Category: Gold

Oil, the Ruble, and Gold Walk into a Bar…

Unpacking the Narrative of how Russia is going to change the global monetary system.

There is a Narrative about Russia and how it will change the monetary system. Many analysts in the gold community are promoting this story. There’s just one problem with this Narrative. It is like how Michael Crighton described the Gell-Mann Amnesia Effect, stating that the newspaper is full of stories explaining how “wet streets cause rain.”

The basic premise of this Narrative is that Russia will create a new gold standard, the dollar will crash, and of course gold will go to the moon.

Author Terry Goodkind, in his Sword of Truth series, wrote about a set of Wizard’s Rules. The Wizards First Rule says that people will believe something because they want to believe it’s true, or because they’re afraid it might be true.

The gold community certainly longs for gold to go up to $100,000. And anyone in the West is afraid of the collapse of America—or at least Pax Americana. That’s why the story of the impending collapse of the dollar and rise of the gold-backed ruble resonates so broadly. It appeals to both greed and fear.

Our goal in writing this article is to help people understand why this Narrative offers a false hope/fear.

How is the Ruble Doing?

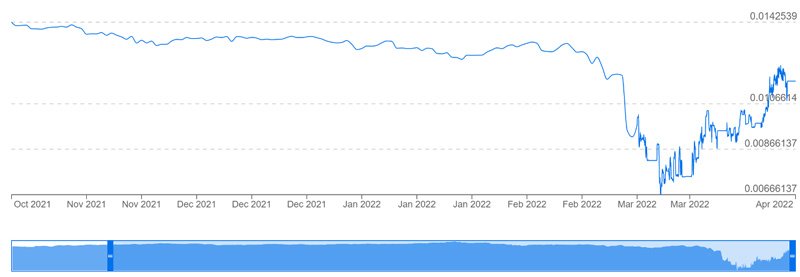

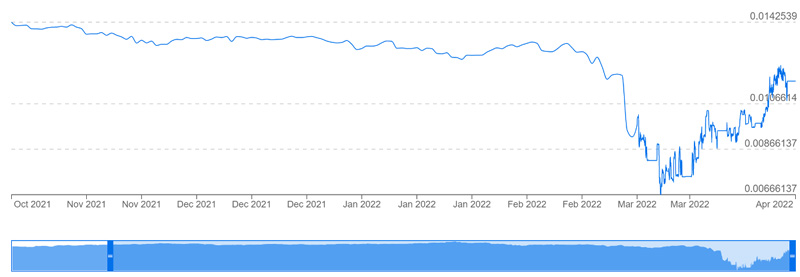

The Narrative starts with the fact that Russia’s central bank is now buying gold from Russian commercial banks, at a price of 5,000 rubles per gram. 5,000 rubles is worth $58.31 as of market close on Friday, April 1. Let’s pause here to look at a graph of the price of the ruble.

Last October, the ruble was around 1.4 cents (yes, it was a toilet paper currency even long before the Ukraine war). It slowly slid to 1.3 cents—which is a loss of 9%, by the way! Then it crashed to 0.66 cents on March 7. Since then, it has bounced to a high of 1.2 cents before leveling back down to 1.1 cents. Some analysts are trumpeting that it recovered its previous level. As of market close on Friday April 1, it had not.

Forced Discounts and Bribing Customers

Anyways, back to the Narrative. In global markets, a gram of gold is worth $61.89 (as of Friday’s close). In other words, the central bank is paying 6% below the market price (the discount was greater when this was announced).

We have looked for a primary source, but cannot tell if Russia is forcing the banks to sell at a discount—i.e. looting them—or if he is helping them by providing a bid. The latter is plausible, as everything Russia exports must go at a discount in order to lure buyers to risk sanctions by the US government.

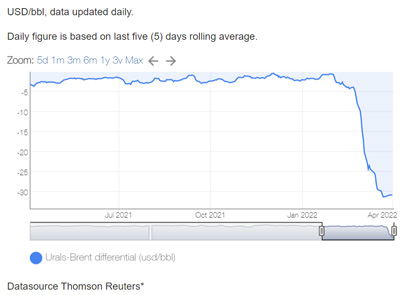

For example, Russia is selling its oil at a big discount. Here is a chart (from Neste) showing the spread between the European standard crude oil Brent and Russian Urals oil.

Russia has no choice but to sell its oil

at about $30 below the market price.

We are already seeing one of the flaws in the Narrative that Russia is powerful enough to force the world change its monetary system. It is not even powerful enough to sell its oil without bribing its customers!

