Category: Gold

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

As Congress sought answers from Federal Reserve chairman Jerome Powell this week, investors are seeking buying opportunities in oversold markets.

Stocks did manage to bounce on hopes that the worst of the inflation spike might be behind us. Precious metals, meanwhile, struggled to gain any upward traction.

As of this Friday recording, the gold market is posting a weekly loss of 0.8% to trade at $1,834 per ounce. Gold has been mired in a trading range between $1,800 and $1,875 over the past few weeks. Traders will be looking for a break of either support or resistance to signal the next directional move.

Turning to the white metals, silver is down 2.4% for the week to bring spot prices to $21.37 an ounce. Platinum is off 2.8% to come in at $919. And finally, palladium prices are up by 3.4% this week to trade at $1,926 an ounce.

It was also a rough week for base metals, energy, and broader commodity markets. The CRB commodity index plunged to its lowest level since March.

Although prices for most raw materials remain considerably higher year to date, the selloff in futures markets since the Fed’s 75 basis-point rate hike may give the economy at least some temporary relief from inflation.

Fed chairman Jay Powell was grilled by lawmakers on the hot topic of inflation during testimony Wednesday and Thursday. Powell actually admitted that the Fed got it wrong when it came to expecting inflation to be transitory. But he denied that the Fed’s massive expansion of the currency supply is a major contributor to rising prices.

Powell’s attempts to skirt blame were shut down by Representative Blaine Luetkemeyer:

Jerome Powell: So most overwhelmingly, most economists would not think of it in terms of money supply, but would think of it in terms of supply and demand. And although there may be a role for money supply, they would think in terms of supply and demand being out of balance and that’s how I think about it.

Rep. Luetkemeyer: The definition of inflation I’ve always had was too many dollars chasing too few goods and services.

Powell was also taken to task over the Fed’s contribution to inflation by Louisiana Senator John Kennedy:

Sen Kennedy: The United States Congress, in addition to its regular budget, has spent $7 trillion. I’m not saying all of it was unnecessary. On top of that, the feds increased its balance sheet from $1.5 trillion dollars to $9 trillion. $9 trillion. I know you’re cutting it back, but we’ve injected all of this money into the economy, and then people go, “Well, we have inflation.” Duh.

Central bankers and politicians who try to dodge responsibility for inflation are counting on people to be very short sighted when it comes to the causes of rising prices. It’s true that supply and demand dynamics that affect prices over any given economic cycle can be tied to a host of things ranging from war to the weather.

President Joe Biden continues to blame Vladimir Putin for inflation even as the Biden administration launched a broad new war on oil and gas producers and showered the public with a more than a trillion dollars in new giveaways shortly after taking office. As Chairman Powell himself acknowledged, the inflation rate was already surging to a multi-decade high before Putin launched his invasion of Ukraine.

Gasoline prices are certainly susceptible to heightened volatility due to international conflict. But there’s a singular reason why gas prices are ranging between $3.00 and $6.00 per gallon this year instead of between $1.00 and $2.00 like they were during the energy shock of the early 1980s. That reason is that the currency has lost two thirds of its purchasing power over the past 40 years.

In any given year, the depreciation of the dollar isn’t necessarily reflected in a particular asset market. Some years, for example, may see home prices surge at the same time as gold prices dip. Other years may see gold outshine all the other major asset classes.

But over a period of many years, the gold market will tend to reflect the dollar’s purchasing power losses – which of course are directly related to the ever-rising supply of dollars.

Gold doesn’t have more intrinsic value today at over $1,800 an ounce than it did 40 years ago at $400 an ounce. It’s the currency in which gold prices are denominated that has changed in value.

The U.S. fiat dollar will continue to lose value even if the Fed manages to get the inflation rate down. Policymakers will never allow all the price level increases that have been built into the economy to date to reverse. That would amount to deflation – something central bankers fear more than anything else.

