Category: Gold

Currency Devaluation Is a Feature, Not a Bug

In the world of trends, history repeats more than it rhymes. Things which were considered “in” decades ago, reemerge as cool again decades later.

From mom jeans to vinyl records and even Marxist ideology. The spotlight of today turns to things – both good and bad – once forgotten.

Inflation is the latest trend to reemerge.

But this isn’t the kind and considerate inflation which hummed quietly in the background for years. This is the face-ripping, headline-making inflation which is dominating the news cycle and causing many to ask: why are things are so much more expensive today than they were a year ago?

Our “Money” isn’t Money

While the increased CPI numbers continue to make headlines (the most recent numbers come to 8.5% annual), the common refrain from Central Bankers has been that there’s no need to panic. This has all been calculated and anticipated by the economists at the Fed.

Just like GDP is a terrible measure of economic health, CPI is a terrible measure of inflation. Not only has the basket of goods used to make the calculation changed numerous times, but the approach to the whole problem is not even wrong as we like to say.

Price increases will impact different people in different ways. An 8.5% increase doesn’t capture the reality of most people. For some, it will be higher, others lower.

Regardless, we can be certain of one thing, the broken IOU of the Federal Government, which we mistakenly call “money” today, and the system built around it, does not help.

In fact, it’s designed to hurt.

You’re supposed to lose value every year holding dollars! It’s a feature, not a bug. While the stated minimum might be 2% by their own mandate, there’s no limit to how high it can go.

The Challenges Investors Face

When the stated minimum loss on your dollar is 2%, and when it overshoots to 8.5%, how is one to make an investing strategy to save and hopefully retire one day?

Since no CD will truly outpace inflation these days many have turned to the stock market.

Certainly, you could shoot for a portfolio that earns, say 4% return every year. But this is not as easy as it sounds. The stock market looks to be overvalued by many different metrics. And as we often say, rising asset prices are not a substitute for earning a yield (despite what just about everyone else will tell you).

There are no signs that the Fed is willing to undo the damage it has already done. The total debt burden continues to grow.

If the past is any indication of the future, one can only conclude that there will be more debt ahead. The growing debt decreases yields, adds default contagion risk, and ultimately increases the risk of owning dollars, because you’re the creditor.

Those are just a few of the known risks which must be considered. Then there’s the unknown unknowns. The black swan type events like COVID cannot be predicted and are extraordinarily difficult to hedge against.

All of that to say – generating a return in this market that beats inflation is no easy task.

It’s Time for TINA to Retire, and for GITA to Take Center Stage

TINA (There Is No Alternative) continues to be a popular reason for why the stock market isn’t slowing down, despite all the risks outlined above.

We think it’s time to retire TINA in favor of GITA—Gold Interest is The Alternative.

OK, maybe it’s not the catchiest of acronyms. But, earning interest on gold is a compelling alternative in this environment, and one investors should consider.

Gold and silver have a solid track record of standing up to the dollar’s shortcomings. Year to date, the price of gold is up about 4%.

Earning interest on your gold (and silver) – possible through Monetary Metals’ program – means your ounces grow, year over year, whether the price of gold is $1,000 an ounce or $1,000,000 an ounce. A steadily increasing quantity of gold and silver together with strong history of rising prices, is a winning combination.

Good Full-Year Outlooks on These 3 Gold Cos.

Source: Adrian Day 04/20/2022

Editor of Adrian Day’s Global Analyst, Adrian Day takes a look at the first quarter results of three gold companies they think are worth watching.

The sell of Yamana Gold Inc. (YRI:TSX; AUY:NYSE; YAU:LSE) from our last bulletin would have filled at or above our limit of $6.11. We have a loss of nearly 48% on this position, bringing the average return on all closed positions to 92%. We have been trimming our list to make room for recent and future new buys.

In today’s bulletin, we look at several companies that have just released their first-quarter production numbers, which were mixed with a positive bias, and given good full-year outlooks.

