Category: Gold

Stocks & Metals Sink on Less Dovish Fed

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

Tough talk from the Fed roiled markets yesterday, with stocks as well as precious metals getting hit.

As of this Friday recording, gold is off 2.1% for the week to trade at $1,939 an ounce. Silver shows a weekly loss of 5.8% to bring spot prices to $24.42 an ounce. Platinum prices are trending lower by nearly $70 or 6.7% since last Friday’s close to trade at $942. And finally, palladium is actually up by 1.2% this week to check in at $2,450 per ounce.

On Thursday, Federal Reserve chairman Jerome Powell said the central bank intends to pursue a more rapid pace of interest rate increases. He indicated that a 50-basis point hike in May is likely.

Jerome Powell: We really are committed to using our tools to get 2% inflation back and I think if you look at, for example, if you look at the last tightening cycle, which was a two-year string of 25 basis point hikes from 2004 to 2006, inflation was a little over 3%. So, inflation’s much higher now and our policy rate is still more accommodating than it was then. So, it is appropriate, in my view, to be moving a little more quickly. And I also think there’s something in the idea of front-end loading, whatever accommodation one thinks is appropriate. So, that does point in the direction of 50 basis points being on the table, certainly. We make these decisions at the meeting and we’ll make them meeting by meeting, but I would say that 50 basis points will be on the table for the May meeting.

Fed officials are vowing to get their benchmark rate up to a “neutral” level by the end of the year. Futures traders are currently anticipating a 2.75% Fed funds rate.

Whether the Fed will actually get there is questionable. A downturn in the economy or a panic in the stock market would likely halt the Fed’s rate hiking campaign dead in its tracks.

Another question is whether the rate hikes that do come will be enough to blunt inflation pressures. The latest Consumer Price Index report shows price levels rising at over 8% annually. Even if inflation cools off in the months ahead, it may not get down to anywhere near the Fed’s 2% target.

Negative real interest rates are likely to persist regardless of how many nominal hikes central planners push through.

That means savers who are hoping for money market yields to catch up with the inflation rate will be disappointed. The need to seek alternative vehicles for saving and preserving wealth is as pressing now as ever.

The worst of the inflation wave could be yet to come.

There are signs that food costs will continue to accelerate higher and a very real possibility of widespread global food shortages. The Russia-Ukraine war will severely diminish farm output in the region. And as Russia is a major producer of fertilizer ingredients, Western sanctions are constricting global supply chains to farmers.

To make matters worse, rail transportation backups in the U.S. are limiting delivery of fertilizer to farmers. Union Pacific Railroad announced this week that it will reduce service to fertilizer suppliers by 20%. Grain capacity is also being reduced.

This development couldn’t have come at a worse time for farmers heading into peak planting season.

What comes next could be social unrest. Inflation uprisings are already occurring in Third World countries.

At the very least, an uprising at the ballot box this November seems certain to occur. President Joe Biden’s approval ratings are low and going lower every month as inflation frustrations mount.

Voters shouldn’t expect any serious political solutions to the current predicament. Yes, there are some things a new Congress could do to push back against the Biden spending agenda and open up domestic energy production.

But regardless of which party controls Congress, the cycle of government spending and borrowing will persist. And an unaccountable Federal Reserve will continue to enable it all by expanding the currency supply.

Despite their tough talk on tightening, central bankers always bend to pressure from Wall Street whenever markets come undone.

Fiscal and monetary soundness won’t return to Washington any time soon. But individual households can still opt to put themselves on a sound money standard.

It starts by doing the opposite of what the political class has been doing over the past few decades. Since abandoning gold backing for the currency, spending and borrowing have exploded and the value of the U.S. dollar has plummeted. That is the root of the current inflation problem.

Households that spend and borrow recklessly will grow poorer over time even as they enjoy the temporary high of new cash infusions from creditors. Those who do what seems to be the responsible thing by saving can also grow poorer over time as any savings denominated in Federal Reserve notes lose value.

There may be a place for chasing growth opportunities when they present themselves in equities and other markets. But a solid foundation of cash reserves should come first.

The best form of cash isn’t issued by any government. It’s dug from the earth by miners and refined into sound money in the form of gold and silver bullion.

