Category: Gold

Financial Times/Gideon Rachman/3-21-2022

“‘Tell me how this ends?’ is one of those things that people say in films — and sometimes also in real life. It is the crucial question about the war in Ukraine — but one that is sometimes obscured by the sheer drama and horror of day-to-day events.”

USAGOLD note: Nobody, including Putin, believed that the war in Ukraine might become a Russian quagmire, but quagmire it is. Rachman raises issues that most of us would rather ignore. The tide of events, he suggests, might offer a different end game, but ultimately expect the worst – a prolonged war.

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.

MarketWatch/Vivien Lou Chen/3-18-2022

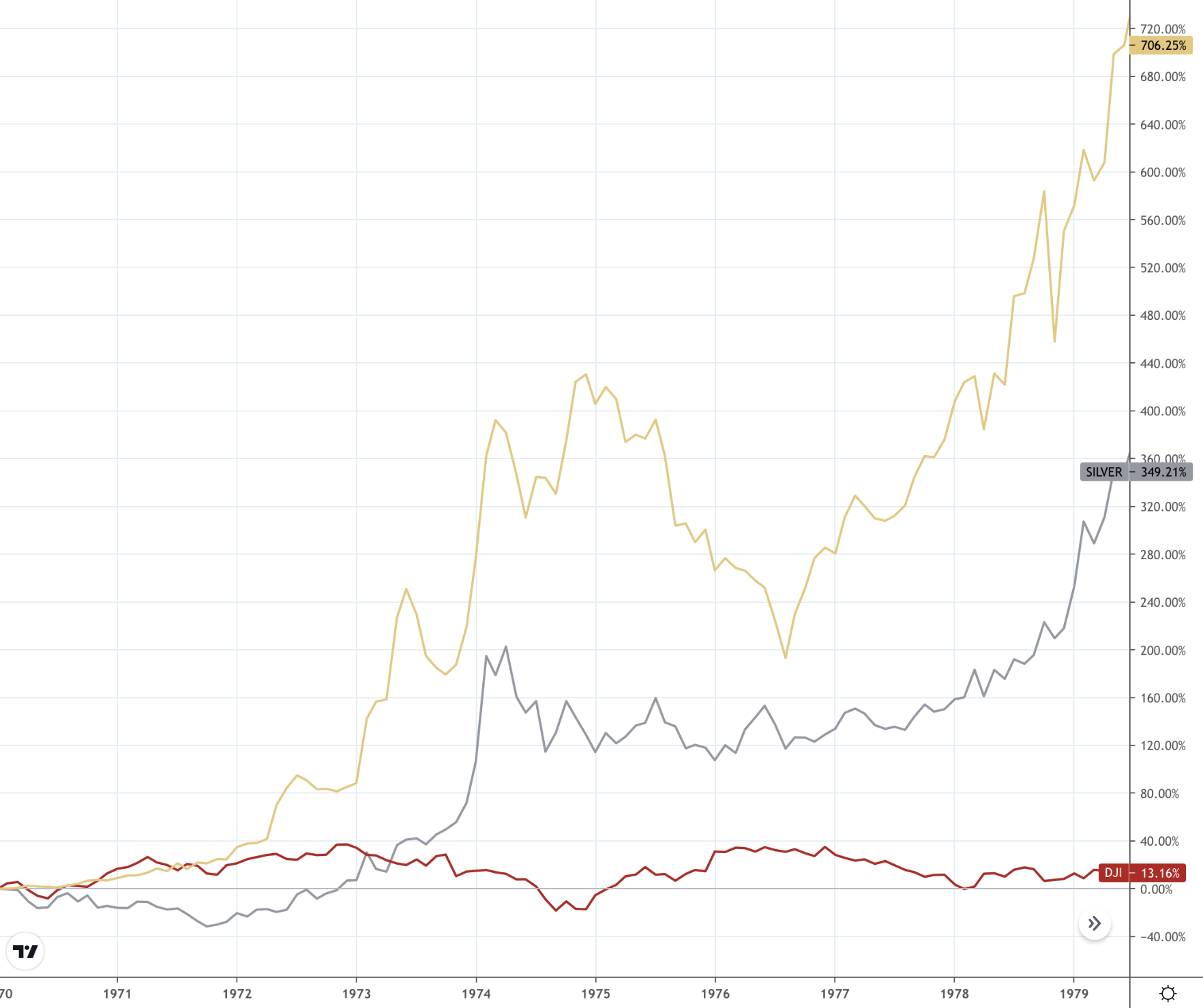

“Rising stagflation risks in the U.S. and Europe are raising the possibility of a ‘lost decade’ for the 60/40 portfolio mix of stocks and bonds, historically seen as a reliable investing choice for those with moderate risk appetites. Such a ‘lost decade’ is defined as an extended period of poor real returns, says Goldman Sachs Group Inc.”