Companies Had Mixed 1Q Results With Positive Outlooks

Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) reported first-quarter production, with both gold and copper output coming in below expectations. Gold production was 990,000, down from 1.2 million in the fourth quarter. The major factor for the quarter-on-quarter decline was the depletion of higher-grade stockpiles at Carlin mines.

Costs per-ounce are expected to be commensurately higher. The company reiterated that it expected the first quarter to be the lowest production quarter of the year, with steady increases throughout the year, as it maintained its annual guidance. Barrick also held an in-depth analyst presentation last week on its Reko Diq project in Pakistan. We have already discussed this project.

One point that CEO Mark Bristow emphasized is that a company does not get to choose in which country is its next tier-one asset. Having both the central and state governments as partners reduces the risk, he said, while a commitment to providing education and infrastructure in the local region would also help.

After a run-up, and with some war premium still in gold price, we rate Barrick a hold.

Record Profits at Osisko With More to Come

Osisko Gold Royalties Ltd. (OR:TSX; OR:NYSE) released preliminary first-quarter results, showing a record quarterly profit. However, even with that, cold weather slowed the ramp-up of a couple of new projects.

Looking ahead, as these projects move to full production and the revenue from the Renaud diamond mine is included (starting next month), profits will continue to grow.

As with Barrick, we rate Osisko a hold.

Gold up, but less than expected, for Fortuna; year looks solid Fortuna Silver Mines Inc. (FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE) first quarter production figures, just released, were generally positive, though mixed.

Gold output saw a 93% increase over the first quarter a year ago, though this was lower than expected; slower operations resulting from a COVID outbreak at the Lindero mine in Argentina was largely responsible for the shortfall.

Contrarywise, silver production saw a 13% decrease of the same quarter a year ago, but this was better than expected. The company re-iterated full-year guidance, saying all mines were on track to achieve their guidance. As with Barrick and Osisko, Fortuna’s stock has rallied recently, though still lags and remains good value.

Buy.

Royal Takes a Breather After Record Year

Royal Gold Inc. (RGLD:NASDAQ; RGL:TSX) released annual guidance, lower than 2021 and below market expectations, due mostly to lower expected output at the Cortez mine (Royal holds a royalty over only part of the mine); and delays in ramping up Khoemacau due to a COVID outbreak. Royal expects full production there by year end.

First-quarter actual production was, however, slightly ahead of guidance; 2021 had seen three quarters achieve record volumes. The guidance is based mostly on public disclosures of operating companies of the mines on which Royal holds royalties or streams.

With the stock up 45% this year, we are holding.

BEST BUYS this week include Vista Gold Corp. (VGZ:NYSE.MKT; VGZ:TSX), and Lara Exploration Ltd. (LRA:TSX.V). Many of the juniors on our list that we have been recommending as buys recently — Orogen Royalties, Midland, in addition to Vista and Lara — are inching up and could have breakouts in the not-to-distant future, so don’t wait too long to buy if you do not already own.

ORWELL LIVES

University of California, Irvine law professor and former “United Nations Special Rapporteur on the Promotion and Protection of the Right to Freedom of Opinion and Expression”, one David Kaye, must have had a large business card.

Anyway, this “promoter of freedom of opinion” praises Twitter for moving away from free speech and “being a more realistic custodian of speech.”

FOLLOW THE LEADER

Leader of the House, that is. House Speaker Nancy Pelosi has the reputation as the best trader of any member of congress. Now, a publicly traded ETF aims to replicate her performance. The name of the fund? The Insider Portfolio!

HAWKISH? Jerome Powell and his band of merry men and women have been portrayed as hawkish as they set about tackling inflation. What piffle!

Even if we take the most aggressive plans from Fed spokesman at face value, the fed funds rate, with two 50 basis point hikes followed by 0.25 bpt as each meeting for the next year, rates will still be more deeply negative in real terms than they were at the onset of the great inflation of the 1970s; while the balance sheet — at the shocking pace of $95 billion per month — would still, one year from now be more than twice its size in August 2019 as it reversed course and starting increasing the size of its balance sheet. Some hawks!