Russia is in a Bind

Now we come to Russia’s gold. Here, it has an additional problem. Russian gold is no longer accredited as “good delivery.” We could not find data on the magnitude of the discount on its gold, but for the same reasons as with oil, it must be substantial to induce buyers to take the risks.

In other words, Russia is in a bind. Its GDP in 2019 (we selected this year, because it is prior to the covid lockdowns) was $1.7 trillion. And its exports that year were $427 billion. In other words, exports were 25% of its GDP.< /p>

We are not experts on the Russian economy, but we would guess that a sudden 30% haircut imposed on a quarter of its economy would have a substantial impact.

We are not saying that the world—especially Europe—would not be devastated if Russia shut off the supply of oil and natural gas. German industry is already planning for the contingency of shutting down manufacturing operations. We are saying that it would be equally, if not more devastating, to Russia.

Picture each side having a firm grip on the other’s throat (we could think of another part of the anatomy which is less appropriate to mention in polite company).

What Makes a Reserve Currency?

Now we get to how “wet streets cause rain”. The US dollar is the world’s reserve currency—so the Narrative goes—because oil is priced in dollars.

We must firmly insist that rain causes wet streets, and reserve currency status causes oil (and everything else) to be priced in dollars.

So, what does the concept of priced in mean, anyways? Does it merely mean which currency is remitted? Or which is used to determine the price, which is used in economic calculation? Let us drill deeper into this distinction because it is an important one.

Remittance

Suppose a neighborhood kid offers to mow a homeowner’s lawn. He says that as payment, he wants a box of ice cream sandwiches. This box sells for about $8, which happens to be the minimum wage in the homeowner’s state. Cutting the grass will take about an hour. The deal seems fair to the homeowner, so he hires the kid.

Everyone can see that the price of lawn-mowing service is not 16 ice cream sandwiches. The ice cream sandwich has not suddenly taken on any monetary characteristics. It is not a new unit of account. It is not a threat to dollar hegemony. The ice cream sandwich is not really how the bargain was offered, and certainly not how it was accepted.

Quite the opposite. The value of the service offered by the kid is determined in the prevailing market for labor. It’s $8. Yes, dollars. The parties simply agreed on remittance of something else—something worth $8.

Russia’s oil is worth a number of dollars a barrel. This number is determined in global markets, which use the dollar in their economic calculations. And, as we saw, oil from Russia, is discounted around 30% from this. The discount too is determined by an economic calculation in dollars.

In the end, Russia can demand payment in ice cream sandwiches. Or rubles, or even gold. And it will get the dollar value of Brent crude, which is $104.75. Minus the current discount, also calculated in dollars, of about $30.75.

In other words, Russia will get $74. It can get this remitted as ice cream sandwiches, or rubles. But either way, it will get $74 worth of those things.

Russia has no power to alter the numeraire used in these calculations. You would find it easier to persuade 7.5 billion people to all move to New York City this year. Or to get the entire Internet to switch to a new protocol.

The Desire for Rubles

It also has no power to make people, or governments, increase their desire to hold rubles. If they are obliged to pay Russia $1 million worth of rubles for delivery of oil, then they will hold a million dollars until a millisecond before remitting payment, and then buy however many rubles trade for a million dollars at that moment. The value of the ruble will be no different than if they remitted dollars, and it was a Russian bank doing the buying of the rubles.

This is a very important point. It does not matter if the dollars are traded for rubles immediately prior to the remittance, or immediately after. It does not matter if the party doing the trading is a European or a Russian bank.

Here is an article from outside the goldbug community, India. It notes that for Indian exporters to be paid in rubles, they would rely on an Indian banking system solution that would fix the rupee to the ruble (the article correctly notes that the fix would have to be dynamic).

What currency would they use to determine the proper exchange ratio between rupees and rubles? The US dollar. And what is driving these Indian companies to seek this solution? Fear of default by their Russian customers.

Russia’s Impaired Ability

So, what is Russia trying to accomplish, in demanding that Europe remit rubles for Russian oil?

The Narrative asserts that this forces buyers of Russian oil to first buy rubles. But it doesn’t work this way. To see why, let’s return to the story of the enterprising lawnmowing kid. Is he pushing up the price of ice cream sandwiches, by making the homeowner buy ice cream sandwiches?

No. What would have happened, if the homeowner paid him the standard $8, is that the kid would have gone to the store to buy the ice cream sandwiches himself. So why would he insist that the homeowner do this for him?