USAGOLD note: While stocks languished during the stagflationary 1970s rising about 13%, gold went on a tear rising over 700%.

Gold, silver and stocks during the stagflationary 1970s

Chart courtesy of TradingView.com

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.

- Gold slips to near 1-week low on Fed Powell’s hawkish stance Reuters.com

- Gold prices end lower in the wake of Powell’s hawkish rate remarks MarketWatch

- Gold drifts lower as investors react to Powell’s hawkish speech Kitco NEWS

- Powell’s hawkish comments send gold price 1% lower – MINING.COM MINING.com

- Gold Price Forecast: XAU/USD renews intraday high past $1,900 as USD ignores strong yields FXStreet

- View Full Coverage on Google News

- This is how gold price takes on $2000 – Bloomberg Intelligence Kitco NEWS

- Gold Price Forecast: Can XAUUSD change its course? FXStreet

- Gold heads for worst week since November as safe-haven demand eases Reuters

- Gold futures end lower as U.S. Treasury yields rise MarketWatch

- Gold Price Surges Above $2,000 to Highest Level Since 2020 The Wall Street Journal

- View Full Coverage on Google News

We get lots of questions from the public about precious metals.

Some people are curious about the basics. Others are skeptical about the case for owning gold and silver. Still others are longtime customers who have highly specialized inquiries.

Here we will answer a few of the most common, most broadly relevant questions we get…

Will Fed rate hikes scare away bullion buyers?

It’s possible that anti-gold takes in the financial media will scare some would-be bullion buyers away. But the reality is that the Fed’s rate hikes are nothing to be afraid of – and won’t be unless and until the central bank actually gets out in front of inflation.

Fed officials opted for only a baby-step rate hike of a quarter point in March despite staring at the worst inflation problem in decades. Their rate-hike campaign may not get far, especially if market volatility and geopolitical turmoil continue to pose risks to the stability of the financial system.

The threats of inflation, supply disruptions, war, and soaring debt levels should make investors nervous.

And it’s likely more of them, not fewer, will find physical precious metals attractive as a safe haven in this environment.

What price would gold need to reach in order to make a new high in inflation-adjusted terms?

A specific price objective would be somewhat arbitrary since inflation itself is constantly in motion and can be measured in many different ways.

The most popular inflation gauge, the Consumer Price Index, is running at a 40-year high of 7.9%.

As alarming as that number is, it understates the true reality of price level increases faced by American households.

The American Institute for Economic Research puts together what it calls the Everyday Price Index.

Based on its 24 components, Everyday Prices are up 9.5% from a year ago.

Meanwhile, the ShadowStats Alternate Inflation Index shows a whopping 16% year-over-year jump in consumer prices. That’s double the headline CPI number!

Even the Bureau of Labor Statistics’ understated inflation data shows that gold is far from an inflation-adjusted high. Despite rallying to over $2,000/oz in March, gold prices remain below their January 1980 peak of $850/oz in real terms. That old high would be equivalent to $3,100/oz after merely adjusting for the portion currency depreciation actually reflected in the CPI.

Gold prices could easily exceed that $3,100 level before being at a real peak.

In the event of a shortage of physical gold and silver, will bullion dealers run out of product to sell?

Recent events have certainly put pressure on product availability. Customers have faced higher premiums and delivery delays on some bullion products, though Money Metals has committed significant resources to keeping those delays to a minimum and has performed better than its competitors in this regard.

While there doesn’t appear to be an actual shortage of silver at the moment, there are shortages in the pipeline from refiners to mints to wholesalers.

