- AMC, Hycroft Mining Shares Rise After Report of Hycroft Share Sale MarketWatch

- Is AMC’s $28M Stake in Gold Mining Company a Smart Move? The Motley Fool

- AMC’s Hycroft Deal Triggers Meme-Stock Gold Rush The Wall Street Journal

- AMC Entertainment Might Launch “There’s Gold in Them Thar Hills” NFTs as CEO Adam Aron Doubles Down on His Hycroft Mining Investment Thesis Wccftech

- Movie Theater Chain AMC Invests In Gold, Silver Miner JCK

- View Full Coverage on Google News

Category: Gold

- Bullion groups launch gold bar database to thwart fraud WTVB

- Gold Industry Embraces Blockchain to Secure Its Supply Chain Bloomberg

- Gold industry taps blockchain for supply chain management and fraud prevention Cointelegraph

- Gold Industry Looks to Blockchain to Make Supply Chains More Transparent — Update MarketWatch

- Gold Industry Tests Tracking Supply Chain With Blockchain Technology Markets Insider

- View Full Coverage on Google News

- Russia sets fixed gold price as it restarts official bullion purchases Kitco NEWS

- Breakingviews – Russia’s gold reserves buy Putin a few options Reuters.com

- Russia just made a case for owning gold — and nobody noticed MarketWatch

- US, allies target Russian transactions in gold Journal Record

- Hard to See Right Now Whether Russia Using Gold to Evade Sanctions: UBS Markets Insider

- View Full Coverage on Google News

Currency Wars Center on Russia’s Gold

In response to Russia’s war on Ukraine, the U.S. and G-7 countries have launched a currency war against the Kremlin. Sanctions imposed on the Russian central bank have effectively blacklisted the country from the U.S. dollar-dominated global financial system.

Now the Biden administration is attempting to prevent Russia from using gold as an alternative medium of exchange.

Last week, the Treasury Department declared, “US persons are prohibited from engaging in any transaction – including gold-related transactions – involving the Central Bank of the Russian Federation, the National Wealth Fund of the Russian Federation or the Ministry of Finance of the Russian Federation.”

In recent years, Russia has significantly increased its gold reserves.

It currently possesses the fifth largest stockpile in the world, worth an estimated $140 billion.

U.S. officials want to prevent Russia from selling gold in order to fund its war machine. But Russian officials seem more inclined to take gold in lieu of dollars as payment in international trade.

Russia declared that “unfriendly” countries must now pay for Russian gas and other products in rubles or in gold – a move that boosted the value of the beleaguered currency.

Moscow is even considering adopting Bitcoin as an alternative means of payment in international trade, according to reports.

“If they want to buy, let them pay either in hard currency, and this is gold for us, or pay as it is convenient for us, this is the national currency [Russian rubles],” said Pavel Zavalny, chairman of the Russian Duma Committee on Energy.

Zavalny is also urging China to de-dollarize and switch to settlements in gold, rubles, or yuan.

China, India, and the Far East are pivotal players in the global currency wars. If they opt out of the increasingly expansive U.S. sanctions regime, a new bipolar monetary order could emerge.

Global confidence in the Federal Reserve Note “dollar” as world reserve currency is rapidly eroding.

If the U.S. can suddenly declare that it is freezing the dollar assets of a major foreign central bank and banning their gold from circulation, a lot of other countries will be worried they might be next to get blacklisted. They will naturally want to have a Plan B in place.

It is impossible to predict exactly how the erupting currency wars will reshape the global monetary system.

One possibility is that gold will play a much more prominent role than before.

Ever since the U.S. rescinded gold convertibility in 1971, the fiat “dollar standard” has been in force – backed implicitly by oil and the promise of Saudi Arabia and other OPEC producers to accept dollars as payment.

The petro-dollar is now at risk of losing its hegemony. While the U.S. has historically been able to use its financial and military might to keep Middle Eastern countries in line, it may be overplaying its hand in trying to force the entire world to shun Russia.

As with waging any war, however justified it may be, there will be blowback. The overt weaponization of the financial system against Russia will result in counterattacks directed at the Federal Reserve Note.

A currency’s value cannot be maintained through force alone. Plenty of dictatorships throughout history have gone down the economically ruinous path of hyperinflation.

America’s recent inflation spike may be an ominous sign of what’s to come.

Got gold (and silver)?

Source: The Critical Investor 03/27/2022

This junior miner, after repeatedly reporting strong drill results, could be well on its way to delineating an estimated 800-1,100koz Au oxide gold resource near surface at its project in Sonora, Mexico.