The only question is where the inflation will show up next. Stocks, housing, and energy markets have each had their big runs since the Fed flooded the economy with emergency liquidity in 2020. Precious metals markets did get a post-COVID boost, but they have lagged behind other asset classes since inflation became a front-page story.

As the headlines shift toward concerns about a recession, gold and silver can be expected to start outperforming economically sensitive assets. Yes, the metals will eventually have their moment to shine as they always do when the dollar declines.

Well, that will do it for this week. Be sure to check back next Friday for our next Weekly Market Wrap Podcast. Until then this has been Mike Gleason with Money Metals Exchange, thanks for listening and have a great weekend everybody.

Emerita Resources Corp.’s (EMO:TSX.V; EMOTF:OTCMKTS; LLJ:FSE) first hole drilled at its Romanera project returned “impressive (and unexpected) precious metals,” reported Research Capital Corp. analyst Adam Schatzker in a June 23 research note.

In the longer term, if it turns out this initial hole is indicative of a large precious metals-rich zone there, that would positively impact the economics of a future Romanera mining operation, Schatzker noted.

This first Romanera drill hole completed by Emerita, LR-002, intersected 14.3 meters of massive sulfides and is remarkable for its high grades of silver and gold, Schatzker reported. Of all five metals encountered, silver had the highest grade, at 311.1 grams per ton (311 g/t). The gold grade was 7.61 g/t, and this, according to the analyst, was surprising and also noteworthy.

These silver and gold grades exceeded those of the high-grade portion (11,200,000 tons) of the 34,000,000 ton historical resource, 64 g/t, and 1 g/t, respectively.

Schatzker pointed out the 7.61 g/t gold grade is “quite high for this kind of deposit.” Because its host hole LR-002 was placed in the upper part of the area on which the historical resource is based, “this appears to present some significant and unexpected upside potential at Romanera.”

In terms of base metals, LR-002 returned 3% zinc, 2.9% lead, and 0.4% copper. These grades, Schatzker wrote, are more in line with those of the historical resource: 2.3% zinc, 1.1% lead, and 0.42% copper.

“We think that the results announced today should help Emerita outperform other base metal explorers in the near term (all else being equal),” wrote Schatzker.

Results of the three other holes comprising the maiden drill program at Romanera are pending. However, according to Emerita’s management, they appear to have encountered significant sulfide mineralization as well, Schatzker relayed.

Looking forward, with six rigs active at Romanera and assay turnaround times faster than previously, investors can expect a steady stream of results from this project in Spain over the coming months.

“It is likely that we will have a much better concept of Romanera’s potential within six months, assuming the pace of drilling and assay results are as expected,” added Schatzker.

Research Capital has a Speculative Buy rating and a CA$4 per share price target on Emerita, the stock of which is currently trading at around CA$1.27 per share.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures

1) Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Emerita Resources Corp. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional, and any action a reader takes as a result of the information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice, and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees, or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in the securities mentioned. Directors, officers, employees, or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Disclosures for Research Capital Corp., Emerita Resources Corp., June 23, 2022

Analyst Certification: I, Adam Schatzker, certify the views expressed in this report were formed by my review of relevant company data and industry investigation, and accurately reflect my opinion about the investment merits of the securities mentioned in the report. I also certify that my compensation is not related to specific recommendations or views expressed in this report. Research Capital Corporation publishes research and investment recommendations for the use of its clients. Information regarding our categories of recommendations, quarterly summaries of the percentage of our recommendations which fall into each category and our policies regarding the release of our research reports is available at www.researchcapital.com or may be requested by contacting the analyst. Each analyst of Research Capital Corporation whose name appears in this report hereby certifies that (i) the recommendations and opinions expressed in this research report accurately reflect the analyst’s personal views and (ii) no part of the research analyst’s compensation was or will be directly or indirectly related to the specific conclusions or recommendations expressed in this research report.

Adam Schatzker has visited Emerita Resources Corp. in the past 18 months.

