-December back in 2016, so I think the bearish effects of the Trump victory and proposed policy initiatives are now being totally discounted by those who take one look at the $34.7 trillion debt bomb and choose gold over U.S. Treasuries with little or no debate.

The current 2.317 million ounces in Nevada are going to not only grow with further drilling but also experience revaluation as the gold price makes its assault on $3,000 per ounce.

Getchell Gold is a “Buy” and the tape is confirming it…

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Getchell Gold Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

- Gold Price Forecast: XAU/USD eases on Friday as investors look elsewhere FXStreet

- Gold Price Forecast: Targets Higher Resistance After Weekly Reversal Signals Strength FX Empire

- Gold slips from three-week high as strong dollar weighs Reuters