Category: Gold

Financial Times/Robin Harding/3-10-2022

“Zoltan Pozsar of Credit Suisse argues that the central bank freeze marks the death of the post-Bretton Woods system, born after Richard Nixon took the US off the gold standard in 1971, and the start of a new monetary order ‘centred around commodity-based currencies in the east.’ If your dollars can vanish at the whim of the issuer, the logic runs, then a reserve must exist outside the dollar-based financial system.”

USAGOLD note: The gist of this article is that, despite Pozsar’s warning, nation-states have little choice but to stick with the dollar as the primary reserve currency, and that very well could turn out to be the case. At current prices, gold is too small a portion of most countries’ nominal reserves to serve as an effective defense mechanism. The fact of the matter is that the price would have to be substantially higher to serve to meet that need. That said, the indigenous population must still find a means for protecting their own assets under such circumstances. That is where gold can serve a useful purpose.

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.

Putin’s options

Daily Reckoning/James Rickards/3-8-2022

“For that matter, a global financial panic may emerge even before the shooting stops. We all see what’s happening on the surface. Here’s what you don’t see: Someone is on the wrong side of every one of those trades. Hedge funds and banks are losing billions and are sinking. It takes about a week for bodies to float to the surface.”

“For that matter, a global financial panic may emerge even before the shooting stops. We all see what’s happening on the surface. Here’s what you don’t see: Someone is on the wrong side of every one of those trades. Hedge funds and banks are losing billions and are sinking. It takes about a week for bodies to float to the surface.”

USAGOLD note: Rickards foresees a boomerang effect wherein sanctions on Russia could cause collateral damage on Wall Street …… Beware the black swan. Over the weekend, Financial Times reported billions in losses among funds and institutions including BlackRock, Pimco, Janus and others, and that is probably just the tip of the iceberg.

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.

The Federal Reserve Note “dollar” may be moving higher versus other fiat currencies, but foreign exchange markets seem to be another example of trading completely decoupled from reality.

Recent news has been full of ominous developments for the dollar.

Russia and China have already established trade without need for U.S. dollars. The two nations signed a treaty in 2019 which provides for using their national currencies in trade.

U.S. sanctions on Russian exports will only serve to increase non-dollar trade between those Eastern powers.

In addition, the Russians have been building an alternative to the SWIFT system for making international payments. Vladimir Putin certainly anticipated U.S. sanctions when he made the decision to invade Ukraine. It is safe to assume he no longer feels subject to U.S. dollar hegemony.

Now India is exploring the possibility of trading rupees for rubles. If China, India and Russia all implement work-arounds, the greenback will become far less useful to a huge portion of the world population.

The dollar’s privilege as the currency required to buy Middle Eastern oil may also be slipping.

The concept of the “petro-dollar” emerged when Saudi Arabia agreed to sell its oil exclusively for U.S. dollars in the 1970s. The extraordinary demand for U.S. dollars from nations needing it to pay for Mid-East oil provided major support for the dollar ever since.

Last week it was widely reported the Saudi crown prince, Mohammed bin Salman, would not return Resident Biden’s call when Biden tried to reach him to discuss Ukraine and surging oil prices.

It may be only a matter of time before Saudi Arabia draws lessons from the sanctions imposed on Iran and Russia and seeks to diversify away from dependence on the Federal Reserve Note.

It’s easy to imagine future historians concluding it was a huge miscalculation for U.S. officials to weaponize the dollar and force nations to adopt alternatives.

Russia and China negotiated the deal to trade without dollars after watching the Fed pursue a decade of “extraordinary” monetary policy. When the answer to every problem is to print money and suppress interest rates, holding U.S. currency and dollar-denominated debt began looking like a very bad bet.

Perhaps Fed officials and federal politicians thought they would get away with abandoning all restraint in fiscal and monetary policy. But gold bugs and many of our trading partners around the world have been preparing for the inevitable reckoning.

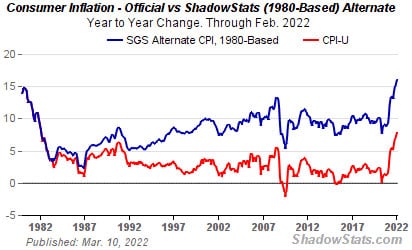

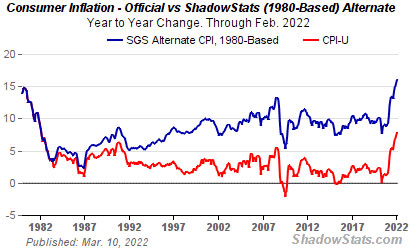

It took a while, but price inflation as measured by the old Consumer Price Index formulation just blew past the 1980 all-time high and there is no end in sight.

Some argue the hegemony of the dollar will persist because it is ultimately backed by the military might of the United States. They expect the U.S. will ultimately go to war to defend the dollar and the nation’s status as the world’s leading economic power.

Set aside the ethics involved in a currency which is supported by the threat of war. Failing confidence also changes this calculus.

Americans have very little appetite left for war. Polling shows Americans do not support sending troops into Ukraine. A portion of the country questions whether the Commander in Chief was legitimately elected. On top of that comes last summer’s humiliating and tragic withdrawal from Afghanistan – a bitter end to the 20-year war.

The trillions of dollars and thousands of lives spent in the Middle East, with almost nothing to show for it, are fresh in the memory of Americans across the political spectrum.

Unfortunately for the Fed and for politicians, it will be hard, if not impossible, to fix issues like that. The decline in the dollar’s purchasing power has perhaps already morphed into a mass psychology event.

If you thought the federal government running a budget surplus in January was a sign that Washington D.C. was getting its fiscal house in order, you’re going to be disappointed. Uncle Sam ran the biggest deficit since last July in February. The budget shortfall for the month came in at $216.6 billion, according to the […]

The post Blog first appeared on SchiffGold.

Last week, we got another big jump in consumer prices with the February CPI data. Peter Schiff appeared on Fox News with Tucker Carlson to talk about the rampant inflation. He said it’s only going to get worse. Inflation only has one way to go. Up. Tucker said Peter should feel vindicated. He’s been right […]

The post Blog first appeared on SchiffGold.