After drilling a stellar intercept of 136.8 meters at 1.49 g/t Au three weeks ago from the California Zone at their majority owned and operated (65/35 JV with Kootenay Silver) Cervantes gold project in Sonora, Mexico, Aztec Minerals Corp. (AZT:TSX.V; AZZTF:OTCQB) continues to publish more goodies, this time somewhat more normal highlights of 138.3 meters at 0.58 g/t Au and 54.7 meters at 0.88 g/t Au. Keep in mind most of the mineralization is oxidized, as Aztec is drilling the oxide cap of a porphyry target model, and anything over 0.40-0.45 g/t Au oxidized with a decent strip ratio could be pretty economic at gold prices over $1,500/oz Au. Combined with other results reported in February like the 88.4 meters at 1.1 g/t Au and 167.2 meters at 1.0g/t Au intercepts, Aztec seems to be firmly on its way to a significant maiden resource later this year.

It seems the 2021-2022 Phase 2 drill program aimed at the California target at Cervantes is going as planned, as all assays coming back from the labs deliver strong results. The program itself has been completed now, with 26 RC holes totaling 4,649m drilled, assays of 10 holes reported, four holes were drilled at the Purisima target with limited success, with the balance of assays of 12 holes pending. The latest highlights are:

- 54.7 meters at 0.88 g/t Au in mineralized quartz feldspar porphyry and hydrothermal breccias, including 13.7 meters at 1.965 g/t Au in CAL22-008, located at the southern edge of the eastern part of the mineralized zone.

- 86.6 meters at 0.50 g/t Au in mineralized porphyries and hydrothermal breccias in CAL22-009 located at the southern edge of the central portion of the mineralized zone.

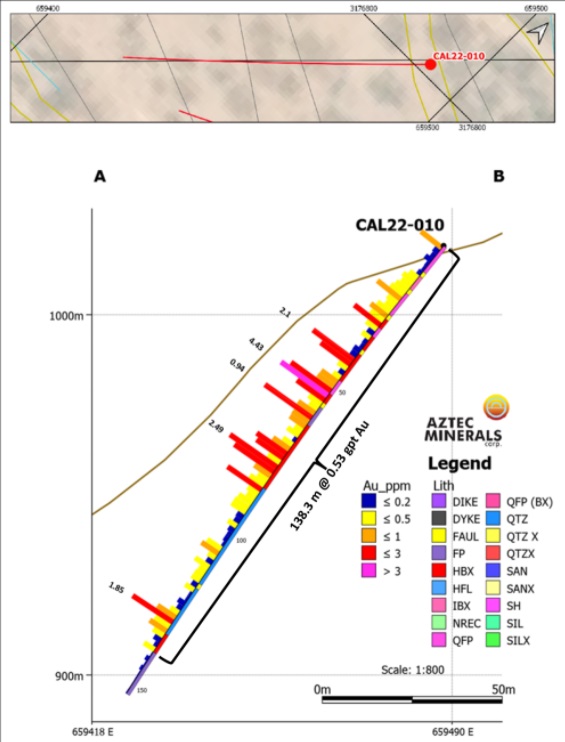

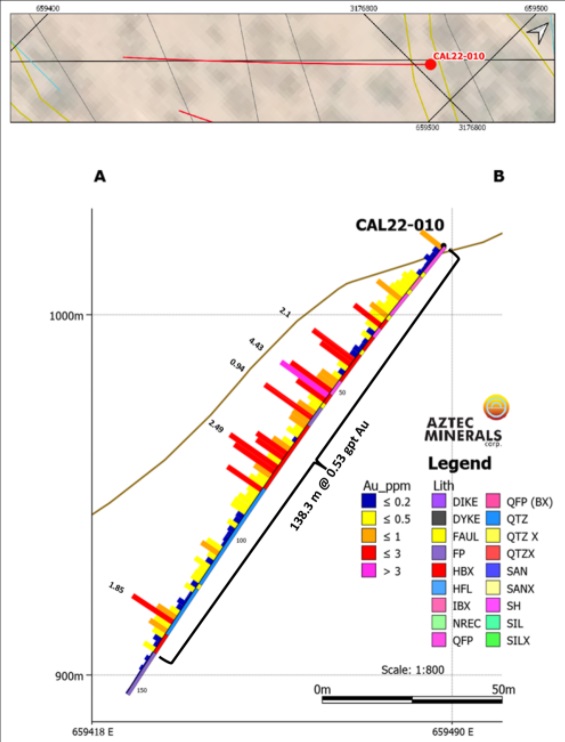

- 138.3 meters at 0.53 g/t Au in mineralized porphyries and hydrothermal breccias, including 10.67 meters of 1.622 g/t Au in CAL22-010, located in the central portion of the mineralized zone.

