Category: Gold

- Gold Miners: The Free Cash Flow Rush Seeking Alpha

- Gold upleg strengthening – MINING.COM MINING.com

- Gold mining stocks: ‘A leveraged play on the price of gold’ Capital.com

- Gold Miners Break Out to Fresh 52-Week Highs Nasdaq

- Gold In 2022 Expected to Continue to Rise Due to Increased Investor & Central Bank Demand PR Newswire

- View Full Coverage on Google News

- Gold, Silver Price Today: 10 Gram Of 24 Carat Tops Over ₹54k, Silver Hits ₹70k. Check Major Cities Rates | Mint Mint

- Gold trading at Rs 54,060 per 10 gm today; silver selling at Rs 70,000 a kg Business Standard

- Gold rate today: Yellow metal tops Rs 53,000, silver edges lower Economic Times

- Gold Price Today, March 9: Yellow metal retreats as stocks, crypto stabilise Zee News

- Gold Price Today: Gold, Silver Rates Fall Ahead Of Fed Policy Outcome NDTV Profit

- View Full Coverage on Google News

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

Another set of troubling inflation reports are generating political shockwaves and roiling financial markets.

On Tuesday, the Bureau of Labor Statistics released the latest Consumer Price Index report. The CPI topped last month’s reading to come in at an annual rate of 8.5%.

The Biden administration has been deflecting blame for the dramatic surge in costs, branding them the “Putin price hikes.” But not even the administration’s allies in the mainstream media are buying the narrative that it’s all Russia’s fault.

CBS News Anchor #1: The U.S. is at its highest level of inflation in over four decades as prices on everyday consumer goods surged in March.

CBS News Anchor #1: That’s right. The labor department says gasoline, housing and food prices are the biggest contributors to last month’s spike. According to the latest consumer price index, inflation rose 1.2% in March. That’s an 8.5% increase from the same time last year. It is the fastest annual rate of inflation since December of 1981.

CBS White House Correspondent: These prices started spiking on all sorts of goods and services before February 24th, when the Russian invasion of Ukraine began. And yet in the week since, the White House has tried to shift blame to the Russian leader saying, “Take it up with him, if you got an issue with these high gas prices.”

The truth is that America’s inflation problem didn’t originate with Russia’s invasion of Ukraine. Nor did it begin when Joe Biden was sworn into office.

A good case can be made than Biden’s big spending agenda along with his restrictions on domestic energy production have exacerbated price level increases in the economy. But inflation pressures have been building for years thanks to monetary policy that enjoys the support of the entire Washington, D.C. establishment.

Let’s not forget that it was Republicans who first installed Jerome Powell as Federal Reserve chairman. When they were in power, they cheered on loose monetary policy.

It seemed like a safe political calculation at the time. Inflation pressures had not yet produced sticker shock at grocery stores and gas stations.

But a few lone voices were warning that running up huge budget deficits, suppressing interest rates, and growing the currency supply faster than the economy would ultimately have consequences. Now those consequences are being felt by everyone.

The 8.5% reading on the CPI is only part of the story. Wholesale prices as measured by the Producer Price Index are rising at an even faster pace. On Wednesday, the PPI came in at an 11.2% annual rate.

That means higher prices are almost certain to continue moving through supply chains down to the consumer. And the real rate of inflation experienced at the consumer level is already higher than what’s being reported officially.

The CRB commodity index surged again this week and is up 35% for the year. Precious metals markets are also staging a rally here.

As of this Friday recording, gold prices are up 1.3% for the week and will close there to come in at $1,981 per ounce. The markets are closed here today for Good Friday. The silver market gained a healthy 3.6% to trade at $25.92 an ounce. Platinum is up 0.4% to trade at $1,010. And finally, palladium will end the week down 2.3% to bring prices to $2,421 per ounce.

More investors are waking up to the need to seek inflation protection through hard assets. Demand for physical bullion continues to run strong as the threats of war and currency depreciation hit conventional financial assets, although demand is down slightly from the record-breaking pace we saw in March.

The U.S. bond market is suffering its worst dip in decades. Not only are bondholders losing out to inflation, but they are also getting stuck with huge capital losses as dollar-denominated debt instruments lose market value.