In March, the dysfunctional U.S. Mint announced that shortages of silver blanks for striking coins will force the cancellation of some planned products. The Mint will no longer be producing replica Morgan and Peace Silver Dollars for 2022 – a big disappointment for fans of these historic coins minted from 1878 to 1935.

The world’s most recognized mint can’t figure out how to source the raw materials needed for striking its products.

For the past two years, it has blamed COVID for failing to produce coins in sufficient quantities to meet demand. Now it’s just looking incompetent.

Investors can avoid the elevated premiums associated with U.S. Mint products by opting for privately minted rounds and bars instead. Or even the bullion coins produced by other government mints.

Even if all mints were to suspend operations, there would still be a large secondary market for coins, rounds, and bars that have previously been purchased. Dealers can get new inventory from customers who sell back to them, though it is possible for demand to overwhelm supply and make acquisition difficult at any price.

Isn’t investing in platinum and palladium risky given that governments are moving to abolish gasoline-powered cars?

Platinum and palladium are used in pollution-scrubbing catalytic converters for conventional automobiles. They have many demand sources beyond that, including from high-tech industries, jewelers, and mints.

Catalytic converters won’t go away anytime soon, especially given rising demand for cars from billions of people in India and China who can’t afford Teslas.

Meanwhile, zero-emission vehicles may start more widely employing fuel-cell technologies that require platinum-group metals – along with silver.

That said, platinum and palladium markets can be more volatile and less liquid than gold and silver. The platinum group metals don’t have a history of being used as money like gold and silver, so they may not offer the same level of protection from a currency crisis.

But when either metal can be obtained at a lower price per ounce than gold – and currently platinum can – it tends to be a great value opportunity.

Vancouver-based Aris Gold Corp. (ARIS:TSX; ALLXF:OTCQX), today announced that “it has entered into a definitive agreement with MDC Industry Holding Company LLC (Mubadala), a wholly owned subsidiary of the Abu Dhabi based investment company Mubadala Investment Company PJSC, whereby Aris Gold will acquire a 20% joint venture interest in the Soto Norte gold project in Colombia, with the option to acquire a further 30% interest.”

The firm stated that Soto Norte is a large property that offers high-grade mineral reserves with district-scale potential. Aris Gold claimed that it has also taken additional steps to strengthen its financial position by $100 million. The company advised that is has leveraged its existing precious metals stream at the Marmato Mine by $65 million and is making arrangements to secure a $35 million convertible debenture.

The company’s Chair Ian Telfer commented, “Acquiring interests in large-scale deposits with low technical risk is the right move for Aris Gold. This is how successful gold mining companies are built, and I’m pleased to see Aris Gold is delivering on this responsible growth strategy.”

Aris Gold’s CEO Neil Woodyer added, “Aris Gold will build a successful operation using state-of-the-art technology that will provide long-lasting benefits to the local communities and significant social development opportunities for the region. Soto Norte dramatically increases our growth profile with its potential to produce over 450 Koz Au per year. Construction of Soto Norte is expected to follow the expansion of our 100%-owned Marmato gold mine.”

Industrials at Mubadala Executive Director and Minesa Chairman Danny Dweik stated, “We are delighted to bring in Aris Gold as our operating partner in Minesa. The Soto Norte project will benefit from their technical capabilities and Colombian experience, and we look forward to working with them and the local communities on bringing this world-class project to fruition.”

“The team at Aris Gold has extensive local market experience and a long track record of successfully executing complex Colombian projects. We believe they are well-positioned to support Minesa in becoming a leading gold mining company in Colombia, ” remarked Mohamed Mirza, Minesa CEO and Director at Industrials at Mubadala.

The company explained that the Soto Norte underground gold project hosts an Indicated resource containing 8.5 Moz Au, 55.3 Moz Ag and 193 Mlb Cu and an Inferred resource of 3.6 Moz Au, 22.8 Moz Ag and 107 Mlb Cu.

The underground operation at Soto Norte has the capacity to process 2.6 Mt of material yearly. The project’s Feasibility Study (FS) estimates initial total capital costs of $1.2 billion with average production of 450 Koz Au per year. The Study calls for a 14-year mine life with average all in sustaining costs (AISC) of $471/oz Au. The FS estimates that utilizing a net present value (NPV) of 5%, the property has an after-tax value of $1.5 billion and an internal rate of return (IRR) of 20.8% based upon a $1,675/oz gold price. If the average gold price were to increase to $1,925/oz, then the projects after-tax project NPV would rise to $2.0 billion, and the IRR would be 24.4%.