Reported lengths are apparent widths, not true widths, and the observed gold mineralization appears to be widely distributed in disseminations, fractures, and veinlets within quartz-feldspar porphyry, feldspar porphyry stocks, and related hydrothermal breccias. A section of CAL22-010 is shown below:

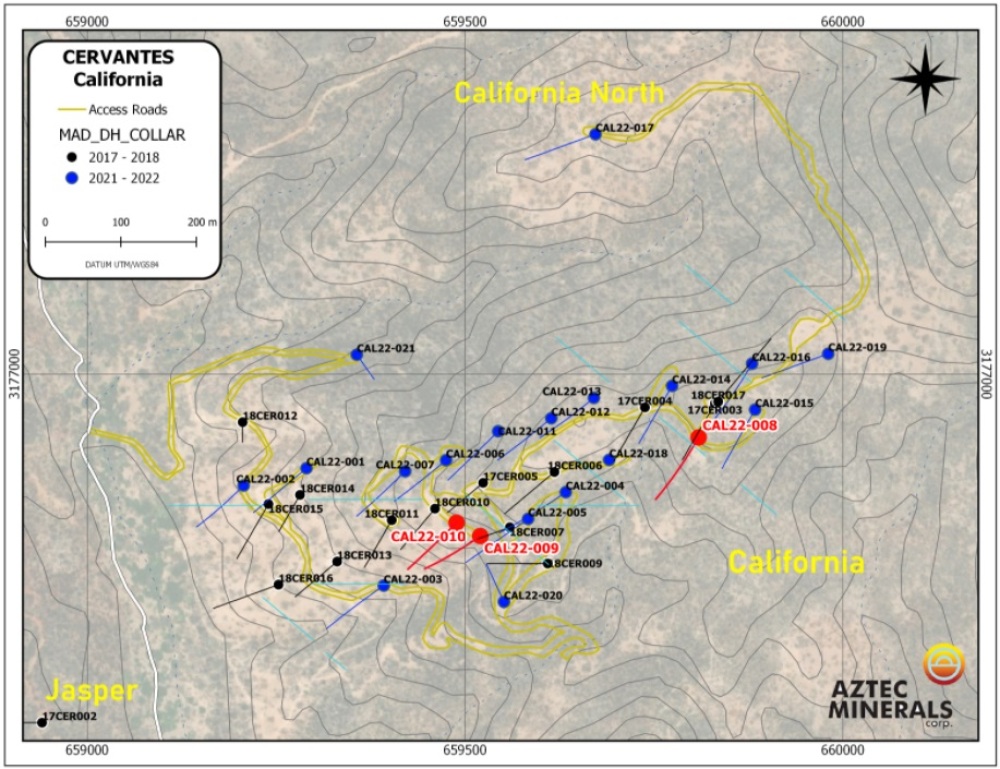

The goal is to expand the known mineralized envelope, resulting from the Phase 1 2017-2018 drill program. Old (black collars) and new drilling (blue and red collars) can be seen on the following map:

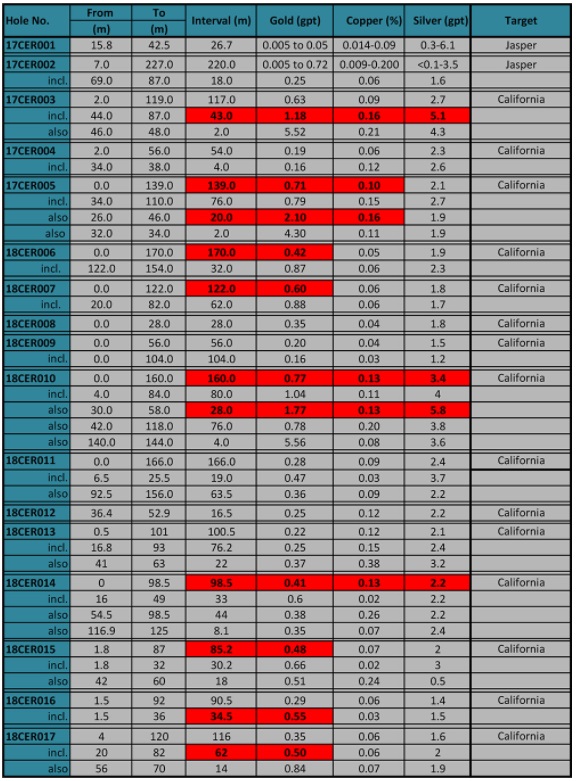

As can be concluded, the Phase 1 program more or less focused on the top of the ridge, whereas Phase 2 is expanding north, south and east of this. The aforementioned stellar hole was CAL22-005, not too far away from CAL22-010. Gold mineralization in 010 was also extensive over 138 meters, but at almost one-third of the average grade of 005. The result of 005 was a surprise, as the nearby hole 18CER007 returned 122 meters at 0.60 g/t Au, and another hole close to 005, hole 18CER006, returned 170 meters at 0.42 g/t Au. For your convenience, here is the table of the Phase I program again, for comparison:

I wondered how these differences in grades could happen within a 30-50 meter distance, as oxide deposits are usually more continuous, and where this relatively high grade could come from, as the combination of length and average grade for 005 is unique. Could this be a local vein structure alongside a fault, or a feeder system? Chief Executive Officer Simon Dyakowski had this to say: “Further drilling is definitely required to understand the zonation and structural controls of the mineraliziation.”