Many investors had wrongly assumed that Treasuries were essentially risk-free. That’s what most financial advisors preach.

The thinking is that the government will never default with the Fed serving as the buyer of last resort. Plus, the Fed’s massive bond buying campaign had been keeping interest rates suppressed and bond values elevated.

That thinking worked out well for investors – until suddenly it didn’t anymore. The risks in owning assets that are artificially propped up is that they can come crashing down to meet reality. That’s what is happening now as the Fed plots further rate hikes and a significant reduction in bond purchases.

Treasuries are not a viable safe haven in an environment of high inflation and rising rates. Gold and silver are.

The U.S. Mint reported sales of more than 426,000 ounces in gold coins during the first quarter of 2022. That’s the highest in 23 years!

And despite the dysfunctional Mint’s failure to secure enough blanks to meet demand for silver coins, sales of silver products overall remain strong. Many investors are avoiding U.S. Mint coins such as Silver Eagles at this time due to high premiums caused by production shortages. They are opting for coins produced by other mints, privately minted rounds, or bullion bars instead.

In other news, your Money Metals legislative team helped to secure an expansion of the Alabama sales tax exemption involving gold and silver.

In 2019, Alabama originally removed sales taxes from most gold, silver, platinum, and palladium coins and bars. Legislation signed by Governor Kay Ivey now clarifies that the exemption covers all common forms of bullion, removes burdensome reporting requirements, and extends the sales tax exemption until 2028.

Alabama follows Virginia, where just days earlier Money Metals had helped secure an expansion of a sales tax exemption in that state. In Virginia, the exemption previously did not apply to transactions under $1,000, thereby singling out smaller investors for the discriminatory tax. That $1,000 threshold will vanish on July 1st, making all precious metals purchases non-taxable going forward in the Old Dominion.

Working through its Sound Money Defense League project, Money Metals Exchange backs sound money reforms like these across the United States. 41 states now fully or partially exempt gold and silver from sales taxes. That leaves 9 states and the District of Columbia that still harshly penalize citizens seeking to protect their savings against the serial devaluation of the Federal Reserve Note. Our joint efforts are seeking to reduce the number even further.

Well, that will do it for this week. Be sure to check back next Friday for our next Weekly Market Wrap Podcast. Until then this has been Mike Gleason with Money Metals Exchange, thanks for listening and have a great Easter weekend everybody.