Well, that will do it for this week. Be sure to check back next Friday for our next Weekly Market Wrap Podcast. Until then this has been Mike Gleason with Money Metals Exchange, thanks for listening and have a great weekend everybody.

Source: Streetwise Reports 04/21/2022

Shares of steel wire manufacturer Insteel Industries Inc. traded 10.5% higher after the company reported Q2/22 financial results that highlighted a 53% YoY increase in revenue and a 65.4% increase in average selling prices.

Steel wire reinforcing products manufacturer Insteel Industries Inc. (IIIN:NYSE), which fabricates prestressed concrete strand (PC strand) and welded wire reinforcement (WWR) used for reinforcing concrete building products, today announced financial results for its second quarter of 2022 ended April 2, 2022.

The company reported that net sales in Q2/22 increased by 53% to $213.2 million, compared to $139.0 million in Q2/21. The company highlighted that the gain in revenue was attributed to a 65.4% increase in average selling prices and a 7.2% decrease in shipments.

The firm listed that during Q2/22 gross profit improved by 510 basis points to 26.8% versus 21.7% in Q2/21. As a result of the combination of higher margins and revenues, the company was able to increase its gross margin in Q2/22 to $57.1 million, which was up from $30.2 million in Q2/21. Insteel noted that the gains were primarily driven by higher spreads between selling prices and raw material costs. The company added that “it benefitted from strong demand for its reinforcing products and incremental price increases to recover the continued escalation in costs.”

The company stated that for Q2/22 it recorded record quarterly net earnings of $39.0 million, or $1.99 per diluted share, versus $14.9 million, or $0.76 per diluted share in Q1/21.

For H1/22, Insteel reported net sales of to $391.7 million, which represented a 51.5% increase over the $258.6 million registered in H1/21. The company advised that for H1/22 it posted net earnings of $62.1 million, or $3.17 per diluted share, compared to $23.1 million, or $1.18 per diluted share during H1/21.

The company listed that as of the end of Q2/22, it held $69.7 million in cash on its balance sheet and had no outstanding balance on its $100.0 million revolving credit line.

Insteel’s President and CEO H.O. Woltz III commented on the outlook for the company’s business for the rest of FY/22 stating, “Momentum across our business remains positive driven by robust demand from our customer base and price increase initiatives to recover rapidly rising raw material, labor, utility and freight costs…For the balance of our fiscal year, we expect continued strong performance due to underlying strength across all our non-residential construction markets together with the usual seasonal upturn in demand that occurs during our third and fourth quarters.”

“While concerns surrounding inadequate supplies of domestically produced wire rod persist, we have supplemented our requirements with offshore material to bridge the gaps we previously identified and do not expect raw material-related disruptions to our operations through the fourth fiscal quarter. We have concerns about the impact of record high steel prices on demand for reinforcing products, but up to this point momentum in our markets remains strong and there is no indication of weakening,” Woltz added.

Insteel is headquartered in Mount Airy, N.C. and operates ten manufacturing facilities in the U.S. The company claims that “it is the nation’s largest manufacturer of steel wire reinforcing products for concrete construction applications.” Insteel produces and sells drawn and formed wire, PC strand for adding structural support to precast concrete used in construction of bridges, parking decks, buildings and other concrete structures and WWR products such as engineered structural mesh, concrete pipe reinforcement and standard welded wire reinforcement. The firm markets its products mostly to concrete products makers and concrete contractors for use in commercial construction projects. Nonresidential construction accounts for about 85% of the Insteel’s total revenues with residential sales making up the remaining 15%.

Insteel started the day with a market cap of around $778.3 million with approximately 19.4 million shares outstanding and a short interest of about 2.6%. IIIN shares opened 6% higher today at $42.58 (+$2.49, +6.21%) over yesterday’s $40.09 closing price. The stock has traded today between $42.52 and $46.15 per share and is currently trading at $44.36 (+$4.27, +10.65%).

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures

1) Stephen Hytha compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

( Companies Mentioned: IIIN:NYSE,

)

Source: Streetwise Reports 04/21/2022

Blackwolf Copper and Gold Ltd. has increased its resources and holdings in Alaska by staking new claims and continuing with infill and expansion drilling. Couloir Capital Ltd. commented in a research note that it has initiated coverage on Blackwolf Copper and Gold Ltd. with a “Buy” rating and estimates that the company has a “Fair Value” of CA$1.28 per share.

