Category: Gold

According to the seasonally adjusted data, M2 increased by $23B in May. This was the smallest monthly increase in M2 since the start of Covid aside from the contraction last month, which was the first monthly reduction in adjusted M2 in 12 years! Despite extremely small growth, money supply is still expanding which is going to […]

The post Money Supply Growth Slows Enough to Pop the Everything Bubble but Not Enough to Cure Inflation first appeared on SchiffGold.

Well-known investment advisor Rick Rule said the Fed will chicken out on its inflation fight. Rule runs Rule Investment Media and formerly served as the president and CEO of Sprott US Holdings Inc. In a recent interview, Rule said that the Fed could get inflation under control with significantly tighter monetary policy for a sustained […]

The post Rick Rule: Fed Will “Chicken Out” on Inflation Fight first appeared on SchiffGold.

The Reserve Bank of Zimbabwe plans to issue gold coins as a way for investors in the country to store value as inflation runs rampant in the economy. The United States isn’t the only country battling rapidly rising prices. The inflation rate in Zimbabwe spiked from 132% in May to 191.6% in June, and the […]

The post Zimbabwe Central Bank to Offer Gold Coins as Inflation Ravages the Country first appeared on SchiffGold.

The Dollar Twenty-Five Tree

Interest.co.nz/Stephen Roach/6-22-2022

“I should have listened to Alan Greenspan – at least when it comes to currency forecasting. The former chair of the Federal Reserve once told me it was a fool’s game, with the odds of getting currency calls right worse than a successful bet on a coin toss. Two years ago, I ignored the maestro’s advice and went out on a limb, predicting that the US dollar would crash by 35%.”

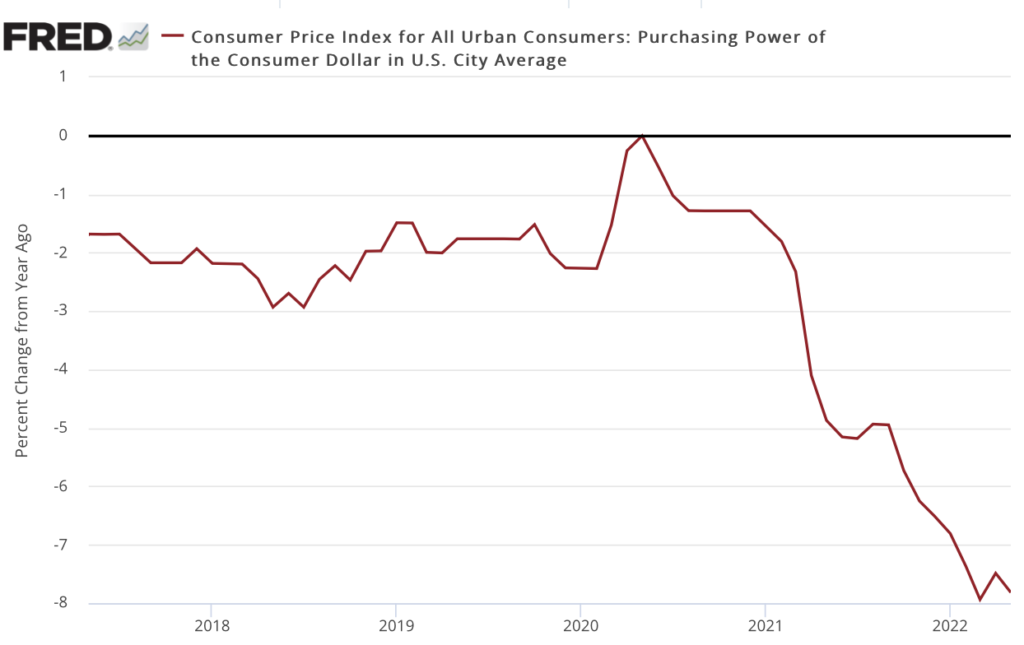

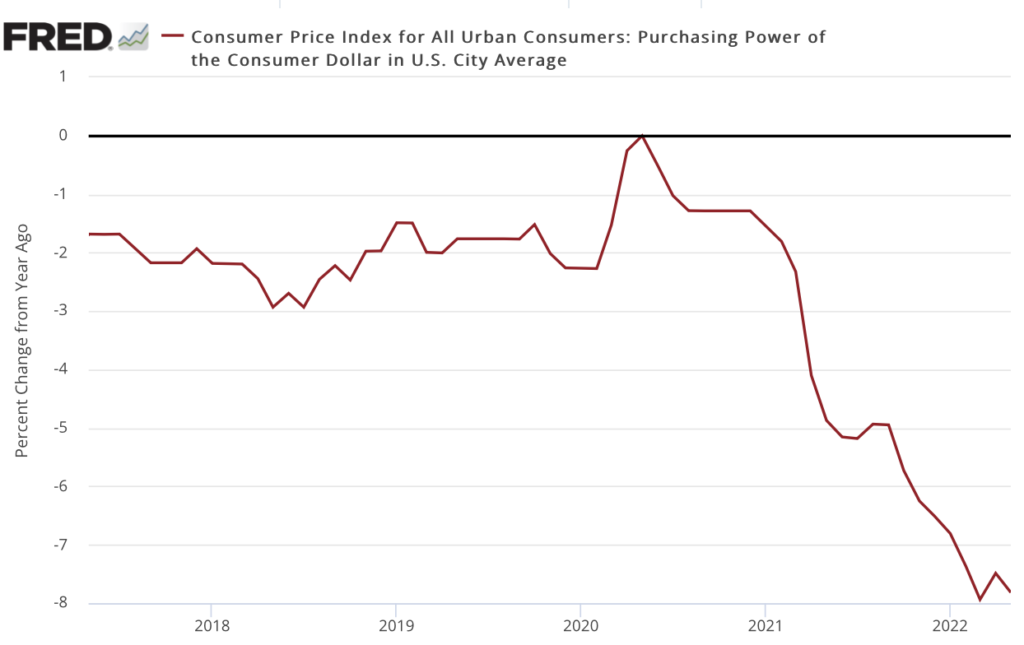

USAGOLD note: Roach says he got it wrong on inflation in 2020, but thinks the dollar is now overvalued. “I know, ” he says, “that’s what I said two years ago.” But did he really get it wrong? Roach’s error, if there was one, comes, in our view, from measuring the value of the dollar against other currencies rather than goods and services. Had he zeroed in on the dollar’s purchasing power in 2020 as the measure of value, his forecast would have been 100% on the money. (See chart below.) Any bets on where we will be on the purchasing power of the dollar two years from now?

Sources: St. Louis Federal Reserve [FRED], Bureau of Labor Statistics

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.

CNBC/Elliot Smith/6-27-2022

“The stock market bounce in recent days is just a relief rally and investors should avoid getting sucked back in, according to Trevor Greetham, head of multi-asset at Royal London Asset Management.”

“The stock market bounce in recent days is just a relief rally and investors should avoid getting sucked back in, according to Trevor Greetham, head of multi-asset at Royal London Asset Management.”

USAGOLD note: That’s assuming of course one had the wisdom to do some selling at record-high prices. Greetham says that what we have experienced thus far is just “the interest-rate driven part of the bear market.” There’s more to come. Greetham’s in the camp that sees the Fed holding to the tightening course.

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.