Source: Streetwise Reports 04/25/2022

Bonzana-grade copper in a hot copper market? Samples found by one Vancouver-based explorer have returned copper grades as high as 9.63% in a region of Argentina known for its world-class discoveries.

Assays on rock samples taken from a calcite-quartz-sulphide vein on Norseman Silver Ltd. (NOC:TSX.V) Taquetren silver-gold project in Rio Negro province, Argentina, have returned copper grades as high as 9.63%.

“They’re huge copper numbers.”

—Norseman Silver President and CEO Sean Hurd

The seven rock chip samples found during reconnaissance exploration were from a 10-20 cm-wide vein known as Veta Juan. They were collected along a strike length of roughly 300 meters.

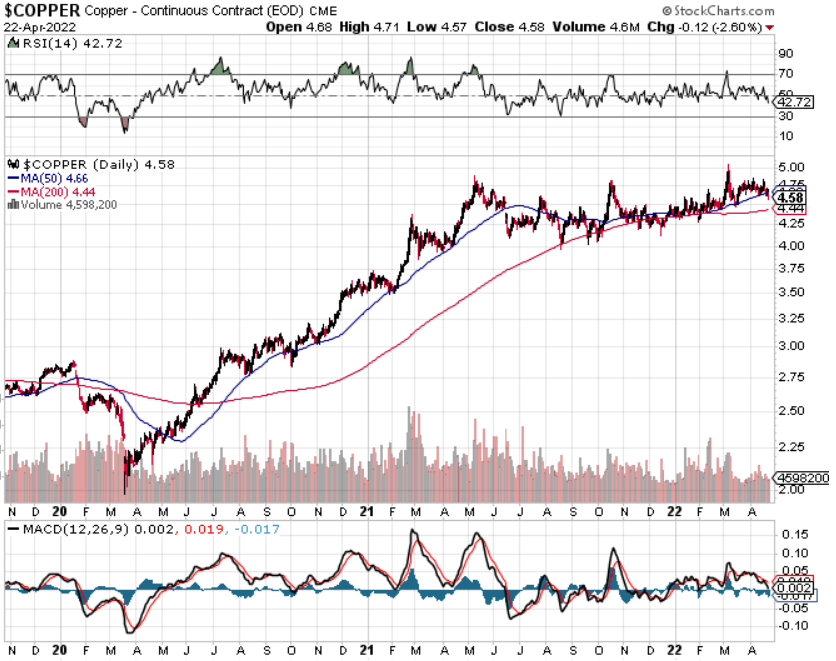

The sample grades averaged 7.73%, with the lowest registering at a robust 2.46%. And with copper prices more than doubling since April 2020 against a backdrop of global supply constraints, the discovery comes at good a time.

Assay labs use different techniques in assaying. The method used initially on the Taquetren samples measured metals values up to a certain threshold but nothing more.

Once Norseman learned that the samples had returned grades above the detection limit, they sent them back to be re-assayed — only without any detection limits in place. That’s when the company learned it had bonanza-grade samples.

“We had a bunch of assays back that were at the upper limit of the detection limit. So we sent them back, and they use a different technique to test for higher grade. And we got the results back and we were pleasantly surprised. They’re huge copper numbers,” Norseman Silver President and CEO Sean Hurd told Streetwise Reports.

The re-analysis confirms the vein mineralization potential along this zone of the 285-sq.-kilometer Taquetren land package in southern Argentina’s Navidad-Calcatreu Mining District.

Sector Pundits Weigh In

And sector experts are taking note.

As early as last Spring, Michael Ballanger affectionately named the Taquetren project the “Son of Navidad” and flagged it as a “world-class exploration play.”

Michael Swanson of WallStreetWindow tagged Norseman as his top stock pick just last month — and NOC is not finished its initial exploration work and continues to collect reconnaissance-scale sediments and other rock samples at Taquetren.

Preliminary assay results of the current samples confirm the anomalous multi-element concentrations along the northwest-southeast trending Veta Juan to the Veta Nueva (new vein) zone.

Veta Nueva is close to Area Marta, a zone which was mapped out with distinct features of low-sulphidation epithermal-style rock textures and alteration. Several outcrops and rock float fields of variably silicified volcanic rocks and calcites with bladed textures were encountered along Area Marta.

Based on the sampling to date, Norseman says the northwest-southeast trending zone extends for a strike length of about 5 km and lies along the rim of a caldera (a former volcano).

Argentina is the world’s eighth-largest country but it remains largely unexplored.

World-Class Discoveries Made

Despite the lack of attention, several world-class discoveries have been made there, including Patagonia Gold Plc’s (PGD:LSE) Calcatreu gold-silver deposit and Pan American Silver Corp.’s (PAAS:TSX; PAAS:NASDAQ) Navidad silver project— the world’s largest undeveloped silver deposit, with a measured and indicated resource exceeding 600 million oz silver.

Hurd is no stranger to Argentina. In 2002, he was a director of former Grosso Group company IMA Exploration when it discovered Navidad in north-central Chubut province.

He later founded Blue Sky Uranium and started development of the Amarillo Grande uranium-vanadium project, also in Rio Negro province.

Norseman has an option to earn a 100% interest in Taquetren.

The company has about CA$1.8 million in cash and plans to spend the summer conducting a modest drill program on its Silver Switchback project near Terrace, B.C.

Norseman trades in a 52-week range of CA$0.48-$0.165 and has about 68.8 million shares outstanding.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures

1) Brian Sylvester compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Norseman Silver Ltd. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Norseman Silver Ltd., a company mentioned in this article.

( Companies Mentioned: NOC:TSX.V,

)

“Investors also pulled $8.7 billion out of bonds and $55.4 billion from cash, pouring $900 million into gold.”

“Investors also pulled $8.7 billion out of bonds and $55.4 billion from cash, pouring $900 million into gold.”