The company stated that Soto Norte offers district-scale potential due to successes achieved in neighboring areas by other companies. The firm indicated that the Soto Norte project is on a path to produce 400 Koz/year in addition to the production from its Marmato mine that has capacity to deliver 175 Koz Au per year.

Aris Gold advised that it is entering into a comprehensive joint venture agreement with Mubadala to advance, build, manage and operate the Soto Norte project. Under the terms of the agreement, Aris is to pay Mubadala $100 million in cash ($50 million at closing plus $50 million within 12 months) in exchange for a 20% interest in the joint venture company and Minesa.

The company stated that the transaction is expected to close in in April 2022, subject to completion of ordinary closing conditions. In addition, Aris Gold at its discretion has the option to acquire an additional 30% interest in the joint venture company and Minesa for an additional payment of $300 million in cash subject to regulatory approvals by mining agencies.

As part of the agreement between the two firms, “Mubadala is retaining a precious metals streaming interest on 7.35% of payable gold and 100% of payable silver.” The report noted that the streaming royalties will only apply to incremental production after the first 5.7 Moz Au gold has been produced.

Aris Gold advised that in order to finance its new JV at Soto Norte, “it has amended its current $110 million precious metals stream at the Marmato mine with Wheaton Precious Metals International (WPMI) to increase the aggregate total funding amount to $175 million, with additional payments to Aris Gold of (i) $15 million upon closing of the Transaction and (ii) $50 million payable during the construction and development of the new Lower Mine.”

The company mentioned that it also has made arrangements to issue a $35 million convertible senior unsecured debenture to GCM Mining Corp. (GCM:TSX) due 18 months from closing of the transaction.

Aris Gold is a mining company headquartered in Vancouver, B.C. In addition to its new JV at Soto Norte, the company operates the Marmato mine in Colombia and the advanced exploration stage Juby gold project located within the Abitibi Greenstone Belt in Ontario, Canada.

Aris Gold started the day with a market cap of around $206.7 million with approximately 137.8 million shares outstanding. ALLXF shares opened 23% higher today at $1.4698 (+$0.2781, +23.34%) over Friday’s $1.1917 closing price. The stock has traded today between $1.446 and $1.732 per share and closed for trading at $1.5479 (+$0.3572, +30.00%).

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Stephen Hytha compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

( Companies Mentioned: ARIS:TSX; ALLXF:OTCQX,

)

The Fed Mandate Has Shifted

Source: Michael Ballanger 03/21/2022

Michael Ballanger submits that steps should be taken to end central banking, and to remove the function known as “control of the currency” from its powers.

In 1978, the year I joined the Canadian investment industry as a trainee, I was sitting in a room full of seasoned brokers while studying for the licensing exams known as The Canadian Securities Course, when I directed a question to the group who were all totally consumed by a game of stud poker (and beer). “Who is the chairman of the …” (glancing down at the reference materials) “err … Federal Reserve Board?”

The brokers turned around and glared at me as if I were a compliance officer and then at each other as this esteemed group of “consummate investment professionals” struggled to produce answers. Not one of the group could muster even the slightest of guesses because back then, mired in a particularly nasty period of “performance anxiety,” these dudes were simply trying to survive the Stagflation Seventies, a period in which the two nasty bear markets ended (1969-1970 and 1973-1974) and gold rose from $35 per ounce to over $850 per ounce.

The brokers turned around and glared at me as if I were a compliance officer and then at each other as this esteemed group of “consummate investment professionals” struggled to produce answers. Not one of the group could muster even the slightest of guesses because back then, mired in a particularly nasty period of “performance anxiety,” these dudes were simply trying to survive the Stagflation Seventies, a period in which the two nasty bear markets ended (1969-1970 and 1973-1974) and gold rose from $35 per ounce to over $850 per ounce.

