Category: Gold

CBO Does Not Expect Revenue Surge to Last

After running the largest monthly surplus ever in April, the Treasury was back to running deficits in May. The Federal government spent $455B in May and collected $389B in taxes, which resulted in a net deficit of $66B. Figure: 1 Monthly Federal Budget Looking historically, this is the smallest May budget deficit since May 2016. As […]

The post CBO Does Not Expect Revenue Surge to Last first appeared on SchiffGold.

The Worst Economic Gloom In 50 Years

MarketsInsider/Zahra Tayeb/6-6-2022

“Spectrum said its European Retail Investor Index (SERIX)hit a high of 116 in the past month, indicating the optimism among investors towards bullion, which can serve as a store of value in times of market turmoil or rising inflation. This was the highest such reading since the data series began, Spectrum said.”

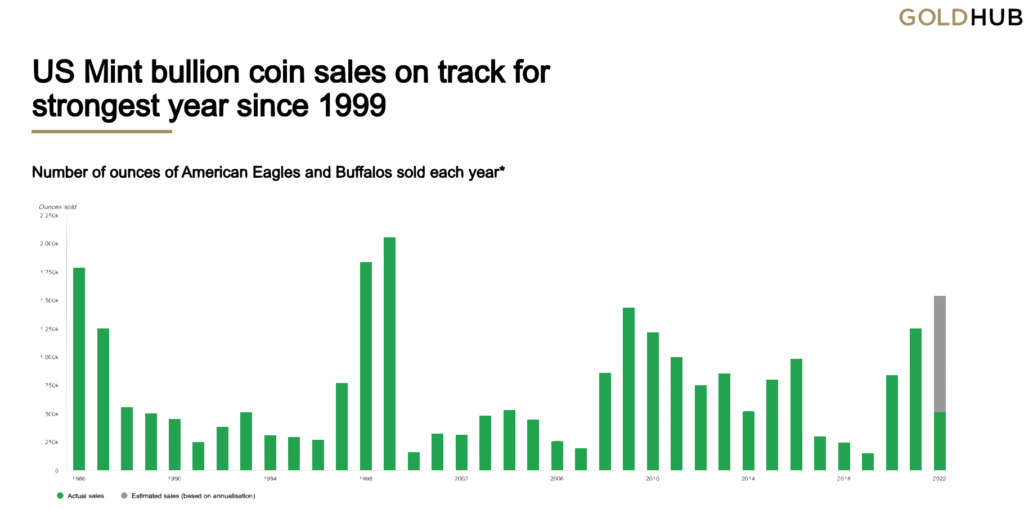

USAGOLD note: As noted in the past on this page, while prices have been trapped in a narrow zone, physical investors have been adding to their coin and bullion holdings at a record pace largely for safe-haven purposes. In the chart below, the World Gold Council shows US Mint bullion gold coin sales on a pace for their best year since 1999. “Considering the macroeconomic backdrop,” says Spectrum’s Michael Hall, “it’s no surprise to see investors looking to take advantage of a dip in the gold price to make safe haven allocations.”

Chart courtesy of the World Gold Council • • • Click to enlarge

Chart note: The green bars in the chart represent actual sales. The grey extension represents projected sales annualized for 2022.

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.

Financial Times/David Sheppard and Tom Wilson/6-7-2022

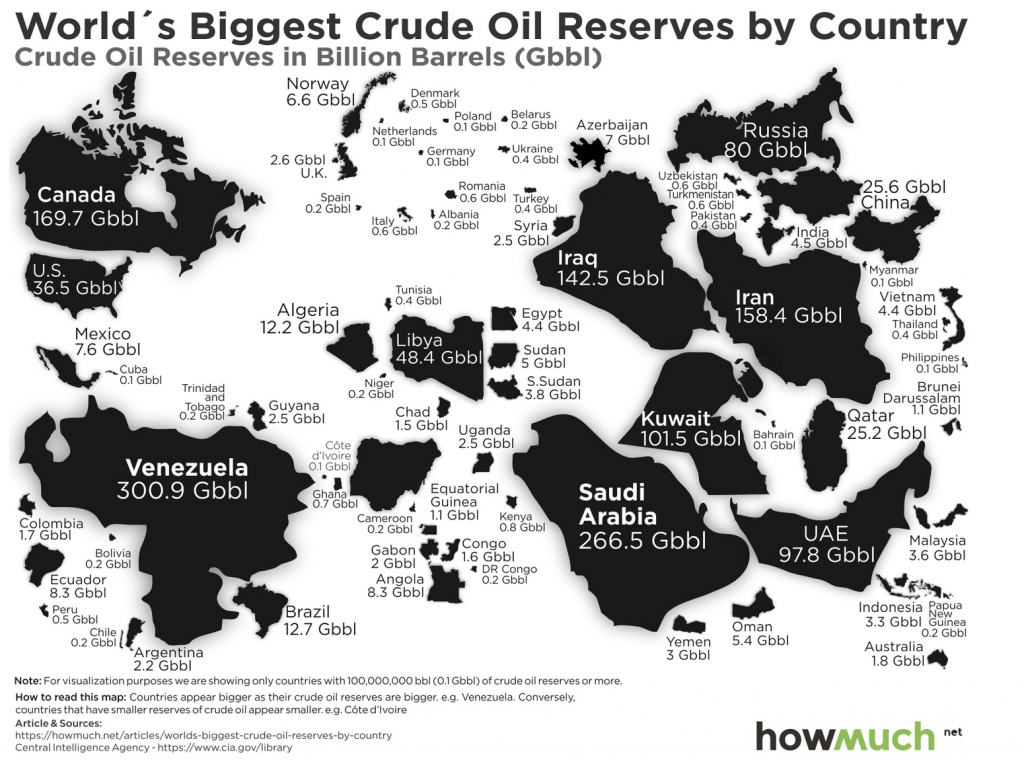

“Jeremy Weir, chief executive of the commodity trader, said that energy markets were in a ‘critical’ state as sanctions on Russia’s oil exports following its invasion of Ukraine had exacerbated already tight supplies created by years of under-investment.”

USAGOLD note: Simultaneously, some question the Middle East’s ability to produce in line with international usage and fill the gap created by Russia’s removal from the supply equation. (Please see Saudi Arabia is increasing supply — so why is the oil price holding firm?)

Graphic courtesy of HowMuch.net

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.