Why Gold & Silver’s Sudden Drop May Have Strengthened the Bull Case

A sudden plunge, a swift rebound, and new questions about the gold and silver market’s foundation have investors paying close attention. In this week’s The […]

A sudden plunge, a swift rebound, and new questions about the gold and silver market’s foundation have investors paying close attention. In this week’s The […]

Gold delivered a record-setting year in 2025 across virtually every major dimension of the market. Demand volumes, market value, investment flows, and pricing all reached […]

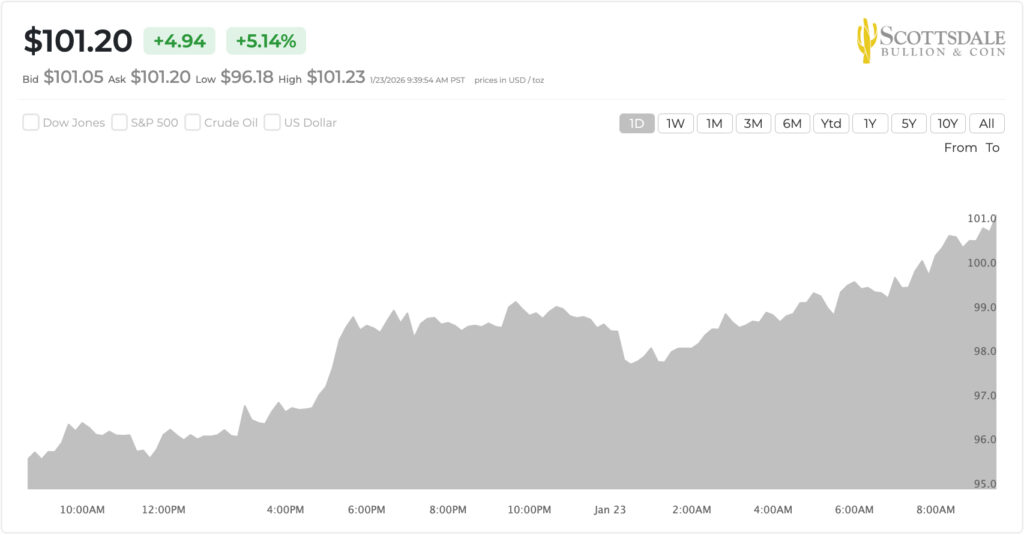

Precious metals entered 2026 at record levels only to capitalize on those gains with unprecedented growth throughout January. Despite all these record highs, major financial […]

Gold crossed $5,300/oz, and silver broke through $115/oz — both within the first month of 2026. These record-high prices follow on the back of an […]

Silver is grabbing headlines, but gold is telling the real story. Beneath the rallies and record highs, the foundations of the financial system are shifting […]

5 Canadian mining company workers found dead in Mexico, authorities confirm ABC News

Canadian mining company’s employees found deceased in Mexico upi.com

Ten silver miners found dead in Mexican mass grave, officials confirm the-independent.com

Five employees of Canadian mining company confirmed dead in Mexico Yahoo

Silver mining stocks jump as metal holds above $90 milestone CNBC

Copyright © 2026 | WordPress Theme by MH Themes