Since the most eastern holes (CAL22-015, 016 and 019) haven’t returned results yet, it is arm waving at best, but with the recent and historic drill results I believe it is possible to conservatively estimate a mineralized envelope of 800x250x80x2.7=43.2Mt, and using an estimated average grade of 0.6 g/t Au we would arrive at a hypothetical 833koz Au. If the remaining holes return intercepts alongside my estimated average range of 80 meters at 0.60 g/t Au or better, then the envelope could increase to a hypothetical 900x300x80x2.7=58.3Mt, generating an arm waving 1.125Moz Au. Let’s wait and see, as the results of 12 holes are on its way.

Besides going after more oxides, let’s not forget Aztec is also hunting large porphyry targets at depth at Cervantes. Deeper tests were planned at California target as part of this drill program to test the large IP chargeability anomaly at depth, but Aztec wasn’t able to get a deep test unfortunately, as the RC drill rig failed below the water table. Because of this the next round of drilling will include core drilling. The balance of the Phase 2 program tested a gold-in-soil anomaly at California Norte, and an outcrop at the Jasper target. The results are expected in the coming weeks.

Aztec is carrying out channel sampling and geologic mapping of the new drill roads at the moment at California, California Norte, and Jasper, as well as expanding surface sampling and mapping on the property in general, in order to continue the 2021 Phase 1 surface program. After this, all exploration results will likely be released, it will be most likely time to do another raise, and, contingent on the current program results, and available funds, management could plan additional drilling this spring season. As the results at California don’t exactly disappoint, it seems only logical to follow up with another drill program. Dyakowski had this to say about it: “We are in the planning stages, but early thinking is to drill again in May-June, with a combination of RC step outs, and Core deep drilling, approximately 5,000 meters.”

As a reminder, the Cervantes oxides aren’t the only thing Aztec is looking to explore, as it is also planning a drill program for their Tombstone gold-silver oxide project (subject to a 75/25 JV with Aztec as the operator) in Arizona for the summer, also enabling them to go after large porphyry/CRD potential at depth at both projects. A diamond drill program is planned for the summer of this year, again contingent on available funds. This upcoming Phase 3 drill program will be designed to target deeper epithermal gold-silver mineralization below the contention pit, and the coveted deep CRD silver-lead-zinc-copper-gold mineralization in Paleozoic limestones underlying the Bisbee Sediments.

Conclusion

Aztec Minerals is going from strength to strength with its Phase 2 drill program at the California target at Cervantes. Hole 004 already was much better than expected with 167 meters at 1 g/t Au from surface, but management surprised investors further with hole 005 (136.8 meters at1.48 g/t Au), and continued to deliver very solid results as for example hole 010 returned 138 meters at 0.53 g/t Au. Since most mineralization appears to be oxidized and/or heap leachable with a very low strip ratio, and my hypothetical back of the envelope estimate points towards 800koz – 1.1Moz Au resource potential at a pretty economic grade, it seems Aztec is on its way to delineate their first company making asset. Which is not all, as they have three other opportunities. Stay tuned.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

This article is also published on www.criticalinvestor.eu. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Aztec’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Aztec or Aztec’s management. Aztec has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high-quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

The author is not a registered investment advisor, and has a long position in this stock. Fancamp Exploration is a sponsoring company. All facts are to be checked by the reader. For more information go to www.fancamp.ca and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Streetwise Reports Disclosures

1) The Critical Investor’s disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

( Companies Mentioned: AZT:TSX.V; AZZTF:OTCQB,

)

Source: The Critical Investor 03/25/2022

The Critical Investor checks in with a junior explorer after it intersects visible gold and completes a CA$5.6 million raise.

