Category: Gold

- Gold Price Forecast: XAU/USD, nothing new here, but a breakout is nigh FXStreet

- Gold steady as inflation, Ukraine worries counter U.S. rate hike bets CNBC

- Gold prices post highest settlement in a week MarketWatch

- Gold moves higher as investors refocus on inflation and Ukraine Kitco NEWS

- Gold Prices Today: Yellow metal to hold support at Rs 51,400; traders can buy on dips Moneycontrol

- View Full Coverage on Google News

- Russia’s central bank says it will stop buying gold at a fixed price Reuters

- The Degussa CEO gives us his current assessment of the gold market Kitco NEWS

- Why Russia has put the rouble on a gold standard – but it’s unlikely to last The Conversation Indonesia

- Pegged to gold, the Russian ruble bounces back Onmanorama

- What traders think of U.S.-led efforts to block gold transactions by Russia’s central bank MarketWatch

- View Full Coverage on Google News

With Tax Day coming up and tax hike proposals coming down the pike, investors are eyeing ways to limit Uncle Sam’s take.

Last week, President Joe Biden proposed several new tax increases to help pay for his massive $5.8 trillion budget.

He wants to impose a “Billionaire Minimum Income Tax” – which would amount to a tax on wealth itself regardless of any realized gains. He also wants to raise the top tax rates on individual and corporate income.

The Biden spending bill would increase the top rate on capital gains and dividends from 20% to 39.6%. It would also exact a new “death tax” by taxing an investor’s unrealized capital gains upon passing.

All told, Biden’s plan would give the U.S. the highest tax rates in the developed world. According to an analysis by the Tax Foundation, the top combined federal/state/local marginal rate on Individual income would reach a confiscatory 57.3%.

Even if Congress balks at raising taxes in an election year, doing nothing means letting tax rates rise. The top marginal tax rate on ordinary income will automatically increase to 39.6% in 2026 when parts of the 2017 tax law expire.

Meanwhile, the inflation tax is taking a huge bite out of household budgets and eating away at investors’ real returns on financial assets.

Bloomberg estimates that inflation will cost the average American family $5,000 more this year. And it will wipe trillions of dollars in value from equity and bond markets, which have been priced for low inflation to persist.

The most essential asset class to own for inflation protection is physical precious metals. Gold and silver bullion is also tax efficient compared to income-generating assets such as bonds and real estate investment trusts.

You have no income tax liability on a gold or silver coin unless and until you decide to sell and realize gains.

Unfortunately, the tax code arbitrarily treats capital gains on all forms of physical precious as “collectibles.” The IRS taxes collectibles at a rate of 28% instead of the lower rates that apply to long-term gains on paper assets such as stocks.

Still, physical precious metals have tax advantages compared to stocks, bonds, mutual funds, and exchange-traded products (including those that purport to track metals markets). These financial instruments can issue taxable distributions that you literally can’t refuse.

Except in very rare circumstances, responsible coin dealers file no tax forms with the IRS or transaction reports with other government agencies. Unlike paper assets, bullion can be held privately.

This isn’t to suggest that you should avoid reporting any capital gains on bullion that you are legally required to report! Fortunately, there are legal ways to shelter your gold and silver gains from taxation.

One of the most straightforward and effective ways to shield metals’ gains from taxes is through an IRA.

Stock brokers and financial advisors aren’t necessarily keen on informing their clients of this opportunity. But in fact, you can hold certain non-financial tangible assets – including IRS-approved gold, silver, platinum, and palladium bullion products – inside a Self-Directed IRA.

Your bullion will typically be held on your behalf by a custodian (this article goes over the nuts and bolts of selecting an IRA custodian and funding the account).

Within the IRA, you can sell some or all of your holdings, trade one metal for another, or even switch the account back to conventional financial assets with your bank or brokerage house – all without tax consequences until you actually take withdrawals.

When it comes time to take distributions, you can do so by taking possession of your actual IRA coins, if you wish.

It is still possible to contribute to an IRA for tax year 2021 before the filing deadline. The maximum individual contribution to a traditional or Roth IRA is $6,000 ($7,000 if over age 50). For tax year 2022, the contribution limits are the same.

The Tax Code is complex and ever-changing. Therefore, investors should seek out the advice of a tax professional before acting on any information contained in this article.

It is especially important that taxpayers not take any chances with the accuracy of their returns given that the Internal Revenue Service is beefing up its enforcement machinery. The agency plans to hire 5,000 new employees this year and additional 5,000 next year.

The Biden administration and Congress aim to raise revenues to try to close enormous budget deficits by any means necessary.

It’s not just billionaires they want to squeeze. The policies of Washington, D.C. will end up squeezing everyone, whether through the tax code itself or the sneaky inflation tax that hits the middle class and working class hardest.

Holding hard money is a double-play in terms of protecting against the twin threats of a falling currency and a rising revenue appetite from Joe Biden’s IRS.