Strong Results Continue for Junior in Mexico

Source: The Critical Investor 04/14/2022

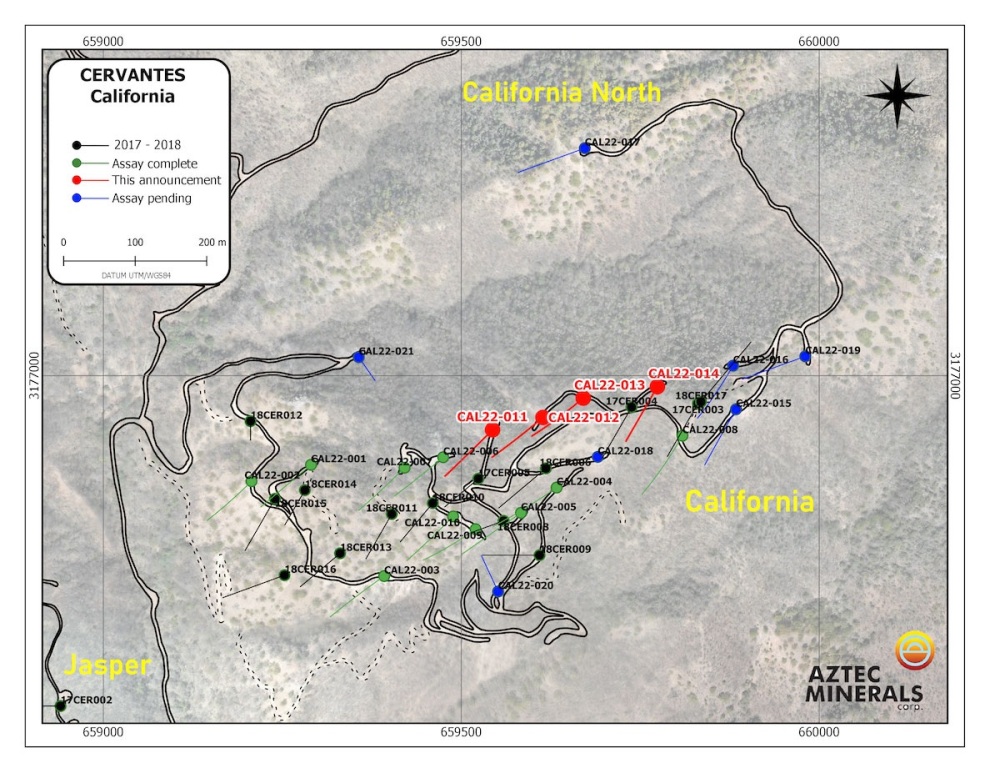

This junior miner appears to be proving up 1 Moz heap leachable gold with ease, as further step-outs from the northern center part of its Cervantes project have returned a few excellent results.

There seems to be no stopping Aztec Minerals Corp. (AZT:TSX.V; AZZTF:OTCQB) as it keeps reeling in very good drill results from the California Zone at its majority owned and operated (65%-35% JV with Kootenay Silver Inc. [KTN:TSX.V]) Cervantes gold project in Sonora, Mexico. Earlier intercepts of 167.2 meters a 1.0 g/t Au, 136.8 meters a 1.49 g/t Au, 138.3 meters at 0.58 g/t Au, and 88.4 meters at 1.1 g/t Au were already excellent, and the currently reported batch of drill results added significantly to the northern center side of the mineralized envelope. Three out of the reported four holes returned pretty economic results again, with the highlight being 152.4 meters at 0.87 g/t Au. Keep in mind most of the mineralization is oxidized, and at least in my view it seems more and more likely Aztec Minerals is surpassing the 1 Moz Au resource number now.

There seems to be no stopping Aztec Minerals Corp. (AZT:TSX.V; AZZTF:OTCQB) as it keeps reeling in very good drill results from the California Zone at its majority owned and operated (65%-35% JV with Kootenay Silver Inc. [KTN:TSX.V]) Cervantes gold project in Sonora, Mexico. Earlier intercepts of 167.2 meters a 1.0 g/t Au, 136.8 meters a 1.49 g/t Au, 138.3 meters at 0.58 g/t Au, and 88.4 meters at 1.1 g/t Au were already excellent, and the currently reported batch of drill results added significantly to the northern center side of the mineralized envelope. Three out of the reported four holes returned pretty economic results again, with the highlight being 152.4 meters at 0.87 g/t Au. Keep in mind most of the mineralization is oxidized, and at least in my view it seems more and more likely Aztec Minerals is surpassing the 1 Moz Au resource number now.

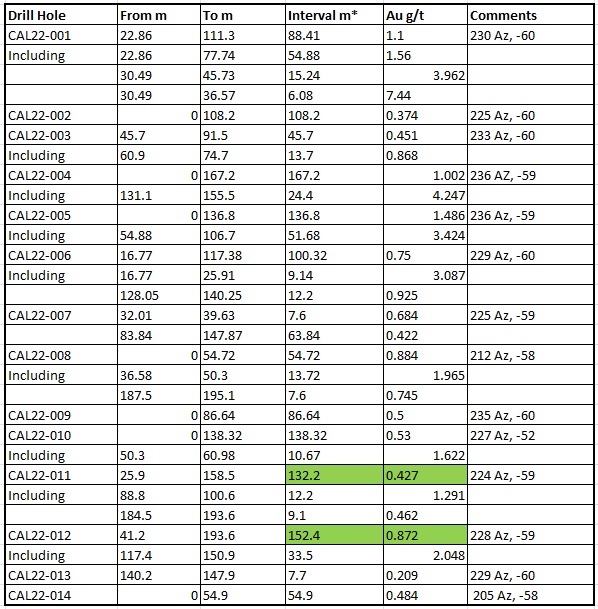

The 2021-2022 Phase 2 RC drill program aimed at the California target at Cervantes has now been completed, for a total of 26 holes with 4,649 meters drilled, and assays of 14 holes reported. Four holes were drilled at the Purisima target with limited success so these were not reported, with the balance of assays of eight holes pending. The latest highlights are:

- 0.43 g/t Au over 132.2 meters in mineralized quartz feldspar porphyry and hydrothermal breccias in CAL22-011, including 12.2 meeters of 1.29 g/t Au located at the northern edge of the central portion of the mineralized zone.