Couloir Capital Ltd. Mining Analyst Niall Tomlinson, MSc. Metals and Energy Finance, MSc. Mining Geology, CGeol commented in an April 19 research report that base, critical and precious metals explorer Blackwolf Copper & Gold Ltd. (BWCG:TSX) presents an interesting opportunity for investors as it offers “a core advanced exploration property that contains several targets for further resource expansion, complimented by an exciting new exploration portfolio in a world class mineral district.”

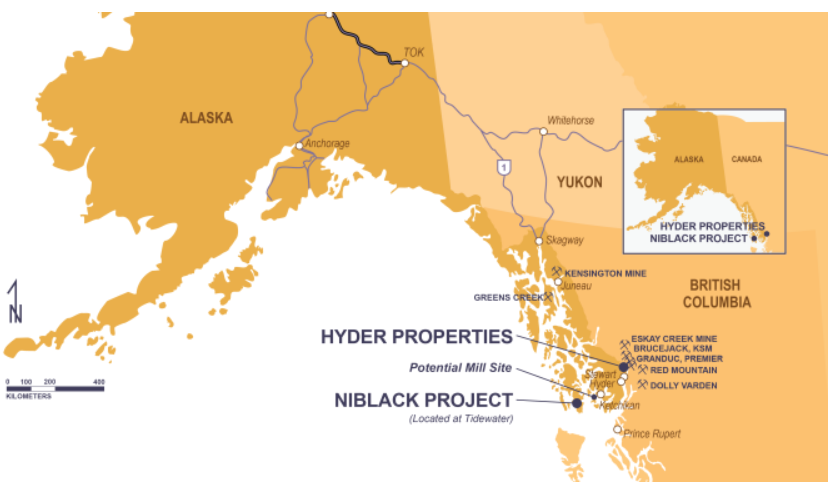

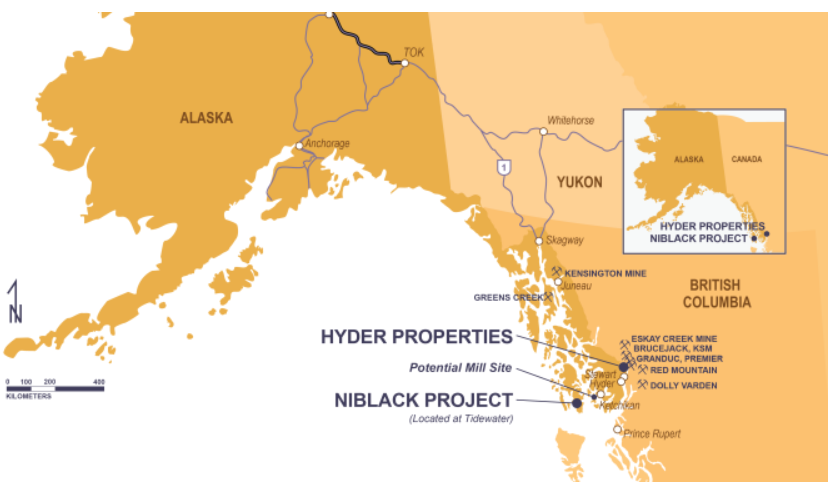

Blackwolf Copper and Gold concentrates its efforts mostly on volcanogenic massive sulfide (VMS) projects in south-eastern Alaska, but also has access to several exciting new gold projects in an unexplored area on the U.S. side of the border along British Columbia’s Golden Triangle.

The company’s Niblack Cu-Au-Zn-Ag project is located on Prince of Wales Island in southeast Alaska. The analyst stated that though the Niblack project has historically produced only relatively small amounts of copper, the company has shown that there are now good prospects for a significant resource at the project as new geological interpretation of untested targets indicate potential for resource growth.

Couloir Capital noted that the company has acquired new Golden Triangle exploration prospects by staking out the Hyder properties. The report said that the three Hyder properties are situated in a previously unexplored slice on the Alaskan side of B.C.’s Golden Triangle region.

The analyst pointed out that even though exploration work is still at a very early stage, the projects are believed to contain several promising geological targets in an area which has historically been known to host world class deposits of both gold and base metals.

Couloir Capital advised that Blackwolf has signaled its intentions to drill test targets at the Hyder properties which if proven successful could drive the total valuation of the company higher.