To find an investment professional who could talk informatively about gold bullion was indeed a rarity, but it was even rarer was to find anyone who traded equities who could name the chairman of the Federal Reserve. To be fair, the bond traders were far more familiar with the Fed than were stock traders, because “common stocks” were the habitat of “commoners,” troglodyte gamblers and conventional boardroom etiquette considered it “poor form” to discuss anything to do with equity markets because real wealth found safety and respectability in fixed income (bonds). Everything else was sacrilege.

Fast forward to 2022, and evidence springs eternal that the times have indeed changed. Instead of coming off eight years of financial malnutrition, the “wealth advisors” of the modern era are coming off 13 years of financial gluttony, lavishly bestowed upon the elite classes by a Federal Reserve (and its other international central bank brethren) by way of zero interest rate policies, stimulus, direct intervention, and outright manipulation in order to maintain the behavioral benefits of “The Asymmetrical Wealth Effect” of rising stock prices on consumers. In fact, so very pivotal in the process has been the rise of the central banker in terms of prestige, power, and influence in the day-to-day performance of the major global stock averages that wealth advisors the world over have shrines in their office complexes paying homage to the likes of Bernanke, Draghi, Lagarde, and more recently, Jerome Powell. The burning of incense and the inflammation of candles as tributes to these canonized civil servants has grown to included charter member fan clubs. It has gone from the Spring of 1978 with gold at $124 per ounce when not one investment professional could name the Fed Chairman to the spring of 2022 when even an Ethiopian cab driver can tell you the color of Jay Powell’s tie on FOMC day. The heady days of shoeshine boys offering stock tips to then financier Joseph Kennedy have been replaced with Uber drivers commenting on FOMC policy initiatives.

As I sat here in my humble office overlooking the Scugog Swamp last Tuesday afternoon, I listened to the Jerome Powell tell the world how he and his central bank cohorts were going to once again save the world and as I watched this former Goldman stock peddler try his damnedest to replicate the benevolent grandpa in an old 1930s movie, I was taken from nauseous to cantankerous in a mere 10 minutes.

What drives me batty is how these unelected purveyors of Wall Street paraphernalia and upper-class agendas are assigned such deference. If you look back to literally every major turning point since Paul Volcker stepped down, the Fed has committed countless policy errors and where it had the opportunity to at the very least withdraw stimulus to cool off an overheating stock or property market, they opted for bubble prolongment rather than price stability. I submit to those reading this missive that steps should be taken to end central banking. Since the Fed was created by the banks, continually acts for the banks, and is owned by the banks, steps should be taken to remove the function known as “control of the currency” from its powers. The debasement of the purchasing power of one’s savings or retirement funds should be a capital offense. Forget debt ceilings or the British North America Act; parliament should draw up a national referendum to constitutionally outlaw the monetization of sovereign debt. If that is deemed unrealistic or inexecutable, then take counterfeiting out of the criminal code and let citizens provide for themselves that which government can do unelected, unlegislated, and unabated.

“I submit to those reading this missive that steps should be taken to end central banking. Since the Fed was created by the banks, continually acts for the banks, and is owned by the banks, steps should be taken to remove the function known as ’control of the currency’ from its powers. The debasement of the purchasing power of one’s savings or retirement funds should be a capital offense.”

I learned a long time ago that there arrives a point in every bull market where the prevailing narrative suddenly and for no apparent reason evaporates. For stocks, it is rarely how the Fed implements “policy” that affects the stock markets; it is frequently the manner in which they announce it that matters. Everything in the Powell statement last week was designed to placate the masses. It was intended to manage expectations of those holding stocks fearful of a too-hawkish agenda while assuaging the bond vigilantes fearful of a too-dovish agenda. The problem as I see it is that there is nothing that the Fed can do to tame inflationary pressures that will not adversely affect stocks. Similarly, there is nothing they can do to support equities that will not adversely affect inflationary expectations. Since the political winds have shifted to price stability from maximum full employment, stocks have smelled the pivot and are slowly metastasizing to “bear market mode.” This is where I am in portfolio construction for the balance of 2022.