The kid is too young to drive to the store himself, and perhaps his parents won’t drive him (or don’t allow him to eat so much ice cream). He is getting the homeowner to do something for him, that he cannot do for himself (or would cost him much more, such as taking an Uber).

Sanctions have impaired Russia’s ability to trade the dollars for rubles in the market. Russia is (partially) locked out of the market. So, it gets Europe to do that trade for them.

The normal lawnmowing case is the homeowner pays the kid dollars. Then the kid trades the dollars for ice cream sandwiches. The negotiated case is the homeowner trades the dollars for ice cream sandwiches and remits them to the kid.

The normal oil case is Europe pays Russia dollars. Then Russia trades the dollars for rubles. The negotiated case is Europe trades the dollars for rubles and remits them to Russia.

In order for the ruble to rise against the dollar, people would have to change their preference from holding dollars to holding rubles. Is this happening, or likely to happen? We will drill deeper into this question, in Part II of this article.

Source: Streetwise Reports 04/04/2022

The sector fared well during Q1/22, but a repeat performance in Q2/22 is not a guarantee due to the uncertainty regarding several macroeconomic factors, noted a Noble Capital Markets report.

Metals miners and metals prices had a good Q1/22, but expected headwinds and the uncertainty about market-impacting factors could affect how they perform during this quarter, Q2/22, reported Noble Capital Markets analyst Mark Reichman in an April 4 research note.

“Despite a cautious near-term outlook, precious and industrial metals prices could hold up relatively well despite near-term headwinds,” Reichman wrote.

Accordingly, the analyst recommended investors consider putting money into the mining sector and particularly junior companies over the seniors. This is because juniors have more attractive valuations and greater potential for being acquired.

“Despite a cautious near-term outlook, precious and industrial metals prices could hold up relatively well despite near-term headwinds.”

—Noble Capital Markets analyst Mark Reichman

In his Q1/22 review and near-term outlook report, Reichman highlighted that metals mining companies fared better during 2022’s first quarter than the overall market did. This was evidenced through performance of three exchange-traded funds (ETFs).

One was the XME, or SPDR S&P Metals & Mining ETF, which rose 36.9%. The GDX, or VanEck Vectors Gold Miners ETF, went up 19.7%. The GDXJ, or Junior Gold Miners ETF, increased 11.8%. Similarly, the futures prices of gold, silver, copper, and zinc futures prices also increased, by 6.5%, 7.5%, 6.7% and 20.9%, respectively.

In contrast, the Standard & Poor’s 500, representing the broader market, dropped 4.9% during Q1/22.

During Q1/22, factors that impacted metals and metals miners included a U.S. dollar value increase (2.4%, according to the U.S. Dollar Index), sustained high consumer and core inflation as well as constrained metals supplies constraints and exacerbated inflation, both resulting from the war on Ukraine.

Moving forward, all three factors remain in play for precious and industrials metals, and are shrouded in uncertainty. Another unknown is whether the Federal Reserve will take further action to reduce inflation.

Reichman wrote that continued inflation and negative interest rates could bode well for gold, for example. However, an interest rate hike by the Fed could hamper the yellow metal’s performance.

“Moreover, precious metals may be viewed as insurance against expected market volatility and economic uncertainty,” added Reichman.

The outlook for industrial metals is similarly cloudy, Reichman noted. Continuing inflation and supply shortages could weaken demand and growth, on one hand. A global recession would hurt the sector. On the other hand, supply improvements, more capital spending and inventory restocking could support metals prices.

Though industrial metals and their miners might not do as well in the near term, Noble Capital remains bullish on them. “We believe the long-term investment case for owning industrial metals mining companies remains favorable,” wrote Reichman.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Disclosures For Noble Capital Markets Inc., April 4, 2022

All statements or opinions contained herein that include the words “we”, “us”, or “our” are solely the responsibility of Noble Capital Markets, Inc.(“Noble”) and do not necessarily reflect statements or opinions expressed by any person or party affiliated with the company mentioned in this report. Any opinions expressed herein are subject to change without notice. All information provided herein is based on public and non-public information believed to be accurate and reliable, but is not necessarily complete and cannot be guaranteed. No judgment is hereby expressed or should be implied as to the suitability of any security described herein for any specific investor or any specific investment portfolio. The decision to undertake any investment regarding the security mentioned herein should be made by each reader of this publication based on its own appraisal of the implications and risks of such decision.