General Disclosures: The opinions, estimates and projections contained in all Research Reports published by Research Capital Corporation (“RCC”) are those of RCC as of the date of publication and are subject to change without notice. RCC makes every effort to ensure that the contents have been compiled or derived from sources believed to be reliable and that contain information and opinions that are accurate and complete; RCC makes no representation or warranty, express or implied, in respect thereof, takes no responsibility for any errors and omissions which may be contained therein and accepts no liability whatsoever for any loss arising from any use of or reliance on its Research Reports or its contents. Information may be available to RCC that is not contained therein. Research Reports disseminated by RCC are not a solicitation to buy or sell. All securities not available in all jurisdictions.

( Companies Mentioned: EMO:TSX.V; EMOTF:OTCMKTS; LLJ:FSE,

)

Source: Michael J. Ballanger 06/23/2022

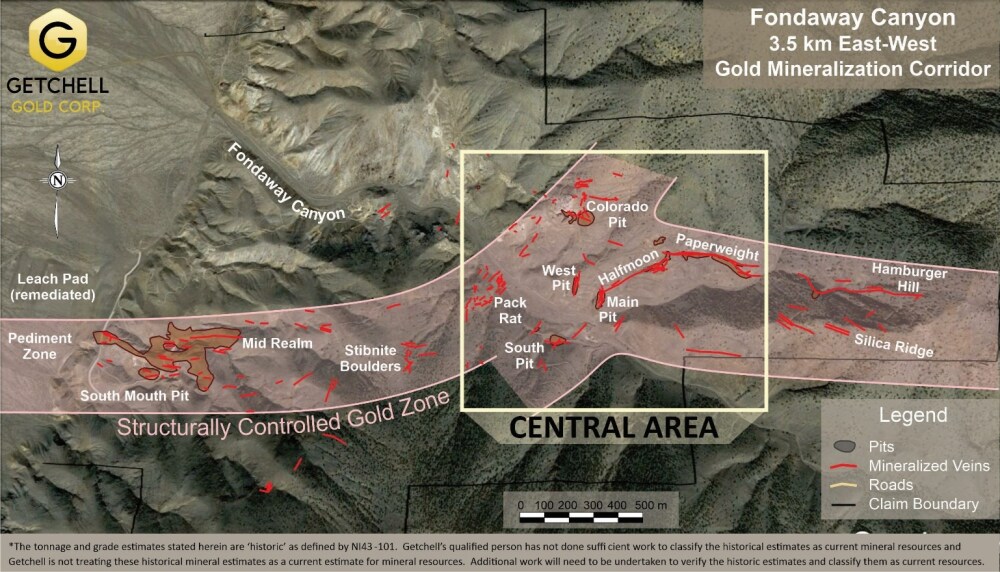

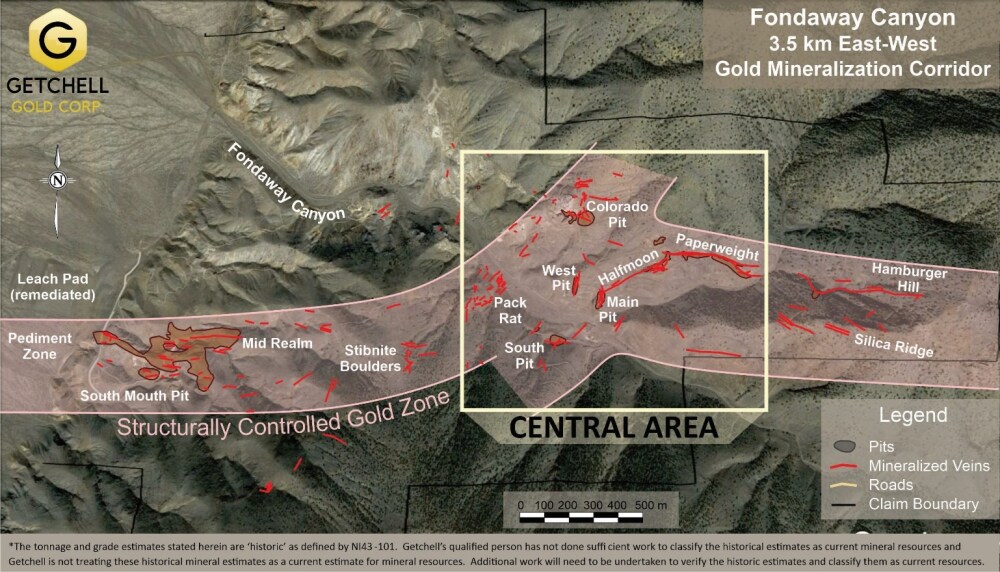

Expert Michael Ballanger goes over the latest news with Getchell Gold Corp. The gold-copper exploration company has announced that they will be working with Apex Geoscience Ltd. to conduct a resource estimate for their Fondaway Canyon gold project in Nevada. Ballanger reviews the highlights of the move and recent results, as well as information on Getchell Gold Corp.’s upcoming webinar.

Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) is pleased to announce the engagement of Apex Geoscience Ltd. of Edmonton, AB, to conduct a resource estimation for the Fondaway Canyon gold project in Nevada.

Key Highlights

• Fondaway Canyon gold project resource estimate is targeted for late September 2022