Source: Clive Maund 04/05/2022

The miner is developing the historical Homestake Mining properties in South Dakota.

Dakota Gold Corp. (DC:NYSE), formerly the rather clumsily named Dakota Territory Resource Corp., was the subject of an email alert sent out before the open this morning about it and Red Cat Holdings, with the relevant parts of it reading as follows…

“There’s big news on 2 of our stocks. Dakota Territory Resource Corp, DTRC, $5.00, that we haven’t looked at for a while, ceased trading at the end of March pending its listing on the NYSE, and will start trading on this market this morning under the new and less clumsy name Dakota Gold. With its new found respectability, especially as its price is high enough to attract institutional interest, it is likely to catch up with the big gold’s rallies of recent weeks, made more likely by what looks like a bull Flag / Pennant forming since mid-February. So we stay long and it is rated a strong buy here.

There is insufficient time to write these 2 stocks up properly before the opening this morning. So this email alert is intended to give you an early “heads up” before trading starts. Articles on both of them will be posted later on the site.”

Those of you who bought near to the open have done well, as it opened little changed from when it was halted on 30th March pending its NYSE listing, but is now up 23% on the day at the time of writing after having risen much higher.

Dakota is a stock that we have followed for quite a while and we profited from its big runup in early to mid-2021. After its rather dramatic peak in the summer of 2021 that can be seen on its 15-month chart below, it initially reacted and then ran off into a long horizontal trading range that continued right up to today.

Early in February it ran sharply up to resistance at the top of the trading range and then reacted back to settle into a Flag/Pennant consolidation pattern which implied that it was setting up to break strongly higher, as has happened this morning. Two additional positive factors that we can observe on this chart are the way that the Accumulation line has improved over the past couple of months and the 200-day moving average catching up to the price after being way below it for much of last year, which partly explains why the stock stalled out for so long.

In addition to showing recent action in much more detail, the 6-month chart reveals various additional beneficial factors in play. One is the upside volume build up of the past couple of weeks, another is the MACD crossing its moving average in the recent past after almost fully unwinding its earlier overbought condition. Lastly, there was bullish cross of the moving averages a couple of weeks ago.

There are several big reasons why Dakota Gold is considered to be one of the top investments in the sector. Probably the biggest is that the company is developing the old Homestake Mining properties in South Dakota, which were prodigiously productive even using the relatively basic mining techniques of the day, about 90 years ago – now of course they are much more sophisticated. Another, as already mentioned, is that the stock will attract big investors in the sector as it now trades on the NYSE. Finally, as the world moves towards hyperinflation it will be impossible for any manipulative or repressive forces to prevent gold and all gold investments soaring. So Dakota Gold has everything going for it.

We last bought Dakota Gold on the 3rd February at a pretty good price of about $4.50, and if you heeded this morning’s email alert you may have bought it or bought it again early this morning at something above $5.02, so we are already well up. No further action is required on our part save to say that positions may be added to or new purchases made on dips, such as we are now seeing as the price has just backed off significantly from this morning’s highs into buying territory.

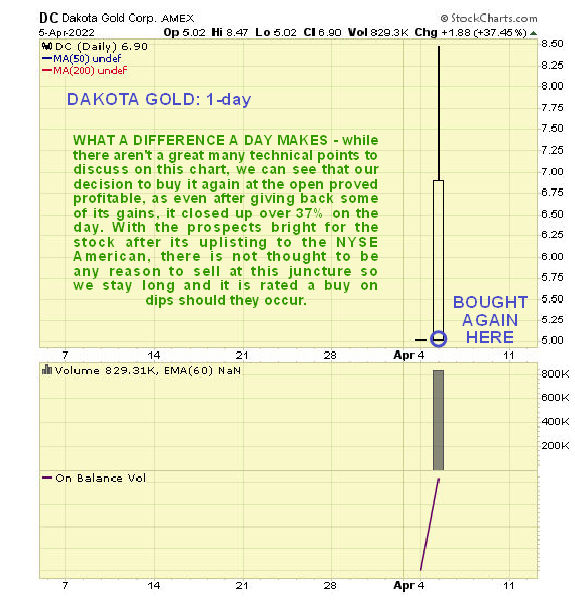

Postscript added the following morning (6th). The new Dakota Gold had a very good day yesterday, closing up 37% on the day after having risen higher still intraday, as we can see on its 1-day chart for yesterday below. If you bought soon after the open as suggested, you will have done well. Given the great prospects for the company there is thought to be little reason to sell at this juncture.

Dakota Gold Corp. website

Dakota Gold Corp., DC, trading at $6.19 at 11.58 am EDT on 5th April 2022.

Originally posted on CliveMaund.com at 12.45 pm EDT on 5th April 2022.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years’ experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures

1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. CliveMaund.com disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Dakota Gold, a company mentioned in this article.

Charts provided by the author.

CliveMaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

( Companies Mentioned: DC:NYSE,

)