If I sound overly repetitive in my constant haranguing over Fed policy and stock market risk, I beg forgiveness, but if there are two phrases overpopulating the social media world, they are “it is different this time” and “face-ripping melt-up.” Literally everyone thinks that Powell is going to do the classic 2017-2021 “stock market stick save” by taking the Fed Funds rate back to zero and launching another liquidity event. “He’s trapped!” they scream. “They (the Fed) backed themselves into a corner!” and “He won’t let stocks crash” are the hymnal refrains we hear day in and day out from all of the internet pundits with their podcasts and their breathless summons to “Buy silver!” If the Fed mandate was still “maximum full employment” and not “price stability,” I might tend to agree, but in his presser, Powell alluded to the “extremely strong economy in the fourth quarter,” but nowhere did I hear the words “stimulus,” “accommodative,” or “transitory.”

So, my strategy is to remain bearish but flexible enough to do my own version of “pivot” the exact nanosecond that I hear any of the Fed rhetoric hinting at the crying of the word “uncle,” which surely could happen with the S&P at 2,409.31 (50% from the all-time high). My wager is that the current 7.3% haircut in the S&P will not suffice to even get the cap off the bottle of Jack that Jerome must be storing in the bottom drawer of his 800-pound mahogany desk with the gold-leaf hardware and state-of-the-art Bat phone to the White House.

Since I exited all leveraged gold and silver positions (one December tax-loss holding as well) over the March 7-8 span of trading, I have been visibly anxious, having owned Market Vectors Junior Gold Miners ETF (GDXJ:NYSE.Arca) since last summer. That experience has been like trying to anchor my boat in a gale force wind; every time I think I am tucked in all safe and sound, another gust takes the vessel 180 degrees from the intended spot. Here I am, flat and nervous, with no position in arguably the singular most positive environment in fifty years for gold and silver ownership. We are in a bonafide bull market in gold (and probably the same for silver) with conditions outrageously positive in terms of geopolitics, commodity prices, and sentiment so why am I out of a market that I consider the best value of any asset class on the planet?

It is, quite simply, because the precious metals are not behaving in a manner befitting their histories of 5,000 years of value storage and insulation from currency debasement. As a veteran trader, I have learned to think, act, and trade as if I am a hired gun for the bullion banks. In the process of fighting fire with fire, when the Twitterverse was absolutely screaming with every gold FinTwit taking victory laps as gold responded to Russia moving into the Ukraine, I determined that the bullion banks would want to lean heavily on the market in order to preserve market integrity and to discourage inflationary expectations and no better way than to crush gold — which they did. The day after I lost the gold and silver positions, gold got hammered from $2,078 to $1,980 in a March 9 orchestrated takedown that is precisely WHY I am leery of re-establishing the leveraged positions. Of course, I will buy them all back at some point because ever since I contracted gold “fever” in 1981, after my first major exploration success with the Hemlo discovery, my life has never been the same. Forty-two years later, I am still holding massive positions in junior gold and silver exploration and development issues on the assumption that the junior resource world is going to enter a period of tech and crypto-like speculation in 2022. Once the masses finally accept that the only bull market left is in gold, silver, and selected resources including copper, oil, and uranium, what is today a minuscule market cap for the sector will become a significant one and with that, enrich patient holders of quality names.

As for my volatility trade, ProShares Ultra VIX Short-Term Futures ETF (UVXY:NSD), the rebound in the S&P 500 which occurred last week has served to work off the overbought condition but since it went out a mere 90 points below the 61.8% Fibonacci retracement level, we could see a smattering of follow-through next week. However, working against that notion is the arrival of the fateful “Death Cross,” where the 50-dma knifed down through the 200-dma and as such has created a powerful sell signal. Needless to say, I am holding to the idea that the January Barometer’s sell signal will result in new lows for the market in the next few weeks thus taking volatility (the VIX) to new highs.

As the chart of the 10-year yield shown at the start of this missive demonstrates, we are in a full rate hike cycle with inflation, not maximum full employment (by way of rising stock prices), solidly in the crosshairs of the Fed policy bazooka. To be sure, they may be forced to pivot at some point to avoid a Depression, but not before a great deal of pain has been inflicted and that is why VOLATILITY remains a dominant theme for 2022.

Originally published March 18, 2022.

