Source: The Critical Investor 06/06/2022

The Critical Investor marvels at the ongoing CA$3 million PP by Tectonic Metals, and explains why he believes in low downside risk, as does for example Tectonic’s strategic partner Crescat Capital.

Although Tectonic Metals Inc. (TECT:TSX.V; TETOF:OTCQB) launched their $3 million private placement under challenging market conditions, their two largest institutional shareholders, well-known Crescat Capital and Alaska’s leading Native regional corporation, Doyon, increased their shareholdings in Tectonic. This was to support what both believe to be a transformative year for Tectonic, with lots of new drilling and exploration.

Their continued support (Crescat made a strategic investment during last year’s raise while Doyon participated in financings from 2020, 2021, and 2022) enabled Tectonic to close the first tranche of a projected CA$3 million private placement for proceeds of CA$1.93 million.

This is quite an achievement in current volatile markets as record inflation, upcoming rate hikes, and increasing shortages everywhere could cause stagflation and/or a recession.

CEO Tony Reda acknowledged this fact and was delighted with this first tranche.

“Current challenging market conditions in no way reflect or diminish the potentially game-changing, district-scale opportunities Tectonic’s projects offer,” he said. “The reality is that the Tectonic team has never been more excited to get into the field and drill test some of the best targets the company has generated to date. As we close this first tranche of our financing, I want to express my gratitude for the continuing support of Crescat Capital and Doyon, Ltd., whose commitment and belief in our process and targets provide us with a solid exploration foundation to build upon. We are truly blessed to have great shareholders. As we launch our 2022 field season, we are primed and focused on our mission to find a mine.”

The ongoing financing is a non-brokered private placement of up to 50 million shares at CA$0.06, with a two-year half warrant (exercise price CA$0.10) for gross proceeds of up to CA$3 million. The warrants are subject to an acceleration clause when the share trades at CA$0.20 or higher during 20 consecutive trading days. Tectonic was originally looking to close this financing before May 16, 2022, but sharply deteriorating market conditions forced them to take a step back.

Tectonic seems to enjoy the full support of the likes of Crescat Capital and Doyon, as both shareholders made strategic investments in the company, enabling Tectonic to commence drilling very soon.

When talking to Reda, he indicated that he considered himself fortunate to have raised almost CA$2 million. Still, he realizes that the “smart money”—the investors adding to their positions or coming on board now—recognizes that the potential of Tectonic’s projects remains substantial, despite shares sitting at record lows.

Right now, this round is standing at about CA$2.4 million in total, and Reda still expects to get to the intended CA$3 million, which would be a strong vote of confidence for the company.

The largest shareholder Doyon announced its participation on May 24, 2022, and is a robust example of integrating Native interests in exploration initiatives. Doyon was pleased to inject fresh capital again.

As their CEO Aaron Schutt explained, “2022 marks the 50th anniversary of the Alaska Native Claims Settlement Act and the formation of Doyon, Ltd. Since that day, our mission has been clear: continually enhance our position as a financially strong Native corporation in order to promote the economic and social well-being of our shareholders and future shareholders, to strengthen our Native way of life, and to protect and enhance our land and resources. Our investment in Tectonic is our mission in action. As Tectonic Metals’ single largest shareholder since 2020, Doyon recognizes that the Company shares our core values—values that today are embraced as “ESG” principles but which our people have adhered to for thousands of years. We welcome the opportunity to reinforce our support for Tectonic and are confident that their professional, diligent and respectful exploration process will prove successful.”

As a reminder, if the intended goal of CA$3 million is reached, significant dilution will be part of it. It would take the share count to 211.68 million shares outstanding and 298.69 million shares fully diluted. But keep in mind that 64% (partially diluted) of the shares remain in strong hands, held by the Tectonic team, their strategic partners (Crescat Capital and Alaska’s leading Native Regional Corporation, Doyon) followed by other resource funds, such as Gold 2000, Australian firm Resource Capital Funds and Toronto-based Mackenzie Investments. On the other hand, of these fully diluted shares, about 30 million warrants will expire before the end of June 2022, which is soon.

