Category: Gold

Please note: the COTs report was published 4/29/2022 for the period ending 4/26/2022. “Managed Money” and “Hedge Funds” are used interchangeably. Gold Current Trends Since the peak on March 8, Managed Money has reduced its Net Long positions by 60k contracts or 43%. Despite massive selling, the gold price has actually held up fairly well. […]

The post CFTC: Swaps Have Increased Gold Short Position by More than 1,300% since Nov 2015 first appeared on SchiffGold.

Gold Likely Not Done on the Downside Yet

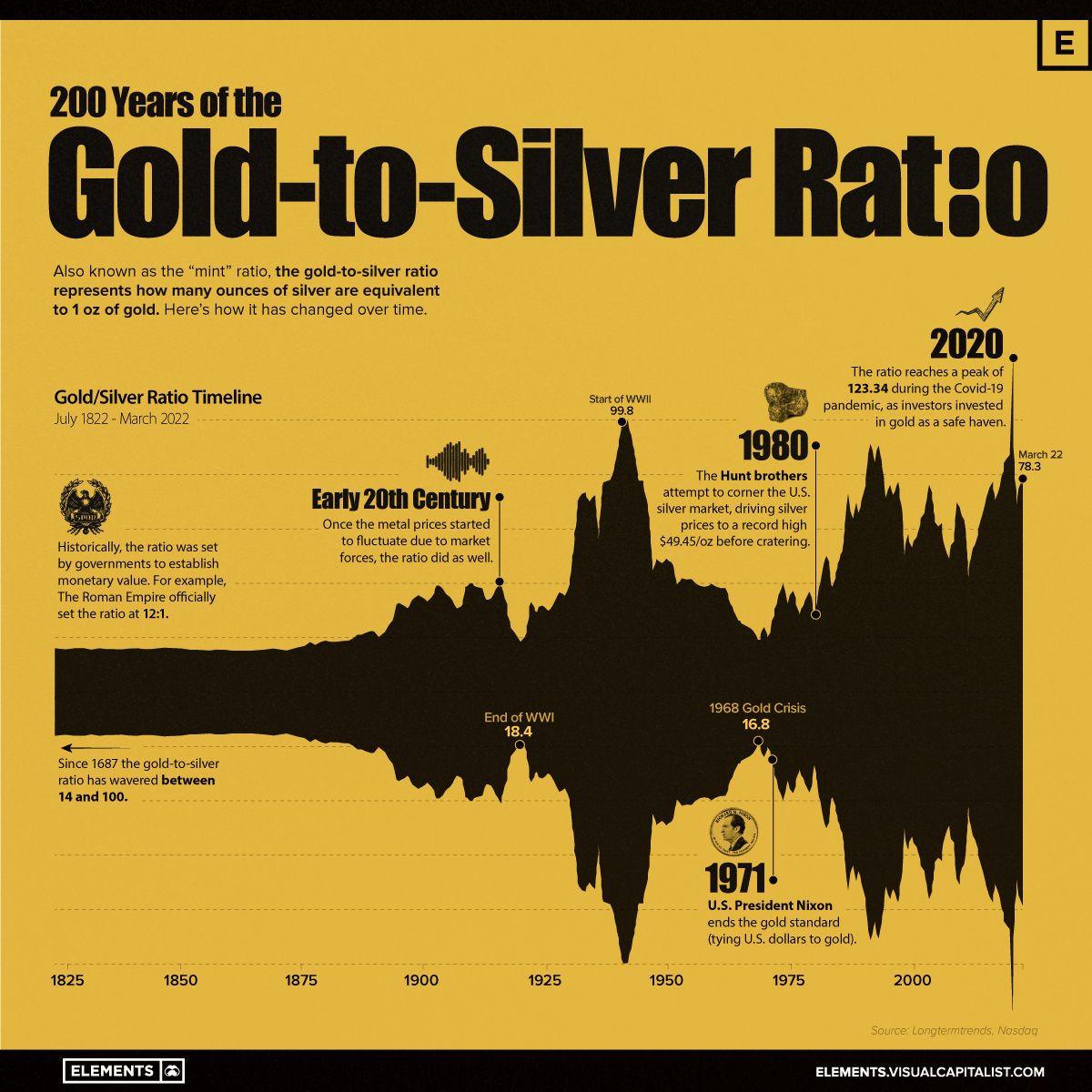

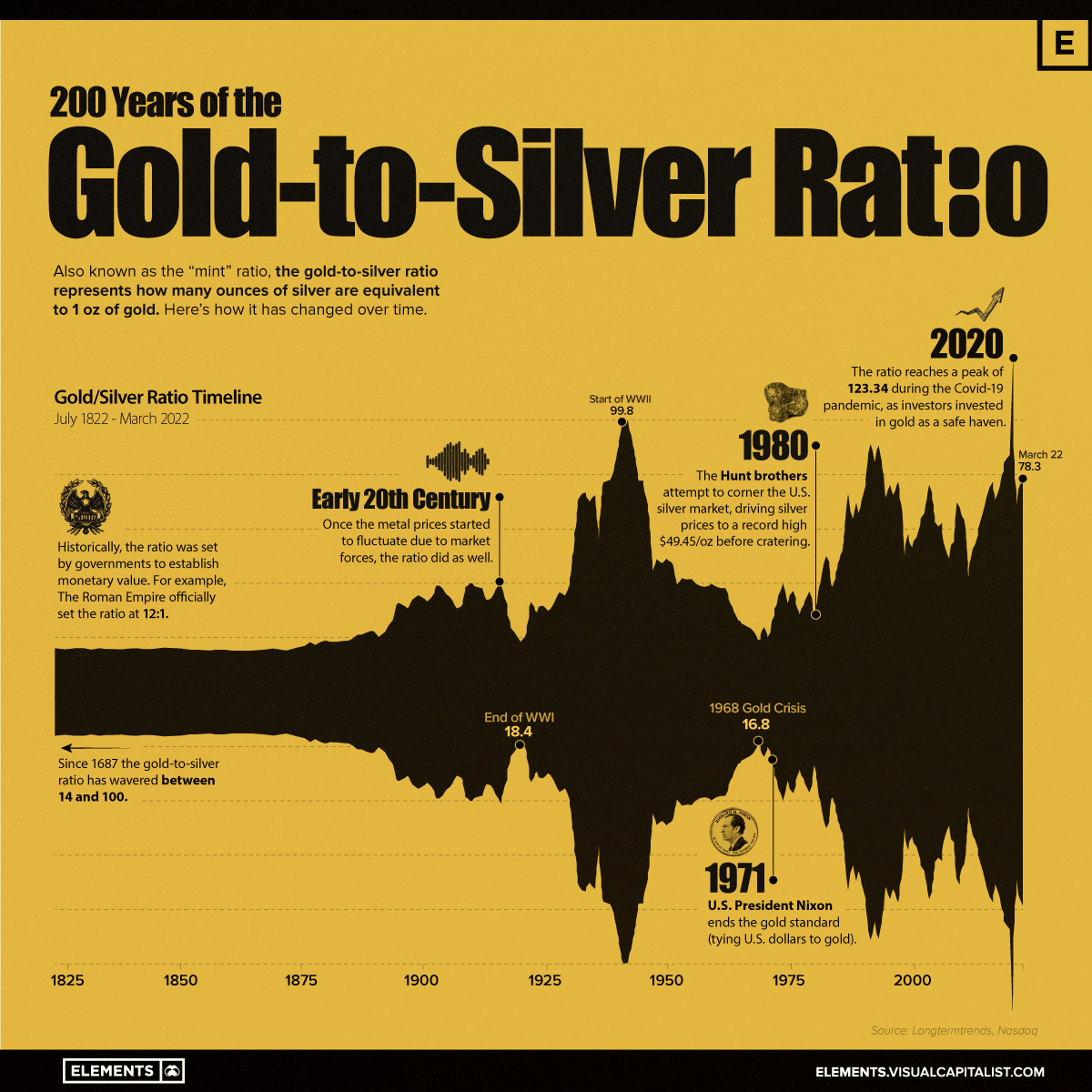

Visual Capitalist/Niccolo Conte/4-27-2022

(Click to enlarge)

(Click to enlarge)

“Gold and silver have been precious and monetary metals for millennia, with the gold-to-silver ratio having been measured since the days of Ancient Rome. Historically, the ratio between gold and silver played an important role in ensuring coins had their appropriate value, and it remains an important technical metric for metals investors today. This graphic charts 200 years of the gold-to-silver ratio, plotting the pivotal historical events that have shaped its peaks and valleys.…Recently in 2020, the ratio set new highs of more than 123:1, as pandemic fears saw investors pile into gold as a safe-haven asset. While the gold-to-silver ratio has since fallen to roughly 80:1, runaway inflation and a potential recession has put gold in the spotlight again, likely bringing further volatility to this historic ratio.”

