MarketWatch/Barbara Kollmeyer/4-26-2022

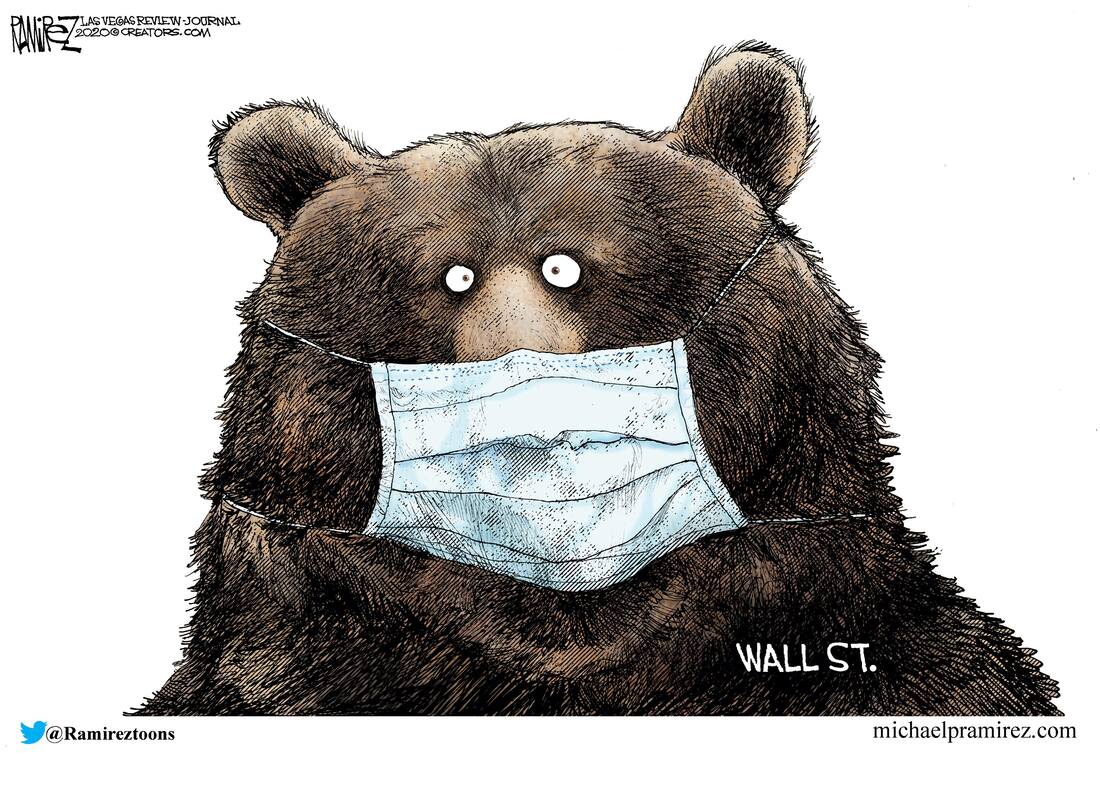

“’Over the last decade everyone has slowly adopted this idea of maybe it’s the Fed that will bail me out, or TINA [There Is No Alternative],’ he said. The casualty list over the past year? Tech dip buyers, long -short equity traders who decided they didn’t need to use stops with GameStop etc., or 60/40 managers who decided instead of paring risk, they bought more bonds, he said.”

USAGOLD note: A rather bleak assessment from RTM Capital Advisor’s Mark Ritchie who says “bonds and equities could continue to fall in tandem.” Among other recommendations, he has a small position in gold. Given the grim outlook, we would venture a guess that his small position might grow over time.

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.