The cash position is estimated at CA$2 million now after the closing of the first tranche, as Tectonic has been deploying funds to execute this year’s exploration program, and hopefully, another CA$1 million could be added soon. As the closing of a second tranche is expected in less than four weeks, exploration plans for the first drill program are scheduled to be announced prior to this second closing, with the first drill rig commencing action the first week of July.

As a reminder, Tectonic is targeting district-scale projects in safe jurisdictions, which have the potential to generate multi-million-ounce deposits. In some senses, choosing a secure and predictable jurisdiction in which to operate has become the new ESG (Environmental, Social, and Governance), as geopolitical uncertainty has focused investors’ attention on the potential for asymmetric negative shocks that can hit companies tremendously.

Examples are new governments that are less mining-friendly, countries exposed to wars as we are seeing in Ukraine now, or even expropriation as we are currently occurring in Mexico with lithium assets. Alaska is one of the most predictable, mining-friendly jurisdictions globally, and investors there can take comfort in the consistent and even application of the rule of law.

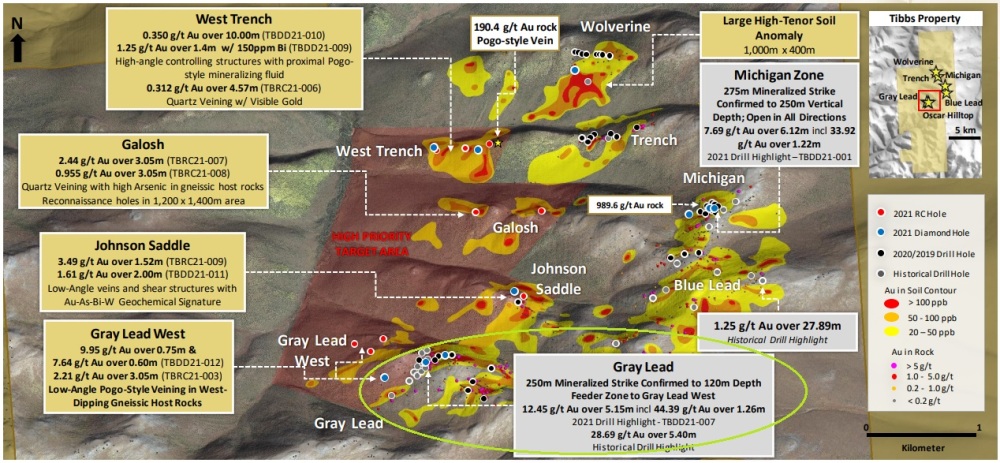

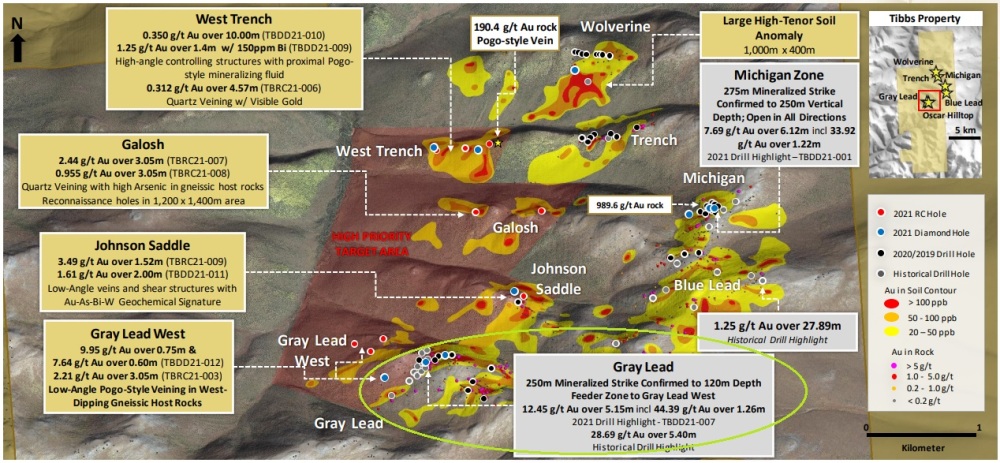

Tectonic’s fully owned flagship is the Tibbs project, covering 29,280 acres, 35 kilometers east of the 200 million ounces gold (200koz Au) per annum Pogo Mine. High-grade gold mineralization at Tibbs occurs in steeply dipping veins, crossing multiple lower grade low-angle veins similar to the Pogo Mine, which serves as an analogy.