- 0.87 g/t Au over 152.4 meters in mineralized porphyries and hydrothermal breccias in CAL22-012, including 33.5 meters of 2.05 g/t Au located at the northern edge of the central portion of the mineralized zone.

- 0.48 g/t Au over 54.9 meters in mineralized porphyries and hydrothermal breccias in CAL22-014, located at the northern edge of the eastern portion of the mineralized zone.

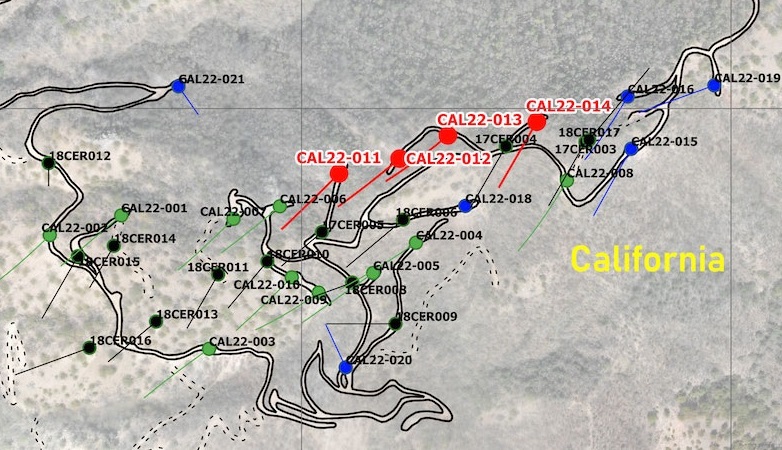

Hole CAL22-013 was strange as it was close to stellar hole CAL22-012, but had by far the lowest reported intercept so far, with 7.7 meters at 0.209 g/t Au. I don’t mind one outlier amidst a barrage of super holes, though. Keep in mind reported lengths are apparent widths, not true widths, and the observed gold mineralization appears to be widely distributed in disseminations, fractures, and veinlets within quartz-feldspar porphyry, feldspar porphyry stocks, and related hydrothermal breccias. The plan map of the California drill program can be seen here:

With a bit of zooming in on drill collars for better visibility:

The most important takeaway here is the fact that holes 011 and 012 are located about 100 meters north and east of the nearest reported holes so far. As such, they represent an entire step-out zone to the north, adding considerable tonnage according to my back-of-the-envelope calculations. One way or the other, mineralization drops off notably towards hole 013, so I will take this into account when doing my guesstimates. All reported results from the Phase 2 program so far can be found in the following table below:

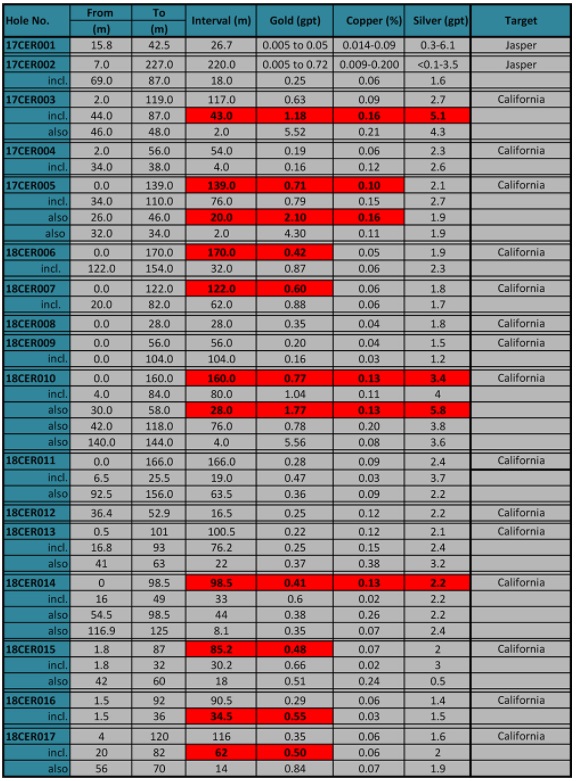

Again for your convenience, here is the table of the Phase 1 program again, provided by Aztec, for comparison:

As holes CAL22-005, 18CER005, and 18CER006 have generated results comparable to CAL22-11 and CAL22-012, I consider this zone more or less continuous. Since hole CAL22-013 hardly returned anything comparable to all other results, and nearby hole 18CER-004 had very low grade as well, it is justified to use a conservative approach when estimating and have mineralization drop off gradually from CAL22-12 to CAL22-13. Fortunately grades and lengths pick up again when going more to the east, with CAL22-14, 18CER-003, and 18CER-017. A slightly overall wider and thicker mineralized hypothetical envelope of 800x275x85x2.7=50.5 Mt can be estimated now, and using an estimated average grade of 0.6 g/t Au we would arrive at a hypothetical 974 koz Au, which is very close to the very important 1 Moz Au threshold, which would put Aztec firmly on the radar of mid tier producers. If the remaining holes return intercepts alongside my estimated average range of 85 meters at 0.60 g/t Au or better, then the envelope could increase to a hypothetical 900x300x85x2.7=61.9 Mt, generating a potential 1.195 Moz Au.

As management is contemplating a 5,000 meter follow up combination drill program of RC and diamond drilling at California in May/June, not only will the near surface heap leachable mineralization be explored, but the diamond drilling will be utilized to drill at depth for large porphyry targets, indicated by a large IP chargeability anomaly. Aztec is also carrying out channel sampling and geologic mapping of the new drill roads at the moment at California, California Norte, and Jasper, and is expanding surface sampling and mapping on the property in general in order to continue the 2021 phase 1 surface program.

As a reminder, the Cervantes oxides aren’t the only thing Aztec is looking to explore, as it is also planning a drill program for its Tombstone gold-silver oxide project (subject to a 75%-25% JV with Aztec as the operator) in Arizona for the summer, also enabling them to go after large porphyry/CRD potential at depth at both projects. A diamond drill program is planned for the summer of this year, again contingent on available funds. This upcoming Phase 3 drill program will be designed to target deeper epithermal gold-silver mineralization below the contention pit, and the coveted deep CRD silver-lead-zinc-copper-gold mineralization in Paleozoic limestones underlying the Bisbee Sediments. It seems with the California drill results continuing to confirm and exceed expectations, and likely indicating a 1 Moz Au heap leachable resource, Aztec is captivating the markets, with volumes not seen in a long time:

Share price six-month time frame (Source: tmxmoney.com)

With a gold price closing in on $2,000/oz Au again, investors seem to become more and more convinced of the Aztec Minerals story. As such, I believe there will be plenty of interest for the upcoming round of financing.

Conclusion

As an investor, you can’t really ask for more regarding an exploration junior like Aztec Minerals. Almost all assayed drill holes at the California target at Cervantes are returning pretty to very economic results, and the continuity is amazing. So far, only only two out of a combined total of 31 holes (Phase 2 and 3) weren’t economic, which is rare. According to my estimates, Aztec could be very close to the magical 1 Moz Au resource number now. Since the strip ratio is extremely low overall (maybe even less than 1), and lots of intercepts are well over 100 meters long, I expect California to be very economic. All superlatives aside, we still have to take into account that Aztec has three more opportunities for significant deposits: California at depth (porphyry), Tombstone oxides, and this second project also has a target at depth (CRD type mineralization). Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. This article is also published on www.criticalinvestor.eu. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Aztec’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Aztec or Aztec’s management. Aztec has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high-quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

The author is not a registered investment advisor, and currently has a long position in this stock. Alianza Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.alianzaminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Streetwise Reports Disclosures

1) The Critical Investor’s disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

( Companies Mentioned: AZT:TSX.V; AZZTF:OTCQB,

)

We got the CPI data for March this week. As expected, prices spiked significantly again last month. A lot of people in the mainstream are calling it “Putin’s price hike.” Friday Gold Wrap host Mike Maharrey says it would be more appropriate to call it Powell’s price hike. In this episode of the podcast, he […]

The post Powell’s Price Hike: SchiffGold Friday Gold Wrap April 15, 2022 first appeared on SchiffGold.