Follow Michael Ballanger on Twitter @MiningJunkie. He is the Editor and Publisher of The GGM Advisory Service and can be contacted at miningjunkie216@outlook.com for subscription information.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Market Vectors Junior Gold Miners ETF, which is mentioned in this article.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

( Companies Mentioned: GDXJ:NYSE.Arca,

UVXY:NSD,

)

Analyst Says These 3 Stocks Are All Buys

Source: Streetwise Reports 03/21/2022

Adrian Day — editor of Adrian Day’s Global Analyst — discusses six companies, several of which are Buys, and looks to the SEC’s latest plans for emissions control.

In today’s briefing, we update developments at several companies, mostly positive news, with several “buys” on our holdings.

Vista Moves Toward a Deal on MT Todd

Vista Gold Corp. (VGZ:NYSE.MKT; VGZ:TSX) appointed CIBC as strategic advisor to assist Vista in evaluating “a broad range of alternatives to unlock the value” of the company’s Mt Todd project, following publication of the company’s feasibility study on the project. CEO Fred Earnest said some companies were undertaking due diligence, some wanting additional testing (such as metallurgical testing), and he expects to have ongoing announcements in coming months. He also said that there would be “significant value created overnight” when a transaction was announced.

Several executives of the company have acquired shares recently, including Earnest. The company has around $15 million in cash, including the $2.5 million received as a final payment of the sale of the Los Reyes project in Mexico. Fixed costs are about $6.5 million per year.

Although the stock has risen from less than 70 cents in January just prior to the release of the feasibility study, the current valuation of the company ($114 million) remains at a fraction of the value of the Mt Todd project ($1.5 billion). With the end-game approaching, Vista can still be bought.

Osisko Raises Money After Accretive Deal

Osisko Gold Royalties Ltd. (OR:TSX; OR:NYSE) announced it was raising $250 million in a bought-deal equity financing at US$13.45 per share, a 5% discount from the previous day’s close. As often happens, the stock fell to the offering price and below, giving an opportunity to buy the stock at its lowest price in March.

The raise follows the purchase of a $90 million silver stream on the producing CSA copper mine in New South Wales, Australia as part of a package financing the acquisition of the mine by Metals Acquisition Corp. Osisko will receive all of the silver mined.

Metals Acquisition has the option of drawing an additional $100 million for a copper stream. The acquisition gives Osisko additional immediate cash flow in a top-tier jurisdiction. Osisko can be bought if you do not own it.

Fortuna Increases Reserve and Resources

Fortuna Silver Mines Inc. (FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE) reported year-end reserves and resources, with modest overall increases. In particular, a first inferred resource at a new deposit at the Sequela project increased the NAV of that project by 15%, offset by a decrease at the Yaraoko mine in Burkina Faso. It is the first year that reserves at Sequela and Yaraoko have been included in Fortuna’s reserves, following he acquisition of Roxgold last year.

At Fortuna’s legacy mines, reserves at Lindero increased about 7% because of more pad capacity; San Jose in Mexico saw a conversion of some inferred material, though overall reserves fell; while resources at Callyoma jumped by 90% though it is the smallest mines in the portfolio. Overall, resources increased modestly over the old Fortuna and Roxgold’s numbers. Fortuna is a buy.

Important Exploration Program to Commence for Midland

Midland Exploration Inc. (MD:TSX.V) said that Rio Tino had commenced work on Midland’s Tete Nord nick-copper property, over which it has an option. This initial work is early stage, mostly a helicopter-borne electromagnetic survey. Rio must spent $4 million over four years (and make some a cash payment of $500,000) to earn 50%, with first-year expenditures a minimum of $500,000.

Across all projects, Midland expected nearly $8 million is drilling, most by partners, on five different projects. Midland stock has traded in a very small range (mostly from 0.47

to 0.52) from early December, after declining from the mid-60 range, as the market awaited exploration detail. The Rio program as well as a resumption of work by the BHP

on its alliance land in the second quarter will regenerate the Midland story. Midland is a buy.

Profits up at Kingsmen as It Adapts to Post-COVID

Kingsmen Creatives Ltd. (KMEN:SI) half-year operational profits fell 16% as revenue fell about 5% on static costs of goods sold. However, due to several large extraordinary expenses in 2020 which were reduced or eliminated, the company moved from a net loss in 2020 to a profit in 2021. On a per-share basis, it went from a $2.87 loss to a $1.34 profit.