QUESTIONS? I welcome your investment or economic questions, which I shall attempt to answer here. Please write to globalanalyst@adrianday.com.

Originally published on April 18, 2022.

Adrian Day, London-born and a graduate of the London School of Economics, is editor of Adrian Day’s Global Analyst. His latest book is “Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks.”

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures

1) Adrian Day: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: All. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Funds controlled by Adrian Day Asset Management, which is unaffiliated with Adrian Day’s newsletter, hold shares of the following companies mentioned in this article: All. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Adrian Day’s Disclosures

Adrian Day’s Global Analyst is distributed by Investment Consultants International, Ltd., P.O. Box 6644, Annapolis, MD 21401. (410) 224-8885. Publisher: Adrian Day. Owner: Investment Consultants International Ltd. Staff may have positions in securities discussed herein. Adrian Day is also President of Global Strategic Management (GSM), a registered investment advisor, and a separate company from this service. In his capacity as GSM president, Adrian Day may be buying or selling for clients securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein. This is not a solicitation for GSM. Views herein are the editor’s opinion and not fact. All information is believed to be correct, but its accuracy cannot be guaranteed. The owner and editor are not responsible for errors and omissions. ©2021. Adrian Day’s Global Analyst. Information and advice herein are intended purely for the subscriber’s own account. Under no circumstances may any part of a Global Analyst e-mail be copied or distributed without prior written permission of the editor. Given the nature of this service, we will pursue any violations aggressively.

( Companies Mentioned: ABX:TSX; GOLD:NYSE,

OR:TSX; OR:NYSE,

RGLD:NASDAQ; RGL:TSX,

)

Source: The Critical Investor 04/20/2022

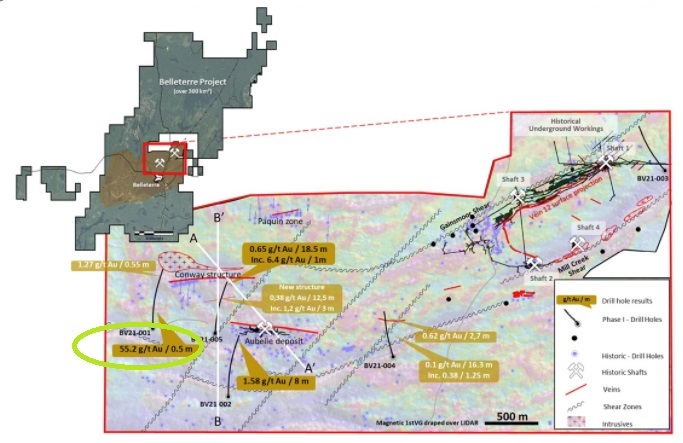

One Québec-based junior is exploring mineralized structures in and around the past-producing Belleterre gold mine. The Critical Investor discusses the company’s first drill results with management.

Amidst rising inflation levels not seen since the 1970s, a Russia-Ukraïne conflict that causes commodity market disruptions, and a Fed not sure what to do with interest rates, Vior Inc. (VIO:TSXV; VL51:FRA) remains focused on gold exploration.

The junior recently received the long-awaited results from the Phase I drill program at its flagship Belleterre gold project in Québec, situated about 100 kilometers south of Rouyn-Noranda. Management was happy with the results, highlighted by one bonanza-grade intercept of 0.5 meter grading 55.2 grams per tonne gold (55.2 g/t Au).

In addition, the company completed the first holes of a 4,000-meter Phase II drill campaign targeting the validation of high-grade feeder structures surrounding the past-producing Belleterre gold mine. The core looks encouraging to management.

Vior’s Phase I drill program consisted of five holes for a total of 3,857 meters.

Phase I was designed to test the continuity of multiple gold-bearing veins at depth and better define the geological framework of the historic Belleterre mine trend, which has seen limited historical drilling below the 200-meter level.