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.

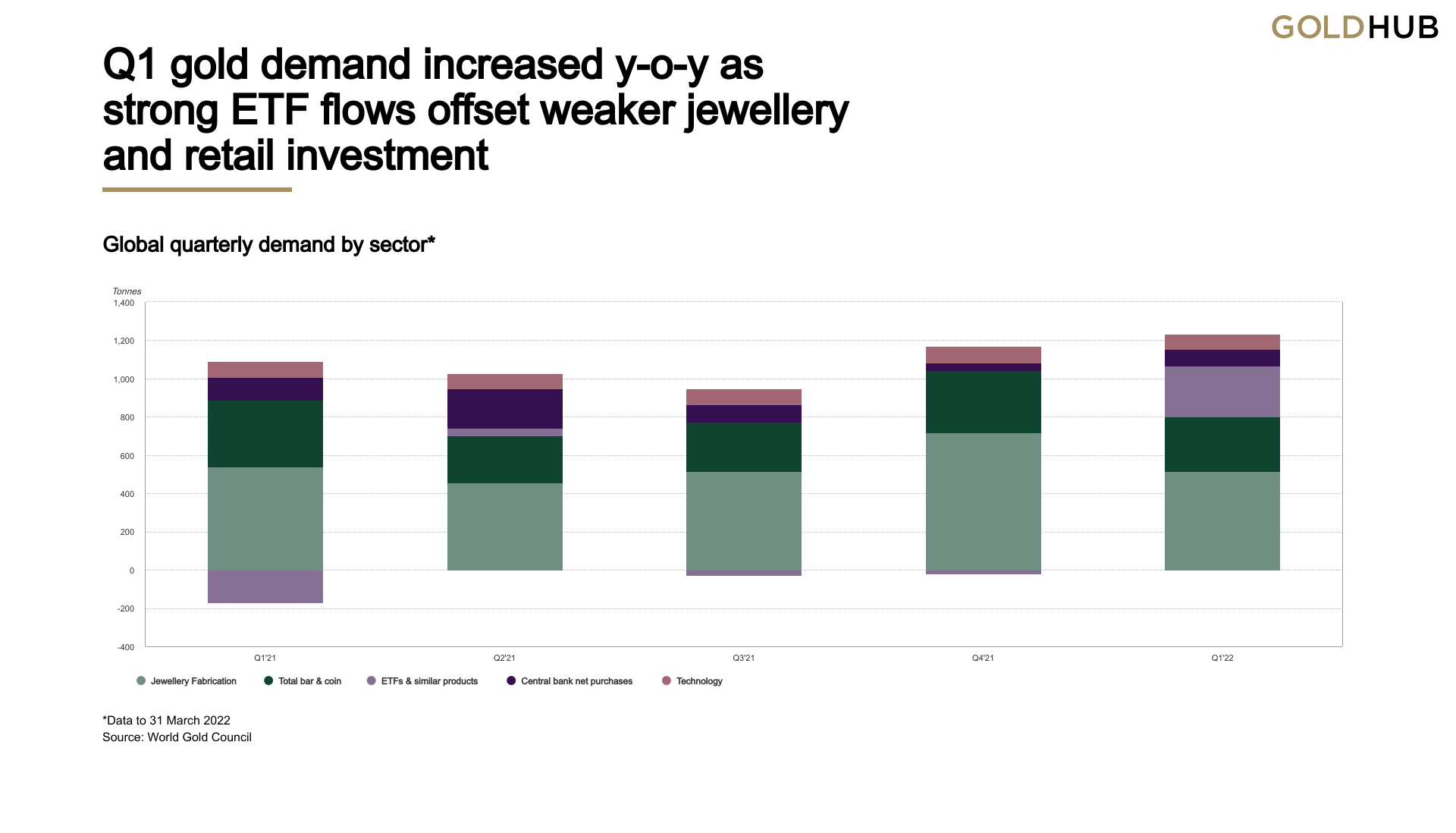

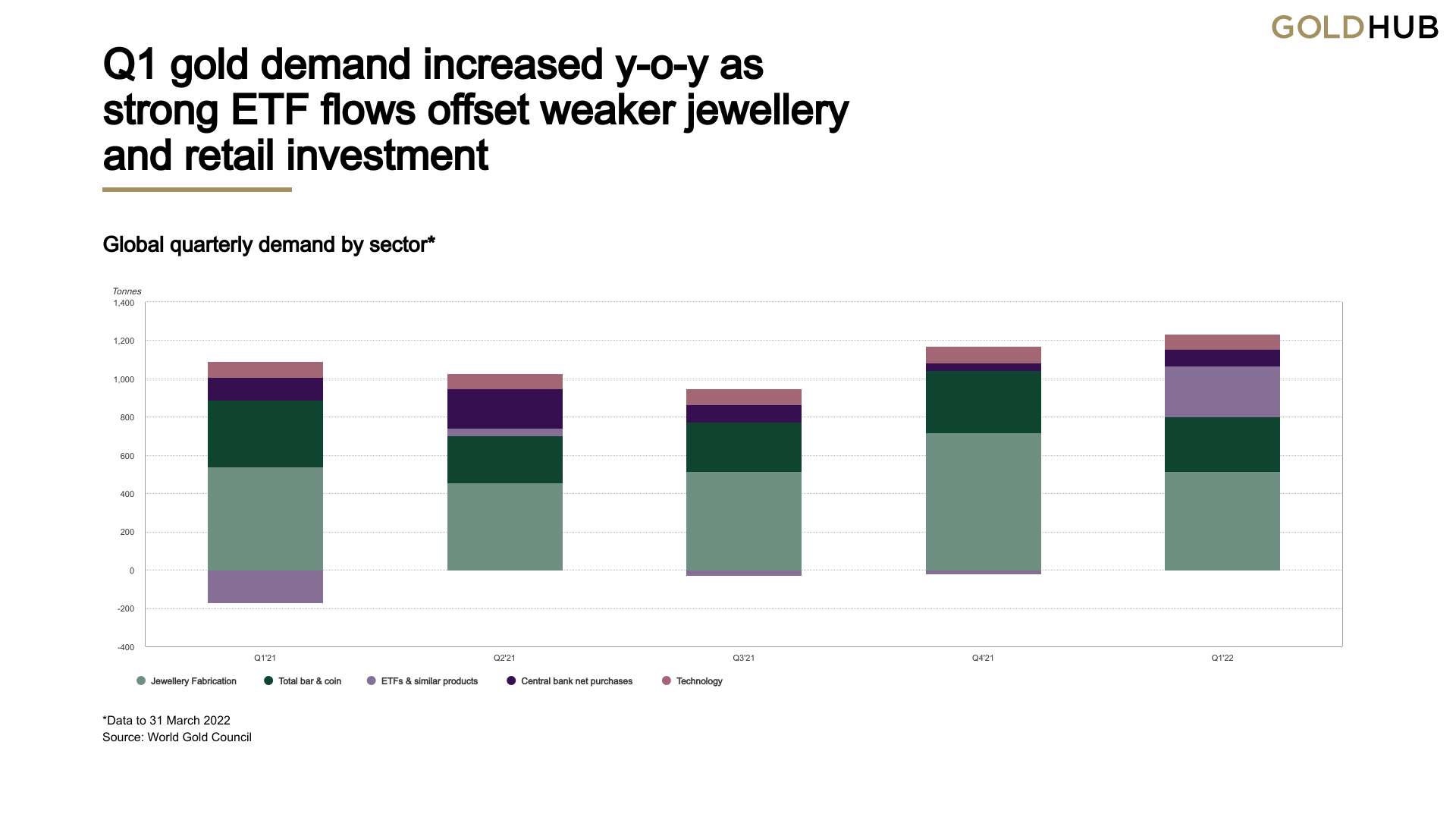

World Gold Council/Staff/4-28-2022

“ETF inflows came flooding back in Q1 on safe-haven demand and inflation concerns; bar and coin investment, although healthy, failed to match lofty year-earlier levels. Investment demand for gold in Q1 returned to levels that were last seen during the early months of the pandemic in 2020, fuelled by similar drivers: namely, safe haven flows and high/rising gold prices. Heightened geopolitical risk, caused by the invasion of Ukraine, encouraged investment flows, which fed through to a sharp rise in the gold price. Inflation concerns – already supportive for gold investment – were accelerated by the conflict, with data prints showing prices across the globe rising at a multi-decade, if not record, pace. Rising interest rates were, however, a continued headwind and this likely tempered investment inflows to an extent.”

USAGOLD note: Overall investment demand was up 203% over the first quarter of 2021. Gold coins and bullion demand was down 20% from last year’s robust pace.

Chart courtesy of the World Gold Council • • • Click to enlarge

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.