Category: Gold

The Tax Man Cometh; He Always Does

Monday was tax day. I don’t know about you, but my wallet is lighter. As always, I had to write a big check. But I took solace in the fact that I’m helping create a more civilized society! That’s the mantra, right? Taxes are the price we pay for a civilized society. That sounds like […]

The post The Tax Man Cometh; He Always Does first appeared on SchiffGold.

American consumers are spending more, getting less, and borrowing more to fund this involuntary spending spree. Retail sales in March were 7% higher than they were in the stimulus-fueled March of 2021, but thanks to inflation, they didn’t get as much bang for their buck. Seasonally adjusted, retail sales were up 0.5% month-on-month in March […]

The post Americans Spending More, Getting Less and Borrowing More to Pay for It first appeared on SchiffGold.

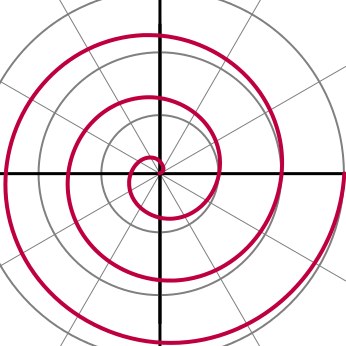

University of Michigan/Richard Curtin/4-15-2022

“There is a high probability that a self-perpetuating wage-price spiral will develop in the next few years. Households have already become less resistant to paying higher prices and firms have become less resistant to offering higher wages. Prices and wages will continue to spiral upward until the cumulative erosion in inflation-adjusted incomes causes the economy to collapse in recession.”

“There is a high probability that a self-perpetuating wage-price spiral will develop in the next few years. Households have already become less resistant to paying higher prices and firms have become less resistant to offering higher wages. Prices and wages will continue to spiral upward until the cumulative erosion in inflation-adjusted incomes causes the economy to collapse in recession.”

USAGOLD note: Curtin, who has headed up the University of Michigan’s oft-cited consumer sentiment surveys since 1976, offers a concise, easy-to-read assessment of the new inflation. His bona-fides are bolstered by having lived through and reported on the inflation of the 1970s. “Another critical characteristic of the earlier inflation era,” he says, “was frequent temporary reversals in inflation, only to be followed by new peaks. That same pattern should be expected in the months ahead.”

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.

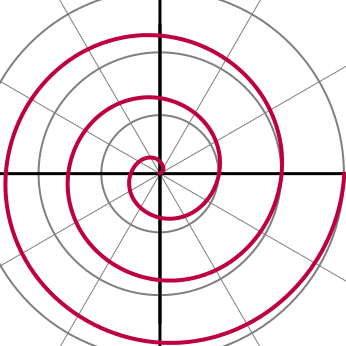

Bloomberg/Vildana Hajric and Michael P. Regan/4-16-2021

“Where we are now is a bit different. We’re in a universe of equities and bonds going down together. There’s a lot of instability. That instability is disconcerting. If they’re both going down, I need to find things that don’t behave like bonds and equities, which means commodities.” – Peter van Dooijeweert, Managing Director, Man Group

USAGOLD note: During a time of secular currency debasement, both stocks and bonds lose value simply on a purchasing-power basis if they do not keep up with or better inflation. Bonds, at present, are in particularly dire straits losing both principal and purchasing power at the same time. In a separate study posted last June, Man Group lists gold and silver as two assets to which investors fled during past episodes of inflation and were rewarded with double-digit returns. The firm also suggest acting sooner rather than later. Man Group is the world’s second largest hedge fund behind Bridgewater Associates. Bridgewater also holds a large position in commodities.

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.