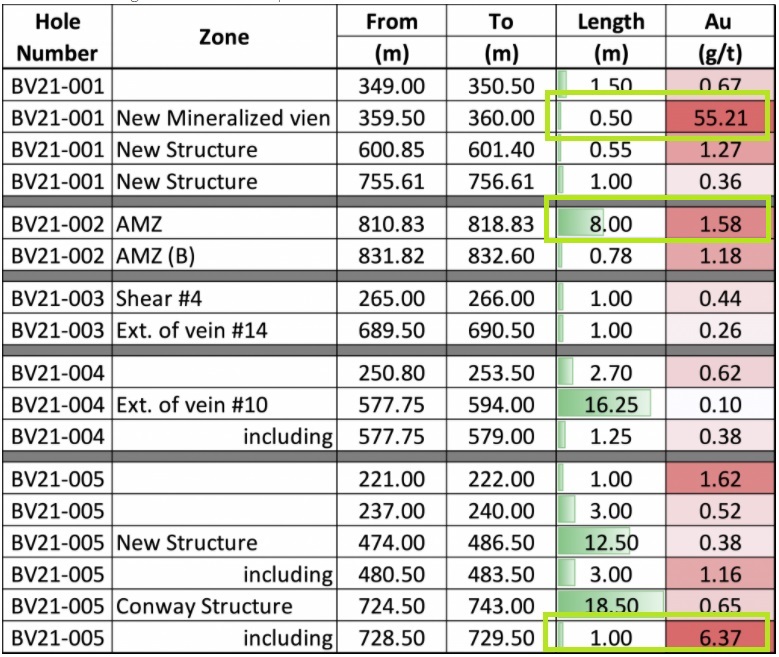

Drilling successfully intersected the down-dip projections of multiple historically mineralized vein structures and other previously unrecognized gold-bearing quartz veins and structures. The full drill results can be observed in the table below:

The highlight — and also the only economic drill result — is hole BV21-001, with 0.5 meter at 55.21 g/t Au. Although the 8 meters at 1.58 g/t Au intercept didn’t look economic, Vice-President of Exploration Laurent Eustache said it (combined with historical data) not only indicates width at depth, but could possibly vector in on nearby mineralization with width at much higher grades.

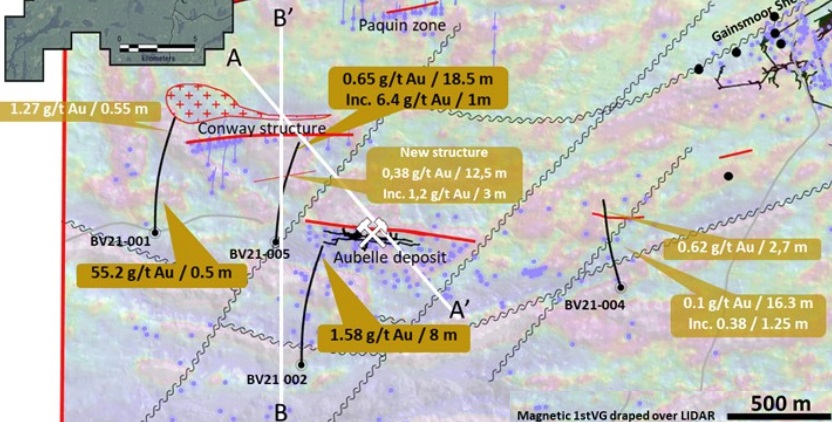

Please note that the holes were drilled under a 50-54 degree dip so the actual depth doesn’t surpass 500 meters. Three out of five holes were targeting the Conway structure and the Aubelle deposit, the trajectories of the sections A-A’ and B-B’ can be seen on this zoomed-in map:

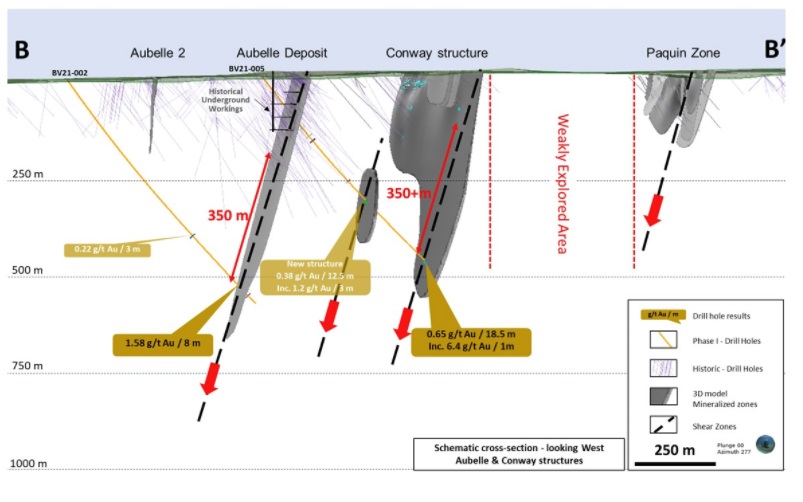

The idea was to target extensions of both mineralized structures at depth, as can be seen below in the B-B’ section:

Although the intersections weren’t spectacular or economic (as a basic threshold, results for vein systems should have a cut-off grade of at least 4 g/t Au and a width of at least 2 meters in order to be economic at current gold prices. Calculation: grams multiplied by meters should equal at least 8 at US$1,950/oz Au), they implied continuity of mineralization, and seem to provide sufficient vectors for management to be encouraged by what they drilled, as CEO Mark Fedosiewich commented:

“Five core holes were drilled in Vior’s Phase I maiden drill program, four of them returned gold intercepts, including two narrow high-grade gold and three thick intercepts of lower-grade gold-bearing quartz veins. Our team is very encouraged by the strength of the gold system, which not only shows exceptional continuity over 350 meters down-dip of the historical Aubelle Mineralized Zone (AMZ) and the Conway vein, but also suggests these zones are increasing in thickness with depth. This initial drill program was a big step towards de-risking the Belleterre gold project, and the structural data obtained from this program will be critical in helping our team vector towards higher-grade vein shoots.”

I wondered what kind of structural data could lead to higher-grade vein shoots in this case.

“The results from the Phase I drill program demonstrated some strong and well distributed gold structures at depth in the continuity of the historical high-grade quartz veins at surface. We have observed wider gold intercepts and are very encouraged by the presence of new mineralized zones between Aubelle and Conway. Evidence of down-dip continuity over 350 meters, new structures in-between, wider gold intercepts and the validation that the high-grade mineralization continues at depth all provide for a strong opportunity for more aggressive exploration,” Eustache explained.

He added: “It is an important milestone in the exploration de-risking process and now opens up the untapped exploration potential in the west part of the historical mining trend. These Archean gold deposits are not homogeneous over an entire structure and commonly develop high-grade gold shoots along structural lineaments, and this is exactly where our technical team is now concentrating.”

As most of the targeting seems to be at considerable depths, I asked if directional drilling could be helpful to limit the meters drilled and associated costs. Eustache said that there are still many targets close to the surface, but for targets at depth, there are various strategies that can be used to mitigate drilling costs, such as directional drilling and the use of wedges.

He noted that when a drill intersects good-looking gold mineralization, the company can avoid re-drilling the beginning of a hole by deviating from the mother hole with another leg, in order to investigate potential mineralization continuity in the surroundings.

Besides these first results coming from the Phase I program, Vior completed several drill holes from its 4,000-meter Phase II program.

The program targets confirmation and step-out drilling along the projected extensions of multiple past-producing gold-bearing vein structures of the historic Belleterre gold mine.

After visual inspection of the core, several vein structures appear to be intersected. Apparently the visuals justified several samples being rushed to the assay labs, so it wouldn’t surprise me if some visual gold was observed. Visual gold often generates grades above 10 g/t Au so I’m curious what results will be reported.

Management anticipates having the first of these assays back in three or four weeks. I wondered if these assays were part of the four holes targeting the 12W vein extension at depth.

“We have increased the number of holes drilled in the 12W vein extension from 4 to 6 because of the very encouraging vein structures that we encountered, and have sent some rush samples from from three of these holes to date,” Fedosiewich said.