During lockdowns, which saw a sharp decline in new contracts, the business shrunk with an emphasis on cost control. The largest decline was in the Exhibitions and Attractions division, down 27% from the prior year. Kingsmen switched gear to attract several virtual projects.

The interiors division, for retail and corporate space, saw an increase of 24%. The company believes that as economies open, “differentiated experiences” will be future drives of the business. The company has secured several joint-venture arrangements in this area. The company said the volume of work had increased, with the core business remaining “robust”.

Selling at less than half times net asset and with a strong balance sheet, Kingsmen is well-positioned to benefit when business recovers. It’s a buy for long-term investors.

Light Ahead for Reservoir?

Reservoir Capital Corp. (REO:TSX.V) provided an update on the dispute with a Nigerian shareholder which has resulted in half the income Reservoir should have received from

Nigerian hydro company for the last two years being withheld. Reservoir now said that in the event of an agreement, the Nigerian shareholder would drop litigation and release

the funds ($2.5 million), a statement which implies that an agreement may be close. Any agreement would be subject to the trading halt on the stock, in effect since August, being

lifted.

TOP BUYS now in addition to any above, include Lara Exploration (LRA, To., 0.58), Orogen Royalties (OGN, To., 0.455), and Ares Capital (ARCC, Nasdaq, 20.40).

SEC WANTS EMISSIONS DATA: The SEC, in a rather expansive interpretation of its mandate, wants top public companies to disclose data on carbon emissions. However,

the proposed rule goes beyond a company’s own carbon emissions. Rather their report must include the emissions of all companies in their supply chain and the emissions of all

customers who buy their productions. This will be quite a task for, say, Apple or Microsoft, and indeed any business.

UPCOMING CONFERENCES: I’ll be speaking at three upcoming live conferences.

First up is the Money Show, Las Vegas, May 9th to 11th. Speakers include Steve Forbes, Keith Fitz-Gerald, Mark Mobius and Ed Yardeni, covering the economic and investment

waterfront. Next up is Vancouver Resource Investment Conference, May 17th and 18th, with multiple exciting speakers including Grant Williams, Robert Kiyosaki, David

Rosenberg, and Ross Beaty. And in July, we head back to Las Vegas for Freedom Fest, 13th to 16th, for a mix of economics, philosophy, politics, and money, with speakers Glenn

Greenwald, Jim Rogers, Lisa Kennedy, and — now for something completely different — John Cleese (yes, that John Cleese!).

After two years of restricted travel and meetings, it would be nice to see you are one or other of these promising-to-be-great conferences.

Originally published on March 19, 2022.

Adrian Day, London-born and a graduate of the London School of Economics, is editor of Adrian Day’s Global Analyst. His latest book is “Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks.”

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures

1) Adrian Day: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Vista Gold Corp., Osisko Gold Royalties Ltd., Fortuna Silver Mines Inc., Midland Exploration Inc., Kingsmen Creatives Ltd., and Reservoir Capital Corp. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Funds controlled by Adrian Day Asset Management, which is unaffiliated with Adrian Day’s newsletter, hold shares of the following companies mentioned in this article: All. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Adrian Day’s Disclosures: Adrian Day’s Global Analyst is distributed by Investment Consultants International, Ltd., P.O. Box 6644, Annapolis, MD 21401. (410) 224-8885. Publisher: Adrian Day. Owner: Investment Consultants International Ltd. Staff may have positions in securities discussed herein. Adrian Day is also President of Global Strategic Management (GSM), a registered investment advisor, and a separate company from this service. In his capacity as GSM president, Adrian Day may be buying or selling for clients securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein. This is not a solicitation for GSM. Views herein are the editor’s opinion and not fact. All information is believed to be correct, but its accuracy cannot be guaranteed. The owner and editor are not responsible for errors and omissions. ©2022. Adrian Day’s Global Analyst. Information and advice herein are intended purely for the subscriber’s own account. Under no circumstances may any part of a Global Analyst e-mail be copied or distributed without prior written permission of the editor. Given the nature of this service, we will pursue any violations aggressively.

( Companies Mentioned: FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE,

KMEN:SI,

MD:TSX.V,

OR:TSX; OR:NYSE,

REO:TSX.V,

VGZ:NYSE.MKT; VGZ:TSX,

)