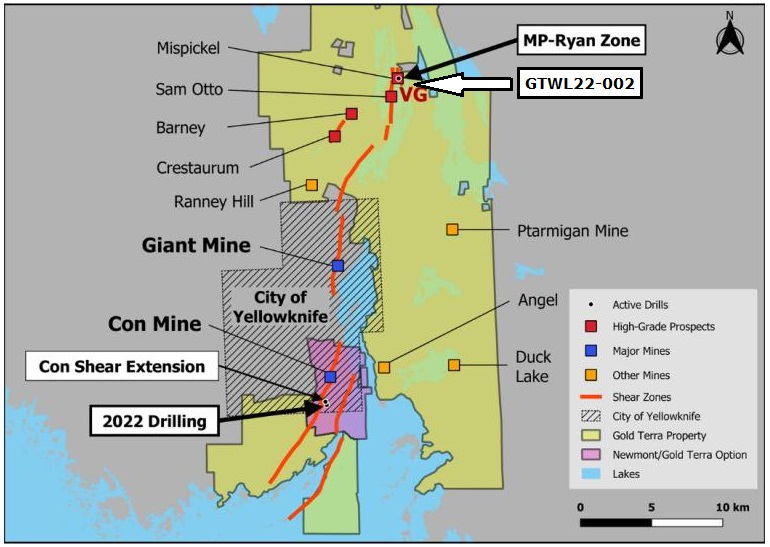

Ukraine has been invaded by Russia, further disturbing supply/demand chains around the world, where commodity prices are soaring and inflation is increasing to levels not reached in decades. Precious metals, and more specifically gold, are doing well with gold hovering at US$1,915/oz. For Gold Terra Resource Corp. (YGT:TSX.V; YGTFF:OTC; TXO:FRANKFURT), it’s still business as usual, operating far away in Canada. It is currently drilling with four rigs at its Yellowknife City Gold Project, intersecting (visible) gold and watching results coming in on a regular basis now. With the closing of an oversubscribed CA$5.6 million (M) capital raise on Feb. 28, it is fully funded to complete the ongoing, extensive 30,000-meter drill program at the Campbell Shear at depth.

Shortly after taking the reins at Gold Terra, Chief Executive Officer Gerald Panneton didn’t waste much time and announced a bought deal offering shortly afterward on Feb. 9. This offering was intended to raise CA$5M, and was a combination of charitable flow-through (FT) shares, offered at a price of CA$0.30, traditional FT shares offered at a price of CA$0.24, and common shares offered at a price of CA$0.21, with no warrants. The offering was made by way of a short form prospectus in each of the provinces of Canada (other than Quebec) and the Northwest Territories. Common Shares were offered by way of private placement in the United States. The offering was made through a syndicate of underwriters led by Stifel GMP and included BMO Capital Markets and Beacon Securities, who received a 7% cash commission (CA$392,000) over total gross proceeds.

It was good to see that directors and officers of Gold Terra also participated in the offering and were issued an aggregate of 900,000 common shares, including 200,000 traditional FT shares. The result was an oversubscribed offering. Panneton told me he had interest for over 30M shares and he had to cut back himself as well to make some room for others. According to SEDI, he still bought 400,000 shares, Chief Financial Officer Mark Brown acquired 100,000 shares, and two directors each bought 200,000 shares. Also, all existing shareholder institutions supported the deal. The end result was a healthy CA$5.6M, due to the exercise in full of the over-allotment option by the underwriters. In total, 21.6M shares were issued, more specifically 8.9M charitable flow-through common shares were issued at a price of 30 cents, 8M traditional flow-through common shares were issued at a price of 24 cents, and 4.7M common shares were issued at a price of 21 cents.

The gross proceeds from the sale of the Charitable FT shares and the traditional FT shares will be used for expenditures which qualify as Canadian exploration expenses (CEE) and flow-through mining expenditures both within the meaning of the Income Tax Act (Canada). The net proceeds from the sale of the common shares will be used for working capital and general corporate purposes. It is good to see that over 80% of proceeds goes into the ground at Gold Terra. This money goes a long way, as all-in costs for drilling is CA$200 per meter until 800 meters depth, and C$250 per meter for deeper holes, as it requires a stronger drill rig.

According to Panneton, net proceeds are attributed to about CA$5.1M, and the total cash position is about CA$7M now. This is good enough for completing 30,000 meters of drilling at both the Campbell Shear south of the Con Mine and the Mispickel target more to the north for the winter program.

The drilling at the Campbell Shear has been underway for quite a while now with two rigs, and regarding Mispickel, the company has recently commenced a small 4,000-meter drill program with another two drill rigs as winter is the best window. Panneton believes that earlier drilling at this target wasn’t done efficiently, and hopes to find more high-grade relatively near surface over there, which could add easy ounces to the 1.2Moz Crestaurum/Sam Otto open pit concept he has in mind. The latest results certainly indicate he is on to something of interest, as the first partial assays of hole GTWL22-002 coming back reported 4 meters @ 19g/t Au from only 20 meters depth, including 1 meter @ 73.9g/t Au.

