Category: Gold

Is gold too expensive?

Eurasia Review/Claudio Grass/3-23-2022

“Now, while these are the sort of arguments I would usually bring up in conversations about ‘how high is too high’ when it comes to the gold price, the events of the last two years have made [me] realize that there [is] so much more to this question and led me to reconsider the way I answer these questions. It really does go a lot deeper than a comparison between gold and stocks, or considering the better ‘play’ for one’s portfolio performance. The real counter-question now is ‘what is your peace of mind worth’? I’ve always outlined this deeper way of thinking about this issue, and I’ve always found many who agreed with me among the rational, responsible, long-term gold investors.”

“Now, while these are the sort of arguments I would usually bring up in conversations about ‘how high is too high’ when it comes to the gold price, the events of the last two years have made [me] realize that there [is] so much more to this question and led me to reconsider the way I answer these questions. It really does go a lot deeper than a comparison between gold and stocks, or considering the better ‘play’ for one’s portfolio performance. The real counter-question now is ‘what is your peace of mind worth’? I’ve always outlined this deeper way of thinking about this issue, and I’ve always found many who agreed with me among the rational, responsible, long-term gold investors.”

USAGOLD note: Claudio Grass, a Swiss-based investment advisor who looks favorably upon gold, addresses a question he sometimes gets from first-time investors looking into gold: Is the metal simply too expensive at current prices? His standard reply, he says, is “expensive compared to what?” But then per above, he digs a bit deeper ……

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.

Bloomberg/Greg Ritchie and Finbarr Flynn/3-23-2022

“The Bloomberg Global Aggregate Index, a benchmark for government and corporate debt total returns, has fallen 11% from a high in January 2021. That’s the biggest decline from a peak in data stretching back to 1990, surpassing a 10.8% drawdown during the financial crisis in 2008. It equates to a drop in the index market value of about $2.6 trillion, worse than about $2 trillion in 2008.”

“The Bloomberg Global Aggregate Index, a benchmark for government and corporate debt total returns, has fallen 11% from a high in January 2021. That’s the biggest decline from a peak in data stretching back to 1990, surpassing a 10.8% drawdown during the financial crisis in 2008. It equates to a drop in the index market value of about $2.6 trillion, worse than about $2 trillion in 2008.”

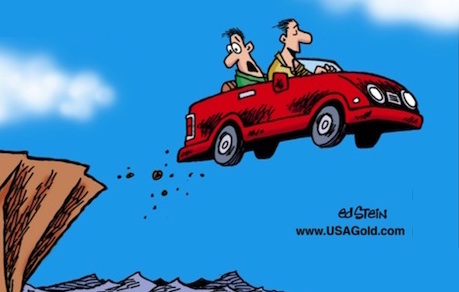

USAGOLD note: Though bonds are often touted as a competitor to gold for safe-haven capital, they do not respond well to inflation. Gold, on the other hand, is widely viewed as an inflation hedge as well as a hedge, like U.S. Treasuries, against stock market uncertainty and systemic risks. Not a time, in short, to be complacent.

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.

- Gold Price Forecast: XAUUSD extends recovery, how high can it go? FXStreet

- Gold scales more than one-week peak on Ukraine, inflation worries CNBC

- Gold, silver sharply up on safe-haven buying, inflation worries Kitco NEWS

- Gold slips to near 1-week low on Fed Powell’s hawkish stance Reuters.com

- Gold Advances as Investors Assess Sanctions, Growth Outlook Bloomberg

- View Full Coverage on Google News

Source: Streetwise Reports 03/23/2022

A junior mining explorer releases a batch of surface fieldwork data and images from its copper project in British Columbia and prepares for a drilling campaign.

Fabled Copper Corp.’s (FABL:CSE) share price jumped up after trading resumed on March 23, and the junior mining explorer released another batch of 2021 surface fieldwork results from its Muskwa copper project, as noted in a news release.

These new data concern the part of Muskwa containing the Magnum mine copper deposit, where the mineralization is a mix of chalcopyrite, quartz, ankerite, and pyrite.

New sampling result highlights include 27.2% copper (Cu) at a 1,571 meter (1,571m) elevation (rubble sample); 25.1% Cu (grab sample) and 17.75% Cu (chip sample), both at a 1,903m elevation; and 14.4% Cu at a 1,802m elevation (rubble sample).

Fabled also released fieldwork images of the vein in the news release, including a drone video (see below), that showed the deposits in stark detail.

“I don’t think people realized what the underlying assets are with Fabled Copper,” Fabled Copper President, Chief Executive Officer, and Director Peter Hawley told Streetwise Reports. “Now they’re starting to be able to visualize them. There’s copper all over the place. It truly is impressive, and I think people are starting to realize it.”

The high-grade (25.1%) Cu grab sample from the Magnum vein also returned 11.9 parts per million of silver, and contained 95% massive chalcopyrite.

Using the 2021 Magnum results to date, Fabled Copper’s field crew will continue sampling and mapping the deposit. Also, the team will investigate the silica anomalies on the southeast side of the hillside.

Management decided that Magnum will be a priority target for drilling once Fabled Copper receives the necessary drill permits, which Hawley said they could receive soon.

The surface data is “setting the stage for this year” and the drilling program, he said. More fieldwork and drone surveys are also expected. The hope is to create a three-dimensional map of the Magnum vein, he said.

The work the junior mining explorer carried out in 2021 at the Magnum deposit included collecting samples (rubble, chip, grab, and float) from various areas as a first pass evaluation. Those included the exposed Magnum vein over a 332m vertical elevation, three spots along the northwest facing slope and two exposures located 500–530m along strike to the southwest, between the two 5,900-foot level adits.

Also, the field crew inspected the main haulage 5,200-foot level adit and the other remaining adits into the Magnum vein. Further, they found the blocked entrances of six adits plus one opening, possibly a cave adit.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures

1) Doresa Banning and Steve Sobek compiled this article for Streetwise Reports LLC and provide services to Streetwise Reports as an independent contractor/employee, respectively. They or members of their household own securities of the following companies mentioned in the article: None. They or members of their household are paid by the following companies mentioned in this article: None.

2) The following company mentioned in this article is a billboard sponsor of Streetwise Reports: Fabled Copper Corp. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fabled Copper Corp., a company mentioned in this article.

( Companies Mentioned: FABL:CSE,

)

Jerome Powell the Tough Guy?

Suddenly, Fed chair Jerome Powell is a tough guy. Is he though? Earlier this week, Powell delivered what Reuters called “his most muscular speech to date” on the battle against inflation. The central bank launched its war on inflation at the March FOMC meeting with an unimpressive first shot. It raised interest rates by a […]

The post Blog first appeared on SchiffGold.