The Tibbs property is close to existing infrastructure and an active mill and has seen lots of exploration, ranging from soil sampling, airborne and land-based geophysical surveys, trenching to drilling. Drill highlights are 28.95 meters (28.95m) at 6 grams per tonne gold (6 g/t Au), 5.3m at 15.7g/t Au, 5.7m at 19.1g/t Au, 1m at 104.5g/t Au and 5.1m at 12.45g/t Au. These are very substantial results, and the most impressive drill results were obtained at the Gray Lead area.

Phase 2 drilling already established a 1000 meters by 350 meters mineralized zone, where the majority of drill results returned grades over 5g/t Au, and within this high grade, steeply-dipping veins with grades up to 127g/t Au. It is still early days, but if we guesstimated a mineralized envelope of 1000x350x5m x2.75t/m3 density, this would result in 4.8 metric tons (4.8 Mt), and at an average grade of say 5g/t, this could already result in a hypothetical 770koz Au. And keep in mind that this is only a small part of the entire project.

Tectonic’s second project is the Seventymile project. It is part of an underexplored, fully owned 40 kilometers long Greenstone belt and located 270 kilometers east of Fairbanks, Alaska. The property is only accessible by air (small aircraft or helicopter) and in the winter by a winter trail. Seventymile is an orogenic gold system (for example, Abitibi, Kalgoorlie, Red Lake, Hope Bay, and Las Cristinas) with lode-style high-grade quartz mineralization occurring in shear zones and faults. Drilling highlights are 5.5 g/t Au over 15.0m, 1.1m at 205.9g/t Au, 6.1m at 2g/t Au, 19.8m at 1.37g/t Au and 6.1m at 4.38g/t Au.

The 100% owned Flat Gold project is Tectonic’s latest acquisition. It is located 40 kilometers north of the 45 million ounces gold (45 Moz Au) Donlin Gold project, jointly owned and operated by Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) and Nova Gold Resources Inc. (NG:NYSE), who are spending $60 million at Donlin this year.

As you probably know, Donlin is one of the largest undeveloped open-pit gold resources in the world (39Moz at 2.24g/t Au), and Flat is located in the same mineral belt that produced this behemoth. According to management, Flat is a 92,000-acre district-scale intrusion-hosted gold system with multi-million-ounce potential in the heart of Alaska’s fourth most prolific placer mining district. Historic drilling from 1997 returned interesting highlights, like 24.7m at 12.5g/t Au, 36.6m at 1.36g/t Au and 31.7m at 1.28g/t Au. The priority target, Chicken Mountain, hosts a robust 4 kilometers long gold-in-soil anomaly where drilling indicated gold mineralization over a kilometer and is the likely source of the majority of the historic 1.4Moz of placer gold mined in the area.

According to CEO Reda, the currently raised budget will mostly be spent at Tibbs and Seventymile, so I’m curious what plans will be announced soon. Tectonic seems to be trading at rock bottom levels at the moment, is cashed up but, on the other hand, has huge exploration upside potential with their project portfolio, so I’m looking forward to what they can achieve this year.

Conclusion

Although the sentiment isn’t positive in the stock markets, and junior mining, in particular, Tectonic seems to enjoy the full support of the likes of Crescat Capital and Doyon, as both shareholders made strategic investments in the company, enabling Tectonic to commence drilling very soon. The former Kaminak team has big ambitions and is ready to go and will announce the extent of their upcoming exploration programs within a few weeks, following the closing of the second tranche of the ongoing private placement.

The current market cap of just CA$8 million is extremely low in my view, as only the management team could very well be worth more, let alone the three district-scale projects with two of them already having pretty interesting drill results and a new drilling season coming up soon.

I hope you will find this article interesting and useful and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Tectonic’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Tectonic or Tectonic’s management. Tectonic Metals has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed, and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high-quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Streetwise Reports Disclosures

1) The Critical Investor’s disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of the information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees, or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in the securities mentioned. Directors, officers, employees, or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

( Companies Mentioned: TECT:TSX.V; TETOF:OTCQB,

)