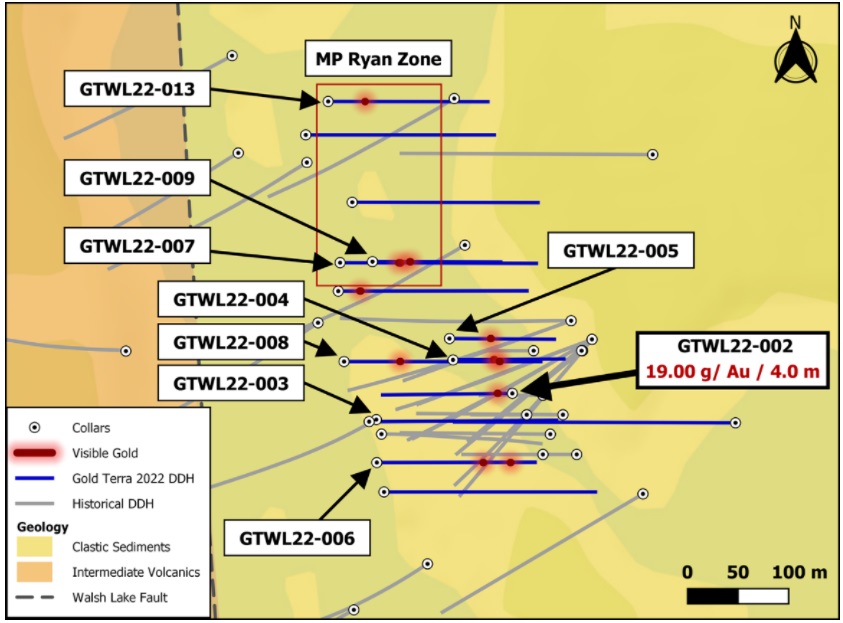

When looking at Mispickel drilling in more detail, Gold Terra is doing a small 4,000-meter winter drill program at the new high-grade MP-Ryan zone 200 meters north of the main Mispickel area. If successful, this program could eventually be expanded to 6,000 meters. Drilling is targeting high-grade trends with the objective of expanding known high-grade mineralization which is open in all directions and identifying new similar zones. To date, 13 holes covering 4611 meters have been drilled with 3,198 samples taken, indicating a sheared vertical gold structure with a strike length of 400 meters. Visible gold (VG) has been reported in 10 out of the 13 holes, and assays are pending for all holes. The collars and trajectories can be seen on the following map of Mispickel:

As can be seen, the orientation of the current drill holes is strictly east-west, as opposed to the more variable historical drilling. Since Panneton indicated that he had a different view on the strategy, I wondered about the thinking behind this. According to Panneton, this was done because winter drilling in Canada allowed them to better drill from the proper azimuth or direction to intersect the mineralized target at the best angle. Also, as winter allowed them to drill from a proper setup, Gold Terra could cover ground more efficiently.

An example of visible gold specs can be seen below:

It isn’t easy to attach certain gold values to visible gold images, but in my view it is very well possible to potentially have over 20-30 g/t Au values here.