• Exploration developments subsequent to 2017 historic resource estimate include:

– Three drill campaigns completed plus one ongoing drill program conducted;

– Significant discoveries and expanded gold zones; and

– Consistently successful drill results.

• Extensive gold mineralized zones complemented by high-grade shear veins add to the project’s potential

• Gold mineralization remains open in most directions

“We have been and continue to be extremely successful in our drill programs and look forward to formally quantifying the mineralization defined to date,” states Mike Sieb, President, Getchell Gold Corp. “I expect this is only the first such exercise as we continue to expand and delineate the extensive gold mineralizing system so readily evident at Fondaway Canyon.”

Fondaway Canyon is an advanced-stage gold property with a large historic resource located in Churchill County, Nevada. Gold was first discovered in Fondaway Canyon in 1977 and over the intervening 40+ years has been the subject of multiple exploration campaigns along a 3.5 kilometers E-W gold mineralized corridor totaling over 700 reverse circulation and core drill holes, small-scale open-pit mining of the oxidized zone at surface, and underground development for exploration and bulk sampling.

There have been three drill campaigns completed (Canagold Resources Ltd. in 2017, Getchell in 2020 and 2021) and one ongoing (Getchell 2022) subsequent to the release of a historic resource estimate in early 2017 by a past operator.

The full complement of the 2017, 2020, and 2021 drill results combined with any drill results received from the current drill program up to a July 31, 2022 cut-off date will be incorporated in the 2022 Resource Estimate. The completion of the 2022 Resource Estimate and supporting NI43-101 technical report is targeted for late September 2022.