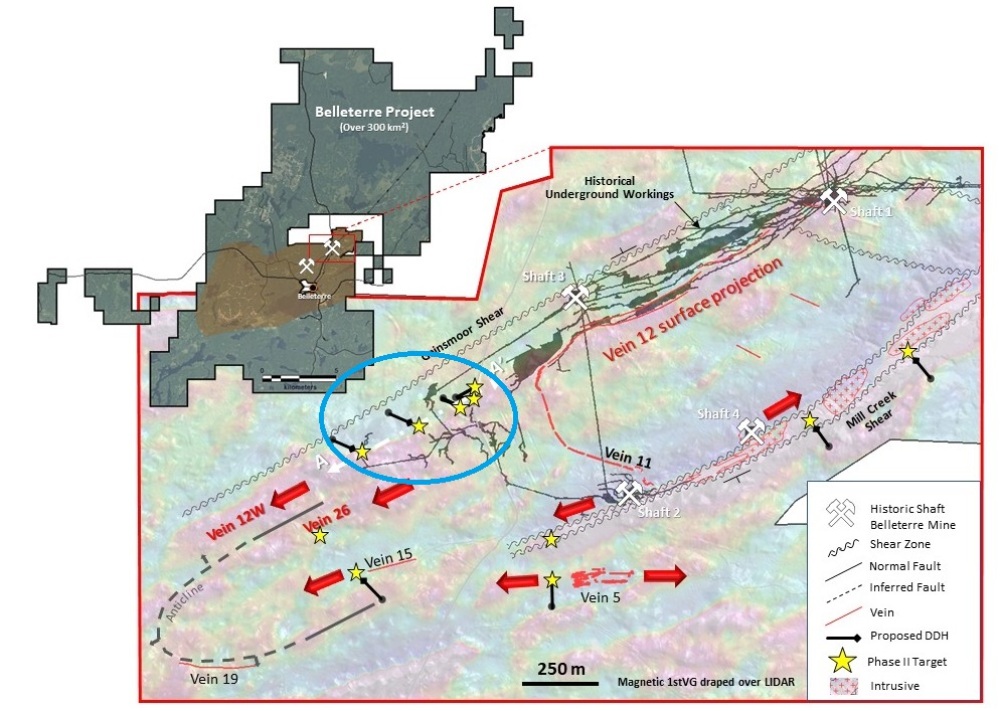

The Phase II drill program consists of 10 high-priority drill targets totalling over 4,000 meters and is focused on the former Belleterre mine concessions. These holes are outlined below:

- Six (from the previously planned four) holes are testing the southwest extension of the 12W vein (see Figure 2 and 3 below). This structure is interpreted to be the extension of the main historical high-grade mineralized horizon of the past-producing Belleterre mine, where the majority of gold production occurred. Vein 12W is also parallel to the regional Gainsmoor deformation shear zone, which is interpreted as a key structural control to mineralization for the greater Belleterre district.

- Three holes are testing the Mill Creek shear zone, which parallels the Gainsmoor deformation shear zone and hosts multiple historical high-grade veins accessed via two of the four shafts of the former Belleterre gold mine. Two of the three holes will test the northeast extension of the structure and will be located within 250 meters of shaft 4 and spaced 400 meters from each other along the structure where intrusives and associated gold mineralization have historically been recognized. The third hole, a greater than 300-meter step out from shaft 2, will test the southwest extension of the mineralized structure (see Figure 2 below).

- One final hole will test a 400-meter step out to the southwest extension of veins 15 and 26, where both zones have been historically under-explored (see Figure 2 below).