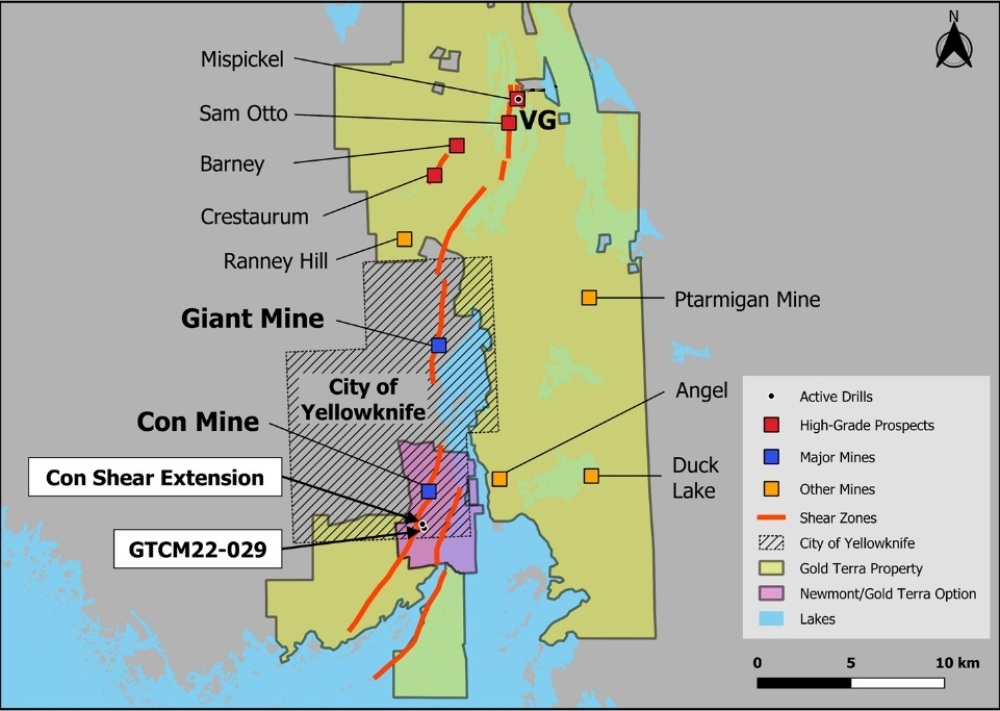

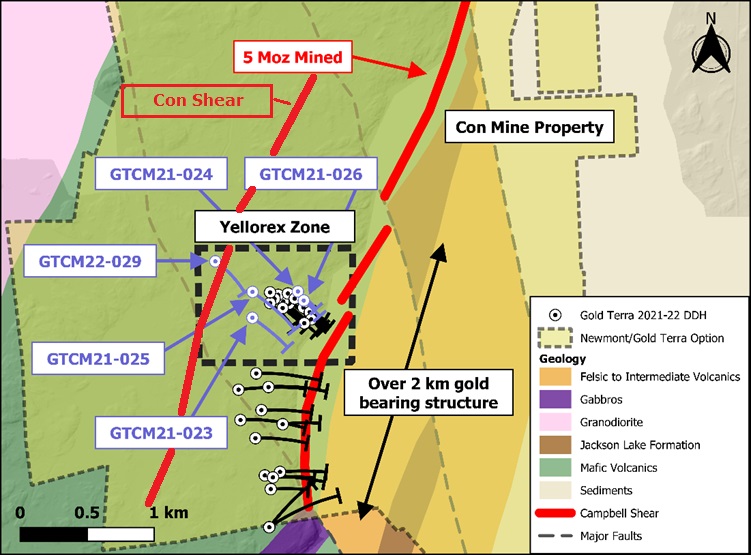

The main drill program is of course targeting the Campbell Shear. The two rigs at the Campbell Shear target are drilling south of the former high-grade Con Mine, with one big drill rig targeting the Campbell Shear at a depth of approximately 1000 meters below surface and at a 200-meter spacing. A second drill rig is allocated to test the Campbell shear, north of Yellorex zone which was not part of the agreement with Newmont (September 2020).

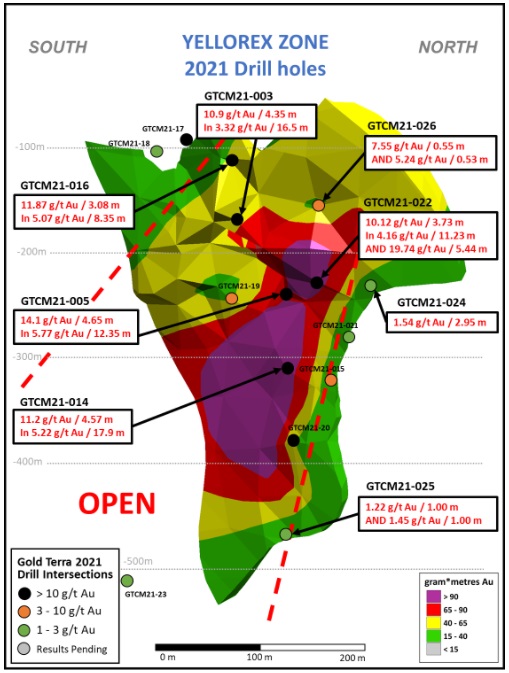

The results of five drill holes with four of them aimed at the Yellorex target (GTCM21-023 to 026) were reported in the last news release (March 15), and one (GTCM22-029) being aimed at the aforementioned deep Campbell Shear target hasn’t completed drilling yet. The drill collar locations can be seen here:

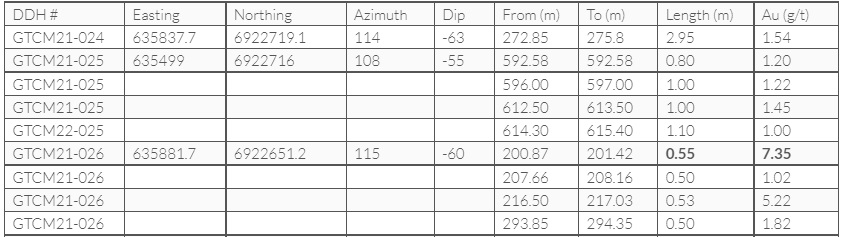

The first four holes — 023, 024, 025 and 026 — were infill drilling, but also testing the outside boundaries of the Yellorex zone (also part of the Campbell Shear). All except 023 hit some gold, although not spectacular high grades as the typical smokey quartz and strong alterations were missing. The table with full results can be observed here:

Hole 23, the deepest one so far in 2021 program, was aiming at the zone in the interpreted down plunge. The results were positive in itself as the Campbell Shear was intersected although without economic mineralization, now it is just a matter of adding more holes in the area. I wasn’t really surprised by 024 and 025 as other holes in the vicinity already indicated limited mineralized potential. I viewed 026 as a bit of an infill disappointment though, as nearby holes 022 and 003 were much better:

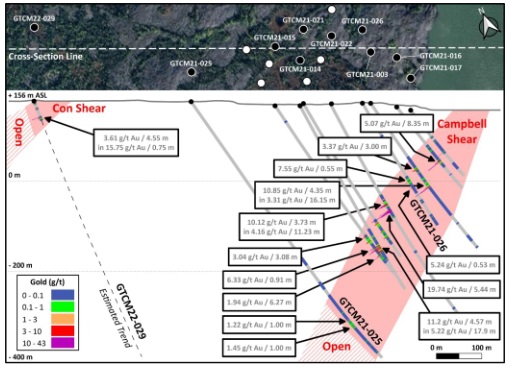

But keep in mind, the big prize on the Campbell Shear is anticipated at depth, and this is where hole 029 is targeted. Panneton thought it would be useful to include the top part of the Con Shear, as near surface ounces are always cheaper to mine than deep underground ounces, a bonus so to say. As only the first 50 meters of the hole were assayed, the result was nice with 4.55 meters @ 3.61g/t Au from 37 meters (including 0.75 meters @ 15.75g/t Au), and the drill is underway now to 1,000 meters depth, aiming at the Campbell Shear at depth:

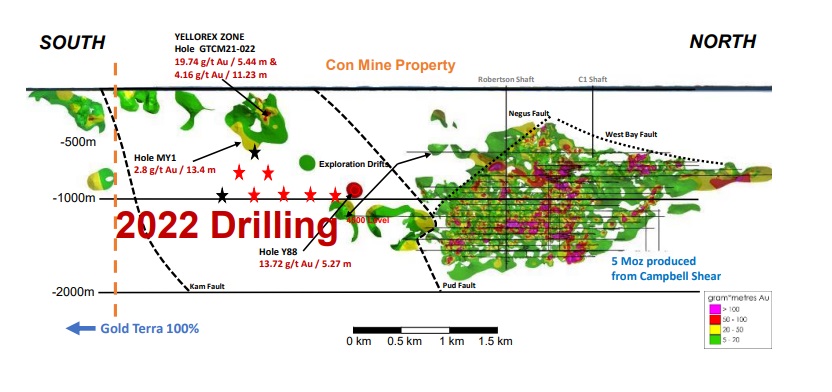

For now the plan is to follow the mineralization at the Campbell Shear down plunge, and over the next 24 months the strategy is to increase the current extent of drilling mainly south of the original Con Mine below depths of 1,000 meters. As a reminder, see the long section below, representing the Con Mine, Yellorex and exploration targets, with the black stars indicating first drill targets, the red ones following up on this:

Management is intending to drill up to about 40,000 meters this year, with the objective of delineating at least a 1.0Moz high grade gold resource at the Campbell Shear at the end of 2022, and eventually a minimum of 1.5Moz high-grade gold the year after, south of the Con Mine. One more powerful rig is targeting the Campbell Shear at 1,000 meters depth at a 200-meter spacing. The second standard rig is allocated to test the Campbell Shear north of Yellorex, until a depth of 800 meters. The current cash position of about CA$7M would cover about 30,000 meters of drilling. Subject to its success, the company could be looking at raising more money for more drilling.

Also, keep in mind that there is a historic resource remaining at the Con Mine of 651koz @ 10.2g/t Au located below 1,000 meters depth, and according to Panneton, there could be about 1 Moz Au down there. It will probably take at least 10-20% verification drilling to convert this into a NI43-101 compliant resource, and this probably has to be done from surface as it is too early to start dewatering the Con Mine. According to Panneton, it is too early for dewatering and going underground, until a resource is reached to support underground drilling.

Conclusion

This is exactly what I hoped for when Panneton took over as CEO, raising another CA$5.6M as fast as he could so drilling at the Campbell Shear could be increased in 2022 with a target of 30,000 meters, even adding some Mispickel drilling to it, which already returned lots of visible gold and a first, pretty economic assay result. Yellorex drilling seems to have hit its boundaries, but the company is awaiting results of deep holes, and as Panneton and myself are anticipating that the big prize might be located right there, I’m very curious about the outcome. And remember, this exploration of the Campbell Shear is being backstopped by a solid, likely economic 1.2Moz NI43-101 resource but also a 0.65Moz historic resource at depth, with pretty good data available on it. 2022 could be an important year for Gold Terra.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

This article is also published on www.criticalinvestor.eu. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Gold Terra Resource Corp.’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Gold Terra Resource Corp. or Gold Terra Resource Corp.’s management. Gold Terra Resource Corp.s has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high-quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

The author is not a registered investment advisor, and has a long position in this stock. Fancamp Exploration is a sponsoring company. All facts are to be checked by the reader. For more information go to www.fancamp.ca and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Streetwise Reports Disclosures

1) The Critical Investor’s disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Gold Terra Resource Corp., a company mentioned in this article.

( Companies Mentioned: YGT:TSX.V; YGTFF:OTC; TXO:FRANKFURT,

)

As Peter Schiff put it in a recent podcast, government solutions make every problem worse. The solutions being floated to help Americans deal with high gas prices are no exception. One proposal is to give Americans $100 per month to help ease the pain at the pump. Peter called this “a hair-brained scheme.” Where’s the […]

The post Peter Schiff: Government Solutions for High Gas Prices Will Just Make Things Worse first appeared on SchiffGold.