This publication is intended for information purposes only and shall not constitute an offer to buy/sell or the solicitation of an offer to buy/sell any security mentioned in this report, nor shall there be any sale of the security herein in any state or domicile in which said offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or domicile. This publication and all information, comments, statements or opinions contained or expressed herein are applicable only as of the date of this publication and subject to change without prior notice. Past performance is not indicative of future results. Noble accepts no liability for loss arising from the use of the material in this report, except that this exclusion of liability does not apply to the extent that such liability arises under specific statutes or regulations applicable to Noble. This report is not to be relied upon as a substitute for the exercising of independent judgement. Noble may have published, and may in the future publish, other research reports that are inconsistent with, and reach different conclusions from, the information provided in this report. Noble is under no obligation to bring to the attention of any recipient of this report, any past or future reports. Investors should only consider this report as single factor in making an investment decision.

IMPORTANT DISCLOSURES: This publication is confidential for the information of the addressee only and may not be reproduced in whole or in part, copies circulated, or discussed to another party, without the written consent of Noble Capital Markets, Inc. (“Noble”). Noble seeks to update its research as appropriate, but may be unable to do so based upon various regulatory constraints. Research reports are not published at regular intervals; publication times and dates are based upon the analyst’s judgement. Noble professionals including traders, salespeople and investment bankers may provide written or oral market commentary, or discuss trading strategies to Noble clients and the Noble proprietary trading desk that reflect opinions that are contrary to the opinions expressed in this research report.

The majority of companies that Noble follows are emerging growth companies. Securities in these companies involve a higher degree of risk and more volatility than the securities of more established companies. The securities discussed in Noble research reports may not be suitable for some investors and as such, investors must take extra care and make their own determination of the appropriateness of an investment based upon risk tolerance, investment objectives and financial status.

Company Specific Disclosures: The following disclosures relate to relationships between Noble and the company (the “Company”) covered by the Noble Research Division and referred to in this research report.

Noble is not a market maker in any of the companies mentioned in this report. Noble intends to seek compensation for investment banking services and non-investment banking services (securities and non-securities related) with any or all of the companies mentioned in this report within the next 3 months.

ANALYST CREDENTIALS, PROFESSIONAL DESIGNATIONS, AND EXPERIENCE: Senior Equity Analyst focusing on Basic Materials & Mining. 20 years of experience in equity research. BA in Business Administration from Westminster College. MBA with a Finance concentration from the University of Missouri. MA in International Affairs from Washington University in St. Louis. Named WSJ ‘Best on the Street’ Analyst and Forbes/StarMine’s “Best Brokerage Analyst.”

FINRA licenses 7, 24, 63, 87

WARNING: This report is intended to provide general securities advice, and does not purport to make any recommendation that any securities transaction is appropriate for any recipient particular investment objectives, financial situation or particular needs. Prior to making any investment decision, recipients should assess, or seek advice from their advisors, on whether any relevant part of this report is appropriate to their individual circumstances. If a recipient was referred to Noble Capital Markets, Inc. by an investment advisor, that advisor may receive a benefit in respect of transactions effected on the recipients behalf, details of which will be available on request in regard to a transaction that involves a personalized securities recommendation. Additional risks associated with the security mentioned in this report that might impede achievement of the target can be found in its initial report issued by Noble Capital Markets, Inc. This report may not be reproduced, distributed or published for any purpose unless authorized by Noble Capital Markets, Inc.

RESEARCH ANALYST CERTIFICATION: Independence Of View: All views expressed in this report accurately reflect my personal views about the subject securities or issuers.

Receipt of Compensation: No part of my compensation was, is, or will be directly or indirectly related to any specific recommendations or views expressed in the public appearance and/or research report.

Ownership and Material Conflicts of Interest: Neither I nor anybody in my household has a financial interest in the securities of the subject company or any other company mentioned in this report.

Most people seem to think that tighter monetary policy will bring on a recession, but they believe that it will solve the inflation problem. In his podcast, Peter Schiff explained why they’ve got it half right. We are heading toward a recession, but it’s not going to solve the inflation problem. In reality, we’re heading […]

The post Peter Schiff: America Is Heading for Stagflation first appeared on SchiffGold.

Despite the biggest increase in average hourly wages for production and non-supervisory workers in 40 years, these people are actually worse off. Why? Rising prices are eating up their income gains. Year-over-year, average hourly wages for production and nonsupervisory employees were up 6.7% in March, according to Bureau of Labor Statistics data. Other than the […]

The post Your Rising Wages May Make You Feel Better — Until You Try to Buy Stuff first appeared on SchiffGold.