Figure 2 can be seen here, showing the Phase II drill targets and their context:

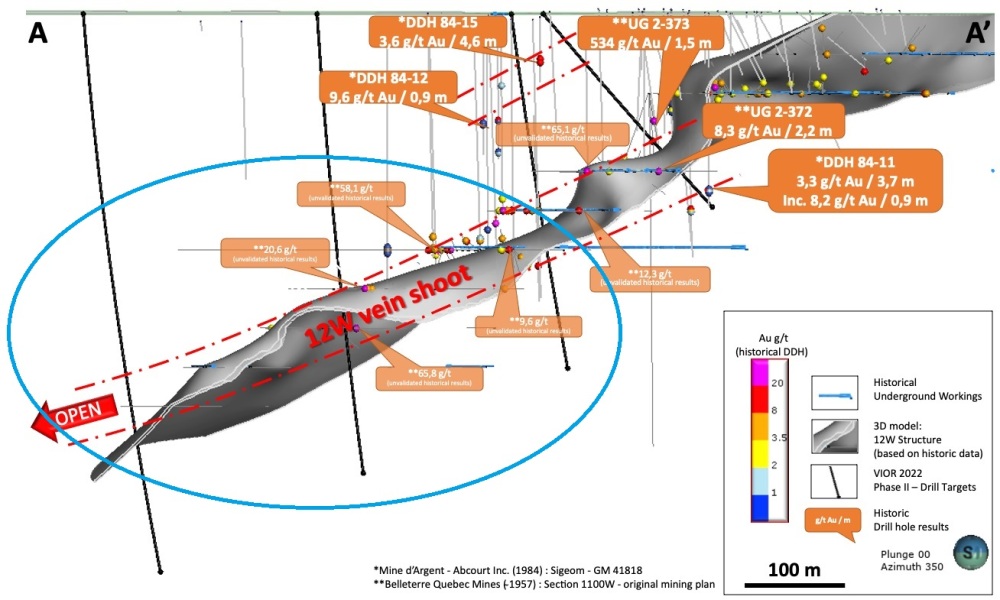

In my view, the six holes testing the Vein 12W strike to depth could be the most meaningful, as most of the mined out mineralization was produced from this very vein in the past, likely with gold left behind in the shoot.

Lots of historical drilling intercepted short, high-grade mineralization, with grades like 20.6 g/t Au, 58.1 g/t Au and 65.8 g/t Au, mostly 100 meters below the deepest mined out level, as shown in Figure 3 below (which shows historical high-grade mineralization in a three-dimensional model):

Previous drilling did not exceed 250 meters below surface — and as Belleterre has been mined to a depth of 750 meters and gold mineralization in the Greenstone Belt in Québec often continues to depths much deeper than that — management is excited by the low level of exploration at depth on the historic mine trend, as continuity of mineralization often provides a high chance at exploration success.

Therefore this could well be one of the most effective and least risky exploration strategies out there, which is exactly what you need being a cash-burning junior like Vior. I like this sound strategy very much. Let’s see what Belleterre has in store at depth.

Eustache also provided an update on Vior’s lower-priority Skyfall project.

“We are still working on the geophysical data reprocessing and are not yet ready to elaborate on our advancements. We will return to the field late spring/summer in order to gradually advance it, and will update the market with our more detailed field strategy at that time. This has everything to do with our current focus, as we will be stretched with all of our personnel at Belleterre during the ongoing exploration program over there,” Eustache said.

The current cash position of Vior sits at around CA$2.8M, and the company is cashed up at the moment to complete the current Phase II 4,000-meter drill program, as well as a summer field program at Belleterre. A big advantage for Vior is the low all-in cost of diamond drilling in Québec’s lower Abitibi region, coming in at about CA$160 per meter.

There are also significant tax incentives for flow-through capital raises dedicated to exploration in Québec. This enables the company to raise at a significant premium, thereby limiting dilution.

Management is already contemplating a Phase III drill program for Belleterre, which will need additional funding, somewhere in the near future.