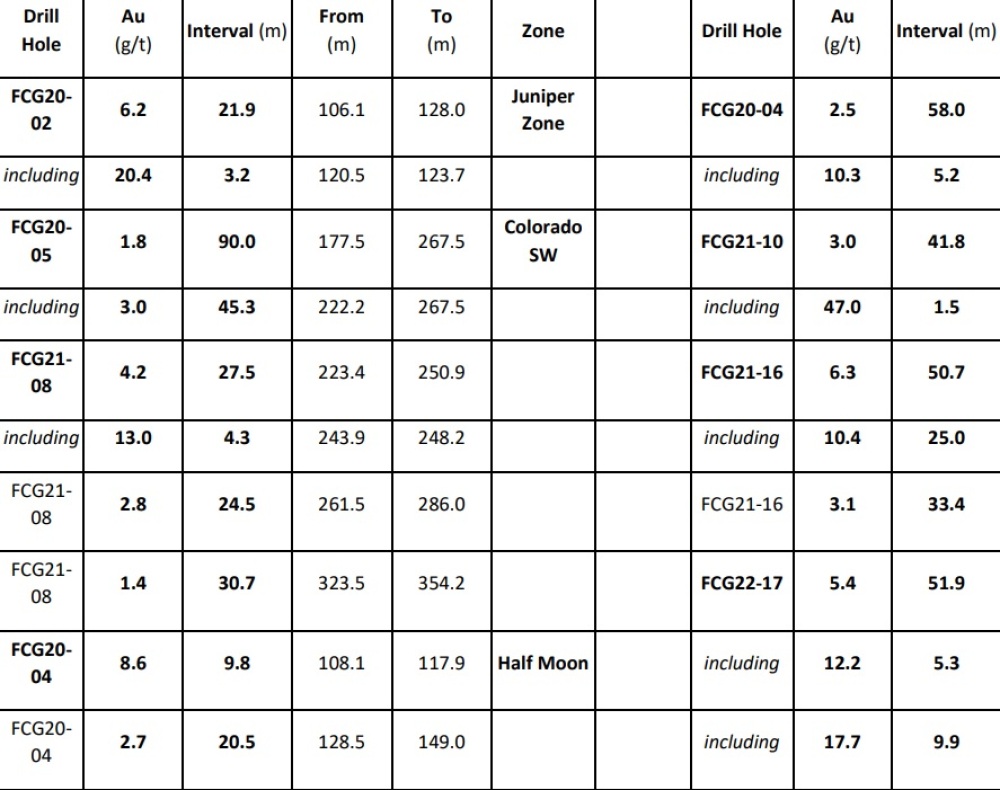

Recent Results

There have been significant advancements and discoveries since the publishing of the historic resource estimate. The delineated envelope of the gold mineralization in the Central Area has considerably expanded with the to-date defined mineralization ranging 600 meters E-W along strike, 800 meters down dip to the SW, and approximately 100 meters thick.

Within this envelope, substantial and very high-grade shear vein structures with significant depth extents contribute to the potential. The drilling has yet to test the full extent of the gold mineralization and the mineralization remains open in most directions.

Below is a partial selection of drill intervals drilled by the Company in recent years that demonstrate some of the broad high-grade intervals characteristic of the gold mineralization encountered at Fondaway Canyon and will be incorporated in the 2022 Resource Estimate.

Of note, additional drilling, both infill and extensional, will be required to further define and add to the gold mineralization model at Fondaway Canyon.

Getchell Webinar Series

As part of the continuing series of webinars to apprise the shareholders of ongoing activities and developments, President Mike Sieb and the Getchell team will host a live webinar on July 12.

All interested Media and investors are invited to Register here.

The Company has posted significant news in 2022, starting with the release of the results from the last hole of the 2021 drill program at Fondaway Canyon, FCG21-16, targeting the North Fork zone (Company news release dated February 15, 2022). FCG21-16 encountered a gold interval grading 6.3 grams per tonne gold (6.3 6/t Au) over 50.7 meters (50.7m) that includes a higher-grade core returning 10.4 g/t Au over 25.0m and represents the greatest ‘gold grade x thickness’ value in the 40+ year history of gold exploration and mining at the Project.

Drill hole FCG22-17, the first drill hole of the 2022 drill program at Fondaway Canyon, designed to further delineate the gold interval encountered by FCG21-16, intersected high-grade gold mineralization at a shallow depth of 66.1m downhole grading 17.7 g/t Au over 9.9m within a broader zone grading 5.4 g/t Au over 51.9m (Company news release dated June 15, 2022).

Of note, assay results from FCG22-17 have been returned to a depth of 119.5m and assays are pending for the remainder of the hole.

With two active drill rigs, one at the Fondaway Canyon gold project and the other at the Star CopperGold-Silver project, the Company expects drill results to be released through 2022. This event will feature a live Question & Answer session and is open to all media and interested investors.