The research firm stated that it is initiating coverage on Blackwolf Copper and Gold Ltd. with a “Buy” rating and estimates the “Fair Value” of the company’s shares at CA$1.28 per share. The analyst noted that Blackwolf’s management team and insiders own 9.82% of the company’s outstanding shares which typically is considered a positive indicator as it tends to align management’s interests with investors.

Blackwolf’s’ exploration assets portfolio consists of its 2,500 ha Niblack VMS Cu-Au type Project which is located in an area that has undergone a sizable amount of exploration over the past 20 years with more than 440 holes having been drilled to date. The company’s Hyder properties include the Texas Creek, Cantoo and Casey properties which together encompass about 4,400 ha in southeastern Alaska along the Canadian border.

During 2020, the company drilled 1,774m in 10 holes at the Niblack mine with the primary goal of testing mineral extensions. Some highlighted results included hole LO20-213 which returned 11.08 m of 2.33% Cu, 2.9 8g/t Au, 1.78% Zn and 45 g/t Ag or 5.52% Cu eq. Two other holes, LO20-215 and LO20-219, returned 7.59 m of 10.75% Cu eq. and 3.10 m of 14.25% Cu eq, respectively.

The company’s 2021 drill program included 1,810m in 5 holes at the Lookout Zone to test known down dip extensions and conduct infill drilling. Assay results from the first two holes intersected 27 m of 1.06% Cu, 1.87 g/t Au, 1.04% Zn and 32.83 g/t Ag or 3.08% Cu eq. and 32.6 m of 1.03% Cu, 1.49 g/t Au, 0.92% Zn and 26.54 g/t Ag or 2.67% Cu eq.

Blackwolf’s shares trade under the symbol “BWCG” on the TSX Venture Exchange and last closed for trading at CA$0.56/share on Wednesday, April 20, 2022.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures

1) Stephen Hytha compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Blackwolf Copper & Gold Ltd. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Blackwolf Copper & Gold Ltd., a company mentioned in this article.

Disclosures for Couloir Capital, Blackwolf Copper & Gold Ltd., April 19, 2022

This report has been prepared by an analyst on contract with or employed by Couloir Capital Ltd. The analyst certifies that the views expressed in this report which include the rating assigned to the issuer’s shares as well as the analytical substance and tone of the report accurately reflects his or her personal views about the subject securities and the issuer. No part of his / her compensation was, is, or will be directly or indirectly related to the specific recommendations.

In the last 12 months, Couloir Capital Ltd. has been retained under a service agreement by the subject issuer.

Couloir Capital holds shares and / or warrants in the Company. The warrant have an exercise price of $0.85 and expire in June of 2022.

Couloir Capital Ltd. is affiliated Couloir Securities Ltd., an Exempt Market Dealer. They shall be referred to interchangeable as Couloir Capital herein. Part of Couloir Capital’s business is to connect mining companies with suitable investors that qualify under available regulatory exemptions. Couloir Capital, its affiliates and their respective officers, directors, representatives, researchers and members of their families may hold positions in the companies mentioned in this document and may buy and/or sell their securities. Additionally, Couloir Capital may have provided in the past, and may provide in the future, certain advisory or corporate finance services and receive financial and other incentives from issuers as consideration for the provision of such services.

Couloir Capital has prepared this document for general information purposes only. This document should not be considered a solicitation to purchase or sell securities or a recommendation to buy or sell securities. The information provided has been derived from sources believed to be accurate but cannot be guaranteed. This document does not consider the particular investment objectives, financial situations, or needs of individual recipients and other issues (e.g. prohibitions to investments due to law, jurisdiction issues, etc.) which may exist for certain persons. Recipients should rely on their own investigations and take their own professional advice before making an investment. Couloir Capital will not treat recipients of this document as clients by virtue of having viewed this document.

( Companies Mentioned: BWCG:TSX,

)

The Fed faces a real conundrum. Bond yields continue to rise. The only thing that can stop it is a central bank pivot back to rate cuts and quantitative easing. But the Fed needs to raise rates and shrink its balance sheet to fight inflation. In this episode of the Friday Gold Wrap podcast, host […]

The post The Fed’s Conundrum: SchiffGold Friday Gold Wrap April 22, 2022 first appeared on SchiffGold.