Conclusion

The first batch of drill results wasn’t the most impressive, but it confirmed the validity of the strategy Vior management is pursuing: seeking gold mineralization at depth below an existing (in this case mined out) deposit, as is often the case with Greenstone Belt projects in the Abitibi in Québec. Even the lower-grade intercepts provided valuable vectoring information for Vior’s geologists to establish sufficient continuation of mineralization of veins at depth. The ongoing Phase II program, focusing on the area directly adjacent to the historic mine, predominantly producing from Vein 12W at the time, already provided the company with such visually interesting cores that it decided to rush the assays. With the results expected back from the labs within 3-4 weeks, it could be an interesting summer for Vior. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. This article is also published on www.criticalinvestor.eu. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Vior’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Vior or Vior’s management. Vior has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high-quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

The author is not a registered investment advisor, and currently has a long position in this stock. Alianza Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.alianzaminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Streetwise Reports Disclosures

1) The Critical Investor’s disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

( Companies Mentioned: VIO:TSXV; VL51:FRA,

)

Source: Streetwise Reports 04/20/2022

The upgrading of resources from Inferred to Measured and Indicated “should allow the company to demonstrate improved economics compared to [its] previous prefeasibility study,” noted a ROTH Capital Partners report.

Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT) converted a significant amount of Inferred resources to the Measured and Indicated (M&I) category with its resource estimate update for KSM’s Mitchell and East Mitchell deposits, reported ROTH Capital Partners analyst Joe Reagor in an April 14 research note. This change “should benefit the project’s economic outlook in the upcoming prefeasibility study (PFS).”

Reagor presented the previous and current resource figures for both deposits.

At Mitchell, Indicated resources now are 1,667,000,0000 (1.667 Bt), up from 1.045 Bt. Measured resources decreased to 691,700,000 tons (691.7 Mt) from 750 Mt.

As for East Mitchell, previously Snowfield, Measured resources grew to 1.012 Bt from 190 Mt. Indicated resources went down to 746 Mt from 1.18 Bt.

The M&I resources for Mitchell and East Mitchell together stand at 4.118 Bt versus the pre-update total of 3.165 Bt.

“We see the aforementioned resource increase as a significant positive for the company as it works to complete an updated PFS” that could be “a significant positive catalyst for Seabridge,” Reagor wrote.

ROTH has a Buy rating and a $30 per share price target on Seabridge. In comparison, its current share price is around $21.49.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Seabridge Gold Inc. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Disclosures for ROTH Capital Partners, LLC, Seabridge Gold Inc., April 14, 2022

ROTH makes a market in shares of Seabridge Gold, Inc. and as such, buys and sells from customers on a principal basis.

ROTH Capital Partners, LLC expects to receive or intends to seek compensation for investment banking or other business relationships with the covered companies mentioned in this report in the next three months. The material, information and facts discussed in this report other than the information regarding ROTH Capital Partners, LLC and its affiliates, are from sources believed to be reliable, but are in no way guaranteed to be complete or accurate. This report should not be used as a complete analysis of the company, industry or security discussed in the report. Additional information is available upon request. This is not, however, an offer or solicitation of the securities discussed. Any opinions or estimates in this report are subject to change without notice. An investment in the stock may involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. Additionally, an investment in the stock may involve a high

degree of risk and may not be suitable for all investors. No part of this report may be reproduced in any form without the express written permission of ROTH.

Regulation Analyst Certification (“Reg AC”): The research analyst primarily responsible for the content of this report certifies the following under Reg AC: I hereby certify that all views expressed in this report accurately reflect my personal views about the subject company or companies and its or their securities. I also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report.

( Companies Mentioned: SEA:TSX; SA:NYSE.MKT,

)

Earlier this week, the yield on the 30-year Treasury rose above 3% for the first time since April 2019 as the carnage in the bond market continues. Rising yields have put pressure on gold. The yellow metal flirted with $2,000 an ounce but has since fallen below the $1,950 resistance. Once again, investors are fixated […]

The post Don’t Miss the “Real” Story on Rising Bond Yields first appeared on SchiffGold.

Americans are earning more, but inflation is eating up their rising wages and then some. In his podcast, Peter Schiff talked about the unprecedented collapse in real incomes and how it will trickle down through the economy. Year-over-year, average hourly wages for production and nonsupervisory employees were up 6.7% in March. That sounds great – […]

The post Peter Schiff: Real Incomes Collapsing at an Unprecedented Rate first appeared on SchiffGold.