Apex Geoscience Ltd.

Apex is a privately-owned, independent geological consulting company that provides high-quality, cost-effective, and timely geological consulting services to exploration companies, government, and non-government organizations. Apex has experience in all aspects of the mineral exploration industry from initial assessment and NI 43-101 reporting through to mining including the identification and outlining of resources. They specialize in managing large mine site and exploration databases, digital capture of historic datasets, and combining rigorous geostatistical analysis with modern

geological, geochemical, and drill datasets to create concise 3D models that result in discovery and expansion of resources.

Apex has wide-ranging Nevada Carlin-type gold experience, including the completion of multiple mineral resource estimates and preliminary economic assessments for various companies across the region. Scott Frostad, P.Geo., is the Qualified Person (as defined in NI 43-101) who reviewed and approved the content and scientific and technical information in the news release.

The true thickness of the gold intervals disclosed herein is not yet known, further work will be required to determine the true thickness. The 2020, 2021, and 2022 drill core was cut at Bureau Veritas Laboratories’ (“BVL”) facilities in Sparks, Nevada, with the samples analyzed for gold and multi-element analysis in BVL’s Sparks, Nevada, and Vancouver, BC laboratories respectively.

Gold values were produced by fire assay with an Atomic Absorption finish on a 30-gram sample (BV code FA430) with over limits re-analyzed using method FA530 (30g Fire Assay with gravimetric finish). The multi-element analysis was performed by ICP-MS following aqua regia digestion on a 30g sample (BV code AQ250). Quality control measures in the field included the systematic insertion of standards and blanks.

About Getchell Gold Corp.

The Company is a Nevada-focused gold and copper exploration company trading on the CSE: GTCH and OTCQB: GGLDF. Getchell Gold is primarily directing its efforts on its most advanced stage asset, Fondaway Canyon, a past gold producer with a significant historic resource estimate, and on the Star project, a past high-grade copper, gold, and silver small-scale producer.

Complementing Getchell’s asset portfolio is Dixie Comstock, a past gold producer with a historic resource and one earlier stage exploration project, Hot Springs Peak (Au). Getchell has the option to acquire 100% of the Fondaway Canyon and Dixie Comstock properties, Churchill County, Nevada.

For further information please visit the Company’s website at www.getchellgold.com or contact the Company by e-mail at info@getchellgold.com or by phone at +1 647 249-4798.

Mr. William Wagener, Chairman & CEO

Getchell Gold Corp.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Getchell Gold Corp. Disclaimer

The Canadian Securities Exchange has not reviewed this press release and does not accept responsibility for the adequacy or accuracy of this news release. Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Forward-looking information includes, but is not limited to, statements with respect to the use of proceeds. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “will” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results to be materially different from those expressed or implied by such forward-looking statements or forward-looking information. Although management of Getchell have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements.

Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. The Company will not update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws.

Michael Ballanger Disclaimer

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved..

Disclosures

1) 1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp., a company mentioned in this article.

Charts provided by the author.

( Companies Mentioned: GTCH:CSE; GGLDF:OTCQB,

)

This analysis focuses on gold and silver physical delivery on the Comex. See the article What is the Comex for more detail. Silver: Recent Delivery Month Silver is wrapping up June which is a minor-month contract on the Comex. Delivery volume was modest, beating out the last minor month (April), but falling behind both Jan and Feb. […]

The post Comex Countdown: What’s Really Going on With Silver? first appeared on SchiffGold.

They tried to deny it for months, but now everybody knows we have an inflation problem. The president, Congress and all of the central bankers at the Fed are trying to find ways to solve this problem. But as host Mike Maharrey explains in this episode of the Friday Gold Wrap, all of their solutions […]

The post Dumping Water on a Drowning Man: SchiffGold Friday Gold Wrap June 24, 2022 first appeared on SchiffGold.